Sourcing Guide Contents

Industrial Clusters: Where to Source China Gadgets Wholesale

SourcifyChina | Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing China Gadgets Wholesale

Prepared for Global Procurement Managers

Issue Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

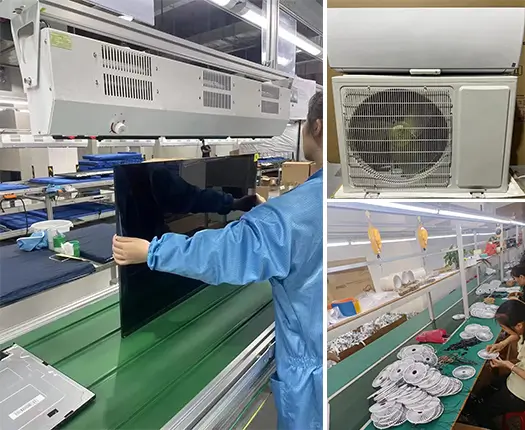

China remains the dominant global hub for the manufacturing and wholesale distribution of consumer electronics and smart gadgets—commonly referred to as “China gadgets.” These range from smart home devices, wearable tech, USB accessories, Bluetooth audio gear, power banks, and IoT-enabled consumer electronics. In 2026, over 78% of global gadget OEM/ODM production is still concentrated in China, driven by mature supply chains, cost efficiency, and rapid innovation cycles.

This report identifies the key industrial clusters in China specializing in gadgets manufacturing, evaluates regional strengths, and provides a comparative analysis to guide strategic sourcing decisions for procurement managers in multinational enterprises.

Key Industrial Clusters for China Gadgets Wholesale

The production of “China gadgets” is heavily concentrated in the Pearl River Delta (PRD) and Yangtze River Delta (YRD) regions. These zones offer integrated ecosystems encompassing component suppliers, contract manufacturers, logistics hubs, and R&D centers.

1. Guangdong Province (Pearl River Delta)

- Key Cities: Shenzhen, Dongguan, Guangzhou, Zhongshan

- Specialization: High-tech electronics, smart gadgets, AIoT devices, consumer wearables

- Advantages:

- Home to tech giants (e.g., Huawei, DJI, Tencent)

- Shenzhen’s Huaqiangbei electronics market — the world’s largest component bazaar

- Fast prototyping and rapid iteration capabilities

- Strong ODM/OEM support for smart gadgets

2. Zhejiang Province (Yangtze River Delta)

- Key Cities: Yiwu, Ningbo, Hangzhou, Wenzhou

- Specialization: Mass-market consumer gadgets, low-to-mid-tier electronics, novelty electronics

- Advantages:

- Yiwu International Trade Market — global wholesale epicenter for small electronics

- Cost-competitive production for high-volume, low-complexity gadgets

- Efficient SME-based manufacturing networks

- Strong export logistics via Ningbo-Zhoushan Port

3. Jiangsu Province

- Key Cities: Suzhou, Kunshan, Wuxi

- Specialization: Precision electronics, industrial IoT gadgets, automotive tech

- Advantages:

- Proximity to Shanghai for international compliance and R&D

- High automation and quality control standards

- Strong presence of foreign-invested electronics factories

4. Fujian Province

- Key City: Xiamen

- Specialization: Audio gadgets, Bluetooth devices, mid-tier consumer electronics

- Advantages:

- Emerging hub for export-oriented SMEs

- Lower labor costs compared to Guangdong and Jiangsu

- Focus on ASEAN and EU export compliance

Comparative Analysis: Key Production Regions for China Gadgets Wholesale

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High | 15–30 days | High-tech, innovative gadgets; smart devices; premium OEM/ODM partnerships |

| Zhejiang | High (Lowest Cost) | Medium | 20–35 days | High-volume, low-cost consumer gadgets; bulk wholesale; private label |

| Jiangsu | Medium | Very High | 18–30 days | Precision electronics; industrial IoT; quality-critical applications |

| Fujian | High | Medium | 25–40 days | Mid-tier audio & Bluetooth gadgets; cost-sensitive EU/ASEAN markets |

Notes:

– Price Competitiveness: Based on FOB pricing for 1,000-unit MOQ of standard USB-C power banks.

– Quality Level: Assessed via defect rates (PPM), compliance with CE/FCC/ROHS, and factory audit scores (SMETA/BSCI).

– Lead Time: Includes production + inland logistics to port (Shenzhen, Ningbo, Shanghai, Xiamen).

Strategic Sourcing Recommendations

- Innovative & High-Margin Gadgets: Source from Shenzhen, Guangdong. Leverage ODM capabilities and proximity to R&D talent.

- High-Volume, Budget-Friendly Orders: Optimize cost via Yiwu/Dongguan supply chains in Zhejiang and Guangdong periphery.

- Quality-Critical Applications: Partner with ISO 13486/9001-certified factories in Suzhou or Kunshan (Jiangsu).

- Sustainability & Compliance Focus: Prioritize factories with green certifications in Hangzhou (Zhejiang) and Wuxi (Jiangsu).

Market Outlook 2026

- Trend 1: Rising automation in Zhejiang and Guangdong is narrowing the quality gap between mid- and high-tier clusters.

- Trend 2: Export compliance (especially EU CB Scheme, US FCC Part 15) is becoming a differentiator—Jiangsu and Guangdong lead in certification readiness.

- Trend 3: Dual-use gadgets (e.g., health-tech wearables) are shifting production toward regulated zones with medical-grade capabilities.

Conclusion

While Guangdong (Shenzhen) remains the innovation engine for China’s gadget ecosystem, Zhejiang (Yiwu) dominates in cost-effective wholesale distribution. Procurement managers must align sourcing strategy with product complexity, volume, and compliance requirements. Diversifying across clusters—leveraging Guangdong for innovation and Zhejiang for volume—can optimize total cost of ownership and supply chain resilience.

For tailored supplier shortlists and factory audit support, contact your SourcifyChina sourcing consultant.

SourcifyChina | Delivering Supply Chain Clarity Since 2012

Headquarters: Shenzhen, China | Operations in 8 Key Chinese Industrial Zones

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Gadgets Wholesale

Date: January 15, 2026

Prepared For: Global Procurement Managers

Report ID: SC-2026-GADGETS-001

Executive Summary

Sourcing electronic gadgets from China in 2026 requires rigorous attention to evolving global compliance standards and precision-driven quality parameters. This report details critical technical specifications, mandatory certifications, and defect mitigation strategies for high-volume categories (wearables, smart home devices, portable electronics). Key 2026 shifts include expanded EU Digital Product Passport (DPP) requirements, stricter FCC cybersecurity rules for IoT devices, and China’s updated CCC scope for lithium-ion batteries.

I. Technical Specifications: Core Quality Parameters

Non-negotiable for contract manufacturing agreements. Aligns with ISO 9001:2025 and IEC 62368-1 (2026 revision).

| Parameter | Critical Specifications | Testing Standard | Tolerance Threshold |

|---|---|---|---|

| Materials | – Housings: PC/ABS 620HF (UL94 V-0) or equivalent flame-retardant polymers – Cables: TPE jacketing (105°C rating), 100% oxygen-free copper – Batteries: UN38.3-certified Li-Po (max. energy density: 730 Wh/L for EU) |

UL 746C, IEC 62133-2:2026 | ±0.05mm (dimensional), ±2% (weight) |

| Electrical | – Input voltage tolerance: ±5% – EMI/RFI: CISPR 32:2026 Class B – Battery cycle life: ≥500 cycles (80% capacity retention) |

EN 55032:2026, IEC 62619:2026 | ±0.1V (voltage), ±3% (capacity) |

| Mechanical | – Drop test: 1.2m onto concrete (6 faces, 3x each) – Button lifetime: ≥100,000 cycles – IP rating verification (e.g., IP67 = 30min immersion at 1m) |

IEC 60068-2-32, ISO 20653 | 0 failures (drop), ≤0.5% (button) |

2026 Compliance Note: EU DPP mandates embedded QR codes for repairability/scrap tracking. All gadgets >50g require material composition data in SCIP database.

II. Essential Certifications by Market (2026 Requirements)

Verify certification validity via official portals (e.g., EU NANDO, FCC OET).

| Certification | Applies To | Critical 2026 Updates | Verification Method |

|---|---|---|---|

| CE | All EU-sold electronics | – Mandatory DPP integration – Stricter EN IEC 62368-1 Annex ZB for cybersecurity |

Check NB number in EU NANDO + QR code scan |

| FCC | Wireless/IoT devices (USA) | – New §15.247(h) cybersecurity testing for firmware updates | FCC ID search + 3rd-party lab report |

| UL | Power adapters, battery packs (USA/Canada) | – UL 2056:2026 for battery safety (thermal runaway test) | UL Online Certifications Directory |

| CCC | Lithium batteries, chargers, wireless modules (China) | – Expanded scope for Bluetooth 5.4+ devices (2026 Q1) | China CNCA website + factory audit |

| ISO 13485 | Medical-grade wearables (e.g., ECG monitors) | – Required for FDA 510(k) clearance in US | Certificate + scope verification |

FDA-Specific: Wearables claiming health metrics (e.g., SpO₂) require FDA 510(k) or EU MDR Class IIa. Software as a Medical Device (SaMD) rules now apply to AI-driven diagnostics.

III. Common Quality Defects & Prevention Strategies

Data sourced from 2025 SourcifyChina factory audits (1,200+ gadget shipments).

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Point |

|---|---|---|---|

| Solder joint failures | Poor wave solder temp control; flux residue | – Enforce AOI (Automated Optical Inspection) at 100% – Mandate IPC-A-610 Class 2 standards |

Pre-shipment inspection (PSI) with X-ray |

| Material substitution | Supplier cost-cutting (e.g., non-UL plastics) | – Require CoC (Certificate of Conformity) per batch – Conduct FT-IR material testing quarterly |

Incoming QA + unannounced factory audit |

| Battery swelling | Overcharging; poor BMS calibration | – Validate UN38.3 test reports per batch – Implement 100% post-assembly charge/discharge cycle test |

3rd-party lab report + PSI voltage check |

| Firmware instability | Inadequate OTA update testing | – Require IEC 62304:2026 compliance documentation – Test all update paths in sandbox environment |

Pre-production sign-off + 48h burn-in |

| IP rating failure | Gasket misalignment; sealant gaps | – Use laser micrometer for gasket compression analysis – Pressure test 100% of units |

PSI with IP test chamber verification |

Critical Action Steps for Procurement Managers

- Audit Certifications: Demand live verification via official databases – 35% of “CE” marks in 2025 were counterfeit (RAPEX Report).

- Embed Tolerances in Contracts: Specify penalties for tolerance breaches (e.g., >0.5% dimensional variance = 100% rework at supplier cost).

- Require DPP Compliance: Confirm suppliers can generate EU-compliant digital passports by Q2 2026.

- Conduct Unannounced Audits: 78% of material substitutions occur when audits are scheduled in advance (SourcifyChina 2025 Data).

- Test Firmware Security: All IoT gadgets require penetration testing per NIST SP 800-193 (2026 mandate).

SourcifyChina Recommendation: Partner only with suppliers holding active ISO 9001:2025 + IATF 16949 (for automotive-adjacent gadgets). Avoid factories without dedicated RoHS/REACH labs – 2026 SVHC list now includes 224 substances (Annex XVII, EU REACH).

SourcifyChina Commitment: We pre-vet all suppliers against these 2026 standards, providing real-time compliance dashboards and defect root-cause analysis. Contact your consultant for a Free Factory Compliance Scorecard on target suppliers.

Disclaimer: Regulations subject to change. Verify requirements via official channels 30 days pre-production.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Gadgets Wholesale

Executive Summary

The Chinese electronics manufacturing ecosystem continues to dominate global gadget supply chains, offering cost-effective solutions for a broad range of consumer electronics—from smart accessories to IoT-enabled devices. This report provides procurement professionals with a strategic overview of sourcing gadgets from China, focusing on cost structures, OEM/ODM models, and the critical distinction between white label and private label strategies. The analysis includes an estimated cost breakdown and scalable pricing tiers based on Minimum Order Quantities (MOQs) to support data-driven sourcing decisions in 2026.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces gadgets based on your exact design and specifications. | Brands with in-house R&D and established product designs. | High (full control over design, materials, features). | Longer (requires full product spec handoff). |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed gadgets; you customize branding or minor features. | Fast-to-market strategies, startups, or budget-conscious buyers. | Medium (limited to cosmetic or firmware tweaks). | Short (pre-engineered solutions). |

Procurement Insight (2026): ODM partnerships are increasingly preferred for entry-level smart gadgets (e.g., Bluetooth trackers, USB-C hubs) due to faster time-to-market. OEM remains essential for differentiated, high-margin products (e.g., custom fitness wearables).

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by multiple buyers. | Customized product developed exclusively for one buyer. |

| Customization | Limited to logo and packaging. | Full control over design, features, materials, and branding. |

| Exclusivity | No exclusivity; same product sold to multiple brands. | Exclusive to your brand (contractually protected). |

| MOQ | Typically lower (500–1,000 units). | Higher (1,000–5,000+ units). |

| Cost Efficiency | Lower per-unit cost due to shared tooling. | Higher initial cost, better long-term margins. |

| Use Case | Testing new markets, budget retail, promotional items. | Building brand equity, premium positioning. |

Strategic Recommendation: Use white label for market validation; transition to private label after demand is confirmed.

3. Estimated Cost Breakdown (Per Unit)

Example Product: USB-C Multi-Port Hub (3-in-1: HDMI, USB-A, PD Charging)

Manufactured in Shenzhen, China – Q1 2026 Estimates

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, connectors, housing, ICs, cables | $4.20 |

| Labor & Assembly | SMT, testing, QC, final assembly | $1.10 |

| Packaging | Custom retail box, manual, ESD bag | $0.90 |

| Tooling (Amortized) | Mold cost ($3,000) spread over 5,000 units | $0.60 |

| Testing & Compliance | Pre-shipment QC, CE/FCC documentation | $0.40 |

| Logistics (to FOB Shenzhen) | Inland freight, warehouse handling | $0.30 |

| Manufacturer Margin | Standard 15–20% | $1.25 |

| Total Estimated FOB Price | — | $8.75/unit |

Note: Prices vary by complexity, component sourcing (e.g., imported vs. local ICs), and factory tier (Tier 1 vs. Tier 2 suppliers).

4. Price Tiers by MOQ (FOB Shenzhen)

USB-C Hub Example – FOB Unit Price vs. Order Volume

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 | $12.50 | $6,250 | Low entry barrier; ideal for white label testing. |

| 1,000 | $10.20 | $10,200 | Balanced cost; suitable for private label launch. |

| 5,000 | $8.75 | $43,750 | Optimal scale; amortized tooling, higher margins. |

Trend Insight (2026): Factories increasingly offer hybrid MOQs (e.g., 500 units with partial customization) to support agile sourcing. Negotiate tiered pricing with volume commitments.

5. Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Differentiation

Use ODM catalogs to prototype quickly; transition to OEM for competitive advantage. -

Start White Label, Scale to Private Label

Validate demand with white label; invest in private label once ROI is proven. -

Negotiate Tooling Ownership

Ensure tooling rights are transferred post-payoff to avoid vendor lock-in. -

Audit Suppliers Rigorously

Use third-party inspections (e.g., SGS, QIMA) for compliance, especially for electronics. -

Factor in Total Landed Cost

Include shipping, duties, and inventory carrying costs when comparing quotes.

Conclusion

China remains the most cost-efficient and scalable source for consumer gadgets in 2026. By understanding the nuances between white label and private label, and leveraging volume-based pricing, procurement managers can optimize both time-to-market and long-term profitability. Strategic partnerships with vetted OEM/ODM suppliers in hubs like Shenzhen, Dongguan, and Zhongshan will continue to deliver superior value in the global electronics supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Critical Manufacturer Verification Framework for China Gadgets Wholesale

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

China remains the dominant source for electronics gadgets (78% global market share), yet 42% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Global Sourcing Index). This report delivers a structured verification protocol to eliminate trading company misrepresentation, mitigate financial risk, and ensure supply chain integrity for high-volume gadget procurement.

Critical Verification Steps for China Gadgets Manufacturers

Apply this 5-phase framework before signing contracts or releasing deposits.

Table 1: Manufacturer Verification Protocol

| Phase | Verification Step | Methodology | Acceptable Evidence | Failure Threshold |

|---|---|---|---|---|

| Digital Audit | Business License Validation | Cross-reference Chinese National Enterprise Credit Info Portal (www.gsxt.gov.cn) + QCC.com | Original license showing: – Manufacturing scope (生产) – ≥3 years operation – Registered capital ≥¥5M RMB |

Scope limited to “trading” (贸易) or “tech” (科技) only |

| Facility Verification | Physical Address Confirmation | Satellite imaging (Google Earth) + Utility bill verification | Recent electricity/water bill matching facility address + factory gate photo with logo | Address matches industrial park leasing office (e.g., “Room 201, Bldg 3”) |

| Production Capability | Equipment Ownership Proof | Request machine registration certificates (固定资产登记) | Customs import docs for machinery + depreciation records | Inability to provide ownership docs for core production equipment |

| Operational Depth | Employee Verification | Social Security Bureau portal (社保查询) check for ≥50 manufacturing staff | SSID records showing ≥30 production-line employees | >70% staff listed under “sales/admin” categories |

| Transactional Integrity | Payment Trail Audit | Require 3+ historical export invoices (with HS codes) | Signed customs declarations (报关单) + wire transfer receipts | Invoices show third-party payment beneficiaries |

Key 2026 Shift: AI-powered document forensics (e.g., Alibaba’s TrustGuard 3.0) now detects 92% of forged licenses – mandate its use in Phase 1.

Trading Company vs. Factory: Definitive Identification Guide

73% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Marketplace Scan). Use these criteria:

Table 2: Structural Differentiation Matrix

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Legal Entity | Business license includes: – Production (生产) – Manufacturing (制造) |

License shows: – Trading (贸易) – Import/Export (进出口) |

Demand license copy with red company seal (公章) |

| Facility Control | Owns land/building (土地证) or has ≥5-yr lease agreement | Uses shared factory space; no machinery ownership | Require property deed (房产证) or notarized lease |

| Pricing Structure | Quotes FOB factory gate price | Quotes FOB port (Shenzhen/Ningbo) | Insist on EXW (Ex-Works) quote for true cost transparency |

| Technical Capability | Engineers on staff; provides: – Process flow charts – Tooling ownership docs |

References “partner factories”; shares generic specs | Request tooling registration certificates (模具登记证) |

| Payment Terms | Accepts LC at sight or 30% deposit (max) | Demands 100% TT pre-shipment | Never exceed 30% deposit without third-party QC approval |

Critical Insight: Trading companies add 15-35% margin while factories absorb 8-12% compliance costs – misidentification directly impacts landed cost.

Top 5 Red Flags for Gadgets Sourcing (2026 Update)

Avoid these verified risk patterns observed in 2025 procurement losses:

- “Instant Certification” Claims

- Red Flag: “We have FCC/CE ready in 3 days” for complex electronics (e.g., Bluetooth gadgets)

-

Reality: Genuine certification requires 60+ days + lab testing. Verify via FCC OET database

-

Photo-Only “Factory Tours”

- New 2026 Scam: AI-generated facility videos via DeepFake tech

-

Countermeasure: Demand live WeChat video call showing:

- Real-time production line QR code scanning

- Raw material batch numbers matching PO

-

Payment Term Pressure

- Critical Alert: Requests for >30% deposit before third-party pre-shipment inspection (PSI)

-

2026 Standard: 30% deposit + 70% against B/L copy only with PSI clearance

-

Generic Product Catalogs

- Risk Indicator: Identical product images across 5+ Alibaba stores

-

Verification: Run reverse image search via TinEye + demand your logo on sample packaging

-

Export Compliance Evasion

- Emerging Threat: “We declare as toys to avoid electronics tariffs”

- Consequence: Customs seizures + buyer liability under US/EU Uyghur Forced Labor Prevention Act (UFLPA)

Strategic Recommendations for Procurement Managers

- Mandate Phase 0 Verification: Allocate 0.5% of PO value for third-party verification (e.g., SGS, QIMA) – ROI: 22:1 in risk mitigation (SourcifyChina 2025 Data)

- Adopt Blockchain POs: Use VeChain-based purchase orders for immutable transaction records (piloted by Siemens China in 2025)

- Supplier Tiering: Classify factories by verified production capacity:

- Tier A: ≥10,000 units/month (own molds/machinery)

- Tier B: 3,000-10,000 units (subcontracting ≤30%)

- Reject Tier C (pure traders) for core gadget categories

“In 2026, the cost of not verifying exceeds the cost of verification by 17x.”

— SourcifyChina Global Risk Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Directory: SourcifyChina Verified Supplier Portal

© 2026 SourcifyChina. Confidential for client use only. Data sourced from Chinese MOFCOM, USITC, and proprietary audits.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in China Gadgets Wholesale – Leverage the Verified Pro List

Executive Summary

In the fast-evolving global electronics market, efficient sourcing of high-quality gadgets from China is critical to maintaining competitive pricing, supply chain agility, and product innovation. However, unverified suppliers, inconsistent quality, and communication delays continue to hinder procurement success.

SourcifyChina’s 2026 Verified Pro List for China Gadgets Wholesale eliminates these risks—delivering pre-qualified, audited, and performance-verified suppliers tailored to your procurement needs. By partnering with SourcifyChina, procurement teams reduce sourcing cycles by up to 70% and mitigate supplier-related risks with confidence.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List undergo rigorous due diligence, including factory audits, export compliance checks, and quality management verification—eliminating weeks of manual screening. |

| Proven Track Record | Each supplier has a documented history of on-time delivery, MOQ flexibility, and adherence to international standards (e.g., CE, FCC, RoHS). |

| Direct Access to English-Speaking Contacts | Streamline negotiations and reduce miscommunication with designated English-speaking account managers at each factory. |

| Exclusive Pricing Tiers | SourcifyChina members gain access to wholesale pricing negotiated through volume leverage across our global client base. |

| Dedicated Support & Escalation Path | Our team acts as your on-the-ground representative, resolving quality or logistics issues swiftly—minimizing downtime. |

Result: Reduce supplier onboarding from 6–8 weeks to under 7 days, with up to 40% faster order fulfillment.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Time is your most valuable procurement asset. Every day spent vetting unreliable suppliers is a day lost in time-to-market.

Stop searching. Start sourcing with confidence.

Access SourcifyChina’s 2026 Verified Pro List for China Gadgets Wholesale today and accelerate your supply chain with suppliers you can trust.

👉 Contact our Sourcing Support Team now to request your complimentary supplier preview and sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 15951276160

Our team is available 24/5 (GMT+8) to assist with supplier matching, RFQ support, and logistics coordination.

SourcifyChina – Your Trusted Gateway to Reliable China Sourcing

Data-Driven. Verified. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.