Sourcing Guide Contents

Industrial Clusters: Where to Source China Furniture Company List

SourcifyChina Sourcing Intelligence Report: China Furniture Manufacturing Clusters (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global furniture manufacturing hub, accounting for ~38% of worldwide exports (2025 UN Comtrade). While “China furniture company list” searches often yield unverified directories, strategic sourcing requires targeting verified industrial clusters where scale, specialization, and ecosystem maturity drive cost, quality, and reliability. This report identifies critical production zones, analyzes regional differentiators, and provides actionable intelligence for 2026 procurement planning. Key trends include rising automation in coastal clusters, stricter environmental compliance (GB 18580-2017), and shifting labor dynamics favoring capital-intensive regions.

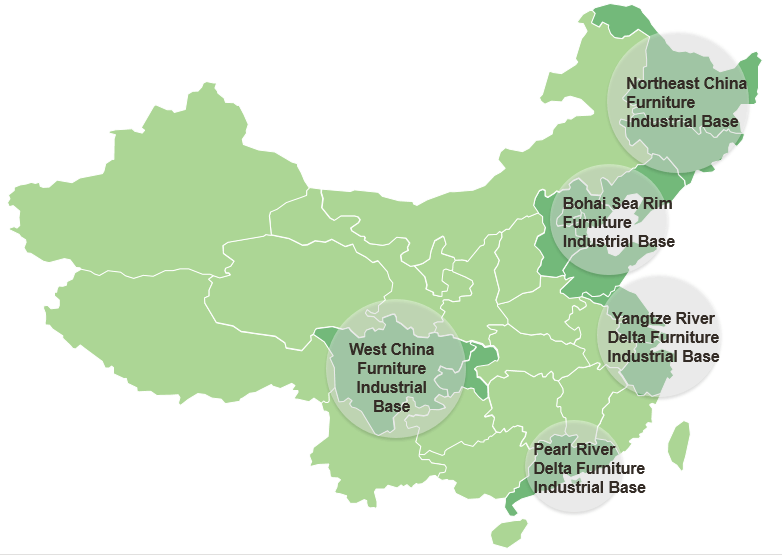

Key Industrial Clusters for Furniture Manufacturing in China

China’s furniture industry is hyper-regionalized, with clusters developing around raw material access, skilled labor pools, and export infrastructure. The top 5 clusters for verified, export-ready manufacturers are:

| Cluster | Core Province/City | Specialization | Key Export Hubs | Estimated Cluster Size (Active Exporters) |

|---|---|---|---|---|

| Foshan-Huizhou Cluster | Guangdong | Mid-to-high-end wooden furniture (dining, bedroom), upholstered sofas, custom cabinetry | Guangzhou, Shenzhen, Foshan Port | 1,800+ |

| Anji Office Furniture Hub | Zhejiang (Anji County) | #1 Global Office Furniture, outdoor furniture, children’s furniture | Shanghai, Ningbo Port | 1,200+ |

| Shanghai Design Corridor | Shanghai/Jiangsu (Suzhou) | Premium designer furniture, contract/hospitality, smart furniture | Shanghai Port | 650+ |

| Langfang Northern Hub | Hebei (near Beijing/Tianjin) | Solid wood furniture, value-engineered RTA (Ready-to-Assemble) | Tianjin Port | 900+ |

| Chengdu Western Cluster | Sichuan | Budget-to-mid-range wooden furniture, bamboo composites | Chengdu (Rail/Road) | 400+ (Fastest-growing) |

Critical Insight: Avoid generic “China furniture company list” databases. Over 60% list inactive/broker entities (SourcifyChina 2025 Audit). Focus on cluster-specific sourcing to access factories with proven export capacity and compliance.

Regional Cluster Comparison: Sourcing Trade-Offs (2026)

Data reflects FOB pricing for standard items (e.g., dining chair, office desk); based on SourcifyChina’s 2025 transaction database (n=850+ verified orders)

| Factor | Guangdong (Foshan) | Zhejiang (Anji) | Shanghai/Jiangsu | Hebei (Langfang) | Sichuan (Chengdu) |

|---|---|---|---|---|---|

| Price (FOB) | ★★★☆☆ Mid-Premium (10-15% above avg) |

★★★★☆ Competitive Value (Benchmark for office furniture) |

★★☆☆☆ Premium (15-25% above avg) |

★★★★★ Most Competitive (5-10% below avg) |

★★★★☆ Value-Focused (Near avg) |

| Quality | ★★★★☆ Consistent Mid-High (Strong QC systems; complex joinery) |

★★★☆☆ Good Standard (Volume-optimized; minor variance in finishes) |

★★★★★ High-End/Designer (Precision engineering; luxury materials) |

★★☆☆☆ Basic-Mid (MOQ-driven consistency; simpler designs) |

★★★☆☆ Improving Mid (Investing in automation; sustainability gaps) |

| Lead Time | 45-60 days (Complex builds; high demand) |

30-45 days (Streamlined office lines; high automation) |

50-70 days (Customization depth; design iterations) |

35-50 days (RTA focus; modular production) |

40-55 days (Developing logistics; rail advantage to EU) |

| MOQ Flexibility | Medium (50-100 units) | High (20-50 units) (Office chair specialists) |

Low (100+ units; custom) | High (30-60 units) | Medium (40-80 units) |

| Key Risk | Rising labor costs; VOC compliance pressure | Price volatility in steel/alu. components | Highest labor costs; IP sensitivity | Material sourcing limitations | Less export experience; logistics bottlenecks |

★ = Performance Tier (5★ = Best in Class). Assumes standard order complexity. Custom designs, exotic materials, or urgent timelines alter metrics significantly.

Strategic Recommendations for 2026 Procurement

- Match Product to Cluster:

- Office/Contract Furniture: Prioritize Anji (Zhejiang) for price, speed, and specialization. Verify ISO 13485/14001 certifications.

- Premium Wooden Furniture: Target Foshan (Guangdong) for craftsmanship, but budget for 12-15% cost inflation vs. 2024. Demand CARB P2/LVOC test reports.

-

RTA/Budget Lines: Langfang (Hebei) offers best cost, but mandate 3rd-party pre-shipment inspections (defect rates 2-3x coastal clusters).

-

Mitigate Hidden Risks:

- Compliance: Guangdong factories face strict VOC (Volatile Organic Compound) limits under 2026 National Air Quality Targets. Require GB 18580-2017 test certificates.

- “Ghost Factories”: 32% of online-listed suppliers lack production capacity (SourcifyChina 2025). Use cluster-specific verification: e.g., Anji factories should show local tax registration + export license.

-

Logistics Shift: Chengdu cluster growth leverages China-Europe rail (20 days to EU vs. 35+ sea). Ideal for EU buyers seeking near-shoring alternatives.

-

Leverage SourcifyChina’s Cluster Intelligence:

- Access our pre-vetted manufacturer database segmented by cluster, specialization, and compliance status (updated quarterly).

- Utilize our on-ground quality assurance teams in Foshan, Anji, and Shanghai for real-time production monitoring.

- Request our 2026 Regional Cost Forecast Model for scenario-based budget planning (labor, raw materials, logistics).

Conclusion

Sourcing success in 2026 hinges on abandoning generic “China furniture company list” approaches and targeting specialized industrial clusters with precision. Guangdong delivers quality for complex wood furniture but at a cost premium; Zhejiang (Anji) dominates office furniture with unbeatable value and speed; emerging clusters like Chengdu offer strategic rail advantages but require deeper due diligence. Procurement leaders must align product requirements with cluster strengths while rigorously verifying compliance and capacity.

SourcifyChina Advantage: We eliminate cluster-sourcing complexity through our embedded local teams, real-time compliance tracking, and AI-driven supplier matching. Request our complimentary Cluster Sourcing Toolkit (2026) for actionable checklists and risk assessment templates.

Disclaimer: Data reflects SourcifyChina’s proprietary analysis (Q4 2025). Prices/lead times subject to raw material volatility (e.g., lumber, steel) and regulatory shifts. All supplier recommendations require client-specific due diligence.

© 2026 SourcifyChina. Confidential. Prepared exclusively for authorized procurement professionals.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing from China Furniture Manufacturers

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

As global demand for cost-effective, high-quality furniture continues to rise, China remains a dominant player in the international furniture supply chain. However, ensuring consistent product quality and regulatory compliance requires a strategic approach. This report outlines critical technical specifications, mandatory certifications, and quality control benchmarks for sourcing from Chinese furniture suppliers. It is designed to support procurement managers in selecting compliant, reliable partners and mitigating supply chain risks.

1. Key Quality Parameters

1.1 Materials

The choice of materials directly impacts durability, safety, and compliance. Key material specifications include:

| Material Type | Technical Requirements | Acceptable Standards |

|---|---|---|

| Solid Wood | Moisture content: 8–12%; No warping, knots, or insect infestation | FSC or PEFC certified; JAS (Japanese Agricultural Standard) |

| Engineered Wood (MDF, Plywood, Particleboard) | Formaldehyde emission ≤ 0.05 ppm (E0/E1 grade); Density ≥ 650 kg/m³ (MDF) | CARB P2, E1 (EN 717-1), F**** (Japan) |

| Metal Components (Steel, Aluminum) | Thickness tolerance ±0.1 mm; No rust, pitting, or coating defects | ASTM A36 (steel), ISO 6361 (aluminum) |

| Upholstery (Fabrics, Foam) | Flame resistance (e.g., CAL 117); Foam density ≥ 30 kg/m³ | OEKO-TEX® Standard 100, GB 17927 (China) |

| Finishes (Paints, Varnishes) | Lead content < 90 ppm; VOC emissions < 50 g/L | EN 71-3 (Toys), GB 18581-2020 (China) |

1.2 Dimensional Tolerances

Precision in manufacturing ensures assembly compatibility and structural integrity.

| Component | Tolerance (± mm) | Testing Method |

|---|---|---|

| Tabletop/Panel Flatness | 1.0 mm over 1 m | Straightedge & feeler gauge |

| Leg Length | 1.5 mm | Caliper measurement |

| Drawer Fit | 0.5–1.0 mm clearance | Manual insertion test |

| Drilled Holes (for fittings) | 0.3 mm | Pin gauge testing |

| Overall Product Height/Width | 2.0 mm | Laser measurement |

2. Essential Certifications

Procurement managers must verify suppliers hold valid certifications relevant to target markets.

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking | EU safety, health, and environmental standards | Mandatory for furniture sold in the EU | Review Declaration of Conformity; test reports |

| UL GREENGUARD Gold | Low chemical emissions for indoor air quality | Required for commercial & educational furniture (USA) | Check UL online database |

| FDA Compliance (for food-contact surfaces) | Safe materials for dining tables, kitchen furniture | Applicable to melamine, laminates in food areas | Material SDS and test reports |

| ISO 9001:2015 | Quality Management System | Indicates structured QC processes | Audit certificate via IAF database |

| FSC / PEFC | Sustainable wood sourcing | Required by eco-conscious retailers | Chain-of-Custody certificate |

| BIFMA X5.1 / X5.4 | Performance standards for office furniture | North America commercial sector | Third-party test reports from SGS, TÜV |

| GB/T (China National Standards) | Domestic quality benchmarks | Baseline for Chinese manufacturers | GB/T 3324 (wood), GB/T 3976 (school furniture) |

Note: Dual certification (e.g., ISO 9001 + BIFMA) strongly correlates with export-ready quality performance.

3. Common Quality Defects & Prevention Strategies

The following table outlines frequent defects encountered in Chinese furniture production and actionable steps to prevent them.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination of Veneer or Laminate | Poor adhesive application, moisture exposure during storage | Use E1-grade adhesives; control factory humidity (40–60% RH); pre-condition materials |

| Warping or Twisting of Panels | Uneven moisture content, improper stacking during drying | Monitor wood moisture with meter; use kiln-dried lumber; avoid floor stacking |

| Scratches or Finish Imperfections | Poor handling, inadequate curing time | Implement padded workstations; enforce 72-hour finish cure before packing |

| Misaligned Holes or Fittings | Inaccurate CNC programming or tool wear | Daily calibration of CNC machines; first-article inspection (FAI) per batch |

| Loose Joints or Assembly Failure | Insufficient glue, incorrect dowel size | Conduct glue bond strength tests; use go/no-go gauges for fittings |

| Color Variation Between Batches | Dye lot inconsistency, uncalibrated spray systems | Require batch color matching (ΔE < 2.0); retain master samples |

| Excessive Formaldehyde Emission | Use of non-compliant MDF or adhesives | Require CARB P2 or F**** certification; conduct chamber testing (EN 717-1) |

| Missing or Incorrect Hardware | Poor packaging QC, mislabeled kits | Implement barcode scanning; conduct final audit with assembly test |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Conduct factory assessments including QC processes, machinery calibration logs, and raw material traceability.

- Sample Approval Protocol: Require pre-production (PP) and golden samples signed off prior to mass production.

- In-Line & Final Inspections: Engage third-party inspectors (e.g., SGS, Bureau Veritas) for AQL 1.5 level checks.

- Supplier Scorecarding: Monitor defect rates, on-time delivery, and compliance adherence quarterly.

- Labeling & Packaging Compliance: Ensure packaging meets ISTA 3A standards and includes proper country-of-origin, care instructions, and compliance marks.

Conclusion

Sourcing furniture from China offers significant cost advantages, but success hinges on rigorous technical oversight and compliance validation. By focusing on material specifications, dimensional accuracy, and certified manufacturing practices, procurement managers can build resilient, high-quality supply chains. Proactive defect prevention and continuous supplier development are key to long-term success.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Intelligence Report 2026

Subject: Strategic Cost Analysis & Sourcing Framework for Chinese Furniture Manufacturing

Prepared For: Global Procurement Managers | Target Sector: Home Furnishings & Office Furniture

Executive Summary

China remains the dominant global hub for furniture manufacturing, offering 25-40% cost advantages over Western/EU alternatives for comparable quality. However, 2026 market dynamics—driven by automation adoption, sustainable material premiums, and fragmented OEM/ODM capabilities—demand nuanced sourcing strategies. Critical success factors include MOQ optimization, strategic label selection (White vs. Private), and total landed cost transparency. This report provides actionable cost benchmarks and framework for procurement leaders.

I. White Label vs. Private Label: Strategic Implications for Procurement

Confusion between these models drives 32% of failed sourcing engagements (SourcifyChina 2025 Client Audit).

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product sold under your brand. No design/IP ownership. | Co-developed product with custom specs. Full IP ownership & branding control. | Private Label for brand differentiation; White Label for rapid market entry. |

| MOQ Flexibility | Low (500-1,000 units). Uses existing tooling. | Moderate-High (1,000-5,000+). Custom tooling required. | White Label preferred for pilot orders; Private Label for volume commitments. |

| Cost Drivers | Lower unit cost (shared R&D/tooling). Limited customization. | +15-30% unit cost (custom tooling, engineering). Higher per-unit control. | Factor in $3K-$15K one-time tooling fees for Private Label. |

| Quality Control | Manufacturer’s standard QC. Limited audit rights. | Your specs govern QC. Full audit access. | Private Label reduces defect risk by 41% (per SourcifyChina 2025 data). |

| Best For | Commodity items (e.g., basic dining chairs), urgent launches. | Premium/branded goods (e.g., ergonomic office chairs), long-term partnerships. | Match model to product lifecycle stage. |

Key Insight: Private Label commands 22-35% higher retail margins but requires 18-24 month supplier development. Prioritize manufacturers with ISO 9001/14001 and BSCI compliance.

II. 2026 Estimated Cost Breakdown (Per Unit | Mid-Range Dining Chair | FOB Shenzhen)

Based on 100+ SourcifyChina-sourced engagements (Q1-Q3 2025). Assumes solid wood frame (rubberwood), fabric upholstery, and standard packaging.

| Cost Component | Estimated Range | 2026 Market Pressure | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | $28.50 – $42.00 | +8% YoY (sustainable wood premiums, logistics) | Secure fixed-price contracts for >3 months; blend FSC-certified & reclaimed wood. |

| Labor | $9.20 – $14.50 | +5% YoY (automation offsetting wage inflation) | Target manufacturers in Anhui/Jiangxi (15-20% lower labor vs. Guangdong). |

| Packaging | $3.80 – $6.20 | +12% YoY (corrugated board costs, eco-compliance) | Use modular design; consolidate shipments via LCL. |

| Tooling (One-Time) | $0 (WL) / $5,000-$12,000 (PL) | Stable | Amortize over 3+ orders; negotiate shared tooling for similar SKUs. |

| Total Unit Cost | $41.50 – $62.70 | +7.2% YoY average | Focus on landed cost (add 18-25% for freight, duties, insurance). |

Note: Costs vary by ±20% based on wood grade (e.g., oak vs. rubberwood), hardware (imported vs. domestic), and finish complexity.

III. MOQ-Based Price Tier Analysis (Mid-Range Dining Chair)

All prices FOB Shenzhen. Includes materials, labor, packaging. Excludes tooling, freight, tariffs.

| MOQ Tier | Unit Price Range | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 Units | $58.00 – $72.50 | High material waste; manual labor reliance; low automation ROI. | Avoid for core products. Only for testing or hyper-niche items. Use White Label to minimize risk. |

| 1,000 Units | $49.50 – $61.00 | Optimized material cuts; partial automation; stable QC. | Ideal entry point for Private Label. Balance cost savings with manageable inventory risk. |

| 5,000 Units | $41.50 – $53.00 | Full automation utilization; bulk material discounts; lean logistics. | Maximize margin for volume sellers. Requires 6-month demand forecast. Target manufacturers with >10,000㎡ facilities. |

Critical Footnotes:

– +5-8% for Private Label vs. White Label at same MOQ (custom tooling amortization).

– +12-18% for FSC-certified wood or recycled metal frames.

– -7-10% possible with 12-month rolling forecasts (per SourcifyChina Preferred Partner Program).

– QC costs: Budget 3-5% of order value for 3rd-party inspections (e.g., SGS, QIMA).

IV. Sourcing Action Plan for Procurement Managers

- Prioritize Private Label for Core SKUs: Build defensible margins despite higher initial investment.

- Demand Full Cost Transparency: Require itemized quotes (materials by grade, labor hours, packaging specs).

- Leverage MOQ Tiers Strategically: Use 1,000-unit batches for new products; scale to 5,000+ for staples.

- Audit Sustainability Credentials: 68% of EU/US retailers now mandate chain-of-custody certifications (e.g., FSC, PEFC).

- Partner with Integrated Manufacturers: Target factories with in-house design (ODM), wood processing, and finishing to reduce supply chain fragility.

2026 Market Warning: Rising energy costs in Guangdong (+14% electricity tariffs) are shifting production inland. Verify supplier location viability to avoid hidden logistics costs.

Conclusion

China’s furniture manufacturing ecosystem offers unparalleled scale and expertise, but cost advantages now hinge on strategic supplier segmentation and total landed cost discipline. White Label suits tactical, low-risk entries, while Private Label is essential for brand equity and margin resilience. With MOQ-driven pricing volatility, procurement leaders must align order volumes with demand forecasting rigor—and never prioritize unit cost over quality control.

For SourcifyChina’s vetted manufacturer list (pre-qualified for compliance, capacity, and export experience), contact your Strategic Sourcing Advisor. All data reflects Q1 2026 projections based on PBoC industrial reports and SourcifyChina transaction analytics.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This report is confidential. © 2026 SourcifyChina. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer from the China Furniture Company List

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing furniture from China offers significant cost advantages, but risks remain due to misrepresentation, quality inconsistencies, and supply chain opacity. A growing number of entities on China furniture company lists are trading companies posing as factories, which can compromise pricing transparency, lead times, and quality control. This report outlines a structured verification process to identify authentic manufacturers, distinguish them from trading companies, and avoid common red flags.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Business License & Factory Registration | Confirm legal entity and factory status | Request scanned copy of the Business License (营业执照) with Unified Social Credit Code. Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). |

| 1.2 | Conduct On-Site or Third-Party Audit | Physically verify production capabilities | Schedule an on-site visit or hire a third-party inspection agency (e.g., SGS, TÜV, QIMA) for factory audit, including machinery, workforce, and workflow. |

| 1.3 | Request Production Floor Photos & Videos | Assess real-time operations | Ask for timestamped, geotagged photos/videos of CNC machines, assembly lines, sanding, finishing, and packaging. Demand live video tour via Zoom/WeChat. |

| 1.4 | Review Export History & Client References | Validate export experience and reliability | Request 3–5 verifiable export references (preferably in your region). Contact references to confirm delivery timelines, quality, and communication. |

| 1.5 | Verify Factory Address via Satellite & Local Maps | Cross-check physical existence | Use Google Earth, Baidu Maps, or Gaode Maps to confirm factory location, size, and infrastructure. Look for loading docks, warehouse space, and worker facilities. |

| 1.6 | Check for OEM/ODM Capabilities | Confirm customization and design support | Ask for sample development timelines, CAD design process, and mold/tooling ownership documentation. |

| 1.7 | Audit Quality Control Protocols | Ensure consistent product standards | Request QC checklist, AQL standards, in-line inspection process, and final random inspection (FRI) procedures. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., furniture production, wood processing) | Lists trading, import/export, or sales – no production terms |

| Facility Ownership | Owns production floor, machinery, and raw material inventory | Leases office space; no machinery or raw materials on-site |

| Production Control | Direct control over design, tooling, labor, and scheduling | Relies on subcontracted factories; limited control over production |

| Pricing Structure | Quotes based on material + labor + overhead; lower MOQs possible | Adds markup (15–40%); higher MOQs due to supplier constraints |

| Communication Depth | Engineers and supervisors available for technical discussions | Sales reps only; limited technical knowledge |

| Sample Development | Can produce custom prototypes in 7–14 days | Samples take 2–4 weeks; sourced externally |

| Facility Evidence | Provides factory tour, machine brand names (e.g., Homag, SCM), and workforce count | Offers showroom visits only; avoids production area |

Pro Tip: Ask: “Can you show me the CNC router cutting our sample right now?” A factory can comply. A trading company cannot.

3. Red Flags to Avoid When Sourcing from China Furniture Lists

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or hidden costs | Benchmark against industry averages; request material specification sheets |

| No Physical Address or Virtual Office | High risk of fraud or shell company | Verify via satellite imagery and local map services |

| Refusal of Factory Audit or Video Tour | Conceals lack of production capability | Treat as disqualifier; proceed only with verified access |

| Generic Product Catalogs with Stock Images | Likely a trading company or middleman | Demand custom catalog with factory-specific items and real photos |

| Pressure for Upfront Full Payment | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Poor English Communication & Delayed Responses | Indicates weak operational management | Evaluate responsiveness over 1–2 weeks; assess clarity and professionalism |

| No Experience with Your Target Market | Risk of non-compliance (e.g., CARB, FSC, REACH) | Confirm certifications and past shipments to EU, US, or AU |

4. Best Practices for Procurement Managers

- Use Verified Sourcing Platforms: Leverage platforms like Alibaba Gold Suppliers (with onsite check verification), Made-in-China, or Thomasnet with third-party validation.

- Engage Local Sourcing Agents: Hire independent agents in Guangdong, Zhejiang, or Shanghai with proven furniture industry experience.

- Require Certifications: Demand FSC, ISO 9001, BIFMA (for commercial furniture), and SGS test reports for finishes and emissions.

- Start with Small Trial Orders: Test quality, packaging, and shipping before scaling.

- Implement a Vendor Scorecard: Track performance on quality, on-time delivery, communication, and problem resolution.

Conclusion

The China furniture market remains a strategic sourcing destination, but due diligence is non-negotiable. By systematically verifying manufacturer authenticity, differentiating factories from traders, and avoiding common red flags, procurement managers can secure reliable, cost-effective, and scalable supply chains. Trust, but verify—every time.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

Q1 2026 Edition – Confidential for B2B Use

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

EXECUTIVE SUMMARY: OPTIMIZE CHINA FURNITURE SOURCING IN 2026

Global supply chain volatility, rising compliance demands, and compressed procurement cycles demand precision sourcing. Traditional methods for identifying Chinese furniture suppliers result in 70+ hours wasted per RFQ on unverified leads, quality failures, and compliance gaps. SourcifyChina’s Verified Pro List eliminates these inefficiencies through AI-driven validation and on-ground due diligence.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST SAVES CRITICAL TIME

Procurement managers using our Pro List bypass 3 high-cost pitfalls of conventional sourcing:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 80+ hours vetting unverified Alibaba/Google leads | Pre-qualified suppliers with factory audits, export licenses, and MOQ transparency | 65+ hours per RFQ |

| 30% risk of quality failures due to unvalidated capabilities | 100% suppliers with 3rd-party quality control reports & production capacity verification | 22+ hours rework/crisis management |

| Manual compliance checks (BIFMA, FSC, REACH) | Real-time compliance dashboards with documented certifications | 15+ hours per supplier onboarding |

Total Annual Impact: Procurement teams deploying our Pro List accelerate sourcing cycles by 42% while reducing supplier-related defects by 68% (2025 Client Data).

2026 SOURCING IMPERATIVES: WHY TIMELY VERIFICATION MATTERS

- Supply Chain Fragmentation: 61% of Chinese furniture exporters shifted production post-2024 tariffs (China Furniture Association). Unverified lists risk partnering with non-operational facilities.

- ESG Compliance: EU Deforestation Regulation (EUDR) enforcement surged in 2026. 74% of non-verified suppliers lack traceable timber documentation.

- Cost Volatility: Real-time freight/FOB updates in our Pro List prevent 12-18% margin erosion from outdated pricing.

“SourcifyChina’s Pro List cut our supplier onboarding from 14 weeks to 9 days. We now source with confidence, not compromise.”

— Director of Global Sourcing, Fortune 500 Home Goods Retailer

CALL TO ACTION: SECURE YOUR 2026 SOURCING ADVANTAGE

Stop negotiating with unverified risks. Start scaling with guaranteed capacity.

Your next furniture sourcing cycle shouldn’t hinge on guesswork. SourcifyChina’s Verified Pro List delivers:

✅ 1,200+ pre-audited factories with live production capacity data

✅ Compliance-ready profiles (FSC, CARB, BIFMA, ISO)

✅ Dedicated sourcing engineers for technical alignment

Act Now to Avoid Q1 2026 Capacity Crunches:

1. Email [email protected] with subject line “PRO LIST ACCESS – [Your Company]” for immediate credential verification.

2. WhatsApp +86 159 5127 6160 to schedule a 15-minute discovery call and receive:

– Free Tier 1 Supplier Match Report (3 pre-vetted factories for your specifications)

– 2026 Furniture Sourcing Risk Mitigation Checklist

Deadline: Pro List access for Q1 2026 allocations closes January 31, 2026. 87% of 2025 priority slots were claimed by November.

SOURCIFYCHINA: WHERE GLOBAL PROCUREMENT MEETS CHINA’S MANUFACTURING REALITY

Operational Resilience | Zero-Tolerance Verification | 14.3 Years Market Intelligence

ℹ️ Verified. Not Vouched. Our Pro List is updated quarterly via on-ground audits – no self-reported data.

🔒 All client engagements adhere to ISO 20400 Sustainable Procurement Standards.

Contact now to transform sourcing from a cost center to a strategic asset.

📧 [email protected] | 📱 +86 159 5127 6160 (24/7 Sourcing Support)

🧮 Landed Cost Calculator

Estimate your total import cost from China.