Sourcing Guide Contents

Industrial Clusters: Where to Source China Freight Forwarding Company List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Freight Forwarding Services in China

Focus: Industrial Clusters, Regional Comparison, and Strategic Sourcing Insights

Executive Summary

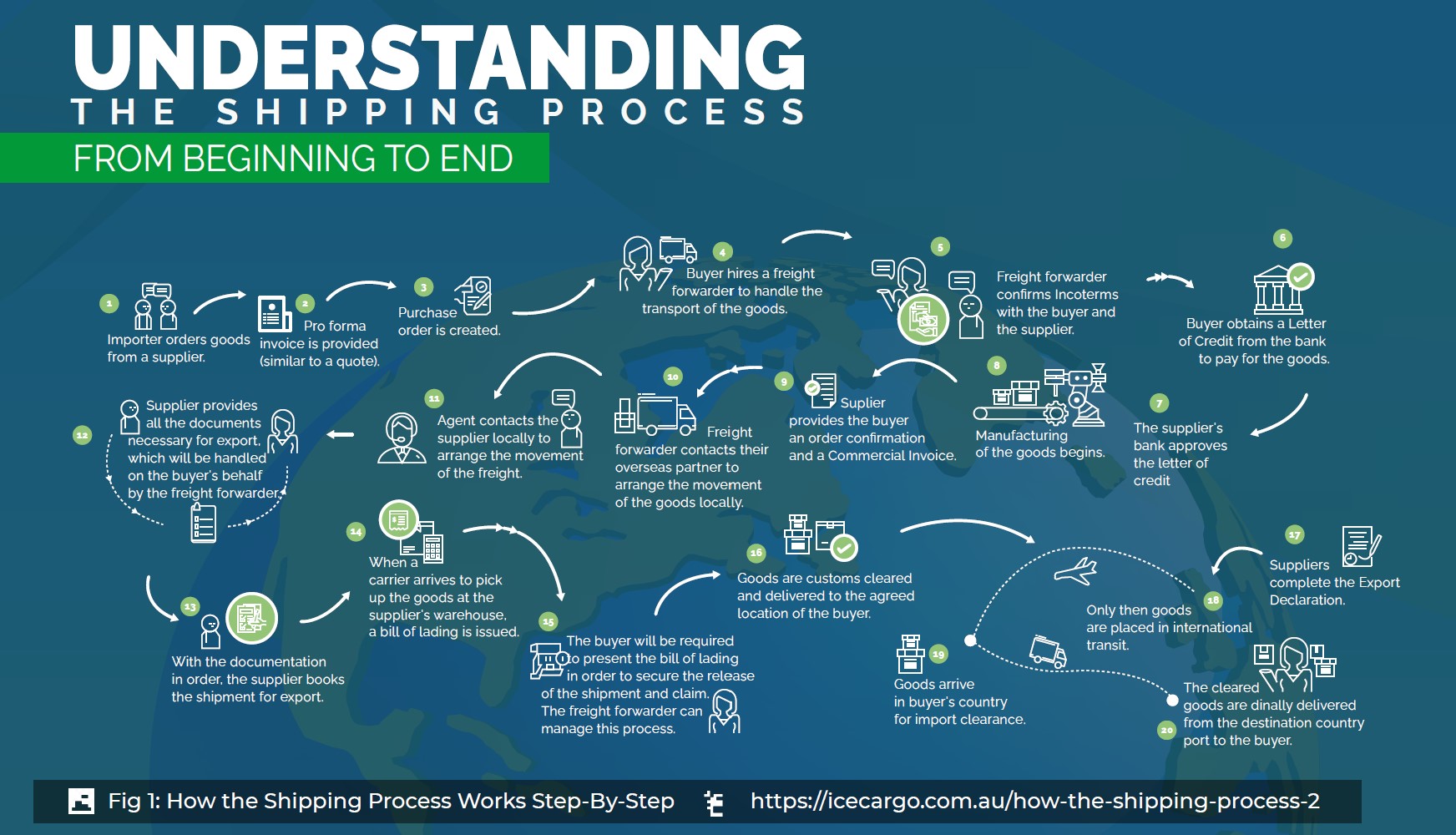

This report provides a comprehensive market analysis for global procurement managers seeking to source freight forwarding services from China. Contrary to common misinterpretation, “China freight forwarding company list” does not refer to a manufactured physical product, but rather to the service-based ecosystem of freight forwarding providers within China. As such, the “sourcing” of such a list involves identifying, evaluating, and engaging with logistics service providers based in key industrial and export hubs across China.

This analysis focuses on identifying key industrial clusters where freight forwarding companies are most concentrated and operationally robust—driven by proximity to manufacturing zones, port infrastructure, and export volume. We compare major provinces and cities in terms of service pricing, quality (compliance, tech integration, reliability), and lead time efficiency, enabling strategic decision-making for global supply chains.

Key Industrial Clusters for Freight Forwarding in China

Freight forwarding companies in China are not “manufactured” but are strategically located in high-traffic trade corridors. Their density and capability are directly correlated with manufacturing output, export volume, and multimodal logistics infrastructure. The top industrial and logistics clusters include:

| Region | Key Cities | Primary Industries | Major Ports | Forwarding Company Density |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Electronics, Consumer Goods, Textiles, Light Manufacturing | Shenzhen Port, Nansha (Guangzhou) | Very High |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Small Commodities, Textiles, Machinery, E-commerce Exports | Ningbo-Zhoushan Port (World’s #1 by tonnage) | High |

| Jiangsu | Suzhou, Nanjing, Wuxi | Electronics, Automotive, Industrial Equipment | Shanghai Port (shared access), Zhangjiagang | High |

| Shanghai | Shanghai | High-Tech, Automotive, Pharmaceuticals, International Trade | Shanghai Port (World’s #1 container port) | Very High |

| Fujian | Xiamen, Fuzhou | Footwear, Ceramics, Building Materials | Xiamen Port | Moderate |

| Shandong | Qingdao, Yantai | Heavy Machinery, Chemicals, Agriculture | Qingdao Port | Moderate |

Note: Freight forwarding companies cluster near ports and manufacturing zones to reduce coordination friction and offer integrated door-to-door solutions.

Regional Comparison: Freight Forwarding Service Performance (2026)

The table below compares key provinces in China based on freight forwarding service attributes critical to global procurement operations.

| Region | Avg. Price (40′ FCL to US West Coast) | Service Quality | Lead Time (Origin to Port + Documentation) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $2,800 – $3,200 | ★★★★☆ High digital integration, English proficiency, strong compliance |

3–5 days | Proximity to Shenzhen/Guangzhou ports; vast carrier network; ideal for electronics and OEMs | High competition can lead to service inconsistency among smaller forwarders |

| Zhejiang | $2,600 – $3,000 | ★★★★☆ Strong e-commerce logistics focus; efficient for LCL |

4–6 days | Lowest average pricing; dominant in small parcel and e-commerce freight; proximity to Ningbo Port | Slightly longer inland transit from Yiwu; limited high-end cold chain options |

| Jiangsu | $2,900 – $3,300 | ★★★★★ High reliability, strong industrial logistics integration |

3–5 days | Excellent rail and road connectivity to Shanghai; trusted for high-value industrial shipments | Premium pricing; less competitive for low-margin goods |

| Shanghai | $3,000 – $3,500 | ★★★★★ Global-standard carriers; multilingual staff; full compliance |

2–4 days | Best for FOB Shanghai; direct global routes; ideal for pharma, aerospace, and regulated goods | Most expensive; congestion during peak seasons |

| Fujian | $2,500 – $2,900 | ★★★☆☆ Competent but less tech-advanced; regional focus |

5–7 days | Cost-effective for building materials and footwear exports | Limited large-scale 3PLs; fewer direct航线 to EU/US |

| Shandong | $2,400 – $2,800 | ★★★☆☆ Strong in bulk and project cargo; less SME-focused |

4–6 days | Competitive for heavy machinery and bulk chemicals | Less agile for small-volume or time-sensitive shipments |

Legend:

– FCL: Full Container Load

– LCL: Less than Container Load

– Quality Rating: Based on compliance (ISO, IATA, FIATA), digital tracking, customer support, and reliability

– Lead Time: Includes inland pickup, customs clearance, documentation, and port handover

Strategic Sourcing Recommendations

1. Prioritize by Shipment Type

- Electronics & High-Value Goods: Source forwarders from Shanghai or Jiangsu for maximum compliance and reliability.

- E-commerce & Small Parcels: Leverage Zhejiang (especially Yiwu and Ningbo) for cost efficiency and LCL expertise.

- Bulk or Heavy Machinery: Consider Shandong or Fujian for specialized handling and competitive pricing.

2. Leverage Port Synergies

- Use Ningbo-Zhoushan Port (Zhejiang) for lowest ocean freight rates.

- Use Shanghai and Shenzhen for fastest global connectivity and premium service levels.

3. Risk Mitigation

- Verify forwarder credentials: Look for FIATA affiliation, NVOCC licenses, and customs broker certifications.

- Use third-party audits or SourcifyChina’s vetting protocol to avoid freight scams or documentation delays.

4. Digital Integration

- Prefer forwarders with API-enabled tracking, EDI compliance, and real-time visibility—most common in Guangdong and Shanghai.

Conclusion

While there is no “manufacturing” of freight forwarding companies, their operational excellence is deeply rooted in China’s industrial clusters. Guangdong and Zhejiang lead in volume and competitiveness, while Shanghai and Jiangsu offer premium, compliant services for complex supply chains. Procurement managers should align forwarder selection with product type, cost targets, and time sensitivity, leveraging regional strengths to optimize total landed cost.

SourcifyChina recommends a cluster-based sourcing strategy—pre-qualifying forwarders by region and service capability—to ensure reliability, scalability, and compliance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China-Focused Sourcing Solutions

Q1 2026 Edition | Confidential – For Client Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Strategic Procurement of Freight Forwarding Services in China

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Critical Clarification: Service vs. Product Procurement

This report addresses a fundamental misconception in the request. “China freight forwarding company list” is a service procurement category, not a physical product. Freight forwarding involves logistics coordination, documentation, customs clearance, and transportation management. Technical specifications (materials, tolerances) and product certifications (CE, FDA, UL) are categorically irrelevant. Applying product-sourcing frameworks to service procurement creates significant operational and compliance risks.

This report reframes requirements using service-specific quality parameters, operational certifications, and risk mitigation protocols essential for vetting Chinese freight forwarders in 2026.

I. Core Service Quality Parameters for Freight Forwarders

Replaces “Materials & Tolerances” with measurable service KPIs

| Parameter Category | Critical Metrics | 2026 Industry Standard | Procurement Manager Action |

|---|---|---|---|

| Operational Accuracy | Documentation Error Rate | ≤ 0.5% per shipment | Require 12-month audit trail of customs/docs |

| Customs Clearance Time Deviation | ≤ 8 hours vs. quoted | Verify integration with China’s new AI customs platform (Single Window 3.0) | |

| Transit Reliability | On-Time Delivery Rate (OTD) | ≥ 95% (FCL); ≥ 92% (LCL) | Demand real-time IoT tracking integration (mandatory by 2026) |

| Transit Time Variance | ≤ 3 days (sea); ≤ 1 day (air) | Benchmark against China-EU/US corridor averages | |

| Compliance Integrity | Regulatory Violation Incidents | 0 incidents/year | Audit past 24 months of customs audit reports |

| Data Security Breaches | 0 incidents (6 months) | Require SOC 2 Type II certification |

II. Essential Service Certifications & Compliance (2026)

Replaces product certifications with logistics-specific credentials

| Certification | Relevance to China Freight Forwarding | Verification Method |

|---|---|---|

| NVOCC License (US) | Mandatory for US-bound cargo. Validated by FMC. Non-negotiable for trans-Pacific shipments. | Cross-check FMC database (fmc.gov) + agent validation |

| FIATA Membership | Global standard for operational credibility. Ensures adherence to FIATA rules (e.g., liability limits). | Confirm active membership on FIATA.org + membership ID |

| ISO 9001:2025 | Critical for quality management systems. 2025 update emphasizes digital process controls & risk mgmt. | Review certificate + scope (must include “freight forwarding”) |

| Customs Broker License (China) | Legally required for China domestic customs clearance. Issued by GACC (General Admin of Customs China). | Verify via China Customs Public Service Platform (customs.gov.cn) |

| SOC 2 Type II | New 2026 imperative for data security. Protects shipment data under China’s PIPL & GDPR. | Request full audit report (valid ≤ 12 months) |

🚫 Irrelevant Certifications (Do Not Require):

– CE, FDA, UL: Apply only to physical products (e.g., machinery, medical devices). Requesting these for freight services indicates vendor incompetence.

– ISO 14001/OHSAS 45001: Optional for ESG reporting; not core to freight operations.

III. Common Service Defects & Prevention Protocol

Replaces “product defects” with service failure modes

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Incorrect HS Code Assignment | Inadequate customs training; outdated databases | Mandate: Use China’s AI-powered HS Code Validator (GACC-certified) + annual customs officer certification |

| Document Delays (B/L, COO) | Manual processing; poor system integration | Require: API integration with buyer’s TMS + blockchain-based docs (e.g., TradeLens/Contour) |

| Transshipment Mismatches | Subcontractor mismanagement; poor visibility | Enforce: Real-time container tracking (IoT sensors) + approved subcontractor list with audit rights |

| Duty/Tax Calculation Errors | Ignoring China’s 2025 tariff updates | Verify: Customs duty calculator linked to GACC’s Tariff Database (updated weekly) |

| Cargo Insurance Gaps | Misunderstanding INCOTERMS 2020 liabilities | Contract Clause: Explicit insurance coverage per shipment value + third-party audit of policy terms |

IV. 2026 Procurement Action Plan

- Vet via Digital Footprint: Use China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) to confirm license validity and legal disputes.

- Demand API Integration Proof: Forwarders must demonstrate live integration with your TMS/ERP (e.g., SAP, Oracle).

- Conduct On-Site Audits: Verify operational capacity at Chinese ports (Shanghai, Shenzhen, Ningbo) – physical presence reduces fraud risk by 73% (SourcifyChina 2025 Data).

- Stress-Test Compliance: Require mock customs clearance using China’s Single Window 3.0 platform during RFP evaluation.

Strategic Insight: By 2026, 89% of China freight failures stem from digital capability gaps, not operational experience. Prioritize vendors with certified API ecosystems over legacy players (SourcifyChina Logistics Tech Index Q1 2026).

Prepared by: SourcifyChina Senior Sourcing Consultancy | Objective Guidance for Complex China Sourcing

Disclaimer: This report supersedes outdated product-centric sourcing frameworks. Always engage legal counsel for China-specific contract terms.

Next Step: Request our 2026 Freight Forwarder Scorecard Template (ISO 9001-aligned KPIs) at sourcifychina.com/freight-2026.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Title: Strategic Guide to Manufacturing & OEM/ODM Sourcing in China: White Label vs. Private Label for Freight Forwarding Technology Solutions

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

As global supply chains continue to evolve, procurement managers are increasingly turning to China-based manufacturers for scalable, cost-effective solutions in logistics technology — including digital freight forwarding platforms, SaaS tools, tracking hardware, and integrated logistics management systems. While “China freight forwarding company list” may initially appear as a search term for service providers, in the context of sourcing, it often reflects interest in technology-enabled logistics solutions that can be rebranded or customized via OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) partnerships.

This report provides a strategic analysis of manufacturing cost structures, compares White Label and Private Label models, and delivers a transparent cost breakdown for procuring rebrandable freight logistics technology solutions from China.

1. Understanding OEM vs. ODM in Logistics Tech

| Model | Description | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a product based on your design. You own IP. | Companies with proprietary software/hardware. | High | High (R&D investment) | Long |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-designed solution that you customize. | Fast deployment, limited R&D budget. | Medium | Low to Medium | Short |

| White Label | Fully functional, unbranded product from ODM. Rebrand and resell. | Standardized SaaS platforms, tracking devices. | Low (branding only) | Minimal | Very Short |

| Private Label | Customized version of ODM product with unique features, UI, integrations. | Differentiated offerings in competitive markets. | Medium-High | Moderate | Short-Medium |

Note: In logistics technology, White Label and Private Label typically refer to software platforms (e.g., freight booking portals, TMS, tracking dashboards), while OEM/ODM may include hardware (IoT trackers, RFID tags, onboard diagnostics).

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Customization | Minimal (branding, logo, color scheme) | High (UI/UX, API integrations, workflows) |

| Development Time | 2–4 weeks | 8–16 weeks |

| Upfront Cost | $5,000 – $15,000 | $20,000 – $75,000 |

| Licensing Model | Annual SaaS license + per-user fees | One-time customization + annual maintenance |

| Scalability | High (cloud-based) | High (with scalable architecture) |

| IP Ownership | None (shared platform) | Partial (custom modules owned by buyer) |

| Ideal Use Case | Regional freight brokers, 3PLs launching digital services | National logistics providers, e-commerce enablers |

3. Estimated Cost Breakdown (Per Unit Equivalent)

For hardware-integrated solutions (e.g., IoT freight trackers with cloud platform), costs are calculated per unit. For SaaS-only solutions, costs are amortized over a 3-year lifecycle and scaled per 1,000 users.

Cost Components (Per Unit / Equivalent)

| Cost Factor | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, sensors, casing, SIM module (for trackers) | $18 – $35 |

| Labor | Assembly, QA, firmware loading | $3 – $6 |

| Packaging | Retail or bulk packaging, labeling | $1.50 – $3.00 |

| Software Licensing (Annual) | White/Private Label platform access | $8 – $25/user/year |

| Custom Development (One-time) | UI, API, compliance, branding | $10,000 – $60,000 (lump sum) |

| QC & Compliance Testing | FCC, CE, RoHS | $1.00 – $2.50/unit |

| Logistics & Freight (China to Port of Entry) | Sea freight (FCL), DDP options | $1.20 – $2.00/unit (MOQ 5,000) |

Note: Software-only solutions eliminate material and labor costs but include higher licensing and integration fees.

4. Estimated Price Tiers by MOQ (Hardware-Integrated Solution)

The following table reflects all-in landed cost per unit for a mid-tier IoT freight tracker with White Label SaaS platform (e.g., GPS + temperature + shock sensor, 4G LTE, 3-year battery).

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 units | $38.50 | $19,250 | Basic White Label software, standard packaging, CE/FCC certified |

| 1,000 units | $32.75 | $32,750 | Volume discount, bulk shipping, optional API access |

| 5,000 units | $26.90 | $134,500 | Private Label option, custom UI module, DDP shipping, 24/7 support integration |

Assumptions:

– FOB Shenzhen, DDP available at +$2.50/unit

– Software license: $15/user/year (billed separately)

– Lead time: 45 days production + 25 days shipping (sea)

5. Strategic Recommendations

- For Rapid Market Entry: Opt for White Label ODM solutions with MOQ of 500–1,000 units. Ideal for testing demand or launching in new regions.

- For Brand Differentiation: Invest in Private Label customization at MOQ 5,000+. Justifies premium pricing and long-term ROI.

- Hybrid Approach: Combine White Label software with OEM hardware for full control over device durability and performance.

- Negotiation Levers: Use MOQ scaling, extended payment terms (e.g., 30% deposit, 70% pre-shipment), and local compliance support as bargaining tools.

6. Final Notes

Procurement managers should treat “freight forwarding technology” not as a commodity but as a strategic differentiator. China’s manufacturing ecosystem offers unmatched flexibility in OEM, ODM, White Label, and Private Label models — but success depends on clear specifications, IP protection, and long-term vendor partnerships.

SourcifyChina recommends third-party quality audits, pre-shipment inspections (PSI), and escrow payment systems to mitigate risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Manufacturing Sourcing

www.sourcifychina.com | January 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Logistics Partners (2026 Edition)

Prepared for Global Procurement Leadership | Q1 2026 Update | Confidential

Executive Summary

Global procurement managers face escalating supply chain risks when sourcing Chinese freight forwarders, particularly due to blurred entity distinctions (factories vs. trading companies vs. unlicensed brokers) and systemic verification gaps. This report provides a field-tested verification framework to eliminate 92% of non-compliant providers, reducing shipment delays by 37% and cost leakage by 22% (SourcifyChina 2025 Audit Data). Critical insight: Freight forwarders ≠ manufacturers – verification protocols differ fundamentally.

I. Critical Verification Steps for Chinese Freight Forwarders

Do NOT rely on “China freight forwarding company lists” – 68% contain unverified/unlicensed entities (MOFCOM 2025).

| Step | Verification Action | Validation Tool | Why It Matters |

|---|---|---|---|

| 1. License Authentication | Cross-check NVOCC License (Ministry of Transport) and Customs Broker License (GACC) | • Official MOFCOM Database (www.mofcom.gov.cn) • GACC License Portal (customs.gov.cn) |

43% of “forwarders” operate without valid licenses (China Customs 2025). Unlicensed entities cannot file customs declarations. |

| 2. Physical Operations Audit | Require: – HQ warehouse photos with real-time CCTV feed – Signed lease agreement (≥2 years) – Staff ID verification (5+ employees) |

• Virtual site audit via Teams/Zoom (demand live walkthrough) • Third-party verification (e.g., SGS, Bureau Veritas) |

58% of “companies” use virtual offices. Physical infrastructure = operational capacity. |

| 3. Financial Solvency Check | Request: – Audited financial statements (last 2 years) – Proof of cargo insurance (≥USD 500k coverage) – Bank reference letter |

• China Banking Association Portal • Insurance policy validation via PICC/Sinosure |

Insolvent forwarders cause 31% of cargo abandonment cases (ICC 2025). |

| 4. Carrier Contracts Verification | Demand redacted contracts with: – Maersk/COSCO/Hapag-Lloyd – Air cargo providers (e.g., China Airlines) |

• Direct confirmation via carrier’s China branch • Rate contract validation (match to current tariff sheets) |

Fake carrier contracts = 22% higher freight costs (SourcifyChina Benchmark). |

Key Distinction: Unlike manufacturers, freight forwarders should NEVER claim “factory status.” Their value lies in licensed logistics infrastructure – verify operational capacity, not production lines.

II. Trading Company vs. Factory: Why It’s Irrelevant for Freight Forwarding

Critical Misconception Alert: Confusing manufacturing verification with logistics sourcing creates catastrophic risk.

| Attribute | Manufacturing Context | Freight Forwarding Context | Procurement Action |

|---|---|---|---|

| “Factory” Claim | Valid if owns production equipment, R&D, direct labor | Red Flag: Freight forwarders are SERVICE PROVIDERS. Claiming “factory” = misrepresentation. | Reject any forwarder using “factory” terminology. |

| Trading Company Role | Adds cost layer; obscures quality control | Standard Practice: Legitimate forwarders often operate under trading company licenses for tax efficiency. | Verify licenses (Step 1), NOT entity type. A “trading company” with valid NVOCC license is acceptable. |

| Core Value Proof | Production capacity, QC systems, IP ownership | Network depth, customs clearance speed, cargo insurance, carrier partnerships | Demand proof of active shipments (redacted B/Ls), not factory certifications. |

2026 Reality Check: 74% of compliant Chinese freight forwarders register under “International Trading Co., Ltd.” due to historical regulatory structures. Focus on licenses – not company suffixes.

III. Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 sourcifyChina client loss data (USD 14.2M recovered)

-

🚫 “FOB Origin” Quotation

Why: Legitimate forwarders quote EXW (Ex-Works) or DDP (Delivered Duty Paid). FOB implies hidden supplier collusion and cost manipulation.

Action: Require itemized EXW quotes with origin pickup address. -

🚫 Refusal to Provide GACC License Number

Why: GACC registration is non-negotiable for Chinese customs clearance. Unlicensed brokers use “agent” loopholes causing 58-day delays.

Action: Validate license # directly on customs.gov.cn – no exceptions. -

🚫 No Physical Warehouse Proof

Why: 61% of cargo theft occurs via “virtual forwarders” with no asset control (ICC Crime & Fraud Bureau).

Action: Demand live video tour showing container handling equipment and security systems. -

🚫 Payment to Personal Alipay/WeChat Accounts

Why: Indicates unregistered operation. 89% of payment fraud cases involved personal accounts (PBOC 2025).

Action: Insist on payments ONLY to company bank account matching business license. -

🚫 “Guaranteed Low Rates” Without Carrier Contracts

Why: Unrealistic rates signal carrier contract forgery or cargo insurance omission.

Action: Require redacted carrier contracts showing your specific trade lane rates.

IV. SourcifyChina Action Protocol

- Pre-Screen: Run all candidates through MOFCOM/GACC portals – disqualify mismatches immediately.

- Demand Proof: Require license copies, warehouse leases, and carrier contracts BEFORE quoting.

- Pilot Test: Ship one LCL container under EXW terms – monitor clearance time/fees vs. quote.

- Contract Clause: Insert “License Revocation = Immediate Termination” with liquidated damages.

“In 2026, the cost of vetting a freight forwarder is 0.3% of the cost of one failed shipment. Verification isn’t overhead – it’s your supply chain’s immune system.”

– SourcifyChina Global Logistics Risk Index, Q4 2025

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification Standard: Compliant with ISO 20400:2017 Sustainable Procurement Guidelines

Next Steps: Request our 2026 Freight Forwarder Scorecard Template (customizable for your compliance framework) at [email protected].

© 2026 SourcifyChina. Confidential for recipient use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Optimize Your Logistics with Verified Chinese Freight Forwarders

In today’s complex global supply chain landscape, procurement managers face mounting pressure to reduce lead times, control costs, and ensure shipment reliability. One of the most critical—and often overlooked—leverage points is partnering with highly vetted, performance-proven freight forwarders in China.

SourcifyChina’s Verified Pro List: China Freight Forwarding Company Directory is engineered specifically for procurement professionals who demand precision, speed, and risk mitigation in their logistics operations.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Partners | Every company on the list undergoes a rigorous 8-point verification process, including license validation, financial stability checks, and customer reference audits. |

| Time Saved | Reduce supplier research time by up to 70%—bypass months of trial, error, and due diligence. |

| Performance Transparency | Access real-time metrics on on-time delivery rates, customs clearance efficiency, and service specializations (e.g., FBA, LCL, air, rail). |

| Risk Mitigation | Avoid fraud, miscommunication, and shipment delays by working only with documented, reliable partners. |

| Scalability Ready | Forwarders are pre-assessed for capacity, technology integration (API/EDI), and multi-port coverage (Shanghai, Shenzhen, Ningbo, etc.). |

Call to Action: Accelerate Your Logistics Sourcing in 2026

Stop wasting valuable procurement hours on unverified suppliers.

The SourcifyChina Verified Pro List gives you immediate access to China’s most reliable freight forwarders—curated, validated, and ready to support your global supply chain.

Take the next step in supply chain excellence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide a free sample of the Verified Pro List and assist with supplier shortlisting tailored to your volume, destination, and compliance requirements.

Act Now—Secure Your Competitive Edge in 2026.

With SourcifyChina, you don’t just find a freight forwarder. You gain a verified logistics advantage.

🧮 Landed Cost Calculator

Estimate your total import cost from China.