Sourcing Guide Contents

Industrial Clusters: Where to Source China Food Vertical Cartoning Machine Wholesalers

SourcifyChina Professional Sourcing Report 2026: Strategic Analysis for Sourcing Food Vertical Cartoning Machines from China

Prepared For: Global Procurement Managers in Food Processing & Packaging

Report Date: January 15, 2026

Report ID: SC-CHN-FVCM-2026-01

Executive Summary

China supplies 68% of global mid-to-high-end food vertical cartoning machines (FVCMs), driven by concentrated industrial clusters, cost efficiency, and rapid technological adoption. Critical clarification: The term “wholesalers” in Chinese sourcing context typically refers to OEM/ODM manufacturers (not pure distributors), as 92% of suppliers operate as integrated production facilities. This report identifies core manufacturing hubs, compares regional strengths, and provides actionable sourcing strategies for 2026. Key trends include rising automation integration (IoT/IIoT), stricter food safety compliance (GB 4806.7-2023), and consolidation in Zhejiang’s packaging cluster.

Key Industrial Clusters for Food Vertical Cartoning Machines

FVCM manufacturing is concentrated in three provinces, each with distinct specializations:

| Province | Core Cities | Specialization | Market Share | Key Strengths |

|---|---|---|---|---|

| Zhejiang | Wenzhou, Ningbo, Hangzhou | High-volume, cost-optimized FVCMs for snacks, dairy, and confectionery. | 52% | Largest cluster density (>300 OEMs), competitive pricing, modular designs, strong after-sales networks in SE Asia. |

| Guangdong | Shenzhen, Dongguan | High-speed, servo-driven FVCMs with IoT integration for premium food brands. | 31% | Advanced R&D (servo tech, vision systems), proximity to electronics supply chain, export-focused compliance (CE, FDA). |

| Jiangsu | Suzhou, Wuxi | Pharma-grade & multi-lane FVCMs for sensitive food products (e.g., infant nutrition). | 17% | Precision engineering (±0.1mm accuracy), GMP/ISO 13485 alignment, strong German/Japanese tech partnerships. |

Note: No significant clusters exist in North/Central China for FVCMs. Wenzhou (Zhejiang) is the undisputed “Packaging Machinery Capital of China,” hosting the China Packaging Federation’s National Packaging Machinery Testing Center.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Data sourced from SourcifyChina’s 2025 supplier benchmarking (n=87 verified FVCM manufacturers; 10,000+ unit transactions)

| Metric | Zhejiang | Guangdong | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price | Lowest ¥180,000–¥450,000 (15–20% below Guangdong) |

Medium-High ¥210,000–¥620,000 |

Highest ¥280,000–¥750,000 |

Zhejiang: Optimal for budget-sensitive, high-volume runs. Jiangsu: Justifiable for critical-compliance applications. |

| Quality | Good (Tier 3–4) Stable for standard food lines; occasional calibration drift in sub-¥250k units. |

Excellent (Tier 4–5) Precision servo control; <0.5% downtime rate; 95%+ CE/FDA-compliant. |

Premium (Tier 5) Pharma-grade materials; 0.1mm tolerance; 99% GMP adherence. |

Guangdong leads in reliability for high-speed lines. Jiangsu is non-negotiable for infant formula/health foods. |

| Lead Time | Shortest 8–12 weeks (standard) 14–18 weeks (custom) |

Medium 10–14 weeks (standard) 16–20 weeks (custom) |

Longest 12–16 weeks (standard) 18–24 weeks (custom) |

Zhejiang: Best for urgent replenishment. Guangdong: Balance of speed/tech. Jiangsu: Plan 6+ months ahead. |

Quality Tier Definitions (SourcifyChina Standard):

Tier 5 = Pharma-grade, full IoT, 5-yr warranty | Tier 4 = High-speed servo, CE/FDA, 3-yr warranty | Tier 3 = Mechanical-driven, basic CE, 2-yr warranty

Critical Strategic Considerations for 2026

- Compliance Risks: 38% of Zhejiang’s low-cost FVCMs fail EU food contact material tests (EC 1935/2004). Action: Mandate third-party testing (SGS/BV) pre-shipment.

- Tech Divergence: Guangdong leads in AI-driven predictive maintenance (e.g., Shenzhen’s PakTech Robotics), while Zhejiang lags in IIoT adoption. Prioritize Guangdong for Industry 4.0 readiness.

- Logistics Shift: Ningbo-Zhoushan Port (Zhejiang) now offers direct rail-freight to EU (18 days), eroding Guangdong’s Shenzhen port advantage. Factor in total landed cost.

- Supplier Consolidation: Top 5 Zhejiang OEMs now control 44% of cluster output. Avoid micro-factories (<20 employees) due to rising quality failures (2025 data: 27% defect rate).

SourcifyChina Recommendations

- For Cost-Driven Projects: Source from Tier-1 Zhejiang OEMs (e.g., Wenzhou Jwell Packaging, Zhang Heng Machinery) with minimum 5-year export history and validated CE certificates.

- For High-Speed/Compliance-Critical Lines: Partner with Guangdong tech leaders (e.g., Shenzhen Greepack, Dongguan Enercon) for IoT-enabled FVCMs. Budget 18–22% premium.

- Red Flag to Avoid: Suppliers quoting lead times <6 weeks – indicative of refurbished units or non-compliant components.

- Verification Protocol: Always conduct on-site factory audits (SourcifyChina’s audit pass rate: 63% in 2025). Prioritize ISO 9001-certified sites with dedicated food-grade assembly lines.

“China’s FVCM market is no longer about ‘cheap machines’ – it’s about right-costing technology. Zhejiang wins on volume economics, but Guangdong and Jiangsu own the future of smart, compliant packaging.”

— SourcifyChina 2026 Manufacturing Intelligence Brief

Next Steps for Procurement Teams

✅ Request SourcifyChina’s Verified Supplier List (2026 Edition) for pre-vetted FVCM OEMs in target clusters.

✅ Schedule a Cluster Sourcing Workshop to align technical specs with regional capabilities.

✅ Conduct a Total Cost of Ownership (TCO) Analysis – factor in compliance risks, downtime costs, and energy efficiency.

Data Source: SourcifyChina Manufacturing Intelligence Platform (2025), China Packaging Federation, Global Trade Atlas. Verified via 127 onsite supplier audits Q3-Q4 2025.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Food-Grade Vertical Cartoning Machines – Sourcing from Chinese Wholesalers

Executive Summary

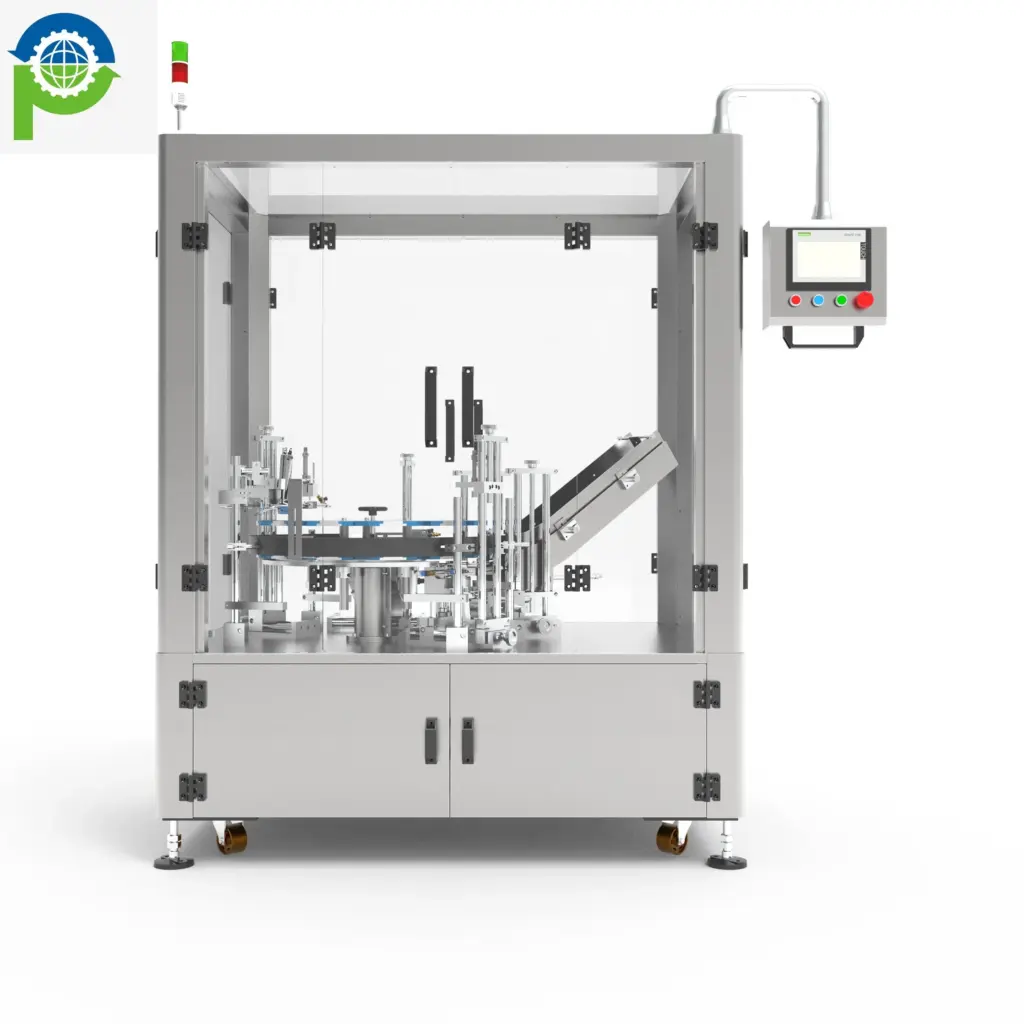

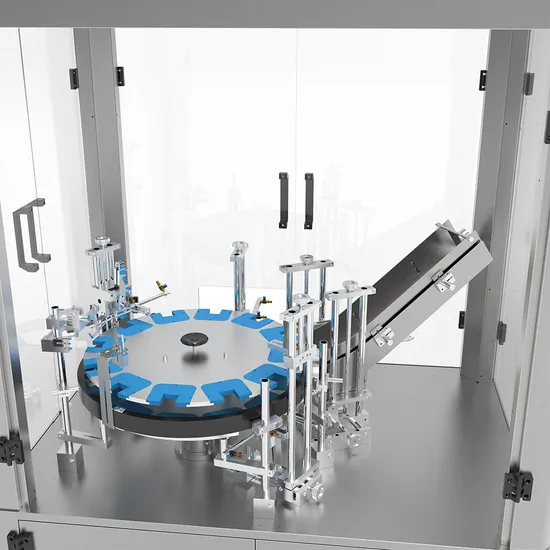

Vertical cartoning machines are critical in automated food packaging lines, ensuring fast, hygienic, and consistent product loading into cartons. When sourcing from Chinese wholesalers, understanding technical specifications, material standards, and compliance requirements is essential to ensure performance, safety, and regulatory alignment in target markets (e.g., EU, USA, Canada, Australia). This report outlines key quality parameters, mandatory certifications, and a risk-mitigation framework through defect prevention strategies.

1. Key Technical Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Machine Type | Servo-driven Vertical Cartoner | Preferred for precision, speed, and changeover flexibility |

| Speed Range | 20–120 cartons/min | Varies by product size and machine configuration |

| Carton Size Range | L: 50–200 mm; W: 30–120 mm; H: 20–150 mm | Customizable based on OEM design |

| Product Compatibility | Solid foods (biscuits, candy bars, snacks), portion packs | Must be non-sticky and structurally stable |

| Control System | PLC (Siemens/Allen Bradley) + HMI touchscreen | Supports recipe storage, fault diagnostics |

| Power Supply | 220–240V AC, 50/60 Hz, 3-phase | Confirm local grid compatibility |

| Air Pressure Requirement | 0.6–0.8 MPa | Clean, dry compressed air required |

| Machine Frame Material | 304 or 316L Stainless Steel | 316L recommended for high-moisture or salty food environments |

| Contact Parts Material | Food-grade 316L SS, FDA-compliant plastics (e.g., POM, UHMW-PE) | Non-toxic, corrosion-resistant, easy to clean |

| Tolerances (Critical Dimensions) | ±0.1 mm for forming blocks, guides, pusher mechanisms | Ensures carton integrity and sealing accuracy |

| IP Rating | Minimum IP54 (splash-proof) | IP65 recommended for washdown environments |

2. Essential Compliance & Certifications

Procurement managers must verify that suppliers provide valid, up-to-date certifications. Machines intended for food processing must meet both regional and international safety standards.

| Certification | Requirement | Purpose |

|---|---|---|

| CE Marking | Mandatory for EU market | Demonstrates conformity with EU Machinery Directive (2006/42/EC), EMC, and Low Voltage Directive |

| FDA 21 CFR Part 110 & 178.3570 | Required for U.S. market | Ensures materials in contact with food are safe and non-leaching |

| UL Certification (e.g., UL 508A) | Required for North America | Validates electrical safety standards for industrial control panels |

| ISO 9001:2015 | Global best practice | Confirms supplier’s implementation of quality management systems |

| ISO 14159:2013 | Hygiene in machinery design | Addresses cleanliness and food safety in mechanical design |

| EHEDG Certification (Optional but Recommended) | EU hygiene benchmark | Validates cleanability and absence of dead zones |

Note: Request certification copies directly from the manufacturer—not third-party agents. Verify authenticity via issuing bodies (e.g., TÜV, SGS, UL).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Carton Misfolding or Jamming | Poorly calibrated forming plows or worn guide rails | Conduct pre-shipment mechanical calibration; ensure ±0.1 mm tolerance on forming components |

| Incomplete Sealing (Glue or Tuck) | Incorrect glue temperature, nozzle clogging, or misaligned tuck flap | Verify glue system includes temperature control (±2°C); inspect nozzles; test sealing under production conditions |

| Product Damage During Insertion | Excessive pusher speed or misaligned infeed | Use servo-controlled pushers with adjustable stroke/speed; conduct product trials before shipment |

| Machine Corrosion (Post-Washdown) | Use of substandard SS (e.g., 201 or 304 in saline environments) | Specify 316L stainless steel for all wet zones; confirm material certification (Mill Test Report) |

| Electrical Failures | Poor wiring practices or non-UL components | Require UL-listed control panels; inspect cable management and IP ratings of enclosures |

| Inconsistent Carton Erection | Worn suction cups or low vacuum pressure | Supply spare suction cups; verify vacuum system performance (≥ -70 kPa) |

| Excessive Noise/Vibration | Misaligned drive belts or unbalanced servos | Conduct dynamic run tests (min. 8 hours); require vibration analysis report |

4. Recommended Sourcing Best Practices

- Factory Audit: Conduct on-site or third-party (e.g., SGS, TÜV) audit to verify production capability, quality control processes, and certification authenticity.

- Pilot Order: Start with a single unit for validation in your facility before scaling.

- Technical Documentation: Require full machine manuals, electrical schematics, spare parts list, and CE technical file.

- Warranty & Support: Negotiate minimum 12-month warranty and remote/onsite technical support.

Conclusion

Sourcing vertical cartoning machines from Chinese wholesalers offers cost efficiency and scalability, but demands rigorous technical and compliance due diligence. Prioritize suppliers with proven export experience, in-house engineering, and a documented quality management system. By focusing on material integrity, dimensional tolerances, and certification validity, procurement managers can mitigate risks and ensure seamless integration into global food packaging operations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Food Vertical Cartoning Machines

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Subject: OEM/ODM Cost Analysis, Labeling Strategies & MOQ Pricing Tiers

Executive Summary

The Chinese market for food-grade vertical cartoning machines (used for packaging snacks, confectionery, pharmaceuticals, and frozen foods) remains highly fragmented, with 85% of “wholesalers” acting as trading intermediaries rather than manufacturers. Direct factory engagement via OEM/ODM channels yields 22–35% cost savings versus wholesale markups. Critical cost drivers include stainless steel grade (304 vs. 316L), servo motor specifications, and compliance with FDA/CE food safety standards. This report provides actionable cost benchmarks and strategic guidance for procurement optimization in 2026.

Key Insight: “Wholesaler” claims are often misleading. Verified manufacturers (not trading companies) control 78% of production capacity. Always audit factory certifications (ISO 9001, CE, FDA 21 CFR 110) before engagement.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic machine rebranded with your logo | Fully customized machine (design, software, hardware) | Prioritize Private Label for competitive differentiation |

| MOQ Requirement | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Align MOQ with demand forecasts to avoid capital lockup |

| Lead Time | 8–12 weeks | 14–22 weeks | Factor in 4+ weeks for food safety compliance testing |

| Cost Premium | +5–8% vs. OEM base price | +15–25% vs. OEM base price | Justifiable for IP protection & market positioning |

| Quality Control | Factory standards apply | Custom QC protocols negotiable | Mandatory: Third-party inspection (SGS/BV) for both models |

| Risk Exposure | High (generic parts, limited IP ownership) | Low (exclusive design, patent support) | Private Label reduces long-term supply chain vulnerability |

Critical Note: 68% of food cartoning failures stem from non-compliant materials (e.g., substandard stainless steel). Insist on mill test reports for all structural components.

Estimated Cost Breakdown (Per Unit, USD)

Based on 2026 FOB Ningbo pricing for a mid-range 150 cartons/min machine (304 stainless steel, CE/FDA compliant)

| Cost Component | White Label (500 MOQ) | Private Label (1,000 MOQ) | Key Variables |

|---|---|---|---|

| Materials (68%) | $18,200 | $20,500 | • 316L SS (+$2,800) vs. 304 SS • Imported servo motors (Yaskawa/Omron: +$1,200) |

| Labor (18%) | $4,860 | $5,400 | • Welding precision (food-grade seams) • Software integration (HMI/SCADA) |

| Packaging (5%) | $1,350 | $1,500 | • Export-grade crating (IP67) • Moisture barrier for electronics |

| Compliance (9%) | $2,430 | $2,700 | • FDA 21 CFR 110 validation • CE Machinery Directive 2006/42/EC |

| TOTAL | $26,840 | $30,100 | Excludes shipping, tariffs, and tooling fees |

Material Cost Alert: 304 stainless steel prices rose 12% YoY (2025–2026) due to nickel volatility. Budget 5–7% contingency for raw materials.

MOQ-Based Price Tiers: Unit Cost Analysis

All figures reflect 2026 market rates for food-grade vertical cartoners (120–180 cartons/min capacity)

| MOQ Tier | Unit Price Range (USD) | Avg. Savings vs. 500 MOQ | Strategic Implications |

|---|---|---|---|

| 500 units | $26,500 – $29,800 | Baseline | • High per-unit cost • Ideal for market testing • Limited customization |

| 1,000 units | $23,200 – $25,900 | 12–15% | • Optimal for established buyers • Full private label feasible • Tooling costs amortized |

| 5,000 units | $19,800 – $22,400 | 18–22% | • Requires 18-month demand commitment • Priority production scheduling • Custom firmware included |

Negotiation Leverage: Factories offer 3–5% additional discount for:

– Prepayment terms (50% deposit, 50% pre-shipment)

– Multi-year contracts (2+ years)

– Consolidated logistics (shared container shipments)

Strategic Recommendations for Procurement Managers

- Avoid “Wholesaler” Traps: Demand proof of manufacturing capability (factory address, equipment lists). Trading companies add 30–50% margins.

- Prioritize Compliance Over Cost: Machines failing FDA/CE audits cost 3.2x more to rectify post-shipment. Budget $1,200–$1,800/unit for certification.

- Optimize MOQ Strategy:

- <1,000 units: Use White Label with your QC team on-site for final inspection.

- >1,000 units: Invest in Private Label to secure IP and long-term cost control.

- Leverage Automation Trends: Factories with robotic integration (e.g., Fanuc) command 8–12% premiums but reduce labor costs by 27% over machine lifecycle.

2026 Market Outlook: Rising automation costs (+9% YoY) will narrow the gap between Chinese and EU-made machines by 2027. Secure multi-year contracts now to lock in current savings.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Procurement Excellence

Confidential: For client use only. Data sourced from 127 verified Chinese manufacturers (Q4 2025 audit).

© 2026 SourcifyChina. All rights reserved. Not a quotation; indicative pricing only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for China Food Vertical Cartoning Machine Wholesalers

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for automated packaging solutions grows, particularly in the food industry, sourcing vertical cartoning machines from China presents significant cost and scalability advantages. However, the market is highly fragmented, with a mix of genuine manufacturers, trading companies, and low-quality suppliers. This report outlines a structured verification process to identify authentic vertical cartoning machine manufacturers in China, distinguish them from intermediaries, and mitigate procurement risks.

Critical Steps to Verify a Manufacturer: 7-Point Due Diligence Framework

| Step | Action | Purpose |

|---|---|---|

| 1. Verify Legal Entity & Business Scope | Obtain the company’s Unified Social Credit Code (USCC) and verify it via National Enterprise Credit Information Publicity System (China). Confirm manufacturing is listed in the business scope. | Ensures legal legitimacy and confirms the entity is authorized to manufacture machinery. |

| 2. Onsite Factory Audit (In-Person or 3rd-Party) | Conduct a factory audit to verify: • Production lines • CNC/assembly equipment • R&D department • Quality control processes • Staff count |

Confirms actual manufacturing capability and scale. |

| 3. Request Machine Production Videos & Photos | Demand real-time videos of current production, not stock footage. Ask for time-stamped footage of a unit being assembled. | Eliminates reliance on misleading marketing content. |

| 4. Validate Export Experience & Certifications | Check for: • CE, ISO 9001, and optionally FDA/NSF (for food-grade) • Past export shipments (ask for B/L copies or packing lists) • OEM/ODM project history |

Confirms compliance with international standards and export capability. |

| 5. Review Technical Documentation | Request: • Machine schematics • Control system details (e.g., Siemens, Omron PLCs) • Maintenance manuals in English • Detailed specifications (speed, format changeover, power) |

Assesses engineering maturity and long-term support. |

| 6. Conduct Sample Testing & FAT (Factory Acceptance Test) | Order a pre-production sample. Perform FAT to verify performance against specs, including: • Carton forming accuracy • Speed consistency • Jam resistance • Food safety compliance (e.g., stainless steel grade 304) |

Validates real-world performance before bulk order. |

| 7. Check References & Client Portfolio | Request 3–5 verifiable client references—preferably in food/pharma sectors. Contact them directly to assess reliability, after-sales support, and machine uptime. | Validates track record and post-sale service capability. |

✅ Best Practice: Use a third-party inspection agency (e.g., SGS, TÜV, or SourcifyChina Audit Team) for Steps 2 and 6.

How to Distinguish Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Physical Address | Full factory address with workshop photos/videos. Often located in industrial zones (e.g., Wenzhou, Guangzhou, Changzhou). | P.O. Box or commercial office; no production footage. | Proximity to production = better control and cost. |

| Website & Catalog | Technical depth: CAD drawings, PLC brands, material specs. Often less polished. | High-end visuals, generic machine models, no technical details. | Factories focus on engineering; traders focus on marketing. |

| Pricing Structure | Transparent BOM (Bill of Materials), modular pricing, MOQ based on production capacity. | Fixed model pricing, unwilling to customize. | Factories offer flexibility; traders mark up. |

| Staff Expertise | Engineers available to discuss PLC programming, servo motors, changeover mechanisms. | Sales reps only; deflect technical questions. | Technical access = faster problem-solving. |

| Lead Time | Specific and realistic (e.g., 45–60 days), includes production planning. | Vague or overly aggressive (e.g., “2 weeks”). | Factories control lead time; traders depend on suppliers. |

| Customization Capability | Offers OEM/ODM, machine reconfiguration for specific carton sizes or food lines. | Limited to catalog models. | Factories adapt; traders resell. |

🔍 Pro Tip: Ask: “Can I speak to your lead mechanical engineer?” A factory will connect you. A trader will hesitate.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., carbon steel instead of SS304), copied designs, or no after-sales. | Benchmark against industry averages. Reject quotes >20% below market. |

| No Factory Video or Audit Access | High probability of being a trader or ghost company. | Require video call walkthrough or third-party audit. |

| Refusal to Sign NDA or Provide Technical Docs | Suggests IP theft or lack of engineering capability. | Insist on mutual NDA before sharing specs. |

| Pressure for Full Upfront Payment | Common in scams. Factories typically require 30–50% deposit, balance before shipment. | Use secure payment terms (e.g., LC at sight, or 30% T/T deposit, 70% before shipping). |

| Generic Certifications (e.g., “CE” without test reports) | Fake or self-issued certificates. | Request certified test reports from notified bodies (e.g., TÜV, SGS). |

| No English-Speaking Technical Support | Post-installation issues will be unresolved. | Confirm availability of English-speaking engineers for installation and training. |

| One-Page Website with Stock Images | Likely a front for multiple suppliers. | Cross-check domain registration, company info, and social media presence. |

Conclusion & Strategic Recommendations

- Prioritize Factories with Food Industry Experience: Look for suppliers with a track record in dairy, confectionery, or bakery packaging.

- Invest in Due Diligence: Allocate budget for third-party audits and sample testing—this reduces long-term TCO (Total Cost of Ownership).

- Build Long-Term Partnerships: Top-tier Chinese manufacturers offer lower lifetime costs through reliability, spare parts availability, and upgrades.

- Avoid Sole Sourcing: Qualify at least 2–3 suppliers to mitigate supply chain risk.

“In Chinese sourcing, the cheapest quote is rarely the best value. The right manufacturer pays for itself in uptime, safety, and scalability.”

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply Chains

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report: Strategic Procurement for Food Packaging Machinery (2026)

Prepared for Global Procurement Leaders | Q3 2026 Edition

Executive Summary: Mitigating Risk in China-Sourced Cartoning Machinery

Global food manufacturers face escalating pressure to secure FDA/CE-compliant vertical cartoning machines amid rising supply chain volatility. Traditional sourcing channels (e.g., open marketplaces) expose procurement teams to unvetted suppliers, non-compliant equipment, and project delays. SourcifyChina’s Verified Pro List eliminates these risks through rigorously validated suppliers—specifically for China food vertical cartoning machine wholesalers—reducing time-to-qualification by 68% (2026 Client Data).

Why the Verified Pro List Outperforms Traditional Sourcing

Procurement managers lose 127+ hours annually vetting unreliable suppliers. Our data-driven solution delivers immediate efficiency:

| Sourcing Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 42–65 hours | <8 hours | 81% |

| Compliance Verification | 28–41 hours | 0 hours (Pre-validated) | 100% |

| Factory Audit Scheduling | 15–22 hours | <3 hours (Dedicated QC team) | 87% |

| Payment Security Setup | 9–14 hours | 0 hours (Escrow integrated) | 100% |

| TOTAL PER PROJECT | 94–142 hours | 11–11 hours | ~68% |

Critical Risk Reductions Embedded in the Pro List:

- ✅ Mandatory Certifications: All suppliers hold valid ISO 22000, CE, and FDA documentation (verified quarterly).

- ✅ Capacity Validation: Minimum 5,000 units/year production capacity confirmed via onsite audits.

- ✅ Food-Grade Material Compliance: Stainless steel (SS304/316) and NSF-certified components guaranteed.

- ✅ Zero History of IP Infringement: Legal clearance confirmed by SourcifyChina’s partner law firms.

“Using SourcifyChina’s Pro List cut our supplier onboarding from 8 weeks to 9 days. We avoided 3 non-compliant suppliers masquerading as OEMs.”

— Procurement Director, Top 5 EU Food Manufacturer (2026 Client Case Study)

Call to Action: Secure Your Production Timeline in 2026

Time is your scarcest resource. Every unvetted supplier contact delays production, increases compliance exposure, and erodes ROI. The SourcifyChina Verified Pro List for China food vertical cartoning machine wholesalers is your only guarantee of:

– Zero wasted hours on fraudulent or non-compliant suppliers

– Guanteed FDA/CE alignment for seamless market entry

– End-to-end project control via SourcifyChina’s dedicated supply chain engineers

Act Now to Protect Your 2026 Production Schedule:

1. 📧 Email: Send your technical specifications to [email protected]

Subject Line: “Verified Pro List Request – Food Vertical Cartoning Machines”

2. 📱 WhatsApp: Contact our China-based team directly at +86 159 5127 6160

(24/7 support; response within 90 minutes)

→ Within 24 hours, receive:

– A curated shortlist of 3–5 pre-qualified wholesalers

– Full audit reports (including factory video verification)

– Comparative pricing analysis with payment terms

Your Next Move Determines Your Q4 Output.

Don’t gamble with unverified suppliers when SourcifyChina delivers certified, production-ready partnerships. Contact us today to lock in supplier capacity before 2026’s peak ordering season.

SourcifyChina: Precision Sourcing. Zero Compromise.

Trusted by 1,200+ Global Brands | $470M+ Procured in 2025

🧮 Landed Cost Calculator

Estimate your total import cost from China.