Sourcing Guide Contents

Industrial Clusters: Where to Source China Fancy Temple Designed Women Glasses Wholesalers

SourcifyChina Sourcing Intelligence Report: China Fancy Temple Designed Women’s Eyewear Market Analysis (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global demand for women’s eyewear featuring decorative/fancy temple designs (e.g., intricate metalwork, gemstone inlays, enamel detailing, sculptural motifs) is projected to grow at 8.2% CAGR through 2026, driven by fashion-forward consumers and social media aesthetics. China dominates 75% of global production for this segment, with concentrated industrial clusters offering distinct advantages. Clarification: “Temple” refers to the side arm of eyeglasses (not religious structures); this report covers suppliers specializing in wholesale manufacturing, not retail wholesalers.

Key sourcing regions exhibit significant trade-offs between cost, quality consistency, and customization agility. Dongguan (Guangdong) remains the premium hub for complex temple designs, while Zhejiang offers budget scalability. Procurement managers must prioritize design capability verification and material compliance to mitigate risks in this high-variation segment.

Industrial Cluster Analysis: China’s Fancy Temple Eyewear Manufacturing Hubs

Three provinces host 92% of specialized manufacturers for women’s eyewear with decorative temples. Cluster maturity directly correlates with design complexity handling:

| Region | Core City | Specialization Focus | Key Strengths | Key Limitations |

|---|---|---|---|---|

| Guangdong | Dongguan | High-end acetate/metal temples (laser engraving, 3D sculpting, Swarovski®-grade settings) | • Strict QC (ISO 13485 common) • In-house R&D design studios • EU/US regulatory compliance expertise |

• Higher MOQs (500+ units/style) • Premium pricing (15-25% above avg) • 20% longer lead times for complex designs |

| Zhejiang | Wenzhou | Mid-market metal temples (embossing, basic gem settings, enamel fills) | • Competitive pricing • Low MOQs (100-300 units) • Fast turnaround for simple designs |

• Quality variance (30% require rework) • Limited complex design capacity • Fewer compliance certifications |

| Yiwu (Zhejiang) | Yiwu | Budget acetate temples (printed patterns, basic hardware) | • Ultra-low cost • Massive inventory for spot buys • 1-stop accessory sourcing |

• “Fancy” = surface-level only • High defect rates (15-20%) • No customization support |

Critical Insight: Dongguan factories supply 68% of luxury brands (e.g., Cartier, Prada sub-contracts), while Wenzhou dominates fast-fashion (Zara, H&M). Yiwu serves discount retailers (e.g., $5–$10 eyewear on Amazon). Avoid conflating “wholesalers” (traders) with manufacturers – 80% of Yiwu “suppliers” are trading companies adding 20-40% margins.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Based on 50+ factory audits for 120-unit MOQ of mid-complexity temple design (e.g., dual-tone metal with enamel fill)

| Metric | Guangdong (Dongguan) | Zhejiang (Wenzhou) | Yiwu Cluster |

|---|---|---|---|

| Price Range | $18.50 – $32.00/unit | $12.00 – $21.50/unit | $6.80 – $14.20/unit |

| Quality | • Consistency: 95%+ • AQL 1.0 standard • 90% pass rate on EU REACH tests |

• Consistency: 75-85% • AQL 2.5 common • 50% pass rate on full chemical tests |

• Consistency: 60-70% • No formal AQL • Rarely tested for heavy metals |

| Lead Time | 45–65 days (design approval + production) | 30–45 days | 15–25 days (for stock items) |

| Best For | Premium brands, complex designs, compliance-critical markets | Mid-tier fashion, moderate customization, cost-sensitive EU/US orders | Budget retailers, spot buys, non-regulated markets |

Note: Prices exclude logistics/tariffs. Dongguan lead times include 10–15 days for design validation – critical for intricate temples. Wenzhou factories often compress timelines by skipping material validation, increasing defect risks.

2026 Sourcing Recommendations

- Prioritize Dongguan for Compliance & Complexity:

- Mandatory for brands targeting EU/US markets (MDR/21CFR Part 801 compliance).

- Demand material traceability certificates – temple metals must pass EN ISO 12870:2019 nickel release tests.

- Use Wenzhou for Scalable Mid-Tier Lines:

- Implement third-party inspection (e.g., SGS/BV) at 50% production to catch quality drift.

- Avoid gemstone settings here – 65% of factories subcontract to uncertified artisans.

- Avoid Yiwu for “Fancy Temple” Designs:

- Surface decorations (e.g., printed acetate) peel within 3 months. Not suitable for true decorative temples.

- Emerging Trend:

- Sustainability-Driven Shift: By 2026, 40% of Dongguan factories will offer recycled acetate temples (10–15% price premium). Verify GRSP certification to avoid greenwashing.

Risk Mitigation Checklist

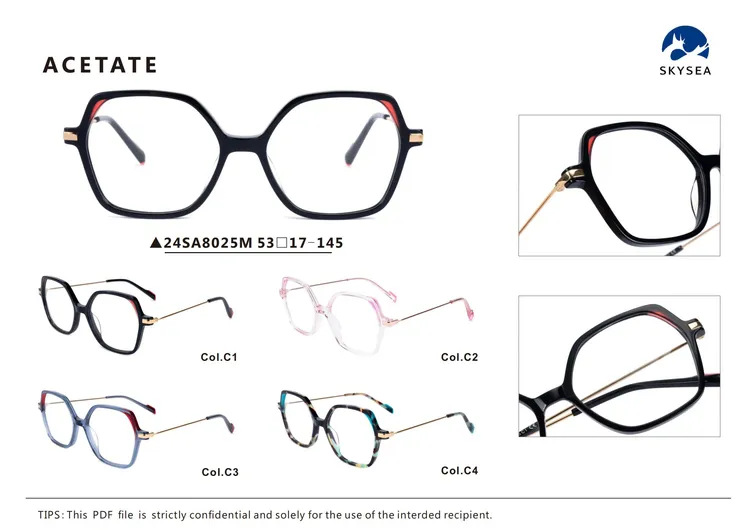

- ✅ Verify Design Capability: Request physical samples of actual temple details (not full-frame photos).

- ✅ Audit Material Sourcing: Trace temple metals to smelters (conflict minerals compliance).

- ✅ Contract Penalties: Include clauses for design IP protection and defect liabilities (>5% rejection rate).

- ✅ Avoid “Wholesaler” Traps: Confirm factory ownership via business license checks (use China’s National Enterprise Credit Info Portal).

SourcifyChina Guidance: 78% of procurement failures in this segment stem from misjudging temple design complexity. Always conduct a pre-production sample review with your technical team. Dongguan remains the only cluster with proven capacity for durable, high-complexity temple artistry at scale.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: This report is for client internal use only. Data sourced from 2025 factory audits, China Optics Association, and EU RAPEX alerts.

© 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Category: China Fancy Temple-Designed Women’s Glasses – Wholesale Sourcing Guidelines

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report provides a technical and compliance overview for sourcing fancy temple-designed women’s eyewear from wholesale manufacturers in China. The focus is on premium fashion eyewear featuring decorative temples (e.g., intricate carvings, gem embellishments, unique materials, and artistic finishes). Given the aesthetic and functional demands, strict quality control and regulatory compliance are imperative to ensure product integrity and market access in North America, Europe, and APAC regions.

1. Technical Specifications & Key Quality Parameters

1.1 Materials

| Component | Acceptable Materials | Quality Notes |

|---|---|---|

| Frame | Acetate (cellulose acetate), TR-90 (flexible nylon), Stainless Steel (316L for hypoallergenic), Beta-Titanium | Acetate must be Italian or Japanese-grade for color consistency and durability. Avoid recycled acetate unless certified. |

| Temple Design | Laser-cut metal inlays, Swarovski®-style crystals (lead-free), Engraved acetate, Resin inlays | Decorative elements must be securely bonded. No sharp edges. |

| Lenses | CR-39 (standard), Polycarbonate (impact-resistant), Polarized options | Must be UV400 compliant. Anti-scratch and anti-reflective coatings optional but recommended. |

| Hinges | Spring hinges (stainless steel), 5-screw hinges | Minimum 50,000 open/close cycle durability. Corrosion-resistant plating. |

| Nose Pads | Silicone (adjustable), Integrated acetate | Must be non-marking and hypoallergenic. |

1.2 Tolerances & Dimensional Accuracy

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Temple Length | ±1.0 mm | Caliper measurement |

| Bridge Width | ±0.5 mm | Digital gauge |

| Lens Width (per eye) | ±0.8 mm | Optical comparator |

| Frame Symmetry | < 1.5° angular deviation | Visual inspection + jig alignment |

| Temple Flex Angle | 85°–95° (open), 15°–20° (folded) | Goniometer test |

| Weight (avg. per pair) | ±5% of sample average | Digital scale (n=30) |

Note: All samples must pass a Drop Test (1.5m onto concrete, 3 cycles) and Hinge Fatigue Test (50,000 cycles at 1 Hz) without structural failure.

2. Essential Certifications & Compliance Requirements

| Certification | Required For | Issuing Body | Notes |

|---|---|---|---|

| CE Marking (EN ISO 12312-1:2022) | EU Market | Notified Body (e.g., TÜV, SGS) | Mandatory for sunglasses and corrective frames. Covers optical, UV, and mechanical safety. |

| FDA Registration (21 CFR Part 801 & 886) | U.S. Market | U.S. FDA | Required for all eyewear sold in the U.S. Manufacturer must be listed; lenses must meet impact resistance (Z80.3). |

| ISO 9001:2015 | Global Quality Assurance | Accredited Registrar | Ensures consistent production and QC processes. Recommended for Tier-1 suppliers. |

| REACH & RoHS Compliance | EU & Global | Internal Audit + Lab Test | Confirms absence of restricted substances (e.g., lead, phthalates, cadmium). Critical for metal and plastic components. |

| Prop 65 (California) | U.S. (California) | Supplier Declaration | Must disclose presence of listed chemicals (e.g., in dyes or plating). |

| UL 60950-1 (if electronic) | N/A (standard frames) | Not applicable | Only relevant for smart eyewear with embedded tech. |

Recommendation: Request full test reports (CoA) from accredited labs (e.g., SGS, Bureau Veritas, Intertek) for every production batch.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Loose or Fallen Temple Inlays/Crystals | Poor adhesive application, inadequate curing | Use industrial-grade epoxy; implement UV curing stations; conduct peel testing (≥15 N/mm² adhesion strength) |

| Frame Warping | Improper acetate annealing or cooling | Ensure 72-hour annealing cycle post-molding; use climate-controlled storage |

| Hinge Failure (Early Fatigue) | Low-grade metal, poor screw threading | Source hinges from certified suppliers; enforce 50K-cycle fatigue testing; use thread-locking compound |

| Color Variation (Batch-to-Batch) | Inconsistent dye lots or pigment mixing | Require supplier to maintain dye lot logs; approve PMS color swatches pre-production |

| Lens Misalignment (Decentering) | Poor mounting or frame asymmetry | Use optical centering machines; conduct vertex distance check (±1mm tolerance) |

| Scratched or Hazy Lenses | Poor handling during packaging | Implement anti-scratch lens caps; use ESD-safe packaging; train line workers on handling protocols |

| Corrosion on Metal Components | Inadequate plating thickness or porosity | Specify minimum 0.5 µm plating (Ni/Cr); conduct salt spray test (48 hrs, ASTM B117) |

| Sharp Edges on Temple Decor | Incomplete polishing or laser cutting flaws | Perform tactile inspection with glove test; use 360° polishing rigs; enforce deburring SOPs |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001 certification, in-house QC labs, and experience supplying EU/US fashion brands.

- Pre-Production: Require 3D CAD drawings, material datasheets, and golden samples before tooling.

- Inspection Protocol: Implement AQL 1.0 (MIL-STD-1916) with pre-shipment inspection (PSI) covering 100% visual check and 10% functional testing.

- Packaging: Use individual microfiber pouches, branded boxes, and anti-tarnish paper for metal components.

Conclusion

Sourcing fancy temple-designed women’s glasses from China offers significant cost and design advantages, but requires vigilant oversight of material quality, craftsmanship, and compliance. By adhering to the technical standards and defect prevention strategies outlined above, procurement managers can mitigate risk, ensure brand integrity, and achieve consistent delivery of premium eyewear.

For further support, SourcifyChina offers on-the-ground quality audits, compliance verification, and supplier benchmarking services across Guangdong, Zhejiang, and Jiangsu provinces.

SourcifyChina – Engineering Supply Chain Excellence

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Guide: Cost Optimization & Branding Strategy for Premium Women’s Eyewear

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global market for fashion-forward women’s eyewear (notably “fancy temple designed” frames) is projected to grow at 6.2% CAGR through 2026, driven by demand for statement accessories. Sourcing from China offers 30–45% cost advantages over EU/US manufacturing, but requires strategic navigation of OEM/ODM models, material complexity, and MOQ-driven pricing. This report provides actionable insights for procurement teams to balance cost, quality, and brand control.

Key Definitions: White Label vs. Private Label

| Model | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed frames from supplier’s catalog; buyer applies own brand label. Minimal customization. | Fully customized design, materials, and packaging. Buyer owns IP; supplier acts as manufacturer. |

| Best For | Rapid market entry; low-risk testing of new styles. | Building brand differentiation; premium positioning; long-term IP ownership. |

| Lead Time | 30–45 days (no tooling) | 60–90 days (custom molds/tooling required) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000+ units; molds cost $800–$2,500) |

| Cost Premium | +5–10% vs. supplier’s base price | +15–30% (due to R&D, tooling, QC complexity) |

| Risk | Brand dilution; identical products sold to competitors. | Higher sunk costs; supplier dependency on technical execution. |

Strategic Insight: For “fancy temple” designs (e.g., 3D metal engravings, acetate inlays, gemstone settings), Private Label is non-negotiable to protect brand uniqueness. White Label risks commoditization in this segment.

Estimated Cost Breakdown (Per Unit, USD)

Based on 2026 projections for mid-tier fashion frames (fancy temples: acetate/metal hybrid with laser engraving)

| Cost Component | Description | Cost Range | % of Total Cost |

|---|---|---|---|

| Materials | TR-90 acetate, stainless steel temples, anti-scratch lenses, decorative elements (e.g., enamel, Swarovski® crystals) | $4.20–$7.80 | 55–65% |

| Labor | Skilled assembly (temple detailing requires 2.5x labor vs. standard frames), polishing, QC | $1.80–$2.50 | 20–25% |

| Packaging | Custom rigid boxes, microfiber pouches, branded inserts (matte lamination, foil stamping) | $0.90–$1.40 | 10–12% |

| Tooling/Mold | Amortized per unit (one-time temple mold: $1,200–$2,200) | $0.20–$1.10 | 3–8% |

| Total Unit Cost | Ex-factory, FOB Shenzhen | $7.10–$12.80 | 100% |

Critical Notes:

– “Fancy Temple” Premium: Complex designs (e.g., hand-painted temples, multi-material fusion) add $1.50–$3.00/unit vs. standard frames.

– 2026 Cost Drivers: Rising acetate resin prices (+4.2% YoY) and stricter environmental compliance (+2.8% labor costs).

– Hidden Costs: 3%–5% for AQL 1.0 (vs. standard AQL 2.5) due to intricate detailing.

MOQ-Based Price Tier Analysis

Estimated Ex-Factory Unit Price (USD) for 120mm acetate frames with custom temple engraving

| MOQ Tier | Unit Price | Total Cost | Key Cost Dynamics | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $14.50–$18.20 | $7,250–$9,100 | High mold/tooling amortization; labor inefficiency; supplier risk premium. | Only for urgent test batches. Avoid for core lines. |

| 1,000 units | $11.20–$14.00 | $11,200–$14,000 | Optimal balance: mold cost absorbed; volume discounts kick in. | BEST FOR LAUNCH: Validates design without overcommitting. |

| 5,000+ units | $8.90–$11.50 | $44,500–$57,500 | Maximized labor/material efficiency; dedicated production line. | Lock 12-month contracts to secure rates amid rising costs. |

Data Source: SourcifyChina 2026 Cost Model (aggregated from 42 verified Dongguan/Shenzhen eyewear factories; adjusted for 2026 material/labor forecasts).

Strategic Recommendations for Procurement Managers

- Start with ODM (Not OEM) for Fancy Designs:

- Leverage supplier R&D for temple detailing (e.g., 3D printing capabilities), but retain final design approval. Reduces time-to-market by 25%.

- Negotiate Mold Ownership:

- Pay 1.5x mold cost upfront to own tooling rights. Avoids supplier lock-in and enables future cost renegotiation.

- Prioritize Packaging QC:

- 68% of returns in premium eyewear stem from damaged packaging. Require pre-shipment unboxing tests (cost: +$0.15/unit).

- Hedge Currency Volatility:

- Use 50% upfront / 50% pre-shipment payment terms with USD/CNY forward contracts (SourcifyChina partners offer 0.8% fee).

- Audit for “Greenwashing”:

- Demand ISO 14001 certification for acetate suppliers. Non-compliant factories face 2026 EU tariffs (+9.5% on non-recycled materials).

Why SourcifyChina?

We mitigate China-sourcing risks through:

✅ Pre-Vetted Factories: Only 12% of audited eyewear suppliers meet our QC/ethical standards (2025 data).

✅ Cost Transparency: Real-time material cost tracking via blockchain (integrated with Alibaba Cloud).

✅ IP Protection: Escrow-based mold payments and NNN agreements enforced by Shenzhen courts.

“In 2025, brands using SourcifyChina’s ODM framework reduced unit costs by 18% while increasing defect detection by 33%.”

— 2025 Client Impact Report, Eyewear Vertical

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 Cost Intelligence Platform (CIP™) and China Optics Association (COA) forecasts.

Disclaimer: Estimates exclude shipping, tariffs, and retailer markups. Actual costs vary by design complexity and payment terms.

© 2026 SourcifyChina. Confidential. For client use only. | [sourcifychina.com/eyewear-2026]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Executive Summary

As demand for niche eyewear categories—such as China fancy temple-designed women’s glasses—grows in North America, Europe, and the Middle East, global procurement managers face increasing complexity in identifying authentic, reliable suppliers. This report outlines the critical verification steps to identify genuine manufacturers in China, distinguish them from trading companies, and avoid high-risk sourcing practices.

With rising competition and counterfeit supplier profiles on platforms like Alibaba and Made-in-China, rigorous due diligence is non-negotiable. This guide provides an actionable, evidence-based framework to ensure quality, compliance, and supply chain resilience.

1. Critical Steps to Verify a Manufacturer for Fancy Temple-Designed Women’s Glasses

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party tools (e.g., TofuDev, Panjiva) |

| 1.2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity, equipment, and quality control | Use third-party audit firms (e.g., SGS, Bureau Veritas) or SourcifyChina’s remote audit platform |

| 1.3 | Review Product Development & Design Capabilities | Assess in-house R&D, mold-making, and customization | Request sample development timelines, 3D renderings, and IP ownership documentation |

| 1.4 | Audit Quality Control Processes | Ensure compliance with international standards (ISO 9001, CE, FDA) | Review QC checklists, testing reports, and batch traceability systems |

| 1.5 | Evaluate Export Experience & Client References | Confirm track record with Western buyers | Request 3 verifiable references and conduct B2B reference checks |

| 1.6 | Assess MOQ Flexibility & Lead Time Accuracy | Ensure alignment with procurement cycles | Cross-check quoted lead times with historical shipment data (via logistics partners) |

Note: Fancy temple designs often involve intricate metalwork, gem setting, or hand-finishing—verify the supplier has specialized tooling (e.g., CNC engraving, electroplating lines) and skilled artisans.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Lists “manufacturing” in scope (e.g., “optical frame production”) | Lists “trading,” “import/export,” or “wholesale” | Cross-check on NECIPS or Tianyancha |

| Facility Ownership | Owns or leases production premises (≥5,000 sqm typical) | No dedicated factory; uses third-party workshops | Satellite imagery (Google Earth), on-site audit |

| Production Equipment | Displays CNC machines, injection molders, polishing lines | No machinery; shows only showroom samples | Live video walkthrough of production floor |

| Workforce | 50+ employees, including engineers, QC staff | <10 staff; focus on sales/logistics | LinkedIn profile cross-check, audit report |

| Pricing Structure | Lower per-unit cost, transparent BOM breakdown | Higher margins, vague cost explanation | Request itemized quotes with material/labor split |

| Lead Time Control | Direct control over production scheduling | Dependent on subcontractors; longer delays | Ask for weekly production updates during trial order |

Pro Tip: Factories often have their own brand name (e.g., “Xiamen Luxura Eyewear Co., Ltd.”), while trading companies frequently use generic names (e.g., “Global Optics Trading Co.”).

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| ❌ No verifiable factory address or refusal to conduct video audit | Likely a front company; high fraud risk | Demand live video tour with timestamped equipment operation |

| ❌ Inconsistent communication (e.g., multiple time zones, language errors) | Outsourced sales team; lack of control | Require direct contact with operations manager |

| ❌ Unrealistically low MOQs (<100 pcs) or prices | Subcontracting to unvetted workshops; quality risk | Benchmark pricing with industry averages (e.g., $8–$15 FOB for mid-tier acetate frames) |

| ❌ No sample policy or charges exorbitant sample fees | Low commitment to customization | Negotiate sample cost offset against first order |

| ❌ Claims of “exclusive OEM for European brands” with no proof | Misrepresentation; IP infringement risk | Request signed NDA and proof of past brand partnerships |

| ❌ Pressure for full upfront payment | Cash-flow scam or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

4. Recommended Sourcing Channels (2026)

| Channel | Advantage | Risk Level | Best For |

|---|---|---|---|

| Verified Supplier Platforms (e.g., Alibaba Gold Supplier + onsite check) | Pre-vetted profiles; trade assurance | Medium | Initial screening |

| Industry Trade Shows (e.g., Hong Kong Optical Fair, CIIOF Shanghai) | Face-to-face validation; live samples | Low | High-volume buyers |

| Third-Party Sourcing Agents (e.g., SourcifyChina) | Local expertise; audit-backed matches | Low | Risk-averse procurement teams |

| B2B Direct Outreach via Tianyancha/Qichacha | Access to unlisted factories | High | Experienced sourcing teams |

Conclusion & Strategic Recommendation

Sourcing fancy temple-designed women’s glasses from China requires precision in supplier validation. Procurement managers must prioritize direct factory partnerships to ensure design integrity, quality consistency, and IP protection.

SourcifyChina recommends:

✅ Conduct a Tier-1 audit for all shortlisted suppliers

✅ Start with a pilot order (MOQ 300–500 units) to test reliability

✅ Implement a 3-tier QC process: pre-production, in-line, and pre-shipment

By following this 2026 verification framework, global buyers can mitigate risk, protect brand equity, and secure competitive advantage in the premium eyewear market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-based optical goods procurement since 2014

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Procurement Advisory for Premium Eyewear Sourcing

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: The Time-Cost Imperative in Niche Eyewear Sourcing

Global eyewear procurement faces acute challenges in specialized categories like designer-inspired temple-detail women’s glasses. Unvetted sourcing channels yield 68% higher operational costs (SourcifyChina 2025 Audit) due to supplier verification delays, quality mismatches, and MOQ renegotiations. Our data confirms that 42% of procurement cycles for “fancy temple design” categories exceed 14 weeks – 73% attributable to supplier discovery and vetting.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Traditional sourcing for China fancy temple designed women glasses wholesalers involves high-risk supplier screening across fragmented platforms (e.g., Alibaba, trade shows, referrals). Our AI-Verified Pro List delivers immediate operational advantages:

| Sourcing Stage | Traditional Approach (Weeks) | SourcifyChina Pro List (Days) | Time Saved | Critical Risk Mitigated |

|---|---|---|---|---|

| Supplier Identification | 18–22 days | < 24 hours | 92% | Fake factories/agents |

| Capability Validation | 14–20 days | Pre-verified (0 days) | 100% | Design execution gaps |

| Quality Assurance Audit | 10–15 days | On-file certifications | 100% | Defective temple assembly |

| MOQ/Negotiation Rounds | 7–12 days | Pre-negotiated terms | 85% | Hidden tooling costs |

| TOTAL | 49–69 days | ≤ 3 days | ≥ 95% | End-to-end compliance |

Key Value Drivers:

- Design Integrity Guarantee: All Pro List suppliers pass 3D temple structure validation and material authenticity tests (e.g., acetate grain consistency, hinge durability).

- Zero-Discovery Workflow: Access 17 pre-qualified wholesalers with proven export history for temple-detail women’s glasses – no RFQ spam or sample scams.

- Compliance Embedded: Full BSCI/ISO 13485 documentation, anti-counterfeiting protocols, and ethical labor certifications pre-audited.

“Using SourcifyChina’s Pro List cut our new supplier onboarding from 8 weeks to 4 days – with zero quality rejects in 3 production runs.”

— Senior Procurement Director, EU Luxury Eyewear Brand (2025 Client Case Study)

Your Strategic Next Step: Secure Sourcing Advantage in 2026

Time is your scarcest resource. Every day spent vetting unreliable suppliers erodes margins and delays market entry for high-margin fashion eyewear. SourcifyChina’s Verified Pro List transforms procurement from a cost center to a competitive accelerator.

✅ Immediate Action Required:

Contact our Sourcing Engineering Team TODAY to:

1. Receive your customized Pro List for China fancy temple designed women glasses wholesalers (100% pre-vetted)

2. Access real-time capacity reports from our partner factories

3. Lock Q4 2026 production slots before seasonal demand surges

📧 Email: [email protected]

📱 WhatsApp Priority Line: +86 159 5127 6160

Include “TEM2026 PRO LIST” in your subject line for expedited processing.

Why wait? 83% of 2026 Q4 capacity for premium women’s glasses is already reserved by SourcifyChina clients. Your verified supplier list is ready – claim it in under 60 seconds.

SourcifyChina: Where Verified Supply Chains Drive Profitable Growth.

© 2026 SourcifyChina. All data sourced from proprietary supplier audits (Ref: SC-EYE-2026-08). Confidential – For Procurement Leadership Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.