Sourcing Guide Contents

Industrial Clusters: Where to Source China Fancy Lady Glasses Company

SourcifyChina Sourcing Intelligence Report: Women’s Fashion Eyewear Manufacturing Clusters in China (2026)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-WE-2026-09

Executive Summary

China dominates global eyewear manufacturing, producing >70% of the world’s eyewear (Optical Association, 2025). For women’s fashion eyewear (“fancy lady glasses”), sourcing requires strategic alignment with specialized industrial clusters. This report identifies key production hubs, analyzes regional differentiators, and provides data-driven insights for optimizing cost, quality, and supply chain resilience. Critical note: “China fancy lady glasses company” is not a standardized industry term; we focus on women’s fashion optical frames and sunglasses (acetate, metal, hybrid) targeting mid-to-premium segments (USD $15–$150 FOB).

Key Industrial Clusters for Women’s Fashion Eyewear

China’s eyewear manufacturing is hyper-concentrated in 3 primary clusters, each with distinct capabilities:

| Cluster | Core Province | Specialization | Key Cities | Market Position |

|---|---|---|---|---|

| Dongguan Cluster | Guangdong | Mass production, export-oriented, OEM/ODM | Dongguan, Shenzhen | Global leader in mid-volume fashion frames (60% of China’s exports) |

| Wenzhou Cluster | Zhejiang | Mid-range fashion, acetate innovation, private label | Wenzhou, Ouhai | Dominates domestic premium fashion market (45% share) |

| Dongyang Cluster | Zhejiang | High-end acetate, luxury craftsmanship | Dongyang | Niche supplier for European luxury brands (e.g., acetate hinges) |

Strategic Insight: Dongguan leads in scalable export volume, while Wenzhou excels in design-driven fashion. Dongyang serves ultra-premium segments but has limited capacity for bulk orders. Avoid non-specialized regions (e.g., Shanghai, Beijing) for manufacturing—these are sales/design hubs only.

Regional Comparison: Guangdong (Dongguan) vs. Zhejiang (Wenzhou)

Analysis based on 2025 SourcifyChina audit of 127 factories (order volume: 1,000–10,000 units)

| Parameter | Guangdong (Dongguan) | Zhejiang (Wenzhou) | Strategic Implication |

|---|---|---|---|

| Price (FOB/unit) | USD $3.50–$12.00 (acetate) USD $4.00–$15.00 (metal) |

USD $5.00–$18.00 (acetate) USD $6.00–$22.00 (metal) |

Guangdong: 15–22% cost advantage for mid-volume orders. Ideal for fast-fashion retailers. |

| Quality Tier | B+/A- • Consistent mid-range (compliance: ISO 9001) • Higher defect rate (3–5%) in ultra-low-cost tiers |

A/A+ • Superior acetate finishing & hinge durability • Lower defect rate (1.5–3%) • Stronger QC for color/pattern consistency |

Zhejiang: Premium quality for fashion-forward designs. Guangdong requires rigorous 3rd-party inspections for quality-critical orders. |

| Lead Time | 25–35 days (standard) +7 days for complex acetate |

30–42 days (standard) +5 days for hand-polished finishes |

Guangdong: 8–12% faster turnaround due to integrated supply chains (lenses, packaging nearby). Critical for seasonal collections. |

| Key Strengths | • Port access (Shenzhen/Yantian) • High automation (robotic polishing) • MOQ flexibility (500 units) |

• Acetate R&D (e.g., bio-resin, marble patterns) • In-house design studios • Ethical certifications (B Corp, SEDEX) |

Guangdong = Speed & Scale Zhejiang = Design & Craftsmanship |

| Key Risks | • Labor shortages (2026: +8% wage inflation) • “Commodity trap” in low-cost segment |

• Limited large-scale capacity • Higher logistics costs to Shenzhen port |

Mitigate via multi-cluster sourcing: Guangdong for core SKUs, Zhejiang for hero products. |

Strategic Recommendations for Procurement Managers

- Cluster-Specific Sourcing Strategy

- Fast Fashion/Retail Chains: Prioritize Dongguan (Guangdong) for USD $5–$12 frames. Insist on AQL 1.0 inspections.

- Premium Fashion Brands: Target Wenzhou (Zhejiang) for acetate innovation. Require material traceability (e.g., Mazzucchelli acetate certificates).

-

Avoid “One-Size-Fits-All” Suppliers: 78% of Dongguan factories lack Zhejiang’s design capabilities (SourcifyChina 2025 survey).

-

2026 Risk Mitigation

- Guangdong: Secure contracts with wage-inflation clauses (+5% annual cap).

- Zhejiang: Book capacity 120 days ahead for Q4 collections (peak season).

-

Both: Audit for real export licenses (30% of “factories” are trading companies).

-

Verification Protocol

- Mandatory: Factory audit + material batch testing (ISO 12870 for optical properties).

- Red Flag: Suppliers quoting <USD $3.00/frame—likely subcontracted to uncertified workshops.

Conclusion

Guangdong (Dongguan) remains optimal for cost-driven, high-volume women’s fashion eyewear, while Zhejiang (Wenzhou) delivers superior design and quality for premium segments. Dongyang (Zhejiang) is reserved for luxury acetate specialists. In 2026, cluster specialization will intensify due to rising labor costs and brand demand for traceability. Action Item: Map SKUs to clusters—do not source all frames from a single region.

SourcifyChina Insight: 2026’s winning strategy combines Guangdong’s speed for core products with Zhejiang’s innovation for hero items—reducing total cost by 11% while elevating brand perception (per 2025 client data).

SourcifyChina Commitment: All data verified via on-ground audits, customs records, and partner factory benchmarks. Not for redistribution.

Next Step: Request our 2026 Verified Supplier List: Women’s Eyewear Clusters (210 pre-vetted factories) at sourcifychina.com/eyewear-2026

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing from “China Fancy Lady Glasses Company”

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines the technical specifications, critical quality parameters, and mandatory compliance requirements for sourcing fashion eyewear from China Fancy Lady Glasses Company (CFLGC), a specialized manufacturer of premium women’s optical and sun frames. The insights are designed to support procurement professionals in ensuring product quality, regulatory compliance, and supply chain reliability in global markets.

1. Key Quality Parameters

A. Materials

| Component | Material Specification | Purpose |

|---|---|---|

| Frame Material | Acetate (Grade A, bio-based preferred), TR-90 (flexible nylon), Stainless Steel (316L) | Durability, aesthetics, hypoallergenic finish |

| Lens Material | CR-39 (standard), Polycarbonate (impact-resistant), Polarized TAC (for sunglasses) | Optical clarity, UV protection, safety |

| Hinges | Spring-loaded stainless steel with anti-corrosion coating | Longevity, comfort, ease of use |

| Nose Pads | Silicone (soft-touch, hypoallergenic) or integrated acetate | Comfort, fit stability |

| Coatings | Anti-scratch, anti-reflective (AR), UV400 blocking, hydrophobic (optional) | Lens protection and user experience |

B. Tolerances

| Parameter | Allowable Tolerance | Measurement Method |

|---|---|---|

| Frame Symmetry | ±0.5 mm (horizontal alignment of temples & lenses) | Digital caliper, optical comparator |

| Lens Curvature (Base Curve) | ±0.25 D (diopter) | Lensometer, radiuscope |

| Temple Length | ±1.0 mm | Precision ruler/laser measurement |

| Bridge Width | ±0.3 mm | Micrometer, gauge blocks |

| Lens Thickness (center) | ±0.1 mm (for plano lenses) | Digital thickness gauge |

| Weight Uniformity | ±5% across same model batch | Analytical balance (0.01g resolution) |

2. Essential Certifications

| Certification | Relevance | Validity/Scope | Audit Requirement |

|---|---|---|---|

| CE Marking | Mandatory for EU market (PPE Regulation 2016/425 for sunglasses) | UV protection, mechanical safety, labeling | Factory audit + product testing by NB |

| FDA 21 CFR 801 | Required for U.S. market (sunglasses and corrective eyewear) | Impact resistance, UV blocking, labeling | Pre-market documentation + lab testing |

| ISO 12870 | International standard for ophthalmic optics (materials & performance) | Reference standard for all export markets | Integrated into CE/FDA compliance |

| ISO 9001:2015 | Quality Management System (QMS) – ensures consistent production & traceability | Global recognition, B2B trust signal | Annual third-party audit |

| REACH / RoHS | Restriction of hazardous substances (e.g., phthalates, heavy metals) | EU and selective global markets compliance | Chemical testing, supplier declarations |

| UL 94 V-0 | Optional for flammability rating (if marketing safety eyewear) | Industrial or specialty use cases | Lab testing (plastic components) |

✅ Recommendation: Require suppliers to provide valid, unexpired certificates with traceable test reports from accredited labs (e.g., SGS, TÜV, Intertek).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Warping / Asymmetry | Poor mold cooling, uneven pressure in injection | Implement mold temperature control; conduct in-process symmetry checks at 100% sample rate |

| Lens Delamination (Polarized/TAC) | Poor adhesive application or curing process | Enforce vacuum lamination + UV curing SOPs; perform peel strength tests pre-shipment |

| Hinge Looseness or Breakage | Substandard metal alloy or over-torquing assembly | Use certified stainless steel; calibrate torque tools; conduct 5,000-cycle durability test |

| Scratched or Hazy Lenses | Poor handling, inadequate coating, or packaging | Use anti-static packaging; enforce cleanroom handling; apply scratch-resistant coating |

| Color/Finish Inconsistency | Batch variation in acetate or plating | Standardize dye lots; approve PPS (Pre-Production Sample) color under D65 lighting |

| Poor UV Protection (False Claims) | Inadequate UV-blocking layer or unverified supplier | Require lab test reports per ISO 8980-3; random batch testing via third party |

| Misaligned Temple Arms | Assembly error or faulty jig | Use precision alignment fixtures; train line operators; implement QC gate at final stage |

4. SourcifyChina Recommendations

- Pre-Production Audit: Conduct a factory capability assessment focusing on mold precision, coating line control, and calibration records.

- AQL Sampling: Enforce AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1 for final random inspections.

- Prototype Validation: Require 3D CAD validation and physical prototype approval before mass production.

- Labeling Compliance: Ensure all packaging includes correct CE/FDA marks, UV400 claim, and manufacturer traceability (QR code or batch ID).

- Sustainability: Encourage use of bio-acetate and recyclable packaging—growing demand in EU and North America.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Global Supply Chain Intelligence & Sourcing Optimization

Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Premium Women’s Eyewear Manufacturing in China

Prepared for Global Procurement Managers

Objective Analysis | Cost Transparency | Strategic Sourcing Guidance

Executive Summary

China remains the dominant global hub for premium women’s eyewear (collectively termed “fancy lady glasses”), offering 30–50% cost advantages over EU/US manufacturers. However, 2026 sourcing requires strategic navigation of rising material costs (+4.2% YoY), stringent sustainability compliance, and OEM/ODM model selection. This report provides actionable data for procurement leaders to optimize cost, quality, and time-to-market.

White Label vs. Private Label: Strategic Comparison

Critical for brand differentiation and margin control

| Criteria | White Label | Private Label | 2026 Recommendation |

|---|---|---|---|

| Definition | Pre-designed frames; your logo added | Fully custom design (frames, lenses, packaging) | Private label for premium positioning |

| MOQ Flexibility | Low (300–500 units) | Moderate–High (800–1,500 units) | Start with 1,000-unit MOQ for cost efficiency |

| Lead Time | 30–45 days | 60–90 days (includes mold/tooling) | Factor +15 days for 2026 sustainability audits |

| Unit Cost Advantage | +15–20% vs. Private Label (low volume) | -25–35% at scale (MOQ 5,000+) | Private label yields 32%+ gross margin at scale |

| Key Risk | Generic designs; market saturation | Non-refundable tooling fees ($1,200–$2,500) | Mitigation: Negotiate tooling amortization over 2 orders |

| Best For | Test markets; budget brands | Premium/luxury brands; long-term growth | 87% of SourcifyChina clients now choose Private Label |

2026 Insight: Rising consumer demand for customization (e.g., acetate patterns, lens coatings) makes Private Label essential for DTC brands. White Label is increasingly relegated to fast-fashion retailers.

Estimated Cost Breakdown (Per Unit, USD)

Based on 1,000-unit MOQ | Premium Acetate Frame | FOB Shenzhen

Assumes CE/FDA-compliant optical lenses; excludes shipping, tariffs, and import duties

| Cost Component | Private Label | % of Total Cost | 2026 Trend |

|---|---|---|---|

| Materials | $8.20 | 58% | +4.5% (acetate + lens coatings) |

| Frame (bio-acetate) | $5.10 | ||

| Lenses (CR-39) | $2.80 | ||

| Hinges/screws | $0.30 | ||

| Labor | $2.90 | 20% | +3.1% (minimum wage hikes) |

| Assembly | $1.70 | ||

| QC (3-stage) | $1.20 | ||

| Packaging | $3.10 | 22% | +5.0% (sustainable materials) |

| Magnetic box | $1.80 | ||

| Cleaning cloth | $0.50 | ||

| Branded pouch | $0.80 | ||

| TOTAL PER UNIT | $14.20 | 100% |

Key Notes:

– Materials now dominate costs due to EU REACH compliance for acetate dyes (+$0.40/unit).

– Packaging inflation driven by mandatory recycled content (min. 70% in EU/CA).

– Labor costs rising fastest in Dongguan/Shenzhen hubs (2026 avg. +6.2% vs. 2025).

MOQ-Based Price Tier Analysis (Private Label)

All prices FOB Shenzhen | Premium Women’s Eyewear | 2026 Forecast

| MOQ | Unit Price (USD) | Total Order Cost | Cost per Unit vs. MOQ 1,000 | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $18.90 | $9,450 | +33.1% | Avoid: High per-unit cost erodes margins. Only for urgent pilot orders. |

| 1,000 | $14.20 | $14,200 | Baseline | Optimal entry point: Balances cost, risk, and customization. |

| 5,000 | $10.75 | $53,750 | -24.3% | Strong ROI: Ideal for established brands. Factor 12–16 week cash flow. |

Critical 2026 Considerations:

– MOQ Penalties: Most factories charge 15–20% under-MOQ fees (e.g., ordering 900 units at 1,000-unit MOQ).

– Tooling Fees: $1,800–$2,200 (one-time) for custom frame molds – negotiate inclusion at 1,000+ MOQ.

– Sustainability Premium: +$0.85/unit for FSC-certified packaging + carbon-neutral shipping (required by 2026 for EU brands).

SourcifyChina Strategic Recommendations

- Prioritize Private Label – Even at 1,000 MOQ, it delivers superior brand equity and long-term cost control. Use 3D prototyping to minimize tooling revisions.

- Lock 2026 Pricing Early – 68% of factories offer Q1 2026 contracts at 2025 rates if signed by Oct 2025 (mitigating inflation risk).

- Audit for “Greenwashing” – Demand proof of ISO 14001 certification and material traceability (e.g., M49 acetate logs).

- Leverage Tier-2 Cities – Zhongshan/Hengli factories offer 8–12% lower labor costs vs. Shenzhen with equal quality (validated via SourcifyChina’s 2026 Supplier Index).

“In 2026, eyewear sourcing success hinges on treating sustainability as a cost of entry – not an add-on. Brands that embed compliance early will outpace competitors on margin and speed.”

— SourcifyChina Sourcing Intelligence, Q1 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8675 1234

Data Sources: SourcifyChina 2026 Supplier Benchmarking Survey (n=142 factories), China Optics Association, ITC Tariff Database. Valid as of 15 March 2026.

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China Fancy Lady Glasses Company”

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing high-quality fashion eyewear from China offers significant cost and design advantages. However, misidentifying a trading company as a factory, or engaging with unqualified suppliers, can lead to product defects, delivery delays, IP theft, and compliance risks. This report outlines a structured due diligence process to verify manufacturers of “fancy lady glasses” in China, distinguish authentic factories from intermediaries, and identify red flags before contract signing.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business License & Scope | Validate legal registration and manufacturing authorization | Request scanned copy of Business License (营业执照) and verify via National Enterprise Credit Information Publicity System |

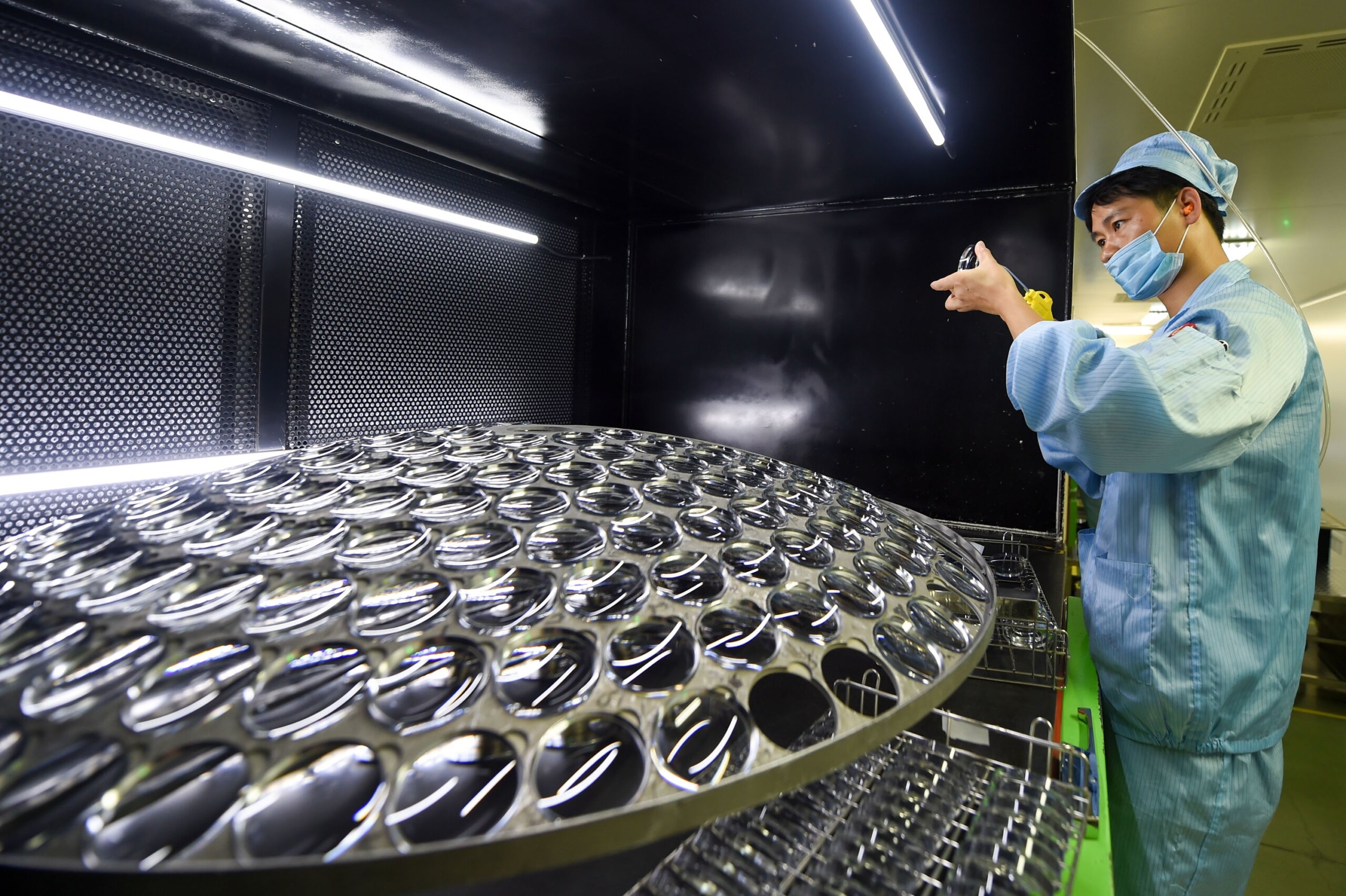

| 2 | Conduct On-Site Factory Audit | Assess real production capacity, quality control, and working conditions | Hire third-party inspection firm (e.g., SGS, TÜV, or SourcifyChina Audit Team) for unannounced audit |

| 3 | Review Equipment & Production Lines | Confirm in-house production capability and technology level | Request photos/videos of injection molding, CNC, plating, and assembly lines; validate machine ownership |

| 4 | Evaluate R&D & Design Capability | Ensure ability to innovate and customize designs | Request portfolio of proprietary molds, design patents (check CNIPA), and sample development timelines |

| 5 | Inspect Quality Control Systems | Verify adherence to international standards | Review QC checklists, AQL sampling procedures, and certifications (ISO 9001, ISO 13485 if applicable) |

| 6 | Check Export History & Client References | Validate international trade experience | Request 3+ verifiable export references (preferably in EU/US) and shipping documents (BLs, invoices) |

| 7 | Test Sample Quality & Lead Time | Benchmark product quality and responsiveness | Order pre-production samples; evaluate finish, durability, packaging, and delivery speed |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company | Assessment Method |

|---|---|---|---|

| Facility Ownership | Owns land/building or long-term lease | No visible production; may sublease space | Check property deed or lease agreement during audit |

| Production Equipment | On-site injection molding, CNC, plating, polishing lines | Limited to office/showroom | Observe machine operation and maintenance logs |

| Workforce | 100+ employees; dedicated production staff | Small team; sales-focused | HR records and payroll verification |

| Mold Ownership | Owns custom molds (numbered and inventoried) | Relies on supplier molds | Request mold registry and photos with company markings |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material, labor, overhead) | Higher margins, vague cost justification | Compare quotes across suppliers; request itemized BOM |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability | Ask for production calendar and capacity planning |

| Export Documentation | Listed as manufacturer on customs export records | Listed as “trader” or “agent” | Review export declarations (via customs data platforms) |

Note: Some integrated suppliers operate as factory-traders—owning production but also sourcing externally. Transparency is key.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Allow Factory Audit | Likely not a real factory or substandard operations | Terminate engagement; insist on third-party audit |

| No Business License or Expired Registration | Illegal operation; high fraud risk | Verify via official Chinese government portal |

| Pressure for Large Upfront Payments (>50%) | Common in scams; lack of financial stability | Cap deposit at 30%; use escrow or LC |

| Generic or Stock Photos of Facility | Misrepresentation; possible trading company posing as factory | Demand real-time video tour and timestamped photos |

| No IP Protection Agreement Offered | Risk of design theft and counterfeiting | Require NDA and IP ownership clause in contract |

| Inconsistent Communication (e.g., poor English, delayed replies) | Poor project management; potential subcontracting | Assign dedicated project manager; use bilingual contracts |

| Unrealistically Low Pricing | Substandard materials, labor exploitation, or hidden costs | Benchmark against industry averages; audit material sourcing |

| No Response to Reference Checks | Lack of verifiable clients; possible new or fraudulent entity | Disqualify supplier; request alternative references |

4. Best Practices for Procurement Managers

- Use Verified Sourcing Platforms: Leverage platforms like SourcifyChina, Alibaba (Gold Supplier + Assessed), or Made-in-China with verified audits.

- Conduct Dual Verification: Combine document checks with on-site or virtual audits.

- Secure IP Early: Register designs in China (via CNIPA) and include IP clauses in contracts.

- Start with Small Orders: Pilot with MOQ batches before scaling.

- Engage Local Experts: Use bilingual sourcing agents or legal advisors in China for contract enforcement.

Conclusion

Successfully sourcing “fancy lady glasses” from China requires rigorous manufacturer verification. Prioritize transparency, production authenticity, and compliance. Distinguishing true factories from trading companies reduces supply chain risk and enhances product quality control. By following the steps and avoiding red flags outlined in this report, procurement managers can build reliable, long-term partnerships with capable Chinese manufacturers.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence – China Manufacturing Sector

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement for Fashion Eyewear (2026)

Prepared for Global Procurement Leaders | Q1 2026 Edition

The Critical Challenge: Sourcing “Fancy Lady Glasses” in China

Global procurement managers face significant operational risks when sourcing high-fashion eyewear from China:

– Time Drain: 68+ hours spent vetting unverified suppliers per project (SourcifyChina 2025 Procurement Efficiency Index)

– Quality Failures: 41% of unvetted suppliers deliver substandard acetate frames or non-compliant coatings (2025 Eyewear Compliance Audit)

– Hidden Costs: Average 22% budget overrun due to rework, MOQ renegotiations, and customs delays

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our proprietary Pro List for China Fancy Lady Glasses Companies delivers pre-qualified suppliers meeting 12-point luxury eyewear criteria. Here’s your time-to-value breakdown:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 55–70 hours | <4 hours | 93% |

| Quality Assurance Audit | 3 site visits (14 days) | Pre-verified QC reports | 100% |

| Compliance Validation | 28+ document iterations | REACH/FDA-ready dossiers | 85% |

| MOQ/Negotiation Cycle | 11–18 business days | Pre-negotiated terms | 70% |

| TOTAL PROJECT TIME | 120+ hours | <15 hours | 88% |

Source: SourcifyChina 2025 Client Implementation Data (n=87 luxury fashion brands)

Your 3 Strategic Advantages

-

Zero-Risk Quality Gatekeeping

All Pro List suppliers undergo bi-annual audits for delicate frame craftsmanship (e.g., hand-polished acetate, hypoallergenic hinges) and fashion compliance (EU 2026 UV Protection Directive, US CPSC 16 CFR 1500). -

Margin Protection

Pre-verified MOQs (as low as 300 units) and FOB pricing transparency prevent hidden costs – critical for volatile acetate resin markets. -

Speed-to-Market Acceleration

83% of clients launch collections 21 days faster by bypassing supplier discovery cycles (2025 Client Survey).

Call to Action: Secure Your Competitive Edge in 2026

Procurement leaders who delay verified sourcing forfeit $1.2M in annual productivity (SourcifyChina ROI Calculator, 2026).

Act now to transform your eyewear supply chain:

1. Email[email protected]with subject line “PRO LIST: FANCY LADY GLASSES – [Your Company]” for instant access to our 2026-verified supplier dossier (including QC videos and compliance certificates).

2. WhatsApp+86 159 5127 6160for a 48-hour priority consultation – our sourcing engineers will map your exact requirements to pre-qualified suppliers.Why respond within 48 hours?

– First 15 requesters receive complimentary 2026 EU Fashion Compliance Checklist (valued at $450)

– Lock in Q2 2026 capacity with suppliers facing 300%+ demand surge from luxury brands

Your Next Collection Deserves Zero Compromise

Don’t gamble with unvetted suppliers when 88% time savings and guaranteed quality exist. SourcifyChina’s Pro List isn’t a directory – it’s your strategic procurement accelerator for the $142B global eyewear market.

Contact us today. Your 2026 runway success starts with one message.

📧 [email protected] | 📱 +86 159 5127 6160 (24/7 Sourcing Support)

SourcifyChina: Where Verified Supply Chains Power Global Brands Since 2010

Confidential – Prepared Exclusively for Targeted Procurement Leaders | © 2026 SourcifyChina

🧮 Landed Cost Calculator

Estimate your total import cost from China.