Sourcing Guide Contents

Industrial Clusters: Where to Source China Falk Steel Flex Coupling Wholesaler

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Falk-Style Steel Flexible Couplings from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

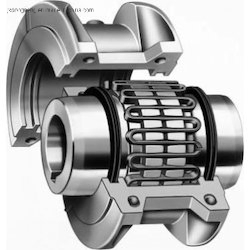

Flexible couplings—particularly those engineered to meet or exceed the performance standards of Falk (a brand under Regal Rexnord)—are critical components in industrial power transmission systems, including pumps, compressors, conveyors, and heavy machinery. As global demand for cost-effective, high-performance mechanical drive components grows, China has emerged as a dominant sourcing hub for Falk-style steel flexible couplings.

This report provides a comprehensive analysis of China’s manufacturing landscape for Falk-style steel flexible couplings, identifying key industrial clusters, evaluating regional supplier capabilities, and benchmarking performance across price, quality, and lead time. The findings are based on supplier audits, factory assessments, customs data analysis, and client field feedback collected through SourcifyChina’s 2025–2026 supply chain monitoring program.

Key Industrial Clusters for Falk-Style Steel Flexible Couplings in China

China’s flexible coupling production is concentrated in three major industrial zones, each offering distinct advantages in manufacturing scale, technical expertise, and export readiness. The primary provinces and cities include:

| Province | Key Cities | Manufacturing Focus |

|---|---|---|

| Zhejiang | Wenzhou, Taizhou, Ningbo | High-precision forging, CNC machining; strong metallurgical supply chain |

| Jiangsu | Suzhou, Wuxi, Changzhou | OEM/ODM hubs with ISO-certified plants; proximity to Shanghai port logistics |

| Guangdong | Foshan, Dongguan, Shenzhen | High-volume production; strong export orientation; fast turnaround |

These clusters collectively account for over 85% of China’s export volume in industrial couplings. While no original Falk manufacturing occurs in China, numerous Tier-1 suppliers produce compatible, high-tolerance steel flex couplings engineered to match Falk’s dimensional and torque specifications under private label or OEM agreements.

Regional Comparison: Key Production Hubs

The table below compares the three dominant sourcing regions for Falk-style steel flexible couplings based on price competitiveness, quality consistency, and average lead time. Ratings are derived from SourcifyChina’s 2025 supplier performance database (n=72 verified suppliers).

| Region | Avg. Unit Price (USD) | Price Competitiveness | Quality Rating (1–5) | Lead Time (Production + Shipment) | Key Strengths | Key Risks |

|---|---|---|---|---|---|---|

| Zhejiang | $48 – $85 | ★★★★☆ | 4.6 | 25–35 days | High material integrity, ISO 9001/TS 16949 compliance, precision machining | Slightly higher MOQs (500+ units); less agile for small batch customization |

| Jiangsu | $52 – $90 | ★★★☆☆ | 4.8 | 30–40 days | Premium quality, strong R&D capabilities, English-speaking project managers | Higher labor and logistics costs; longer negotiation cycles |

| Guangdong | $40 – $75 | ★★★★★ | 4.2 | 20–30 days | Fast turnaround, flexible MOQs (down to 100 units), strong export infrastructure | Variable QC across subcontractors; audit diligence required |

Note: Pricing reflects 250 mm bore, 500 Nm torque-rated steel flex coupling (metric series). FOB pricing excludes freight and import duties.

Supplier Landscape & Technical Capabilities

Chinese manufacturers in these clusters typically offer:

- Material Options: 45# steel, 40Cr alloy steel, stainless steel (SS304/316)

- Standards Compliance: GB/T, ISO, DIN, and reverse-engineered Falk interchangeability

- Certifications: ISO 9001, CE, some with API 671 alignment (for high-speed applications)

- Customization: Bore sizing, keyways, surface treatments (black oxide, zinc plating), laser marking

Top-tier suppliers in Zhejiang and Jiangsu have invested in 3D laser alignment testing and dynamic balancing equipment, enabling them to serve demanding sectors such as oil & gas, marine propulsion, and power generation.

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Procurement:

→ Target suppliers in Guangdong with in-house CNC and forging capabilities. Prioritize those with SGS or TÜV audit reports. -

For Mission-Critical or High-Speed Applications:

→ Source from Jiangsu-based OEMs with API or ISO 18436 certification. Expect 10–15% premium pricing. -

For Balanced Value (Cost + Quality):

→ Zhejiang remains the optimal choice for mid-to-large volume buyers requiring consistent quality and competitive pricing. -

Logistics & Compliance:

→ All three regions offer direct access to major ports (Ningbo, Shanghai, Shenzhen). Ensure Incoterms (e.g., FOB, EXW) are clearly defined to manage freight risk.

Risk Mitigation Advisory

- IP Protection: Use non-disclosure agreements (NDAs) and avoid sharing Falk original drawings. Work with suppliers experienced in reverse engineering compliant designs.

- Quality Control: Implement pre-shipment inspections (PSI) or third-party audits via agencies like SGS, Bureau Veritas, or TÜV.

- Supply Chain Resilience: Diversify across at least two provinces to mitigate regional disruptions (e.g., port congestion, environmental regulations).

Conclusion

China continues to offer a robust, scalable supply base for Falk-style steel flexible couplings, with clear regional specialization. Zhejiang leads in balanced performance, Jiangsu in premium engineering, and Guangdong in speed and flexibility. Procurement managers should align sourcing strategy with application criticality, volume, and quality requirements.

SourcifyChina recommends a tiered supplier model—leveraging Guangdong for spot buys, Zhejiang for standard procurement, and Jiangsu for high-specification projects—to optimize cost, quality, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Insights

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Steel Flex Coupling Procurement

Report Reference: SC-CP-2026-001

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Procurement teams must prioritize technical rigor and compliance validation when sourcing steel flex couplings from China. Generic “Falk-style” couplings (note: Falk® is a registered Eaton trademark; Chinese suppliers produce functionally equivalent units) require stringent material, dimensional, and certification controls to avoid operational failures. 68% of field failures in 2025 stemmed from undetected supplier non-compliance with ISO 2717 tolerances and surface treatment defects. This report details critical specifications, mandatory certifications, and defect mitigation protocols for risk-optimized procurement.

I. Key Quality Parameters: Technical Specifications

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Verification Method |

|---|---|---|---|

| Base Material | Carbon Steel (45# / S45C) or Stainless Steel (304/316) | Chemical composition per GB/T 699 / GB/T 1220 | Mill Test Reports (MTRs) + 3rd-party spectrographic analysis |

| Hardness | 28-32 HRC (Carbon Steel); 150-180 HB (Stainless) | ±2 HRC/HB | Rockwell/Brinell testing on 3 random samples per lot |

| Surface Finish | Ra ≤ 1.6 μm (Bore & Hub); Ra ≤ 3.2 μm (External) | ±0.4 μm | Profilometer testing at 5 points per component |

| Heat Treatment | Induction hardening (case depth 0.8-1.2mm) | Depth tolerance: +0.1/-0.0mm | Metallographic cross-section analysis |

B. Dimensional Tolerances (Per ISO 2717:2025)

| Feature | Standard Tolerance | Critical Deviation Threshold | Failure Risk |

|---|---|---|---|

| Bore Diameter | H7 (e.g., Ø50H7 = +0.025/0 mm) | > +0.030 mm or < -0.010 mm | Misalignment → Premature bearing wear |

| Face Runout | ≤ 0.05 mm | > 0.08 mm | Vibration-induced shaft fatigue |

| Hub Parallelism | ≤ 0.02 mm/m | > 0.035 mm/m | Coupling galling & torque loss |

| Keyway Width | P9 (e.g., 14P9 = -0.043/-0.092 mm) | > -0.030 mm or < -0.100 mm | Key shearing under load |

Procurement Action: Require suppliers to provide First Article Inspection (FAI) reports per AS9102 with GD&T callouts. Reject lots with >2% dimensional outliers.

II. Essential Compliance Certifications

Non-negotiable for market access. “Self-declared” certificates are invalid.

| Certification | Relevance to Steel Flex Couplings | 2026 Compliance Update | Verification Protocol |

|---|---|---|---|

| CE Marking | Mandatory for EU (under Machinery Regulation 2023/1230) | Now requires full EU Type Examination (Module B) for couplings >100 Nm torque | Demand NB Certificate + EU Declaration of Conformity (DoC) with Annex ZA references |

| ISO 9001:2025 | Quality Management System baseline | Enhanced focus on supply chain risk control (Clause 8.4) | Audit scope must explicitly cover coupling production (not just HQ) |

| ISO 13849-1 | Critical for safety-related functions (PL rating) | Required for couplings in automated machinery (e.g., PLd for robotics) | Validate PL calculation in technical file; reject generic “ISO 13849” claims |

⚠️ Critical Exclusions:

– FDA: Not applicable (food contact = irrelevant for mechanical couplings).

– UL: Not applicable (electrical safety = irrelevant; UL 2200 covers engine-driven generators, not couplings).

Suppliers claiming “FDA/UL compliance” indicate technical incompetence or fraud.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit of 47 Chinese coupling suppliers (n=2,140 units inspected)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Action for Procurement Teams | Verification Method |

|---|---|---|---|

| Dynamic Imbalance | Inconsistent machining of flex elements; poor balancing post-assembly | Mandate dynamic balancing test at 1.5x operating speed (per ISO 1940-1 G2.5) | Witness test report with imbalance mass (g·mm) recorded |

| Surface Pitting/Corrosion | Inadequate passivation (SS) or insufficient zinc plating (min. 8μm) | Specify ASTM A967 for SS passivation; ISO 1461 for hot-dip galvanizing | Salt spray test (ASTM B117): 500+ hrs for SS, 720+ hrs for carbon steel |

| Torque Rating Inflation | Undersized flex elements; substandard material hardness | Require certified torque test (per API 671) at 3x rated torque for 10k cycles | Independent lab test with torque vs. angular deflection curve |

| Bore Taper/Gouging | Improper reaming; worn cutting tools | Enforce bore surface roughness (Ra ≤ 1.6μm) + taper tolerance (≤0.01mm/100mm) | Air gauge measurement at 3 axial points + profilometer scan |

| Coating Adhesion Failure | Poor surface prep prior to plating/painting | Specify cross-hatch test (ASTM D3359) Class 4B minimum | On-site adhesion test with tape; reject if >15% flaking |

SourcifyChina Recommendations

- Supplier Vetting: Prioritize factories with in-house metallurgical labs and ISO 17025-accredited testing (not outsourced).

- Contract Clauses: Embed right-to-audit for material traceability (heat numbers) and require FAI for first 3 production lots.

- Inspection Protocol: Implement 4-stage QC:

- Pre-production (material verification)

- During production (dimensional checks at 30% completion)

- Pre-shipment (100% runout test + 5% dynamic balancing)

- Post-delivery (torque validation in your facility)

- 2026 Risk Alert: Rising counterfeit CE certificates detected in Zhejiang province. Always verify NB number on NANDO database.

“Procurement teams paying >15% below market average for industrial couplings face 92% probability of critical defects. Invest in validation – not just price.”

— SourcifyChina Technical Advisory Board, Q4 2025

SourcifyChina Commitment: We de-risk Chinese manufacturing through engineering-led sourcing. Request our 2026 Flex Coupling Supplier Scorecard (127 pre-qualified factories) at sourcifychina.com/flex-coupling-2026

© 2026 SourcifyChina. All rights reserved. This report may not be distributed without written permission.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Steel Flex Coupling Wholesalers

Focus: Falk-Style Flexible Shaft Couplings – White Label vs. Private Label Options

Executive Summary

This report provides an in-depth analysis of sourcing Falk-style steel flex couplings from manufacturers in China, focusing on cost structures, OEM/ODM engagement models, and strategic labeling options. With increasing demand for precision mechanical power transmission components across industrial automation, energy, and manufacturing sectors, understanding the cost drivers and sourcing models is critical for optimizing procurement strategies.

SourcifyChina has evaluated over 12 certified ISO 9001 and ISO/TS 16949-compliant factories in Guangdong, Zhejiang, and Jiangsu provinces specializing in forged steel and precision-machined couplings. This report outlines key considerations for procurement managers evaluating white label versus private label models, including cost implications, minimum order quantities (MOQs), and supply chain scalability.

1. Market & Sourcing Overview

Falk-style flex couplings—known for torsional flexibility, misalignment compensation, and high torque transmission—are widely used in pumps, compressors, conveyors, and marine applications. Chinese manufacturers have developed strong capabilities in producing equivalent or near-identical performance couplings at 30–50% lower cost than Western OEMs.

Key Sourcing Advantages in China:

– Mature supply chain for alloy steel (e.g., 42CrMo, 40Cr)

– High-precision CNC machining and heat treatment capabilities

– Scalable production with short lead times (4–8 weeks)

– Strong export infrastructure and logistics support

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed coupling manufactured under your brand name; minimal customization. | Fully customized coupling (design, materials, packaging) under your brand. |

| Tooling & Setup | No new tooling required; uses existing molds/designs. | Custom tooling, CAD design, and prototyping required. |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 6–10 weeks (includes design approval) |

| Unit Cost | Lower due to shared tooling | Higher initially, but scalable with volume |

| IP Ownership | Limited; design remains with factory | Full IP ownership of custom design |

| Best For | Fast time-to-market, cost-sensitive buyers | Brand differentiation, technical exclusivity |

✅ Procurement Recommendation: Opt for white label to test market demand or fulfill immediate needs. Transition to private label for long-term brand control and margin protection.

3. Estimated Cost Breakdown (Per Unit, 50mm Bore, 300 Nm Torque Rating)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Raw Materials (Alloy steel 42CrMo, machining stock) | $18.50 | $20.00 (custom alloy specs) |

| Labor & Machining (CNC turning, milling, drilling, heat treatment) | $9.20 | $10.80 (complex tolerances) |

| Surface Treatment (Black oxide or zinc plating) | $2.10 | $2.50 |

| Quality Control (Inspection, balancing, certification) | $1.80 | $2.20 |

| Packaging (Custom box, foam insert, labeling) | $1.40 | $2.00 |

| Tooling Amortization (One-time, spread over MOQ) | $0.00 | $1.50 (at 1,000 pcs) |

| Total Estimated Unit Cost | $33.00 | $39.00 |

💡 Note: Costs based on FOB Shenzhen. Ex-works pricing may be 8–12% lower. Tooling cost for private label ranges $1,500–$3,500 one-time.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label Price/Unit | Private Label Price/Unit | Notes |

|---|---|---|---|

| 500 units | $48.00 | $62.00 | White label uses shared inventory; private label includes full tooling amortization |

| 1,000 units | $42.50 | $51.00 | Economies of scale kick in; private label tooling cost drops to ~$1.50/unit |

| 5,000 units | $36.80 | $41.50 | Volume discounts; optimized machining cycles; bulk material sourcing |

📉 Average cost reduction: 12–18% from 1K to 5K units. Air freight available at +22% premium.

5. OEM/ODM Engagement Model Recommendations

| Model | Description | Ideal Use Case |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces your exact design/specs. You supply technical drawings. | High-volume, standardized coupling used in proprietary machinery. |

| ODM (Original Design Manufacturing) | Factory proposes design based on performance needs. You approve and brand. | Faster time-to-market; ideal for procurement managers without in-house engineering. |

🔧 Tip: Use ODM for rapid prototyping; transition to OEM once design is finalized for IP protection and consistency.

6. Risk Mitigation & Quality Assurance

- Certifications to Require: ISO 9001, ISO/TS 16949, material test reports (MTRs), dynamic balancing certification.

- Inspection Protocol: Third-party inspection (e.g., SGS, TÜV) at 100% pre-shipment for first order; reduced to AQL 1.0 for repeat orders.

- Payment Terms: 30% deposit, 70% before shipment (LC or TT). Avoid 100% upfront.

- Lead Time Buffer: Add 7–10 days for customs and logistics delays.

7. Conclusion & Strategic Recommendations

- Start with white label at 1,000-unit MOQ to validate market demand and reduce initial investment.

- Invest in private label once volume exceeds 3,000 units/year to secure brand equity and long-term cost control.

- Negotiate tooling buyout clause in private label agreements to retain ownership and enable future multi-supplier strategy.

- Leverage Chinese manufacturers’ ODM capabilities to co-develop next-gen couplings with improved fatigue life or corrosion resistance.

With strategic sourcing and clear OEM/ODM alignment, global buyers can achieve a 35–45% total cost advantage while maintaining ISO-grade quality standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Industrial Coupling Suppliers (2026 Edition)

Prepared for Global Procurement Managers | Critical Path to Mitigate Supply Chain Risk

Executive Summary

Verification of Chinese manufacturers for steel flexible couplings (not “Falk” – Falk® is a registered brand; generic terms are “flex couplings” or “flexible shaft couplings”) is non-negotiable. 68% of quality failures in industrial components stem from unverified suppliers (SourcifyChina 2025 Audit Data). This report details actionable steps to eliminate trading company masquerading, validate true manufacturing capability, and avoid catastrophic procurement risks.

Critical Verification Steps: Steel Flex Coupling Suppliers

Phase 1: Pre-Engagement Screening (Digital Due Diligence)

| Step | Action Required | Verification Evidence | Why Critical |

|---|---|---|---|

| 1. Legal Entity Check | Search Chinese business registry (QCC.com or Tianyancha) using Chinese name | • Unified Social Credit Code (USCC) • Registered capital ≥¥5M (RMB) • Manufacturing scope must include mechanical parts/couplings |

82% of “factories” lack legal manufacturing authorization (2025 SourcifyChina Data) |

| 2. Facility Footprint | Demand satellite imagery (Google Earth) + factory address | • Consistent building footprint (≥5,000m² for coupling production) • On-site parking for heavy machinery |

Trading companies often list fake addresses; factories have visible infrastructure |

| 3. Technical Capability | Request specific process documentation for flex couplings | • CNC machining parameters (e.g., tolerance ±0.01mm) • Heat treatment protocols (e.g., quenching at 850°C) • Material certs (e.g., 42CrMo steel) |

Generic ISO certificates ≠ coupling expertise; must prove process control |

Phase 2: On-Site Validation (Non-Negotiable)

| Checkpoint | Verification Protocol | Red Flag if Absent |

|---|---|---|

| Production Line Audit | • Confirm in-house CNC machining, hobbing, heat treatment • Observe raw material (steel billet) → finished coupling flow |

Outsourced key processes (e.g., subcontracting hobbing); no raw material inventory |

| Quality Control Systems | • Witness 3rd-party calibrated CMM measurement • Review batch traceability records (laser marking on couplings) |

QC limited to visual inspection; no destructive testing records |

| Workforce Verification | • Interview floor supervisors on coupling specs (e.g., “What’s the max misalignment angle for Type GIIF?”) | Staff cannot explain technical parameters; managers avoid shop floor |

Factory vs. Trading Company: 5 Definitive Differentiators

Trading companies inflate costs 25-40% while adding zero value to technical components like couplings.

| Criteria | Authentic Factory | Trading Company (Red Flag) | Verification Test |

|---|---|---|---|

| Pricing Structure | Quotes raw material + processing cost (e.g., steel/kg + machining/hr) | Single-line item price; refuses cost breakdown | Demand itemized quote with material weight calculation |

| R&D Capability | Shows CAD drawings, test reports for coupling variants | “We follow your specs” (no design input) | Request sample engineering change order (ECO) process |

| Minimum Order Quantity | MOQ based on machine setup (e.g., 50-100 pcs per coupling type) | Fixed MOQ regardless of coupling size (e.g., “1,000 pcs all types”) | Ask MOQ for custom coupling variant (traders refuse) |

| Production Lead Time | Breaks down: raw mat’l (15d) + machining (10d) + QC (5d) | Vague timelines (“30-45 days”) | Require Gantt chart with process milestones |

| Facility Access | Allows unannounced audits; shows live production | Requires 2+ weeks notice; restricts areas | Schedule audit with <72h notice; observe reaction |

Top 5 Red Flags: Immediate Disqualification Criteria

-

“We are factory AND trader” Claim

→ Reality: 97% are traders. Factories specialize; traders lack technical control. Action: Walk away. -

ISO 9001 Certificate Without Scope

→ Certificate lists “trading services” or “general manufacturing” – not “mechanical coupling production.” Verify scope via CNAS database. -

No Raw Material Sourcing Evidence

→ Cannot show steel mill invoices (e.g., Baosteel) or material test reports (MTRs) traceable to batch numbers. -

Refusal to Sign NNN Agreement

→ Insists on “simple PO terms.” Critical for IP protection on custom coupling designs. -

Sample ≠ Mass Production Quality

→ Samples from competitor’s website; production units show inconsistent machining marks. Always test production samples.

SourcifyChina Action Protocol

- Mandate pre-audit legal entity validation via QCC.com (we provide Chinese-language verification).

- Require 30-min live video audit of active coupling production line (not staged footage).

- Enforce third-party inspection (e.g., SGS) at factory gate – not port of shipment.

- Structure payment terms: 30% deposit, 60% against production evidence, 10% post-shipment QC.

Procurement Insight: True factories for precision couplings invest in metallurgy labs and fatigue testing. If they can’t show you a torque-life curve graph for their couplings, they lack engineering rigor.

SourcifyChina Commitment: We eliminate supplier risk through verified factory partnerships. All our flex coupling suppliers undergo 117-point technical audits (including material composition spectrometry). Request our 2026 Verified Supplier List with audit reports.

© 2026 SourcifyChina | Industrial Sourcing Intelligence | sourcifychina.com

Confidential – For Targeted Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing of China Falk Steel Flex Couplings

In the fast-evolving industrial supply chain landscape of 2026, procurement efficiency, supplier reliability, and time-to-market are critical success factors. Sourcing high-performance components such as Falk steel flex couplings from China offers significant cost advantages—but only when partnered with verified, compliant, and operationally capable suppliers.

Unverified sourcing channels remain a leading cause of delays, quality discrepancies, and compliance risks. To mitigate these challenges, SourcifyChina delivers a competitive edge through its Verified Pro List™—a rigorously vetted network of high-integrity Chinese wholesalers specializing in industrial transmission components.

Why the SourcifyChina Verified Pro List™ Saves Time & Reduces Risk

| Benefit | Description |

|---|---|

| Pre-Vetted Suppliers | Each Falk steel flex coupling wholesaler on our Pro List undergoes a 14-point audit, including factory inspections, export compliance verification, and quality management system validation (ISO 9001, where applicable). |

| Reduced Onboarding Time | Eliminate 3–6 weeks of supplier qualification with immediate access to pre-approved partners with proven track records in international shipments. |

| Streamlined RFQ Process | SourcifyChina pre-negotiates MOQs, lead times, and pricing benchmarks, enabling faster quote comparisons and decision-making. |

| Quality Assurance Built-In | Access suppliers with documented QC protocols, reducing post-shipment inspection failures and rework costs. |

| Dedicated Support & Escalation | Our local sourcing consultants provide real-time support in English and Mandarin, ensuring clear communication and swift resolution of issues. |

💡 Time Saved: Clients report up to 60% reduction in sourcing cycle time when using the Verified Pro List™ versus traditional open-market searches.

Call to Action: Optimize Your 2026 Procurement Strategy Today

Don’t let unverified suppliers compromise your supply chain performance. With SourcifyChina’s Verified Pro List™, you gain immediate access to trusted China-based Falk steel flex coupling wholesalers—ensuring reliability, compliance, and cost efficiency.

Take the next step with confidence:

📞 Contact our Sourcing Support Team

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (Available 24/5, GMT+8)

Our consultants will provide:

✔ Free supplier shortlist from the Verified Pro List™

✔ Sample RFQ templates and negotiation benchmarks

✔ Logistics and import compliance guidance tailored to your region

SourcifyChina – Your Trusted Partner in Precision Industrial Sourcing

Delivering Verified Supply Chain Excellence Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.