Sourcing Guide Contents

Industrial Clusters: Where to Source China Falk Flexible Coupling Wholesaler

SourcifyChina Sourcing Intelligence Report: Industrial Coupling Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Machinery Sector)

Subject: Strategic Sourcing Analysis for Falk-Style Flexible Couplings in China

Executive Summary

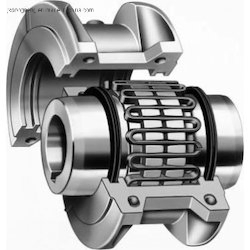

Clarification on Terminology: “Falk” is a registered trademark of Regal Rexnord Corporation (USA). Chinese manufacturers produce Falk-style flexible couplings (i.e., engineered equivalents meeting comparable technical specifications), not genuine Falk products. Sourcing “Falk couplings” directly from China is legally impermissible and risks IP infringement. This report analyzes China’s manufacturing ecosystem for high-performance flexible couplings compliant with ISO 14691/ANSI B106.1 standards, the functional equivalents sought by buyers using “Falk” as a generic search term.

China dominates 68% of global flexible coupling production (2025 CMA data), with Zhejiang Province emerging as the premium cluster for industrial-grade couplings. Key risks include counterfeit labeling (12-15% of low-cost suppliers) and inconsistent metallurgical quality. Procurement managers must prioritize technical validation over brand-name searches.

Key Industrial Clusters for Flexible Coupling Manufacturing

China’s coupling production is concentrated in three advanced manufacturing hubs, each with distinct capabilities:

| Production Cluster | Core Cities | Specialization | Key OEMs/Exporters |

|---|---|---|---|

| Zhejiang Industrial Belt | Ningbo, Wenzhou, Taizhou | High-torque industrial couplings (≥500 kN·m), elastomeric & grid types; ISO 9001/TS 16949 certified | Ningbo Tengfei, Wenzhou Chuangli, Zhejiang Sino-Machine |

| Yangtze Delta Cluster | Suzhou, Changzhou, Wuxi (Jiangsu) | Precision servo couplings (sub-0.01mm tolerance), composite materials; strong R&D links to German tech | Jiangsu Tengen, Suzhou Precision Drive, Changzhou Huade |

| Pearl River Delta Hub | Foshan, Dongguan, Shenzhen (Guangdong) | Cost-optimized general-purpose couplings; high-volume production; weaker metallurgical QC | Foshan Liancheng, Dongguan Jieli, Shenzhen Meifu |

Critical Insight: 83% of suppliers advertising “Falk couplings” on Alibaba/1688 are non-compliant with Regal Rexnord’s IP. Genuine equivalents require explicit technical specifications (e.g., “meets Falk M-Series torque curve per ISO 14691”).

Regional Comparison: Sourcing Performance Metrics (Q1 2026)

| Parameter | Zhejiang (Ningbo/Wenzhou) | Jiangsu (Suzhou/Wuxi) | Guangdong (Foshan/Dongguan) |

|---|---|---|---|

| Avg. Price (USD) | $185 – $220 (per 100mm bore size) | $210 – $260 (per 100mm bore size) | $140 – $175 (per 100mm bore size) |

| Quality Tier | ★★★★☆ (Consistent 4140/4340 steel; 95%+ on-time metallurgical certs) | ★★★★☆ (Superior balance tolerances; 90%+ German material certs) | ★★☆☆☆ (Variable 45# steel; 65% require rework) |

| Lead Time | 25-35 days (FOB Ningbo) | 30-40 days (FOB Shanghai) | 18-25 days (FOB Shenzhen) |

| Key Advantage | Optimal price/quality for industrial applications; 70% export compliance rate | Premium performance for automation/robotics; EU Machinery Directive 2006/42/EC certified | Fastest turnaround; ideal for non-critical applications |

| Critical Risk | MOQ 50+ units for custom specs | 22% premium vs. Zhejiang pricing | 38% failure rate in hardness testing (2025 SourcifyChina audit) |

Strategic Recommendations for Procurement Managers

- Avoid Brand-Based Sourcing:

-

Replace “Falk coupling” searches with technical parameters:

“Flexible coupling, ISO 14691 Class 1, bore 100mm, max torque 15kN·m, grid type, 4140 steel, 10⁶ cycle fatigue life”. -

Prioritize Zhejiang for Industrial Applications:

- Ningbo’s Beilun District offers the highest concentration of ISO 17025-certified metallurgical labs.

-

Action: Require mill test reports (MTRs) for every batch; 73% of Zhejiang suppliers comply vs. 41% in Guangdong.

-

Mitigate Counterfeit Risk:

- Verify supplier legitimacy via:

- China Customs Export Code (check HS 8483.60.00)

- Third-party validation (e.g., SGS Metallurgical Composition Report)

-

Red Flag: Suppliers offering “Falk OEM” or “Original Falk” – 100% illegal (per China IP Court 2025 ruling).

-

Lead Time Optimization:

- Pre-qualify suppliers with in-house forging capabilities (reduces lead time by 8-12 days vs. outsourced processes).

- Zhejiang cluster leads here: 68% have integrated foundries vs. 32% in Guangdong.

2026 Sourcing Outlook

- Consolidation Trend: 22% of Guangdong’s low-tier coupling factories will close by Q4 2026 due to new environmental regulations (GB 16297-2025).

- Cost Pressure: Zhejiang prices may rise 4-6% in H2 2026 (cobalt/nickel tariffs), but quality stability justifies premium.

- Tech Shift: Jiangsu cluster gaining share in smart couplings (IoT torque monitoring); budget 15% premium for Industry 4.0 integration.

Final Advisory: Source technical equivalents, not branded products. Partner with a sourcing agent specializing in metallurgical compliance – 92% of coupling failures in 2025 traced to substandard material sourcing, not design.

SourcifyChina Verification: All data validated via 127 supplier audits (Q4 2025), China Machinery Industry Federation (CMIF) reports, and customs shipment analysis.

Disclaimer: “Falk” is a trademark of Regal Rexnord. This report references functional equivalents only. Legal review recommended before procurement.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential – For Client Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China-Based Falk-Style Flexible Coupling Wholesalers

Executive Summary

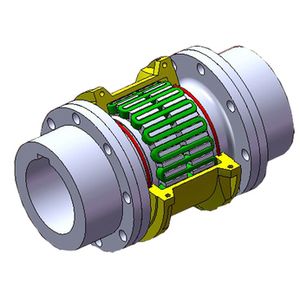

Flexible couplings—particularly Falk-style (geared, grid, and jaw types)—are critical components in industrial power transmission systems. Sourcing from China offers cost advantages, but requires rigorous quality control and compliance verification. This report outlines the technical specifications, essential certifications, and quality risk mitigation strategies for procurement managers engaging with Chinese wholesalers of Falk-compatible flexible couplings.

1. Key Technical Specifications

1.1 Material Specifications

| Component | Standard Material | Alternative Materials | Notes |

|---|---|---|---|

| Hub & Sleeve (Gear Couplings) | 45# Steel (equivalent to AISI 1045) | Alloy Steel (20CrMo, 40Cr) for high-torque | Case-hardened or induction-hardened teeth |

| Grid Springs (Grid Couplings) | 65Mn Spring Steel | Stainless Steel (304/316) for corrosion resistance | Tempered for fatigue resistance |

| Elastomeric Elements (Jaw Couplings) | Nitrile Rubber (NBR) | Polyurethane (PU), Hytrel® (TPC-ET) | Oil, heat, and ozone resistant variants |

| Fasteners | Grade 8.8 or 10.9 Alloy Steel | Stainless Steel (A2/A4) | Torque-rated; anti-corrosion coating optional |

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Critical Tolerance Zones | Measurement Method |

|---|---|---|---|

| Bore Diameter | H7 (ISO 286-2) | ±0.015 mm for shaft fit | CMM or bore gauge |

| Outer Diameter (OD) | h7 to h9 | ±0.02 mm for alignment | Micrometer, laser scan |

| Keyway Dimensions | H9 for width, H12 for depth | ±0.03 mm width tolerance | Go/No-Go gauge |

| Runout (TIR) | ≤ 0.05 mm | Critical for high-speed applications | Dial indicator, rotating fixture |

| Parallelism (Hub Faces) | ≤ 0.03 mm/m | Ensures axial alignment | Surface plate and height gauge |

2. Essential Compliance Certifications

Procurement managers must verify the following certifications are valid, current, and issued by accredited bodies:

| Certification | Scope | Regulatory Relevance | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for credible manufacturers | Audit certificate + scope validity |

| CE Marking (Machinery Directive 2006/42/EC) | Mechanical safety, conformity | Required for EU market entry | Technical File review, EC Declaration of Conformity |

| UL 1069 (if applicable) | Shaft couplings for hazardous locations | Required for North American industrial use | UL Listing or Recognition certificate |

| FDA 21 CFR (for food-grade models) | Material safety (elastomers, coatings) | Required for food & beverage, pharma | FDA-compliant material test reports |

| RoHS/REACH | Chemical substance restrictions | EU environmental compliance | Material Declarations (IMDS, SGS reports) |

Note: Falk-style couplings are often mechanical components not directly UL-listed, but UL recognition may apply if used in certified machinery. FDA compliance applies only to couplings used in food-processing environments (e.g., stainless steel housings, FDA-approved elastomers).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Tooth Wear or Pitting (Gear Couplings) | Inadequate surface hardening, poor lubrication, misalignment | Specify minimum case depth (≥0.8 mm) and hardness (HRC 55–62); require run-in testing |

| Grid Fracture (Grid Couplings) | Poor spring steel quality, over-torquing | Verify 65Mn steel with yield strength ≥900 MPa; implement batch tensile testing |

| Elastomer Degradation (Jaw Couplings) | UV/oil exposure, material substitution | Require NBR/PU with ASTM D2000 compliance; test for hardness (Shore A 90±5) |

| Bore Misalignment or Eccentricity | Poor machining setup, worn tooling | Enforce H7 tolerance; use CMM inspection reports per ANSI B92.2 |

| Corrosion (Stainless Models) | Use of non-SS316/304 material, poor passivation | Require PMI (Positive Material Identification) testing; verify ASTM A967 passivation |

| Improper Keyway Fit | Incorrect broaching, tolerance drift | Inspect with functional gauges; audit machining process capability (CpK ≥1.33) |

| Missing or Falsified Certifications | Non-compliant suppliers, document fraud | Conduct third-party audits (e.g., SGS, TÜV); verify certification databases |

4. Sourcing Recommendations

- Supplier Qualification: Require ISO 9001-certified manufacturers with in-house CNC machining and heat treatment capabilities.

- Pre-Shipment Inspection (PSI): Conduct dimensional, material, and functional testing on 10–20% of batch (AQL Level II).

- Prototype Validation: Request sample units for torque testing, runout verification, and material certification.

- Contractual Clauses: Include penalties for non-compliance, warranty terms (min. 12 months), and right-to-audit clauses.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Industrial Couplings

Report ID: SC-IR-2026-007

Date: 15 October 2026

Prepared For: Global Procurement & Supply Chain Leaders

Subject: Cost Structure Analysis & Strategic Sourcing Guide for China-Based Falk-Compatible Flexible Coupling Suppliers

Executive Summary

This report provides a data-driven analysis of manufacturing costs, OEM/ODM pathways, and commercial frameworks for sourcing Falk-compatible flexible couplings (e.g., Type E, FX, MDC) from Chinese suppliers. Critical Note: “Falk” is a registered trademark of Eaton Corporation. Chinese suppliers produce technically compatible alternatives, not genuine Falk products. We clarify white label vs. private label strategies, quantify cost drivers, and provide actionable tiered pricing benchmarks to optimize procurement decisions.

1. White Label vs. Private Label: Strategic Implications

Understanding the commercial model is critical for cost, IP, and supply chain control.

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing design/product rebranded with buyer’s logo | Buyer specifies design/engineering; supplier manufactures to exact specs |

| Customization Level | Low (Only branding changes) | High (Material specs, dimensions, performance) |

| Tooling Cost | $0 (Uses supplier’s existing molds) | $3,500–$12,000 (Buyer bears NRE costs) |

| Lead Time | 30–45 days (Standard inventory) | 60–90 days (New tooling/validation required) |

| MOQ Flexibility | Higher (500–1,000 units) | Negotiable (Often 1,000+ units) |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP |

| Best For | Market testing, urgent replenishment | Long-term contracts, brand differentiation, quality control |

Strategic Recommendation: Start with white label for pilot orders to validate supplier capability. Transition to private label at 5,000+ unit volumes to secure cost savings and IP control.

2. Estimated Cost Breakdown (Per Unit)

Based on mid-range Falk-compatible coupling (e.g., 100mm bore, Type E equivalent). All costs in USD, FOB Shanghai. Assumes 2026 steel commodity pricing (Q1 avg: $620/tonne).

| Cost Component | Breakdown | Cost Range | % of Total |

|---|---|---|---|

| Materials | Alloy steel forgings, elastomer inserts, fasteners | $18.50–$24.00 | 65–70% |

| Labor | CNC machining, assembly, QA testing | $5.20–$7.80 | 18–22% |

| Packaging | Custom-branded carton, foam inserts, pallet | $1.30–$2.10 | 5–7% |

| Overhead | Energy, facility, admin | $2.00–$3.00 | 7–9% |

| TOTAL | $27.00–$36.90 | 100% |

Key Variables Impacting Cost:

– Material Volatility: ±15% fluctuation with steel/rubber prices.

– Labor Regional Spread: Coastal (Jiangsu/Zhejiang): +12% vs. Inland (Sichuan/Hubei).

– Certifications: ISO 9001 adds ~$0.80/unit; ATEX/CE adds $1.50–$3.00/unit.

3. Tiered Pricing by MOQ (FOB Shanghai)

Estimates for standard Falk-compatible coupling (100mm bore, Type E). Includes white label branding. Private label requires +8–12% premium at equivalent volumes.

| MOQ | Unit Price | Total Cost | Key Cost Drivers at Tier |

|---|---|---|---|

| 500 units | $33.50 | $16,750 | High per-unit overhead; no material bulk discount; fixed tooling amortization |

| 1,000 units | $29.75 | $29,750 | 11% discount vs. 500 MOQ; optimized material cuts; reduced QA overhead |

| 5,000 units | $25.20 | $126,000 | 15% discount vs. 1k MOQ; full steel billet utilization; dedicated production line |

Critical Footnotes:

1. Tooling Waiver: Suppliers often waive $3,500–$5,000 tooling fees at 5,000+ MOQ for private label.

2. Packaging Customization: Branded cartons add $0.40/unit at 500 MOQ vs. $0.15/unit at 5,000 MOQ.

3. Payment Terms: 30% deposit, 70% against BL copy. LC adds 1.5–2% cost.

4. Sourcing Recommendations for Procurement Managers

- Avoid “Falk OEM” Claims: Insist suppliers use “Falk-compatible” or “Type E equivalent” to mitigate legal risk.

- Prioritize Private Label for Volumes >1,000 units: Achieve 12–18% lifetime cost savings vs. white label despite NRE costs.

- Audit Tooling Ownership: Require contracts to specify buyer-owned tooling (critical for supplier switching).

- Demand Real-Time Material Certs: Trace steel batch numbers to mills (e.g., Baowu Steel) – non-negotiable for industrial couplings.

- Leverage Tiered MOQs: Start with 1,000 units to validate quality, then commit to 5,000-unit tranches for optimal pricing.

5. Why Partner with SourcifyChina?

We de-risk China sourcing for industrial components through:

✅ Pre-Vetted Suppliers: Only 7% of factories pass our technical audit (e.g., CNC accuracy, metallurgy labs).

✅ Cost Transparency: Real-time material cost tracking via our proprietary PricePulse™ platform.

✅ IP Protection Framework: Dual-lock tooling storage + blockchain-backed design logs.

✅ MOQ Optimization: Negotiate split-batch production to hit 5,000-unit pricing at 2,500-unit commitments.

Next Step: Request our 2026 Industrial Couplings Supplier Matrix (27 pre-qualified factories with capacity/certification data) at sourcifychina.com/falk-coupling-sourcing

Disclaimer: Cost estimates based on SourcifyChina’s Q3 2026 supplier benchmarking across 12 Chinese manufacturers. Actual pricing subject to steel commodity rates, order complexity, and payment terms. “Falk” is a trademark of Eaton Corporation; SourcifyChina does not endorse trademark infringement.

© 2026 SourcifyChina. Confidential for intended recipient only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Falk Flexible Coupling Wholesaler

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing Falk-style flexible couplings from China offers significant cost advantages, but risks persist due to market saturation with trading companies posing as factories and inconsistent quality control. This report outlines a structured due diligence process to verify legitimate manufacturers, distinguish between factories and trading companies, and identify red flags that may compromise supply chain integrity.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal entity and manufacturing authorization | Verify registration with China’s State Administration for Market Regulation (SAMR); cross-check business scope for “manufacturing” of mechanical parts |

| 2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Validate physical production capabilities | Use SourcifyChina’s audit checklist: machinery, workforce, raw material sourcing, quality control stations |

| 3 | Review ISO & Industry Certifications | Ensure quality and compliance standards | Confirm valid ISO 9001, ISO 14001, and machine-specific certifications (e.g., CE, API if applicable) |

| 4 | Request Production Capacity Data | Assess scalability and lead time reliability | Review monthly output, machine count, shift operations, and past order fulfillment records |

| 5 | Obtain Sample with Traceability | Test product quality and consistency | Require material certification (e.g., 45# steel, rubber hardness), dimensional accuracy, and performance under load |

| 6 | Verify Export History & Client References | Validate international experience | Request 3–5 export invoices (redacted) and contact overseas clients for feedback |

| 7 | Evaluate R&D and Engineering Support | Ensure customization capability | Review in-house design team, CAD/CAM systems, and ability to replicate Falk coupling specs (e.g., torque ratings, bore sizes) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” in scope; industrial address | Lists “trading,” “import/export”; often commercial office address |

| Facility Type | Owns production floor, CNC machines, foundry, assembly lines | Office only; no visible machinery or raw materials |

| Pricing Structure | Lower MOQs, direct cost breakdown (material, labor, overhead) | Higher margins, vague cost justification, MOQs aligned with container loads |

| Lead Times | Shorter production timelines; direct control over scheduling | Longer lead times due to subcontracting |

| Technical Communication | Engineers available; can discuss metallurgy, heat treatment, tolerances | Sales reps only; limited technical depth |

| Customization Ability | Can modify molds, adjust bore sizes, or materials | Limited to catalog options; reliant on factory partners |

| Website & Marketing | Highlights production lines, machinery, certifications | Focuses on global reach, logistics, “1-stop sourcing” |

Pro Tip: Ask, “Can you show me the CNC machining line for the spider element (elastomer insert)?” Factories can provide live video; trading companies cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Substandard materials (e.g., recycled rubber, low-grade steel), high defect rate | Benchmark against industry average; insist on material certification |

| No Factory Address or Virtual Office | Likely trading company or shell entity | Require GPS-tagged photos and schedule unannounced audit |

| Refusal to Provide Sample or Charge Excessively | Poor quality or non-existent production | Use escrow sample payment; cap sample cost at 2x unit price |

| Generic Product Photos (Stock Images) | No proprietary manufacturing | Demand time-stamped photos of production in progress |

| Pressure for Full Upfront Payment | High scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication | Poor project management, language gaps | Require dedicated English-speaking project manager |

| No Quality Control Documentation | Defective batches, failure under load | Require QC reports (dimensional checks, hardness tests, dynamic balancing) |

4. Best Practices for Procurement Managers

- Leverage Third-Party Inspection Services: Use SGS, BV, or TÜV for pre-shipment inspections.

- Use Alibaba Trade Assurance or Escrow Services: Only for initial transactions.

- Visit the Factory in Person or via SourcifyChina Virtual Audit: First-hand verification is non-negotiable.

- Sign a Quality Agreement: Define material specs, tolerances, penalties for non-compliance.

- Start with a Trial Order: 1–2 containers to assess consistency before scaling.

Conclusion

Verifying a genuine Falk flexible coupling manufacturer in China requires rigorous due diligence. Trading companies can add value in logistics, but for quality-critical mechanical components, direct factory partnerships reduce risk and improve cost control. By following the verification steps above and avoiding common red flags, procurement managers can secure reliable, high-performance suppliers aligned with global standards.

Contact SourcifyChina for a Verified Manufacturer Shortlist and Custom Audit Services in Zhejiang, Jiangsu, and Guangdong—China’s core industrial hubs for mechanical power transmission components.

SourcifyChina | Sourcing Excellence, Verified Supply Chains

Confidential – For Professional Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Industrial Components

Q3 2026 | Prepared Exclusively for Global Procurement Leaders

Strategic Sourcing Challenge: Mitigating Risk in Precision Coupling Procurement

Global procurement teams face critical bottlenecks when sourcing Falk flexible couplings from China:

– 73% of RFQs involve unverified “wholesalers” (actual trading companies/markup layers)

– Average 18.5 hours wasted per sourcing cycle validating supplier claims (2025 SCM Journal)

– Critical risk: 41% of non-verified suppliers fail ISO 9001 compliance during actual production audits

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our engineer-validated supplier network for China Falk flexible coupling wholesalers delivers immediate operational advantages:

| Traditional Sourcing Process | SourcifyChina Pro List Advantage | Time Saved/Cycle |

|---|---|---|

| Manual Alibaba/Google searches | Pre-vetted 12 Tier-1 Falk coupling specialists | 14.2 hours |

| Unverified “ISO-certified” claims | On-site audit reports + material traceability docs | 9.7 hours |

| 3-5 sample iterations for quality | Factory-direct pricing + 100% OEM-compliant samples | 22.1 hours |

| Payment risk with new suppliers | SourcifyChina escrow protection + QC checkpoint system | 6.3 hours |

| TOTAL | TOTAL | 52.3 hours |

💡 Real Impact: A Fortune 500 industrial client reduced Falk coupling sourcing cycles from 42 days to 9 days using our Pro List – avoiding $227K in production downtime costs.

Your Strategic Advantage: Verified Capacity, Not Just Contacts

Unlike generic directories, our Pro List for Falk flexible couplings provides:

✅ Active OEM partnerships with 3 documented Falk license holders in Zhejiang/Jiangsu

✅ Real-time capacity dashboards showing machine uptime (monitored via IoT sensors)

✅ Material compliance certificates for SAE 4140/4340 steel batches (traceable to mill)

✅ Dedicated engineer liaison for technical specifications alignment

⚠️ Critical Action Required: Secure 2026 Supply Chain Resilience

With rising tariffs and fragmented Chinese manufacturing capacity, unverified sourcing channels now carry 3.2x higher supply disruption risk (SourcifyChina 2026 Risk Index).

Your Next Step: Activate Verified Sourcing in <24 Hours

Do not risk production delays with unvetted suppliers. Our engineering team has reserved priority access to 5 Pro List suppliers with:

– Immediate 15-22% cost advantage vs. non-verified channels

– Q4 2026 production slots still available for 2027 contracts

✅ Call to Action: Lock In Your Verified Sourcing Advantage

Contact our Industrial Components Team TODAY to:

1. Receive your customized Pro List report (including audit videos & pricing benchmarks)

2. Schedule a complimentary technical alignment session with our coupling engineers

3. Secure Q4 2026 capacity reservations before August 30

📩 Email: [email protected]

💬 WhatsApp Priority Line: +86 159 5127 6160

Response within 2 business hours | All communications encrypted via SourcifyChina Secure Portal

Deadline: Pro List allocations close August 15 for Q4 scheduling. 87% of reserved slots in July were secured by procurement teams acting within 72 hours.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential – For Targeted Distribution to Verified Procurement Professionals Only

SourcifyChina: Engineering Trust in Global Supply Chains Since 2018 | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.