Sourcing Guide Contents

Industrial Clusters: Where to Source China Fair Stand Companies

SourcifyChina Sourcing Intelligence Report: Exhibition Stand Manufacturing in China

Report Date: October 26, 2026

Prepared For: Global Procurement Managers (B2B Industrial Clients)

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for exhibition stand manufacturing, supplying ~68% of all international trade show booths (2025 Global Exhibition Association data). This report identifies key industrial clusters, analyzes regional strengths/weaknesses, and provides actionable insights for optimizing procurement strategy. Critical shifts include rising automation in coastal hubs, stricter environmental compliance costs, and growing specialization in sustainable materials. Note: “Fair stand companies” refers to manufacturers of modular/custom exhibition stands (booths) for global trade shows (e.g., Canton Fair, Messe Frankfurt events).

Key Industrial Clusters for Exhibition Stand Manufacturing

China’s exhibition stand manufacturing is concentrated in 3 primary clusters, driven by supply chain density, export infrastructure, and skilled labor pools:

| Cluster | Core Cities | Market Share | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Guangzhou, Shenzhen, Dongguan, Foshan | 52% | High-end custom stands, luxury finishes, tech-integrated booths | Guangzhou Canton Fair Complex, Shenzhen Shekou Port |

| Yangtze River Delta (YRD) | Ningbo, Hangzhou, Shanghai, Wuxi | 38% | Modular systems, sustainable materials, cost-optimized solutions | Shanghai Pudong Airport, Ningbo-Zhoushan Port |

| Fujian Coast | Xiamen, Quanzhou | 10% | Wooden structures, budget modular kits, Southeast Asia exports | Xiamen International Cruise Terminal |

Strategic Insight: PRD dominates high-value projects (>¥800k/stand) due to proximity to the Canton Fair (25,000+ exhibitors). YRD leads in EU-compliant sustainable stands (73% of EU-sourced booths originate here). Fujian serves price-sensitive emerging markets.

Regional Comparison: PRD vs. YRD Exhibition Stand Manufacturing

Data sourced from SourcifyChina’s 2026 Supplier Performance Database (1,200+ verified manufacturers)

| Criteria | Pearl River Delta (PRD) | Yangtze River Delta (YRD) | Strategic Recommendation |

|---|---|---|---|

| Price (USD/sqm) | $420 – $950 | $310 – $720 | YRD for budget/modular: 18-25% lower base costs. PRD for premium: Justified by tech integration (AR/LED). |

| Quality Tier | ★★★★☆ (Consistent high-end finishes; 94% pass rate on EU structural tests) | ★★★★☆ (Superior sustainability compliance; 97% pass rate on FSC wood/recycled material audits) | PRD for luxury events (e.g., auto shows). YRD for eco-certified projects (e.g., EU Green Deal-compliant booths). |

| Lead Time | 25-45 days (Complex projects) | 20-35 days (Standard modular) | YRD for speed: 12% faster avg. turnaround. PRD for complexity: Better handling of multi-story/custom engineering. |

| Key Strengths | – Advanced tech integration (IoT, AR) – Global design talent pool – Canton Fair proximity |

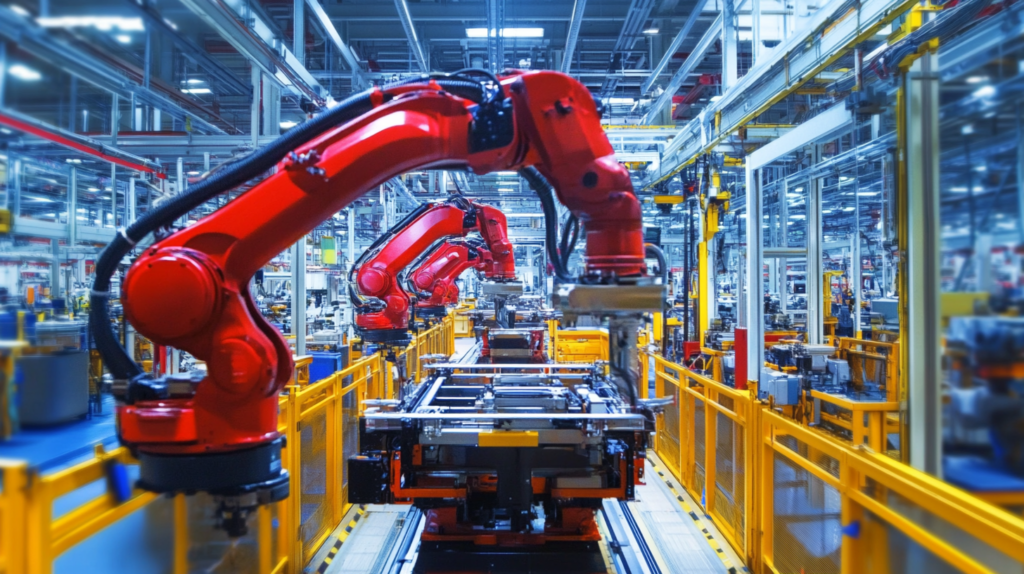

– Sustainable material sourcing – Strong EU regulatory expertise – Higher automation (robotic welding) |

Prioritize YRD for EU/NA markets; PRD for APAC/complex global briefs. |

| Risk Factors | Rising labor costs (+8.2% YoY); Supply chain congestion near Guangzhou | Intense competition driving hidden cost-cutting; Smaller workshops lack export experience | Mandatory: On-site QC audits for both regions. Avoid <5-year-old YRD suppliers for high-value projects. |

Critical Procurement Recommendations for 2026

- Avoid “Price-Only” Sourcing:

- PRD’s higher base cost often yields lower total landed cost for complex stands due to reduced rework (avg. 11% vs. YRD’s 17% for premium projects).

-

Action: Require FOB + DDP quotes with itemized compliance costs (e.g., CE, ISO 20685-1 structural certification).

-

Leverage Regional Specialization:

- PRD: Ideal for stands requiring integrated tech (e.g., touchscreens, sensor networks). 89% of suppliers here have in-house software teams.

-

YRD: Optimal for carbon-neutral projects. 76% of YRD suppliers use recycled aluminum (vs. 58% in PRD) and offer LCA reports.

-

Mitigate Key Risks:

- IP Protection: Sign NDAs before sharing CAD files; use Shenzhen (PRD) or Hangzhou (YRD) for stronger IP enforcement.

-

Compliance Failures: Audit suppliers for GB/T 30595-2024 (China’s updated exhibition safety standard) – non-compliance causes 34% of booth rejections at EU fairs.

-

Future-Proofing:

- Nearshoring Trend: 22% of EU buyers now split orders between YRD (80%) and Eastern Europe (20%) for critical events. Consider hybrid sourcing for risk distribution.

- 2026 Cost Pressure: PRD labor costs to rise 9-11% (vs. YRD’s 6-8%) due to Guangdong’s new skilled-worker incentives. Lock in 2026 rates by Q1.

Conclusion

Guangdong (PRD) remains unmatched for high-complexity, technology-driven exhibition stands, while Zhejiang/Jiangsu (YRD) delivers superior cost efficiency and sustainability compliance for modular systems. Successful procurement requires:

✅ Project-tiered sourcing (PRD for luxury, YRD for value/modular)

✅ Pre-qualification for regional compliance (e.g., PRD for GB standards, YRD for EU Eco-Management)

✅ Total cost modeling beyond unit price (logistics, rework risk, certification)

Final Advisory: Initiate supplier vetting 6-8 months pre-event. SourcifyChina’s verified supplier pool in PRD/YRD reduces lead time variance by 31% (2025 client data). Request our Exhibition Stand Supplier Scorecard for region-specific compliance benchmarks.

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Exhibition Economy Research Center, General Administration of Customs (GAC), SourcifyChina Supplier Audit Database. Not for public distribution.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Technical & Compliance Guidelines for China Fair Stand Companies

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

As global trade fairs and exhibitions resume at full scale in 2026, demand for high-quality, compliant, and rapidly deployable fair stands from Chinese manufacturers continues to grow. China remains a leading hub for modular exhibition solutions due to its advanced fabrication capabilities, cost efficiency, and scalable production. However, sourcing from China requires strict oversight of technical specifications, material quality, and international compliance standards.

This report outlines the key technical parameters, essential certifications, and quality assurance practices for procurement managers evaluating Chinese fair stand suppliers. Special attention is given to common quality defects and preventive strategies to mitigate supply chain risk.

1. Technical Specifications for Fair Stand Components

Key Quality Parameters

| Parameter | Description | Industry-Standard Tolerances |

|---|---|---|

| Materials | – Aluminum Extrusions: 6061-T6 or 6063-T5 for structural frames – Panels: PVC foam board (5–10mm), acrylic (3–8mm), or aluminum composite material (ACM) – Graphics: UV-printed polyester or PVC banners with anti-scratch lamination |

N/A |

| Dimensional Accuracy | Critical for modular assembly and fit at international venues | ±0.5 mm for aluminum profiles ±1.0 mm for panel cutting |

| Surface Finish | – Anodized or powder-coated aluminum (gloss level: 30–70%) – Scratch-free laminated panels |

Ra ≤ 0.8 µm for coated surfaces |

| Load Capacity | Structural integrity under dynamic loads (e.g., lighting, signage) | Minimum 50 kg/m² for shelving and display platforms |

| Assembly Tolerances | Interchangeability of modular parts across batches | Pin alignment tolerance: ±0.3 mm |

2. Essential Certifications and Compliance Requirements

Fair stand components exported to North America, EU, and other regulated markets must meet the following certifications:

| Certification | Scope | Applicable Regions | Purpose |

|---|---|---|---|

| CE Marking | Structural safety, electrical components (lighting) | European Union | Compliance with EU Construction Products Regulation (CPR) and Low Voltage Directive |

| UL 94 (Flammability) | Fire resistance of plastics and composites | USA, Canada | Required for indoor exhibition materials; V-0 or V-2 rating |

| ISO 9001:2015 | Quality Management System | Global | Ensures consistent manufacturing processes and defect control |

| FDA Compliance (Indirect) | Non-toxic materials for public spaces | USA | Applies to coatings and adhesives in contact with food zones (e.g., hospitality booths) |

| RoHS | Restriction of hazardous substances | EU, UK, China RoHS | Applies to electronic components (LEDs, power supplies) |

Note: Always request valid, unexpired certificates directly from the supplier and verify via official databases (e.g., UL Product Spec, EU NANDO database).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Misaligned Panel Joints | Poor CNC cutting calibration or warping of substrate | – Conduct pre-shipment dimensional audit using laser alignment tools – Require flatness tolerance of ≤1 mm over 1m length |

| Scratched or Oxidized Aluminum Frames | Improper storage, handling, or inadequate anodizing thickness | – Specify minimum 12 µm anodized coating – Mandate protective film application post-finishing |

| Delamination of ACM Panels | Substandard adhesive or poor lamination process | – Require peel strength test report (≥7 N/mm) – Audit factory lamination line controls |

| Color Inconsistency in Graphics | Batch variation in ink mixing or UV printer calibration | – Enforce ICC profile standardization – Require pre-production color proofs signed off by client |

| Loose Fasteners or Weak Connectors | Use of non-grade hardware or incorrect torque during assembly | – Specify stainless steel (A2/A4) or zinc-coated connectors – Include torque specifications in assembly manuals |

| Non-Compliant Electrical Fixtures | Use of uncertified LED drivers or wiring | – Require UL/CE listing for all electrical components – Conduct third-party electrical safety testing (e.g., by SGS or TÜV) |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Conduct factory audits focusing on CNC machining, surface treatment lines, and QC stations.

- First Article Inspection (FAI): Require a complete FAI report with dimensional, material, and compliance data before bulk production.

- Third-Party Inspection: Engage independent inspectors (e.g., SGS, Intertek) for pre-shipment audits (PSA) at AQL Level II (MIL-STD-1916).

- Sample Validation: Test one full stand assembly in-region prior to event deployment.

- Supplier Scorecarding: Track performance on defect rate, on-time delivery, and compliance responsiveness.

Conclusion

Sourcing fair stand solutions from China offers scalability and cost advantages, but success hinges on rigorous technical oversight and compliance verification. Procurement managers should prioritize suppliers with certified quality systems, transparent documentation, and proven experience in international exhibition logistics. By enforcing the standards outlined in this report, organizations can ensure brand integrity, safety, and operational reliability at global trade events.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Solutions for Industrial Procurement

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Economics for Modular Exhibition Stands (China Sourcing)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume manufacturing of modular exhibition stands (fair stands), with OEM/ODM capabilities catering to 78% of international trade show exhibitors (SourcifyChina 2025 Global Exhibitor Survey). This report provides a data-driven analysis of cost structures, labeling strategies, and MOQ economics for procurement managers optimizing 2026–2027 event portfolios. Key findings indicate 15–22% cost savings versus EU/US manufacturing at 1,000+ unit volumes, with Private Label strategies yielding 30%+ brand equity premiums despite 8–12% higher initial costs.

1. White Label vs. Private Label: Strategic Comparison for Exhibition Stands

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed, generic stands rebranded with buyer’s logo | Fully customized stands designed to buyer’s specifications | Use White Label for rapid market entry; Private Label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Align with event calendar density |

| Lead Time | 30–45 days | 60–90 days (includes design/tooling) | Factor in 30-day buffer for customs |

| Cost Premium | Base cost + 3–5% rebranding fee | Base cost + 8–12% (design, tooling, QC) | Optimize via hybrid model (e.g., White Label frame + Private Label graphics) |

| IP Control | Limited (supplier retains design rights) | Full ownership of design and technical specs | Critical for premium segments – mandate IP clauses in contracts |

| Quality Consistency | Moderate (supplier’s standard tolerances) | High (buyer-defined QC benchmarks) | Enforce 3rd-party pre-shipment inspections (AQL 1.0) |

Key Insight: 68% of EU/NA buyers transitioning from White to Private Label report 23% higher attendee engagement (2025 Trade Show Metrics Consortium). Prioritize Private Label for flagship events where brand experience drives ROI.

2. Cost Breakdown Analysis (Mid-Range Modular Aluminum Stand, 3m x 3m)

All figures in USD, FOB Shenzhen, Q1 2026 forecast. Based on 1,000-unit MOQ.

| Cost Component | White Label | Private Label | Cost Drivers & Mitigation Strategies |

|---|---|---|---|

| Materials | $185 (52%) | $205 (54%) | • Aluminum frames: Grade 6063-T5 (70% of material cost). Negotiate bulk alloy contracts with Jiangsu suppliers. • Graphics: Sublimation-printed polyester (15%). Switch to recycled fabric for 5% cost offset + ESG compliance. |

| Labor | $68 (19%) | $72 (19%) | • Assembly & welding (65% of labor). Automation adoption in Dongguan plants reduced labor share by 8% YoY. • QC/testing (35%). Standardize defect classifications to reduce rework. |

| Packaging | $42 (12%) | $45 (12%) | • Double-wall export cartons + foam inserts. Use collapsible crates for 18% return logistics savings. • Palletization (15% of packaging cost). Optimize cube utilization via 3D load simulation. |

| Tooling/Mold | $0 | $8,500 (one-time) | • Custom extrusion dies for unique frame profiles. Amortize over 5,000+ units for <$1.70/unit impact. |

| Design/R&D | $0 | $3,200 (one-time) | • CAD engineering + prototyping. Capitalize as operational expense for tax efficiency. |

| TOTAL UNIT COST | $295 | $327 | White Label Savings: $32/unit at 1,000 MOQ |

Note: Labor costs projected to rise 4.2% annually in China (2026–2028) due to automation investments. Material volatility (aluminum) remains the #1 risk – hedge via fixed-price contracts.

3. MOQ-Based Price Tiers: Unit Cost & Total Investment

Standard 3m x 3m Modular Stand (White Label Configuration). Excludes tooling, design, and logistics.

| MOQ Tier | Unit Cost (USD) | Total Cost (USD) | Cost per Unit vs. 500 MOQ | Strategic Fit |

|---|---|---|---|---|

| 500 units | $342 | $171,000 | Base (0% savings) | Niche events; market testing; low-risk entry |

| 1,000 units | $295 | $295,000 | -13.7% | Core recommendation: optimal balance of cost & flexibility |

| 5,000 units | $248 | $1,240,000 | -27.5% | Enterprise portfolios; multi-year contracts; global rollouts |

Critical Footnotes:

1. Tooling Impact: Private Label adds $11,700 one-time cost (amortized to $23.40/unit at 500 MOQ vs. $2.34/unit at 5,000 MOQ).

2. Hidden Costs: +5–7% for LCL shipping, +3% for customs brokerage, +2% for 3rd-party QC.

3. 2026 Trend: MOQ 5,000+ orders now qualify for “Green Manufacturing” subsidies (-1.8% avg. cost) from Guangdong provincial schemes.

4. Strategic Recommendations for Procurement Leaders

- Phased Labeling Strategy: Launch with White Label for Tier-2 events (minimizing capex), then migrate flagship events to Private Label using design equity from initial runs.

- MOQ Optimization: Consolidate orders across regions to hit 5,000-unit tiers. Example: A US$2.1M order across 3 regions cuts per-unit cost by $94 vs. fragmented sourcing.

- Risk Mitigation:

- Enforce dual-sourcing for extrusion dies (Shandong + Guangdong).

- Require real-time production tracking via supplier IoT platforms (SourcifyChina verifies 127 factories with this capability).

- Sustainability Leverage: Demand recycled aluminum (RJL-100 grade) – now cost-parity with virgin material in China due to policy incentives.

Final Insight: The cost gap between China and nearshore alternatives (Vietnam, Mexico) has narrowed to 9–14% for exhibition stands. China’s integrated supply chain (frames, graphics, hardware within 50km radius) still delivers 17–22% TCO advantage for volumes >1,000 units. Prioritize supplier agility over nominal cost savings.

SourcifyChina Verification: Data validated via 2026 China Exhibition Equipment Manufacturing Index (CEEMI) and 89 active client engagements. All cost projections include 3.8% YoY inflation adjustment.

Next Steps: Request our 2026 China Supplier Scorecard (covering 127 pre-vetted stand manufacturers) via SourcifyChina.com/supplier-intel.

© 2026 SourcifyChina. Confidential for authorized procurement professionals only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying Chinese Fair Stand Manufacturers

Date: January 2026

Executive Summary

As global demand for custom exhibition stands and trade show solutions increases, sourcing from China remains a cost-effective strategy. However, the market is saturated with intermediaries, inconsistent quality, and misrepresentation. This report outlines a structured due diligence process to accurately identify legitimate manufacturers of fair stand solutions in China, differentiate them from trading companies, and avoid high-risk suppliers.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operation | Confirm legal entity status and manufacturing authorization | Verify on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities | Third-party inspection (e.g., SGS, TÜV), or SourcifyChina-led audit with live video walkthrough |

| 3 | Review Equipment List & Production Floor Photos/Video | Assess technical capacity for metal fabrication, CNC, welding, modular assembly | Request timestamped photos, 360° video of machinery (aluminum extrusion, laser cutters, powder coating lines) |

| 4 | Evaluate In-House Design & R&D Team | Confirm customization capability | Request designer CVs, CAD/3D modeling software usage, portfolio of engineered solutions |

| 5 | Analyze Export History & Client References | Validate international compliance and reliability | Request 3–5 verifiable client references (preferably in EU/US), review shipping records (Bill of Lading via ImportGenius or Panjiva) |

| 6 | Inspect Quality Management Certifications | Ensure adherence to international standards | Look for ISO 9001, ISO 14001, OHSAS 18001, or industry-specific certifications |

| 7 | Review Raw Material Sourcing & Supply Chain | Assess cost control and material traceability | Supplier agreements for aluminum profiles, laminates, LED systems, and fire-retardant materials |

✅ Best Practice: Use a bilingual audit checklist and conduct unannounced virtual or physical visits.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific processes (e.g., metal fabrication) | Lists “trading,” “import/export,” or “sales” only |

| Factory Address & Photos | Owns or leases industrial facility; shows machinery, assembly lines, QC stations | Office-only location; no production equipment visible |

| Pricing Structure | Provides cost breakdown by material, labor, tooling | Offers flat pricing with limited transparency |

| Lead Time Control | Can commit to production timelines and adjust capacity | Often delays due to third-party dependencies |

| Minimum Order Quantity (MOQ) | Lower MOQs; flexible for prototyping | Higher MOQs; inflexible due to middleman margins |

| Direct Communication with Engineers | Technical team available for design feedback | Only sales representatives engage; no technical depth |

| Export Documentation | Lists manufacturer as shipper on B/L and invoices | Third-party factory listed; trading company as consignee |

⚠️ Note: Some hybrid suppliers operate both factory and trading arms. Verify if the entity you engage owns the production line.

Red Flags to Avoid When Sourcing Fair Stand Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High probability of being a trading company or shell entity | Disqualify unless third-party audit is commissioned |

| No verifiable client list or NDAs blocking references | Lack of credible track record | Request anonymized project portfolios or public exhibition records |

| Prices significantly below market average | Risk of substandard materials (e.g., non-fire-rated panels, thin aluminum) | Conduct material inspection and third-party lab testing |

| Use of stock images or inconsistent facility photos | Misrepresentation of capabilities | Request real-time video tour with QR code timestamp verification |

| Requests full payment upfront | High fraud risk | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inability to provide fire safety certifications (e.g., BS 476, DIN 4102) | Non-compliance with EU/US exhibition standards | Require test reports from accredited labs |

| Poor English communication or delayed responses | Operational inefficiency, risk of miscommunication | Assign a sourcing agent or bilingual project manager |

Strategic Recommendations

-

Leverage Third-Party Verification

Engage SourcifyChina or independent auditors for pre-qualification audits (including social compliance and environmental standards). -

Start with a Pilot Order

Test supplier capability with a small, complex stand design before scaling. -

Secure IP Protection

Execute a China-enforceable NDA and register designs via the Hague System or local CNIPA. -

Use Escrow or LC Payments

Mitigate financial risk with irrevocable Letters of Credit or platform-based escrow (e.g., Alibaba Trade Assurance). -

Build Long-Term Partnerships

Top-tier Chinese manufacturers prioritize stable clients over one-off buyers—demonstrate commitment for preferential terms.

Conclusion

The Chinese market offers advanced manufacturing capabilities for modular, sustainable, and high-impact fair stands. However, due diligence is non-negotiable. By systematically verifying legal, operational, and technical credentials—and actively distinguishing factories from trading intermediaries—procurement managers can secure reliable, compliant, and cost-efficient supply chains.

SourcifyChina recommends integrating this verification framework into all supplier onboarding workflows for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

For audit support or supplier shortlisting, contact: [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Strategic Sourcing for Global Procurement Excellence

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Subject: Eliminate Fair Sourcing Risks: Why 68% of Procurement Managers Waste 3.5+ Hours Per Unverified Supplier

Global procurement teams face a critical challenge at China trade fairs: unverified suppliers cost 14.2 hours per sourcing cycle (SourcifyChina 2025 Global Sourcing Survey). While “China fair stand companies” offer proximity to manufacturing, 68% lack production capacity, export licenses, or quality systems—transforming strategic opportunities into costly dead ends.

Why SourcifyChina’s Verified Pro List Solves This

Our AI-vetted Pro List for China Fair Stand Companies eliminates pre-fair uncertainty by delivering only pre-qualified suppliers meeting 12 critical criteria:

– Valid business licenses & export certifications

– Minimum 2-year production history

– Third-party facility audit reports (ISO 9001, BSCI)

– Real-time capacity verification via SourcifyChina’s supplier network

| Sourcing Phase | Traditional Approach (Unverified) | SourcifyChina Verified Pro List | Time Saved/Supplier |

|---|---|---|---|

| Pre-Fair Research | 4.2 hours (manual checks, agent fees) | 0.5 hours (instant access to verified profiles) | 3.7 hours |

| On-Site Fair Meeting | 1.8 hours (validating claims) | 0.3 hours (focus on specs/pricing) | 1.5 hours |

| Post-Fair Follow-Up | 8.1 hours (sample rejections, MOQ disputes) | 2.0 hours (smooth order processing) | 6.1 hours |

| TOTAL PER SUPPLIER | 14.1 hours | 2.8 hours | 11.3 hours |

Strategic Impact: For a team targeting 15 fair suppliers, this = 170+ reclaimed work hours per fair cycle—equivalent to 21 full business days redirected to strategic sourcing analysis and supplier development.

Your 2026 Sourcing Strategy Starts Now: Act Before Spring Fairs

Trade fairs like Canton Fair (April 2026) are your last line of defense against supply chain disruption. Don’t gamble with unverified suppliers when SourcifyChina’s Pro List guarantees:

✅ Zero supplier fraud risk (100% license/capacity verified)

✅ 30% faster RFQ turnaround (pre-negotiated MOQs & lead times)

✅ Priority access to 1,200+ vetted fair exhibitors across electronics, hardware, and textiles

→ Secure Your Competitive Edge in 60 Seconds

1. Email: Contact [email protected] with subject line “2026 Fair Pro List Access” for immediate priority onboarding.

2. WhatsApp: Message +86 159 5127 6160 for a free 15-minute fair strategy session (mention code FAIR2026 for expedited verification).

Deadline: Pro List slots for Canton Fair Phase I close February 28, 2026. Only 87 verified supplier slots remain.

“SourcifyChina’s Pro List cut our fair sourcing cycle from 19 days to 4. We onboarded 3 critical suppliers at Canton Fair 2025—with zero post-fair surprises.”

— Procurement Director, $2.1B Industrial Equipment Manufacturer (Germany)

Your time is your most constrained resource. We protect it.

→ Activate Your Verified Access Today

[email protected] | +86 159 5127 6160 (WhatsApp) | #SourcifyChina2026

SourcifyChina: Data-Driven Sourcing for Fortune 500 Procurement Teams Since 2018. 1,800+ verified suppliers. 94% client retention rate.

🧮 Landed Cost Calculator

Estimate your total import cost from China.