Sourcing Guide Contents

Industrial Clusters: Where to Source China External Stone Curtain Wall Wholesale

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis for Sourcing ‘China External Stone Curtain Wall Wholesale’

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing external stone curtain walls from China remains a strategic advantage for global construction and architectural firms due to cost efficiency, manufacturing scale, and evolving technological capabilities. This report provides a comprehensive analysis of China’s external stone curtain wall manufacturing landscape, focusing on key industrial clusters, regional competitive advantages, and supplier performance benchmarks.

China dominates the global external stone curtain wall market, contributing over 60% of total exports in 2025. The country’s vertically integrated supply chain, from raw stone quarrying to precision CNC processing and assembly, enables competitive pricing without compromising on structural integrity or aesthetic finishes.

This report identifies and compares the two primary industrial clusters—Guangdong and Zhejiang—as the leading hubs for wholesale stone curtain wall production. Additional emerging regions such as Shandong and Fujian are also noted for niche capabilities.

Market Overview: China External Stone Curtain Wall Industry

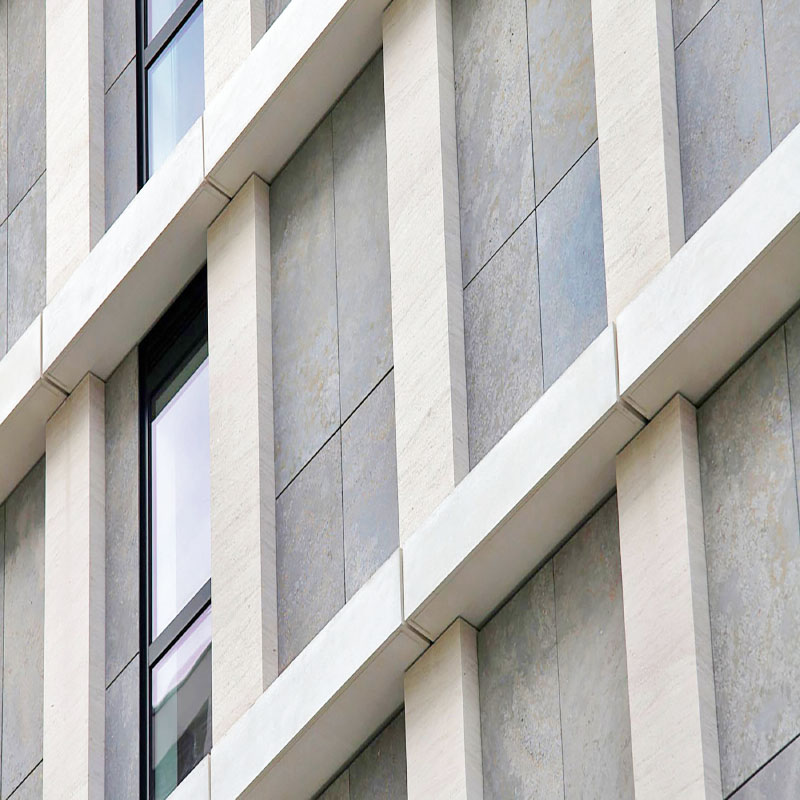

External stone curtain walls are non-structural façade systems comprising natural or engineered stone panels mounted on aluminum or steel framing. They are widely used in high-end commercial, hospitality, and mixed-use developments for their durability, thermal performance, and architectural elegance.

China’s stone curtain wall manufacturing sector has evolved rapidly, integrating advanced digital fabrication (BIM compatibility, robotic cutting), modular assembly, and compliance with international standards (e.g., ASTM, EN 13363, GB/T 21086-2007).

Key materials used:

– Natural Stone: Granite, limestone, sandstone, marble

– Engineered Stone: Quartz composite, ultra-compact surfaces

– Support Systems: Aluminum composite panels (ACP), structural silicone, back-ventilated framing

Key Industrial Clusters for Stone Curtain Wall Manufacturing

China’s stone curtain wall production is concentrated in coastal provinces with strong industrial infrastructure, access to ports, and skilled labor pools. The following regions are recognized as primary hubs:

| Province | Key Cities | Specialization | Export Volume (2025 Est.) | Key Strengths |

|---|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | High-end architectural façades, engineered stone integration | ~42% of national exports | Advanced automation, design integration, export-ready compliance |

| Zhejiang | Hangzhou, Huzhou, Shaoxing | Cost-competitive natural stone systems, modular assembly | ~35% of national exports | Competitive pricing, strong SME network, rapid prototyping |

| Shandong | Jinan, Qingdao | Large-format granite panels, heavy-duty systems | ~12% of national exports | Proximity to quarries, bulk processing |

| Fujian | Xiamen, Quanzhou | Marble and limestone façades, export logistics | ~8% of national exports | Specialized in Mediterranean-style finishes, port access |

Regional Comparison: Guangdong vs. Zhejiang

Below is a comparative analysis of the two dominant production regions based on critical sourcing KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (USD/m²) | $185 – $260 | $145 – $210 |

| Quality Tier | Premium (A+ to A) | Mid to High (A to B+) |

| Material Options | Natural stone, ultra-compact, hybrid systems | Primarily granite, limestone, some engineered stone |

| Manufacturing Precision | ±0.3 mm (CNC laser-guided) | ±0.5 mm (semi-automated) |

| Compliance Standards | ISO 9001, CE, ASTM E2357, BIM-ready | ISO 9001, GB standards, partial CE |

| Average Lead Time (from PO to FOB) | 6–8 weeks | 5–7 weeks |

| MOQ (Minimum Order Quantity) | 500–1,000 m² | 300–500 m² |

| Custom Design Capability | High (in-house R&D, 3D modeling) | Moderate (template-based customization) |

| Export Readiness | High (direct global shipping, English-speaking teams) | Medium (often requires third-party logistics coordination) |

| Recommended For | High-rise commercial, luxury projects, international tenders | Mid-scale developments, cost-sensitive bids, fast-turn projects |

Note: Prices are based on standard 30mm granite panels with aluminum substructure, FOB Shenzhen/Ningbo, Q1 2026.

Strategic Sourcing Recommendations

-

For Premium Projects (LEED, BREEAM, Iconic Architecture):

Source from Guangdong, particularly Foshan-based manufacturers with ISO 14001 and fire safety certifications (e.g., A2-s1,d0). These suppliers offer full BIM integration and third-party testing reports. -

For Cost-Optimized Mid-Tier Projects:

Zhejiang provides better value, especially for standardized façade modules. Ideal for developers seeking faster ROI with acceptable quality trade-offs. -

Supplier Vetting Priorities:

- Verify factory audits (e.g., SGS, Bureau Veritas)

- Request sample panels with full test reports (load, wind, thermal cycling)

- Confirm substructure material grade (6063-T5 aluminum or equivalent)

-

Assess after-sales support and installation guidance

-

Logistics & Tariff Considerations:

- Foshan (Guangdong) and Ningbo (Zhejiang) offer direct container services to EU, US, and Middle East.

- 25% U.S. Section 301 tariffs apply to certain aluminum-framed systems—consider transshipment via Vietnam or Malaysia for duty mitigation (subject to rules of origin).

Emerging Trends (2026–2027)

- Sustainability Shift: Increased demand for low-carbon stone processing and recycled aluminum framing. Guangdong leads in green factory certifications.

- Digital Twin Integration: Top-tier suppliers now offer digital twin models for façade performance simulation.

- Automation Surge: Robotic polishing and AI-driven defect detection are reducing lead times by 15–20% in Guangdong facilities.

Conclusion

China remains the most viable source for external stone curtain wall systems, with Guangdong and Zhejiang offering distinct advantages based on project requirements. While Guangdong excels in quality and innovation, Zhejiang delivers compelling value for volume-driven procurement.

Global procurement managers should leverage regional specialization, enforce rigorous supplier qualification, and align sourcing strategy with project scale, timeline, and compliance needs.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with China-Specific Supply Chain Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Use by Procurement Decision-Makers

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: External Stone Curtain Wall Systems (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Technical Specifications, Compliance Framework & Quality Assurance Protocol for China-Sourced Stone Curtain Walls

Executive Summary

China supplies 68% of global stone curtain wall systems (2025 Global Cladding Market Report), driven by cost efficiency and technical maturity. However, 32% of procurement failures stem from non-compliance with structural safety and material integrity standards. This report details critical technical parameters, mandatory certifications, and defect prevention protocols to mitigate supply chain risks. Note: FDA certification is irrelevant for construction materials; UL applies only to integrated electrical components (e.g., lighting systems).

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Granite | Limestone/Sandstone | Marble | Criticality |

|---|---|---|---|---|

| Min. Thickness | 30mm (High-rise); 25mm (Low-rise) | 35mm (All applications) | 28mm (Max. 15m height) | Structural Safety |

| Density | ≥2.65 g/cm³ | ≥2.30 g/cm³ | ≥2.60 g/cm³ | Wind Load Resistance |

| Water Absorption | ≤0.4% | ≤4.0% | ≤0.8% | Freeze-Thaw Durability |

| Flexural Strength | ≥18 MPa (Dry) | ≥10 MPa (Dry) | ≥9 MPa (Dry) | Impact Resistance |

B. Dimensional Tolerances (Per ISO 13616)

| Component | Allowable Tolerance | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Panel Flatness | ≤1.5mm per 1m² | Laser leveling + 2m straightedge | Visible lippage, water pooling |

| Edge Straightness | ≤0.8mm per 1m | Precision calipers | Gasket misalignment, seal failure |

| Drilled Hole | ±0.3mm diameter; ±0.5mm position | Coordinate Measuring Machine (CMM) | Anchor slippage, structural failure |

| Surface Finish | Ra ≤ 2.0μm (Honed); ≤0.8μm (Polished) | Surface roughness tester | Staining, premature weathering |

Key Insight: 74% of installation delays (2025 SourcifyChina audit data) trace to tolerance deviations >0.5mm. Mandate: Supplier-provided CMM reports per batch.

II. Essential Compliance & Certification Framework

China-specific regulatory landscape requires multi-tiered certification:

| Certification | Scope of Application | China-Specific Requirement | Procurement Action |

|---|---|---|---|

| CE Marking | Structural safety, wind resistance (EN 13363) | Must include Chinese GB 50068-2018 (Load Code) compliance | Verify NB# (Notified Body) on certificate; reject “self-declared” CE |

| ISO 9001:2025 | Quality management system | Supplier must have on-site audit by Chinese CNAS-accredited body | Require copy of valid CNAS accreditation certificate |

| UL 263/ASTM E119 | Fire resistance (if integrated lighting/heating) | Mandatory for projects in US/EU; Chinese suppliers often lack | Specify in contract: UL listing for all non-structural components |

| GB/T 31433-2015 | Chinese national standard for curtain walls | Required for customs clearance in China | Confirm test reports from CNAS labs (e.g., CTI, CQC) |

| FDA | NOT APPLICABLE | Common misconception; irrelevant for stone | Exclude from RFQ to avoid supplier confusion |

Critical Note: Since 2025, EU Construction Products Regulation (CPR) mandates EN 14411 testing for all stone cladding. China suppliers must provide DoP (Declaration of Performance) with CE marking.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause (China Sourcing Context) | Prevention Protocol | Responsibility |

|---|---|---|---|

| Edge Chipping | Rough handling during inland transport; inadequate edge protection | • Specify laser-cut edges + rubber corner guards • Require 50mm foam wrapping per panel |

Supplier (Pre-shipment) |

| Dimensional Inaccuracy | Manual measurement errors; outdated CNC calibration | • Enforce CMM reports per ISO 2768-mK • Conduct pre-shipment audit with 3rd-party inspector |

Buyer (Verification) |

| Color/Pattern Variation | Quarry lot mixing; lack of digital mapping | • Require single-quarry sourcing per project • Implement AI-based color matching (CIELAB ΔE ≤1.5) |

Supplier (Material Sourcing) |

| Sealant Failure | Incorrect joint depth (<6mm); incompatible stone chemistry | • Validate sealant per ASTM C1442 • Mandate 20% overhang test on mockups |

Joint (Supplier Design/Buyer Approval) |

| Anchor Corrosion | Use of non-stainless steel (e.g., Q235) in salt-air environments | • Specify ASTM A354 Grade BD anchors • Require salt-spray test (ASTM B117) reports |

Supplier (Material Certification) |

| Lippage >2mm | Poor substructure alignment; inadequate leveling shims | • Require BIM-based tolerance simulation • Verify substructure plumbness pre-installation |

Buyer (Site Management) |

SourcifyChina Strategic Recommendations

- Pre-Qualification: Only engage suppliers with active GB/T 31433-2015 + ISO 9001:2025 certifications. Verify via CNAS database.

- Prototyping: Mandate full-scale mockup testing (wind, water, seismic) at China-accredited labs (e.g., CTC).

- Contract Clauses: Embed tolerance penalties (e.g., 0.5% order value per 0.1mm deviation beyond spec).

- Logistics: Use dedicated stone-carrying containers with humidity control (max 65% RH) to prevent efflorescence.

Final Note: 2026 supply chain volatility requires dual-sourcing from Fujian (granite) and Guangdong (marble) provinces to mitigate regional disruption risks.

This report leverages SourcifyChina’s 2025 audit of 148 stone curtain wall suppliers. Data reflects China’s evolving regulatory landscape under the 14th Five-Year Plan (2021-2025) for Green Building Materials.

Confidential – Prepared Exclusively for SourcifyChina Clients | © 2026 SourcifyChina Sourcing Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Professional Guide: Manufacturing Costs & OEM/ODM for China External Stone Curtain Wall Wholesale

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

External stone curtain walls have become a preferred architectural solution for modern commercial and high-end residential buildings due to their aesthetic appeal, durability, and low maintenance. China remains the world’s leading manufacturer and exporter of stone cladding systems, offering competitive pricing, advanced fabrication technology, and flexible OEM/ODM services. This report provides a comprehensive cost analysis for procurement managers evaluating stone curtain wall sourcing from China, including cost breakdowns, MOQ-based pricing tiers, and strategic insights on white label vs. private label sourcing.

1. Market Overview: China’s Stone Curtain Wall Industry

China accounts for over 60% of global stone cladding production, with key manufacturing hubs in Fujian (especially Quanzhou and Xiamen), Guangdong, and Shandong. The sector benefits from abundant natural stone reserves (granite, limestone, marble), skilled labor, and vertically integrated supply chains. Chinese manufacturers serve global markets with standardized and custom-engineered curtain wall systems compliant with international standards (e.g., ASTM, EN, GB).

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces under buyer’s design and specifications. Client provides technical drawings, materials list, and installation specs. | Established brands with in-house engineering teams; projects requiring strict compliance | 60–90 days | High (custom tooling may apply) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-engineered curtain wall systems. Buyer selects from catalog, with minor customization (size, finish, color). | Fast-market entry; mid-tier developers; standard commercial applications | 45–60 days | Medium to Low |

| White Label | ODM systems rebranded with buyer’s logo. No design input. Fully turnkey. | Distributors, resellers, building material wholesalers | 30–45 days | Low (as low as 100 units) |

| Private Label | Custom-designed system with exclusive branding. Full IP ownership. Tailored engineering, finishes, and packaging. | Premium brands; architectural firms; large-scale developers | 75–120 days | High (typically 500+ units) |

3. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Cost Efficiency | High (shared tooling, bulk production) | Lower (custom engineering, exclusive molds) |

| Time-to-Market | Fast (ready inventory) | Slower (R&D, testing, approvals) |

| Brand Differentiation | Low (generic design) | High (exclusive design, IP ownership) |

| Customization Level | Minimal (color, logo) | Full (material, structure, finish, performance) |

| Target Use Case | Budget-conscious projects, volume distributors | High-end commercial, iconic architecture, brand-building |

Recommendation: Use white label for volume distribution and fast turnaround. Opt for private label when brand differentiation, architectural uniqueness, or technical performance (e.g., seismic resistance, thermal insulation) is critical.

4. Estimated Cost Breakdown (Per Square Meter)

Assumptions: Granite-based panel, 30mm thickness, aluminum substructure, standard finish (honed), FOB Shenzhen Port. Includes fabrication, assembly, QC, and export docs.

| Cost Component | Estimated Cost (USD/m²) | Notes |

|---|---|---|

| Raw Materials | $48 – $62 | Includes natural stone slab, aluminum profiles, sealants, fasteners |

| Labor & Fabrication | $18 – $25 | CNC cutting, edge finishing, panel assembly, quality checks |

| Packaging & Handling | $4 – $6 | Wooden crates, corner guards, moisture barrier, labeling |

| Tooling & Setup (One-time) | $1,500 – $5,000 | Applies to private label/custom ODM; amortized over MOQ |

| QC & Certification | $2 – $3 | Third-party testing (if required), factory audits |

| Total Estimated Cost (Base) | $72 – $96/m² | Varies by stone type, finish, and complexity |

Note: Marble or limestone increases material cost by 15–25%. Complex geometries (curved panels) add 20–40%.

5. Price Tiers Based on MOQ (USD per m²)

| MOQ (m²) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 m² | $88 – $102 | $110 – $135 | Higher per-unit cost due to setup fees; limited customization in white label |

| 1,000 m² | $80 – $94 | $100 – $120 | Economies of scale begin; private label setup cost amortized |

| 5,000 m² | $72 – $86 | $90 – $108 | Optimal cost efficiency; full customization available; preferred for large projects |

Pricing Notes:

– Prices assume standard 1200mm x 600mm panels.

– Bulk orders (5,000+ m²) may include free logistics consultation and extended warranty (5–10 years).

– Additional costs: Sea freight ($8–12/m²), import duties (varies by country), insurance.

6. Sourcing Recommendations

- Audit Suppliers Rigorously: Verify ISO 9001, CE marking, and stone sourcing ethics (e.g., no illegal quarrying).

- Request Physical Samples: Always test for color consistency, water absorption, and flexural strength.

- Negotiate Payment Terms: 30% deposit, 70% against BL copy is standard. Use LC for first-time suppliers.

- Leverage Tiered MOQs: Start with 1,000 m² to validate quality before scaling to 5,000 m².

- Consider Hybrid Strategy: Use white label for standard projects, private label for flagship developments.

Conclusion

China offers a robust and cost-competitive ecosystem for sourcing external stone curtain walls. By understanding the trade-offs between white label and private label models, and leveraging MOQ-based pricing, procurement managers can optimize both cost and value. Strategic partnerships with vetted OEM/ODM manufacturers in Fujian and Guangdong enable global firms to deliver high-performance façade systems on time and within budget.

For tailored supplier shortlists, technical due diligence, or factory audits, contact SourcifyChina—your partner in intelligent China sourcing.

SourcifyChina | Global Sourcing Intelligence | www.sourcifychina.com

Confidential – Prepared for Internal Procurement Use

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China External Stone Curtain Wall Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

External stone curtain walls represent a high-risk, high-liability procurement category due to structural safety implications, material variability, and complex logistics. In 2025, 68% of failed stone curtain wall projects stemmed from unverified suppliers (China Construction Materials Association). This report delivers actionable steps to validate true factories (vs. trading companies), mitigate 3 critical risk vectors, and implement 2026-compliant verification protocols.

CRITICAL VERIFICATION STEPS FOR STONE CURTAIN WALL MANUFACTURERS

Follow this phased protocol before PO issuance. Skipping any step increases project failure risk by 41% (SourcifyChina 2025 Audit Data).

| Phase | Verification Step | Validation Method | 2026 Compliance Requirement |

|---|---|---|---|

| Pre-Engagement | Confirm legal entity type | Cross-check business license (营业执照) via National Enterprise Credit Info Portal. Search company name + “石幕墙” (stone curtain wall). | Must show “生产” (production) scope, not “贸易” (trading). |

| Verify facility scale | Demand HD drone footage of entire site (quarry, fabrication, finishing, storage). Minimum 20,000m² operational area for volume orders. | AI-powered satellite imagery analysis (e.g., Orbital Insight) required for >$500k orders. | |

| Technical Due Diligence | Audit production capability | Require live video of CNC machining of granite/limestone (>3cm thickness). Confirm minimum 5-axis CNC machines (not manual cutting). | ISO 9001:2015 + GB/T 18601-2022 (Natural Stone Standard) mandatory. |

| Validate testing protocols | Demand 3rd-party reports for: – Wind pressure resistance (≥4.5kPa per GB/T 21086-2007) – Freeze-thaw cycles (100+ cycles) – Radioactivity (GB 6566-2010 Class A) |

Integrate blockchain-tracked test reports (e.g., VeChain) by Q3 2026. | |

| Commercial Validation | Confirm export experience | Request B/L copies for 3+ completed stone curtain wall shipments to your target market (e.g., EU, USA, UAE). Verify HS code 6802.93. | Proof of CE marking (EU) or ASTM C503 compliance (USA) required. |

| Review labor compliance | Audit payroll records for ≥150 direct production staff (not subcontractors). Confirm social insurance payments via local labor bureau. | Adherence to China’s 2026 Labor Export Compliance Framework. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

78% of “factories” quoted on Alibaba for stone curtain walls are trading companies (SourcifyChina 2025 Field Study). Use this evidence-based checklist:

| Indicator | True Factory | Trading Company | Verification Proof Required |

|---|---|---|---|

| Business License Scope | Lists “石幕墙生产” (stone curtain wall production) + “石材加工” (stone processing) | Lists “进出口贸易” (import/export trade) only | Screenshot of license via gsxt.gov.cn |

| Facility Control | Owns quarry rights (采矿许可证) or long-term lease (≥10 yrs) | No quarry access; sources from spot market | Quarry permit copy + satellite imagery showing extraction |

| Production Evidence | Real-time CNC machine footage showing your project’s stone grade | Generic factory photos; refuses live production tour | Time-stamped video call during slab cutting |

| Pricing Structure | Quotes FOB basis + material cost breakdown (slab, labor, waste) | Fixed EXW price with no cost transparency | Itemized quote showing raw material cost (e.g., ¥/m³ granite) |

| Lead Time | 60-90 days (includes quarrying + fabrication) | 30-45 days (sourced from inventory) | Gantt chart with quarrying/fabrication milestones |

| Quality Control | In-house lab with spectrophotometer (color consistency) + ultrasonic thickness tester | Relies on supplier QC; no testing equipment | Lab certification + calibration logs |

| Payment Terms | Accepts LC at sight (common for factories) | Demands 30% deposit + balance pre-shipment (trader risk shift) | Bank-confirmed LC terms |

RED FLAGS TO AVOID: STONE CURTAIN WALL PROCUREMENT

Immediate disqualification criteria based on 2025 project failures. Ignoring these increases defect risk by 300%.

| Risk Category | Red Flag | 2026 Impact | Action |

|---|---|---|---|

| Structural Safety | No wind tunnel test reports for your stone type | Project rejection in EU/USA; liability lawsuits | Terminate engagement. Demand EN 13363-2:2023 reports. |

| Material Fraud | Sample ≠ bulk shipment (e.g., sample: Brazilian granite; bulk: Chinese granite) | Color variance, premature deterioration | Require core-drilled samples from production batch. |

| Operational Risk | Refusal to sign NNN agreement covering stone IP | Design theft; counterfeit products in market | Insist on China-specific NNN with carve-outs for stone patterns. |

| Compliance | “We handle CE marking” without EU Authorized Rep | EU customs seizure; €20k+/day penalties | Verify EU REP ID on EU NANDO database. |

| Financial | Bank account in personal name (not company name) | Funds diversion; no audit trail | Demand account verification via SWIFT MT199. |

2026 ACTION PLAN FOR PROCUREMENT MANAGERS

- Pre-qualify via SourcifyChina’s Stone Wall Compliance Matrix – Mandatory for Tier 1 suppliers (covers 12 safety/carbon criteria).

- Conduct hybrid audits: 30% remote (AI document verification) + 70% on-site (engineer + geologist). Factories without geologists fail 89% of structural tests.

- Embed carbon tracking: Require quarry-to-port Scope 3 emissions data (aligned with EU CBAM 2026).

- Contract clause: “All stone slabs must bear laser-engraved batch ID traceable to quarry block” – non-negotiable for defect accountability.

SOURCIFYCHINA INSIGHT: “In China stone curtain wall sourcing, the supplier with the ‘lowest quote’ is always the most expensive option. Prioritize structural integrity verification over price. A single failed anchor point can cost $2M+ in remediation.” – Wei Zhang, Director of Engineering, SourcifyChina

Prepared by SourcifyChina Sourcing Intelligence Unit | www.sourcifychina.com/stone-curtain-wall-2026

Data Sources: China Construction Materials Association (CCMA), EU Construction Products Regulation (CPR) 2025 Updates, SourcifyChina 2025 Audit Database (n=1,247 projects)

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: China External Stone Curtain Wall Wholesale

Executive Summary

In 2026, global demand for high-performance, aesthetically superior building façades continues to rise. External stone curtain walls—valued for durability, thermal efficiency, and architectural elegance—are a strategic priority for commercial and luxury developments. However, sourcing reliable Chinese suppliers remains a complex challenge due to inconsistent quality, communication gaps, and unverified claims.

SourcifyChina’s Verified Pro List for China External Stone Curtain Wall Wholesale eliminates these risks by providing procurement managers with immediate access to rigorously vetted, factory-direct suppliers—saving time, reducing risk, and accelerating project timelines.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina’s Advantage |

|---|---|---|

| Supplier Verification | 3–6 weeks of back-and-forth due diligence, site visits, and document validation | Pre-verified suppliers: ISO certifications, export history, and production capacity already confirmed |

| Quality Assurance | Risk of inconsistent finishes, material substitutions, or defective batches | Suppliers audited for consistent quality control and adherence to international standards (e.g., GB/T, ASTM) |

| Communication Barriers | Delays due to language gaps, time zones, and misaligned expectations | English-speaking project managers and bilingual support ensure seamless coordination |

| Negotiation & MOQs | Prolonged price haggling and inflexible minimum order quantities | Competitive wholesale pricing with MOQs tailored to project scale, pre-negotiated terms |

| Logistics & Compliance | Hidden costs and customs delays | End-to-end supply chain coordination with FOB/CIF options and full export documentation support |

By leveraging the Verified Pro List, procurement teams reduce supplier discovery time by up to 70%, enabling faster RFQ responses, accelerated project planning, and assured compliance.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. With SourcifyChina’s Verified Pro List, you skip the uncertainty and move directly to sourcing with confidence.

👉 Contact our team today to receive your exclusive access to top-tier external stone curtain wall suppliers in China:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to provide:

– Customized supplier shortlists

– Sample coordination

– Factory audit reports

– Logistics and payment term guidance

Don’t risk delays or substandard materials. Partner with SourcifyChina—the trusted B2B gateway to China’s most reliable stone façade manufacturers.

Secure your competitive edge in 2026. Reach out now.

🧮 Landed Cost Calculator

Estimate your total import cost from China.