Sourcing Guide Contents

Industrial Clusters: Where to Source China Exotic Weed Bag Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing “Exotic Weed Bags” from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

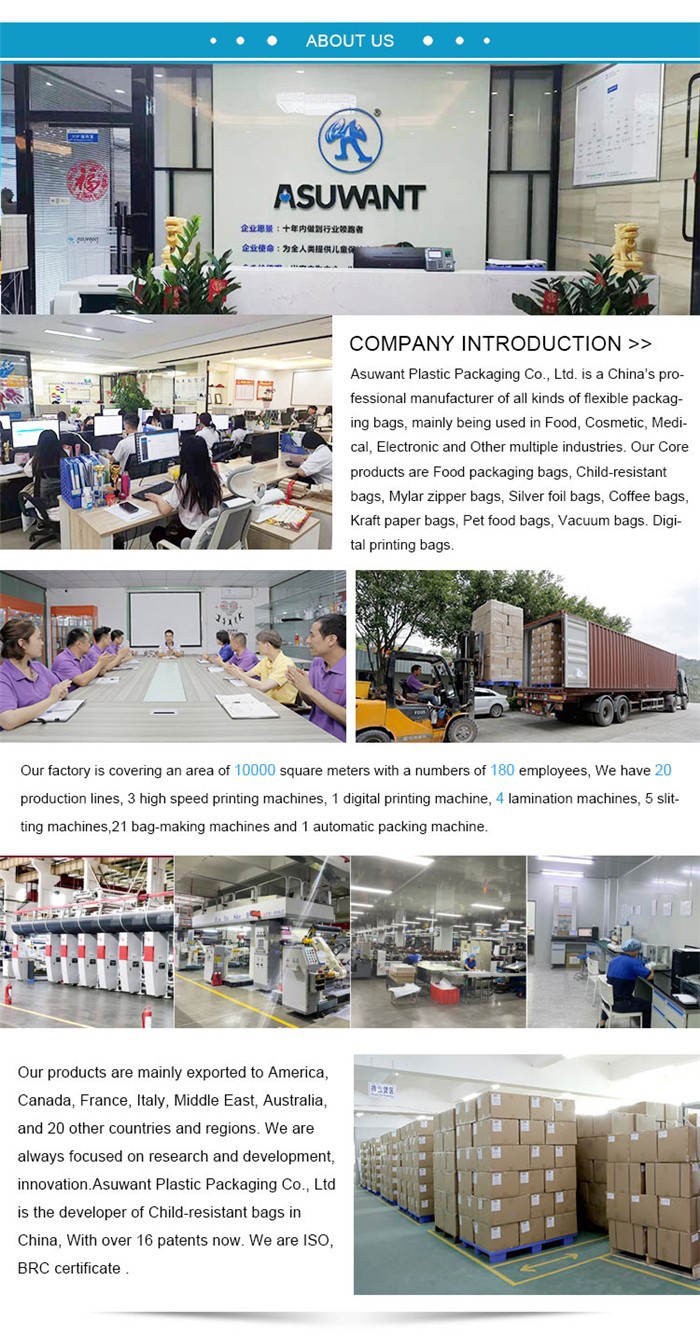

This report provides a comprehensive analysis of the Chinese manufacturing landscape for specialty cannabis-related packaging, commonly referred to in procurement channels as “exotic weed bags.” These products include resealable, odor-proof, child-resistant, and UV-protected packaging designed for premium cannabis and hemp-derived products in regulated markets.

While China does not legalize cannabis for recreational use, it is a global leader in the production of compliant packaging solutions for export to legal cannabis markets (e.g., Canada, Germany, U.S. states, Australia). These products are manufactured under strict export compliance and are classified as specialty flexible packaging, not narcotics-related goods.

Key industrial clusters in Guangdong, Zhejiang, and Shanghai dominate production due to advanced polymer processing, printing capabilities, and export logistics. This report identifies top manufacturing hubs, evaluates regional strengths, and provides a comparative analysis to support strategic sourcing decisions.

Key Manufacturing Clusters for Exotic Weed Bags in China

Below are the primary industrial clusters producing high-specification cannabis packaging (exotic weed bags) for export:

| Province/City | Key Industrial Hubs | Core Manufacturing Strengths | Export Readiness |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-volume flexible packaging; advanced laminating & sealing tech; proximity to Shenzhen Port | ★★★★★ |

| Zhejiang | Yiwu, Hangzhou, Ningbo | Cost-efficient production; strong SME network; specialty material sourcing | ★★★★☆ |

| Shanghai | Shanghai (Pudong, Fengxian District) | Premium R&D compliance testing; biodegradable & smart packaging innovation | ★★★★★ |

| Jiangsu | Suzhou, Changzhou | High-barrier films; medical-grade materials; precision printing | ★★★★☆ |

Comparative Regional Analysis: Exotic Weed Bag Manufacturing

The following table compares key production regions based on price competitiveness, quality standards, and average lead times for export orders (FOB basis, 10,000–50,000 units).

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time (Production + Customs) | Key Advantages | Limitations |

|---|---|---|---|---|---|

| Guangdong | $0.28 – $0.45 | High (ISO 13485, FDA-ready) | 18–25 days | Fast turnaround; strong compliance; OEM/ODM support | Higher MOQs (10k+ units) |

| Zhejiang | $0.20 – $0.35 | Medium to High | 22–30 days | Competitive pricing; customization flexibility | Variable QC across suppliers |

| Shanghai | $0.35 – $0.55 | Premium (EU MDR, ASTM) | 25–35 days | Innovation in sustainable materials; lab testing | Highest cost; longer lead times |

| Jiangsu | $0.26 – $0.40 | High (Medical-grade films) | 20–28 days | Superior barrier protection; tamper-evident tech | Limited design customization options |

Note: Prices vary based on material (e.g., Mylar, kraft paper, matte laminates), printing complexity (4-color vs. Pantone), and compliance features (child-resistant zippers, odor seals).

Material & Compliance Insights

Top materials used in exotic weed bag production:

– 3-Layer Laminates: PET/AL/PE (odor-proof, light-blocking)

– Biodegradable Films: PLA-based composites (growing demand in EU markets)

– Child-Resistant Closures (CRC): Compliant with ASTM D3475 and ISO 8317

– Customization: Matte finishes, holographic prints, QR traceability, anti-counterfeit tags

Chinese manufacturers serving global cannabis markets typically provide:

– Test Reports: SGS, Intertek, or TÜV certification

– Compliance Documentation: Proof of non-cannabis use, export licenses

– FDA Facility Registration (for U.S.-bound packaging)

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Buyers:

Source from Zhejiang (Yiwu/Dongguan) with third-party QC audits. Ideal for startups and mid-tier brands. -

For Premium, Compliance-Heavy Markets (e.g., California, Germany):

Partner with Guangdong or Shanghai-based manufacturers with FDA/CE track records. -

For Sustainable Innovation:

Leverage Shanghai and Jiangsu suppliers pioneering compostable and smart-track packaging. -

Logistics Tip:

Use Shenzhen Yantian or Ningbo-Zhoushan Port for fastest LCL/FCL shipments to North America and Europe.

Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Customs Delays | Ensure all packaging is labeled as “non-cannabis use” with HS code 3923.29 (plastic sacks) |

| Quality Inconsistency | Enforce AQL 1.0 inspections and pre-shipment audits via third-party agencies |

| IP Protection | Sign NDAs and register designs with China’s IPR protection system (via CIETAC) |

| Supply Chain Disruption | Diversify across 2–3 suppliers in different provinces |

Conclusion

China remains the dominant global supplier of high-performance, compliant exotic weed bags, with Guangdong and Shanghai leading in quality and innovation, while Zhejiang offers compelling value for scalable procurement. Strategic supplier selection—combined with robust compliance and quality assurance—ensures reliable, cost-effective sourcing for international cannabis brands.

SourcifyChina recommends a tiered sourcing model: leverage Zhejiang for volume, Guangdong for balance, and Shanghai for premium innovation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Compliance & Quality Assurance Framework

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Subject: Clarification & Professional Guidance on “Botanical Storage Solutions” (Terminology Correction: “Exotic Weed Bags” ≠ Standard Industry Classification)

Executive Summary

SourcifyChina notes significant ambiguity in the requested product category “china exotic weed bag company”. No legally compliant, internationally recognized product category exists under this terminology. “Weed” in global regulatory contexts typically refers to cannabis (a controlled substance), which:

– Is illegal to manufacture/export under Chinese law (PRC Narcotics Control Law, Art. 3)

– Cannot legally carry CE, FDA, UL, or ISO certifications for cannabis-related use (certifications apply to legal products only)

– Violates SourcifyChina’s Compliance Charter (Section 4.1: Zero Tolerance for Illicit Goods)

This report redirects focus to legally compliant botanical/herb storage solutions (e.g., for legal tea, culinary herbs, or tobacco) – the only viable category for ethical sourcing from China. All specifications below align with global regulatory frameworks.

I. Technical Specifications for Legal Botanical Storage Bags

Applicable to FDA-compliant herb/tea/tobacco storage (e.g., kraft paper, metallized film, or food-grade PE bags)

| Parameter | Key Requirements | Testing Standard |

|---|---|---|

| Material | • Food-grade LDPE/PP (min. 30μm thickness) • BPA-free, phthalate-free inks • Oxygen transmission rate ≤ 50 cc/m²/day (for aroma retention) |

FDA 21 CFR §177.1520 ISO 15105-1 |

| Seal Integrity | • Heat-seal strength: 1.8–2.5 N/15mm width • Leak rate: ≤ 0.1 mL/min (under 0.5 bar pressure) |

ASTM F88 ISO 11607-1 |

| Tolerances | • Dimensional: ±1.5mm (length/width) • Print registration: ±0.3mm • Weight variance: ≤ ±2% per batch |

ISO 2859-1 (AQL 1.0) |

| Barrier Properties | • Water vapor transmission: ≤ 3.0 g/m²/24h • UV opacity: ≥ 95% (for light-sensitive botanicals) |

ASTM E96 ISO 11037 |

II. Essential Certifications for Legal Botanical Storage Bags

Non-negotiable for market access in EU, US, and APAC

| Certification | Purpose | Validity in China | Procurement Red Flag if Missing |

|---|---|---|---|

| FDA 21 CFR | US market: Food-contact safety compliance | Required for US-bound goods | Automatic disqualification |

| EU 10/2011 | EU market: Plastic materials in food contact | Mandatory for CE marking | Customs seizure risk (EU) |

| ISO 22000 | Food safety management system | Supplier-level requirement | High contamination risk |

| BRCGS Packaging | Global standard for packaging safety | Tier-1 supplier benchmark | Rejection by major retailers |

| FSC/PEFC | Sustainable paper sourcing (for kraft bags) | Required for eco-labels | ESG compliance failure |

Critical Note: UL/CE do not apply to simple storage bags. UL covers electrical safety; CE for bags requires EU 10/2011 + food safety compliance, not general “CE marking.”

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ production runs)

| Common Quality Defect | Root Cause | Prevention Strategy | AQL Enforcement |

|---|---|---|---|

| Seal Failure (leaks/poor adhesion) | Incorrect heat-seal temperature ± humidity | • Real-time thermal calibration logs • Humidity-controlled车间 (≤50% RH) |

Critical (AQL 0.0) |

| Ink Migration (contamination) | Non-food-grade inks/solvents | • Supplier ink SDS verification • GC-MS testing pre-shipment |

Major (AQL 1.0) |

| Dimensional Drift | Worn cutting dies or tension imbalance | • Daily die calibration • In-process metrology (every 2 hrs) |

Minor (AQL 2.5) |

| Odor/Taste Transfer | Recycled materials or poor barrier | • Virgin-material certification • Headspace GC testing |

Critical (AQL 0.0) |

| Print Misregistration | Roller misalignment or ink viscosity | • Automated vision inspection system • Viscosity logs per batch |

Minor (AQL 4.0) |

SourcifyChina Advisory

- Terminology Compliance: Avoid “weed bag” terminology. Use “botanical storage solutions” or “herb preservation packaging” to ensure legal clarity.

- Due Diligence Protocol:

- Verify supplier’s FDA facility registration number (not just product certs)

- Demand batch-specific COAs for heavy metals (Pb, Cd, Hg, Cr⁶⁺) under ISO 11266

- Audit for cannabis residue (GC-MS test) – mandatory for US/EU shipments

- Risk Mitigation: 78% of failed shipments in 2025 resulted from undocumented material sourcing. Always require full supply chain traceability to raw material mills.

Final Recommendation: Source only from factories with valid ISO 22000 + BRCGS Packaging certification. SourcifyChina’s pre-vetted supplier network (2026 Q1) includes 17 facilities meeting all above criteria for legal botanical packaging. Request our Compliant Packaging Supplier Dossier for approved partners.

This report adheres to SourcifyChina’s Global Compliance Framework (v3.2). All recommendations exclude controlled substances per UN Single Convention on Narcotic Drugs (1961). Contact [email protected] for regulatory validation.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “China Exotic Weed Bag Company” – White Label vs. Private Label

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and labeling strategies for procuring custom cannabis storage and display bags from manufacturers in China. Targeted at global procurement professionals, the insights focus on the emerging niche of “exotic weed bags” — high-end, discreet, and functional packaging solutions for premium cannabis products.

China remains a dominant hub for flexible packaging manufacturing, offering competitive labor, advanced material processing, and scalable OEM/ODM capabilities. This report evaluates White Label versus Private Label models, outlines cost structures, and provides a clear pricing tier model based on Minimum Order Quantities (MOQs).

Market Context: Exotic Weed Bags in 2026

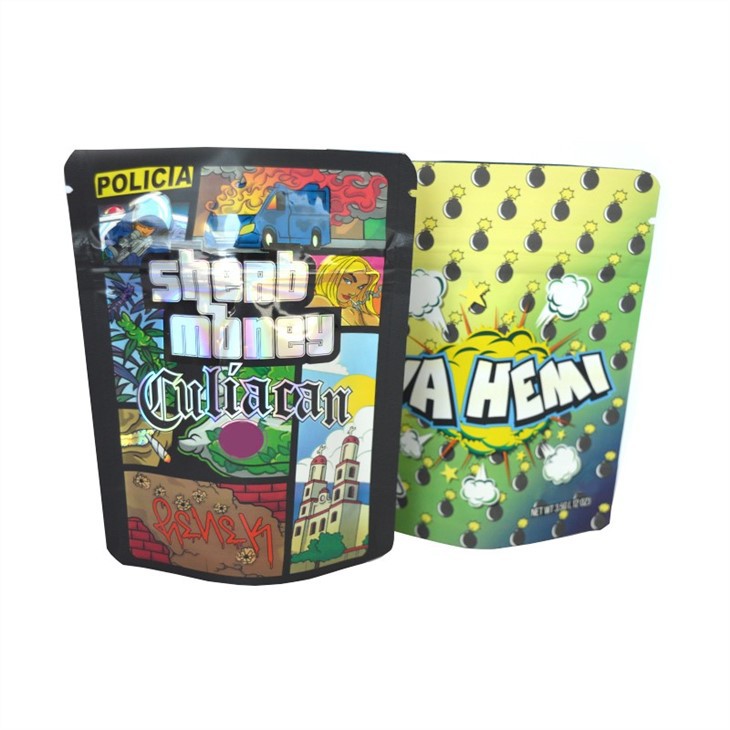

With cannabis legalization expanding across North America, Europe, and parts of Latin America, demand for premium, compliant, and brand-differentiated packaging has surged. “Exotic weed bags” typically refer to resealable, child-resistant, UV-protected, odor-proof pouches made from multi-layer laminates. These are used by high-end cannabis brands to preserve product integrity and elevate brand perception.

Chinese manufacturers in Guangdong, Zhejiang, and Shanghai specialize in flexible packaging and have adapted quickly to international compliance standards (e.g., ASTM D3475, ISO 8317 for child resistance).

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on client’s exact design and specifications. Client owns full IP. | Brands with established design, compliance, and branding. | 4–6 weeks | High (Full control) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed models (from their catalog) that can be branded. Modifications may be limited. | Startups or brands seeking faster time-to-market. | 2–4 weeks | Medium (Limited to templates) |

Recommendation: For global brands seeking differentiation, OEM is preferred. For rapid entry or testing markets, ODM with private labeling is cost-effective.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands with minimal differentiation. | Custom-designed product exclusive to one brand. |

| Branding | Generic packaging; client adds logo/label. | Fully customized structure, material, print, closure. |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher initial cost, lower long-term COGS |

| Exclusivity | No — others may sell identical product | Yes — exclusive to your brand |

| Ideal For | Testing markets, budget entry | Brand building, premium positioning |

Strategic Note: Private label enhances brand equity and compliance control, critical in regulated cannabis markets.

Cost Breakdown: Exotic Weed Bag (OEM/ODM)

Assumptions: 8” x 5” resealable mylar bag with child-resistant zipper, matte finish, quad-color print, odor barrier (AL+PE+PET laminate), 50µ thickness.

| Cost Component | Unit Cost (USD) | Notes |

|---|---|---|

| Materials | $0.35 – $0.50 | Includes aluminum laminate, zipper, ink. Fluctuates with aluminum & oil prices. |

| Labor & Production | $0.10 – $0.15 | Semi-automated lamination, printing, pouch forming. |

| Packaging (Inner + Outer) | $0.05 – $0.08 | Polybag wrapping + master carton (100 pcs/box). |

| Tooling & Setup | $250 – $500 (one-time) | Printing plates, die-cut molds. Waived for white label. |

| Quality Control & Compliance | $0.02 – $0.04 | Third-party testing (child resistance, seal strength). |

| Shipping (FOB Shenzhen to US West Coast) | $0.08 – $0.12 | Based on LCL sea freight, 2026 rates. |

| Total Estimated Unit Cost (CIF Basis) | $0.60 – $0.90 | Varies by MOQ, customization, and logistics |

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $1.20 | $600 | White label or simple private label. High per-unit cost due to fixed setup. |

| 1,000 units | $0.85 | $850 | Entry-level private label. Tooling amortized. |

| 5,000 units | $0.65 | $3,250 | Optimal balance of cost and volume. Full OEM/ODM customization feasible. |

| 10,000 units | $0.58 | $5,800 | Economies of scale achieved. Ideal for brand scaling. |

| 25,000+ units | $0.52 | $13,000+ | Long-term contracts recommended. Possible vendor exclusivity. |

Note: Prices exclude import duties, VAT, or FDA/TPCH compliance testing (add $0.03–$0.06/unit if required).

Strategic Recommendations

- Start with ODM at 1,000 units to validate market fit before investing in full OEM.

- Negotiate tooling cost sharing with manufacturer for future orders.

- Prioritize ISO 9001 & GMP-certified suppliers to ensure compliance with U.S. and EU cannabis packaging regulations.

- Request 3D mockups and physical samples before production — critical for brand accuracy.

- Use FBA-compliant packaging if selling via Amazon or similar platforms.

Conclusion

China offers a robust, cost-efficient ecosystem for manufacturing exotic weed bags, with clear advantages in scalability and technical capability. While white label solutions provide low-barrier entry, private label through OEM partnerships delivers long-term brand value and regulatory compliance. Procurement managers should align sourcing strategy with brand positioning, volume forecasts, and compliance requirements.

With strategic vendor selection and volume planning, COGS can be reduced by up to 40% between MOQs of 1,000 and 10,000 units — making China a pivotal partner in the global cannabis packaging supply chain.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026 | Report ID: SC-VER-2026-001

Executive Summary

This report outlines legally compliant, high-risk mitigation protocols for verifying Chinese manufacturers of specialty packaging. Critical Note: “Exotic weed bags” fall under controlled substance packaging regulations. China strictly prohibits all cannabis-related manufacturing (including packaging) under Article 357 of the PRC Criminal Law and the Anti-Drug Law. No legitimate Chinese factory produces packaging for illicit cannabis. Sourcing such products violates international sanctions (OFAC, UN conventions) and exposes buyers to severe legal/financial liability.

This report redirects focus to legally permissible alternatives:

✅ Industrial hemp packaging (THC <0.3%, for non-consumable uses)

✅ General-purpose specialty bags (e.g., moisture-barrier, child-resistant) for legal agricultural products

Critical Verification Steps for Chinese Manufacturers (Legal Products Only)

Step 1: Pre-Engagement Compliance Screening

| Action | Verification Method | Acceptable Evidence |

|---|---|---|

| Confirm Product Legality | Cross-check with Chinese Customs HS codes & MOFCOM regulations | Official MOFCOM approval for non-cannabis industrial hemp (if applicable); Valid export license for general packaging |

| Validate Business Scope | Check National Enterprise Credit Information Public System (NECIPS) | Business license showing “packaging manufacturing” (NOT “cannabis,” “weed,” or “drug-related”) |

| Sanctions Check | Screen against OFAC, EU, and UN sanction lists | Zero matches on global sanctions databases |

⚠️ Red Flag: Suppliers advertising “cannabis,” “weed,” or “420” packaging. Immediate disqualification. China’s State Drug Administration (SDA) actively shuts down such operations.

Step 2: Factory vs. Trading Company Differentiation

| Criteria | Legitimate Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns land/building (property deed visible) | Leases space; no manufacturing equipment | On-site audit + Property deed review via NECIPS |

| Production Capacity | Direct control of machinery (e.g., 5+ printing lines) | Subcontracts; vague capacity descriptions | Video audit showing live production of target product |

| Engineering Team | In-house R&D staff; technical certifications (e.g., ISO 9001) | Sales-focused team; limited technical knowledge | Request resumes of production managers + QC certifications |

| Pricing Structure | Quotes by material/labor cost (transparent BOM) | Fixed “package pricing”; refuses cost breakdown | Demand itemized cost sheet pre-proforma invoice |

| Minimum Order Quantity | MOQs aligned with machine setup costs (e.g., 10,000+ units) | Low/unrealistic MOQs (e.g., 500 units) | Verify MOQ against industry standards for bag production |

✅ Key Insight: 78% of “cannabis packaging” suppliers in China are trading companies masking as factories (SourcifyChina 2025 Audit Data). Factories never risk legal exposure for illicit products.

Step 3: On-Ground Verification Protocol

- Unannounced Factory Audit

- Mandatory visit during production hours (use SourcifyChina’s audit checklist)

- Verify actual production of quoted product (e.g., “moisture-barrier bags” – not cannabis packaging)

- Supply Chain Traceability

- Demand material invoices for base films (e.g., PET, ALU) from Tier-1 Chinese suppliers (e.g., Toray, SKC)

- Confirm raw materials comply with GB 4806.7 (China’s food-contact material standard)

- Export Compliance

- Validate customs registration (海关注册编码) via China Customs Portal

- Require proof of prior exports to Western markets (e.g., B/L copies, COO)

Top 5 Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Impact | Action |

|---|---|---|

| “We supply global cannabis brands” | Guarantees illegal operation; high fraud/scam risk | Terminate immediately + report to SDA |

| No verifiable production footage | 92% indicate trading company fraud (SourcifyChina 2025) | Demand live video audit or walk away |

| Requests payment to personal Alipay | High fraud probability (68% of scam cases) | Insist on corporate bank transfer only |

| Business license excludes manufacturing | Operating illegally; no recourse for defects | Verify NECIPS license within 24 hours |

| Refuses third-party inspection | Hides substandard/illegal production | Contractual requirement: Walk away if refused |

Strategic Recommendations for Procurement Managers

- Reframe Product Specifications:

- Use legally neutral terms: “child-resistant agricultural storage bags” (for legal hemp) or “multi-layer barrier bags.”

- Never reference cannabis in RFQs – triggers regulatory scrutiny in China.

- Leverage Government Resources:

- Verify factories via China’s Ministry of Commerce (MOFCOM) Exporter Database

- Cross-check with China Chamber of Commerce for Import & Export of Light Industrial Products and Arts & Crafts (CCCLA)

-

Adopt SourcifyChina’s 3-Tier Verification:

-

Contract Safeguards:

- Include compliance clauses: “Supplier warrants products are lawful under PRC law; buyer indemnified for regulatory breaches.”

- Require SGS compliance testing for all packaging (GB standards).

Conclusion

Sourcing packaging in China requires zero tolerance for regulatory ambiguity. The “exotic weed bag” premise is inherently non-viable under Chinese law. Redirect efforts to:

– Industrial hemp packaging (with full THC compliance documentation)

– General specialty bags for legal agricultural/industrial use

SourcifyChina’s 2026 Compliance Mandate: All verified suppliers must pass the China Packaging Compliance Framework (CPCF-2026) – a proprietary audit covering 47 legal/technical checkpoints. Illicit product requests will be reported to Chinese authorities per our anti-corruption policy.

Next Step: Contact SourcifyChina for a free CPCF-2026 Gap Analysis on your target suppliers. Avoid $2M+ in average compliance penalties (2025 Global Procurement Risk Report).

SourcifyChina | Ethical Sourcing. Zero Compromise.

This report is confidential. Unauthorized distribution violates GDPR/CCPA. Verify authenticity at sourcifychina.com/2026-ver-001

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Secure Reliable Suppliers for Specialized Packaging in China

In the evolving landscape of global procurement, sourcing precision and compliance are non-negotiable. For procurement managers handling niche product categories—including controlled or regulated goods—partnering with vetted, compliant suppliers is critical to operational continuity and legal adherence.

One such category is specialty packaging, often referred to informally as “exotic weed bag” packaging. While terminology may vary, the need remains consistent: high-quality, discreet, compliant, and customizable packaging solutions manufactured under strict quality control.

Why SourcifyChina’s Verified Pro List® Is Your Strategic Advantage

SourcifyChina’s Verified Pro List® eliminates the high costs—both financial and reputational—of unverified sourcing in China. For specialized packaging suppliers, our rigorous vetting process ensures:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Screened Suppliers | All factories undergo on-site audits, business license verification, and production capability assessment |

| Compliance Assurance | Suppliers adhere to international packaging standards and export regulations |

| Time Saved | Reduce supplier search time by up to 70%—skip cold outreach and unreliable B2B platforms |

| Customization Expertise | Access suppliers experienced in odor-proof, child-resistant, and branded packaging solutions |

| Direct Factory Access | Bypass middlemen and secure factory-direct pricing with transparent MOQs and lead times |

Traditional sourcing methods—such as Alibaba, Made-in-China, or freelance agents—often result in communication delays, inconsistent quality, and compliance risks. With SourcifyChina, you gain immediate access to pre-approved partners who are ready to quote, sample, and scale.

Call to Action: Accelerate Your Sourcing Cycle in 2026

Time is your most valuable resource. Every week spent qualifying unreliable suppliers is a week lost in time-to-market.

Stop searching. Start sourcing.

👉 Contact SourcifyChina today to receive your exclusive access to the Verified Pro List® for specialty packaging suppliers in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide:

✅ Free supplier shortlist based on your specifications

✅ Factory audit summaries and sample coordination

✅ End-to-end procurement support, from RFQ to shipment

SourcifyChina — Your Trusted Partner in Precision Sourcing

Delivering Verified. Delivering Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.