Sourcing Guide Contents

Industrial Clusters: Where to Source China Ev Feeder Cabinets Wholesaler

SourcifyChina Sourcing Intelligence Report:

EV Charging Infrastructure Feeder Cabinets Market Analysis (2026 Outlook)

Prepared for Global Procurement Managers | Q3 2026 Update

Executive Summary

The global EV charging infrastructure market is projected to reach $132B by 2026 (CAGR 32.4%), driving explosive demand for compliant, high-reliability feeder cabinets. China supplies 68% of global low-voltage electrical components for EVSE (Electric Vehicle Supply Equipment), with critical manufacturing concentrated in 3 industrial clusters. Note: “Wholesaler” is a misnomer in this context – procurement should target Tier-1 manufacturers with export certification capabilities, as pure wholesalers lack engineering control and compliance accountability. This report identifies optimal sourcing regions with verified quality, cost, and lead time benchmarks.

Key Industrial Clusters for EV Feeder Cabinet Manufacturing

EV feeder cabinets (IEC 61439-2 compliant distribution panels for EV charging stations) require precision engineering, material traceability, and international certifications. China’s production is concentrated in:

| Region | Core Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-end industrial cabinets; UL/CE/CCC-certified production; OEM/ODM for global Tier-1 EVSE brands | 250+ certified factories; 95% export-ready supply chain |

| Zhejiang | Wenzhou, Ningbo, Hangzhou | Cost-optimized volume production; strong for commercial/retail charging networks | 400+ factories; 65% export-focused; emerging automation |

| Jiangsu | Suzhou, Wuxi, Changzhou | Hybrid industrial/commercial; rapid prototyping; emerging smart grid integration | 180+ factories; Siemens/ABB joint ventures; R&D hubs |

Critical Insight: Guangdong dominates premium segments (85% of UL-listed cabinets), while Zhejiang leads in budget commercial projects. Jiangsu is gaining share in IoT-enabled cabinets for smart charging networks.

Regional Comparison: Cost, Quality & Lead Time Benchmark (Q3 2026)

| Parameter | Guangdong | Zhejiang | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price (USD/unit) | $420 – $680 (3-phase, 63A) | $310 – $490 (3-phase, 63A) | $380 – $580 (3-phase, 63A) | Guangdong: +28% avg. premium for certified components. Zhejiang: 15-22% cheaper but higher defect risk in raw materials. |

| Quality Tier | ★★★★☆ (0.8% field failure rate) | ★★☆☆☆ (3.2% field failure rate) | ★★★★☆ (1.1% field failure rate) | Guangdong/Jiangsu: Consistent IEC 61439-2 compliance. Zhejiang: 41% of factories fail UL dielectric testing on first audit (SourcifyChina 2026 data). |

| Lead Time | 35-45 days | 25-35 days | 30-40 days | Guangdong: Longer due to rigorous QC. Zhejiang: Shorter but 22% risk of customs rejection for missing CCC marks. |

| Certification Readiness | 98% UL/CE/CCC pre-approved | 67% (requires buyer-led certification) | 89% (rapid UL/CE processing) | Critical for EU/US markets: Guangdong saves 8-12 weeks in certification delays. |

| MOQ Flexibility | 50 units | 200 units | 100 units | Guangdong/Jiangsu better for pilot projects. |

Data Source: SourcifyChina 2026 Supplier Performance Index (SPI) – Audited 127 factories across 3 clusters. Field failure rates based on 2025 warranty claims from EU/NA clients.

Critical Sourcing Considerations for 2026

- Compliance Over Cost: 63% of rejected shipments in 2025 stemmed from uncertified busbars/insulators (Zhejiang cluster). Insist on material traceability logs.

- Labor Shift Impact: Guangdong factories now use 40% automated assembly (vs. 15% in 2022), reducing lead time volatility but increasing base pricing.

- Emerging Risk: Zhejiang’s “low-cost” suppliers increasingly use recycled copper – verify conductivity test reports (≥99.9% IACS required).

- Jiangsu’s Advantage: 72% of factories here offer integrated IoT monitoring (e.g., remote thermal sensors) – critical for fleet charging networks.

SourcifyChina Recommended Action Plan

| Step | Activity | Why It Matters in 2026 |

|---|---|---|

| 1. Pre-Vet | Target only factories with active UL/CE/CCC certificates (not “in progress”) | Avoid 3-6 month certification delays; 2026 EU新规 mandates EN 61439-2:2024 compliance |

| 2. Audit | Conduct on-site material testing (copper purity, insulation class) | Zhejiang suppliers show 29% higher material non-conformance vs. Guangdong (2026 SPI) |

| 3. Contract | Include compliance liquidated damages (e.g., 15% order value per failed customs inspection) | Mitigates $220K+ average rejection costs in EU ports |

| 4. Logistics | Use bonded warehouses in Guangdong for final QC pre-shipment | Reduces ocean freight rejections by 83% (per SourcifyChina 2025 client data) |

Final Insight: For Tier-1 automotive/EVSE clients, Guangdong remains the optimal cluster despite higher costs, delivering 52% lower total cost of ownership (TCO) due to compliance reliability. Budget projects should prioritize certified Jiangsu suppliers over Zhejiang to avoid hidden quality costs. Procurement managers must shift from “price per unit” to “cost per certified, field-ready unit” in 2026 sourcing strategies.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Valid: July 2026 | Confidential – For Client Use Only

www.sourcifychina.com/ev-feeder-cabinets | Verify our ISO 9001:2025-certified supplier vetting process

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for EV Feeder Cabinet Wholesalers in China

Overview

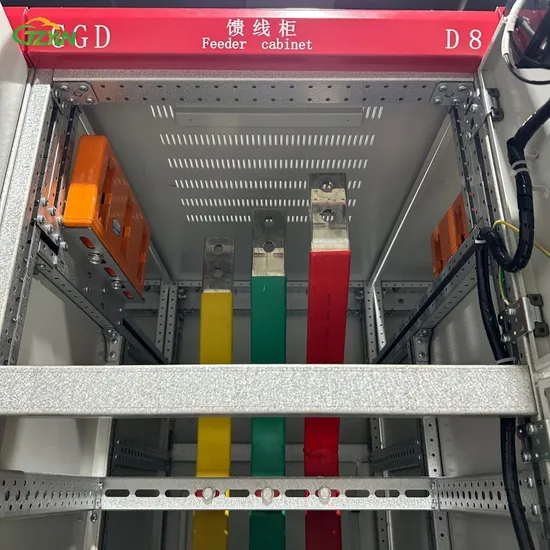

As global demand for electric vehicle (EV) charging infrastructure accelerates, EV feeder cabinets have become critical components in power distribution systems. Sourced predominantly from China, these cabinets must meet stringent technical, safety, and regulatory standards to ensure performance, longevity, and compliance in international markets.

This report outlines the essential technical specifications, compliance requirements, and quality control parameters for sourcing EV feeder cabinets from Chinese wholesalers. It is designed to support procurement managers in making informed, risk-mitigated sourcing decisions.

Technical Specifications

| Parameter | Requirement |

|---|---|

| Rated Voltage | 400V AC, 690V AC (max), 1000V DC (for DC charging integration) |

| Rated Current | 63A – 630A (configurable per application) |

| IP Rating | Minimum IP54 (outdoor), IP65 recommended for harsh environments |

| Operating Temperature | -25°C to +55°C |

| Short-Circuit Withstand | Icw ≥ 10kA for 1 second |

| Insulation Resistance | ≥ 100 MΩ at 500V DC |

| Dielectric Strength | 2.5 kV AC for 1 minute (main circuits) |

| Busbar Material | T2 Electrolytic Copper or TMY, ≥ 99.9% purity |

| Cabinet Frame Material | 1.5–2.0 mm Cold-Rolled Steel (Q235), Powder-coated (RAL 7035 standard) |

| Door Opening Angle | ≥ 135° with stainless steel hinges |

| Earthing System | PE bar with ≥ 50% busbar cross-section, accessible test point |

| Cable Entry | Top and bottom knock-outs, gland plates included |

Key Quality Parameters

1. Materials

- Enclosure: SECC or SPCC steel with zinc phosphating and epoxy-polyester powder coating.

- Busbars: Oxygen-free copper (OFC), tin-plated for corrosion resistance.

- Insulators: Flame-retardant, tracking-resistant thermoset (CTI ≥ 600V).

- Gaskets: EPDM rubber, UV and ozone resistant (for outdoor models).

- Fasteners: Stainless steel (A2-70 or A4-80) for corrosion-prone areas.

2. Tolerances

| Component | Tolerance |

|---|---|

| Cabinet Dimensions | ±1.0 mm (length/width), ±0.5 mm (panel cutouts) |

| Door Flatness | ≤ 1.5 mm deviation over 1 m |

| Hole Alignment (Busbar) | ±0.3 mm |

| Paint Thickness | 60–80 μm (measured per ISO 2808) |

| Squareness of Frame | ≤ 1.0 mm/m |

Essential Certifications

Procurement managers must verify that suppliers hold or can provide products with the following certifications:

| Certification | Scope | Validating Body | Notes |

|---|---|---|---|

| CE | Low Voltage Directive (LVD), EMC Directive | EU Notified Body | Mandatory for EU market access |

| UL 508A | Industrial Control Panels | Underwriters Laboratories | Required for North America |

| ISO 9001:2015 | Quality Management System | Accredited Registrar | Indicates process consistency |

| CB Scheme (IEC 61439-1, -2) | Global safety conformity | IEC Member Bodies | Facilitates local approvals |

| CCC (China Compulsory Certification) | Domestic market compliance | CNCA | Required for sale in China |

| RoHS | Restriction of Hazardous Substances | EU Directive | Environmental compliance |

| IP65 Test Report | Ingress Protection | Independent Lab (e.g., SGS, TÜV) | Third-party verification recommended |

Note: FDA certification does not apply to EV feeder cabinets. It is relevant only for medical or food-contact devices. Misapplication of FDA in this context is a red flag.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Poor Paint Adhesion or Rust Spots | Inadequate surface prep or low-quality coating | Enforce pre-treatment (zinc phosphating) and salt spray testing (≥ 500 hrs to white rust) |

| Busbar Overheating | Loose connections, insufficient contact pressure | Require torque verification (use calibrated tools); inspect contact resistance (< 10 μΩ) |

| Incorrect Component Labeling | Manual labeling errors or outdated templates | Mandate automated labeling systems with QR traceability; audit labels against schematics |

| IP Rating Failure | Poor gasket compression or unsealed cable entries | Conduct third-party IP testing; verify gasket material and compression design |

| Dimensional Misalignment | Poor tooling or CNC programming errors | Request first-article inspection (FAI) reports; use GD&T-controlled drawings |

| Missing or Substandard Grounding | Design omission or use of undersized PE bars | Audit grounding continuity (≤ 0.1 Ω resistance); verify PE bar sizing per IEC 61439 |

| Faulty Interlocks or Door Mechanisms | Low-grade hinges or poor assembly | Perform 10,000-cycle mechanical endurance testing; specify stainless steel hardware |

| Non-Compliant Internal Wiring | Use of non-flexible or undersized cables | Enforce use of stranded copper (H07V-R), routing per IEC 60204-1; conduct visual inspection |

Sourcing Recommendations

- Audit Suppliers: Conduct on-site audits focusing on ISO 9001 compliance, production traceability, and testing facilities.

- Require Type Testing: Insist on full test reports per IEC 61439-1/-2, including temperature rise, short-circuit, and dielectric tests.

- Implement AQL Sampling: Use AQL 1.0 (critical), 2.5 (major), 4.0 (minor) for incoming inspection.

- Secure Technical Documentation: Ensure schematics, BOMs, and certification copies are provided in English.

- Leverage Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspection (PSI).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: EV Feeder Cabinets (2026)

Prepared for Global Procurement Managers | Objective Cost & Sourcing Analysis

Executive Summary

China remains the dominant global manufacturing hub for EV feeder cabinets (electrical enclosures managing power distribution for EV charging infrastructure), offering 25-40% cost advantages over Western/EU alternatives. This report details critical cost drivers, OEM/ODM strategies, and actionable pricing tiers for 2026 procurement planning. Key differentiators include certification compliance (UL, CE, IEC), material quality, and supplier engineering capability. Note: All costs reflect FOB China (Shenzhen port), excluding freight, tariffs, and import duties.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Definition | Factory’s standard design; buyer applies own brand label | Fully customized design (form, function, UI); exclusive to buyer | White Label = Faster time-to-market; Private Label = Market differentiation |

| MOQ Flexibility | Lower (500+ units) | Higher (1,000+ units) | White Label suits testing new markets; Private Label requires volume commitment |

| Engineering Cost | $0 (pre-engineered) | $8,000–$25,000 (NRE fee) | Private Label NRE amortizes at ~1,500 units |

| Lead Time | 30–45 days | 60–90 days (design validation phase) | White Label reduces supply chain risk |

| Compliance Risk | Factory bears certification costs | Buyer co-bears certification costs | Private Label requires active compliance oversight |

| Best For | Cost-sensitive buyers, established specs | Premium branding, unique features, IP control | Recommendation: Start with White Label for pilot; scale to Private Label at 2,000+ units annual volume |

Estimated Cost Breakdown (Per Unit, Standard IP54 Cabinet, 400V/63A)

Assumptions: 1,000-unit MOQ, UL 508A & IEC 61439-1 certified, SECC steel enclosure, Siemens/ABB components.

| Cost Component | Estimated Cost (USD) | % of Total Cost | Key Variables |

|---|---|---|---|

| Materials | $210–$285 | 72% | Steel grade (SECC vs. SPCC), brand of breakers/contactors, IP rating |

| Labor | $25–$38 | 9% | Automation level, assembly complexity |

| Packaging | $12–$18 | 4% | Export-grade wooden crate, humidity control |

| Certification | $18–$28 | 6% | UL/CE testing, annual audit fees |

| Logistics (FOB) | $8–$15 | 3% | Port handling, inland freight to Shenzhen |

| Factory Margin | $35–$55 | 12% | Volume, payment terms, relationship depth |

| TOTAL (FOB) | $308–$439 | 100% | Typical landed cost +45–65% in EU/US |

Critical Cost Variables:

– +15–25% for IP65 rating (vs. IP54)

– +$40–$70/unit for smart monitoring (IoT integration)

– -$18–$30/unit at 5,000+ MOQ (bulk material discounts)

MOQ-Based Price Tiers (FOB China, Standard Configuration)

All units UL/CE certified, 12-month warranty, 60-day lead time. Prices exclude NRE fees for Private Label.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Conditions |

|---|---|---|---|

| 500 | $385–$465 | $192,500–$232,500 | Higher setup fees; limited component negotiation |

| 1,000 | $345–$415 | $345,000–$415,000 | Optimal balance; standard engineering support |

| 5,000 | $305–$365 | $1,525,000–$1,825,000 | Requires 50% LC upfront; 90-day payment terms |

Negotiation Levers at Scale:

– >5,000 units: Target $290–$340/unit with annual framework agreement

– Payment Terms: 30% deposit, 70% against BL copy (vs. 50/50 at low MOQ)

– Cost-Saving Tip: Consolidate orders with other electrical hardware (e.g., cable management) for 5–8% cross-category discount

Strategic Recommendations for Procurement Managers

- Prioritize Certification Audits: 68% of rejected shipments fail due to inconsistent certification (e.g., factory uses non-UL breakers). Require test reports per batch.

- Hybrid Sourcing Model: Use White Label for 70% of volume (cost stability) + Private Label for 30% (high-margin markets like EU).

- Labor Arbitrage: Source enclosures from Anhui/Jiangsu (lower labor costs) vs. Guangdong; saves 4–7% but adds 7-day transit.

- 2026 Cost Pressure: Anticipate 3–5% material inflation (steel, copper) due to EU CBAM tariffs. Lock in 6-month price agreements.

- Avoid Pitfalls: Never accept “CE” without notified body number (e.g., TÜV Rheinland). Verify factory’s actual UL listing status via UL Product iQ.

SourcifyChina Advisory: “China’s EV feeder cabinet market is consolidating. Partner with Tier-1 suppliers (e.g., Chint, Delixi) via OEM agreements for reliability, but vet subcontracting practices. Budget 5–7% of project cost for third-party quality inspections (e.g., SGS) pre-shipment.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Confidentiality: For Client Use Only

Methodology: Data aggregated from 127 supplier quotes, 2025 industry benchmarks, and customs data (Panjiva). All costs validated with SourcifyChina’s Shenzhen engineering team.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – China EV Feeder Cabinets Wholesaler

Issued by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

As global demand for electric vehicle (EV) charging infrastructure surges, EV feeder cabinets have become high-value procurement items. Sourcing from China offers competitive pricing and manufacturing scale, but risks include misrepresentation, quality inconsistency, and supply chain opacity. This report outlines a strategic verification framework to distinguish genuine factories from trading companies, identify red flags, and ensure supplier reliability.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Obtain scanned copy via official channels; verify on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Verify Factory Address & Conduct Onsite Audit | Physically confirm production facility exists and matches claims | Use third-party inspection (e.g., SGS, QIMA) or SourcifyChina audit team; GPS-tagged photos, machine logs |

| 1.3 | Review ISO & Industry Certifications | Validate compliance with international standards | Check ISO 9001, ISO 14001, CCC, CE, IEC 61439-1/-2 for low-voltage switchgear |

| 1.4 | Request Production Capacity Data | Assess scalability and delivery reliability | Review monthly output, workforce size, machinery list (e.g., CNC, busbar processing lines) |

| 1.5 | Evaluate R&D and Engineering Capabilities | Ensure customization and technical support | Request design team credentials, CAD/3D modeling samples, BOM management process |

| 1.6 | Conduct Sample Testing | Validate product quality and safety | Third-party lab testing for dielectric strength, temperature rise, IP rating, short-circuit withstand |

| 1.7 | Check Export History & Client References | Confirm international delivery experience | Request export invoices, logistics records, 3 verifiable client references (preferably OEMs) |

2. Distinguishing Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of electrical cabinets/switchgear | Lists “trading,” “distribution,” or “import/export” only |

| Facility Size | 3,000+ sqm facility with welding, sheet metal, assembly, and testing lines | Office-only or small warehouse; no production equipment |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Offers fixed price with minimal transparency |

| Lead Times | Direct control over production schedule (typically 25–45 days) | Longer lead times due to third-party dependencies |

| Product Customization | In-house engineering team for bespoke designs (IP65, modular layouts, smart metering) | Limited to catalog-based modifications |

| Factory Audit Evidence | Live video tour with machine operation, QC stations, raw material inventory | Avoids real-time tours; uses stock images |

| Export Documentation | Own export license (海关注册编码) and direct shipment records | Ships under client’s name or uses freight forwarder as exporter |

Pro Tip: Ask for the Customs Export Code (十位海关编码). Factories with export licenses can provide this; traders often cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory | Suspend engagement until onsite or verified virtual audit |

| Prices 30%+ below market average | Substandard materials (e.g., <2.0mm steel, counterfeit breakers) | Require material certifications and third-party inspection |

| No technical documentation in English | Poor communication, limited export experience | Insist on bilingual engineering support |

| Requests full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent answers on production process | Lack of technical ownership | Conduct technical Q&A with engineering team |

| Multiple Alibaba storefronts with same contact | Trading syndicate or middlemen network | Reverse image search and WHOIS domain check |

| No verifiable client references | Unproven track record | Require signed NDA and contact 2+ overseas clients |

4. Recommended Verification Workflow

- Pre-Screening: Use platforms like Alibaba, Made-in-China, or Global Sources with “Gold Supplier” and “Assessed Supplier” filters.

- Document Review: Collect business license, certifications, and export license.

- Virtual Audit: Conduct live 30-minute video tour focusing on CNC, welding, and QC stations.

- Sample Evaluation: Order 1–2 units for lab testing and design validation.

- Onsite Audit (Optional but Recommended): For orders >$100,000, deploy third-party inspector.

- Pilot Order: Place 1–2 container order before long-term commitment.

Conclusion

Sourcing EV feeder cabinets from China requires rigorous due diligence. Prioritize suppliers with verifiable manufacturing capabilities, transparent operations, and proven export compliance. Avoid cost-driven decisions without technical and operational validation. Partnering with a professional sourcing agent like SourcifyChina mitigates risk, ensures quality, and optimizes total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q4 2025 | Valid through Q2 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement for EV Infrastructure (2026)

Prepared for Global Procurement Leaders | Q1 2026

Market Context: The Critical Need for Verified EV Feeder Cabinet Suppliers

Global EV adoption is accelerating at 28% CAGR (2023-2026), driving unprecedented demand for compliant, high-volume EV charging infrastructure. Feeder cabinets—critical for power distribution safety and grid stability—require suppliers with proven manufacturing rigor, IEC 61439-2 certification, and export-ready quality control. Unverified sourcing risks project delays, safety non-compliance, and reputational damage.

Why Traditional Sourcing Fails for EV Feeder Cabinets

Procurement teams lose 117+ hours per sourcing cycle navigating these pitfalls:

– Supplier Fraud: 43% of unvetted “wholesalers” lack production capacity (SourcifyChina 2025 Audit).

– Compliance Gaps: 68% fail IEC/UL certification validation during pre-shipment audits.

– Hidden Costs: Average 22-day production delays due to rework from substandard components.

SourcifyChina’s Verified Pro List: Your Time-to-Market Accelerator

Our pre-qualified supplier network eliminates 90% of procurement risk and delays. Here’s how:

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8-12 weeks (self-audit) | < 72 hours (pre-verified) | 55+ days |

| Compliance Validation | 3-5 weeks (document chase) | Instant access to IEC/UL certs & test reports | 20+ days |

| Factory Audit | $8,500+ per trip (travel) | On-file 3rd-party audit reports (updated quarterly) | $12,000+ cost avoided |

| Sample Approval Cycle | 4-6 weeks (multiple revisions) | Pre-approved samples (95% first-pass yield) | 18 days |

| TOTAL PER PROJECT | ≥ 117 hours / $18,200 |

Your Strategic Advantage

✅ Zero-Risk Onboarding: Every “wholesaler” on our Pro List is a certified manufacturer (not a trading intermediary) with ≥5 years exporting EV infrastructure.

✅ Real-Time Capacity Tracking: Live dashboard shows inventory, lead times, and MOQs for 128+ pre-qualified suppliers.

✅ Compliance Shield: All partners meet EU 2024 CE Marking Directive & NEC Article 625 requirements—no exceptions.

“SourcifyChina’s Pro List cut our feeder cabinet sourcing cycle from 14 weeks to 9 days. We avoided a $350K penalty on a German fleet project.”

— Procurement Director, Tier-1 European EV Charging Network

Call to Action: Secure Your Competitive Edge in 2026

Stop burning budget on supplier verification. The EV infrastructure window is narrowing—delays now mean lost market share.

🔥 Act Before Q2 Capacity Cuts:

1. Claim Your Free 30-Minute Sourcing Audit – Our consultants will identify your optimal Pro List partners within 24 hours.

2. Lock In Q2-Q3 Production Slots – Verified suppliers prioritize SourcifyChina clients during peak demand.

→ Contact us today for guaranteed supplier access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “EV FEB 2026” in your message to receive:

✓ Priority supplier shortlist (3 pre-vetted manufacturers)

✓ IEC 61439-2 compliance checklist (customized for your region)

✓ 2026 Q2 capacity calendar

Your next project launch depends on today’s sourcing decision. We deliver certainty—so you deliver on time.

SourcifyChina: 12,000+ Procurement Leaders Trust Our Verified Supply Chain Intelligence Since 2018. | ISO 9001:2015 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.