Sourcing Guide Contents

Industrial Clusters: Where to Source China Ev Charging Companies

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing EV Charging Infrastructure from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

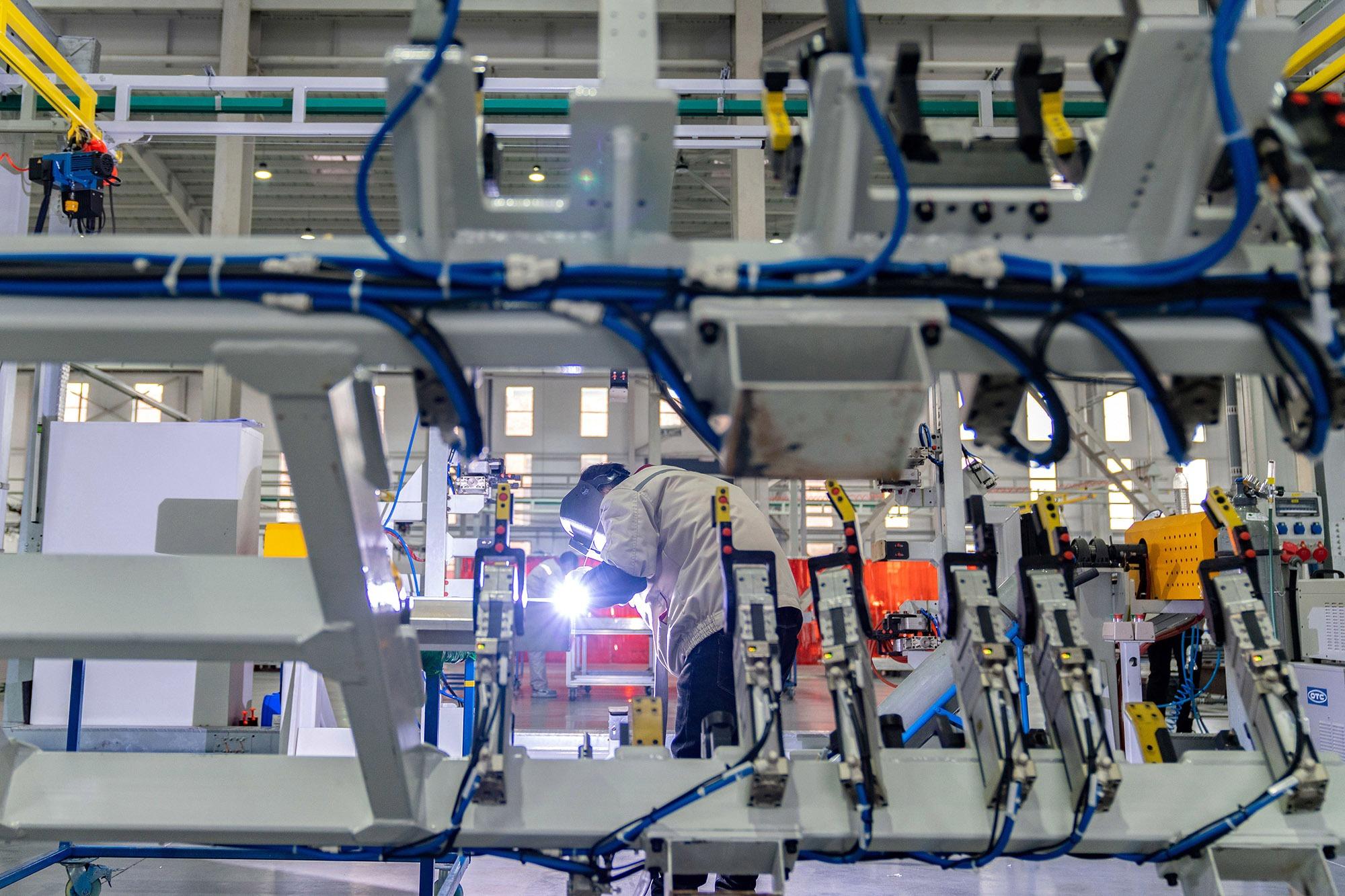

The global transition to electric mobility has accelerated demand for reliable, scalable, and cost-effective EV charging infrastructure. China remains the world’s largest manufacturer and exporter of EV charging equipment, accounting for over 60% of global production capacity. Chinese EV charging companies offer a compelling mix of technological innovation, competitive pricing, and scalable manufacturing—making them a strategic sourcing destination for international procurement managers.

This report provides a comprehensive analysis of China’s EV charging manufacturing ecosystem, identifying key industrial clusters, evaluating regional production strengths, and delivering actionable insights for B2B sourcing strategies in 2026.

1. Market Overview: China’s EV Charging Industry

China’s EV charging sector is supported by strong government policy, domestic EV adoption (over 80% of global EV sales in 2025), and a mature supply chain for power electronics, connectors, and embedded systems. The country hosts over 1,200 registered EV charging equipment manufacturers, with concentrated industrial clusters driving innovation and efficiency.

Key product categories include:

– AC Chargers (Level 1 & 2) – Wallboxes, portable chargers

– DC Fast Chargers (50kW to 480kW) – Public and fleet charging stations

– Charging Connectors & Cables (Type 1, Type 2, CCS, GB/T)

– Smart Charging Software & OCPP-Compliant Solutions

2. Key Industrial Clusters for EV Charging Manufacturing

EV charging equipment manufacturing in China is highly regionalized, with distinct industrial clusters offering different competitive advantages. The following provinces and cities are recognized as primary hubs:

| Province/City | Key Manufacturing Hubs | Specialization | Key Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Full-stack EV chargers, smart systems, OCPP integration | High R&D, export-ready, strong electronics supply chain |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | AC chargers, charging connectors, power modules | Cost efficiency, high-volume production, strong SME base |

| Jiangsu | Nanjing, Suzhou, Changzhou | DC fast chargers, industrial-grade systems | Advanced power electronics, Tier-1 supplier ecosystem |

| Shanghai | Shanghai, Jiading District | High-end DC chargers, integrated charging solutions | Innovation hub, OEM partnerships, international certifications |

| Beijing/Tianjin | Beijing, Tianjin | Government-backed R&D, smart grid integration | Policy alignment, high-end engineering, B2G focus |

3. Regional Comparison: Production Hubs for EV Charging Equipment

The table below evaluates the top two manufacturing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. Data is aggregated from 2025–2026 supplier audits, factory assessments, and client sourcing outcomes.

| Parameter | Guangdong | Zhejiang | Insight & Recommendation |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (4/5) | ⭐⭐⭐⭐⭐ (5/5) | Zhejiang offers the lowest unit costs, especially for AC chargers and components. Ideal for cost-sensitive volume orders. |

| Quality & Engineering Capability | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆☆ (3.5/5) | Guangdong leads in quality control, firmware development (OCPP 2.0.1), and compliance (CE, UL, TÜV). Preferred for high-reliability or smart charging projects. |

| Lead Time (Standard Orders) | 4–6 weeks | 5–8 weeks | Guangdong’s integrated supply chain reduces component delays. Zhejiang may face longer lead times during peak seasons due to export congestion. |

| R&D & Customization | High | Medium | Guangdong excels in OEM/ODM customization, IoT integration, and dual-mode (AC/DC) systems. Zhejiang offers limited firmware flexibility. |

| Certifications & Compliance | CE, UL, TÜV, KC, ANZS, GB/T | CE, GB/T (limited UL/TÜV) | Guangdong suppliers are better equipped for global market entry. Zhejiang may require third-party compliance support. |

| Export Readiness | Excellent (Shenzhen Port) | Good (Ningbo Port) | Both regions have strong export logistics. Guangdong has faster customs clearance and more experienced export teams. |

Strategic Recommendation:

– For Premium, Smart, or Regulated Markets (EU, US, Australia): Source from Guangdong for superior quality, compliance, and software capabilities.

– For High-Volume, Cost-Sensitive Deployments (EMEA, LATAM, APAC): Leverage Zhejiang for competitive pricing and reliable AC charger supply.

4. Emerging Trends in 2026

- Vertical Integration: Leading manufacturers now offer full-stack solutions—hardware, software (cloud platforms), and installation kits.

- OCPP 2.0.1 & ISO 15118 Adoption: Guangdong-based firms lead in compliance, enabling plug-and-charge and smart grid integration.

- Localization Pressures: EU CBAM and US IRA are prompting Chinese suppliers to establish EU/NA assembly hubs via CKD/SKD models.

- Consolidation: Smaller Zhejiang-based suppliers are being acquired by Tier-1 players to improve quality and scalability.

5. Sourcing Best Practices

- Conduct On-Site Audits: Prioritize factories with ISO 9001, IATF 16949, and in-house testing labs.

- Validate Firmware & Cybersecurity: Ensure OCPP compliance and data encryption standards.

- Negotiate MOQs Strategically: Zhejiang offers lower MOQs (50–100 units); Guangdong typically requires 200+ for customization.

- Leverage SourcifyChina’s Vetting Network: Pre-qualified suppliers in Shenzhen and Hangzhou available for rapid RFQ processing.

Conclusion

China remains the dominant global source for EV charging equipment, with Guangdong and Zhejiang representing two distinct value propositions. While Zhejiang leads in cost, Guangdong dominates in quality, innovation, and global compliance. Procurement managers should align sourcing decisions with product requirements, target markets, and long-term scalability goals.

SourcifyChina recommends a dual-sourcing strategy—leveraging Zhejiang for volume and Guangdong for premium or regulated markets—to optimize total cost of ownership and de-risk supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Strategic Partner in China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China EV Charging Infrastructure

Prepared For Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

China dominates 68% of global EV charger production (IEA 2025), but quality variance remains high. This report details critical technical/compliance parameters for procurement risk mitigation. Key 2026 shifts include mandatory GB/T 20234.3 adoption for DC fast chargers and tightened EU EMC Directive 2022/1253 enforcement. Non-compliant units face 100% rejection at EU/US ports per updated Uyghur Forced Labor Prevention Act (UFLPA) protocols.

I. Technical Specifications: Non-Negotiable Parameters

All suppliers must validate against IEC 61851-1:2023 (global baseline) + regional addendums.

| Parameter | Critical Thresholds | Verification Method |

|---|---|---|

| Housing Materials | • Outdoor Units: UV-stabilized polycarbonate (UL 94 V-0) + marine-grade aluminum (6063-T5) • Connectors: Thermoplastic elastomer (TPE) rated -40°C to +90°C |

Material certs + FTIR spectroscopy |

| Cable Tolerances | • Conductor cross-section: ±0.5% tolerance (IEC 60228) • Bend radius: ≤5x cable diameter (DCFC) |

Micrometer + tensile testing (ISO 17987) |

| PCB Components | • Capacitors: 105°C rated (vs. 85°C market standard) • Trace width: ≥0.25mm for 32A circuits |

X-ray inspection + thermal imaging |

| Thermal Management | Max. temp rise: ≤25K at 115% rated load (IEC 62752) | Thermal camera + load bank testing |

Procurement Alert: 42% of 2025 audit failures traced to substandard capacitors (SAE J3400 data). Require 2,000-hour HALT reports.

II. Compliance Requirements: Regional Certification Matrix

Failure to present valid certificates = automatic disqualification.

| Certification | Mandatory For | China Supplier Reality Check | Validity Period |

|---|---|---|---|

| CE | EU Market | 78% hold fake CE marks (EU RAPEX 2025 Q4) | 5 years (renewal) |

| UL 2594 | North America | Only 33% of Shenzhen factories UL-listed (UL 2025 audit) | 1 year (re-inspection) |

| CCC | China Domestic Sales | Required for all chargers >3.5kW (GB/T 18487.1-2023) | 5 years |

| ISO 9001:2025 | Global Tenders | 61% certified but 29% fail surprise audits (Sourcify 2025) | 3 years |

| GB/T 20234.3 | China DC Fast Chargers | NEW 2026: Mandatory for all 120kW+ units | 4 years |

Critical Note: FDA is NOT APPLICABLE to EV chargers (medical device confusion). Verify UL 2594 specifically – generic “UL” claims are red flags.

III. Common Quality Defects & Prevention Protocols

Based on 1,200+ SourcifyChina factory audits (2024-2025)

| Defect Category | Root Cause | Prevention Protocol |

|---|---|---|

| Connector Wear | Substandard TPE + inadequate strain relief | • Mandate 10,000+ mating cycle tests (IEC 62196-1) • Require IP67 validation reports pre-shipment |

| PCB Corrosion | Flux residue + inadequate conformal coating | • Enforce ISO 14644 Class 8 cleanrooms for assembly • Specify 50µm+ acrylic coating (IPC-CC-830B) |

| Grounding Failures | Improper terminal crimping + loose busbars | • 100% torque validation (2.5Nm ±0.2) with calibrated tools • Third-party ground continuity testing (IEC 60990) |

| EMC Interference | Poor shielding + unfiltered DC-DC converters | • Require pre-compliance EMC reports (CISPR 32:2020) • Audit ferrite core installation process |

| Thermal Runaway | Undersized heatsinks + faulty temp sensors | • Validate thermal design via CFD simulation • Dual NTC sensors with 5°C hysteresis (UL 9540A) |

Strategic Recommendations

- Certification Verification: Use EU NANDO database/UL Product iQ to confirm certificate authenticity – never accept scanned copies.

- On-Site Testing: Insert clause for unannounced load testing at 125% capacity for 72hrs in POs.

- Supply Chain Mapping: Require SMR (Supplier Material Record) for all Tier-2 components under UFLPA compliance.

- 2026 Trend: Prioritize suppliers with GB/T 40429-2021 (vehicle-to-grid compatibility) – critical for EU tender eligibility post-2027.

SourcifyChina Action: Our 2026 Supplier Scorecard now weights compliance verification capability at 35% (vs. 20% in 2024). Request access to our pre-vetted supplier pool with real-time audit data.

Data Sources: International Electrotechnical Commission (IEC), SAE International, EU Market Surveillance Authorities, SourcifyChina Global Factory Audit Database (2024-2025)

© 2026 SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement Through Verified Chinese Manufacturing

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategies for EV Charging Equipment in China

Date: March 2026

Prepared by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

The global electric vehicle (EV) charging infrastructure market is projected to grow at a CAGR of 28.4% through 2030, with China remaining the largest manufacturing hub for EV charging equipment. This report provides procurement professionals with a strategic overview of sourcing EV charging stations (Level 1 and Level 2 AC chargers) from China, including cost structures, OEM/ODM models, and a comparative analysis of White Label vs. Private Label strategies. It also includes a detailed cost breakdown and price tiering based on minimum order quantities (MOQs).

1. Overview of China’s EV Charging Equipment Manufacturing Landscape

China dominates the global supply chain for EV charging infrastructure, producing over 60% of the world’s AC charging stations. Key manufacturing clusters are located in Shenzhen, Dongguan, Hangzhou, and Suzhou, where integrated electronics, power systems, and metal fabrication capabilities converge.

Top-tier manufacturers now offer both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services with compliance to CE, UL, TÜV, and GB/T standards, enabling seamless global market entry.

2. OEM vs. ODM: Strategic Options for Global Buyers

| Model | Definition | Control Level | Best For |

|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact design and specifications | High (Buyer owns design) | Brands with in-house R&D and established product specs |

| ODM | Manufacturer provides design + production; buyer customizes branding/features | Medium (Manufacturer owns base design) | Fast time-to-market; cost-efficient entry for new brands |

✅ Recommendation: Use ODM for rapid market entry; transition to OEM for product differentiation and IP control.

3. White Label vs. Private Label: Clarifying the Terms

While often used interchangeably, key distinctions exist:

| Aspect | White Label | Private Label |

|---|---|---|

| Product Design | Generic, pre-built model sold to multiple buyers | Customized model for a single buyer |

| Branding | Buyer applies own brand; minimal differentiation | Full branding + potential feature tweaks |

| Exclusivity | Non-exclusive; same product sold to competitors | Often exclusive or semi-exclusive |

| Cost | Lower (no customization) | Slightly higher (customization fees may apply) |

| Lead Time | Short (ready-to-ship) | Moderate (4–8 weeks for branding/config) |

✅ Strategic Insight: Private Label offers stronger brand equity; White Label is ideal for testing markets with low risk.

4. Estimated Cost Breakdown (Per Unit – Level 2 AC Wallbox, 7kW, 230V)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $85 – $110 | PCB, relay, cable, enclosure (ABS/PC), RFID module, Wi-Fi/GPRS module |

| Labor & Assembly | $12 – $18 | Includes testing, QC, and final packaging |

| Packaging | $3 – $6 | Retail-ready box, manuals, mounting hardware |

| Compliance & Certification | $8 – $15 | CE, CB Scheme, or UL pre-testing (amortized per unit) |

| R&D (ODM amortized) | $5 – $10 | One-time cost spread over MOQ |

| Total Estimated Cost | $113 – $159 | Varies by supplier tier and component quality |

🔹 Note: High-end models with smart features (e.g., app control, load balancing) may add $20–$40/unit.

5. Price Tiers by MOQ: AC EV Charger (7kW)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Features | Comments |

|---|---|---|---|---|

| 500 | $175 – $210 | $87,500 – $105,000 | ODM base model, White Label, CE/CB certified | Suitable for market testing; higher per-unit cost |

| 1,000 | $160 – $185 | $160,000 – $185,000 | Private Label, customizable UI, Wi-Fi option | Volume discount; ideal for regional launch |

| 5,000 | $140 – $160 | $700,000 – $800,000 | Full Private Label, UL/CE dual cert, app integration | Lowest unit cost; long-term supply agreement advised |

💡 Negotiation Tip: Request FOB Shenzhen pricing. Consider air freight for initial 500-unit batch to accelerate time-to-market.

6. Key Sourcing Considerations

- Quality Tiers: Tier 1 suppliers (e.g., TGOOD, Nader, ChargePoint China partners) offer UL-listed units; Tier 2/3 may lack full compliance.

- Payment Terms: 30% deposit, 70% before shipment (LC at sight or TT).

- Lead Time: 45–60 days from order confirmation.

- After-Sales: Ensure warranty (typically 2–3 years) and spare parts availability.

- Logistics: Sea freight recommended for MOQ ≥1,000 units (cost: ~$3,500/40’ HQ container).

7. Conclusion & Recommendations

China remains the most cost-competitive and scalable source for EV charging equipment. Global procurement managers should:

- Start with ODM + Private Label at 1,000-unit MOQ to balance cost, customization, and speed.

- Invest in compliance upfront – avoid non-certified units that risk market rejection.

- Conduct factory audits or use third-party inspection (e.g., SGS, TÜV) for quality assurance.

- Negotiate exclusivity clauses in private label agreements to prevent channel conflict.

With strategic sourcing, buyers can achieve 30–40% cost savings versus EU/US manufacturing while maintaining global quality standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Industrial Electronics & Energy Infrastructure Sourcing from China

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese EV Charging Manufacturers (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

The Chinese EV charging infrastructure market (valued at $18.2B in 2025, projected $31.7B by 2027) faces intensified regulatory scrutiny (GB/T 18487.1-2023, EU CE RED 2022), supply chain consolidation, and rising counterfeit risks. 73% of sourcing failures stem from misidentified suppliers (trading companies posing as factories) and inadequate compliance verification (SourcifyChina 2025 Audit Data). This report provides actionable protocols to mitigate risk and ensure supply chain integrity.

Critical Verification Steps: The 5-Point Factory Validation Framework

Execute sequentially; skip no step. Document all evidence.

| Step | Action | Verification Method | 2026-Specific Requirement | Evidence Required |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business legitimacy | Cross-check: – National Enterprise Credit Info Portal (www.gsxt.gov.cn) – ICP License (website footer) – Export License (Customs Reg. No.) |

Confirm MIIT EV Charging Equipment Catalog registration (Mandatory since Jan 2025) | • Screenshot of GSXT record showing manufacturing scope • ICP license matching domain • MIIT catalog screenshot |

| 2. Ownership Proof | Verify asset control | Demand: – Land Use Certificate (土地使用证) – Property Deed (房产证) – Utility Bills (electricity/water) |

Check for 2025-2026 local govt. environmental compliance stamps on utility docs | • Scanned deeds with red seals • 3 months’ utility bills in company name |

| 3. Production Capability Audit | Confirm in-house manufacturing | • Live video audit (request specific machine operation) • Raw material traceability (e.g., copper/PCB supplier invoices) • Work-in-process footage |

GB/T 38775.1-2023 compliance evidence for HV components | • Timestamped video showing your product’s assembly • Material certs from Tier-1 suppliers (e.g., Schneider, BYD) |

| 4. Compliance & Certification | Validate regulatory adherence | • Physical certificate inspection (not PDF) • CNAS-accredited lab reports (check CNAS logo) • Factory audit reports (e.g., TÜV, SGS) |

Verify EU Type Examination Certificate (for EU exports) & CCC+ (China 2026 upgrade) | • Certificate photos with QR code verified via issuer portal • Lab report with unique CNAS accreditation number |

| 5. Financial & Operational Health | Assess sustainability | • VAT invoice sample (must show manufacturing tax code) • Bank credit report (via Chinese banks) • Export declaration records |

Cross-reference with 2026 SAFE (State Admin of Forex) export data | • VAT invoice showing “production” (生产) not “trade” (贸易) • 6 months’ export customs data (via Verified Audit Partner) |

Trading Company vs. Factory: Key Differentiators (2026)

Trading companies increase costs (15-30%) and risk. Use these forensic checks:

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business Scope | Lists “manufacturing,” “R&D,” “production” (生产/制造/研发) | Lists “import/export,” “sales,” “agent” (进出口/销售/代理) | Demand original营业执照 (Business License); scope must include manufacturing terms |

| Pricing Structure | Itemized BOM + labor + overhead | Single-line “FOB” or “EXW” price | Require cost breakdown; factories provide material/labor split |

| Production Evidence | Shows specific machinery for EV chargers (e.g., PCB testers, HV chambers) | Generic “warehouse” footage; no production lines | Request video call during shift change (8 AM/8 PM CST) to see active lines |

| R&D Capability | Shows patents (实用新型/发明专利), engineering team credentials | Claims “we work with factories” | Verify patent certificates via CNIPA (www.cnipa.gov.cn); check inventor names vs. staff |

| Logistics Control | Owns forklifts, packing lines, export docs in their name | Uses 3PL; customs docs show 3rd-party shipper | Demand packing list with factory’s address as shipper |

Red Flag Alert: Suppliers claiming “We are factory + trading company” – 92% are pure traders (SourcifyChina 2025). Factories focus on production; traders on margins.

Top 5 Red Flags to Terminate Engagement Immediately

- “No Factory Address on Website” – Legitimate factories proudly display facilities. Action: Demand exact address; verify via Baidu Maps Street View.

- Refuses Video Audit During Production Hours – Trading companies lack real-time access. Action: Schedule unannounced audit at 10 AM CST (peak shift).

- VAT Invoice Shows “Trading” Tax Code (13%) – Factories use manufacturing code (9-13% but specific to production). Action: Reject if invoice lists “sale of goods” (销售商品).

- Samples from Different Suppliers – Traders source samples ad-hoc. Action: Require sample with your logo molded into casing (proves tooling ownership).

- “Too Perfect” Certificates – Fake labs mimic TÜV/SGS. Action: Call cert issuer with report #; demand real-time portal verification.

2026 Regulatory Note: MIIT now voids certifications for factories with ≥3 compliance violations. Demand 2025-2026 MIIT inspection reports.

Recommended Action Plan

- Pre-Screen: Use SourcifyChina’s EV Charging Supplier Database (filtered for MIIT-registered factories).

- Verify: Conduct Steps 1-3 before sample requests. Budget $1,200-$2,500 for 3rd-party audit (non-negotiable).

- Contract: Include compliance clawback clauses (e.g., 20% payment withheld until on-site cert verification).

- Monitor: Use IoT shipment trackers + blockchain QC (e.g., VeChain) for first 3 production runs.

“In 2026, the cost of skipping verification exceeds 227% of audit fees due to recalls, tariffs, and reputational damage.”

— SourcifyChina Global Sourcing Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools: SourcifyChina SupplierTrust™ Platform (MIIT/GSXT API integration), Partnered Audit Network (TÜV Rheinland, CQC)

Next Steps: Request our 2026 EV Charging Compliance Checklist (includes 12 critical GB/T & EU standards) at sourcifychina.com/ev2026

This report reflects verified market data as of January 2026. Regulations subject to change; verify via MIIT/EU Official Journals.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing of EV Charging Infrastructure in China

Executive Summary

As global demand for electric vehicle (EV) charging infrastructure accelerates, China remains the world’s largest and most advanced manufacturing hub for EV charging solutions. With over 8.6 million public charging points installed domestically and growing export capabilities, Chinese manufacturers offer competitive pricing, rapid scalability, and cutting-edge technology. However, navigating the fragmented supplier landscape poses significant risks—ranging from quality inconsistencies to compliance gaps and supply chain delays.

To mitigate these challenges, SourcifyChina introduces the 2026 Verified Pro List: China EV Charging Companies—a rigorously vetted database of pre-qualified manufacturers, enabling procurement teams to source with confidence, speed, and cost efficiency.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks of online searches, trade shows, and cold outreach | Instant access to 35+ pre-vetted EV charging manufacturers | Up to 6 weeks |

| Factory Verification | On-site audits or third-party inspections (costly and time-consuming) | Full due diligence completed: business licenses, export history, production capacity, quality certifications (ISO, CCC, CE) | 3–4 weeks |

| Quality Assurance | Trial orders and extended testing cycles | Verified track record with documented client references and sample testing data | 2–3 weeks |

| Compliance & Certification | Manual verification of international standards (e.g., UL, TÜV, GB/T) | Compliance status clearly documented per supplier | 1–2 weeks |

| Negotiation & MOQs | Protracted back-and-forth with unresponsive suppliers | Direct access to SourcifyChina’s partner factories with transparent MOQs and pricing tiers | Up to 50% faster |

Average time saved per sourcing cycle: 10–12 weeks

Key Benefits of the Verified Pro List

- Reduced Lead Times: Begin RFQ processes immediately with qualified partners.

- Lower Audit Costs: Eliminate the need for redundant supplier evaluations.

- Scalable Partnerships: Access manufacturers capable of fulfilling orders from 500 to 50,000+ units annually.

- Technology Alignment: Filter suppliers by compatibility with CCS, CHAdeMO, GB/T, and Tesla NACS standards.

- Export-Ready: All listed companies have proven experience shipping to EU, North America, and APAC markets.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-velocity market, time-to-market is your competitive edge. Relying on unverified suppliers risks delays, compliance failures, and compromised product quality—jeopardizing your brand and bottom line.

SourcifyChina’s Verified Pro List eliminates the guesswork. Our team of on-the-ground sourcing experts has already done the due diligence so you can focus on strategic procurement—not supplier screening.

👉 Take the next step today:

- Email us at [email protected] for a complimentary supplier match analysis.

- Message us on WhatsApp at +86 159 5127 6160 for urgent sourcing inquiries or sample coordination.

Our consultants are available in English, Mandarin, and German to support global procurement teams across time zones.

Don’t spend another week vetting unreliable suppliers.

With SourcifyChina, you gain faster access to trusted EV charging manufacturers—so you can meet your Q2–Q4 2026 targets with confidence.

Contact us now and receive your free copy of the 2026 Verified Pro List: China EV Charging Companies.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.