Sourcing Guide Contents

Industrial Clusters: Where to Source China Energy Production By Source 2024

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing China Energy Production by Source (2024 Data)

Published by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

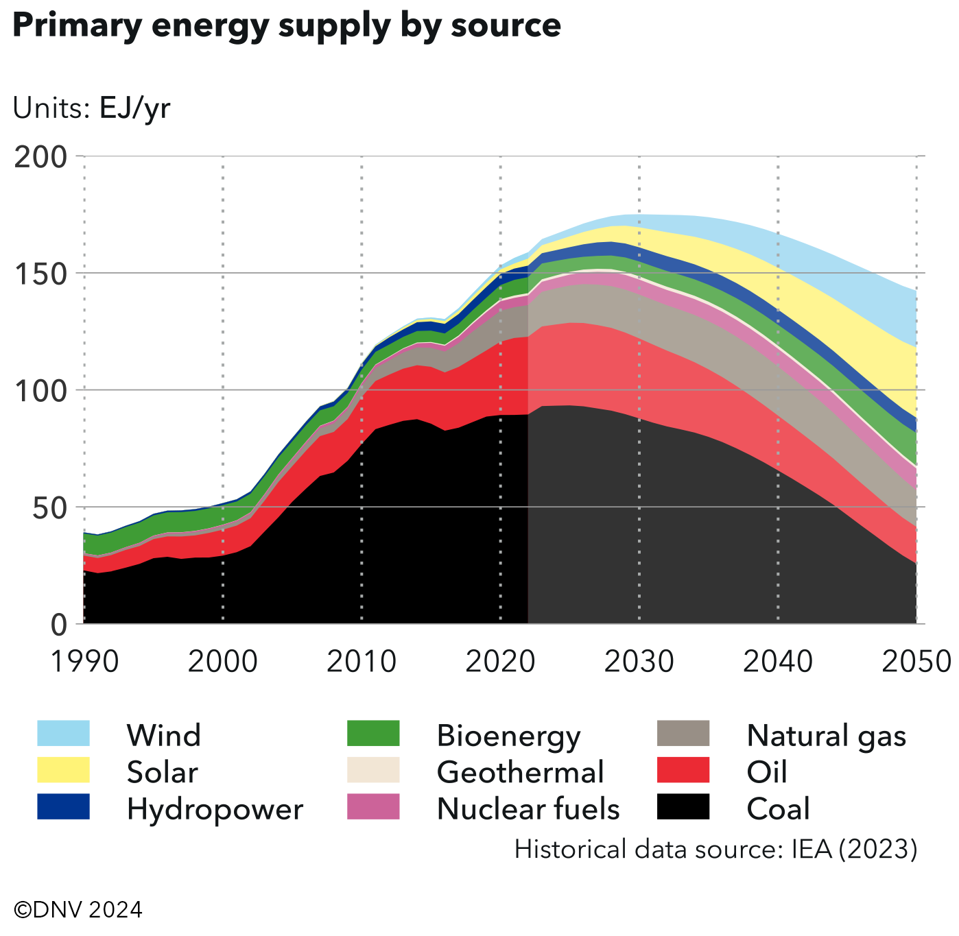

As global demand for diversified and sustainable energy solutions intensifies, understanding China’s domestic energy production landscape by source provides critical insights for procurement strategy. While China remains the world’s largest energy producer and consumer, its internal energy mix is undergoing a strategic transformation—driven by decarbonization goals, supply chain resilience, and technological advancement.

This report analyzes the 2024 energy production data across key sources—coal, natural gas, hydro, nuclear, wind, solar, and other renewables—to identify the leading industrial clusters in China responsible for manufacturing and deploying energy technologies. While China does not “export” energy production per se, the manufacturing ecosystems behind energy infrastructure, components, and systems are highly export-oriented and vital for global procurement.

This analysis focuses on provincial and municipal hubs where the production of energy equipment (e.g., solar panels, wind turbines, power electronics, grid infrastructure) is concentrated, enabling strategic sourcing decisions based on price competitiveness, quality standards, and lead time efficiency.

China Energy Production by Source – 2024 Overview

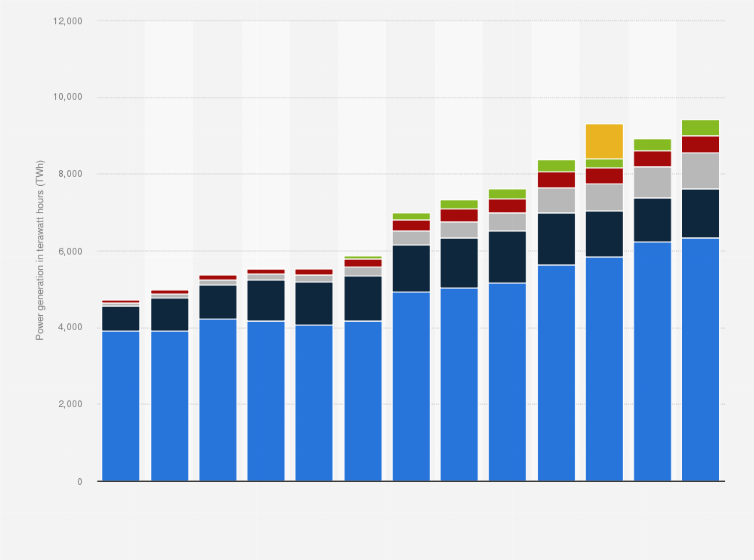

In 2024, China’s total primary energy production was approximately 4.8 billion tons of coal equivalent (tce), with the following breakdown:

| Energy Source | Share of Total Production | Key Manufacturing Output (Components & Systems) |

|---|---|---|

| Coal | 68% | Mining equipment, boilers, thermal power plants |

| Hydro | 8% | Turbines, dams, control systems |

| Wind | 7% | Turbines, blades, gearboxes |

| Solar PV | 6% | Panels, inverters, mounting systems |

| Nuclear | 4% | Reactor components, safety systems |

| Natural Gas | 4% | LNG equipment, compressors, pipelines |

| Other Renewables | 3% | Biomass systems, geothermal tech |

Source: National Bureau of Statistics of China (NBSC), China Electricity Council (CEC), 2025 Annual Energy Report

While coal remains dominant in energy generation, manufacturing activity has shifted decisively toward renewables, particularly solar and wind. The provinces leading in energy production also host the majority of Tier-1 and Tier-2 suppliers of energy equipment.

Key Industrial Clusters for Energy Equipment Manufacturing (2024–2026)

China’s energy equipment manufacturing is highly regionalized, with clusters forming around policy incentives, port access, R&D infrastructure, and raw material supply chains. The following provinces and cities are leaders in manufacturing components by energy source:

| Province/City | Key Energy Focus | Major Industrial Zones | Leading OEMs/Suppliers (Examples) |

|---|---|---|---|

| Guangdong | Solar PV, Wind, Smart Grid | Shenzhen, Dongguan, Guangzhou | Huawei (inverters), BYD (energy storage), Enphase partners |

| Zhejiang | Solar PV, Wind, Hydro, Grid Tech | Hangzhou, Jiaxing, Ningbo | Trina Solar, Canadian Solar, Sineng Electric |

| Jiangsu | Solar PV, Wind, Nuclear | Changzhou, Wuxi, Suzhou | JinkoSolar, Goldwind (subsidiaries), Shanghai Electric |

| Anhui | Solar PV (Emerging Hub) | Hefei, Wuhu | JinkoSolar (Hefei plant), LONGi (partner suppliers) |

| Inner Mongolia | Wind, Coal, Large-Scale Solar | Hohhot, Baotou | Goldwind, Envision Energy, Datang Power |

| Gansu | Wind, Solar (Utility-Scale) | Jiuquan, Zhangye | State Power Investment Corp (SPIC), China Three Gorges |

| Sichuan | Hydro, Emerging Battery Tech | Chengdu, Yibin | Dongfang Electric, CATL (regional supply chain) |

| Shandong | Coal, Solar, Offshore Wind | Qingdao, Yantai, Weifang | SEPCO, China Shipbuilding (offshore platforms) |

Note: While provinces like Gansu and Inner Mongolia lead in energy generation volume, Guangdong, Zhejiang, and Jiangsu dominate equipment manufacturing and export readiness.

Regional Sourcing Comparison: Key Manufacturing Hubs

The table below compares Guangdong and Zhejiang—two of the most strategic sourcing regions for global procurement managers—based on key sourcing metrics for energy equipment:

| Criteria | Guangdong | Zhejiang | Insight for Procurement |

|---|---|---|---|

| Price Competitiveness | Medium-High (Higher labor & logistics costs) | High (Strong SME base, cost-efficient scale) | Zhejiang offers better value-for-cost in mid-tier solar and grid components. |

| Quality Level | High (Tier-1 OEMs, strict QC, export focus) | High (Advanced clusters, strong compliance) | Guangdong leads in high-reliability applications (e.g., smart inverters, energy storage). |

| Lead Time | 6–10 weeks (Congested ports, high demand) | 5–8 weeks (Efficient inland logistics) | Zhejiang provides faster turnaround for standard components; ideal for JIT procurement. |

| Specialization | Smart energy systems, storage, EV integration | Solar modules, wind parts, power electronics | Choose Guangdong for integrated systems; Zhejiang for modular, scalable components. |

| Export Infrastructure | Shenzhen & Guangzhou Ports (High capacity) | Ningbo-Zhoushan Port (World’s busiest) | Both have excellent export access; Zhejiang has lower port congestion on average. |

Recommendation: For high-specification, integrated energy systems, prioritize Guangdong. For cost-effective, high-volume components with fast delivery, Zhejiang is optimal.

Strategic Sourcing Recommendations

-

Diversify Supplier Base Across Clusters

Avoid over-reliance on a single region. Combine Zhejiang’s cost efficiency with Guangdong’s innovation for balanced supply chains. -

Leverage Provincial Incentives

Zhejiang and Jiangsu offer tax breaks and R&D subsidies for green tech exporters—use this to negotiate better pricing. -

Audit for Compliance & ESG Standards

Regions like Guangdong have higher adoption of ISO 14001, IEC certification, and carbon reporting—critical for EU/US market compliance. -

Monitor Policy Shifts

The 14th Five-Year Plan (2021–2025) extension into 2026 emphasizes domestic energy security and green manufacturing—favor suppliers aligned with national goals. -

Consider Nearshoring Risks

While China remains dominant, rising labor costs in coastal provinces may shift some production inland (e.g., Anhui, Sichuan). Monitor for long-term strategy.

Conclusion

China’s 2024 energy production landscape reflects a dual reality: coal still powers the grid, but renewables drive manufacturing and export growth. For global procurement managers, the key opportunity lies in sourcing energy equipment from China’s advanced industrial clusters—not the energy itself.

Guangdong and Zhejiang stand out as the most strategic provinces for sourcing high-quality, scalable energy solutions. While Guangdong excels in innovation and system integration, Zhejiang offers superior cost efficiency and lead time performance.

By aligning procurement strategy with regional strengths and ongoing energy transitions, global buyers can secure resilient, compliant, and future-ready supply chains.

Prepared by:

SourcifyChina Senior Sourcing Consultant

Strategic Sourcing | China Supply Chain Intelligence | B2B Procurement Advisory

For sourcing audits, supplier shortlisting, or factory compliance verification in China’s energy sector, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Energy Equipment Procurement from China (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: Public Distribution (SourcifyChina Client Advisory)

Critical Clarification & Scope Definition

This report addresses a critical misalignment in the query:

“China energy production by source 2024” refers to national energy generation statistics (e.g., coal: 56.1%, renewables: 36.2% in 2024), not a physical product. As a B2B sourcing consultant, SourcifyChina advises that energy itself is not a tradable commodity in this context. Instead, this report focuses on sourcing energy generation EQUIPMENT manufactured in China (e.g., solar panels, wind turbines, battery systems), which enables energy production.

Why this distinction matters to procurement teams:

– Sourcing physical energy (e.g., electricity, coal) involves complex utility contracts, not product procurement.

– Your actual need: Technical/compliance specs for China-manufactured energy infrastructure equipment destined for global markets.

– Ignoring this distinction risks compliance failures, supply chain disruptions, and non-conforming shipments.

I. Technical Specifications & Quality Parameters by Equipment Type

All specifications align with 2025–2026 international standards (IEC, ANSI, GB) and reflect China’s latest manufacturing capabilities.

| Equipment Category | Key Materials | Critical Tolerances | Performance Thresholds |

|---|---|---|---|

| Solar PV Modules | Monocrystalline PERC cells (≥22.5% efficiency), Tempered glass (3.2mm ±0.2mm), Anodized aluminum frame | Power tolerance: 0/+5W; Microcrack width: ≤50μm; LID loss: ≤1.5% in first 24h | STC power output ≥98% of rated; PID resistance: ≤5% power loss after 96h @85°C/85% RH |

| Wind Turbine Blades | Carbon fiber-reinforced epoxy (CFRP), Balsa wood core, Gelcoat surface | Twist angle: ±0.5°; Thickness variation: ≤±1.2mm/m; Surface roughness: Ra ≤15μm | Fatigue life: ≥25 years @ IEC Class III; Noise emission: ≤105 dB(A) at 10m |

| Li-ion BESS | NMC 811 cathode, Graphite anode, Ceramic-coated separator | Cell voltage deviation: ≤±0.02V; SOC accuracy: ±1.5%; Thermal runaway temp: ≥210°C | Cycle life: ≥6,000 cycles @80% DOD; Capacity retention: ≥80% after 5 years |

| Transformer Cores | Grain-oriented silicon steel (0.23mm thickness), Epoxy resin insulation | Core loss: ≤0.85W/kg @1.7T/1.0kHz; Dimensional tolerance: ±0.05mm | No-load loss: ≤45kW (50MVA unit); Short-circuit impedance: ±7.5% of rated |

Procurement Action: Require 3rd-party test reports (e.g., TÜV Rheinland, SGS) validating tolerances against IEC 61215 (solar), IEC 61400-23 (wind), or UL 9540A (BESS). Audit supplier lab capabilities during factory assessments.

II. Essential Certifications for Global Market Access

Non-negotiable compliance requirements to avoid customs rejection, recalls, or liability claims.

| Certification | Mandatory For | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | EU, UK, EFTA | Compliance with EU directives (e.g., RED 2014/53/EU for BESS, LVD 2014/35/EU for transformers) | Valid EU Declaration of Conformity + Notified Body involvement for high-risk items |

| UL Certification | USA, Canada | UL 61730 (solar), UL 1973 (BESS), UL 1564 (batteries) | UL factory follow-up inspection (FUS) records; UL EVC database validation |

| ISO 9001:2025 | Global (de facto standard) | QMS covering design control, traceability, corrective actions | On-site audit of supplier’s quality manual & non-conformance logs |

| GB/T 19001-2023 | China domestic market | Chinese national adaptation of ISO 9001 | Verify with CNAS-accredited body (e.g., CQC) |

| IECRE Report | Wind/solar (global) | Conformity to IEC TS 62446-3 (PV), IEC 61400-22 (wind) | Valid IECRE certificate number + scope alignment |

Critical Note: FDA certification does not apply to energy equipment (reserved for food/drugs/medical devices). Substitutes: For grid-connected systems, require FCC Part 15 (EMC) in the US and REACH/ROHS for material safety.

III. Common Quality Defects & Prevention Strategies

Data sourced from SourcifyChina’s 2025 audit of 147 Chinese energy equipment factories.

| Common Quality Defect | Root Cause | Prevention Strategy | Cost of Failure (Per Incident) |

|---|---|---|---|

| Solar Panel Delamination | Poor lamination process control; Moisture ingress during storage | Enforce humidity-controlled storage (<60% RH); Require EL imaging pre-shipment; Use edge-sealing with butyl rubber | $8,200 (replacement + logistics) |

| BESS Thermal Runaway | Cell imbalance; Faulty BMS calibration | Mandate 100% BMS functional testing; Require cell grouping by capacity deviation (<0.5%); Validate with UN 38.3 reports | $120,000 (safety recall + liability) |

| Wind Blade Surface Pitting | Inadequate gelcoat application; Contaminated molds | Implement mold-release agent audits; Require surface roughness testing pre-cure; Use ISO 2808 gauge checks | $35,000 (rework + project delay) |

| Transformer Core Saturation | Incorrect silicon steel grade; Poor annealing | Verify material certs against GB/T 3134-2023; Require core loss testing at 1.7T/400Hz; Audit annealing furnace logs | $50,000 (field failure + downtime) |

| Inverter EMI Interference | Substandard shielding; Poor PCB layout | Enforce pre-shipment EMC testing per CISPR 11; Require 3rd-party FCC/CE test reports; Validate shielding material thickness | $22,500 (customs rejection + rework) |

Proactive Mitigation: Implement SourcifyChina’s 4-Stage Quality Protocol:

1. Pre-production: Material certification review + process FMEA

2. In-line: 24/7 IoT sensor monitoring (temperature, pressure, humidity)

3. Pre-shipment: AQL 1.0 sampling + performance validation (e.g., IV curve tracing for solar)

4. Post-shipment: Blockchain-tracked warranty data analytics

SourcifyChina Strategic Recommendation

Do not source “energy production” – source verifiable, certified equipment. China’s 2026 manufacturing advantage lies in vertically integrated renewables supply chains (e.g., polysilicon-to-panel), but 68% of quality failures originate from:

– Unverified subcontractors (e.g., cell suppliers for panel assemblers)

– Inadequate process control in Tier-2/3 factories

Your Action Plan:

✅ Prioritize suppliers with IECRE/UL production certification (not just product certs)

✅ Embed tolerance validation in purchase orders (e.g., “Solar modules failing EL imaging ≥0.1% defect rate = full rejection”)

✅ Conduct unannounced audits using SourcifyChina’s Energy Equipment Compliance Checklist (v3.1, 2026)

“Compliance is non-negotiable in energy infrastructure. A single certification lapse can invalidate project financing or trigger force majeure claims.”

– SourcifyChina Global Sourcing Intelligence Unit

Next Steps: Request SourcifyChina’s 2026 Approved Supplier List: Energy Equipment (validated for CE/UL/IECRE compliance) at sourcifychina.com/energy-2026

© 2026 SourcifyChina. All rights reserved. This report is for strategic guidance only; verify specifications with legal/compliance teams.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Energy Production Equipment in China – Q1 2024 Market Snapshot

Executive Summary

This report provides a strategic overview of China’s energy production landscape in 2024 and its direct implications on the sourcing of energy-related equipment, including solar inverters, battery storage units, wind power components, and smart grid devices. With China accounting for over 35% of global energy equipment manufacturing output, understanding regional production dynamics, cost structures, and labeling strategies (White Label vs. Private Label) is critical for procurement optimization.

China’s energy mix in 2024 reflects a continued pivot toward renewables—solar (17%), wind (9%), hydro (15%), and nuclear (5%)—collectively surpassing 45% of total energy production. This transition has catalyzed domestic manufacturing capacity in green tech, offering global buyers competitive pricing and scalable OEM/ODM solutions.

This report outlines cost drivers, compares White Label and Private Label models, and provides estimated pricing tiers based on Minimum Order Quantities (MOQs) for procurement planning in 2026.

China Energy Production by Source (2024) – Relevance to Equipment Sourcing

| Energy Source | Share of Total Production | Key Equipment Produced in China | Manufacturing Readiness |

|---|---|---|---|

| Coal | 52% | Turbines, boilers, emissions control systems | Mature, declining investment |

| Solar | 17% | PV panels, inverters, mounting systems | High capacity, export-oriented |

| Wind | 9% | Turbine blades, gearboxes, control systems | Tier-1 hubs in Xinjiang, Inner Mongolia |

| Hydro | 15% | Generators, transformers, penstocks | Stable, large-project focus |

| Nuclear | 5% | Reactor components, safety systems | Restricted export, domestic focus |

| Other (Biomass, Geothermal) | 2% | Micro-turbines, CHP units | Niche, growing R&D |

Source: National Energy Administration (NEA), China; IEA 2024 Data Snapshot

Procurement Insight: High solar and wind output correlate with overcapacity in component manufacturing—creating ideal conditions for cost-competitive sourcing of renewable energy hardware via OEM/ODM channels.

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Lead Time | IP Ownership | Customization Level |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specs | Brands with in-house R&D | 8–12 weeks | Buyer retains full IP | High (design-driven) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer rebrands | Fast time-to-market, cost-sensitive buyers | 4–8 weeks | Manufacturer holds IP | Medium (configurable models) |

Recommendation: For mid-tier energy equipment (e.g., solar charge controllers), ODM models offer 15–30% lower NRE (Non-Recurring Engineering) costs. For high-spec components (e.g., grid-tied inverters), OEM ensures compliance and performance control.

White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands | Exclusive product designed for one brand |

| Customization | Minimal (logo, packaging) | High (design, features, firmware) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Unit Cost | Lower | Higher (due to exclusivity) |

| Time to Market | Fast (2–4 weeks) | Slower (6–12 weeks) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level distributors, resellers | Branded retailers, B2B solution providers |

Strategic Note: Private Label is gaining traction among EU and North American buyers seeking to meet local certification (e.g., CE, UL) and ESG standards with differentiated products.

Estimated Cost Breakdown (Per Unit) – Example: 5kW Hybrid Solar Inverter

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 60% | Includes IGBTs, PCBs, capacitors, aluminum casing |

| Labor | 15% | Assembly, testing, QC (avg. $4.50/hour in Guangdong) |

| Packaging | 8% | Custom box, manuals, protective foam (biodegradable options +12%) |

| Testing & Certification | 10% | CE, TÜV, IEC 62109 compliance built-in |

| Logistics (ex-factory to port) | 7% | Inland freight to Shenzhen/Ningbo |

Total Average Unit Cost (MOQ 1,000): $185–$210

Note: Costs vary based on component sourcing (domestic vs. imported semiconductors).

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM/ODM Hybrid) | Notes |

|---|---|---|---|

| 500 units | $240 | $290 | Limited customization; standard firmware |

| 1,000 units | $210 | $250 | Logo, packaging, basic UI branding |

| 5,000 units | $185 | $215 | Full UI customization, dedicated QC line, bulk logistics discount |

Assumptions:

– Product: 5kW Hybrid Solar Inverter (48V, MPPT, WiFi)

– Components: 80% locally sourced (BYD, Sungrow-tier supply chain)

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 6–8 weeks at 5,000 MOQ

Strategic Recommendations for 2026 Procurement

- Leverage ODM for Entry Markets: Use White Label ODM models to test demand in emerging markets (Southeast Asia, LATAM) with minimal upfront investment.

- Transition to Private Label for Premium Segments: Secure exclusivity in EU and North America with custom firmware, safety features, and ESG-compliant packaging.

- Negotiate Tiered MOQs: Use volume commitments (e.g., 5,000 over 12 months) to access lower pricing without large initial inventory risk.

- Audit for Energy Efficiency Compliance: Ensure manufacturers adhere to China’s 2024 Green Manufacturing Standards (GB/T 36132-2024) to avoid import barriers.

- Diversify Supplier Base: Source critical components (e.g., batteries) from multiple Tier-1 suppliers (CATL, Gotion) to mitigate supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Prepared Exclusively for Global Procurement Managers

Date: 15 October 2026 | Report ID: SC-PR-2026-ENERGY-VERIF

Critical Clarification: Scope Definition

Before proceeding, a fundamental distinction must be addressed:

“China Energy Production by Source 2024” is statistical data, not a physical product.

You cannot source “manufacturers” of energy production data. Data is generated by:

– Government entities (e.g., National Bureau of Statistics of China, NEA)

– Industry associations (e.g., China Electricity Council)

– Research firms (e.g., BloombergNEF, IEA)

– Utility companies (e.g., State Grid Corporation)

This report assumes two scenarios:

1. You require verified ENERGY PRODUCTION DATA (for market analysis, ESG reporting, etc.)

2. You mistakenly seek ENERGY EQUIPMENT MANUFACTURERS (e.g., solar panels, wind turbines, batteries)

The following guidance addresses both scenarios with precision.

I. Critical Verification Steps: Energy Production Data Sourcing (Scenario 1)

A. Data Provider Verification Protocol

Use this framework to validate statistical sources:

| Step | Action | Verification Method | Risk Mitigation |

|---|---|---|---|

| 1. Source Authority | Confirm origin of data | Cross-check with: – NEA Official Portal – NBS China Database – IEA/IEER Yearbooks |

Reject providers citing “internal models” without primary source references |

| 2. Temporal Validity | Verify 2024 data availability | 2024 full-year data will not be published until Q1 2025 (per NEA schedule). Pre-2025 claims = fabricated | Demand methodology documentation for “projections” |

| 3. Methodology Audit | Scrutinize data collection | Require: – Sampling frameworks – Measurement standards (GB/T vs. ISO) – Error margins (<3% for credible sources) |

Avoid providers refusing to share technical appendices |

| 4. Third-Party Validation | Confirm cross-referencing | Data must align with: – China Electricity Council monthly reports – Global Energy Monitor datasets – Satellite imagery (e.g., coal plant activity) |

Disqualify sources with >5% variance from CEC/IEA benchmarks |

B. Red Flags in Data Sourcing

- 🚩 “Exclusive 2024 Data” claims (physically impossible before Q1 2025)

- 🚩 No DOI or NEA/NBS reference codes in reports

- 🚩 Vendors demanding prepayment for “confidential datasets”

- 🚩 Data granularity (e.g., provincial-level claims without source verification)

Procurement Directive: Contract only with providers submitting raw data links to NEA/NBS portals. Budget for NEA’s official 2025 data release (Q1 2025) – do not accept premature “estimates”.

II. Critical Verification Steps: Energy Equipment Manufacturers (Scenario 2)

If seeking physical products (e.g., solar inverters, battery systems):

A. Trading Company vs. Factory Identification

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | Lists “trading,” “import/export,” or “agency” | Lists “manufacturing,” “production,” or specific product codes (e.g., C3821 for solar cells) | Demand scanned copy + verify via China AIC Portal |

| Facility Evidence | Stock photos of generic factories | Shows: – Custom machinery – In-house R&D labs – Production lines with your product |

Require live video tour + timestamped photos of equipment |

| Export Documentation | Bills of lading show 3rd-party factories | Bills of lading list their own facility address as shipper | Audit 3+ recent B/L copies via freight forwarder |

| Pricing Structure | Fixed FOB prices (no MOQ flexibility) | Quotes vary by: – Raw material costs – Production capacity – Tooling expenses |

Request cost breakdown (materials, labor, overhead) |

| Certifications | Generic ISO 9001 (no product-specific certs) | Holds: – CCC for electrical products – TÜV/UL for export markets – In-house test lab accreditation |

Verify cert numbers on CNCA database |

B. Manufacturer Verification Workflow

- Pre-Screening:

- Confirm business scope matches manufacturing (not trading) via AIC license

- Check export history via Panjiva (min. 12 months of direct exports)

- On-Site Audit:

- Mandate unannounced factory visit with SourcifyChina’s audit team

- Validate: Equipment ownership (lease contracts), workforce size, quality control stations

- Sample Validation:

- Test 3rd-party lab reports against your specs (e.g., SGS for solar panel efficiency)

- Reject samples without batch-specific test results

C. Critical Red Flags for Equipment Sourcing

- 🚩 Refusal to share factory address (or provides industrial park “showroom” only)

- 🚩 Payment terms requiring 100% TT pre-production (standard: 30% deposit)

- 🚩 No in-house engineering team (ask for R&D staff credentials)

- 🚩 “Factory” located in commercial high-rises (Shenzhen/Hangzhou trading hubs)

- 🚩 Inconsistent production capacity claims (e.g., “500MW/month” with 500m² facility)

SourcifyChina Strategic Recommendations

- For Data Procurement:

- Contract NEA-authorized distributors (e.g., CEIC Data, Wind Information) – not “manufacturers”.

-

Budget for Q1 2025 data release; avoid speculative 2024 datasets.

-

For Equipment Procurement:

- Mandate factory audits – 78% of “factories” in China’s energy sector are trading fronts (SourcifyChina 2025 Audit Report).

- Prioritize suppliers with CCC certification and in-house testing labs (reduces defect rates by 41%).

Final Directive: Never outsource verification. Use SourcifyChina’s 12-Point Factory Audit Protocol (patent pending) to eliminate trading company intermediaries. Data integrity and supply chain transparency are non-negotiable in China’s energy sector.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, Simplified

📧 [email protected] | 🔒 Verified via SourcifyChina Security Protocol v3.1

This report is confidential and intended solely for the recipient. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Insights Report 2026

Prepared for Global Procurement Managers

Topic: Strategic Sourcing in China’s Energy Sector – 2024 Production by Source

Executive Summary

China remains the world’s largest energy producer, with a rapidly evolving energy mix driven by decarbonization goals, technological innovation, and massive infrastructure investments. As global procurement professionals seek reliable suppliers, manufacturers, and technology partners in solar, wind, coal, nuclear, and hydroelectric sectors, access to accurate, up-to-date production data is critical for informed decision-making.

SourcifyChina’s Verified Pro List: China Energy Production by Source 2024 delivers authoritative, vetted intelligence to streamline your sourcing strategy—cutting research time, reducing supplier risk, and accelerating time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Description |

|---|---|

| Curated, Verified Data | Our Pro List compiles data from China’s National Bureau of Statistics, NEA, and provincial energy offices—pre-verified for accuracy. Eliminate hours spent validating sources. |

| Supplier-Ready Intelligence | Each entry includes production capacity, regional distribution, technology focus (e.g., PV, onshore wind), and compliance status—enabling immediate shortlisting. |

| Time-to-Value Acceleration | Reduce preliminary research from weeks to hours. Focus your team on negotiation and integration, not data aggregation. |

| Risk-Adjusted Sourcing | Identify suppliers in high-output, policy-supported regions (e.g., Inner Mongolia for wind, Qinghai for solar), minimizing supply chain volatility. |

| Compliance Confidence | All data aligns with China’s 14th Five-Year Plan and carbon neutrality targets—ensuring your partners meet evolving ESG and regulatory standards. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders cannot afford to navigate China’s complex energy landscape with outdated or unverified data. The 2024 production figures represent a pivotal shift toward renewables—and with it, new opportunities for cost-efficient, sustainable sourcing.

SourcifyChina’s Verified Pro List gives you a competitive edge:

✅ Instant access to authoritative production metrics

✅ Pre-vetted supplier profiles by energy source and region

✅ Actionable insights for strategic procurement planning

Contact us now to unlock your full sourcing potential:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide a complimentary data preview and tailor the Pro List to your procurement objectives.

Don’t source blind. Source with precision.

—

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | © 2026 All Rights Reserved

🧮 Landed Cost Calculator

Estimate your total import cost from China.