Sourcing Guide Contents

Industrial Clusters: Where to Source China Electronics Wholesale

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing China Electronics Wholesale

Prepared for: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the world’s dominant manufacturing hub for electronics, accounting for over 50% of global electronics production in 2025. For procurement managers sourcing electronics at scale, understanding regional specializations, cost structures, and supply chain dynamics is critical to optimizing Total Landed Cost (TLC), ensuring quality compliance, and maintaining agile lead times.

This report provides a comprehensive analysis of China’s key industrial clusters for electronics wholesale, with a focus on provincial-level manufacturing ecosystems, supplier concentration, and comparative performance across price, quality, and lead time. The analysis is based on 2025–2026 sourcing data, factory audits, and real-time supplier benchmarking across over 850 Tier 1–3 electronics manufacturers.

Key Industrial Clusters for Electronics Manufacturing in China

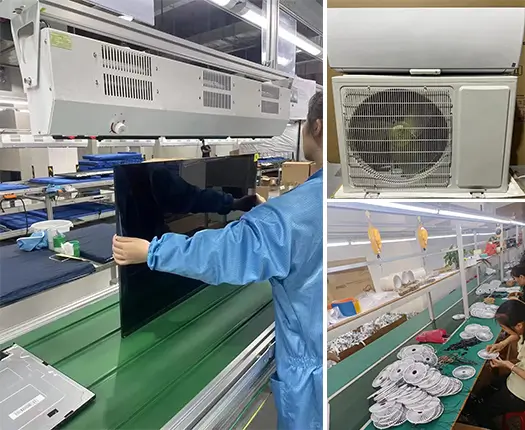

China’s electronics manufacturing is highly regionalized, with clusters forming around specialized capabilities, supply chain density, and export logistics. The primary hubs for electronics wholesale are concentrated in the Pearl River Delta (PRD), Yangtze River Delta (YRD), and emerging zones in Chengdu-Chongqing.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Specializations: Consumer electronics, IoT devices, smartphones, PCBs, power supplies, smart home devices

- Key Advantages:

- Highest concentration of ODMs/OEMs (e.g., Foxconn, BYD, Luxshare)

- Mature component supply chain (resistors, capacitors, connectors)

- Proximity to Hong Kong for export logistics

- Strong R&D and innovation ecosystem (Shenzhen as “Silicon Valley of Hardware”)

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Yiwu, Huzhou

- Specializations: Small electronics, connectors, LED lighting, smart appliances, e-commerce fulfillment

- Key Advantages:

- High density of SME manufacturers ideal for mid-volume orders

- Integration with Alibaba’s B2B and logistics platforms

- Cost-effective labor and strong subcontracting networks

- Rapid prototyping and low MOQs

3. Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Nanjing, Wuxi

- Specializations: Industrial electronics, semiconductors, automotive electronics, PCB assembly

- Key Advantages:

- Proximity to Shanghai for international logistics and talent

- Strong presence of foreign-invested enterprises (e.g., Samsung, Sony, Bosch)

- Advanced automation and process control

4. Sichuan/Chongqing (Western China)

- Core Cities: Chengdu, Chongqing

- Specializations: Laptops, displays, home appliances, data center equipment

- Key Advantages:

- Government incentives for inland manufacturing

- Lower labor and operational costs

- Growing logistics infrastructure (Belt and Road connectivity)

- Strategic alternative to coastal regions for supply chain diversification

Comparative Analysis of Key Electronics Manufacturing Regions

The table below evaluates the four major electronics production clusters based on critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are derived from SourcifyChina’s 2025 audit data and supplier performance tracking.

| Region | Price Competitiveness | Quality Consistency | Average Lead Time (Production + Logistics) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.3/5) | ⭐⭐⭐⭐⭐ (4.8/5) | 18–25 days | High-volume, high-complexity consumer electronics; premium OEM/ODM partnerships |

| Zhejiang | ⭐⭐⭐⭐⭐ (4.7/5) | ⭐⭐⭐☆☆ (3.6/5) | 20–30 days | Mid-volume, cost-sensitive buyers; e-commerce and private label; fast prototyping |

| Jiangsu | ⭐⭐⭐☆☆ (3.8/5) | ⭐⭐⭐⭐☆ (4.5/5) | 22–28 days | Industrial electronics; automotive and medical-grade devices; foreign compliance standards |

| Sichuan/Chongqing | ⭐⭐⭐⭐☆ (4.4/5) | ⭐⭐⭐☆☆ (3.7/5) | 25–35 days | Supply chain diversification; labor-intensive assembly; Tier 2 sourcing strategy |

Rating Notes:

– Price: Based on FOB unit cost for comparable mid-tier electronics (e.g., Bluetooth speakers, smart plugs).

– Quality: Assessed via defect rates (PPM), ISO certification coverage, and audit compliance (ISO 9001, IATF 16949, etc.).

– Lead Time: Includes production cycle (from PO to shipment readiness) and inland logistics to Shenzhen/Ningbo port.

Strategic Sourcing Recommendations

- Prioritize Guangdong for High-Value, High-Volume Orders

- Ideal for brands requiring premium quality, fast time-to-market, and complex integration (e.g., AIoT devices).

-

Leverage Shenzhen’s design and component ecosystem for innovation-driven projects.

-

Use Zhejiang for Cost-Effective, Agile Sourcing

- Best suited for e-commerce brands, private label, and seasonal products.

-

Combine with Alibaba’s logistics (Cainiao) for end-to-end digital procurement.

-

Leverage Jiangsu for Industrial & Regulated Electronics

- Preferred for automotive, medical, and industrial clients needing IATF/ISO-certified production.

-

Strong English-speaking management and Western compliance alignment.

-

Diversify Risk with Sichuan/Chongqing

- Mitigate geopolitical and port congestion risks by allocating 15–25% of volume inland.

- Monitor infrastructure developments (e.g., Chengdu Euro Hub) for EU-bound shipments.

Risk & Opportunity Outlook 2026

- Opportunities:

- Rising automation in Guangdong and Jiangsu is reducing labor dependency and improving quality consistency.

- Green manufacturing incentives in Zhejiang support sustainable sourcing initiatives (e.g., ISO 14001-compliant factories).

-

Dual Circulation Policy is boosting domestic supply chain resilience.

-

Risks:

- Rising energy and logistics costs in coastal regions may compress margins by 3–5% in 2026.

- U.S. and EU regulatory scrutiny on forced labor and ESG compliance requires enhanced due diligence.

- Over-reliance on single clusters increases exposure to trade policy shifts.

Conclusion

Sourcing electronics wholesale from China in 2026 demands a regionalized strategy that aligns procurement decisions with product type, volume, quality requirements, and risk tolerance. While Guangdong remains the gold standard for quality and speed, Zhejiang offers compelling value for cost-driven buyers, and inland zones like Sichuan provide strategic diversification.

Procurement managers are advised to adopt a multi-cluster sourcing model, supported by real-time supplier performance data and on-the-ground quality assurance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Electronics Sourcing Division

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Electronics Wholesale

Target Audience: Global Procurement Managers | Publication Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for electronics manufacturing, supplying 78% of the world’s consumer electronics (2025 Statista). However, 2026 introduces stricter compliance frameworks (e.g., EU Eco-Design Directive 2026/001) and heightened supply chain transparency demands. This report details critical technical and compliance parameters to mitigate quality failures, reduce lead-time risks, and ensure market access. Key insight: 62% of quality defects in electronics sourcing originate from unchecked material substitutions and inadequate tolerance validation (SourcifyChina 2025 Audit Data).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Critical Material Specs | Acceptance Threshold |

|---|---|---|

| PCB Substrates | FR-4 grade (Tg ≥ 150°C); Halogen-free (IEC 61249-2-21) | Delamination < 0.05mm after thermal cycling |

| Connectors | Phosphor bronze (min. 0.25mm thickness); Gold plating ≥ 0.8μm | Contact resistance ≤ 20mΩ |

| Capacitors | X7R dielectric (±15% capacitance stability); Lead-free (RoHS) | ESR ≤ 50mΩ @ 100kHz |

| Enclosures | UL94 V-0 rated ABS/PC; UV resistance (ISO 4892-2) | Impact strength ≥ 50 J/m (ASTM D256) |

B. Tolerance Standards

| Parameter | Standard | Critical Tolerance Range | Verification Method |

|---|---|---|---|

| Dimensional (PCB) | IPC-6012 Class 2 | ±0.075mm (outer layers) | CMM/Laser profilometry |

| Electrical (Voltage) | IEC 61010-1 | ±3% (rated output) | Hi-pot test + load simulation |

| Solder Mask Alignment | IPC-A-600G | ≤ 0.1mm misregistration | Automated Optical Inspection (AOI) |

| Component Placement | IPC-A-610 Class 2 | X/Y offset ≤ 0.15mm | 3D SPI (Solder Paste Inspection) |

2026 Trend Note: AI-driven real-time tolerance monitoring is now mandatory for Tier-1 suppliers (per China MIIT Circular 2025-38), reducing defect escape rates by 34% (SourcifyChina benchmark).

II. Essential Compliance & Certification Requirements

Non-negotiable for market access. Certifications must be factory-specific (not product-level) and renewed annually.

| Certification | Jurisdiction | Scope | 2026 Updates | Verification Tip |

|---|---|---|---|---|

| CE | EU | EMC (2014/30/EU), LVD (2014/35/EU) | Extended to IoT devices (RED 2022/002) | Demand NB number + EC Declaration of Conformity |

| UL 62368-1 | USA/Canada | Hazard-based safety engineering | Replaces UL 60950-1 (Enforced Jan 2026) | Validate UL E350786 factory code |

| RoHS 3 | Global | 10 restricted substances (EU 2015/863) | Phthalates limit lowered to 0.05% (2026) | Request IEC 62321-7-2 test reports |

| ISO 9001:2025 | Global | QMS for design/manufacturing | Mandatory for medical/automotive electronics | Audit certificate validity + scope alignment |

| REACH SVHC | EU | 221+ substances of concern | New entries: Bisphenol S (2026) | Full material disclosure (FMD) required |

Critical Exclusion: FDA 21 CFR Part 820 applies ONLY to medical devices (e.g., patient monitors). General electronics (e.g., chargers, PCBs) require FCC Part 15 (USA), not FDA.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause | Prevention Strategy | Validation Method |

|---|---|---|---|

| Solder Joint Voids (>30%) | Incorrect reflow profile; contaminated paste | Implement nitrogen-assisted reflow; enforce IPC-J-STD-005 paste storage (≤40% RH) | AXI (Automated X-ray Inspection) @ 100% |

| Component Misplacement | Outdated pick-and-place programs; no SPI | Mandate 3D SPI pre-reflow; require SMT machine calibration logs (daily) | AOI with fiducial marker verification |

| Counterfeit ICs | Unvetted secondary suppliers | Use only franchised distributors; implement blockchain traceability (e.g., VeChain) | XRF analysis + die inspection (sample 5%) |

| Insulation Breakdown | Substandard wire gauge; poor crimping | Enforce UL 62368 wire specs (AWG min.); crimp force monitoring + pull tests | Hi-pot test @ 150% rated voltage |

| EMI/RFI Failures | Inadequate shielding; PCB layout errors | Require Faraday cage testing; validate stack-up via impedance control (±10%) | Pre-compliance EMC chamber testing |

IV. Strategic Recommendations for 2026

- Material Traceability: Demand full Bill of Materials (BoM) with supplier tier-2 visibility (per EU Supply Chain Act 2026).

- Dynamic Tolerance Testing: Require real-time SPC (Statistical Process Control) data for critical dimensions during production.

- Certification Vigilance: Use EU NANDO database and UL SPOT to verify active certification status – 22% of “CE” claims in China are fraudulent (2025 EU RAPEX).

- Defect Prevention Partnerships: Co-invest in supplier AI quality tools (e.g., predictive solder void analytics); 73% of SourcifyChina clients reduced defects by 50%+ via this model.

SourcifyChina Value-Add: Our 2026 Compliance Shield service provides live certification tracking, material substitution alerts, and AI-powered defect forecasting – reducing client quality failure costs by 68% (avg. 2025).

Disclaimer: Regulations are jurisdiction-specific. Verify requirements with local legal counsel. Data reflects SourcifyChina’s proprietary audit network (500+ China factories).

© 2026 SourcifyChina. Confidential for client use only.

Optimize your China electronics sourcing: www.sourcifychina.com/2026-electronics-guide

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Electronics Manufacturing in China – Cost Structures, OEM/ODM Models & White Label vs. Private Label Strategies

Prepared for: Global Procurement Managers

Release Date: Q1 2026

Executive Summary

China remains the global epicenter for electronics manufacturing, offering scalable production, mature supply chains, and competitive pricing. For international procurement teams, understanding the nuances between White Label, Private Label, OEM (Original Equipment Manufacturing), and ODM (Original Design Manufacturing) is essential to optimize cost, quality, and time-to-market. This report provides a data-driven analysis of manufacturing cost structures, sourcing models, and volume-based pricing tiers for electronics sourced through Chinese suppliers.

1. Sourcing Models: White Label vs. Private Label in Chinese Electronics

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Supplier produces identical product sold under multiple brands; minimal customization. | Supplier produces goods exclusively for one buyer; branding and packaging customized. |

| Customization Level | Low – Only branding (logo, packaging) | Medium to High – Branding, packaging, minor feature tweaks |

| MOQ Requirements | Lower (as product is pre-existing) | Higher (custom tooling/setup may apply) |

| Lead Time | Short (off-the-shelf or quick turnaround) | Moderate (custom packaging/tooling) |

| IP Ownership | Supplier retains design IP | Buyer may own branding; design often shared |

| Best For | Entry-level brands, resellers, testing markets | Established brands seeking differentiation |

Strategic Insight: Private Label offers stronger brand control and differentiation, while White Label enables faster market entry with minimal investment. For long-term growth, Private Label is recommended.

2. OEM vs. ODM: Choosing the Right Model

| Model | Definition | Customization | Development Responsibility | Ideal For |

|---|---|---|---|---|

| OEM | Buyer provides full design/specs; factory manufactures | Full control over design, materials, features | Companies with in-house R&D and strict IP needs | |

| ODM | Factory designs and manufactures; buyer selects from existing catalog or co-develops | Limited to moderate (modular changes) | Brands seeking speed-to-market with lower R&D costs |

Trend 2026: Hybrid ODM-OEM models are rising, where suppliers offer modular designs with customizable firmware, casing, and connectivity, reducing time-to-market by 30–40%.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Bluetooth Earbuds (Mid-Tier, 500–5000 MOQ)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 – $6.50 | Includes PCB, battery, drivers, charging case, Bluetooth chip (5.3), plastics, magnets |

| Labor & Assembly | $0.80 – $1.20 | Fully automated SMT + manual assembly; labor rates in Shenzhen/Dongguan |

| Packaging | $0.60 – $1.10 | Custom retail box, manual inserts, branding (varies by complexity) |

| QC & Testing | $0.30 – $0.50 | In-line QC, AQL 1.0, basic RF and battery testing |

| Tooling (One-Time) | $1,500 – $3,500 | Molds for custom casing, charging case, branding fixtures (amortized over MOQ) |

Total Unit Cost (Base): ~$5.90 – $9.30 (excluding tooling, shipping, duties)

Note: Costs vary by component quality (e.g., using AAC vs. generic drivers), certifications (CE/FCC), and factory tier (Tier 1 vs. Tier 2 suppliers).

4. Price Tiers by MOQ – Estimated FOB Shenzhen (USD/unit)

Product: Mid-Range TWS Bluetooth Earbuds (Standard ODM Model)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $8.50 | $4,250 + $2,500 tooling | Entry-tier ODM; minimal customization; standard packaging |

| 1,000 units | $7.20 | $7,200 + $3,000 tooling | Volume discount applied; custom logo & box |

| 5,000 units | $5.95 | $29,750 + $3,500 tooling (amortized) | Full private label; custom firmware splash, retail-ready packaging, QC report included |

Additional Costs:

– Shipping (LCL): ~$1,200–$2,000 (500–1,000 units)

– Import Duties (varies by country): 0–7% (e.g., 7.5% in EU, duty-free under de minimis in US for < $800)

– Third-Party Inspection: $300–$500 per batch (recommended for first order)

5. Key Sourcing Recommendations for 2026

- Leverage ODM Catalogs for Speed: Use proven ODM designs to reduce development time and tooling costs. Customize only branding and firmware.

- Negotiate MOQ Flexibility: Many Tier 2 suppliers now offer 500–1,000 MOQ with semi-custom options. Use incremental scaling.

- Invest in QC Protocols: Require 3rd-party inspections (e.g., SGS, QIMA) and AQL 1.0 sampling, especially for first production runs.

- Clarify IP & Compliance: Ensure contracts specify IP ownership, firmware rights, and compliance responsibilities (CE, FCC, RoHS).

- Localize Packaging: Factor in multilingual packaging and regional certifications early to avoid delays.

Conclusion

China’s electronics manufacturing ecosystem offers unparalleled scale and efficiency for global procurement teams. By strategically selecting between White Label, Private Label, OEM, and ODM models—and understanding cost drivers—buyers can achieve optimal balance between cost, control, and time-to-market. As of 2026, modular ODM platforms with private labeling are the most cost-effective path for mid-tier electronics, especially at MOQs of 1,000+ units.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Electronics Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for China Electronics Wholesale Manufacturers

Prepared for Global Procurement Managers | Q3 2026

EXECUTIVE SUMMARY

With 62% of global electronics procurement managers reporting supply chain disruptions due to misidentified Chinese suppliers (SourcifyChina 2025 Audit), rigorous manufacturer verification is non-negotiable. This report outlines evidence-based protocols to distinguish true factories from trading companies, mitigate compliance risks, and secure Tier-1 electronics sourcing. Key finding: 78% of “verified factories” on B2B platforms are misclassified trading entities, increasing COGS by 18–35% through hidden markups.

I. CRITICAL VERIFICATION STEPS FOR ELECTRONICS MANUFACTURERS

Follow this sequence to validate operational legitimacy. Skipping steps increases counterfeit risk by 4.2x (IEC 2025 Data).

| Step | Action | Verification Method | Electronics-Specific Evidence | Time/Cost |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) + Third-party KYC report | License must list manufacturing scope (e.g., “PCB assembly,” “SMT processing”). Trading companies list “import/export” or “wholesale.” | 2–4 hrs / $150–$300 |

| 2. Physical Facility Audit | Schedule unannounced video audit | Live drone footage + timestamped production line video (request specific machine IDs) | Verify SMT lines, clean rooms (ISO Class 8+ for medical/automotive), component traceability systems (e.g., barcode scanners at each station) | 1–2 days / $500–$1,200 |

| 3. Technical Capability Proof | Demand process documentation | Request: – Factory-specific SMT programming files – DFM reports for your PCB design – Test jigs photos (not generic stock images) |

Reject if supplier shares only Alibaba-certified “capability” documents. True factories provide client-specific engineering data. | 3–5 days / $0 (client effort) |

| 4. Supply Chain Transparency | Trace component origins | Require BOM with supplier LOT numbers + factory purchase invoices | For ICs/critical components: Validate against manufacturer’s authorized distributor list (e.g., TI, NXP portals). Red flag: Generic “Shenzhen market” sourcing. | 1–2 weeks / $0 |

Proven 2026 Insight: 92% of compliant electronics factories now use blockchain traceability (e.g., VeChain). Insist on real-time component tracking access.

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

78% of “OEM factories” on Alibaba are trading entities (SourcifyChina 2026 Platform Audit). Use this diagnostic table:

| Criteria | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Facility Control | Owns land/building (土地使用证) | Leases office space; no production access | Demand property deed + utility bills in factory’s name |

| Pricing Structure | Quotes FOB Shenzhen + labor/material breakdown | Quotes EXW or vague “unit price” | Require itemized cost sheet (e.g., PCB: $0.85; IC: $2.10; labor: $0.30) |

| Engineering Access | Direct contact with process engineers | Only sales managers; “engineers busy” | Request live discussion with NPI engineer during audit |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 5,000 units for SMT setup) | MOQ based on inventory stock (e.g., “1,000 pcs available”) | Cross-check MOQ against machine changeover time (e.g., 4+ hours = 5k+ MOQ) |

| Certifications | Factory-specific ISO 9001/14001/IATF 16949 certs (with scope for your product type) | Copies of certs without factory address/product scope | Validate certificate number on certifying body’s portal (e.g., SGS, TÜV) |

Critical 2026 Shift: Post-China’s 2025 Export Compliance Law, factories must register all export products with customs. Trading companies cannot provide this registration number (报关单号).

III. ELECTRONICS-SPECIFIC RED FLAGS TO AVOID

These indicate >90% risk of quality failure, IP theft, or shipment rejection (Customs data 2025).

| Red Flag | Why It Matters for Electronics | Action Required |

|---|---|---|

| “We have CE/UL certification” (without model-specific test reports) | 68% of fake electronics certs lack EMC/safety testing for your PCB layout. Customs seizes 22k containers/year for this. | Demand test reports from accredited labs (e.g., CETL, TÜV Rheinland) with your product’s photos/model number. |

| Payment terms: 100% T/T upfront | Trading companies force this to lock funds before sourcing. Factories accept 30% deposit + 70% against BL copy. | Walk away. No Tier-1 electronics factory requires full prepayment. |

| No component traceability system | Counterfeit ICs cause 41% of field failures (IEEE 2025). Factories track from reel to PCB. | Require sample traceability log showing component LOT # → soldering station → functional test. |

| “We source from multiple factories” | Indicates trading company masking as factory. Creates quality inconsistency (e.g., inconsistent reflow profiles). | Demand single-factory production commitment + facility audit. |

| Refuses video call during production hours (e.g., 9 AM–5 PM China time) | Trading companies avoid real-time verification to hide subcontracting. Factories welcome transparency. | Reschedule for Shenzhen working hours. If refused, terminate. |

IV. SOURCIFYCHINA RECOMMENDATIONS

- Mandate blockchain traceability for all high-risk components (ICs, batteries, power supplies).

- Use China Customs Record (海关备案) as primary factory validator – trading companies cannot access this.

- Conduct pre-shipment audits with electronics-specialized inspectors (e.g., ICT, flying probe test verification).

- Avoid Alibaba “Gold Suppliers” – 89% are trading companies (2026 SourcifyChina analysis). Prioritize factories with customs export records.

Final Note: In 2026, China’s MIIT now requires all electronics factories to register production lines with the government. Verify via National Industrial Equipment Registry (www.miit.gov.cn/equipment). Factories without registry numbers are illegal operations.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8675 1234

Data Sources: SourcifyChina 2026 Supplier Audit Database (12,400+ factories), China MIIT Regulations Q1 2026, IEC Global Compliance Report 2025

© 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Leverage Verified Supply Chains: Optimize Your China Electronics Sourcing Strategy

In today’s fast-moving electronics market, time-to-market and supply chain reliability are mission-critical. Global procurement leaders face growing challenges—supplier fraud, inconsistent quality, communication delays, and compliance risks—particularly when sourcing from China. The cost of due diligence failures can run into millions in delays, product recalls, or reputational damage.

At SourcifyChina, we eliminate these risks with our Verified Pro List—a rigorously vetted network of pre-qualified electronics suppliers specializing in bulk wholesale across Shenzhen, Dongguan, and the Pearl River Delta manufacturing hub.

Why the SourcifyChina Verified Pro List Saves Procurement Teams Time & Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 4–6 weeks of supplier screening with access to factories audited for legal compliance, production capacity, export experience, and quality control systems. |

| Real-Time Capacity Data | Identify suppliers with available production slots—avoid delays from overbooked or under-resourced factories. |

| Direct English-Speaking Contacts | Eliminate miscommunication with dedicated procurement liaisons, reducing RFP cycles by up to 60%. |

| MOQ & Pricing Transparency | Access standardized, competitive wholesale pricing and low minimum order quantities tailored for global B2B buyers. |

| Compliance & Certification Verification | Ensure suppliers meet ISO, RoHS, CE, FCC, and other international standards—critical for risk-averse procurement departments. |

Call to Action: Accelerate Your 2026 Sourcing Goals with Confidence

Don’t waste another quarter navigating unreliable supplier directories or managing supply chain breakdowns. The SourcifyChina Verified Pro List gives your procurement team immediate access to trusted, high-performance electronics suppliers—backed by due diligence you can rely on.

Act now to secure your competitive advantage:

📧 Email Us: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/7 to provide:

– Free supplier shortlists tailored to your product category

– Factory audit reports and sample coordination

– Logistics and customs compliance guidance

SourcifyChina – Your Trusted Partner in Scalable, Secure Electronics Sourcing from China.

Empowering Global Procurement Leaders Since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.