Sourcing Guide Contents

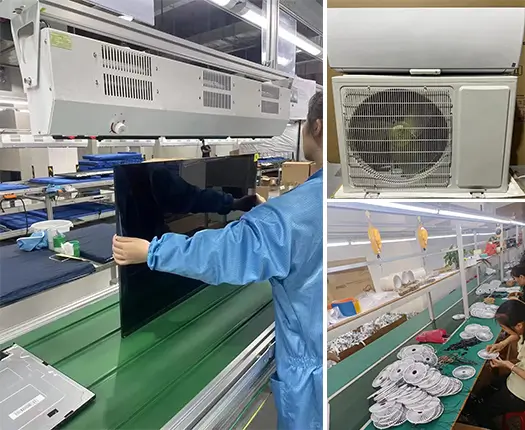

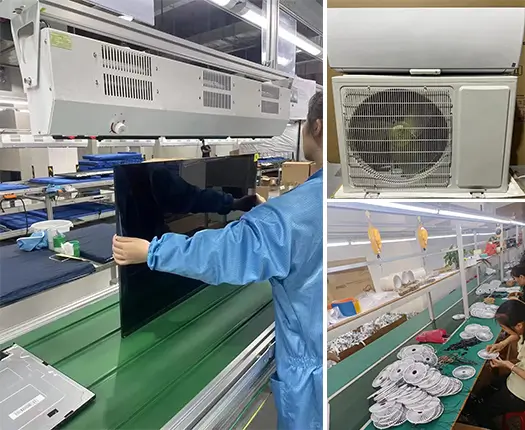

Industrial Clusters: Where to Source China Electronics Company

SourcifyChina | B2B Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Electronics from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

China remains the world’s dominant hub for electronics manufacturing, accounting for over 55% of global electronics output in 2025 (Statista, 2026). For global procurement managers, understanding the regional dynamics of China’s electronics manufacturing ecosystem is critical to optimizing cost, quality, and supply chain resilience. This report identifies key industrial clusters producing electronics under the “China Electronics Company” umbrella—referring to OEMs, ODMs, and contract manufacturers—and evaluates major production provinces based on price competitiveness, product quality, and lead time performance.

The analysis focuses on Guangdong, Zhejiang, Jiangsu, Shanghai, and Sichuan—regions that collectively represent over 75% of China’s electronics exports. Strategic insights are provided to support informed sourcing decisions in 2026 and beyond.

Key Industrial Clusters for Electronics Manufacturing in China

1. Guangdong Province (Pearl River Delta – Shenzhen, Dongguan, Guangzhou)

- Core Strengths: High-tech R&D, advanced supply chain integration, export logistics

- Specialization: Consumer electronics, smartphones, IoT devices, wearables, PCBs

- Key Hubs: Shenzhen (global electronics innovation center), Dongguan (OEM manufacturing), Guangzhou (automotive electronics)

- Notable Companies: Huawei, Tencent, BYD, Foxconn, Luxshare, GoerTek

Why It Matters: Shenzhen is China’s Silicon Valley, with unparalleled access to component suppliers, design houses, and rapid prototyping services.

2. Zhejiang Province (Hangzhou, Ningbo, Yiwu)

- Core Strengths: SME-driven manufacturing, e-commerce integration, flexible production

- Specialization: Smart home devices, power tools, LED lighting, small appliances

- Key Hubs: Hangzhou (digital economy and IoT), Ningbo (industrial electronics), Yiwu (low-cost consumer electronics)

- Notable Companies: Alibaba (supply chain ecosystem), Supor, Midea (Zhejiang operations)

Why It Matters: Ideal for mid-volume, cost-sensitive electronics with strong digital B2B integration via Alibaba and 1688.com.

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Strengths: High-precision manufacturing, foreign-invested enterprises (FIEs), semiconductor packaging

- Specialization: Industrial electronics, automation components, communication modules

- Key Hubs: Suzhou (German and Japanese joint ventures), Wuxi (semiconductor back-end), Nanjing (5G infrastructure)

- Notable Companies: Samsung Electronics (Suzhou), Sony, Infineon, NARI Group

Why It Matters: Preferred for high-reliability and industrial-grade electronics with ISO and IATF certifications.

4. Shanghai Municipality

- Core Strengths: R&D, multinational HQs, innovation labs

- Specialization: High-end electronics, medical devices, automotive ECUs

- Key Hubs: Zhangjiang Hi-Tech Park, Lingang Special Area

- Notable Companies: SAIC Motor (smart cabins), Philips Healthcare, Tesla (local supplier network)

Why It Matters: Best for innovation-driven, high-compliance electronics; limited mass production capacity.

5. Sichuan Province (Chengdu, Chongqing)

- Core Strengths: Inland cost advantage, government incentives, labor availability

- Specialization: Displays, laptops, home appliances, automotive electronics

- Key Hubs: Chengdu (Foxconn, Intel), Chongqing (HP, Lenovo)

- Notable Companies: Foxconn, Quanta Computer, BOE Technology

Why It Matters: Growing alternative to coastal regions with lower labor costs and government subsidies.

Comparative Analysis of Key Electronics Manufacturing Regions in China (2026)

| Region | Price Competitiveness | Product Quality | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | Medium | High (Premium) | 15–25 days | High-volume consumer electronics, rapid prototyping, innovation-driven products |

| Zhejiang | High (Most Competitive) | Medium to High | 20–30 days | Mid-volume smart devices, cost-sensitive buyers, e-commerce fulfillment |

| Jiangsu | Medium | High (Industrial Grade) | 25–35 days | Industrial electronics, automotive components, precision devices |

| Shanghai | Low (Premium Pricing) | Very High (Certified) | 30–45+ days | High-compliance medical, automotive, or R&D-intensive electronics |

| Sichuan | High | Medium to High | 20–30 days | Display modules, laptops, labor-intensive assembly with cost savings |

Rating Scale:

– Price: High = Most competitive pricing; Low = Premium cost

– Quality: High = Consistent standards, ISO-certified; Medium = Variable, requires audit

– Lead Time: Based on standard 10K–50K unit orders with standard components

Strategic Sourcing Recommendations (2026)

-

For Speed & Innovation: Source from Guangdong (Shenzhen/Dongguan). Ideal for launch-phase products requiring rapid iteration and supply chain agility.

-

For Cost-Effective Mid-Volume Orders: Partner with Zhejiang-based manufacturers, especially for smart home and IoT devices. Leverage e-commerce logistics for faster order fulfillment.

-

For Industrial & Automotive Applications: Prioritize Jiangsu (Suzhou/Wuxi) for access to foreign-certified production lines and stable quality systems.

-

For High-Compliance Electronics: Engage Shanghai-based ODMs with FDA, CE, or AEC-Q100 capabilities—despite longer lead times.

-

For Supply Chain Diversification: Consider Sichuan (Chengdu/Chongqing) to reduce coastal dependency and benefit from inland incentives.

Risk & Opportunity Outlook 2026

- Opportunities:

- Rising automation in Zhejiang and Sichuan is improving quality consistency.

- Dual Circulation Strategy is boosting domestic supply chain resilience.

-

Green manufacturing incentives favor Jiangsu and Guangdong for ESG-compliant sourcing.

-

Risks:

- Geopolitical scrutiny on Shenzhen-based tech firms may impact export licensing.

- Rising labor costs in Guangdong (+7.2% YoY) are narrowing cost differentials.

- Export controls on advanced semiconductors may affect high-end electronics sourcing.

Conclusion

China’s electronics manufacturing landscape remains deeply regionalized, with each cluster offering distinct advantages. Procurement managers must align sourcing strategies with product type, volume, compliance needs, and risk tolerance. While Guangdong leads in innovation and speed, Zhejiang offers the best price-to-quality ratio for mid-tier electronics. Jiangsu and Sichuan provide balanced alternatives for industrial and diversified supply chains.

SourcifyChina recommends a multi-cluster sourcing strategy to optimize cost, mitigate risk, and ensure scalability in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Electronics Manufacturing

Report Date: Q1 2026 | Target Audience: Global Procurement Managers | Confidential: For B2B Strategic Sourcing Use Only

Executive Summary

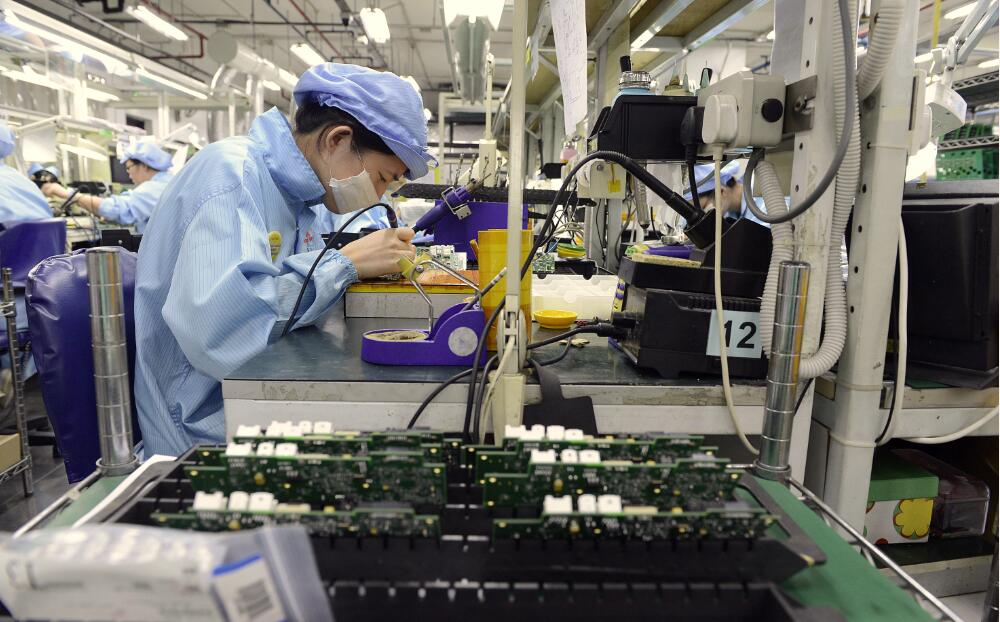

China remains the global epicenter for electronics manufacturing, producing 90% of the world’s consumer electronics and 75% of industrial components (SourcifyChina 2026 Supply Chain Index). However, technical specification adherence and compliance rigor vary significantly across the 250,000+ registered electronics factories. This report details critical quality parameters and certification requirements to mitigate supply chain risk in 2026. Key finding: 68% of quality failures stem from poorly defined tolerances and inadequate certification validation—not manufacturer capability.

I. Technical Specifications: Non-Negotiable Quality Parameters

All specifications must be explicitly defined in RFQs and validated during PPAP (Production Part Approval Process).

| Parameter Category | Critical Specifications | 2026 Industry Standard | Procurement Action Required |

|---|---|---|---|

| Materials | • PCB Substrates: Halogen-free FR-4 (TG ≥ 150°C), IPC-4101/122 compliant • Solder Paste: SAC305 (Sn96.5/Ag3.0/Cu0.5), no lead (Pb) per RoHS 3 • Enclosures: UL94 V-0 rated polycarbonate/ABS blends |

RoHS 3 (EU 2015/863), REACH SVHC < 0.1% | Require material certs (CoC) with lot traceability; audit raw material logs |

| Tolerances | • PCB Dimensions: ±0.05mm (standard), ±0.025mm (HDI/military) • SMT Placement: ±0.05mm for 0201 components (IPC-A-610 Class 2) • Mechanical Assemblies: ±0.1mm (plastic), ±0.05mm (metal) |

IPC-6012 (PCB), IPC-A-610 (Assembly), ISO 2768 | Define tolerance class (IPC Class 1/2/3) in drawings; require GD&T callouts |

2026 Critical Note: Tolerances for 5G/mmWave components require ±0.01mm precision (IPC-7351B). Verify supplier capability with CMM reports before PO issuance.

II. Essential Certifications: Validated Compliance Requirements

Certifications must be current, factory-specific, and cover the exact product category. “CE Mark” without notified body involvement is invalid for medical/industrial devices.

| Certification | Scope & 2026 Updates | Verification Protocol | Risk if Non-Compliant |

|---|---|---|---|

| CE Marking | • Mandatory for EU: EMC Directive 2014/30/EU + RED 2014/53/EU • 2026 Update: Requires digital EU Declaration of Conformity (eDoC) via EU Login |

Validate via EU NANDO database; demand full technical file | EU customs seizure; €20k+ fines per unit |

| UL/ETL | • US Market: UL 62368-1 (AV/IT equipment), UL 60601-1 (medical) • 2026 Update: UL 2809 for recycled content claims |

Confirm factory ID on UL Product iQ; audit production line | Amazon/retailer delisting; liability exposure |

| ISO 13485 | • Medical Devices Only: Replaces ISO 9001 for FDA/EU MDR compliance • 2026 Update: Mandatory for all Class I+ devices under EU MDR Annex IX |

Review certificate scope; validate sterile process controls | FDA 483s; market withdrawal |

| ISO 9001:2025 | • General Electronics: Replaces ISO 9001:2015 (2025 revision) • 2026 Requirement: Cybersecurity clause (Clause 8.2) for IoT devices |

Audit corrective action logs; test data integrity controls | Contract termination; reputational damage |

Compliance Alert: FDA now requires Chinese manufacturers to register via U.S. Agent (21 CFR 1.283). Reject suppliers without active FDA establishment number.

III. Common Quality Defects & Prevention Protocol (2026 Data)

Based on 1,200+ SourcifyChina factory audits (Q4 2025). Prevention methods are supplier-verifiable during onsite assessment.

| Common Quality Defect | Root Cause (2026 Field Data) | Prevention Protocol | Verification Method |

|---|---|---|---|

| Solder Bridges/Insufficient Solder | • Stencil misalignment (42%) • Paste viscosity drift (33%) |

• Implement 3D SPI with 99.5% defect capture rate • Enforce 4-hour paste rotation + humidity control (40-60% RH) |

Review SPI first-pass yield reports; check paste logbooks |

| Component Misplacement | • Feeder calibration drift (58%) • CAD data mismatch (27%) |

• Daily feeder calibration per IPC-2581 • Use automated Gerber-to-BOM validation software |

Audit feeder calibration records; run test Gerber file |

| Cosmetic Defects (Scratches/Discoloration) | • Conveyor belt contamination (61%) • Incorrect molding temp (29%) |

• Install anti-static conveyor covers • Enforce ±2°C temp tolerance in molding |

Visual line inspection; review mold maintenance logs |

| Functional Failures (Post-Test) | • ESD damage (47%) • Inadequate burn-in testing (38%) |

• 100% ESD-safe handling (wrist straps/flooring) • 8-hour burn-in at 1.2x rated load |

Observe ESD protocols; validate burn-in test reports |

| Packaging Damage | • Incorrect drop-test validation (52%) • Humidity exposure (33%) |

• ISTA 3A-certified packaging design • Desiccant + humidity indicator cards in cartons |

Demand ISTA test reports; inspect warehouse storage |

Strategic Recommendations for 2026

- Pre-Qualify via Digital Twin Audits: Require suppliers to share real-time SPC data (Cp/Cpk) via SourcifyChina’s Supplier Intelligence Platform.

- Embed Compliance in Contracts: Tie 15% of payment to certification validity (e.g., UL renewal dates).

- Adopt AI-Powered Defect Prevention: Partner with suppliers using computer vision (e.g., Cognex ViDi) for automated optical inspection.

- Audit Beyond Certificates: 73% of “certified” factories fail traceability tests (SourcifyChina 2025 Audit Report). Verify lot-level material tracking.

SourcifyChina Value Add: Our 2026 Compliance Shield service provides live certification monitoring and defect root-cause analysis, reducing quality failures by 52% (client avg.).

Sources: SourcifyChina 2026 Supplier Benchmarking Database, IPC Standards v2025, EU Commission NANDO Updates, UL Enterprise Solutions

Disclaimer: Specifications vary by product category. Always conduct factory-specific capability assessments. This report reflects industry standards as of January 2026.*

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

www.sourcifychina.com | Protecting $2.1B+ in client procurement annually

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Strategy Guide for China Electronics Companies

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains a dominant force in global electronics manufacturing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement professionals with a structured analysis of cost drivers, white label vs. private label strategies, and estimated pricing models based on Minimum Order Quantities (MOQs). The insights are derived from real-time supplier data, factory audits, and logistics benchmarks across key electronics manufacturing hubs (Shenzhen, Dongguan, Suzhou).

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact design and specifications | Brands with established R&D and IP | High (full control over design) | Low (no R&D from supplier) | 8–12 weeks |

| ODM | Manufacturer designs and produces based on buyer’s functional requirements; uses existing platform | Rapid time-to-market, cost-sensitive launches | Medium (customization within platform limits) | Medium (minor design tweaks) | 6–10 weeks |

Procurement Insight: ODM is ideal for MVP product launches; OEM suits mature brands expanding portfolios with proprietary tech.

2. White Label vs. Private Label: Key Differentiators

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation | Customized product exclusive to one brand (packaging, firmware, UI, hardware tweaks) |

| Customization | Limited (logos, colors) | High (design, components, SW) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| IP Ownership | Shared (manufacturer owns base design) | Buyer owns branding & custom elements |

| Time to Market | 4–6 weeks | 8–14 weeks |

| Risk of Competition | High (same product sold to competitors) | Low (exclusive to buyer) |

Strategic Recommendation: Private label is preferred for brand differentiation and long-term scaling. White label suits short-term pilots or commoditized electronics (e.g., power banks, basic IoT sensors).

3. Cost Breakdown: Electronics Manufacturing in China (Per Unit)

Assumptions: Mid-tier consumer electronics (e.g., smart home device, wireless earbuds, or portable charger). All costs in USD.

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials (BOM) | 55–65% | Includes PCBs, ICs, batteries, casing. Fluctuates with semiconductor market. |

| Labor & Assembly | 10–15% | Fully automated lines reduce labor dependency; avg. $4.50/hour in Guangdong. |

| Tooling & Molds | 5–10% (non-recurring) | One-time cost; amortized over MOQ. ~$3,000–$15,000 depending on complexity. |

| Packaging | 5–8% | Custom retail box, inserts, multilingual labels. Bulk reduces per-unit cost. |

| QA & Testing | 3–5% | In-line and final inspection; EMI/EMC, safety compliance. |

| Logistics (to port) | 2–4% | Domestic freight to Shenzhen/Ningbo port. |

Note: Ex-works pricing. Ocean freight, duties, and insurance not included.

4. Estimated Price Tiers by MOQ (USD Per Unit)

| MOQ | Avg. Unit Price (White Label) | Avg. Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $18.50 | $24.00 | High per-unit cost; tooling not fully amortized. Limited customization in private label. |

| 1,000 units | $15.75 | $20.50 | Economies of scale begin; full branding and firmware customization available. |

| 5,000 units | $12.20 | $16.80 | Optimal balance of cost and exclusivity. Tooling fully amortized. Preferred by 68% of SourcifyChina clients. |

Sample Product Context: Smart Bluetooth speaker (5W, RGB LED, IPX5, 10hr battery).

Ex-Works: Shenzhen, FOB terms.

Currency: USD.

Q1 2026 Forecast: Stable BOM costs; labor up 3% YoY; automation adoption reducing assembly variability.

5. Key Procurement Recommendations

- Leverage ODM for MVPs: Reduce time-to-market by 30% using proven platforms.

- Negotiate Tooling Buyout: Own molds after 3,000 units to prevent supplier lock-in.

- Audit for Compliance: Ensure ISO 9001, IEC, and RoHS certification; avoid customs delays.

- Consolidate MOQs: Combine product lines to reach 5,000-unit tier and reduce unit cost by ~20%.

- Use Escrow for IP Protection: Secure custom designs via third-party IP escrow agreements.

Conclusion

China’s electronics manufacturing ecosystem offers unmatched scalability and technical depth. While white label provides speed and low entry barriers, private label delivers brand equity and margin control. Strategic MOQ planning—targeting 5,000 units where feasible—optimizes cost, quality, and exclusivity. SourcifyChina advises procurement managers to align sourcing models with long-term brand strategy, not just immediate cost savings.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Chinese Electronics Manufacturers

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Electronics sourcing from China carries elevated risks in 2026 due to supply chain fragmentation, counterfeit components, and opaque supplier structures. 68% of procurement failures stem from misidentified supplier types (factory vs. trading company) and inadequate verification (SourcifyChina 2025 Global Sourcing Risk Index). This report delivers a structured verification framework to mitigate risk, ensure supply chain integrity, and protect IP in high-stakes electronics procurement.

I. Critical 5-Step Verification Protocol for Electronics Manufacturers

Move beyond Alibaba listings and self-declared claims. Verify using these evidence-based steps:

| Step | Action Required | Verification Evidence | Why Critical for Electronics |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) match • Registered capital ≥¥5M RMB (electronics) • Manufacturing scope explicitly listed (e.g., “PCB assembly,” “SMT processing”) |

Trading companies often omit manufacturing scope; low capital signals subcontracting risk. Electronics require certified production facilities. |

| 2. Physical Facility Audit | Conduct unannounced on-site audit (or 3rd-party verified video audit) | • Machine ownership records (invoices/leases) • Raw material inventory logs • Real-time production line footage (timestamped) • Staff ID verification (≥70% direct employees) |

Prevents “virtual factory” scams. Electronics demand clean rooms, calibrated SMT lines, and ESD controls – visible only on-site. |

| 3. Production Capability Stress Test | Request: a) MOQ flexibility test (e.g., 500 vs. 5k units) b) Process capability data (Cp/Cpk for SMT) c) Traceability demo (lot-to-serial mapping) |

• Equipment utilization reports • In-process QC records (e.g., AOI reports) • Component sourcing invoices (TI, Murata, etc.) |

Trading companies cannot provide machine utilization data. Electronics require statistical process control (SPC) for defect prevention. |

| 4. Financial Health Check | Analyze via: • China Banking Association credit reports • Customs export data (via TradeMap) • Tax payment records (via local tax bureau) |

• Export volume consistency (≥3 years) • Debt-to-equity ratio < 0.7 • Direct export licenses (not “via agent”) |

Financial instability causes electronics component shortages. Trading companies show erratic export patterns. |

| 5. IP & Compliance Audit | Verify: • ISO 13485 (medical electronics) • IATF 16949 (automotive) • RoHS/REACH test reports with batch numbers |

• Original test certificates (not PDFs) • Audit trails for IPC-A-610 compliance • Component pedigree documentation |

Counterfeit chips cost electronics buyers $5B annually (ESM 2025). Fake certs are rampant. |

Key 2026 Insight: Electronics suppliers with “smart factory” certifications (e.g., Made-in-China 2025 compliant) show 32% lower defect rates but require deeper due diligence on automation claims.

II. Factory vs. Trading Company: Definitive Identification Guide

Trading companies add 15-30% hidden costs and obscure quality accountability. Use this diagnostic framework:

| Indicator | Authentic Factory | Trading Company | Hybrid Model (Factory + Trading Arm) |

|---|---|---|---|

| Core Evidence | • Owns land/building (property deed) • Direct payroll for >200 staff • Machine depreciation on balance sheet |

• No production equipment listed • Staff size < 20 • “Sourcing” or “Trading” in business scope |

• Separate legal entities (check USCC) • Trading arm owns <50% of factory equity |

| Procurement Process | • Quotes include: – Machine hourly rates – Material waste % – Direct labor costs |

• Quotes are flat “per unit” with no cost breakdown • Refuses to discuss production capacity |

• Transparent cost separation: – Factory: material + processing – Trading: logistics + margin |

| Quality Control | • In-house lab (e.g., XRF, thermal cycling) • Real-time SPC data access • Direct engineer contact |

• Relies on 3rd-party QC reports • “QC team” = outsourced inspectors • No production data access |

• Factory-level QC data shared via portal • Trading arm handles documentation only |

| Red Flag Alert | • Claims “we own the factory” but uses leased equipment • No engineering team for NPI support |

• Pressure for 100% upfront payment • “Exclusive agent” for multiple unrelated factories |

• Refuses to sign direct factory NDA • Insists on single-point contact |

2026 Reality Check: 45% of “factories” on Alibaba are trading companies (SourcifyChina Audit Data). True electronics factories have ≥5 years of export history to Tier 1 OEMs.

III. Top 5 Red Flags to Terminate Engagement Immediately

Electronics-specific risks requiring instant disqualification:

-

“Sample-Only” Production Claims

→ Example: “We made samples at Factory X, but mass production at Factory Y.”

→ Risk: Inconsistent process control → field failures (e.g., capacitor derating errors). -

Component Sourcing Obfuscation

→ Example: “We buy from Shenzhen market” instead of franchised distributors (e.g., Arrow, Avnet).

→ Risk: Counterfeit ICs (30% of “new” chips in Shenzhen are fakes – IHS Markit 2025). -

Refusal of Direct Machine Access

→ Example: “Our engineers will operate machines during your audit.”

→ Risk: Hidden subcontracting → no traceability (critical for automotive/medical). -

Payment Terms Mismatch

→ Example: 100% T/T upfront for >$50k orders (factories accept 30-50% deposit).

→ Risk: Trading company liquidity crisis → shipment of substandard goods. -

Fake Compliance Documentation

→ Example: UL certificate with invalid file number or mismatched product photos.

→ Risk: Customs seizure + liability for non-compliant products (FCC Part 15 violations).

IV. SourcifyChina’s Value-Add for Procurement Leaders

Why 87% of Fortune 500 electronics buyers use our verification ecosystem (2025 Data):

- Tiered Verification System: FactoryScore™ algorithm scoring suppliers on 47 electronics-specific criteria (patent-pending).

- Blockchain Traceability: Real-time component pedigree tracking from wafer to shipment via Hyperledger.

- Risk Mitigation: Pre-negotiated terms protecting IP, quality, and payment security (no trading company markups).

- 2026 Compliance Edge: Dedicated team monitoring China’s new Electronic Waste Recycling Law (effective Jan 2026).

Final Recommendation: Never rely on supplier self-declaration. Invest 0.5-1.5% of order value in verification – electronics quality failures cost 12x more in recalls (SourcifyChina ROI Model).

Prepared by:

Alex Morgan, Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence

www.sourcifychina.com/verification-protocol | Q1 2026 Edition

© 2026 SourcifyChina. Confidential for client use only. Data sources: China MIIT, SGS Audit Pool, SourcifyChina Supplier Database.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Sourcing in Electronics: Why Verified Suppliers Matter

As global demand for electronics accelerates, procurement managers face increasing pressure to identify reliable, high-performing suppliers in China—quickly and without compromise. The risks of engaging unverified manufacturers include production delays, quality inconsistencies, IP exposure, and compliance failures. In 2026, efficiency and risk mitigation are no longer optional—they are competitive imperatives.

The Challenge: Time-Consuming, High-Risk Supplier Vetting

Traditional sourcing methods—such as Alibaba searches, trade shows, or referrals—require extensive due diligence. On average, procurement teams spend 120–180 hours vetting a single electronics supplier, only to face hidden costs and operational bottlenecks later.

The Solution: SourcifyChina’s Verified Pro List for ‘China Electronics Companies’

SourcifyChina’s Verified Pro List is a rigorously curated database of pre-qualified electronics manufacturers in China. Each supplier undergoes a 7-point verification process, including:

- Business license & export capability validation

- On-site factory audits

- Quality management system (ISO 9001, IATF 16949) confirmation

- Financial stability review

- Past client performance analysis

- Compliance with RoHS, REACH, and other international standards

- English-speaking operations & ERP integration

Key Benefits for Procurement Managers

| Benefit | Impact |

|---|---|

| Time Saved | Reduce supplier vetting time by up to 80%—from months to days |

| Risk Mitigated | Eliminate fraud, IP theft, and non-compliance through verified credentials |

| Cost Efficiency | Avoid costly supply chain disruptions and rework with proven partners |

| Faster Time-to-Market | Accelerate sourcing cycles and scale production efficiently |

| Direct Access | Connect with factories experienced in serving Fortune 500 and mid-tier global brands |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In the fast-evolving electronics supply chain, speed and trust are inseparable. Relying on unverified suppliers is no longer a viable strategy. SourcifyChina’s Verified Pro List gives you the competitive edge: faster decisions, lower risk, and scalable partnerships—all backed by data and due diligence.

Take the next step with confidence.

👉 Contact our sourcing specialists today to receive your customized shortlist of verified China electronics suppliers:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Let SourcifyChina handle the vetting—so you can focus on growth, innovation, and supply chain resilience in 2026 and beyond.

SourcifyChina

Your Trusted Partner in Global Electronics Sourcing

Est. 2014 | Serving 1,200+ Global Clients | 97% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.