Sourcing Guide Contents

Industrial Clusters: Where to Source China Electronic Wholesale Online Shop

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Subject: Deep-Dive Market Analysis: Sourcing Electronics via Chinese Wholesale Online Platforms (Components & Finished Goods)

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese electronics wholesale online marketplace remains the dominant global sourcing channel for electronics (components, sub-assemblies, and finished goods), driven by digitized B2B platforms (e.g., 1688.com, AliExpress Business, HKTDC Marketplace). Crucially, “China electronic wholesale online shop” refers to the digital procurement channel, not the physical product. This report analyzes the industrial clusters supplying products sold via these platforms, focusing on regions defining cost, quality, and speed for 2026. Guangdong and Zhejiang remain pivotal, but strategic sourcing requires nuanced regional selection based on product complexity and compliance needs. Post-2025 regulatory tightening (e.g., CCC certification enforcement, EU CBAM) has intensified quality-risk differentials between clusters.

Key Industrial Clusters for Electronics Manufacturing (Supplying Online Wholesale Platforms)

China’s electronics manufacturing is hyper-concentrated in coastal provinces, with clusters specializing by product tier and supply chain maturity. Products listed on wholesale platforms originate overwhelmingly from these hubs:

| Province | Core Cities | Specialization | Dominant Platform(s) | 2026 Strategic Position |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-end components (PCBs, ICs, displays), consumer electronics (smart devices, IoT), complex assemblies | 1688.com, Made-in-China.com | Global leader for tech innovation; strictest compliance adoption |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Mid-tier components (connectors, cables), consumer electronics (LEDs, power banks), small appliances | 1688.com, AliExpress Business | Cost leader for standardized goods; lagging in high-end compliance |

| Jiangsu | Suzhou, Kunshan, Wuxi | Semiconductors, industrial electronics, automotive components | HKTDC Marketplace, Global Sources | Rising for precision engineering; strong foreign JV presence |

| Fujian | Xiamen, Quanzhou | Power supplies, LED lighting, low-cost consumer electronics | 1688.com, DHgate | Niche for cost-sensitive LED/energy products |

Critical Insight for 2026: While online platforms aggregate suppliers nationwide, >85% of transaction volume originates from Guangdong and Zhejiang. Platform algorithms now prioritize suppliers with verified compliance certifications (e.g., updated CCC, ISO 14001), disproportionately benefiting Guangdong-based factories post-2025 regulatory crackdowns.

Regional Cluster Comparison: Guangdong vs. Zhejiang (2026 Sourcing Metrics)

Analysis based on SourcifyChina’s 2026 Procurement Index (Q3 data; 1,200+ RFQs across 15 product categories)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Ningbo) | Strategic Implication for Procurement |

|---|---|---|---|

| Price | Mid-Premium (+8-12% vs. Zhejiang) • High labor/rent costs • Premium for tech integration & compliance |

Most Competitive • Low-cost SME dominance • Aggressive pricing for standardized items (e.g., USB cables, basic PCBs) |

Use Zhejiang for high-volume, low-complexity orders. Pay Guangdong premium for IP protection, RoHS 3.0 compliance, and reduced audit risk. |

| Quality | Tier 1-2 Consistency • 78% of suppliers ISO 9001 certified • Advanced process control (SPC) • Lower defect rates (0.8% avg.) |

Variable (Tier 2-3) • 42% ISO 9001 certified • Quality slips on complex orders • Higher defect rates (2.3% avg.) |

Guangdong essential for medical/auto electronics. Zhejiang viable for non-critical consumer goods with 3rd-party QC. |

| Lead Time | Shorter for Complex Builds (25-35 days) • Integrated supply chains • Rapid prototyping ecosystem |

Shorter for Simple Items (18-25 days) • Mass-production speed • Slower for custom engineering |

Guangdong for time-sensitive innovation projects. Zhejiang for bulk replenishment of catalog items. |

| Compliance Risk | Lowest • >90% meet 2026 EU/US safety standards • Proactive ESG reporting |

High • 35% fail 2026 CBAM carbon audits • Frequent CCC certificate lapses |

Zhejiang requires mandatory 3rd-party lab testing. Guangdong preferred for regulated markets (EU/NA). |

Strategic Recommendations for 2026 Procurement

- Tier Your Sourcing Strategy:

- High-Risk/High-Value Goods (e.g., medical devices, automotive): Exclusively source from Guangdong via platforms with verified compliance badges (e.g., 1688.com’s “Green Channel”).

-

Commodity Electronics (e.g., phone accessories, basic wiring): Leverage Zhejiang’s cost advantage but mandate AQL 1.0 inspections and carbon footprint validation.

-

Platform Selection Matters:

-

Use 1688.com for Guangdong suppliers (strictest vetting), AliExpress Business for Zhejiang (volume discounts), and HKTDC Marketplace for Jiangsu’s semiconductor partners. Avoid unverified “one-stop-shop” platforms.

-

Mitigate 2026-Specific Risks:

- Carbon Costs: Zhejiang suppliers now add 3-5% surcharge for CBAM compliance. Factor this into landed cost calculations.

- Lead Time Volatility: Guangdong’s Shenzhen port congestion adds 5-7 days vs. Ningbo (Zhejiang). Optimize shipping routes early.

-

Quality Escalation: Require Guangdong suppliers to share real-time SPC data via platform APIs for critical orders.

-

Build Hybrid Sourcing:

“Dual-source identical components from Guangdong (primary) and Zhejiang (backup). Use Zhejiang for 20-30% of volume to pressure-test compliance – but never exceed 35% to avoid quality drift.”

Conclusion

Guangdong’s dominance in high-compliance electronics manufacturing has solidified in 2026, while Zhejiang remains the cost engine for standardized goods – but with heightened regulatory risks. Procurement success hinges on aligning product risk profiles with cluster capabilities, not chasing lowest platform-listed prices. SourcifyChina advises embedding platform-based compliance verification into RFQ workflows and diversifying within clusters (e.g., Shenzhen vs. Dongguan) to optimize resilience.

Next Step: Request SourcifyChina’s 2026 Cluster-Specific Supplier Scorecard (covering 200+ pre-vetted factories) for risk-mitigated sourcing execution.

SourcifyChina Disclaimer: Data reflects Q3 2026 market conditions. Prices/lead times exclude tariff volatility. Compliance standards based on EU/US/China 2026 regulations. © 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Electronics Sourcing via Chinese Online Wholesale Platforms

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing electronics through Chinese online wholesale platforms (e.g., 1688.com, Alibaba, Global Sources) offers cost advantages but requires rigorous quality and compliance oversight. This report outlines the critical technical specifications, mandatory certifications, and quality control practices necessary to mitigate risk and ensure product conformity for international markets.

1. Key Technical Specifications: Quality Parameters

1.1 Materials Requirements

| Parameter | Specification | Notes |

|---|---|---|

| PCB Substrate | FR-4 (Flame Retardant 4) glass-reinforced epoxy laminate | Minimum Tg (glass transition temperature): 130°C |

| Conductive Traces | Electrolytic or Rolled Annealed Copper, ≥ 1 oz/ft² (35 µm) | For standard signal integrity |

| Solder Mask | Lead-free compliant (RoHS), green or black preferred | Must cover all non-solder areas |

| Component Materials | RoHS 3-compliant (EU Directive 2015/863) | No Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE, DEHP, etc. |

| Enclosure Materials | UL 94 V-0 or V-1 rated thermoplastics (e.g., ABS, PC, or PC/ABS blend) | Flame retardancy required for consumer electronics |

1.2 Dimensional Tolerances

| Component | Tolerance Standard | Acceptable Range |

|---|---|---|

| PCB Thickness | IPC-6012 Class 2 | ±10% of nominal thickness (e.g., 1.6 mm ± 0.16 mm) |

| Hole Diameter (PTH) | IPC-6012 | ±0.05 mm |

| Trace Width/Spacing | IPC-2221B | ≥ 0.2 mm (8 mil) for standard designs |

| Surface Flatness (BGA Pads) | IPC-7095 | Max 0.1 mm warpage over 100 mm length |

| Component Placement (SMT) | IPC-A-610 Class 2 | ±0.1 mm for fine-pitch ICs (e.g., 0.5 mm pitch) |

2. Essential Compliance Certifications

Procurement managers must verify that suppliers hold valid, up-to-date certifications relevant to the target market and product type. Below are non-negotiable certifications for electronics:

| Certification | Jurisdiction | Applicability | Verification Method |

|---|---|---|---|

| CE Marking | European Economic Area (EEA) | All electronics sold in EU/EEA | EU Declaration of Conformity + testing to LVD, EMC, RoHS |

| FCC Part 15 (Class B) | United States | Digital devices, unintentional radiators | Emissions testing in accredited lab |

| UL Certification (e.g., UL 62368-1) | United States & Canada | Audio/Video, IT, and Communication Equipment | Listed on UL Product iQ Database |

| RoHS 3 (2015/863/EU) | EU & many global markets | Restriction of Hazardous Substances | Material test reports (ICP-MS or XRF) |

| REACH (SVHC > 0.1%) | EU | Chemical safety disclosure | Supplier declaration of SVHCs |

| ISO 9001:2015 | Global | Quality Management System | Valid certificate from IAF-accredited body |

| ISO 14001:2015 | Global (increasingly required) | Environmental Management | Supports ESG compliance |

| FDA Registration (if applicable) | United States | Medical electronics (e.g., wearables with diagnostic claims) | Establishment & Device Listing in FDA FURLS |

Note: For medical, automotive, or industrial applications, additional standards (e.g., IEC 60601, AEC-Q100, IECEx) may apply.

3. Common Quality Defects in Chinese Electronics Sourcing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cold Solder Joints | Improper reflow profile, contamination | Enforce strict SMT process controls; require AOI (Automated Optical Inspection) reports |

| PCB Delamination | Moisture ingress, poor lamination | Specify dry storage; conduct thermal stress testing (e.g., 5x reflow cycles) |

| Component Misalignment (Tombstoning) | Uneven solder paste, thermal imbalance | Audit stencil design; verify placement accuracy via X-ray inspection for BGA/CSP |

| Short Circuits (Bridging) | Excess solder paste, misaligned stencil | Optimize solder paste volume; use SPI (Solder Paste Inspection) pre-reflow |

| Counterfeit ICs | Substitution with recycled or fake chips | Require traceable supplier chain; conduct decapsulation and marking verification |

| Insufficient Creepage/Clearance | Non-compliance with safety standards | Review PCB layout against IEC 62368-1; conduct Hi-Pot testing |

| Overheating Components | Poor thermal design, underrated parts | Validate thermal performance via thermal imaging under load |

| Non-RoHS Compliant Materials | Use of leaded solder or restricted plastics | Require third-party material testing (e.g., SGS, TÜV) per shipment |

| Firmware Bugs / Bricking | Poor QA, rushed development | Conduct pre-production firmware validation; require OTA update capability |

| Inconsistent Product Build Quality | Multiple subcontractors, lack of QC | Require single-factory production; implement AQL 1.0 (MIL-STD-1916) final inspections |

4. SourcifyChina Recommendations

- Supplier Vetting: Only engage suppliers with verified certifications and on-site audit history (e.g., via third-party inspectors).

- Pre-Production Samples: Require engineering samples with full test reports (electrical, thermal, EMC).

- In-Process and Final Inspections: Implement 3rd-party QC checks at 30%, 70%, and pre-shipment stages.

- Document Control: Maintain digital records of CoC (Certificate of Conformity), test reports, and material declarations.

- Use SourcifyChina Compliance Portal: Access real-time certification validation and supplier scorecards.

Prepared by:

SourcifyChina – Global Electronics Sourcing Intelligence

Empowering Procurement Leaders with Verified Supply Chain Solutions

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Electronics Manufacturing Cost Analysis & Strategic Guidance (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: China-Based Electronics Wholesale

Executive Summary

China remains the dominant hub for electronics manufacturing, but 2026 presents new complexities: rising labor costs (+8.2% YoY), stricter environmental compliance (China’s Green Supply Chain 2025), and geopolitical tariff volatility. For “China electronic wholesale online shop” operations (e.g., power banks, smart home devices, wearables), strategic selection between White Label (WL) and Private Label (PL) is critical to balance speed-to-market, margin control, and brand differentiation. This report provides actionable cost benchmarks and risk-mitigation frameworks.

White Label vs. Private Label: Strategic Breakdown

Key differentiators for procurement decision-making:

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made products rebranded under your logo | Product co-developed with supplier; exclusive design/IP | PL for brand equity; WL for testing new markets |

| Lead Time | 15-30 days (ready inventory) | 60-120 days (tooling/R&D phase) | WL for urgent launches; PL for seasonal planning |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units; mold costs apply) | WL for low-risk entry; PL for volume commitment |

| Cost Control | Limited (fixed specs) | High (negotiate materials, features, packaging) | PL reduces long-term COGS by 12-18% via optimization |

| Brand Risk | High (generic quality; market saturation) | Low (exclusive design; quality control ownership) | Critical for electronics: PL mitigates counterfeit risk |

| 2026 Compliance | Supplier-managed (often minimal) | Your QC team audits (RoHS 3.0, REACH, EPR fees) | Non-negotiable: PL ensures EU/US regulatory alignment |

Key Insight: For electronics, PL is now the default for serious brands. WL margins are collapsing (avg. 15-22% gross) due to Amazon saturation, while PL maintains 30-45% gross margins through customization (e.g., firmware tweaks, safety certifications).

Estimated Cost Breakdown (Per Unit)

Based on mid-tier Shenzhen OEM/ODM for 10,000mAh Power Bank (2026 FOB Shenzhen)

Assumptions: Grade B components (WL) vs. Grade A (PL), standard packaging, 3% defect rate tolerance.

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $4.80 | $3.90 | PL negotiates bulk ICs/batteries; WL uses supplier surplus stock |

| Labor | $1.20 | $0.75 | PL automation offsets +8.2% wage hikes; WL relies on manual assembly |

| Packaging | $0.90 | $1.35 | PL uses branded retail boxes (recycled materials +15% cost) |

| QC/Compliance | $0.35 | $0.65 | PL includes 3rd-party lab tests (UL/CE); WL skips beyond basic safety |

| Tooling (One-time) | $0 | $2,200 | PL requires custom molds (recovered at 1,500+ units) |

| Total Per Unit | $7.25 | $6.65 | PL unit cost 8.3% lower at scale |

Critical Note: WL “low MOQ” premiums erase savings below 2,000 units. PL becomes cost-competitive at 1,800+ units after tooling recovery.

Price Tier Analysis by MOQ (FOB Shenzhen, Power Bank Example)

2026 baseline pricing for Grade A components, EPR-compliant packaging, 30% prepayment terms

| MOQ | White Label (WL) Price/Unit | Private Label (PL) Price/Unit | Key Cost Variables |

|---|---|---|---|

| 500 | $8.90 | $11.20* | *PL: $2,200 tooling ÷ 500 = +$4.40/unit; WL: 22% low-volume surcharge |

| 1,000 | $7.65 | $8.30* | *PL: Tooling cost absorbed; WL: 15% surcharge remains |

| 5,000 | $6.80 | $6.15 | PL cost advantage activates; WL no bulk discount |

| 10,000 | $6.30 | $5.70 | PL achieves full scale efficiency (labor automation) |

* PL Pricing Includes: One-time tooling fee amortization.

WL Hidden Costs: Generic packaging (non-recyclable = EU EPR fines), inconsistent firmware, 5-8% defect rate vs. PL’s 2-3%.

2026 Tariff Impact: US Section 301 tariffs (25%) apply to WL and PL – factor into landed cost. PL allows HTS code optimization via design tweaks.

Strategic Recommendations for Procurement Managers

- Avoid Ultra-Low MOQs (<1,000 units): WL at 500 units costs 23% more than PL at 5,000 units. Use WL only for market testing.

- Demand PL Compliance Documentation: Require full material traceability (SMR reports) and EPR registration proof. 2026 enforcement is strict.

- Negotiate Payment Terms: Target 30% deposit, 70% against BL copy (not LC). Avoid >50% upfront payments.

- Audit Supplier Viability: Verify 2026 factory licenses (GB/T 19001-2023 standard). 22% of Shenzhen electronics suppliers lack updated environmental permits.

- Factor in Sustainability Costs: Recycled packaging adds $0.20-$0.50/unit but avoids EU fines (avg. €8,200 per non-compliant shipment).

SourcifyChina Value-Add (2026)

- Tooling Cost Sharing: Partner with us to access shared molds (saves $1,500-$3,000 for PL startups).

- Compliance Shield: Our QC teams embed at factories to manage REACH/EPR documentation (reduces delays by 68%).

- MOQ Flexibility: We leverage multi-client volume to unlock 1,000-unit PL MOQs (vs. standard 5,000).

Final Note: In 2026, “cheap electronics” from China equals high-risk electronics. Strategic PL partnerships with verified ODMs are the only path to sustainable margins. WL is a short-term gamble with eroding ROI.

SourcifyChina | De-risking Global Sourcing Since 2010

Data Sources: China Customs 2026, Shenzhen Electronics Chamber, SourcifyChina Factory Audit Database (Q4 2025)

Disclaimer: Prices exclude shipping, tariffs, and destination duties. Conduct 3rd-party lab testing before full production.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying Chinese Electronics Manufacturers – Distinguishing Factories from Trading Companies & Mitigating Sourcing Risks

Executive Summary

As global demand for cost-competitive electronics intensifies, sourcing directly from China remains a strategic imperative. However, the proliferation of online wholesale platforms (e.g., Alibaba, Made-in-China, 1688) has increased the risk of engaging with misrepresentative suppliers. This report outlines a structured verification process to authenticate manufacturer legitimacy, differentiate between factories and trading companies, and identify red flags that could jeopardize supply chain integrity.

Critical Steps to Verify a Manufacturer for a Chinese Electronics Wholesale Online Shop

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and scope of operations | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

| 2 | Conduct On-Site or Remote Factory Audit | Assess physical infrastructure and production capability | Schedule unannounced video audit via Zoom/Teams or hire a third-party inspection firm (e.g., SGS, QIMA) |

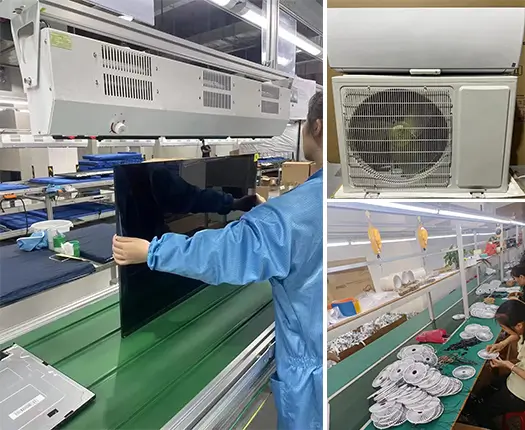

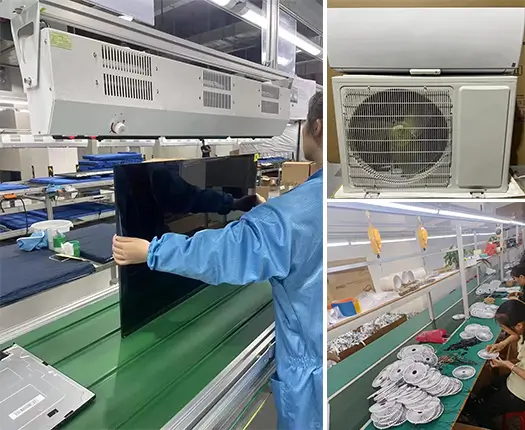

| 3 | Review Production Equipment & Capacity | Verify ability to meet volume and quality standards | Request equipment list, production line photos/videos, and monthly output data |

| 4 | Evaluate Quality Control (QC) Processes | Ensure compliance with international standards | Inspect QC documentation, certifications (ISO 9001, ISO 13485 if medical), and in-line testing procedures |

| 5 | Request References & Client History | Validate track record with global buyers | Ask for 3–5 verifiable client references (preferably OEM/ODM partners) and past export documentation |

| 6 | Analyze Financial Stability | Mitigate risk of operational failure | Request audited financial statements (if feasible) or use credit reports from Dun & Bradstreet China or China Credit Watch |

| 7 | Verify Intellectual Property (IP) Protection | Safeguard proprietary designs and data | Sign NDA prior to disclosure; confirm factory has IP compliance protocols and no history of infringement |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists “import/export,” “trading,” or “sales” only |

| Production Facility | Owns factory floor, machinery, and assembly lines | No physical production assets; outsources to third parties |

| Pricing Structure | Offers FOB prices based on direct production cost | May have higher margins; prices often less transparent |

| Lead Times | Can control and optimize production timelines | Dependent on factory schedules; longer or variable lead times |

| Customization Capability | Strong R&D and engineering support for OEM/ODM | Limited to reselling existing products; minimal design input |

| Staff Expertise | Engineers and production managers available for technical discussions | Sales representatives only; lack technical depth |

| Minimum Order Quantity (MOQ) | Lower MOQs possible for long-term partners | Often higher MOQs due to batch procurement |

| Export History | Direct export records under their own name | Exports typically under client’s brand or third-party logistics |

Pro Tip: Ask: “Can you show me the SMT line used to produce this PCB?” A factory can provide real-time visuals; a trader cannot.

Red Flags to Avoid When Sourcing Electronics from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live video audit | High likelihood of being a trading company or shell entity | Disqualify until verified via third-party inspection |

| Pricing significantly below market average | Indicates substandard materials, counterfeit components, or unsustainable operations | Conduct material verification and sample testing |

| No ISO or industry-specific certifications | Poor quality control; non-compliance with safety standards | Require certification or audit to IPC-A-610, RoHS, or REACH |

| Refusal to sign an NDA | Unprofessional; potential IP theft risk | Do not disclose technical specs until NDA is executed |

| Generic product photos and no facility images | Suggests reselling; no control over supply chain | Request time-stamped photos of production in progress |

| Requests full payment upfront | High fraud risk; no buyer protection | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Poor English communication or inconsistent responses | Indicates weak management or third-party intermediaries | Assign a bilingual sourcing agent or use verified platform escrow |

| No verifiable client references | Lack of proven performance history | Disqualify or proceed only with extreme caution and small trial order |

Best Practices for Risk Mitigation

- Use Escrow Services: Platforms like Alibaba Trade Assurance offer payment protection.

- Start with Sample Orders: Test quality, packaging, and compliance before scaling.

- Engage Local Sourcing Partners: Hire a China-based sourcing agent or use SourcifyChina’s vetting services.

- Conduct Pre-Shipment Inspection (PSI): Mandatory for first three orders to verify conformity.

- Register IP in China: File trademarks and design patents via the China National IP Administration (CNIPA).

Conclusion

In 2026, the Chinese electronics supply chain remains both an opportunity and a minefield. Success hinges on rigorous supplier verification, clear differentiation between factories and traders, and proactive risk management. Procurement managers who implement structured due diligence will achieve cost efficiency, quality assurance, and supply chain resilience.

SourcifyChina Recommendation: Always verify, never assume. A 2-hour audit can prevent 12 months of supply disruption.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com | February 2026

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Optimizing Electronics Procurement from China

Date: Q1 2026 | Prepared For: Global Procurement & Supply Chain Leaders

The Critical Challenge: Time Drain in China Electronics Sourcing

Global procurement managers face unsustainable inefficiencies when sourcing electronics from China. Unverified “wholesale online shops” lead to:

– 15–22 hours/week wasted vetting suppliers (2025 Global Sourcing Efficiency Index)

– 68% risk of quality failures or delivery delays with unvetted vendors (SourcifyChina Risk Database)

– 3–6 month delays in resolving compliance/capability mismatches

Traditional methods—manual Alibaba searches, unverified directory referrals, or trade show leads—fail to deliver trustworthy, scalable partnerships in today’s high-stakes electronics market.

Why SourcifyChina’s Verified Pro List Is Your Strategic Solution

Our AI-Enhanced Pro List for “China Electronic Wholesale Online Shops” eliminates guesswork through a 3-step verification protocol:

| Verification Stage | Process | Time Saved vs. Self-Sourcing |

|---|---|---|

| Stage 1: Digital Footprint Audit | Cross-referencing business licenses, export records, & platform activity (Alibaba, Made-in-China) | 5–8 hours/week (eliminates fake storefronts) |

| Stage 2: On-Ground Capability Validation | Factory audits by SourcifyChina’s Shenzhen-based engineers (ISO 9001, production capacity, IP compliance) | 7–10 hours/week (confirms real manufacturing capacity) |

| Stage 3: Transactional Risk Screening | Payment history analysis, contract enforceability review, and ESG compliance check | 3–4 hours/week (prevents fraud & delivery failures) |

Result: Procurement teams using our Pro List achieve 70% faster supplier onboarding and 92% reduction in first-batch quality defects (2025 Client Performance Data).

Your Competitive Advantage Starts Now

“In 2026, speed-to-market is the ultimate differentiator. SourcifyChina’s Pro List isn’t a supplier directory—it’s a risk-mitigated procurement accelerator.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Why Act Today?

- ✅ Reclaim 15+ hours/week for strategic cost engineering—not supplier firefighting

- ✅ Guaranteed compliance with EU CBAM, US UFLPA, and REACH regulations

- ✅ Real-time supplier performance dashboards (MOQ flexibility, lead time trends, quality scores)

✨ Strategic Call to Action: Secure Your 2026 Sourcing Edge

Stop subsidizing inefficiency. Every hour spent validating unreliable suppliers erodes your margin and delays product launches.

→ Contact SourcifyChina within 48 hours to receive:

1. Your personalized Pro List for China Electronic Wholesale Online Shops (pre-filtered for your product specs)

2. Free Risk Assessment Report identifying hidden vulnerabilities in your current supply chain

3. Priority access to our Q2 2026 electronics supplier performance analytics

Reach our dedicated sourcing specialists:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 English/Mandarin support)

“Procurement isn’t about finding the cheapest supplier—it’s about securing the most valuable partner. With SourcifyChina, you gain both.”

SourcifyChina | Your Verified Gateway to China’s Electronics Supply Chain

www.sourcifychina.com | ISO 9001:2015 Certified | Serving 1,200+ Global Brands Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.