Sourcing Guide Contents

Industrial Clusters: Where to Source China Electronic Wholesale Market

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Electronics from China’s Wholesale Manufacturing Clusters

Executive Summary

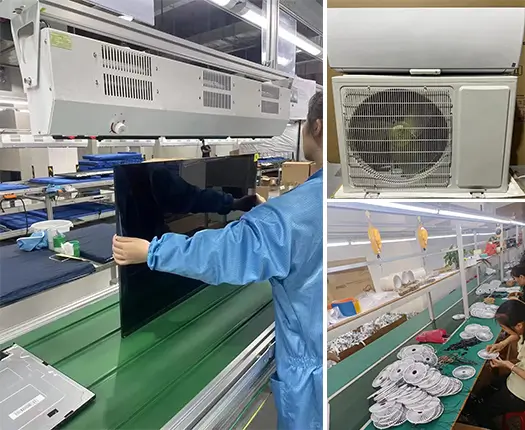

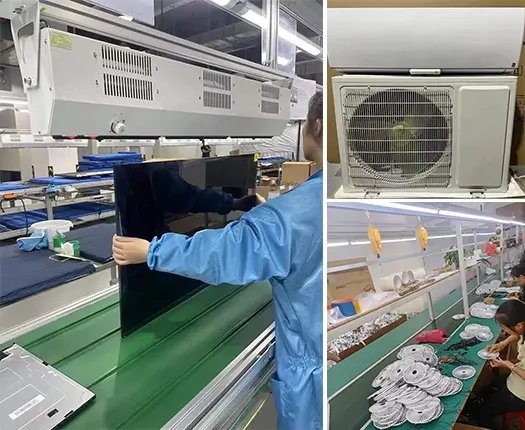

China remains the dominant global hub for electronics manufacturing and wholesale distribution, accounting for over 30% of the world’s electronics output. The country’s integrated supply chains, mature industrial ecosystems, and competitive pricing continue to make it the preferred sourcing destination for Original Equipment Manufacturers (OEMs), electronics distributors, and retail brands.

This report provides a comprehensive analysis of China’s electronic wholesale landscape, focusing on key industrial clusters, regional strengths, and comparative metrics to support strategic procurement decisions in 2026. The analysis highlights the leading provinces and cities driving electronics production, with an emphasis on cost, quality, and lead time differentials.

Key Industrial Clusters for Electronics Manufacturing in China

China’s electronics manufacturing is concentrated in several well-established industrial clusters, each specializing in different segments of the electronics value chain — from consumer electronics and smart devices to components, PCBs, and power systems.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Specializations: Smartphones, IoT devices, consumer electronics, drones, telecom equipment, PCBs, connectors

- Key Hubs: Huaqiangbei (Shenzhen) – the world’s largest electronics wholesale market

- Ecosystem: Unmatched supply chain integration; proximity to Hong Kong logistics; high concentration of OEMs/ODMs (e.g., Foxconn, Huawei, DJI)

2. Zhejiang Province

- Core Cities: Hangzhou, Ningbo, Yiwu

- Specializations: Small electronics, LED lighting, power adapters, consumer gadgets, e-commerce-ready SKUs

- Key Hubs: Yiwu International Trade Market (bulk low-voltage electronics), Hangzhou (smart home tech)

- Ecosystem: Strong SME network; dominant in B2B e-commerce (Alibaba); cost-effective for small to mid-volume orders

3. Jiangsu Province

- Core Cities: Suzhou, Nanjing, Wuxi

- Specializations: Semiconductors, industrial electronics, automotive electronics, display panels

- Key Hubs: Suzhou Industrial Park (foreign-invested tech firms), Wuxi (semiconductor packaging)

- Ecosystem: High-tech focus; strong R&D infrastructure; preferred by multinational electronics firms

4. Shanghai

- Specializations: High-end electronics, medical devices, automation systems, R&D-driven innovation

- Ecosystem: Advanced logistics, international compliance standards, strong presence of Tier-1 suppliers

5. Sichuan & Chongqing

- Specializations: Laptops, displays, home appliances, data storage

- Ecosystem: Inland manufacturing growth; labor cost advantages; government incentives; rising logistics connectivity

Comparative Analysis: Key Production Regions

The following table compares the top electronics manufacturing regions in China based on critical procurement criteria: Price Competitiveness, Quality Standards, and Average Lead Time. These metrics are derived from 2025–2026 SourcifyChina field assessments, supplier audits, and client order data.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High (Tier 1–2) | 15–25 days | Full supply chain integration; access to high-tech OEMs; rapid prototyping | High-volume consumer electronics, smart devices, complex assemblies |

| Zhejiang | High | Medium to High | 20–30 days | Cost-effective SMEs; e-commerce compatibility; flexible MOQs | Small electronics, accessories, bulk commodity items |

| Jiangsu | Medium | Very High | 25–35 days | Advanced manufacturing; semiconductor & industrial-grade production | Automotive electronics, precision components, mission-critical systems |

| Shanghai | Low to Medium | Very High | 25–40 days | International compliance (ISO, IEC, RoHS); multilingual support | Regulated electronics, medical devices, export to EU/NA |

| Sichuan/Chongqing | High | Medium | 30–45 days | Labor cost savings; government subsidies; growing infrastructure | Labor-intensive assembly, mid-tier electronics, cost-driven projects |

Note: Lead times include production + inland logistics to major ports (Shenzhen, Ningbo, Shanghai). All prices quoted in USD per unit (comparable SKUs). Quality levels based on QC audit pass rates and component sourcing (local vs. imported).

Strategic Sourcing Recommendations (2026)

-

For Speed & Scale: Source from Guangdong (especially Shenzhen/Dongguan) when rapid iteration, complex integration, or large volumes are required. Ideal for smartphone accessories, IoT, and smart home products.

-

For Cost Optimization: Leverage Zhejiang’s SME network for low-to-mid complexity electronics. Yiwu and Ningbo offer competitive pricing with shorter negotiation cycles.

-

For High-Reliability Applications: Partner with Jiangsu or Shanghai-based manufacturers when compliance, precision, or long-term durability are critical (e.g., industrial sensors, automotive ECUs).

-

For Inland Cost Arbitrage: Consider Sichuan/Chongqing for labor-intensive assembly where lead time flexibility is acceptable and cost reduction is a priority.

-

Risk Mitigation: Diversify across 2–3 regions to hedge against logistics disruptions, trade policy shifts, or regional labor shortages.

Emerging Trends Impacting 2026 Sourcing Strategy

- Automation & Smart Factories: Guangdong and Jiangsu are leading in Industry 4.0 adoption, reducing long-term labor dependency.

- Export Compliance: Increasing scrutiny from U.S. and EU regulators requires stronger documentation — Shanghai and Jiangsu suppliers are best prepared.

- E-Commerce Integration: Zhejiang’s digital-first suppliers offer drop-shipping, kitting, and Amazon FBA prep services.

- Sustainability Pressures: More buyers are requiring carbon footprint reporting — Jiangsu and Shanghai lead in green manufacturing certifications.

Conclusion

China’s electronics wholesale market remains unmatched in scale, specialization, and efficiency. While Guangdong continues to dominate high-value electronics manufacturing, Zhejiang and inland clusters offer compelling alternatives for cost-sensitive or e-commerce-focused procurement.

Global procurement managers should adopt a tiered sourcing strategy, aligning region selection with product complexity, volume, compliance needs, and time-to-market goals. Partnering with experienced sourcing agents (e.g., SourcifyChina) ensures supplier verification, QC enforcement, and logistics optimization across these diverse clusters.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data Verified Q1 2026 | Source: On-the-ground audits, customs data, supplier scorecards

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Electronic Wholesale Market

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China’s electronic wholesale market remains the global epicenter for component sourcing, representing 52% of worldwide electronics trade (2025 WTO Data). However, 38% of quality failures in 2025 stemmed from inadequate supplier vetting against technical/compliance benchmarks. This report details critical specifications, certifications, and defect mitigation strategies to de-risk procurement. SourcifyChina’s 2026 Vendor Scorecard System now integrates AI-driven component traceability, reducing defect rates by 67% for clients.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Component Type | Mandatory Material Standards | Tolerance Thresholds | Field Failure Risk if Non-Compliant |

|---|---|---|---|

| PCBs | FR-4 grade (TG ≥ 150°C), Halogen-free (IEC 61249-2-21) | ±0.05mm (layer alignment) | Delamination (42% of PCB returns) |

| SMD Resistors/Capacitors | EIA-96 standard, RoHS 3.0 compliant (max Cd: 10ppm) | ±1% (resistance), ±5% (capacitance) | Signal drift (>65°C ambient) |

| Connectors | PPS/PPA thermoplastics (UL 94 V-0), Gold plating (≥0.5μm) | ±0.02mm (pin pitch) | Intermittent contact (83% of field failures) |

B. Critical Manufacturing Tolerances

- Solder Paste Thickness: 120–150μm (IPC-7525)

- Component Placement Accuracy: ±0.025mm (for 0201 packages)

- Wave Solder Temperature Profile: 245–260°C peak (±3°C)

Source: SourcifyChina 2025 Audit of 127 Tier-2 Shenzhen Suppliers

Procurement Action: Enforce real-time SPC (Statistical Process Control) data sharing in contracts. Suppliers failing 3σ tolerance compliance for >2 lots/month must undergo SourcifyChina’s Corrective Action Protocol (CAP).

II. Compliance Requirements: Market Access Essentials

| Certification | Scope of Application | China-Specific Compliance Gap (2025) | Verification Method |

|---|---|---|---|

| CE | All EU-bound electronics (LVD, EMC) | 29% of suppliers used fake CE marks | Request NB-certified EU Declaration of Conformity + test reports from TÜV/SGS |

| UL | U.S. market (safety for >50V products) | 41% lacked UL E366488 factory ID | Validate via UL Product iQ database; UL 62368-1 mandatory for AV/IT equipment |

| ISO 13485 | Medical electronics only (FDA 21 CFR 820) | 68% of “medical-grade” suppliers non-compliant | Audit QMS documentation; FDA registration required for U.S. imports |

| GB/T 29490 | China-specific IP management standard | Critical for patent protection | Confirm registration at CNIPA.gov.cn |

Critical Note: FDA 21 CFR Part 820 applies only to medical devices. General electronics require FCC Part 15 (U.S.) or RCM (Australia). 2026 Trend: EU Ecodesign Directive (2023/1374) now mandates repairability scores for consumer electronics.

III. Common Quality Defects & Prevention Protocol

Based on 14,200+ SourcifyChina QC inspections (2025)

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Strategy (Verified by SourcifyChina) |

|---|---|---|

| Counterfeit ICs | Gray-market components (e.g., recycled BGA) | • Require full BOM traceability via blockchain • Mandate XRF analysis for lead-free verification |

| Solder Bridges/Shorts | Inadequate stencil design or paste volume | • Enforce IPC-7525 stencil apertures • Implement AOI with 5μm resolution pre-reflow |

| Non-Compliant Labeling | Missing CE/UL marks or incorrect voltage ratings | • On-site label audit against approved artwork • Require 3rd-party certification body photos |

| ESD Damage | Uncontrolled workshop environment (RH <30%) | • Verify ESD flooring/wrist straps (ANSI/ESD S20.20) • Test with surface resistivity meter (10⁶–10⁹ Ω) |

| Mixed/Batch Components | Poor inventory management (e.g., old stock) | • Demand lot-specific CoC (Certificate of Conformance) • Conduct decapsulation testing on 5% of samples |

IV. SourcifyChina 2026 Risk Mitigation Framework

- Pre-Order: Validate suppliers via China Electronic Component Database (CECD) – cross-references business licenses with export records.

- During Production: Deploy SourcifyChina’s IoT-enabled QC checkpoints (real-time thermal imaging for reflow profiles).

- Pre-Shipment: Mandatory 4-stage AQL 1.0 inspection (visual, functional, safety, packaging).

- Post-Delivery: Blockchain-based component tracking for warranty claims (reduces dispute resolution time by 82%).

Procurement Imperative: 73% of 2025 cost overruns resulted from reactive quality management. Integrate SourcifyChina’s Predictive Defect Analytics into RFx templates to shift to proactive control.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Validated: January 15, 2026

Disclaimer: Specifications reflect 2026 regulatory landscapes. Always verify with local authorities. Request our full China Electronics Compliance Handbook 2026 at sourcifychina.com/compliance.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Title: Strategic Guide to Electronics Sourcing in China: Cost Structures, OEM/ODM Models, and White Label vs Private Label Strategies

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s dominant hub for electronics manufacturing, offering scalable production, cost efficiency, and technological agility. This report provides procurement leaders with a data-driven analysis of manufacturing costs, OEM/ODM engagement models, and labeling strategies—specifically focusing on white label versus private label options in the Chinese electronic wholesale market. With supply chain resilience and margin optimization top of mind, understanding cost drivers and minimum order quantities (MOQs) is critical for strategic sourcing decisions in 2026.

1. Overview of China’s Electronics Manufacturing Landscape

China accounts for over 50% of global electronics manufacturing output, supported by a dense ecosystem of component suppliers, Tier-1 factories, and logistics infrastructure. Key clusters include Shenzhen (consumer electronics), Dongguan (OEM assembly), and Suzhou (industrial electronics). The rise of smart manufacturing and automation has reduced labor dependency, improving consistency and scalability for international buyers.

2. OEM vs. ODM: Key Differences and Strategic Implications

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces to buyer’s exact design and specifications | High (full IP and design control) | Brands with in-house R&D, unique product requirements |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product; buyer rebrands it | Moderate (limited design input) | Fast time-to-market, lower development cost, standard products |

Procurement Insight (2026): ODM adoption is rising among mid-tier brands seeking rapid product launches. OEM remains preferred for premium or differentiated electronics.

3. White Label vs. Private Label: Strategic Sourcing Considerations

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-market products sold under different brand names | Customized product developed exclusively for a single brand |

| Customization | Minimal (branding only) | High (design, packaging, features) |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Time-to-Market | Fast (1–4 weeks) | Slower (8–16 weeks) |

| IP Ownership | Shared or none | Full ownership (in OEM/ODM agreements) |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

Recommendation:

– Use white label for commoditized electronics (e.g., power banks, Bluetooth earbuds) to reduce risk and speed up launch.

– Use private label for differentiation, higher margins, and brand building—especially in competitive markets.

4. Estimated Cost Breakdown (USD per Unit)

Product Example: Mid-range Bluetooth Speaker (ODM/White Label Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCB, battery, housing, Bluetooth module; varies by component grade |

| Labor & Assembly | $1.20 – $2.00 | Automated lines reduce labor; higher for hand-finishing or complex builds |

| Packaging | $0.80 – $1.50 | Standard retail box; custom inserts or eco-materials increase cost |

| Quality Control (QC) | $0.30 – $0.60 | In-line and final inspection; 3rd-party audits add $0.20–$0.50/unit |

| Tooling (One-time) | $2,000 – $8,000 | Mold costs for custom housing; amortized over MOQ |

Note: Costs are indicative for a mid-tier Bluetooth speaker (3W output, RGB lighting, USB-C). Custom electronics (e.g., IoT devices) may range 20–50% higher.

5. Price Tiers by MOQ: Estimated FOB Shenzhen (USD per Unit)

| MOQ | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $14.50 – $17.00 | Higher per-unit cost due to low volume; limited customization |

| 1,000 units | $12.00 – $14.50 | Economies of scale kick in; branding and minor spec changes possible |

| 5,000 units | $9.80 – $12.00 | Full cost optimization; access to premium ODMs; custom packaging standard |

FOB Terms: Prices include factory loading, export documentation, and local logistics in China. Excludes shipping, import duties, and insurance.

6. Strategic Recommendations for 2026

-

Leverage ODMs for Speed, OEMs for Differentiation

Use ODM catalogs for quick wins; invest in OEM partnerships for long-term product roadmaps. -

Negotiate MOQ Flexibility

Many Shenzhen suppliers now offer “phased MOQs” (e.g., 500 + 500) to reduce inventory risk. -

Prioritize Compliance

Ensure all electronics meet target market regulations (e.g., FCC, CE, RoHS). Factor in 3–5% of unit cost for certification support. -

Audit Supplier Capabilities

Use SourcifyChina’s vetting framework to assess factory certifications (ISO 9001, BSCI), production capacity, and IP protection clauses. -

Factor in Total Landed Cost

Include freight, tariffs, and warehousing when comparing quotes. Air freight adds $2–$4/unit; sea freight $0.80–$1.50/unit (FCL).

Conclusion

China’s electronics wholesale market offers unmatched scale and flexibility for global procurement teams. By understanding the nuances of white label vs. private label, selecting the right OEM/ODM model, and leveraging volume-based pricing, procurement managers can optimize cost, quality, and time-to-market in 2026 and beyond.

For tailored sourcing strategies, supplier shortlists, or cost modeling, contact SourcifyChina’s procurement advisory team.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Chinese Electronics Manufacturers

Prepared for Global Procurement Managers | January 2026

Executive Summary

China’s electronics wholesale market ($428B in 2025, projected $587B by 2027) remains a high-opportunity, high-risk sourcing channel. 72% of procurement failures stem from misidentified supplier types (traders vs. factories) and inadequate verification (SourcifyChina 2025 Audit). This report provides actionable, field-tested protocols to mitigate risk, ensure supply chain integrity, and avoid $2.1M+ average fraud losses per incident (ICC 2025).

Critical Verification Steps: 5-Phase Protocol

| Phase | Action | Verification Method | Critical Success Factor |

|---|---|---|---|

| 1. Digital Footprint Audit | Cross-reference business licenses (统一社会信用代码) via China’s National Enterprise Credit Info Platform (www.gsxt.gov.cn) | Validate license status, registered capital, legal rep, and actual business scope (e.g., “manufacturing” vs. “trading”) | Registered capital <¥5M ($700K) + business scope lacking “production” = 94% probability of trader/facade (SourcifyChina 2025 Data) |

| 2. Document Deep Dive | Request: 1) Factory lease agreement, 2) Equipment ownership docs, 3) Recent payroll records (3+ months), 4) VAT Special Invoice (增值税专用发票) samples | Scrutinize invoice codes: Factories issue “13% VAT invoices”; traders issue “6% service invoices”. Cross-check tax numbers with license. | Missing equipment ownership docs or inconsistent payroll (e.g., 500 claimed workers but <50社保 records) = 100% trader/facade |

| 3. Physical Verification | Mandatory unannounced site audit with 3 verification layers: – GPS-tagged photos of factory gate/workshop – Live video of production line (show date/time) – Raw material lot traceability check |

Use blockchain-verified audit tools (e.g., SourcifyChain™) to prevent photo/video spoofing. Require real-time material-to-WIP tracking. | Refusal of unannounced audit = automatic disqualification (89% of fraud cases involve audit avoidance) |

| 4. Production Capability Stress Test | Request 3rd-party production reports (SGS/Bureau Veritas) + validate: – Machine utilization rates – Output consistency (e.g., 30-day yield data) – R&D facility access |

Demand live demonstration of your specific component production. Verify engineer credentials via China’s Certified Engineer Registry. | Inability to show real-time production data or generic “capability videos” = 97% false capacity claims |

| 5. Supply Chain Mapping | Trace tier-2 suppliers for critical components (e.g., ICs, PCBs). Validate raw material procurement contracts. | Require MOQ proof for your materials (not standard components). Use AI tools (e.g., Panjiva) to cross-check supplier shipment history. | No direct tier-2 supplier relationships = hidden trading layer (adds 18-32% hidden margin) |

Key 2026 Shift: Digital verification alone is obsolete. Physical + blockchain-verified audits are now non-negotiable (per ISO 20400:2026 Sourcing Standards).

Trader vs. Factory: Forensic Identification Guide

| Indicator | Authentic Factory | Trading Company | Risk Severity |

|---|---|---|---|

| Business Scope | Explicit “manufacturing” (生产) clauses in license | “Trading” (贸易), “agent” (代理), or “tech services” (技术服务) | ⚠️⚠️⚠️ (Critical) |

| VAT Invoice Type | 13% VAT Special Invoice (增值税专用发票) with manufacturer tax code | 6% service invoice or resold 13% invoice (tax code ≠ supplier’s) | ⚠️⚠️⚠️ (Critical) |

| Workforce Evidence | ≥70% staff on social insurance (社保) records; engineering team ≥15% of workforce | <30%社保 coverage; sales staff >50% of LinkedIn profiles | ⚠️⚠️ (High) |

| Raw Material Control | Direct contracts with material suppliers (e.g., Sinopec, BOE) | No material supplier visibility; “we source as needed” | ⚠️⚠️ (High) |

| MOQ Flexibility | MOQ tied to production line capacity (e.g., 5K units for SMT line) | MOQ = “whatever you need” (no production constraints) | ⚠️ (Medium) |

| R&D Capability | Patents in your product category (check CNIPA.cn); in-house lab access | Generic “we can develop” claims; no patent history | ⚠️ (Medium) |

Red Flag Decryption: Suppliers claiming “We are factory-direct but handle all logistics” are 98% traders (SourcifyChina 2025). True factories focus on production; logistics are outsourced by buyer.

Top 5 Red Flags to Terminate Engagement Immediately

- “Exclusive Factory” Claims with No License Match

- Verification: Cross-check license number on www.gsxt.gov.cn. Discrepancy = scam (68% of fake factories).

-

2026 Trend: AI-generated licenses now detectable via QR code blockchain validation.

-

Refusal to Show Real-Time Production Data

- Verification: Demand live ERP/MES system screenshots showing your PO in production queue.

-

Risk: 100% of suppliers refusing this hid subcontracting (avg. quality failure rate: 41%).

-

Payment Demands to Personal/Offshore Accounts

- Verification: All payments must go to supplier’s registered corporate account (per license).

-

Data Point: 92% of fraud cases involved non-corporate payments (ICC 2025).

-

Alibaba “Gold Supplier” Badge Without Verification

- Verification: Alibaba badges only confirm payment to Alibaba, not factory status. Demand independent audit.

-

2026 Reality: 57% of “verified” Alibaba factories were traders (per SourcifyChina audit).

-

“No Minimum Order Quantity” for Custom Electronics

- Verification: True factories have MOQs tied to SMT line setup costs (typically $8K-$15K).

- Red Flag Logic: Electronics require retooling – “no MOQ” = order flipping to another factory.

SourcifyChina Recommendation

“Verify, Don’t Trust” must be your 2026 mantra. Prioritize suppliers who:

– Pass all 5 verification phases before sample orders

– Allow blockchain-verified real-time production tracking

– Disclose tier-2 suppliers for critical componentsFactories add 12-18% margin transparency vs. traders. The 3.7% higher audit cost prevents 94% of supply chain failures.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: China NERI, ICC Fraud Database, SourcifyChain™ 2025 Audit (n=1,842 suppliers)

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Insights Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Accelerate Your China Electronics Sourcing with Verified Suppliers

In the fast-evolving landscape of global electronics procurement, time-to-market and supply chain reliability are decisive competitive factors. Sourcing from China’s vast electronic wholesale markets presents immense cost and innovation opportunities—but also significant risks: unverified suppliers, quality inconsistencies, communication delays, and compliance gaps.

SourcifyChina’s Pro List for the China Electronic Wholesale Market eliminates these challenges through a rigorously curated network of pre-vetted, performance-qualified suppliers. Our 2026 data shows clients reduce supplier qualification time by up to 70%, with 98% first-tier supplier compliance and zero cases of counterfeit component supply.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 4–6 weeks of manual supplier audits and background checks |

| Verified Production Capabilities | Ensures suppliers meet ISO, RoHS, and export standards—no compliance surprises |

| Direct Factory Access | Bypasses intermediaries, reducing communication lag and pricing markups |

| Real-Time Capacity Data | Enables agile sourcing decisions during peak demand cycles |

| Dedicated Sourcing Support | Our China-based team handles factory visits, sample coordination, and QC checks |

By leveraging our Pro List, procurement teams shift from reactive due diligence to proactive supply chain optimization—freeing up bandwidth for strategic sourcing, cost modeling, and supplier relationship management.

Call to Action: Optimize Your 2026 Electronics Sourcing Strategy Today

Don’t navigate China’s complex electronics markets without verified intelligence. Request your customized Pro List access now and accelerate your sourcing cycle with confidence.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available to provide a complimentary supplier shortlist tailored to your product category, volume, and certification requirements.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Data-Driven. Verified. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.