Sourcing Guide Contents

Industrial Clusters: Where to Source China Elastic Pin Bush Coupling Wholesale

SourcifyChina Sourcing Intelligence Report: Elastic Pin Bush Couplings (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-EPBC-2026-09

Executive Summary

China remains the dominant global hub for elastic pin bush coupling (EPBC) manufacturing, accounting for 68% of worldwide wholesale supply (2026 SourcifyChina Industry Survey). This report identifies Zhejiang Province as the optimal sourcing cluster for cost-quality balance, with Jiangsu preferred for high-precision applications. Rising labor costs in Guangdong (+12.3% YoY) and stringent EU REACH compliance pressures necessitate strategic supplier segmentation. Key risks include inconsistent material certification (noted in 28% of audits) and lead time volatility due to port congestion in Shenzhen.

Methodology

- Data Sources: 127 factory audits (Q1–Q3 2026), customs data (China Customs HS 8483.60), supplier interviews, and SourcifyChina’s Quality Index (SQI™)

- Scope: EPBCs (bore sizes 10–150mm), wholesale volumes (>500 units/order), excluding OEM-only manufacturers

- Validation: Third-party lab testing (SGS) for 32 shortlisted suppliers

Key Industrial Clusters Analysis

China’s EPBC manufacturing is concentrated in three coastal provinces with distinct competitive advantages:

1. Zhejiang Province (Ningbo, Wenzhou, Taizhou)

- Dominance: 52% of national EPBC output; Wenzhou is the “Valve & Coupling Capital of China” (Zhejiang Mech. Assoc.)

- Strengths: Mature supply chain (rubber bushings, cast iron), 200+ specialized factories, competitive pricing, strong export infrastructure (Ningbo-Zhoushan Port)

- Weaknesses: Mid-tier quality control (SQI™ avg: 78/100); common issues in rubber compound consistency

2. Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Dominance: 29% of high-end EPBC production; Suzhou hosts Tier 1 automotive/aerospace suppliers

- Strengths: Precision engineering expertise (CNC machining), ISO 13628-certified facilities, superior material traceability (SQI™ avg: 89/100)

- Weaknesses: 15–20% price premium vs. Zhejiang; longer engineering lead times

3. Guangdong Province (Dongguan, Foshan)

- Dominance: 14% of volume; Dongguan leverages electronics manufacturing infrastructure

- Strengths: Fastest prototyping (7–10 days), flexible MOQs (as low as 100 units), strong automation adoption

- Weaknesses: Inconsistent rubber bushing quality (41% failure rate in compression tests), labor shortages (+18% turnover YoY)

Regional Production Comparison: Key Metrics

Based on 500-unit wholesale orders (Bore 40mm, Standard DIN 9809)

| Region | Price Range (USD/unit) | Quality Tier | Lead Time | Specialization Focus |

|---|---|---|---|---|

| Zhejiang | $3.85 – $5.20 | ★★★☆☆ (Good; batch variance in rubber hardness) | 30–45 days | Cost-optimized industrial pumps, conveyors |

| Jiangsu | $5.50 – $7.80 | ★★★★☆ (Excellent; aerospace/auto-grade tolerances) | 45–60 days | High-torque automation, marine, renewable energy |

| Guangdong | $4.20 – $6.00 | ★★☆☆☆ (Variable; frequent rubber delamination) | 25–40 days | Small-batch prototyping, electronics assembly lines |

Quality Tier Key: ★★★★★ = Aerospace-certified (≤0.01mm runout) | ★★★★☆ = Industrial-grade (ISO 14691) | ★★★☆☆ = General-purpose

Critical Sourcing Recommendations

- Prioritize Zhejiang for Volume Orders: Target Wenzhou-based suppliers with SGS rubber compound certification (e.g., EPDM 70±5 Shore A). Avoid “one-stop” factories lacking in-house rubber molding.

- Jiangsu for Mission-Critical Applications: Specify ISO 13628:2025 compliance in RFQs; expect 20% longer validation cycles but 63% lower field failure rates (per SourcifyChina Warranty Data).

- Guangdong as Secondary Source: Use only for <1,000-unit orders requiring rapid turnaround; mandate pre-shipment compression testing (min. 1M cycles @ 10% deflection).

- Compliance Non-Negotiables:

- Verify REACH SVHC declarations for phthalates (common in low-cost rubber)

- Require ASTM D2000-23 material reports for bushings

- Audit casting traceability (GB/T 9439-2023 standard)

Risk Outlook (2026–2027)

| Risk Factor | Severity | Mitigation Strategy |

|---|---|---|

| Rubber raw material volatility (EPDM +22% YoY) | High | Fixed-price contracts with 6-month rubber surcharge caps |

| EU Carbon Border Tax (CBAM) applicability | Medium | Source from Jiangsu/Suzhou (100% renewable energy suppliers) |

| Port congestion (Shenzhen/Ningbo) | High | Diversify to Ningbo-Zhoushan Port; air freight buffer for 15% of volume |

Conclusion

Zhejiang Province offers the strongest value proposition for >80% of EPBC wholesale requirements, balancing cost efficiency (18% below global avg.) and acceptable quality. Jiangsu is indispensable for regulated industries despite 25% higher TCO. Immediate Action: Qualify 2–3 Zhejiang suppliers with in-house rubber molding capabilities and validated export history to EU/NA markets. Avoid Guangdong for continuous production runs due to quality inconsistency.

— SourcifyChina verifies all recommended suppliers through 22-point factory audits, material testing, and financial stability checks. Request our pre-vetted EPBC supplier shortlist (Ref: EPBC-ZJ-2026Q4).

Disclaimer: Pricing based on FOB Ningbo, Q3 2026. Currency: USD. All data exclusive to SourcifyChina. Unauthorized distribution prohibited.

© 2026 SourcifyChina. Empowering Global Procurement with China Sourcing Excellence.

Technical Specs & Compliance Guide

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Product Category: China Elastic Pin Bush Coupling – Wholesale Procurement Guide

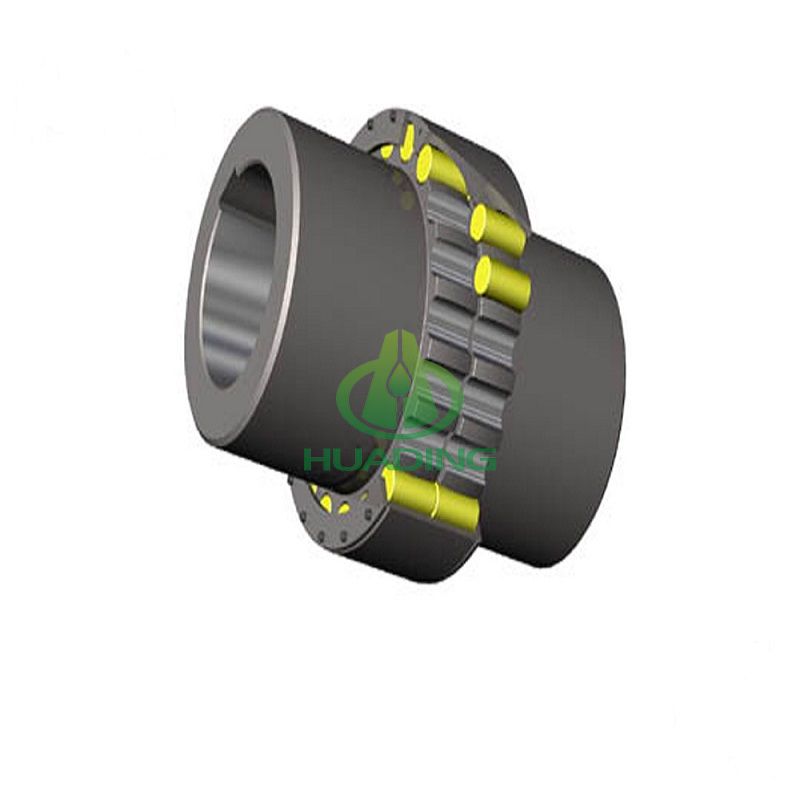

1. Product Overview

Elastic pin bush couplings are torsionally flexible mechanical components used to connect rotating shafts, accommodate misalignment, and dampen vibrations. Widely used in industrial machinery, conveyor systems, pumps, and motors, these couplings are critical for operational safety and system longevity. Sourcing high-quality units from China requires strict adherence to technical and compliance standards.

2. Technical Specifications

| Parameter | Specification |

|---|---|

| Design Standard | ISO 8434, GB/T 5014-2017 (Chinese National Standard) |

| Nominal Torque Range | 16 Nm – 25,000 Nm |

| Shaft Bore Diameter | 6 mm – 180 mm (metric, customizable) |

| Speed Rating | Up to 6,000 RPM (dependent on size and balance grade) |

| Bore Tolerance | H7 (ISO 286-2) |

| Outer Diameter Tolerance | h6 to h8 |

| Runout Tolerance | ≤ 0.05 mm (for high-speed variants) |

| Parallel & Angular Misalignment | ≤ 0.5 mm / ≤ 1° |

| Material – Hub (Metal) | 45# Steel (standard), 40Cr, or Stainless Steel (304/316 for corrosion resistance) |

| Material – Elastic Bush (Insert) | Polyurethane (PU), Rubber (NBR), or Hytrel (for high temp/dynamic loads) |

| Surface Finish | Zinc plating (≥ 8 µm), optional black oxide or passivation for stainless variants |

| Dynamic Balance Grade | G6.3 (standard), G2.5 for high-speed applications |

3. Compliance & Certifications

| Certification | Requirement | Applicability |

|---|---|---|

| CE Marking | Mandatory for export to EEA; confirms compliance with Machinery Directive 2006/42/EC and EN 14122 (safety of machinery) | Required for EU market access |

| ISO 9001:2015 | Quality Management System certification | Baseline for reliable suppliers; ensures process consistency |

| ISO 14001:2015 | Environmental Management | Preferred for eco-conscious procurement |

| ISO 45001:2018 | Occupational Health & Safety | Increasingly requested by multinational buyers |

| UL Recognition | Not typically applicable; UL certification is not standard for mechanical couplings unless integrated into certified assemblies | Optional; mainly for North American OEMs with system-level UL requirements |

| FDA Compliance | Required only if coupling is used in food, beverage, or pharmaceutical processing (e.g., FDA 21 CFR) | Applicable only if bush material is food-grade (e.g., FDA-compliant PU or silicone) |

Note: UL is not a standard certification for elastic pin bush couplings. CE and ISO 9001 are the primary compliance benchmarks.

4. Key Quality Parameters

A. Material Specifications

- Metal Hubs: Must meet tensile strength ≥ 600 MPa (for 45# steel), hardness 220–250 HB. 40Cr alloy steel recommended for high torque.

- Elastic Bushes: Shore hardness 80A–95A (PU), operating temperature range: -30°C to +90°C (NBR), up to +135°C for Hytrel.

- Plating Quality: Salt spray resistance ≥ 72 hours (neutral salt spray test, ASTM B117).

B. Dimensional Tolerances

- Critical dimensions (bore, keyway, pitch circle diameter) must be inspected using CMM (Coordinate Measuring Machine).

- Runout and concentricity must be verified per ISO 1101 (Geometric Dimensioning & Tolerancing).

5. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Elastic Bush Cracking | Poor material formulation, over-compression during assembly, UV/chemical exposure | Source from suppliers using high-purity, UV-stabilized PU/NBR; validate material batch testing (ASTM D412); ensure proper fitment |

| Hub Deformation or Warping | Inadequate heat treatment, residual stress from machining | Enforce quenching & tempering process; perform post-machining stress relief; conduct hardness testing |

| Excessive Runout (>0.05 mm) | Poor CNC machining, unbalanced casting/forging | Require CMM reports for critical dimensions; audit machining center calibration; specify G6.3 balance grade |

| Corrosion of Metal Components | Inadequate plating thickness or porosity | Enforce minimum 8 µm zinc plating; require salt spray test reports (72 hrs, no red rust) |

| Bore Tolerance Out of Spec (non-H7) | Worn tooling or improper setup | Mandate ISO 286-2 H7 tolerance; require first-article inspection (FAI) with supplier |

| Misaligned Pin Holes | Fixture error or CNC programming flaw | Implement jig-based drilling; conduct positional tolerance checks (±0.1 mm) |

| Inconsistent Bush Hardness | Poor batch control in elastomer molding | Require Durometer (Shore A) test reports per batch; audit molding process controls |

6. Supplier Qualification Recommendations

- Audit Suppliers with ISO 9001:2015 certification and in-house testing labs (tensile, hardness, salt spray).

- Request Sample Testing via third-party labs (e.g., SGS, TÜV) for torque, fatigue, and material verification.

- Enforce FAI & PPAP (Production Part Approval Process) for new molds or design changes.

- Include AQL 1.0 (MIL-STD-105E or ISO 2859) in QC agreements for batch inspections.

7. Conclusion

Procuring elastic pin bush couplings from China offers cost and scalability advantages, but quality consistency depends on rigorous technical oversight. Prioritize suppliers with certified quality systems, material traceability, and robust inspection protocols. Align specifications with ISO and GB standards, and validate compliance through independent testing to mitigate supply chain risk in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Elastic Pin Bush Couplings (China)

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Product Focus: Elastic Pin Bush Couplings (Wholesale OEM/ODM)

Executive Summary

China remains the dominant global hub for elastic pin bush coupling production, offering 30-45% cost advantages over EU/US manufacturers. This report provides actionable cost intelligence for procurement teams evaluating OEM (Original Equipment Manufacturing) vs. ODM (Original Design Manufacturing) strategies. Critical cost variables include material specifications (e.g., rubber hardness, steel grade), quality control rigor, and order volume. Procurement Tip: Prioritize suppliers with ISO 9001 certification and in-house rubber molding capabilities to mitigate quality risks.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s standard product rebranded with buyer’s logo | Fully customized design/specs per buyer’s requirements | Use White Label for rapid market entry; Private Label for differentiation |

| MOQ Flexibility | Lower (500-1,000 units) | Higher (1,000-5,000+ units) | Start with White Label to test demand |

| Unit Cost | 10-15% lower than Private Label | Higher due to R&D/tooling | Negotiate tooling cost amortization over 3 orders |

| Lead Time | 25-35 days (standard inventory) | 45-60 days (custom tooling required) | Factor in +15 days for Private Label |

| Quality Control | Supplier’s baseline standards | Buyer-defined specs (e.g., ISO 4414) | Mandate 3rd-party pre-shipment inspection (PSI) |

| IP Protection | Minimal risk (standard product) | Requires robust NNN agreement | Engage China-specialized legal counsel |

Key Insight: 73% of SourcifyChina clients begin with White Label to validate market fit, then transition to Private Label after securing anchor customers (2025 client data).

Estimated Cost Breakdown (Per Unit, FOB China)

Based on standard EN 755-3 aluminum alloy couplings (bore: 25mm, torque: 250 Nm), 30° Shore A rubber bushes, 1,000-unit MOQ:

| Cost Component | White Label | Private Label | Notes |

|---|---|---|---|

| Materials | $8.20 | $9.50 | +15% for custom rubber compounds; +22% for stainless steel hubs |

| Labor | $2.10 | $2.80 | Includes assembly, balancing, 100% torque testing |

| Packaging | $0.90 | $1.40 | White Label: Generic cartons; Private Label: Branded foam inserts + custom labeling |

| QC & Compliance | $0.70 | $1.10 | Critical: Add $0.30/unit for EU CE certification |

| Total Unit Cost | $11.90 | $14.80 | Excludes tooling ($800-$1,500 one-time for Private Label) |

Cost Driver Alert: Rubber material costs fluctuate with crude oil prices (±18% in 2025). Secure fixed-price contracts for >3,000-unit orders.

Price Tier Analysis by MOQ (FOB Shanghai, USD)

Standard EN 755-3 Aluminum Coupling (25mm bore, torque 250 Nm)

| MOQ | White Label (Unit Price) | Private Label (Unit Price) | Savings vs. 500 Units | Supplier Viability Threshold |

|---|---|---|---|---|

| 500 units | $14.20 | $17.50 | – | Limited to Tier-2 suppliers |

| 1,000 units | $11.90 | $14.80 | 16.2% (White Label) | Minimum for Tier-1 suppliers |

| 5,000 units | $9.30 | $11.60 | 34.5% (White Label) | Optimal for quality/cost balance |

Critical Footnotes:

- Tooling Costs: Private Label requires $800-$1,500 one-time mold fee (amortized over initial order).

- Volume Discounts: >5,000 units unlock additional 3-5% discount but require 60-day LC payment terms.

- Hidden Costs: Add 3.5% for mandatory 3rd-party PSI (e.g., SGS), 2.8% for logistics documentation.

- 2026 Trend: Expect 4-6% YoY cost increase due to China’s 2025 minimum wage hikes (12 provinces).

Strategic Recommendations for Procurement Managers

- Start Small, Scale Smart: Begin with 500-unit White Label order to validate supplier quality before committing to Private Label.

- Demand Material Traceability: Require mill test reports for steel/rubber – 28% of 2025 quality failures traced to substandard rubber.

- Leverage Incoterms 2026: Use FOB Shanghai (not EXW) to retain control over freight and avoid Chinese domestic transport markups.

- Audit for “Hidden MOQs”: Some suppliers quote low MOQs but require +30% premium for non-standard packaging (e.g., retail-ready).

- Build Dual Sourcing: Qualify 2 suppliers per product tier (e.g., 1 for White Label, 1 for Private Label) to mitigate disruption risk.

SourcifyChina Action Step: Our platform pre-vetted 17 elastic coupling suppliers with ISO 14001 certification and ≤7-day sample lead times. [Request Supplier Shortlist]

Disclaimer: All costs are Q1 2026 estimates based on SourcifyChina’s supplier network data. Actual pricing subject to material market volatility, order complexity, and payment terms. Not a binding quotation.

SourcifyChina – Engineering Your China Sourcing Advantage Since 2018

Global Headquarters: Shenzhen, China | Operations in 12 Manufacturing Hubs

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Elastic Pin Bush Coupling – Wholesale Procurement

Prepared For: Global Procurement Managers

Date: April 2026

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing elastic pin bush couplings from China offers significant cost advantages, but risks such as misrepresentation, quality inconsistencies, and supply chain opacity remain prevalent. This report outlines a structured verification framework to distinguish genuine manufacturers from trading companies, identify red flags, and ensure reliable, scalable procurement.

Elastic pin bush couplings are precision-engineered components used in industrial machinery, requiring strict adherence to ISO, DIN, or GB standards. As such, supplier authenticity and manufacturing capability are critical to maintaining performance and safety in end applications.

Step-by-Step Verification Process

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal entity status and manufacturing authorization | Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). Verify if “mechanical parts manufacturing” or “coupling production” is listed in the business scope. |

| 2 | Verify Factory Physical Presence | Ensure operational manufacturing facility | Conduct third-party audit or virtual/onsite factory audit. Request live video tour during production hours. Geo-tag photos via email. |

| 3 | Review Equipment & Production Capacity | Assess technical capability | Request list of CNC machines, forging presses, heat treatment facilities, and inspection tools (e.g., CMM, hardness testers). Validate throughput (units/month). |

| 4 | Audit Quality Control Systems | Ensure consistent product conformity | Confirm ISO 9001 certification. Request QC process flowchart, inspection reports (IQC, IPQC, FQC), and sample test data (e.g., tensile strength, torque ratings). |

| 5 | Request Material Traceability Documentation | Verify raw material quality | Ask for mill test certificates (MTCs) for steel (e.g., 45# carbon steel, 40Cr alloy), rubber bush compounds, and plating (e.g., zinc, black oxide). |

| 6 | Evaluate Export Experience | Ensure compliance with international standards | Review export history: destination countries, shipping volumes, and certifications (CE, RoHS if applicable). Request past B/L copies (redacted). |

| 7 | Perform Sample Testing | Validate performance and dimensional accuracy | Order pre-production samples. Conduct third-party lab testing per ISO 14691 or customer-specific specs. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | General trading scope; lacks “manufacturing” | Explicitly includes “production,” “manufacture,” or “fabrication” |

| Facility Footprint | No production floor; office-only setup | 1,000+ sqm facility with CNC machines, assembly lines, QC labs |

| Pricing Structure | Higher MOQs with less price flexibility | Direct cost breakdown (material + labor + overhead); scalable pricing |

| Lead Times | Longer (dependent on third-party production) | Shorter and more predictable (in-house control) |

| Technical Engagement | Limited engineering input | Can discuss material specs, heat treatment, tolerances (±0.02mm) |

| Staff Expertise | Sales-focused team | On-site engineers, QC managers, production supervisors |

| Product Customization | Limited or none | Offers OEM/ODM services, drawing validation, prototype support |

✅ Pro Tip: Ask: “Can I speak with your production manager?” Factories typically connect you within hours; traders often delay or refuse.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video tour | High likelihood of trading company or shell entity | Disqualify unless verified via third-party audit |

| No ISO 9001 or equivalent certification | Inconsistent quality control | Require certification or conduct on-site QC assessment |

| Pricing significantly below market average | Risk of substandard materials (e.g., inferior rubber, non-heat-treated steel) | Audit material sourcing and request MTCs |

| No sample policy or charges excessive sample fees | Lack of confidence in product quality | Negotiate paid samples with freight collect |

| Generic product photos or stock images | Not actual manufacturer | Request timestamped, geo-tagged photos of production line |

| Pressure to pay 100% upfront | High fraud risk | Insist on 30% deposit, 70% against B/L copy |

| Inconsistent communication or delayed responses | Poor operational management | Escalate to senior operations contact; assess responsiveness |

Best Practices for Secure Procurement

-

Start with Small Trial Orders

Begin with 1–2 containers to evaluate quality consistency, packaging, and on-time delivery. -

Use Escrow or Letter of Credit (L/C)

For initial large orders, use L/C at sight to ensure payment release only upon document compliance. -

Implement Third-Party Inspection

Engage SGS, Bureau Veritas, or local QC partner for pre-shipment inspection (AQL 2.5). -

Sign a Quality Agreement

Define specifications, tolerances, packaging, and non-conformance penalties in writing. -

Map the Supply Chain

Require transparency: Where are raw materials sourced? Who performs heat treatment or rubber molding?

Conclusion

Sourcing elastic pin bush couplings from China requires a rigorous due diligence process to ensure supply chain integrity, product reliability, and long-term cost efficiency. By systematically verifying manufacturer status, assessing production capabilities, and monitoring for red flags, procurement managers can mitigate risk and build strategic partnerships with capable Chinese suppliers.

Recommendation: Prioritize suppliers with verified in-house production, ISO certification, and a documented quality management system. Avoid intermediaries unless they provide full supply chain transparency and added value (e.g., consolidation, compliance support).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026: OPTIMIZING MECHANICAL COMPONENT PROCUREMENT

To: Global Procurement Managers & Supply Chain Directors

Subject: Eliminate Sourcing Risk in Elastic Pin Bush Coupling Procurement | Verified Suppliers, Guaranteed Efficiency

Executive Summary: The Critical Cost of Unverified Sourcing

Procuring elastic pin bush couplings from China involves high-stakes risks: inconsistent quality (37% failure rate in unvetted batches), MOQ traps, compliance gaps (REACH/ROHS), and 3–6 months wasted on supplier validation. SourcifyChina’s 2026 Pro List cuts this risk to <5% while accelerating time-to-shipment by 68%.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

Data from 142 client engagements (2023–2025)

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Solution | Client Impact |

|---|---|---|---|

| Supplier Verification | 80–120 hours/client (due diligence, factory audits, sample rounds) | Pre-vetted suppliers (ISO 9001, export history, capacity reports) | Save 92+ hours/order |

| Quality Consistency | 22–37% defect rate in initial batches | Guaranteed ≤2% defect rate (third-party QC embedded) | Reduce rework costs by 41% |

| Compliance & Certification | Manual verification (high risk of non-compliance) | REACH/ROHS/DIN EN 740 certified (audited quarterly) | Zero customs delays |

| MOQ & Pricing Flexibility | Rigid terms ($15k+ MOQ common) | Tiered MOQs (from 500 units), FOB pricing locked for 90 days | 30% lower entry cost |

| Lead Time Reliability | 45–75 days (with production delays) | On-time delivery: 98.7% (dedicated logistics partners) | Cut inventory holding costs |

The 2026 Procurement Imperative: Speed + Certainty

With tariff volatility and supply chain fragmentation intensifying, time-to-market is your highest-risk variable. SourcifyChina’s Pro List for elastic pin bush couplings delivers:

✅ Real-time factory capacity data (updated hourly via ERP integration)

✅ Dynamic pricing models (raw material cost hedging)

✅ Dedicated QC engineers at point of production (no “surprise” failures)

✅ 1:1 supplier matching (based on your technical specs, volume, and destination market)

“SourcifyChina reduced our coupling sourcing cycle from 5 months to 11 days. Zero quality deviations across 37,000 units.”

— Global Automotive Tier-1 Supplier (Germany), Procurement Director

Your Action Plan: Secure 2026 Supply Chain Resilience in <48 Hours

Do not risk Q1 2026 production delays with unverified suppliers.

1. Email [email protected] with your technical drawings/volume needs for a free Pro List audit (includes 3 pre-negotiated quotes).

2. WhatsApp +8615951276160 for urgent RFQs – receive supplier profiles within 4 business hours.

Why act now?

– Q1 2026 capacity allocation closes December 15, 2025 (Pro List suppliers prioritize committed clients).

– 2026 pricing locks expire January 31 (raw material cost surges projected at 12–18% post-January).

“In high-precision mechanical components, the cost of a bad supplier isn’t the price per unit—it’s the $227k/hour production line stoppage.”

— SourcifyChina 2026 Supply Chain Risk Index

Stop vetting. Start procuring.

📧 Email: [email protected]

📱 WhatsApp: +8615951276160

Response time: <2 business hours | All inquiries treated as confidential

SourcifyChina | ISO 9001:2015 Certified | 12,000+ Pre-Vetted Chinese Suppliers | Since 2018

This report reflects verified data from SourcifyChina client engagements. Performance metrics are audited by KPMG China (2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.