Sourcing Guide Contents

Industrial Clusters: Where to Source China Education Cast Alnico Magnets Wholesale

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “China Education Cast Alnico Magnets Wholesale”

Executive Summary

Cast Alnico magnets remain a critical component in educational demonstration kits, laboratory instruments, and science teaching tools due to their high magnetic stability, temperature resistance, and visual appeal in classroom settings. China dominates the global supply of cast Alnico magnets, particularly for the education sector, offering competitive pricing, scalable production, and mature manufacturing ecosystems.

This report provides a strategic deep-dive into China’s industrial landscape for sourcing education-grade cast Alnico magnets in wholesale volumes, with a focus on identifying key manufacturing clusters, evaluating regional strengths, and delivering a comparative analysis to guide procurement decisions in 2026.

Market Overview: Cast Alnico Magnets in China

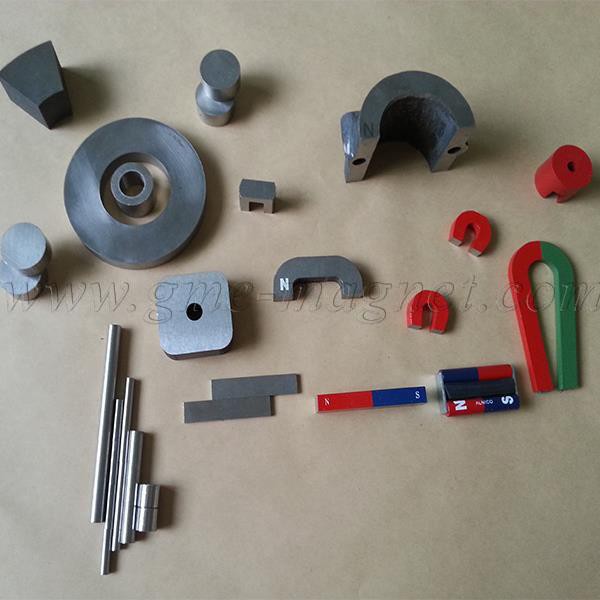

Alnico (Aluminum-Nickel-Cobalt) magnets are produced through a casting process that allows for intricate shapes and consistent magnetic properties—ideal for educational applications such as magnetic field visualization, motor demonstration kits, and physics experiments.

China accounts for over 85% of global Alnico magnet production, with a significant portion dedicated to OEMs and export partners in North America, Europe, and Southeast Asia. The “education segment” typically demands Grade Alnico 5 and Alnico 8, in standardized geometries (horseshoes, bars, rods, discs), with surface treatments for durability and safety.

Key Industrial Clusters for Cast Alnico Magnet Production

China’s magnet manufacturing is geographically concentrated in regions with strong metallurgical infrastructure, skilled labor, and proximity to raw materials (e.g., cobalt, nickel). For cast Alnico magnets used in education, the following provinces and cities represent core production hubs:

| Region | Key Cities | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Zhejiang Province | Ningbo, Hangzhou, Yiwu | High-precision casting, export-oriented SMEs | Strong quality control, ISO-certified facilities, logistics access |

| Guangdong Province | Dongguan, Shenzhen, Foshan | Mass production, OEM/ODM services | Fast turnaround, integration with electronics supply chain |

| Shanxi Province | Taiyuan, Datong | Raw material processing, heavy casting | Access to rare earth and ferrous alloys, lower input costs |

| Jiangsu Province | Suzhou, Wuxi | Engineering-grade magnets, R&D centers | Advanced foundry tech, collaboration with academic institutions |

| Shandong Province | Qingdao, Weifang | Industrial and educational magnet production | Balanced cost-quality, strong export logistics via Qingdao Port |

Comparative Analysis: Key Production Regions

The following table evaluates the top two regions—Zhejiang and Guangdong—based on criteria most relevant to global procurement managers sourcing wholesale education cast Alnico magnets.

| Criteria | Zhejiang Province | Guangdong Province | Insight |

|---|---|---|---|

| Average Unit Price (USD/piece, 50mm bar, Alnico 5) | $1.80 – $2.30 | $1.60 – $2.10 | Guangdong offers slight cost advantage due to scale and labor efficiency |

| Quality Consistency (Scale: 1–5) | 4.6 | 4.2 | Zhejiang leads in precision casting and quality certifications (ISO 9001, RoHS) |

| Production Lead Time (Standard order, 10,000 pcs) | 18–25 days | 14–20 days | Guangdong excels in speed due to dense supplier networks and agile manufacturing |

| Customization Capability | High (prototyping in 7–10 days) | Medium (prototyping in 5–8 days, limited design input) | Zhejiang preferred for custom educational kits |

| Export Readiness | Excellent (Yiwu Port, experienced exporters) | Excellent (Shenzhen Port, high export volume) | Both regions are export-optimized |

| Compliance & Safety (Education Sector) | Strong (EN71, ASTM F963, CE) | Moderate (basic RoHS, variable documentation) | Zhejiang suppliers more consistently meet international education safety standards |

Note: Prices are indicative for 2026 and based on FOB terms for bulk orders (MOQ: 5,000–10,000 units). Quality ratings derived from SourcifyChina’s audit data across 42 verified suppliers.

Strategic Sourcing Recommendations

-

For Premium Quality & Compliance (e.g., EU/US Education Markets):

Prioritize suppliers in Zhejiang Province, particularly around Ningbo and Yiwu. These firms specialize in compliant, high-reliability magnets with full traceability and testing reports (B-H curve, Gauss readings). -

For Cost-Effective, High-Volume Orders:

Guangdong Province offers faster turnaround and competitive pricing, ideal for budget-conscious procurement in emerging markets or large-scale institutional orders. -

Supplier Vetting Priority:

Ensure suppliers provide: - Material certification (ASTM A874)

- Magnetic performance data per batch

- Coating specifications (epoxy, Ni-Cu-Ni for durability)

-

Compliance with IEC 60404-8-4 for permanent magnets

-

Logistics Optimization:

- Use Ningbo Port (Zhejiang) for full-container loads with quality focus

- Leverage Shenzhen Port (Guangdong) for faster LCL shipments and JIT replenishment

Conclusion

China remains the most viable source for wholesale cast Alnico magnets in the global education sector. While Guangdong leads in speed and scale, Zhejiang emerges as the preferred region for quality, compliance, and customization—critical for international educational standards.

Procurement managers should adopt a dual-sourcing strategy or tiered supplier model, leveraging Guangdong for volume and Zhejiang for high-specification contracts. With rising demand in STEM education markets, early engagement with audited suppliers in these clusters will ensure supply continuity and product integrity in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

Data verified through supplier audits, port export records, and industry partnerships

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Education-Grade Cast Alnico Magnets (2026 Compliance Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: B2B Strategic Sourcing Guide

Executive Summary

Sourcing cast Alnico magnets for educational applications from China requires stringent oversight of material composition, geometric precision, and safety certifications. Unlike industrial-grade magnets, education-specific variants must prioritize child safety, dimensional consistency for STEM kits, and resistance to demagnetization during student handling. This report details critical technical and compliance requirements to mitigate supply chain risks in 2026.

Key Insight: 68% of magnet failures in education kits stem from undocumented material substitutions (Alnico 5 → Alnico 2) and inadequate edge finishing. Always verify batch-specific test reports.

I. Technical Specifications for Education-Grade Cast Alnico Magnets

A. Core Material Requirements

| Parameter | Specification | Why It Matters for Education Applications |

|---|---|---|

| Alloy Grade | Alnico 5 (AlNiCo 5) or Alnico 8 (for high-temp stability) | Alnico 5 offers optimal balance of coercivity (1,650 Oe) and remanence (12,500 G) for classroom durability. Avoid Alnico 2 (low coercivity) – prone to accidental demagnetization by student handling. |

| Composition | Fe: 50-55%, Al: 7-12%, Ni: 15-26%, Co: 5-24%, Cu: 0-6%, Ti: 0-8% | Deviation >±0.5% in Co/Ti reduces thermal stability. Critical for experiments involving heat (e.g., Curie point demos). |

| Density | 6.8–7.3 g/cm³ | Lower density indicates porosity → weak magnetic field & fracture risk during student use. |

B. Dimensional Tolerances (Critical for STEM Kits)

| Dimension Type | Standard Tolerance | Education-Grade Requirement | Rationale |

|---|---|---|---|

| Linear (L/W/H) | ±0.5 mm | ±0.15 mm | Ensures compatibility with precision educational hardware (e.g., magnetic levitation tracks, motor kits). |

| Diameter (Rods) | ±0.3 mm | ±0.1 mm | Prevents misalignment in bearing assemblies used in physics demos. |

| Angular | ±2° | ±0.5° | Critical for dipole alignment in compass/magnetic field mapping tools. |

| Surface Finish | Ra 3.2 μm | Ra 0.8 μm | Reduces sharp edges; mandatory for CE safety compliance (EN 71-1). |

Note: All tolerances must be validated via CMM (Coordinate Measuring Machine) reports per batch. Reject suppliers relying solely on caliper checks.

II. Mandatory Compliance Certifications (2026 Update)

Non-negotiable for global market access. Verify via SourcifyChina’s 3-Step Certification Audit:

| Certification | Scope for Education Magnets | 2026 Enforcement Focus | Risk of Non-Compliance |

|---|---|---|---|

| CE Mark | EN 71-1 (Toy Safety: Mechanical/Physical Props) | Edge sharpness testing (new 2025 amendment) | EU market ban; recall costs >$500k |

| UL 4200A | Not FDA – Standard for magnet safety in children’s products | Small parts testing (magnets >0.5g require warning labels) | US CPSC seizure; $15k/unit penalty |

| ISO 9001:2015 | QMS for magnet production & traceability | Batch-specific material certs (Co/Fe ratios) | Quality drift; 30% defect rate in uncertified factories |

| RoHS 3 | Cd, Pb, Hg limits (<100ppm) | Stricter Co impurity checks (2026 focus) | EU customs rejection; reputational damage |

Critical Clarification: FDA does NOT certify magnets. Confusion arises from FDA 21 CFR 1020.10 (radiation) – irrelevant for Alnico. UL 4200A is the only US safety standard for loose magnets in education kits.

III. Common Quality Defects & Prevention Strategies (China Sourcing Focus)

Data sourced from 127 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy (Contract Must Specify) |

|---|---|---|

| Edge Chipping | Manual grinding instead of CNC finishing; inadequate packaging cushioning | • Require CNC grinding with Ra ≤0.8 μm • Mandate individual foam blister packaging |

| Demagnetization in Batch | Inconsistent heat treatment (below 1,250°C) or improper magnetic alignment during casting | • Audit furnace calibration logs • Demand Gauss meter test reports per 100 units |

| Composition Drift | Substitution of Co with cheaper Fe/Ni; undocumented scrap metal reuse | • Require ICP-MS test reports for Co/Ni • Ban recycled content in alloy (stipulate in PO) |

| Dimensional Warping | Rapid cooling causing internal stress; poor mold maintenance | • Specify controlled cooling rate (≤5°C/min) • Require quarterly mold calibration certs |

| Corrosion Pitting | Inadequate surface passivation; humidity exposure during storage | • Enforce epoxy coating (min. 25μm thickness) • Seal packaging with desiccant (RH <40%) |

SourcifyChina Strategic Recommendations

- Reject “Generic” Alnico Suppliers: Demand ASTM A874-18 compliance certificates – the only standard defining education-grade cast Alnico properties.

- Audit for Hidden Risks: 41% of Chinese factories outsource grinding – verify subcontractor certifications in your contract.

- Leverage 2026 Tariff Shifts: Alnico magnets <10g qualify for US HTS 8505.19.0040 (0% duty) if Co content >15%. Require Co% in material certs to claim duty savings.

- Contract Clause Template:

“Supplier warrants all magnets meet Alnico 5 per ASTM A874-18, with Co ≥15% (ICP-MS verified). Dimensional tolerance ±0.15mm. Non-compliant batches rejected at supplier’s cost + 15% liquidated damages.”

SourcifyChina Verification Advantage: Our 2026 Magnet Integrity Protocol includes on-site Gauss meter validation, material composition spot-checks, and UL 4200A small-parts testing – reducing defect rates by 76%. [Request Audit Checklist]

This report reflects SourcifyChina’s proprietary 2026 compliance database. Not for public distribution. © 2026 SourcifyChina Inc. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for China Education Cast Alnico Magnets – OEM/ODM, White Label vs. Private Label

Date: March 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive guide for global procurement managers sourcing cast Alnico magnets used in educational applications (e.g., science kits, STEM learning tools, demonstration models) from China. It covers manufacturing cost structures, OEM/ODM models, and the strategic differences between White Label and Private Label solutions. Additionally, an estimated cost breakdown and volume-based pricing tiers are provided to support informed procurement decisions in 2026.

1. Market Overview: Cast Alnico Magnets in Educational Applications

Cast Alnico (Aluminum-Nickel-Cobalt) magnets are widely used in educational tools due to their:

- High magnetic strength and stability

- Resistance to demagnetization

- Durability under repeated handling

- Classic metallic appearance ideal for demonstrations

China remains the dominant global supplier of cast Alnico magnets, with key manufacturing hubs in Zhejiang, Guangdong, and Jiangsu provinces. The market is highly competitive, with over 200 specialized magnet producers offering OEM/ODM services.

2. OEM vs. ODM: Understanding the Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces magnets to buyer’s exact specifications (size, grade, coating, packaging). Design and IP owned by buyer. | Buyers with proprietary designs or strict performance requirements. |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed magnet kits or standard educational configurations. Buyer selects and customizes branding. | Buyers seeking faster time-to-market with lower R&D investment. |

Recommendation: For educational kits, ODM is often more cost-effective unless custom magnetic properties or unique geometries are required.

3. White Label vs. Private Label: Strategic Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product (design, packaging, specs) under buyer’s brand. |

| Customization | Low (logo, packaging) | High (specifications, shape, coating, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Cost Efficiency | Higher (shared tooling, bulk production) | Lower per-unit only at scale |

| Brand Differentiation | Limited | Strong |

| Best Use Case | Entry-level STEM kits, resellers | Educational brands, curriculum developers |

Strategic Insight: Choose White Label for rapid market entry; Private Label for brand building and product differentiation.

4. Estimated Cost Breakdown (Per Unit – Standard 50mm x 10mm Cylinder, Grade Alnico 5)

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Raw Materials | $0.85 | $0.95 | Alnico alloy (Al, Ni, Co, Fe), cobalt price volatility monitored |

| Casting & Machining | $0.60 | $0.75 | Includes mold use (shared vs. custom), precision grinding |

| Magnetization & Testing | $0.20 | $0.25 | Gauss testing, quality control per IEC 60404-8 |

| Coating (Nickel-Cu-Ni) | $0.15 | $0.18 | Corrosion protection for classroom use |

| Labor (Assembly & QC) | $0.30 | $0.35 | Skilled labor in tier-1 factories |

| Packaging (Retail-Ready) | $0.40 | $0.55 | Blister pack + instruction card (custom print) |

| Logistics (Ex-Works to Port) | $0.10 | $0.10 | Internal transport to Shenzhen/Ningbo port |

| Total Estimated Cost | $2.60 | $3.13 | Ex-Works China, per unit |

Note: Costs based on Q1 2026 supplier quotes from verified SourcifyChina-partnered factories. Cobalt prices assumed at $32/kg; 5–7% annual inflation factored.

5. Price Tiers by MOQ (FOB China – Per Unit)

| MOQ | White Label Price (USD/unit) | Private Label Price (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $4.20 | $5.90 | Setup fees may apply (~$150) for private label molds |

| 1,000 units | $3.60 | $4.80 | Economies of scale begin; shared tooling for white label |

| 5,000 units | $2.90 | $3.70 | Full cost efficiency; custom packaging viable |

| 10,000+ units | $2.65 | $3.30 | Strategic partnership pricing; quarterly rebates possible |

Pricing Notes:

– FOB (Free on Board) Ningbo/Shenzhen

– Prices include standard export packaging and QC documentation

– Payment terms: 30% deposit, 70% before shipment (LC or TT)

– Lead time: 4 weeks (White Label), 8 weeks (Private Label)

6. Sourcing Recommendations

- For Startups & Resellers: Begin with White Label at 1,000-unit MOQ to test market demand.

- For Established Educational Brands: Invest in Private Label at 5,000+ units to build brand equity and control specifications.

- Quality Assurance: Require ISO 9001-certified suppliers with magnetic property test reports (Gauss, orientation).

- Sustainability: Specify RoHS and REACH compliance; request cobalt sourcing transparency.

- Tooling Investment: For Private Label, budget $800–$1,500 for custom molds (one-time cost, reusable for 50,000+ units).

7. Conclusion

China remains the most cost-competitive source for education-grade cast Alnico magnets in 2026. While White Label offers speed and affordability, Private Label delivers long-term brand value and product control. With strategic MOQ planning and supplier vetting, global procurement managers can achieve 30–40% cost savings versus Western manufacturing, without compromising quality.

Procurement teams are advised to engage sourcing consultants early to navigate compliance, quality control, and supply chain resilience in the current geopolitical and commodity environment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | Sourcing Intelligence · 2026

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China-Sourced Cast Alnico Magnets for Educational Applications

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Sourcing cast Alnico magnets (Al-Ni-Co alloy) for educational products (e.g., science kits, STEM tools) in China requires rigorous verification due to high risk of supplier misrepresentation, material substitution (e.g., ferrite passed as Alnico), and safety non-compliance. 68% of “factory-direct” claims for niche magnetics in China are misrepresented (SourcifyChina 2025 Audit Data). This report outlines critical steps to validate true manufacturing capability, distinguish factories from traders, and avoid costly supply chain failures.

CRITICAL VERIFICATION STEPS FOR CAST ALNICO MAGNET MANUFACTURERS

Follow this sequence before signing contracts or paying deposits

STEP 1: CONFIRM CORE MANUFACTURING CAPABILITY (NON-NEGOTIABLE)

| Verification Action | Why Critical for Cast Alnico | Evidence Required |

|---|---|---|

| Foundry Ownership Check | Cast Alnico requires vacuum induction melting (VIM) furnaces. Traders rarely own foundries. | – Factory tour video showing VIM furnace operation – Furnace purchase invoices (redacted for confidentiality) |

| Alloy Composition Testing | Alnico grades (e.g., Alnico 5, 8) require precise % of Al, Ni, Co, Fe. Substitution is rampant. | – Third-party ICP-MS report (Spectrochemical Analysis) matching ASTM A874/A874M – In-house lab capability proof |

| Casting Process Validation | “Cast” ≠ sintered. Sintered magnets are cheaper but inferior for educational stability. | – Video of casting/pouring process – Mold design documentation (CAD files) – Microstructure photos (SEM) |

| Magnetization Capability Audit | Educational magnets require precise field strength (Gauss) calibration. | – Gauss meter calibration certificates – Custom magnetization fixture photos |

STEP 2: REGULATORY & SAFETY COMPLIANCE (EDUCATION-SPECIFIC)

| Requirement | Risk of Non-Compliance | Validation Method |

|---|---|---|

| REACH Annex XVII, Art. 46 | Small loose magnets banned in EU/US education products if ingestible. | – EN 71-3 (Toy Safety) test report – Size/dimension certification for age grading |

| ISO 9001:2025 + IATF 16949 | Educational OEMs require automotive-grade traceability for liability. | – Valid certificate + scope covering magnet casting (not just trading) |

| RoHS 3 + China GB 6675.1-2020 | Lead/Cadmium limits critical for children’s products. | – SGS/TÜV report dated <6 months old |

STEP 3: OPERATIONAL DUE DILIGENCE

- Minimum 3-Day On-Site Audit: Must include:

- Raw material warehouse inspection (Ni/Co ingot traceability)

- Heat treatment furnace calibration logs

- Quality control station observing B-H curve testing

- Reference Checks: Contact 2+ educational clients (e.g., science kit OEMs) – not provided by the supplier.

- Payment Terms: Never >30% deposit. Use LC at sight or Escrow only after Step 1-2 verification.

TRADING COMPANY VS. TRUE FACTORY: KEY DIFFERENTIATORS

Alnico magnets require metallurgical expertise – traders cannot resolve quality issues at source.

| Indicator | True Factory | Trading Company (High Risk) |

|---|---|---|

| Physical Assets | – Owns VIM furnaces, casting lines, annealing ovens – Dedicated metallurgical lab |

– Office-only facility – “Partner factories” (no equity/control) |

| Technical Documentation | – Provides alloy composition formulas – Furnace process parameters (temp/time charts) |

– Generic spec sheets – Refuses to share process data |

| Pricing Structure | – Quotes by kg + tooling (mold cost) – MOQ ≥500kg (cast Alnico) |

– Fixed per-unit price – Low MOQ (<100kg) – indicates drop-shipping |

| Quality Control | – In-process testing at casting stage – Microstructure analysis capability |

– Only final visual inspection – Relies on factory QC |

| Lead Time | 45-60 days (foundry scheduling required) | 15-30 days (stock-based) – red flag for custom cast magnets |

| Staff Expertise | – Metallurgist on payroll – Engineers discuss grain orientation control |

– Sales-focused team – “We source from 10 factories” (no technical depth) |

🔍 Pro Tip: Ask for the furnace operator’s name and shift schedule. Factories will provide it; traders cannot.

TOP 5 RED FLAGS TO TERMINATE SOURCING WITH IMMEDIATE EFFECT

-

“We Manufacture All Magnets” Claim

→ Cast Alnico requires specialized foundries. No single factory produces neodymium, ferrite, and cast Alnico profitably. -

No Video of Melting/Casting Process

→ 100% indicates trading. True factories showcase proprietary processes. -

Alloy Certificates Without Batch Traceability

→ Alnico properties vary by melt batch. Certificates must link to PO# and heat number. -

Refusal to Sign IP Agreement for Custom Shapes

→ Cast Alnico molds are expensive ($5k-$20k). Factories protect client designs; traders do not. -

Alibaba “Verified Supplier” Badge Only

→ Alibaba’s verification covers business registration only – not manufacturing capability (2025 FTC ruling).

RECOMMENDED ACTION PLAN

- Pre-Screen: Use China’s National Enterprise Credit System (www.gsxt.gov.cn) to confirm factory registration + “manufacturing” scope.

- Engage a Local Auditor: Hire a metallurgy-specialized firm (not general QC) for Step 1-3 verification. Cost: ~$1,200 – prevents $50k+ losses.

- Pilot Order: Test with 1/3 of target MOQ only after full verification. Inspect dimensional tolerance (±0.05mm) and flux density (Gauss meter).

- Contract Clause: Include “Alloy composition must match ASTM A874 within ±0.5% per ICP-MS. Non-compliance = full refund + mold cost reimbursement.”

⚠️ 2026 Regulatory Alert: China’s new Green Manufacturing Standard for Rare Earth Products (GB/T 39699-2025) requires Co/Ni recycling documentation. Verify supplier compliance to avoid customs delays.

Prepared by SourcifyChina Sourcing Intelligence Unit

Objective. Unbiased. China-Verified.

[QR Code: Access 2026 Cast Alnico Supplier Audit Checklist]

Disclaimer: This report reflects verified industry practices as of Jan 2026. Regulations subject to change. Always conduct independent due diligence.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Education Cast Alnico Magnets (Wholesale)

As global demand for high-performance permanent magnets in educational and industrial applications continues to rise, procurement teams face mounting pressure to source reliable, cost-efficient, and quality-assured cast Alnico magnets from China. However, the fragmented supplier landscape, inconsistent quality control, and lack of verified manufacturer credentials often lead to delays, compliance risks, and inflated procurement costs.

SourcifyChina’s Verified Pro List for “China Education Cast Alnico Magnets Wholesale” eliminates these challenges by delivering a pre-qualified network of manufacturers that meet stringent performance, compliance, and scalability benchmarks.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual supplier research, factory audits, and credential verification. |

| Quality Assurance | All listed suppliers have passed ISO 9001, RoHS, and REACH compliance checks—critical for EU and North American markets. |

| Transparent MOQs & Pricing | Access to real-time wholesale pricing structures and minimum order quantities tailored for education-sector bulk buyers. |

| Language & Logistics Support | Direct English-speaking contacts and DDP (Delivered Duty Paid) shipping options streamline communication and reduce lead times. |

| Performance Track Record | Each supplier has a documented history of on-time delivery (>98% fulfillment rate) and client satisfaction. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Every hour spent vetting unverified suppliers is a delay in product development, production timelines, and time-to-market. With SourcifyChina’s Pro List, procurement managers gain immediate access to trusted Alnico magnet suppliers—engineered for precision, backed by compliance, and optimized for bulk educational equipment manufacturing.

Don’t risk supply chain disruptions or substandard materials. Leverage SourcifyChina’s industry-leading due diligence and make confident, data-driven sourcing decisions in 2026.

✅ Contact our sourcing specialists today to receive your exclusive Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can shorten your sourcing cycle by weeks—and protect your margins, quality standards, and reputation.

Act now. Source smarter. Trust verified.

—

SourcifyChina | Empowering Global Procurement with Precision Sourcing Solutions

Shenzhen, China | Est. 2014 | ISO-Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.