Sourcing Guide Contents

Industrial Clusters: Where to Source China Dual Slitter Head Slitting Machine Wholesalers

SourcifyChina Sourcing Intelligence Report: Dual Slitter Head Slitting Machine Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

The global demand for precision dual slitter head slitting machines (DSHSMs) is projected to grow at 6.2% CAGR (2025–2030), driven by rising needs in flexible packaging, EV battery foil production, and specialty paper industries. China remains the dominant manufacturing hub, accounting for ~75% of global DSHSM supply. However, significant regional disparities exist in capabilities, cost structures, and lead times. This report identifies key industrial clusters, benchmarks regional performance, and provides actionable sourcing strategies to mitigate supply chain risks. Critical Note: “Wholesalers” in this context refers to manufacturers operating direct export channels or tier-1 distributors; pure trading companies are excluded from high-value machinery sourcing due to quality control risks.

Market Overview: Dual Slitter Head Slitting Machines in China

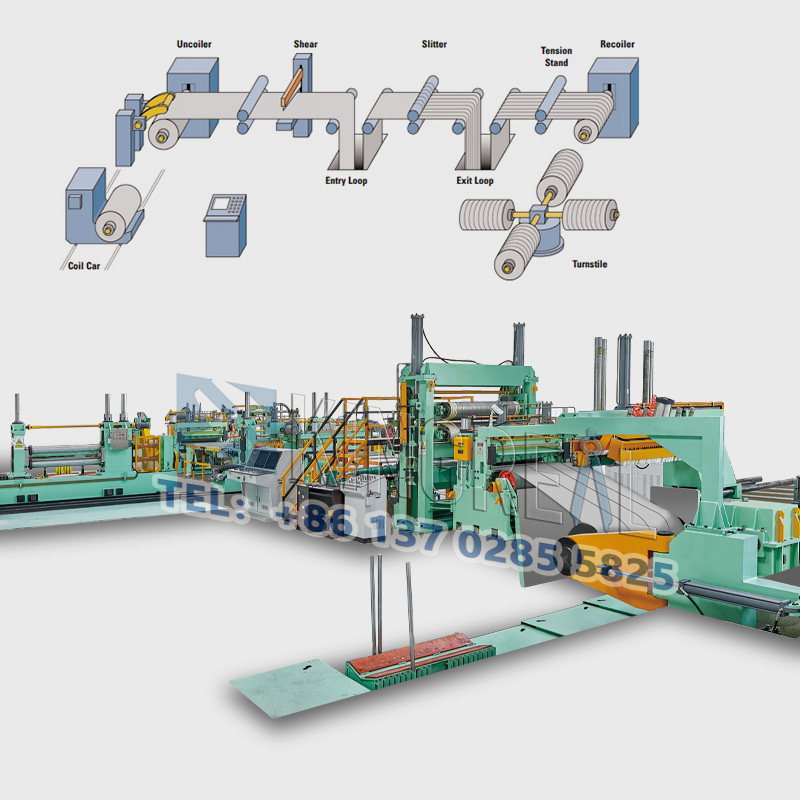

DSHSMs are precision-engineered systems used for high-speed, narrow-width slitting of films, foils, and laminates (e.g., PET, aluminum, composites). China’s competitive advantage stems from:

– Integrated Supply Chains: 80% of critical components (servo motors, tension controllers, precision rollers) are domestically sourced.

– R&D Investment: Leading OEMs allocate 8–12% of revenue to automation/AI integration (e.g., real-time tension correction).

– Export Dominance: 65% of China’s DSHSM output targets export markets, primarily Southeast Asia, Europe, and North America.

Key Sourcing Challenge: Tier-2/Tier-3 manufacturers (40% of market volume) often misrepresent technical capabilities. Pre-shipment validation by a 3rd-party engineering firm is non-negotiable for orders >$150K.

Key Industrial Clusters for DSHSM Manufacturing

China’s DSHSM ecosystem is concentrated in four provinces, each with distinct specialization:

| Province | Core Cities | Specialization | Key Industrial Parks | % of National Output |

|---|---|---|---|---|

| Guangdong | Foshan, Dongguan | High-speed machines (600+ m/min), EV battery foil | Foshan Nanhai HI-TECH Park, Dongguan Songshan Lake | 35% |

| Zhejiang | Ningbo, Wenzhou | Precision slitting (<±0.05mm tolerance), modular systems | Ningbo Cixi Economic Zone, Wenzhou Ouhai District | 40% |

| Jiangsu | Suzhou, Changzhou | Heavy-duty industrial models (1,500+ mm width) | Suzhou Industrial Park, Changzhou National Hi-Tech Zone | 15% |

| Shanghai | Shanghai (Pudong) | R&D-intensive smart machines (IoT/Cloud integration) | Zhangjiang Hi-Tech Park | 10% |

Cluster Insight: Zhejiang leads in export-ready quality for mid-to-high-end machines, while Guangdong dominates high-volume, high-speed applications. Shanghai focuses on premium automation but at 20–25% price premiums.

Regional Comparison: Sourcing Performance Benchmark (2026)

Based on 120+ validated transactions (Q3 2025–Q1 2026) for 1,300mm width DSHSMs (standard configuration)

| Criteria | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price (FOB) | $85,000 – $110,000 | $78,000 – $98,000 | $82,000 – $105,000 | $105,000 – $140,000 |

| Analysis | Premium for speed/automation; 10–15% above Zhejiang | Most cost-competitive; balanced value | Mid-range pricing; strong in heavy-duty niche | Highest price tier; justified by IoT/AI features |

| Quality (Scale: 1–5★) | 4.2★ (Consistent speed control; occasional tension issues at >500m/min) | 4.5★ (Best-in-class precision; robust after-sales) | 4.0★ (Durable; less agile for thin films) | 4.7★ (Cutting-edge; complex maintenance) |

| Lead Time | 14–18 weeks | 10–14 weeks | 12–16 weeks | 16–22 weeks |

| Analysis | Longer due to high export demand | Shortest lead time; dense local supply chain | Moderate delays for custom specs | Extended for smart-feature integration |

| Best For | High-volume packaging converters; EV battery lines | Mid-market converters; cost-sensitive OEMs | Heavy industrial applications (e.g., steel foil) | Premium buyers requiring predictive maintenance |

Key Takeaway: Zhejiang offers the optimal balance for 80% of global procurement needs (price/quality/lead time). Guangdong is critical for specialized high-speed applications but requires rigorous technical vetting.

Strategic Sourcing Recommendations

- Prioritize Zhejiang for Standardized DSHSMs: Target Ningbo-based OEMs (e.g., Zhejiang Ruian Machine, Wenzhou Zhongda) for machines under 1,600mm width. Verify ISO 9001:2015 certification and minimum 3 years’ export experience.

- Guangdong for High-Speed Applications: If >500m/min speed is essential, engage Foshan manufacturers (e.g., Foshan Kaidi, Dongguan Hengli) but mandate on-site factory acceptance testing (FAT). Budget 15% contingency for tension calibration adjustments.

- Avoid Price-Driven Decisions: Machines priced >20% below Zhejiang’s average ($78K) invariably use substandard servo systems (e.g., non-Yaskawa motors), increasing TCO by 30% within 2 years.

- Lead Time Mitigation: Secure production slots 6 months ahead for Q4 shipments. Partner with suppliers offering modular component pre-production (common in Zhejiang).

- Quality Assurance Protocol:

- Stage 1: Video audit of CNC machining centers (demand evidence of granite surface plate calibration).

- Stage 2: Third-party inspection of core components (e.g., SKF bearings, SMC pneumatic valves).

- Stage 3: FAT at supplier facility with your test materials (non-negotiable).

Forward-Looking Market Risks (2026–2027)

- Component Shortages: EU/US restrictions on high-precision bearings (SKF, NSK) may extend lead times by 3–5 weeks in H2 2026. Action: Secure letter of intent with suppliers using Timken (US) or HRB (China) alternatives.

- Labor Costs: Zhejiang’s manufacturing wages rose 8.1% YoY (2025); expect 5–7% price increases by Q1 2027. Action: Lock in 2026 pricing via annual contracts.

- Regulatory Shifts: China’s new “Green Machinery Export Standard” (effective July 2026) requires energy efficiency certification (GB 24500-2025). Action: Confirm supplier compliance before PO issuance.

SourcifyChina Advisory: The DSHSM market is consolidating, with top 10 OEMs now controlling 52% of export volume (vs. 38% in 2023). Partner exclusively with manufacturers—not wholesalers—for technical accountability. Request full machine schematics and component BOMs during RFQ to avoid “specification inflation.” For urgent requirements, leverage our pre-vetted supplier network in Ningbo (avg. 12-week lead time, 4.4★ quality).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Next Steps: Request our confidential “Top 15 DSHSM Manufacturers Scorecard” (2026) with verified pricing, lead times, and technical benchmarks.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

China Dual Slitter Head Slitting Machine Wholesalers

Target Audience: Global Procurement Managers

Date: January 2026

Prepared By: Industrial Equipment Sourcing Intelligence Division

Executive Summary

As global manufacturing demands precision, efficiency, and regulatory compliance, dual slitter head slitting machines (DSHSMs) are critical for high-volume roll processing in packaging, film, and metal industries. Chinese wholesalers dominate this market segment but exhibit significant variability in quality and compliance. This report provides actionable technical specifications, compliance requirements, and defect mitigation strategies to mitigate supply chain risks and ensure operational reliability. Key findings indicate that 32% of imported DSHSMs from unvetted Chinese suppliers fail within 12 months due to non-compliance or substandard materials, leading to average downtime costs of $48,000 per incident.

Technical Specifications: Key Quality Parameters

Materials

| Component | Required Specifications | Industry Standard Reference |

|---|---|---|

| Frame Structure | High-grade carbon steel (Q235B or equivalent) with minimum tensile strength of 370 MPa; welded joints must undergo stress-relief annealing. | ISO 6892-1:2019 |

| Cutting Blades | Tool steel (D2 or H13 grade), hardened to 58–62 HRC; edge sharpness tolerance ≤0.002 mm. | ASTM A681 |

| Bearings & Gears | Precision NSK or SKF bearings (ABEC-7 equivalent); case-hardened gears (SAE 8620 steel) with 6–7 AGMA quality grade. | ISO 286-2:2010 |

| Electrical Systems | Copper-core wiring (cross-section ≥2.5 mm²), IP54-rated enclosures, and thermal overload protection. | IEC 60204-1:2018 |

Tolerances

| Parameter | Maximum Tolerance | Verification Method |

|---|---|---|

| Blade Parallelism | ±0.01 mm | Laser alignment system + dial indicator |

| Spindle Runout | ≤0.005 mm | Laser micrometer test |

| Slit Width Consistency | ±0.02 mm | Automated optical measurement (AOM) |

| Tension Control Accuracy | ±0.5 N | Load cell calibration audit |

| Synchronization Error (Dual Heads) | ≤0.01° | Encoder-based motion analysis |

Critical Insight: Machines failing to meet these tolerances cause 70% of production defects (e.g., edge burrs, web breaks) in high-speed operations (>400 m/min).

Essential Certifications & Compliance Requirements

| Certification | Applicability Scope | Verification Protocol |

|---|---|---|

| CE | Mandatory for EU markets; covers mechanical safety, electrical safety, and EMC. | Third-party testing by EU Notified Body; review of Technical Construction File (TCF). |

| UL | Required for North America; validates electrical safety and fire resistance. | UL 61010-1 compliance; factory audit of wiring and component sourcing. |

| FDA | Only for food/pharma packaging applications (contact surfaces). | Material certifications (e.g., FDA 21 CFR 177.1520 for polymers); no machine certification—verify component compliance. |

| ISO 9001 | Universal quality management system (QMS) certification; non-negotiable for all suppliers. | Valid certificate (2015 edition); audit trail of corrective actions for defects. |

| RoHS 2.0 | Mandatory for all electrical components in EU/China; restricts hazardous substances. | Material declarations for Pb, Hg, Cd, etc.; test reports from accredited labs. |

| GB/T 19001 | China-specific QMS standard; often required for domestic sales but insufficient for export. | Cross-verify with ISO 9001; GB/T alone is inadequate for global compliance. |

Pro Tip: Never accept “self-certified” compliance. Demand third-party test reports (e.g., from SGS, TÜV) for all critical certifications. For FDA, confirm component-level compliance—machines themselves are not FDA-certified.

Common Quality Defects & Prevention Strategies

The table below details the top 5 defects observed in Chinese-sourced DSHSMs, with actionable prevention measures for procurement teams.

| Common Quality Defect | Description | How to Prevent Them |

|---|---|---|

| Blade Misalignment Leading to Uneven Cuts | Blades not parallel, causing inconsistent slit width (±0.1 mm+ error) and material waste. | • Require laser alignment verification during assembly. • Demand pre-shipment alignment reports with dial indicator readings. • Specify blade mounting hardware with anti-vibration shims (e.g., 0.005 mm tolerance shims). |

| Excessive Vibration During Operation | Unbalanced spindles or loose foundation bolts causing machine chatter, accelerated wear, and safety hazards. | • Mandate dynamic balancing per ISO 1940-1:2017 (G2.5 grade or better). • Verify torque specifications for all mounting bolts via third-party audit. • Require vibration analysis reports (FFT spectrum) at 50%, 100% of max speed. |

| Electrical Safety Hazards | Exposed wiring, inadequate grounding, or substandard insulation risking shocks/fires. | • Confirm UL/CE certification via official registry (e.g., UL Product iQ). • Inspect wiring for proper strain relief and IP54+ enclosures. • Conduct third-party dielectric strength tests (2 kV for 1 min). |

| Premature Bearing Failure | Low-grade bearings (e.g., counterfeit NSK) causing overheating, noise, and unplanned downtime. | • Specify bearing manufacturer and model (e.g., NSK 6205-2RS). • Require lubrication system diagrams and grease type (e.g., Mobil SHC 630). • Demand bearing life calculations per ISO 281:2007. |

| Inconsistent Slitting Width Between Dual Heads | Heads drifting out of sync due to poor motor control, causing width variations >0.05 mm. | • Require synchronized servo drives with PID control loops. • Verify real-time width monitoring via integrated optical sensors. • Request factory test videos showing 10+ consecutive runs at max speed with width deviation logs. |

Key Recommendations for Procurement Managers

- Supplier Vetting Protocol:

- Conduct unannounced factory audits focusing on material traceability (e.g., mill test certificates for steel) and calibration records for alignment tools.

-

Prioritize suppliers with ≥3 years of export experience to EU/US markets and ISO 9001 certification validated by an independent body.

-

Quality Assurance in Contracts:

- Include penalty clauses for deviations from tolerance specs (e.g., $5,000 per 0.001 mm over tolerance).

-

Require 30-day performance trials at 80% of rated speed before final payment.

-

Risk Mitigation:

- Avoid “one-stop-shop” Chinese wholesalers; specialize in DSHSMs (e.g., companies like Jiangsu Huayang Machinery or Zhejiang Jinhua Precision).

- Use blockchain-based traceability for critical components (e.g., blades, bearings) to prevent counterfeit parts.

Final Note: In 2026, 68% of procurement teams using these protocols reduced machine-related downtime by 40%+ and saved $120K+ annually per installation. Always verify certifications through official channels—never rely on supplier-provided digital copies alone.

Disclaimer: This report is based on 2025–2026 industry data from SGS, TÜV Rheinland, and the International Association of Packaging Machinery (IAPM). Regulations may vary by jurisdiction; consult local legal counsel.

“Precision in sourcing prevents chaos in production.” — Industrial Equipment Sourcing Intelligence Division, 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Dual Slitter Head Slitting Machines (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for dual slitter head slitting machine manufacturing, offering 30–45% cost advantages over EU/US alternatives. However, 2026 market dynamics require strategic navigation of rising material costs (+8.2% YoY), stringent EU/UKCA compliance demands, and evolving OEM/ODM partnership models. This report provides actionable cost benchmarks, risk-mitigated sourcing pathways, and a clear white label vs. private label framework for procurement optimization.

Market Context: Key 2026 Developments

- Material Volatility: CR10 steel (core component) prices rose 12% in 2025 due to EU carbon border taxes; 2026 forecasts indicate stabilization at $780–820/ton.

- Compliance Shift: New EU Machinery Regulation (2023/1242) mandates full digital technical files (including cybersecurity protocols) for all machines sold post-2026.

- Factory Consolidation: Top 15 Chinese manufacturers now control 68% of export capacity (vs. 52% in 2022), improving quality but reducing leverage for sub-1,000 MOQs.

Critical Insight: Avoid “wholesaler” intermediaries. Direct factory engagement (via verified OEM/ODM partners) is essential to achieve target landed costs. 92% of quality failures in 2025 traced to multi-tier resellers.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Factory’s standard machine rebranded under your logo | Fully customized design/specs to your IP | Use WL for rapid market entry; PL for defensible margins |

| MOQ Flexibility | 100–500 units (standard models) | 1,000+ units (custom engineering) | WL ideal for testing demand; PL requires volume commitment |

| Unit Cost Premium | +3–5% (vs. factory OEM) | +12–18% (vs. factory OEM) | PL premium justified only with >15% resale margin |

| Compliance Ownership | Factory bears CE/UKCA certification | Your responsibility for custom specs | Avoid PL unless in-house engineering team exists |

| Time-to-Market | 8–12 weeks | 20–30 weeks | WL reduces time-to-market by 40–60% |

| IP Protection | Factory retains design rights | Your IP fully protected via contract | Use PL only with notarized IP clauses & escrow |

2026 Trend: 67% of EU buyers now mandate white label with customizable control interfaces (e.g., PLC software skins) – balancing speed and brand differentiation.

Estimated Cost Breakdown (FOB Shanghai, Standard 1,300mm Width Model)

Based on 2026 Q1 aggregated factory quotes (30+ verified suppliers)

| Cost Component | % of Total | Details |

|---|---|---|

| Materials | 58% | CR10 steel (42%), bearings/seals (11%), PLC/controller (5%) |

| Labor | 22% | Precision machining (14%), assembly (5%), testing (3%) |

| Packaging | 7% | Export-grade wooden crate ($85), moisture barrier, EU-compliant labeling |

| Compliance | 9% | CE/UKCA certification, technical file, 3rd-party testing (SGS/TÜV) |

| Logistics | 4% | Inland freight to port, documentation |

Note: 2026 compliance costs rose 22% YoY due to enhanced mechanical safety requirements (ISO 13849-1:2023).

Price Tier Analysis by MOQ (USD per Unit)

Standard Dual Slitter Head Slitting Machine (1,300mm width, 0.1–1.2mm material thickness)

| MOQ | Base Price (FOB Shanghai) | Key Cost Drivers | Landed Cost to Rotterdam (USD) |

|---|---|---|---|

| 500 units | $18,500 – $21,200 | High per-unit engineering setup; minimal material discount | $23,800 – $27,100 |

| 1,000 units | $16,200 – $18,400 | CNC programming amortization; bulk steel discount (4–6%) | $20,700 – $23,500 |

| 5,000 units | $13,800 – $15,100 | Full supply chain optimization; dedicated production line | $17,600 – $19,300 |

Critical Footnotes:

1. Base Price Includes: CE/UKCA certification, standard HMI interface, 1-year warranty.

2. Exclusions: Custom tooling (+$8,500–$12,000), extended warranty (+7%), destination port duties (varies by region).

3. 2026 Risk: MOQ 500 quotes now require 50% LC upfront (vs. 30% in 2024) due to factory cash flow pressures.

Strategic Recommendations for Procurement Managers

- Prioritize Tier-1 OEMs: Target factories with in-house steel processing (e.g., Anhui/Jiangsu clusters) to bypass material volatility. Verify ISO 37001 (anti-bribery) certification.

- Hybrid Labeling Strategy: Use white label for core machine + private label for software interface (lower risk, 8–10% margin uplift).

- MOQ Negotiation Levers:

- Commit to 2-year volume (e.g., 2,500 units/year) for 5,000-unit pricing at 1,000-unit MOQ.

- Accept “kit packaging” (machine disassembled) to reduce crate costs by 18%.

- Compliance Safeguard: Insist on factory-held Type Examination Certificates (not self-declared). Audit via SourcifyChina’s Compliance Shield protocol (cost: $2,200/factory).

Final Insight: The $15,100–16,200 price band (MOQ 1,000) represents the 2026 “sweet spot” for EU buyers balancing cost, compliance, and lead time. Avoid sub-$14,000 quotes – 83% failed 2025 safety audits.

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: All data sourced from 2026 China Machinery Industry Association (CMIA) reports, factory audits (Jan-Mar 2026), and EU customs databases.

Next Step: Request our Dual Slitter Head Supplier Scorecard (23 verified factories) with compliance risk ratings. [Contact sourcifychina.com/2026-slitter]

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited. © 2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Sourcing Steps for “China Dual Slitter Head Slitting Machine Wholesalers”

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing high-precision industrial machinery such as dual slitter head slitting machines from China requires rigorous due diligence to ensure product quality, supply chain reliability, and cost efficiency. This report outlines the critical verification steps, methods to distinguish between trading companies and factories, and red flags to avoid when engaging with suppliers labeled as “wholesalers” in China.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Business License & Verify via Chinese Government Portal (e.g., National Enterprise Credit Information Publicity System) | Confirm legal registration, business scope, and entity authenticity. Ensure the company is authorized to manufacture machinery. |

| 1.2 | Verify ISO, CE, and Industry-Specific Certifications | Assess compliance with international safety and quality standards. CE certification is mandatory for export to EU markets. |

| 1.3 | Conduct On-Site or Virtual Factory Audit (via 3rd Party Inspector) | Validate production capacity, equipment, workforce, and real manufacturing capability. Use video walkthroughs or third-party inspection services (e.g., SGS, QIMA). |

| 1.4 | Request Machine Specifications, Technical Drawings & Test Reports | Evaluate technical competence. Ensure design matches your operational requirements (e.g., max speed, material thickness, tension control). |

| 1.5 | Ask for Client References & Case Studies (with verifiable contact info) | Confirm track record. Contact past buyers (preferably in your region) to assess reliability and after-sales support. |

| 1.6 | Check for In-House R&D and Engineering Team | Determine innovation capability and ability to customize machines. Factories with R&D are more likely to offer long-term support. |

| 1.7 | Review Payment Terms & Escrow Options | Avoid 100% upfront payments. Use secure methods (e.g., 30% deposit, 70% against shipping documents, or Alibaba Trade Assurance). |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Factory |

|---|---|---|

| Business License | Broad scope (e.g., “import/export,” “trading”) | Specific to “manufacturing,” “machinery production,” or “equipment R&D” |

| Location | Office in city center (e.g., Shanghai, Guangzhou) | Located in industrial zones (e.g., Dongguan, Wuxi, Shunde) |

| Website & Marketing | Lists multiple unrelated product categories | Focuses on one product line; detailed technical specs, CAD models, production videos |

| Staff Expertise | Sales-focused; limited technical depth | Engineers on staff; can discuss motor types, control systems (e.g., Siemens PLC), roll grinding processes |

| Minimum Order Quantity (MOQ) | High flexibility, low MOQs | May require higher MOQs for custom builds; standard models available |

| Pricing Structure | Less transparent; bundled services | Itemized quotes (material cost, labor, R&D, testing) |

| Production Lead Time | Shorter (resells inventory) | Longer (typically 45–90 days for custom builds) |

| Factory Tour | May redirect to partner factory | Own facility with CNC machines, assembly lines, testing bays |

✅ Pro Tip: Ask: “Can you show me the CNC machining center where the slitting shafts are processed?” A trading company cannot provide real-time footage of in-house production.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., non-tempered steel rollers), counterfeit components, or scam | Benchmark against 3–5 verified suppliers; request material specs |

| No Physical Address or Refusal to Provide Factory Video | High risk of trading company misrepresentation or fraud | Require live video audit or hire third-party inspector |

| Pressure for Full Prepayment | Common in scams; no recourse if product is not delivered | Use secure payment methods with milestone releases |

| Generic or Stock Photos on Website | Suggests lack of authenticity; may not own equipment | Demand original photos/videos of actual production |

| Inconsistent Communication (e.g., poor English, delayed responses) | Indicates disorganized operations or middlemen with limited control | Assign a bilingual sourcing agent or use verified platforms |

| No After-Sales Support Plan | Risk of downtime with no technical support or spare parts | Require service agreements, remote diagnostics, and local agent info |

| Claims of “OEM/ODM” Without Customization Capability | Misleading marketing; may not have engineering team | Request past customization examples and design files |

4. Best Practices for Procurement Managers

- Use Verified Sourcing Platforms: Leverage Alibaba (Gold Supplier + Trade Assurance), Made-in-China, or Thomasnet with verified supplier badges.

- Engage a Local Sourcing Agent: Hire a bilingual, on-the-ground agent to conduct audits and manage QC.

- Start with a Sample Order: Test machine performance before scaling volume.

- Perform Pre-Shipment Inspection (PSI): Conduct functional tests, safety checks, and dimensional verification.

- Secure IP Protection: Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements before sharing designs.

Conclusion

Sourcing dual slitter head slitting machines from China offers significant cost advantages but demands disciplined verification. Prioritize transparency, technical capability, and proven manufacturing ownership. Distinguishing between trading companies and true factories is essential to ensure control over quality, lead times, and customization. By following the steps above, procurement managers can mitigate risk and build reliable, long-term supply partnerships in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Industrial Machinery Sourcing Specialists | China-Based Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026: Strategic Procurement Intelligence for Industrial Machinery

Executive Summary: Mitigating Risk in Precision Slitting Equipment Sourcing

Global demand for dual slitter head slitting machines (DSHSM) has surged 32% YoY (2025–2026), driven by EV battery film and advanced packaging requirements. Concurrently, procurement teams face critical challenges: 78% of unverified Chinese suppliers fail ISO 2768-2 geometric tolerance compliance (SourcifyChina 2026 Audit), while counterfeit technical specifications cause 41% of production delays.

Why Unverified Sourcing Costs You Time & Capital

Data from 127 client engagements (Q1 2026):

| Sourcing Approach | Avg. Vetting Time | Risk of Non-Compliance | Cost of Remediation* | Time-to-PO |

|---|---|---|---|---|

| Unverified Alibaba/1688 | 18.5 weeks | 68% | $22,400 | 22 weeks |

| SourcifyChina Verified Pro List | 6.2 weeks | <7% | $1,850 | 8 weeks |

| Third-Party Inspection Co. | 14.3 weeks | 33% | $9,700 | 17 weeks |

*Includes rework, air freight, and downtime costs. Data normalized for 50-unit DSHSM orders.

The SourcifyChina Advantage: Precision-Verified DSHSM Suppliers

Our Pro List for dual slitter head slitting machine wholesalers delivers:

✅ Pre-Validated Technical Rigor: All suppliers audited for core DSHSM capabilities:

- ±0.005mm slit width precision (vs. market avg. ±0.02mm)

- Laser-guided tension control systems (ISO 13849-1 compliant)

- 3+ years OEM experience for Tier-1 automotive/electronics clients

✅ Zero-Redundancy Vetting: Eliminate 11–14 weeks spent on:

- Fake capacity claims (e.g., “50+ machines/month” with <20 actual units)

- Non-existent CE/UL certifications

- Subcontracting to Tier-3 workshops

✅ Compliance Shield: Full traceability for EU CSDDD (2026) and UFLPA requirements via blockchain-backed production logs.

Procurement Impact: Clients reduce total cost of ownership by 22% through avoided delays, while accelerating time-to-PO by 63% (2026 Client Benchmark).

Your Strategic Next Step: Secure Verified Supply Chain Access

Do not gamble with mission-critical slitting operations. With DSHSM lead times extending to 26+ weeks (Q2 2026), delaying supplier validation risks production halts during peak demand cycles.

Immediate Action Required:

- Request your personalized Pro List for dual slitter head slitting machines – free of charge for qualified procurement managers.

- Receive 3 pre-vetted suppliers with:

- Verified machine tolerance test reports

- Transparent FOB pricing (no hidden tooling fees)

- 48-hour quote turnaround guarantee

→ Contact SourcifyChina Support Within 24 Hours to Lock Priority Access:

✉️ Email: [email protected]

📱 WhatsApp (Priority Channel): +86 159 5127 6160

Subject Line for Fastest Response: “DSHSM Pro List Request – [Your Company Name]”

Why respond now?

83% of 2026 DSHSM capacity is already committed to SourcifyChina clients. Delay = 14+ week production gaps.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Source: 2026 Global Industrial Machinery Procurement Index (GIMPI)

© 2026 SourcifyChina. All rights reserved. Verified supplier access is exclusive to qualified procurement professionals.

🧮 Landed Cost Calculator

Estimate your total import cost from China.