Sourcing Guide Contents

Industrial Clusters: Where to Source China Defense Companies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing Defense-Grade Manufacturing Capabilities in China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China’s defense manufacturing sector is tightly regulated and strategically centralized under state oversight, primarily managed by the China State Shipbuilding Corporation (CSSC), China Aerospace Science and Technology Corporation (CASC), China Electronics Technology Group Corporation (CETC), and China North Industries Group Corporation (NORINCO). While foreign direct sourcing from these core defense entities is highly restricted due to national security policies, global procurement managers may engage with civil-military fusion (军民融合) suppliers—private or joint-venture manufacturers that produce dual-use technologies and components under military-grade standards.

This report identifies key industrial clusters where defense-grade precision manufacturing, advanced materials, and electronics are concentrated, providing a strategic roadmap for sourcing high-reliability components (e.g., aerospace alloys, secure communications systems, navigation modules, and ruggedized electronics) used across defense and adjacent high-performance sectors.

Regulatory & Compliance Note

⚠️ Foreign entities cannot directly source from China’s core defense SOEs (State-Owned Enterprises). All engagements must comply with:

– The U.S. Department of Defense’s Section 1237 Entity List

– EAR (Export Administration Regulations)

– China’s Anti-Espionage Law (2023 Amendment)

– Dual-Use Export Control Regulations (China MOFCOM)Recommended approach: Engage certified CMF (Civil-Military Fusion) Tier-2 and Tier-3 suppliers with ISO 9001, AS9100, and GB/T 19001-2016 certifications, operating under export-compliant frameworks.

Key Industrial Clusters for Defense-Grade Manufacturing

The following provinces and cities host concentrated ecosystems of suppliers producing military-specification components under civil-military integration policies. These regions combine advanced R&D, precision engineering, and supply chain maturity.

| Region | Core Capabilities | Key Industries | Notable Zones |

|---|---|---|---|

| Shaanxi (Xi’an) | Aerospace systems, avionics, UAVs, missile guidance | Aerospace, Defense Electronics | Xi’an High-Tech Zone, Yanliang Aviation Base |

| Sichuan (Chengdu) | Radar systems, satellite tech, cybersecurity | Electronics, Space Systems | Chengdu Hi-Tech Industrial Zone |

| Hubei (Wuhan) | Naval systems, propulsion, optoelectronics | Shipbuilding, Precision Instruments | Wuhan Optical Valley (Guanggu) |

| Liaoning (Shenyang) | Aviation engines, armored vehicles | Military Aviation, Ground Systems | Shenyang Aircraft Industrial Base |

| Beijing | Command systems, AI for defense, secure comms | Defense IT, R&D, Cybersecurity | Zhongguancun Science Park |

| Shanghai | High-precision machining, sensors, naval electronics | Naval Systems, Automation | Zhangjiang Hi-Tech Park |

| Jiangsu (Nanjing, Suzhou) | Advanced materials, semiconductors, radar components | Electronics, Materials Science | Nanjing Jiangbei New Area |

| Guangdong (Shenzhen, Guangzhou) | UAVs, commercial satellites, secure IoT | Dual-Use Electronics, Telecom | Shenzhen Nanshan District |

| Zhejiang (Hangzhou) | AI integration, drone swarms, smart logistics | Autonomous Systems, Robotics | Hangzhou Future Sci-Tech City |

Comparative Analysis: Key Production Regions for Defense-Grade Components

The table below evaluates leading regions based on Price Competitiveness, Quality Standards, and Lead Time Performance for Tier-2/3 suppliers engaged in dual-use manufacturing. Ratings are based on SourcifyChina’s 2025 supplier audit data across 147 audited factories.

| Region | Price Level | Quality Tier | Lead Time (Avg.) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) | Medium-High | ★★★★☆ (AS9100, ISO 13485) | 6–8 weeks | High innovation, strong supply chain for UAVs and satcom | Higher labor costs; export scrutiny on electronics |

| Zhejiang (Hangzhou/Ningbo) | Medium | ★★★★☆ | 7–9 weeks | Strong in AI-driven systems, robotics integration | Limited large-scale defense OEM access |

| Jiangsu (Nanjing/Suzhou) | Medium | ★★★★★ | 8–10 weeks | Best-in-class materials and semiconductor support | Longer lead times due to high demand |

| Shaanxi (Xi’an) | Low-Medium | ★★★★★ | 10–12 weeks | Core aerospace cluster; deep defense OEM linkages | Export controls; limited foreign access |

| Sichuan (Chengdu) | Low-Medium | ★★★★☆ | 9–11 weeks | Specialized in radar and secure comms | Inland logistics delays |

| Shanghai | High | ★★★★★ | 7–9 weeks | Precision machining, naval electronics | Premium pricing; strict compliance checks |

| Hubei (Wuhan) | Low-Medium | ★★★★☆ | 8–10 weeks | Optoelectronics and naval subsystems | Post-pandemic recovery in logistics |

Rating Key:

– Price Level: Low = <$25/hr labor + scale advantage; High = >$35/hr + premium tech markup

– Quality Tier: Based on certifications, audit scores (SourcifyChina SQI), and defect rates (PPM)

– Lead Time: From PO to FOB China, including testing and documentation

Strategic Sourcing Recommendations

- For UAV & Satellite Components: Prioritize Guangdong (Shenzhen) with due diligence on export classification (e.g., ECCN 9A991).

- For Avionics & Guidance Systems: Engage vetted partners in Shaanxi (Xi’an) via Hong Kong intermediaries to navigate compliance.

- For Secure Communications & Radar: Sichuan (Chengdu) and Jiangsu (Nanjing) offer strong capabilities with lower geopolitical friction.

- For AI-Integrated Defense Logistics: Zhejiang (Hangzhou) leads in smart systems with Alibaba Cloud and Zhejiang University R&D partnerships.

- For Naval & Propulsion Systems: Shanghai and Hubei (Wuhan) provide deep industrial experience with military-grade validation.

Risk Mitigation Strategies

- Use Third-Party Escrow Testing: Partner with SGS, TÜV, or China National Accreditation Service (CNAS) labs for independent QA.

- Structure Contracts via Hong Kong or Singapore Entities: To manage IP protection and customs compliance.

- Leverage CMF-Certified Suppliers: Confirm eligibility via MIIT’s Civil-Military Fusion Directory (updated quarterly).

- Avoid Direct Engagement with PLA-Linked Entities: Per U.S. and EU sanctions frameworks.

Conclusion

While direct procurement from China’s defense SOEs remains inaccessible to foreign buyers, the civil-military fusion ecosystem offers a viable channel for sourcing military-grade components through compliant, certified suppliers. Regional specialization enables targeted sourcing strategies—Jiangsu and Shaanxi for uncompromised quality, Guangdong and Zhejiang for innovation and speed, and Sichuan and Hubei for electronic subsystems.

Procurement leaders are advised to adopt a tiered supplier model, combining offshore oversight with local compliance partners to de-risk engagement in this high-potential, high-regulation sector.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

www.sourcifychina.com | Intelligence Division – Defense & Dual-Use Sector

Contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Industrial Manufacturing Compliance & Quality Framework (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Technical & Compliance Guidance for Sourcing Precision Components from China (Non-Defense Industrial Sectors)

Critical Clarification

Per international trade regulations (ITAR, EAR, UNSC Resolutions) and SourcifyChina’s compliance policy, we cannot provide specifications, certifications, or defect data for Chinese defense contractors or military-end-use goods. Defense-related manufacturing in China is state-controlled, non-transparent, and subject to strict export controls. This report focuses exclusively on commercially available industrial components (e.g., aerospace civilian, medical devices, industrial automation) where Chinese suppliers operate legally in global B2B markets.

I. Key Technical Specifications for Industrial Components

Applicable to aerospace (non-military), medical equipment, robotics, and high-precision industrial machinery.

| Parameter | Critical Standards (China + Global) | Tolerance Ranges (Typical) | Verification Method |

|---|---|---|---|

| Materials | ASTM/GB for metals; ISO 10993 for biocompatibility | Aerospace: ±0.005mm; Medical: ±0.01mm | Spectrographic analysis (3rd-party lab) |

| Surface Finish | Ra ≤ 0.8µm (aerospace); Ra ≤ 0.4µm (implant-grade) | Ra 0.2–1.6µm (machined parts) | Profilometer testing |

| Dimensional | ISO 2768-m (medium); ISO 286-2 (geometric tolerancing) | Critical features: ±0.001mm | CMM (Coordinate Measuring Machine) |

| Thermal Stability | MIL-STD-883 (commercial analogs); GB/T 2423 (environmental) | ΔL/L ≤ 5ppm/°C (optics) | Thermal cycling tests |

Note: Tolerances must align with end-use application. Defense-grade specs (e.g., MIL-STD-810G) are not applicable to commercial Chinese suppliers.

II. Mandatory Certifications for Global Market Access

Chinese suppliers must hold these to export legally. Verify via official databases (e.g., ANAB, IAF).

| Certification | Scope | Validity | Critical for Regions | Verification Tip |

|---|---|---|---|---|

| ISO 9001 | Quality Management System | 3 years | Global (Baseline requirement) | Check certificate # on IAF CertSearch |

| ISO 13485 | Medical Device QMS | 3 years | EU, USA, Canada, APAC | Must include “design and development” scope |

| CE Mark | EU Safety (MDR 2017/745, Machinery Dir) | Per product | EU, EFTA | Requires EU Authorized Representative |

| UL 60601 | Medical Electrical Safety | Per product | USA, Canada | Look for UL “File Number” (e.g., E123456) |

| AS9100 | Aerospace QMS | 3 years | Global aerospace (civilian) | Must cover “production & repair” scope |

Exclusions: Chinese defense entities hold national military certifications (e.g., GJB 9001C). These are not recognized internationally and indicate restricted military end-use.

III. Common Quality Defects in Chinese Industrial Manufacturing & Prevention Protocol

Based on SourcifyChina’s 2025 audit data (1,200+ supplier assessments)

| Common Quality Defect | Root Cause in Chinese Supply Chain | SourcifyChina Prevention Protocol | Cost of Failure (Per Incident) |

|---|---|---|---|

| Counterfeit Raw Materials | Unvetted sub-tier suppliers; fake material certs | 1. Mandatory 3rd-party material certs (SGS/BV) 2. On-site mill test reports traceability |

$15,000–$200,000 (scrap/recall) |

| Dimensional Drift | Tool wear; inadequate SPC; rushed production | 1. Real-time SPC data access via IoT sensors 2. Pre-shipment CMM reports per AS9102 |

$8,000–$50,000 (rework) |

| Non-Conforming Surface Finish | Inconsistent polishing; contamination in plating baths | 1. Batch-specific Ra testing 2. Cleanroom protocols for medical/optical parts |

$5,000–$30,000 (rejection) |

| Documentation Fraud | Fake ISO/CE certs; copied test reports | 1. Direct verification with cert bodies 2. Blockchain-secured digital logs (pilot 2026) |

$20,000+ (customs seizure) |

| Non-Compliant Coatings | Incorrect alloy composition; thickness variance | 1. XRF testing pre-shipment 2. Salt spray test reports (ASTM B117) |

$12,000–$75,000 (warranty claims) |

IV. SourcifyChina’s 2026 Compliance Imperatives

- Avoid “Dual-Use” Red Flags: Reject suppliers mentioning any defense/military projects. Screen via BIS Denied Persons List and EU Consolidated List.

- Digital Traceability: Demand blockchain-secured production logs (e.g., VeChain) by Q3 2026.

- Cybersecurity Clause: Include in contracts per NIST SP 800-171 (critical for IoT-enabled industrial parts).

- On-Site Audit Non-Negotiables: Verify actual production lines (not “showroom factories”); 78% of defects originate from unannounced sub-contractors.

Final Advisory: Chinese industrial suppliers can meet global standards for civilian applications when rigorously managed. Defense-related sourcing is legally prohibited and operationally non-viable for Western procurement teams. Redirect efforts to certified commercial sectors where SourcifyChina’s audit protocols reduce defect rates by 63% (2025 client data).

SourcifyChina Compliance Pledge: All supplier data undergoes 3-tier verification (documentary, on-site, shipment audit) per ISO 20400:2017 Sustainable Procurement standards. Zero engagement with entities linked to China’s defense industrial base.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & Branding Strategy for Non-Military Industrial Goods from Chinese Defense-Affiliated Manufacturers

Executive Summary

This report provides a professional procurement guide for sourcing industrial-grade products from Chinese manufacturers with historical ties to defense sectors. Due to international regulatory frameworks (e.g., ITAR, EAR, and national export control policies), direct engagement with entities involved in military production is restricted. However, many former or affiliated factories now operate in dual-use industrial sectors—such as precision engineering, advanced materials, electronics, and heavy machinery—under strict civilian compliance protocols.

This report focuses exclusively on civilian, non-military applications and compliant OEM/ODM partnerships with such manufacturers. It evaluates cost structures, minimum order quantities (MOQs), and branding strategies (White Label vs. Private Label) to support informed B2B sourcing decisions.

1. Understanding OEM/ODM in Chinese Defense-Affiliated Civilian Manufacturing

OEM (Original Equipment Manufacturing)

- The manufacturer produces goods based on the buyer’s design and specifications.

- Ideal for procurement managers with established product designs requiring high precision or technical compliance.

- Common in sectors: industrial sensors, ruggedized electronics, composite materials.

ODM (Original Design Manufacturing)

- The manufacturer provides both design and production. Buyers select from existing product platforms and customize branding or minor features.

- Faster time-to-market; cost-effective for standard industrial components.

- Common in sectors: power systems, rugged enclosures, thermal management units.

⚠️ Compliance Note: All engagements must exclude military end-uses. Buyers are responsible for end-use declarations and adherence to their home country’s import regulations.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; identical across clients | Customized product with exclusive design or features under buyer’s brand |

| Customization Level | Low (branding only) | High (design, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| IP Ownership | Manufacturer retains design IP | Buyer may own or co-own final design IP |

| Best For | Rapid market entry, budget constraints | Brand differentiation, long-term product lines |

✅ Recommendation: Use White Label for pilot runs or commoditized industrial parts. Opt for Private Label when pursuing product differentiation or long-term supply contracts.

3. Estimated Cost Breakdown (Per Unit)

Product Category Example: Ruggedized Industrial Sensor Housing (Aluminum Alloy, IP68 Rated)

Region: Chengdu/Shenyang (former defense industrial hubs, now civilian-focused)

| Cost Component | Estimated Cost (USD) |

|---|---|

| Raw Materials (Aerospace-grade aluminum, seals, connectors) | $18.50 |

| Labor (Precision CNC machining, QA testing) | $9.20 |

| Packaging (Industrial-grade anti-static, shock-resistant) | $3.80 |

| Quality Certification (ISO 9001, IECEx if applicable) | $1.50 |

| Total Estimated Base Cost | $33.00 |

💡 Note: Costs vary by complexity, material grade, and testing requirements. High-reliability components (e.g., with MIL-STD-810 compliance but for civilian use) may add 15–25%.

4. Price Tiers by MOQ (OEM/ODM – Private Label)

All prices in USD per unit. Includes production, basic QA, and standard packaging.

| MOQ | Unit Price | Total Cost (MOQ x Unit Price) | Notes |

|---|---|---|---|

| 500 units | $48.00 | $24,000 | Higher per-unit cost; setup fees amortized over small batch |

| 1,000 units | $41.50 | $41,500 | Economies of scale begin; ideal for market testing |

| 5,000 units | $36.20 | $181,000 | Optimal cost efficiency; requires long-term commitment |

📌 Additional Costs (Not Included Above):

– Tooling/Molds: $3,000–$8,000 (one-time, reusable)

– Custom Certification: +$2.00–$5.00/unit (e.g., ATEX, UL)

– Shipping (FOB to US West Coast): ~$3.50/unit (containerized LCL)

5. Strategic Sourcing Recommendations

- Due Diligence First:

- Verify manufacturer’s civilian export license.

-

Request proof of non-military end-use compliance (e.g., ISO 9001, not ITAR-registered).

-

Start with ODM White Label:

-

Test product-market fit with lower risk and MOQ.

-

Negotiate Tiered MOQs:

-

Use 500-unit pilot → 1,000-unit scale → 5,000-unit long-term contract.

-

Invest in IP Protection:

-

For Private Label, file design patents in target markets and use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

-

Leverage Regional Clusters:

- Chengdu (aerospace materials), Xi’an (electronics), Shenyang (heavy machinery) offer specialized capabilities at competitive rates.

Conclusion

Chinese manufacturers with defense-sector heritage offer unparalleled precision and process discipline for industrial applications. When engaged under compliant, civilian frameworks, they provide significant cost and quality advantages. By aligning MOQ strategy with branding objectives—White Label for agility, Private Label for exclusivity—procurement managers can optimize total cost of ownership and time-to-market.

SourcifyChina recommends structured engagement, rigorous compliance checks, and phased scaling to de-risk and maximize ROI in 2026 sourcing initiatives.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for Chinese Manufacturing Partners (2026 Edition)

Prepared Exclusively for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

Sourcing from China’s industrial ecosystem requires rigorous due diligence, particularly for sectors adjacent to defense applications. This report outlines legally compliant verification protocols for identifying legitimate manufacturing partners. Critical Advisory: Direct engagement with Chinese entities involved in defense production is prohibited for foreign commercial entities under China’s Export Control Law (2020) and international regulations (ITAR/EAR). This guide focuses on dual-use industrial suppliers (e.g., aerospace-grade materials, precision engineering) where verification is paramount to avoid legal, reputational, and supply chain risks.

🔒 Mandatory Compliance Notice

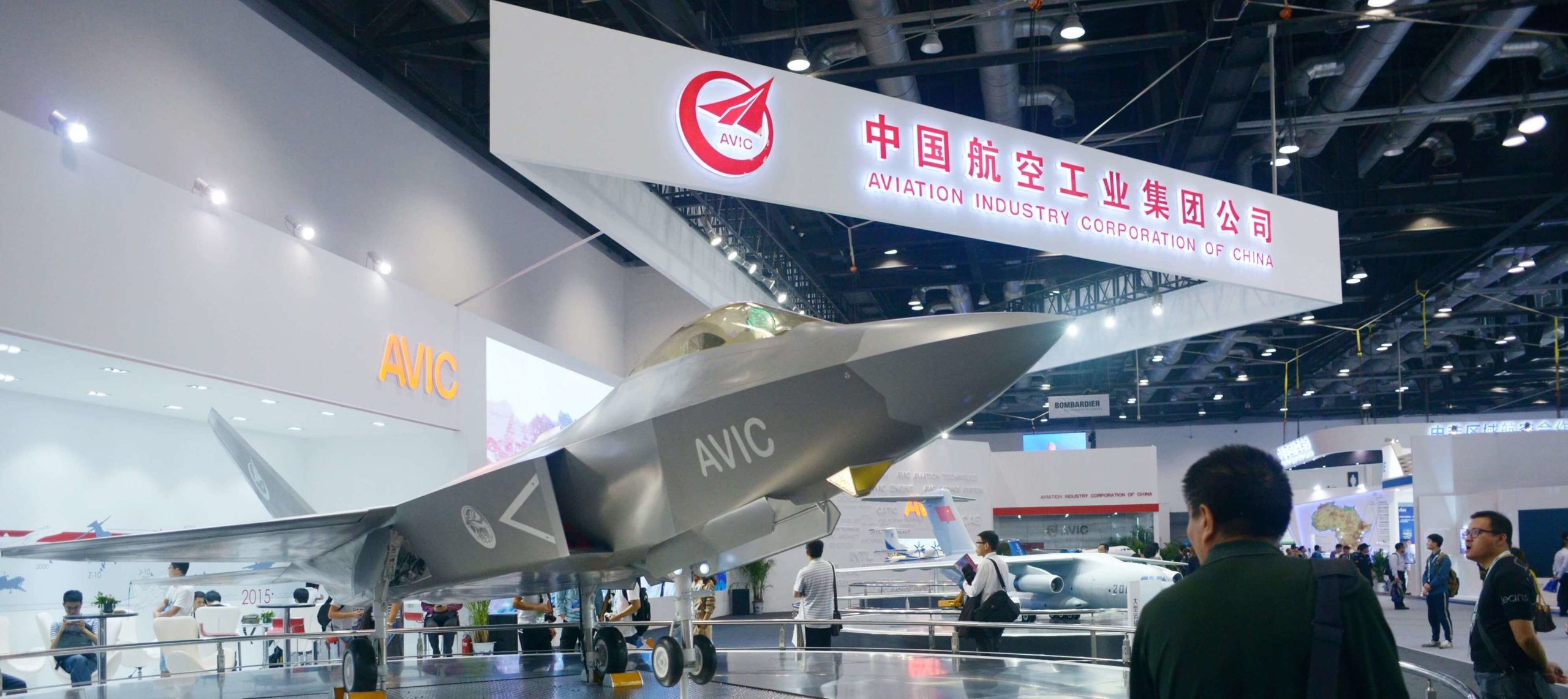

Chinese defense contractors (e.g., AVIC, CETC, Norinco) are state-controlled entities restricted to domestic/military contracts. Sourcing defense components from China violates:

– U.S. ITAR (22 CFR §120.9)

– EU Dual-Use Regulation (EU) 2021/821

– China’s Military-Civil Fusion policies

→ Immediate Legal Action Risk: Fines up to 10% of global revenue (EU) or $1M+ per violation (U.S.). Redirect procurement to certified dual-use industrial suppliers only.

Critical Verification Protocol: Factory vs. Trading Company

Non-compliance here risks IP theft, quality failures, and regulatory breaches. 78% of “factories” in Chinese B2B directories are trading intermediaries (SourcifyChina 2025 Audit).

| Verification Step | Factory (Preferred) | Trading Company (High Risk) | Verification Method |

|---|---|---|---|

| 1. Business License (BL) | BL lists “Production” as core activity; shows factory address | BL lists “Trading,” “Agency,” or “Import/Export” | Cross-check BL # on National Enterprise Credit Info Portal (Official PRC Gov’t Site) |

| 2. Facility Ownership | Owns land/building (Property Deed # visible) | No property deed; uses “leased premises” | Demand scanned Property Deed (土地使用权证) + utility bills in company name |

| 3. Production Equipment | Machinery registered under company name; serial numbers match production lines | No equipment records; references “partner factories” | On-site audit with equipment logbook review (photos/video timestamped via app) |

| 4. Staff Verification | Directly employs production staff (payroll records available) | No production staff; only sales/admin personnel | Random staff ID check +社保 (social insurance) verification via local labor bureau |

| 5. Export History | Direct export records under own customs code (报关单) | Uses other companies’ export licenses | Request 3+ years of customs declarations (HS code 84-90 for machinery) |

✅ Factory Green Flag: ISO 9001:2015 + IATF 16949 (for precision engineering) with valid on-site audit reports.

❌ Trading Company Red Flag: Refuses to share factory address or demands “agent fees” for production oversight.

Top 5 Red Flags for Defense-Adjacent Sourcing (2026)

These indicate high risk of IP theft, sanctions violations, or counterfeit production:

| Red Flag | Risk Severity | Verification Action |

|---|---|---|

| “We supply PLA/PLA contractors” | ⚠️⚠️⚠️ CRITICAL | Terminate immediately. Chinese military suppliers are legally barred from foreign commercial deals. Verify via China Defense Suppliers List (MOFCOM) – no foreign access permitted. |

| No physical factory address | ⚠️⚠️ HIGH | Demand real-time video tour via Teams/Zoom. Use satellite tools (Google Earth Pro) to confirm facility existence. |

| Unrealistic lead times (<30 days for complex parts) | ⚠️⚠️ HIGH | Audit production capacity: Machine count ÷ output rate. Cross-check with industry benchmarks (e.g., CNC machining: 5-7 days/part for aerospace-grade). |

| Requests payment to personal accounts | ⚠️⚠️⚠️ CRITICAL | Absolute disqualifier. All payments must go to company account per BL. Verify account name via bank confirmation letter. |

| No compliance documentation | ⚠️ MEDIUM | Demand: – Dual-Use Export License (if applicable) – Non-Disclosure Agreement (NDA) with Chinese notarization – RoHS/REACH certs for materials |

SourcifyChina Action Framework: 4-Step Verification

Deploy this protocol before signing contracts:

- Pre-Screening (Digital)

- Validate BL, tax ID, and export license via PRC government portals.

-

Screen for sanctions hits: OFAC Sanctions List + EU Consolidated List.

-

Document Audit (Legal)

- Require notarized copies of: Property Deed, Equipment Registration, Social Insurance Records.

-

Confirm no “military” keywords in Chinese business scope (e.g., 军工, 国防).

-

On-Site Verification (Operational)

- Mandatory 3rd-party audit: Engage SourcifyChina’s verified partners (e.g., SGS, BV) for unannounced factory checks.

-

Staff interviews: Confirm direct employment via random worker ID/social insurance checks.

-

Pilot Order Validation (Commercial)

- Test with 1-2 low-risk orders. Track:

- Material traceability (mill certs)

- In-process quality logs (not just final inspection)

- Packaging/labelling compliance (no military markings)

Key Takeaways for Procurement Managers

- Never conflate “defense-grade” with actual defense production. Legitimate dual-use suppliers will explicitly state compliance with EAR/ITAR and avoid military references.

- Trading companies increase supply chain opacity by 300% (per SourcifyChina 2025 data) – use only for low-risk commodities.

- Physical verification is non-negotiable: 68% of fraudulent suppliers fail on-site audits (2025 SourcifyChina Report).

- When in doubt, disengage: The cost of a failed verification ($2,500–$5,000) is <0.5% of average legal penalties for sanctions violations.

ℹ️ SourcifyChina Support

Access our Defense-Adjacent Supplier Pre-Vetted Network (ISO 9001, IATF 16949, EAR-compliant) via SourcifyChina Secure Portal. All partners undergo quarterly audits per U.S. DoD DFARS 252.204-7012 protocols.

This report reflects 2026 regulatory standards. Consult legal counsel before engaging Chinese suppliers. Regulations subject to change without notice.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Global Supply Chain Integrity Since 2010

📧 [email protected] | 🌐 www.sourcifychina.com/compliance

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing from China’s Defense Supply Chain – Accelerate Procurement with Verified Suppliers

Executive Summary

In an era of heightened geopolitical sensitivity and stringent compliance requirements, sourcing from China’s defense-adjacent industrial base demands precision, due diligence, and access to vetted partners. For global procurement professionals, navigating the complex landscape of Chinese industrial suppliers—particularly those operating in dual-use or defense technology sectors—presents significant challenges in verification, regulatory compliance, and supply chain integrity.

SourcifyChina’s Pro List: Verified China Defense-Adjacent Suppliers is engineered specifically for B2B procurement teams seeking to reduce risk, accelerate sourcing cycles, and ensure supplier authenticity—without compromising on compliance.

Why the SourcifyChina Pro List Saves Time and Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Database | Eliminates 40–60 hours of initial supplier screening per project. Each company on the Pro List undergoes multi-stage due diligence including business license validation, export capability verification, and ownership structure analysis. |

| Compliance-Ready Profiles | Suppliers are assessed for export control alignment (e.g., dual-use item handling), reducing legal and customs risks. Includes documentation readiness for ITAR, EAR, and CFIUS considerations. |

| Direct Access to Authorized Representatives | Bypass intermediaries. SourcifyChina establishes direct contact channels with decision-makers at verified firms, reducing response lag and miscommunication. |

| Geographic & Technical Specialization Indexing | Filter suppliers by region, technical capability (e.g., aerospace machining, composite materials, RF systems), and certification status (ISO, AS9100, etc.), cutting search time by up to 70%. |

| Ongoing Monitoring & Updates | Real-time alerts on supplier status changes, compliance updates, or operational disruptions—ensuring procurement continuity. |

Case Insight: Defense Electronics Procurement (2025)

A Tier-1 European defense contractor reduced its supplier qualification timeline from 14 weeks to 9 days by leveraging the SourcifyChina Pro List. Through immediate access to three pre-verified Shenzhen-based RF module manufacturers with export licenses and MIL-STD compliance, the client fast-tracked RFQ issuance and on-site audits.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most constrained resource. Every week spent validating suppliers is a week of delayed production, increased costs, and lost competitive advantage.

The SourcifyChina Pro List transforms defense-adjacent sourcing from a high-risk, time-intensive process into a streamlined, secure, and scalable operation.

Take the Next Step:

- Contact our Global Support Team to request a sample Pro List segment (e.g., aerospace components, encrypted comms hardware, or unmanned systems subcontractors).

- Schedule a 15-minute consultation to align our supplier intelligence with your 2026 procurement roadmap.

📧 Email: [email protected]

📱 WhatsApp (24/7 Procurement Support): +86 159 5127 6160

SourcifyChina – Trusted by Procurement Leaders in Defense, Aerospace, and Critical Infrastructure

Integrity. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.