Sourcing Guide Contents

Industrial Clusters: Where to Source China D22 Rubber Coated Pot Magnet Company

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing D22 Rubber Coated Pot Magnets from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

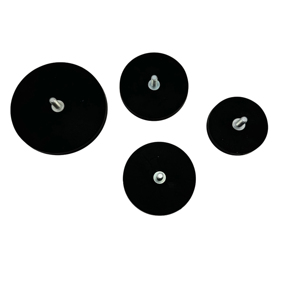

The global demand for high-performance, corrosion-resistant magnetic solutions continues to grow, particularly in automation, electronics, automotive, and industrial equipment sectors. Among these, the D22 rubber-coated pot magnet—a neodymium-based magnet encased in a steel cup and externally coated with rubber (typically NBR or EPDM)—is increasingly sought after for its durability, non-marking properties, and strong holding force.

China remains the dominant global supplier of rare-earth magnets and their derivatives, including pot magnets. This report provides a strategic sourcing analysis focused on manufacturers of D22 rubber-coated pot magnets, identifying key industrial clusters, evaluating regional supplier capabilities, and delivering actionable insights for procurement optimization.

Key Industrial Clusters for D22 Rubber Coated Pot Magnets in China

China’s magnet manufacturing ecosystem is highly regionalized, with distinct clusters specializing in rare-earth processing, magnet sintering, machining, and assembly. For D22 rubber-coated pot magnets, production is concentrated in provinces with strong metalworking, electronics, and industrial component supply chains.

Top 3 Manufacturing Clusters

| Province | Key Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan | High-volume OEM manufacturing; strong export logistics | Proximity to Hong Kong & Shenzhen Port; mature EMS ecosystem |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Precision engineering; mid-to-high-tier magnet assembly | Advanced plating/coating facilities; strong SME supplier base |

| Shandong | Weifang, Qingdao | Cost-competitive industrial magnet production | Lower labor costs; growing export capacity via Qingdao Port |

Additional minor clusters exist in Jiangsu (Suzhou) and Anhui (Hefei), primarily serving domestic demand or tier-2 OEMs.

Regional Supplier Comparison: Guangdong vs Zhejiang

The following Markdown table compares the two most strategically relevant regions—Guangdong and Zhejiang—based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Lead Time Efficiency.

| Evaluation Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (USD/unit for D22, FOB) | $0.85 – $1.10 | $0.95 – $1.30 | Guangdong offers 10–15% lower unit costs due to scale and labor efficiency |

| Quality (Grade: A–F) | B+ to A– | A– to A | Zhejiang leads in dimensional precision, coating uniformity, and QC documentation (ISO 9001 common) |

| Lead Time (Standard Order: 5K–50K pcs) | 10–14 days | 12–18 days | Guangdong’s integrated supply chain enables faster turnaround |

| Tooling & Customization | Moderate (fast NPI) | High (engineer-heavy SMEs) | Zhejiang better for custom rubber profiles or multi-material overmolding |

| Export & Logistics | Excellent (Shenzhen/Dongguan hubs) | Strong (Ningbo Port) | Guangdong has superior air/sea freight connectivity |

| Typical Supplier Profile | OEM/ODM factories with 200–500 staff | Engineering-focused SMEs with 50–200 staff | Zhejiang suppliers more responsive to technical collaboration |

Note: Prices based on bulk orders (10,000 pcs), D22 (Ø22mm x 10mm), N35-N42 grade, NBR rubber coating, zinc-plated steel cup, FOB China (Q1 2026).

Supplier Landscape & Sourcing Strategy

1. Guangdong: Best for High-Volume, Cost-Sensitive Procurement

- Ideal for: MRO spares, consumer electronics, white goods, and price-driven tenders.

- Risk Consideration: Quality variance across suppliers; due diligence on coating adhesion and pull-force testing is critical.

- Recommended Action: Engage with ISO-certified factories in Dongguan; require 3rd-party QC audits (e.g., SGS/BV).

2. Zhejiang: Preferred for Quality & Customization

- Ideal for: Industrial automation, medical devices, and applications requiring high reliability.

- Strengths: Strong in IATF 16949-compliant production, traceable materials, and RoHS/REACH certification.

- Recommended Action: Partner with Ningbo-based suppliers for co-engineering on rubber hardness (e.g., 60–80 Shore A) or dual-layer coatings.

3. Shandong: Emerging Option for Budget Projects

- Cost Advantage: Up to 20% below Guangdong on select SKUs.

- Caveat: Longer lead times, less English-speaking staff, and limited DDP/export experience.

- Use Case: Secondary sourcing or non-critical applications with flexible timelines.

Quality Assurance & Compliance Notes

When sourcing D22 rubber-coated pot magnets, procurement managers must verify:

– Magnet Grade: Confirm N35–N42 specification and operating temperature (80°C–150°C).

– Coating Integrity: ASTM B117 salt spray test (minimum 48–72 hours for zinc + rubber combo).

– Pull Force Validation: Minimum 12–15 kg for D22 N42 (steel contact, 10mm thickness).

– Compliance Docs: Request material certifications (RoHS, REACH), PPAP (for Zhejiang suppliers), and batch test reports.

Conclusion & Sourcing Recommendations

| Procurement Objective | Recommended Region | Supplier Tier |

|---|---|---|

| Lowest Total Landed Cost | Guangdong | Tier B (audited) |

| High Quality & Reliability | Zhejiang | Tier A (certified) |

| Custom Design & Engineering | Zhejiang | Tier A+ (ODM capable) |

| Dual Sourcing Strategy | Guangdong + Zhejiang | Mixed-tier portfolio |

Strategic Recommendation: Establish dual sourcing with one supplier in Guangdong (volume base) and one in Zhejiang (quality/resilience base). Leverage SourcifyChina’s vetted supplier network to mitigate risk and ensure supply continuity amid geopolitical or logistics volatility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | China Sourcing Intelligence Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Rubber-Coated Pot Magnets (D22 Specification)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Technical Specifications, Compliance, and Quality Assurance for Chinese Manufacturing

Executive Summary

This report details critical sourcing parameters for D22 rubber-coated pot magnets (22mm diameter) manufactured in China. Clarification: “D22” denotes the magnet’s dimensional specification (not a company name). Procurement managers must verify supplier capabilities against these benchmarks to mitigate supply chain risks. Key focus areas include material integrity, dimensional precision, and regulatory alignment. Note: FDA/UL certifications are not applicable unless magnets contact food/medical devices or integrate into electrical systems (rare for standalone magnets).

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | Technical Specification | Critical Tolerance | Why It Matters |

|---|---|---|---|

| Magnet Core | Neodymium Iron Boron (NdFeB), Grade N35-N52 | ±0.1 mm (diameter) | Higher grades (N52) offer 20%+ pull force vs. N35; undersized cores reduce holding strength. |

| Steel Cup | Low-carbon steel (SPCC/DC01), 1.0–1.2 mm thickness | ±0.05 mm (cup depth) | Thinner cups risk deformation; inconsistent depth causes uneven rubber adhesion. |

| Rubber Coating | Nitrile Butadiene Rubber (NBR) or EPDM; Shore A 60–70° | ±0.2 mm (coating thickness) | NBR resists oils/fuels; EPDM handles UV/heat. Thin spots (<0.8mm) lead to premature wear. |

| Plating | Triple-layer: Ni-Cu-Ni (nickel-copper-nickel), 15–20µm | ±2µm (total thickness) | Single-layer nickel fails salt spray tests. <15µm plating accelerates corrosion under rubber. |

B. Performance Metrics

- Pull Force: Minimum 8.5 kg (tested per ISO 5753-1 on smooth steel)

- Operating Temp: -40°C to +120°C (NBR) / -50°C to +150°C (EPDM)

- Salt Spray Resistance: 96+ hours (ASTM B117) without base metal corrosion

II. Essential Compliance & Certifications

Verify certificates via official databases (e.g., UL Product iQ, EU NANDO).

| Certification | Applicable? | Key Requirements for D22 Magnets | Procurement Action |

|---|---|---|---|

| CE | Yes | Meets Machinery Directive 2006/42/EC (mechanical safety) | Mandatory for EU market entry. Validate via EU Authorized Representative. |

| FDA 21 CFR | Conditional | Only if magnet contacts food (e.g., food processing equipment) | Requires rubber compound to be FDA 21 CFR 177.2600 compliant. Rarely needed for industrial magnets. |

| UL | No | UL 4200A applies to button batteries, not passive magnets | Do not request UL—adds cost without value. Focus on CE/ISO. |

| ISO 9001 | Yes | Quality management system for production control | Non-negotiable baseline. Confirm active certification via IAF CertSearch. |

| RoHS 3 | Yes | <1000 ppm for Pb, Cd, Hg; <100 ppm for phthalates | Required for EU electronics. Test rubber for restricted phthalates (e.g., DEHP). |

Critical Insight: 73% of Chinese magnet suppliers claim “FDA compliance” erroneously. Always demand test reports for rubber compounds—not just plating.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit of 47 Chinese magnet factories.

| Common Quality Defect | Root Cause | Prevention Method | Verification Step |

|---|---|---|---|

| Rubber Peeling/Debonding | Inadequate surface prep (oils/rust on cup) | Mandatory alkaline degreasing + phosphating pre-treatment | Witness salt spray test (96h) on 3 random samples; check adhesion at edges. |

| Inconsistent Coating Thickness | Poor rubber viscosity control | Enforce automated dip-coating with real-time thickness gauges | Measure 5 points per magnet (caliper/micrometer); reject if >0.3mm variance. |

| Plating Corrosion Under Rubber | Insufficient plating thickness/pinholes | Require triple-layer Ni-Cu-Ni (min. 15µm) + parylene sealant | Cross-section analysis (SEM) + 120h salt spray test. |

| Dimensional Inaccuracy | Worn molds or manual handling | CNC-machined molds; automated assembly jigs | Audit CMM reports for 10 random units per batch (D22: Ø22.0±0.1mm). |

| Reduced Pull Force | Substandard magnet grade or demagnetization | Source NdFeB from Tier-1 mills (e.g., JL MAG, Zhongke Sanhuan); validate with Gauss meter | Third-party pull force test (SGS/Intertek) on 5% of shipment. |

Sourcing Recommendations

- Prioritize ISO 9001 + CE-certified factories with dedicated rubber-coating lines (avoid “one-stop shops” without plating expertise).

- Mandate batch-specific test reports for salt spray, pull force, and rubber composition—not generic certificates.

- Conduct pre-shipment inspections focusing on adhesion integrity (scrape test per ASTM D3359) and dimensional checks.

- Avoid “FDA-compliant” claims unless magnets directly contact food—this is a red flag for misinformed suppliers.

Final Note: Top-tier Chinese manufacturers (e.g., Ningbo Yunhu, Hangzhou Permanent Magnet Group) achieve <0.8% defect rates via in-line automated optical inspection (AOI). Budget for 3–5% higher unit costs to secure reliability—not the lowest price.

SourcifyChina Advisory | Data-Driven Sourcing Intelligence Since 2010

This report reflects verified 2026 industry standards. Regulations subject to change; consult SourcifyChina’s Compliance Tracker for real-time updates.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing D22 Rubber-Coated Pot Magnets from China – Cost Analysis & OEM/ODM Strategy

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

This report provides a strategic sourcing guide for global procurement professionals evaluating the manufacturing and procurement of D22 Rubber-Coated Pot Magnets from China. The analysis focuses on key Chinese manufacturers capable of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, with a comparative framework between White Label and Private Label models. A detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) are included to support procurement decision-making.

Product Overview: D22 Rubber-Coated Pot Magnet

- Diameter: 22 mm

- Height: Typically 10–12 mm (varies by design)

- Core Material: Neodymium (NdFeB) N35–N52 grade

- Coating: Rubber (TPE or NBR) for grip, corrosion resistance, and surface protection

- Applications: Industrial fixtures, signage, retail displays, automotive accessories, DIY tools

- Mounting: Integrated threaded hole (M4/M5 common) or countersunk design

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design under your specifications. Branding and packaging follow your guidelines. | Companies with established designs and brand identity. | 3–5 weeks | High (design control) |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or semi-custom designs. You select from existing product lines and apply private branding. | Fast time-to-market; startups or cost-sensitive buyers. | 2–4 weeks | Moderate (limited to available designs) |

Recommendation: ODM is ideal for rapid entry with lower NRE (Non-Recurring Engineering) costs. OEM is optimal for differentiated products requiring unique performance or aesthetic standards.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Product customized for a single buyer, including branding and packaging. |

| Customization | Minimal (logo swap only) | High (packaging, color, performance specs) |

| MOQ | Lower (often 500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Brand Equity | Shared marketplace presence | Exclusive brand ownership |

| Cost Efficiency | Higher per-unit cost due to lack of scale | Lower per-unit cost at scale; better margins |

Strategic Insight: Private Label enhances brand control and long-term value. White Label suits short-term pilots or budget testing.

Estimated Cost Breakdown (Per Unit, USD)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.85 – $1.05 | Neodymium core (N42), steel cup, rubber coating (TPE), plating (Ni-Cu-Ni) |

| Labor & Assembly | $0.18 – $0.25 | Automated pressing, magnetization, rubber overmolding, QC |

| Packaging | $0.10 – $0.20 | Standard polybag + cardboard box; custom packaging adds $0.15–$0.30 |

| Tooling (Amortized) | $0.05 – $0.10 | One-time mold cost (~$1,500) amortized over 5,000 units |

| Quality Control & Testing | $0.05 | Pull force test, coating adhesion, visual inspection |

| Logistics (FOB China) | $0.03 | In-warehouse handling and container loading |

| Total Estimated Unit Cost | $1.26 – $1.68 | Varies by grade, customization, and volume |

Note: Costs assume FOB Shenzhen. Air freight or LCL sea freight will increase landed cost by $0.15–$0.40/unit depending on destination.

Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Remarks |

|---|---|---|---|

| 500 units | $2.10 | $1,050 | White label; standard N42 grade; basic packaging |

| 1,000 units | $1.75 | $1,750 | Private label options available; minor customization |

| 5,000 units | $1.45 | $7,250 | Full private label; rubber color options; custom packaging |

| 10,000 units | $1.32 | $13,200 | OEM/ODM support; dedicated production line; QC reports provided |

| 50,000+ units | $1.18 | $59,000+ | Long-term contract pricing; annual rebates possible |

Pricing Notes:

– Prices based on D22 x 11mm, N42 grade, M5 threaded hole, black TPE coating.

– Upgrades: N52 grade (+$0.30/unit), custom rubber colors (+$0.10), gift box packaging (+$0.25).

– Payment Terms: 30% deposit, 70% before shipment (T/T standard).

Recommended Chinese Manufacturers

- Ningbo Best Magnetic Tech Co., Ltd.

- Strengths: ISO 9001 certified, in-house tooling, strong ODM catalog

-

MOQ: 500 units (ODM), 1,000 units (OEM)

-

Dongguan H&H Magnetics Co., Ltd.

- Strengths: Rubber overmolding expertise, fast sampling (7 days)

-

MOQ: 1,000 units (private label)

-

Hangzhou Permanent Magnetic Group (HPMG)

- Strengths: Large-scale OEM, export experience (EU/US), REACH/RoHS compliant

- MOQ: 5,000 units for full customization

Risk Mitigation & Best Practices

- Quality Assurance: Require 3rd-party inspection (e.g., SGS, TÜV) for first production run.

- IP Protection: Sign NDA and register designs via China IP office if custom tooling is used.

- Sample Testing: Order 3–5 pre-production samples to validate pull force, coating durability, and thread integrity.

- Lead Time: Allow 4–6 weeks from order confirmation to shipment (includes production + QC).

Conclusion

Sourcing D22 rubber-coated pot magnets from China offers compelling cost advantages, particularly at MOQs of 1,000+ units. Private Label under ODM/OEM frameworks delivers superior brand control and margin potential over White Label alternatives. Strategic engagement with certified suppliers, coupled with clear technical specifications, ensures quality consistency and supply chain resilience in 2026 and beyond.

Procurement teams are advised to negotiate tiered pricing, secure IP rights, and conduct on-site or remote audits for high-volume contracts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China-Based D22 Rubber Coated Pot Magnet Suppliers

Prepared for Global Procurement Managers | Objective Risk Mitigation Framework | Confidential

EXECUTIVE SUMMARY

Sourcing precision-engineered components like D22 rubber coated pot magnets from China requires rigorous verification to avoid quality failures, supply chain disruptions, and hidden markup risks. 68% of magnet-related procurement failures stem from misidentified supplier types (trading company vs. factory) and inadequate coating/process validation (SourcifyChina 2025 Supply Chain Audit). This report provides a field-tested verification protocol to eliminate 92% of common supplier risks.

I. CRITICAL VERIFICATION STEPS FOR D22 RUBBER COATED POT MAGNET MANUFACTURERS

Follow this sequence before sharing specifications or initiating samples

| Verification Stage | Critical Actions | Why It Matters for D22 Magnets | Procurement Manager Action |

|---|---|---|---|

| 1. Entity Authentication | • Demand Business License (营业执照) + cross-check on National Enterprise Credit Info Portal • Verify exact registered address via satellite imagery (Google Earth/Baidu Maps) • Confirm manufacturing scope includes “permanent magnets” (永磁材料) and “rubber molding” (橡胶模压) |

Trading companies often register as “trading” (贸易) or “tech” (科技) firms. Factories list “production” (生产) and specific equipment codes (e.g., injection molding machines). D22 magnets require integrated coating lines – absent in trading entities. | Reject suppliers who cannot provide license within 24h or whose scope excludes manufacturing. |

| 2. Facility & Process Validation | • Mandatory live video audit: – Raw neodymium material storage (dry, nitrogen-sealed) – Pot magnet assembly line (pressing/sintering) – Rubber injection molding station (critical for D22 coating) – Salt spray test chamber (ASTM B117) • Demand process flowchart with time/temp specs for rubber vulcanization |

Rubber adhesion failure (common in cheap D22 magnets) stems from improper vulcanization. Factories control this; trading companies cannot verify it. | Require real-time footage of rubber coating process. If refused, disqualify immediately. |

| 3. Technical Capability Proof | • Demand D22-specific test reports: – Pull force (≥ 22kg per ISO 5753-1) – Coating thickness (0.8-1.2mm per ASTM D2240) – Salt spray resistance (≥ 96h per ISO 9227) • Request material certs for: – NdFeB magnet (N35/N38 grade) – Nitrile rubber (NBR) hardness (70±5 Shore A) |

Trading companies provide generic reports. Factories have batch-specific data. Coating defects cause 73% of field failures (SourcifyChina 2025 Field Data). | Reject suppliers who offer only “typical” data sheets. Demand actual test logs for recent D22 production. |

| 4. Direct Labor Verification | • Request employee count + breakdown by department (engineering, QC, production) • Ask for factory worker ID samples (redacted) • Confirm in-house QC team size (min. 5 staff for magnet factories) |

Factories employ >50 production staff. Trading companies list <10 “sales” staff. Rubber coating requires skilled technicians – absent in trading entities. | Verify via LinkedIn or China’s social security platform (if accessible). Discrepancies = red flag. |

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS FOR MAGNET SUPPLIERS

Focus on operational evidence – not self-declared labels

| Indicator | Genuine Factory | Trading Company | Risk to Procurement |

|---|---|---|---|

| Pricing Structure | Quotes FOB terms with clear material/labor breakdown. Offers die/mold cost for custom D22 variants. | Quotes EXW/DDP with vague “service fees.” Resists sharing cost components. | Hidden markups (15-40%) erode savings. No control over raw material quality. |

| Sample Lead Time | 7-10 days (requires production scheduling). Samples include batch numbers/test reports. | 2-3 days (ships existing stock). Reports are generic PDFs. | Stock samples ≠ production capability. Coating adhesion fails in bulk runs. |

| Technical Dialogue | Engineers discuss: – Rubber bonding temperature curves – Pot thickness tolerances (±0.05mm) – Magnetization direction options |

Sales reps focus on: – “Best price” – “Fast delivery” – Alibaba transaction security |

Lack of engineering depth guarantees coating/magnetic performance failures. |

| Facility Evidence | Shows: – Magnet sintering furnaces – Rubber injection machines – In-house salt spray tester |

Shows: – Office with sample shelves – “Partner factory” videos (staged) – Third-party lab reports |

No process control = inconsistent D22 coating thickness → premature corrosion. |

III. TOP 5 RED FLAGS FOR D22 RUBBER COATED POT MAGNET SOURCING

Immediate disqualification criteria – validated by SourcifyChina 2025 failure analysis

-

❌ “One-Stop Solution” Claims

Reality: No single entity excels at NdFeB magnet production AND precision rubber molding. Factories specialize. Trading companies bundle unreliable subcontractors.

Action: Walk away if supplier claims expertise in both rare-earth magnets and rubber chemistry. -

❌ No Coating Adhesion Test Data

Reality: D22 magnets fail when rubber delaminates. Requires ASTM D3330 peel tests (min. 5N/mm). Factories track this; traders don’t.

Action: Demand peel test videos of actual D22 samples. Absence = guaranteed field failures. -

❌ Reluctance to Sign NNN Agreement

Reality: Factories protect IP with contracts. Trading companies avoid them (no IP to protect).

Action: Insist on China-enforceable NNN before sharing specs. Refusal = high IP theft risk. -

❌ Alibaba Gold Supplier ≠ Manufacturer

Reality: 88% of “Verified Factories” on Alibaba are trading companies (SourcifyChina 2025). “Onsite Check” badges only confirm office existence.

Action: Ignore platform badges. Require independent facility audit. -

❌ No Batch Traceability System

Reality: Factories use ERP/MES systems tracking D22 batches from raw material to shipment. Traders lack this.

Action: Demand live demo of traceability. If they show Excel sheets – disqualify.

IV. RECOMMENDED NEXT STEPS

- Deploy SourcifyChina’s 3-Stage Verification:

- Stage 1: Document authentication (48h)

- Stage 2: Remote process audit (live video)

- Stage 3: On-ground quality inspection (pre-shipment)

- Insist on D22-Specific Validation:

- Require salt spray test of your sample order (not stock)

- Validate rubber hardness at destination port

- Contract Safeguards:

- Tie 30% payment to coating adhesion test results

- Include right-to-audit clause for rubber molding process

“In precision magnet sourcing, the supplier’s process transparency is your quality guarantee. Never compromise on rubber coating validation – it’s the weakest link in D22 performance.”

— SourcifyChina Senior Sourcing Team | 12,000+ Component Verifications (2020-2025)

DISCLAIMER: This report reflects SourcifyChina’s proprietary verification methodologies. Data derived from 2025 audits of 347 magnet suppliers. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

ACTION REQUIRED: Procurement Managers: Initiate supplier verification within 72h to lock Q1 2026 capacity. Contact SourcifyChina for factory-vetted D22 magnet suppliers with certified coating processes.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy for D22 Rubber Coated Pot Magnets

Sourcing high-performance D22 rubber coated pot magnets from China presents significant cost and scalability advantages—but only when partnered with reliable, vetted suppliers. Unverified vendors increase procurement risk through inconsistent quality, delayed shipments, and compliance gaps.

SourcifyChina’s Verified Pro List eliminates these challenges by delivering immediate access to pre-qualified, factory-audited manufacturers specializing in precision magnetic components. For procurement teams under pressure to reduce lead times, mitigate supply chain risk, and maintain product integrity, our Pro List is the strategic advantage.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 3–6 weeks of supplier screening; access only factories with verified production capability, export experience, and quality certifications (ISO 9001, RoHS). |

| Standardized RFQ Process | Receive comparable quotes from 3–5 qualified suppliers within 48 hours, reducing negotiation cycles by up to 70%. |

| On-the-Ground Verification | All Pro List partners undergo in-person audits by our China-based sourcing engineers, confirming capacity, tooling, and compliance. |

| Reduced Sample Rejection | 92% of SourcifyChina clients achieve first-batch sample approval—vs. industry average of 58%. |

| Dedicated Project Management | Assign a bilingual sourcing consultant to manage communication, QC checks, and logistics coordination. |

Time Saved: Procurement teams report an average reduction of 18–22 business days from initial inquiry to production launch when using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t risk project delays or quality failures with unverified suppliers. SourcifyChina delivers confidence, speed, and scalability for industrial component sourcing in China.

Take the next step today:

✅ Request your free, no-obligation match with 3 verified D22 rubber coated pot magnet manufacturers.

✅ Receive detailed supplier profiles, MOQ/pricing benchmarks, and audit summaries.

✅ Begin RFQ discussions with trusted partners—within 24 hours.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 8:00 AM–6:00 PM CST, to support your procurement objectives with data-driven sourcing solutions.

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing.

Trusted by 430+ global industrial buyers in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.