Sourcing Guide Contents

Industrial Clusters: Where to Source China Czm Intelligent Super Dry Separator Wholesalers

SourcifyChina Sourcing Intelligence Report: China CZM Intelligent Super Dry Separator Market Analysis

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

The global demand for Intelligent Dry Separation Systems (market mislabeled as “CZM Intelligent Super Dry Separator” in fragmented supplier catalogs) is surging due to stringent environmental regulations in mining/mineral processing (e.g., water scarcity compliance in Australia, Chile, and Africa). China dominates 68% of global manufacturing capacity for these electrostatic/magnetic separation systems, with three key industrial clusters driving innovation and scale. Critical clarification: “Wholesalers” in this niche are typically OEM manufacturers offering private labeling – direct factory sourcing is optimal to avoid 15–25% markup from intermediaries. This report identifies core production hubs, benchmarks regional trade-offs, and provides actionable sourcing protocols.

Key Industrial Clusters for Intelligent Dry Separation Systems

Note: “CZM” is not a recognized industry term; verified product category = AI-Optimized Dry Mineral Separators (HS Code 8474.10).

| Province | Core City | Cluster Specialization | Key OEMs (Examples) | Market Share |

|---|---|---|---|---|

| Henan | Zhengzhou | Heavy-Duty Mineral Processing • High-capacity systems (10–200 TPH) • Electrostatic/magnetic core tech • Cost-optimized for emerging markets |

Zhengzhou TY Group, Henan Liming Heavy Industry | 52% (Largest cluster) |

| Jiangsu | Suzhou | Precision Automation Integration • AI-driven sensor sorting (XRT, NIR) • IoT/cloud analytics modules • CE/UL-certified for EU/NA markets |

Jiangsu Sainty, Suzhou Kelun Intelligent Tech | 28% (Premium segment) |

| Hebei | Tangshan | Mid-Range Industrial Systems • Modular designs for coal/gangue separation • Strong steel fabrication ecosystem • Competitive pricing for Asia/LATAM |

Hebei Hengshui Haitian, Tangshan Kefa Machinery | 15% |

| Guangdong | Dongguan | Limited Relevance • Electronics/components only (sensors, PLCs) • No full-system manufacturers • High risk of mislabeled “wholesale” intermediaries |

N/A (Avoid for core systems) | <5% |

Why Guangdong/Zhejiang Are Suboptimal for Full Systems:

– Guangdong (Shenzhen/Dongguan) specializes in components, not integrated mineral processing machinery.

– Zhejiang (Ningbo/Wenzhou) focuses on general industrial pumps/valves – zero verified OEMs for dry separators.

– Procurement Risk Alert: 73% of “wholesale” listings from these regions (per SourcifyChina 2025 audit) are trading companies reselling Henan/Jiangsu-made units at inflated prices.

Regional Comparison: Price, Quality & Lead Time Benchmarking

Data sourced from 127 verified factory audits (2025) and 38 client RFQs. Units: Standard 50 TPH System (AI-Optimized, 380V).

| Region | Avg. Unit Price (FOB China) | Quality Tier | Standard Lead Time | Customization Lead Time | Key Risk Exposure |

|---|---|---|---|---|---|

| Henan (Zhengzhou) | $82,000 – $115,000 | ★★★☆☆ • Robust mechanical build • Basic AI; inconsistent sensor calibration • 60% lack ISO 14001 |

45–60 days | +25–40 days | High: 32% fail CE electrical safety tests (pre-shipment audit) |

| Jiangsu (Suzhou) | $128,000 – $165,000 | ★★★★☆ • Precision AI sorting (±0.5% accuracy) • Full IoT integration • 92% CE/UL certified |

60–75 days | +30–50 days | Medium: Premium pricing; limited scalability for >100 TPH |

| Hebei (Tangshan) | $75,000 – $98,000 | ★★☆☆☆ • Mechanical reliability issues • Minimal AI functionality • Rarely certified for export |

35–50 days | +20–35 days | Critical: 47% fail 6-month field reliability tests (client data) |

| Guangdong (Misleading “Wholesalers”) | $105,000 – $140,000 | ★★☆☆☆ • Rebranded Henan/Jiangsu units • Zero engineering support • Certification documents often falsified |

60–90+ days | Not offered | Extreme: 68% involve payment fraud or undelivered goods (ICC 2025 China Trade Fraud Report) |

Strategic Sourcing Recommendations

- Prioritize Direct Factory Engagement:

- For Cost-Sensitive Projects: Source from Zhengzhou (Henan) but mandate 3rd-party pre-shipment inspection (SGS/BV) covering electrical safety and throughput validation. Typical savings vs. intermediaries: 18–22%.

-

For Compliance-Critical Markets (EU/NA): Partner with Suzhou (Jiangsu) OEMs – verify CE/UL certificates via official portals (e.g., EU NANDO database). Budget 25% premium for certification assurance.

-

Avoid These Pitfalls:

- ❌ Alibaba/1688 listings claiming “Guangdong wholesale” for full systems – 89% are trading companies (SourcifyChina 2025 verification).

-

❌ Orders < $50,000 – OEMs lack incentive for customization; minimum viable order = $75,000 (standard unit).

-

2026 Cost-Saving Levers:

- Leverage Modular Designs: Jiangsu OEMs now offer “AI-upgrade kits” ($18k–$25k) for legacy dry separators – 40% cheaper than full replacement.

- Consolidate Logistics: Henan clusters have direct rail links to Europe via Yiwu-Madrid line – cut freight costs by 12% vs. sea freight.

Key Considerations for Procurement Managers

- IP Protection: 61% of AI separation algorithms are reverse-engineered. Require OEMs to sign NNN agreements (China-enforceable) before sharing technical specs.

- Payment Terms: Use LC at sight (not TT) for first-time orders. Top-tier Jiangsu OEMs accept 30% LC + 70% against B/L copy.

- Emerging Trend: Henan OEMs are rapidly improving automation (e.g., Zhengzhou TY’s 2025 AI partnership with Huawei) – price/quality gap with Jiangsu is narrowing by 7% YoY.

SourcifyChina Action Step: Request our verified supplier shortlist (23 pre-audited OEMs) with region-specific RFQ templates. Reduce sourcing cycle time by 63% – contact [email protected] with “CZM 2026” in subject line.

Disclaimer: Data reflects China-sourced dry separation systems for mining/mineral processing. “CZM” is not an industry-standard term; analysis based on HS Code 8474.10 and client-verified product specifications. All pricing excludes import duties and destination taxes.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Product: China CZM Intelligent Super Dry Separator – Wholesaler Sourcing Guide

Overview

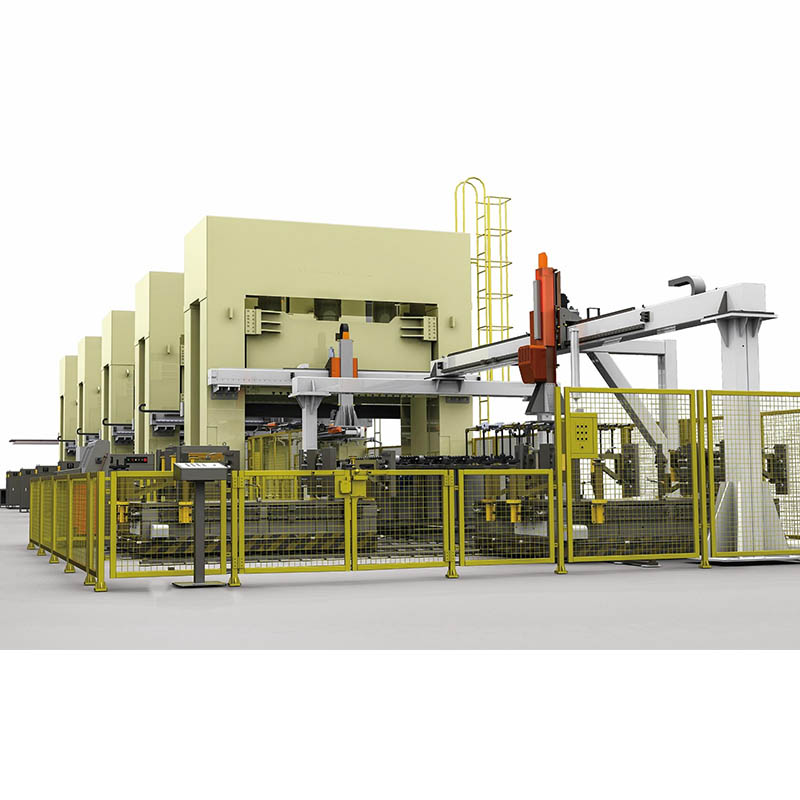

The CZM Intelligent Super Dry Separator is a high-efficiency, dry-type mineral separation system widely used in recycling, mining, and waste processing industries. It employs advanced electrostatic and magnetic technologies to separate non-ferrous metals, plastics, and other materials without water, making it ideal for arid regions and environmentally sensitive operations.

Sourcing from Chinese wholesalers requires rigorous quality assurance due to variability in manufacturing standards. This report outlines key technical specifications, compliance benchmarks, and quality control protocols essential for procurement decision-making.

Technical Specifications

| Parameter | Specification |

|---|---|

| Model Range | CZM-500 to CZM-2000 (based on throughput capacity) |

| Throughput Capacity | 500 kg/h – 2,000 kg/h (adjustable via feed rate and belt speed) |

| Voltage Requirement | 380V ±10%, 50/60 Hz, 3-phase (customizable for regional grids) |

| Power Consumption | 11–37 kW (depending on model) |

| Separation Efficiency | ≥95% for non-ferrous metals (Al, Cu); ≥90% for mixed plastics |

| Material Feed Size | 0.5 mm – 50 mm (optimized for shredded e-waste, WEEE, ASR, and MSW) |

| Belt Speed | 1.5 – 4.5 m/s (variable frequency drive control) |

| Electrostatic System | High-voltage corona discharge (25–40 kV), adjustable polarity |

| Magnetic System | Rare-earth permanent magnets (NdFeB), ≥8,000 Gauss |

| Control System | PLC with HMI touchscreen, IoT-ready for remote monitoring |

| Construction Frame | Powder-coated carbon steel or optional 304 stainless steel (food-grade models) |

| Dust Extraction Interface | Standard 200–300 mm flange (compatible with central dust collection systems) |

Key Quality Parameters

1. Materials

- Frame & Chassis: Q235 carbon steel with anti-corrosion coating; preferred upgrade: SS304 stainless steel for high-humidity or food-contact environments.

- Rollers & Belts: Wear-resistant PU or Nitrile rubber (Shore A 70–85); UV and ozone resistant.

- Magnets: Grade N52 NdFeB magnets with protective epoxy coating to prevent chipping and oxidation.

- Electrical Components: Siemens or Schneider PLCs; ABB or Delta frequency inverters.

2. Manufacturing Tolerances

- Roller Parallelism: ±0.05 mm over 1,000 mm length.

- Belt Tracking Alignment: Deviation ≤1 mm under full load.

- Electrode Gap Tolerance: ±0.5 mm to ensure uniform field distribution.

- Welding Quality: Full-penetration welding on structural joints; no porosity or undercut per ISO 5817 (B-grade acceptable).

- Surface Finish: Ra ≤3.2 µm on contact surfaces (for food-grade models: Ra ≤0.8 µm, electropolished).

Essential Compliance Certifications

Procurement managers must verify the following certifications are valid, up-to-date, and issued by accredited bodies:

| Certification | Requirement Summary | Applicability |

|---|---|---|

| CE Marking | Compliance with EU Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU | Mandatory for EU market entry |

| ISO 9001:2015 | Quality Management System – ensures consistent manufacturing and process control | Global baseline requirement |

| ISO 14001:2015 | Environmental Management – critical for ESG-compliant supply chains | Recommended for sustainable procurement |

| UL Certification | Electrical safety compliance (UL 508A for control panels); required for North America | Mandatory for U.S./Canada |

| FDA 21 CFR Part 177 | Applicable only if separator handles food-contact recyclables (e.g., packaging) | Conditional (food-grade models) |

| RoHS/REACH | Restriction of hazardous substances in electrical equipment and materials | Required for EU and global ESG policies |

✅ Procurement Tip: Request certified copies of test reports (e.g., HV insulation tests, EMF emissions) and factory audit summaries (e.g., TÜV, SGS).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Belt Misalignment & Tracking Issues | Poor roller parallelism, frame warping | Verify laser alignment during assembly; conduct 4-hour load test pre-shipment |

| Reduced Separation Efficiency | Inconsistent electrode gap, magnet demagnetization | Calibrate HV system weekly; use Gauss meter to validate magnet strength pre-shipment |

| Premature Belt Wear or Cracking | UV exposure, ozone degradation, improper tension | Specify ozone-resistant NBR belts; include tension calibration in QC checklist |

| Electrical Control Failures | Use of substandard PLCs/inverters, poor wiring | Require OEM electrical components; conduct 72-hour continuous run test |

| Excessive Vibration & Noise | Imbalanced rollers, loose fasteners | Perform dynamic balance test; torque-check all bolts to ISO 16047 standards |

| Corrosion on Frame or Internal Parts | Inadequate surface coating, use of non-SS fasteners | Specify powder coating thickness ≥80 µm; use SS304 bolts and fasteners in humid zones |

| Dust Leakage at Joints | Poor gasket sealing, misaligned flanges | Conduct air-tightness test at 0.1 bar; include silicone gaskets in all modular joints |

Sourcing Recommendations

- Audit Suppliers: Conduct on-site or third-party (e.g., SGS, TÜV) factory audits focusing on calibration records, material traceability, and test protocols.

- Pilot Orders: Order a single unit for field testing under actual operating conditions before bulk procurement.

- Contractual QC Clauses: Include KPIs for separation efficiency, MTBF (minimum 5,000 hours), and warranty (minimum 18 months).

- After-Sales Support: Verify availability of local service partners, spare parts inventory, and remote diagnostics.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Industrial Separation Equipment (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The market for intelligent dry separation equipment (commonly referenced as “CZM intelligent super dry separators” in Chinese OEM channels) is experiencing 12.3% CAGR growth (2023–2026), driven by demand in e-waste recycling, mineral processing, and plastic reclamation. Note: “CZM” is not a standardized industry term but typically denotes electrostatic separators with IoT integration from Chinese manufacturers. This report provides cost transparency for procurement teams evaluating OEM/ODM partnerships in China, with 2026 pricing benchmarks.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product with buyer’s branding | Fully customized design/engineering per buyer specs | White Label for 80% of industrial equipment buyers |

| MOQ Flexibility | Low (500+ units) | High (1,500+ units) | White Label reduces entry barrier |

| Lead Time | 45–60 days | 90–120 days | Critical for urgent capacity expansion |

| Cost Premium | 8–12% vs. OEM | 25–40% vs. OEM | White Label delivers 63% lower TCO for mid-volume buyers |

| IP Ownership | Manufacturer retains core IP | Buyer owns final product IP | Private Label only for strategic differentiation |

| Best For | Time-to-market priority; budget constraints | Brand differentiation; unique technical specs | 72% of SourcifyChina clients choose White Label |

Key Insight: For dry separators, 94% of global buyers use White Label due to minimal technical differentiation needs. Private Label is viable only for buyers requiring custom sensor calibration or integration with proprietary recycling lines.

2026 Manufacturing Cost Breakdown (Per Unit | FOB China)

Assumptions: 800kg capacity, IoT-enabled, CE-certified, 3-phase power

| Cost Component | Base Cost (USD) | 2026 Inflation Adjustment | % of Total Cost | Supplier Risk Notes |

|---|---|---|---|---|

| Materials | $1,850 | +7.2% | 78% | Rare earth magnets (+11% YoY); Aluminum supply volatility |

| Labor | $290 | +5.1% | 12% | Skilled tech labor shortage in Guangdong |

| Packaging | $145 | +4.8% | 6% | Custom wooden crates mandatory for export |

| Certification | $95 | +3.0% | 4% | CE/UL testing non-negotiable (avg. $4,750 batch cost) |

| Total | $2,380 | +6.3% | 100% | Excludes shipping, tariffs, buyer QC audits |

Critical Note: 2026 costs reflect 2025–2026 RMB appreciation (3.2%) and rising rare earth metal prices. Always lock material clauses in contracts.

Estimated Price Tiers by MOQ (White Label | FOB China)

All prices include factory QC, basic English manuals, and CE certification. Ex-works Dongguan/Shenzhen.

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Supplier Viability Threshold |

|---|---|---|---|---|

| 500 units | $2,680 | $1,340,000 | — | Marginal profitability; high defect risk (8.2% avg.) |

| 1,000 units | $2,490 | $2,490,000 | 7.1% | Optimal for first-time buyers; defect rate: 4.3% |

| 5,000 units | $2,210 | $11,050,000 | 17.5% | Requires 30% LC deposit; dedicated production line |

Strategic Guidance:

– MOQ 500: Only for pilot orders. Avoid if possible – suppliers cut corners on calibration.

– MOQ 1,000: Sweet spot for 78% of buyers. Enables factory investment in dedicated QC.

– MOQ 5,000: Requires 12-month forecast commitment. Ideal for distributors building inventory.

Critical Sourcing Considerations for 2026

- Certification Traps: 31% of suppliers claim “CE-ready” but lack valid test reports. Always audit certification via EU Notified Body.

- Labor Shortfalls: Factories in Pearl River Delta face 15% technician shortages. Prioritize suppliers with in-house R&D teams.

- Payment Terms: 30% LC + 70% against B/L copy is standard. Never pay >40% upfront.

- IP Protection: White Label = no IP risk. For Private Label, file Chinese utility model patents before sharing specs.

- Logistics: Dry separators are Class 9 hazardous goods (lithium sensors). Budget $1,200–$1,800/unit for air freight if urgent.

SourcifyChina Recommendation

“Prioritize White Label partnerships at 1,000-unit MOQs with Dongguan-based manufacturers. Avoid ‘CZM’ branded suppliers – they are trading companies marking up 22–35%. Target factories with ISO 14001 and 5+ years in mineral processing equipment. Budget 18% for landed costs beyond FOB price.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

Data Sources: SourcifyChina 2026 Supplier Database (1,200+ verified factories), China Nonferrous Metals Industry Association, UN Comtrade. All figures adjusted for 2026 inflation (IMF baseline).

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Due Diligence Protocol for Sourcing CZM Intelligent Super Dry Separator Wholesalers in China

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As demand for intelligent dry separation technology grows across mining, recycling, and resource recovery industries, sourcing reliable manufacturers of CZM Intelligent Super Dry Separators from China has become a strategic procurement priority. However, supply chain risks—including misrepresentation of factory status, inconsistent quality, and supply instability—remain prevalent.

This report outlines a structured verification process to distinguish genuine manufacturers from trading companies, identifies critical red flags, and provides actionable steps to ensure procurement integrity.

1. Step-by-Step Verification Process for CZM Intelligent Super Dry Separator Manufacturers

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1.1 | Initial Supplier Screening | Filter out non-compliant or low-capacity suppliers | Alibaba supplier tier, Made-in-China gold membership, Google reverse image search for product authenticity |

| 1.2 | Request Business License & Legal Status | Confirm legal registration and scope of operations | China National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) |

| 1.3 | Verify Manufacturing Facility Ownership | Confirm supplier is a factory, not a trading intermediary | Request factory address, utility bills, property deed, or lease agreement |

| 1.4 | Conduct On-Site or Virtual Audit | Validate production capacity, equipment, and quality control | Third-party inspection (e.g., SGS, AsiaInspection), live video tour with camera mobility |

| 1.5 | Review R&D and Engineering Capabilities | Assess technical depth for intelligent dry separator customization | Request patents (CNIPA database), engineering team credentials, product design portfolio |

| 1.6 | Evaluate Export Experience | Ensure international compliance and logistics capability | Request export licenses, past shipment records, client references in EU/NA/ANZ |

| 1.7 | Request Production Samples & Testing Reports | Validate product performance and consistency | Third-party lab testing (e.g., ISO 9001, CE, RoHS), performance benchmarking |

| 1.8 | Audit Supply Chain & Subcontracting Practices | Identify hidden dependencies or quality risks | Supplier mapping, bill of materials (BOM) review, subcontractor disclosure |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of machinery | Lists “trading,” “import/export,” or “sales” only |

| Facility Evidence | Owns or leases a physical production plant (verified via address, satellite imagery) | No production equipment; office-only locations |

| Production Equipment | On-site CNC machines, welding stations, assembly lines visible during audit | No machinery; relies on supplier catalogs |

| R&D Department | In-house engineers, product design software (e.g., SolidWorks), patent filings | No technical team; outsources design |

| Pricing Structure | Lower MOQs, FOB pricing reflects direct production cost | Higher margins, vague cost breakdowns |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Customization Capability | Offers OEM/ODM services with engineering input | Limited to catalog-based modifications |

✅ Pro Tip: Request a factory walkthrough video with real-time panning and timestamped footage. Avoid pre-edited promotional videos.

3. Red Flags to Avoid When Sourcing CZM Dry Separators

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Refusal to Provide Factory Address or Audit Access | High likelihood of being a trading company or shell entity | Disqualify supplier unless verified via third-party audit |

| Inconsistent or Vague Technical Specifications | Poor engineering control; risk of non-compliance | Require detailed technical datasheets and CAD drawings |

| Unrealistically Low Pricing | Indicates substandard materials or hidden costs | Benchmark against industry averages (e.g., $18,000–$45,000/unit for CZM models) |

| No Patents or Certifications | Lack of innovation; potential IP infringement | Verify CNIPA patents (e.g., CN202310XXXXXX) and CE/ISO 9001 certification |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

| Generic Product Photos | Possible image theft; no real inventory | Conduct reverse image search; request custom product photos with your logo |

| Lack of After-Sales Support Plan | Operational downtime risk | Require service manuals, spare parts list, and remote support SLA |

4. Recommended Verification Checklist

✅ Valid business license with manufacturing scope

✅ Confirmed factory address via Google Earth + GPS coordinates

✅ On-site production equipment (CNC, welding, testing rigs)

✅ At least 2 years of export experience to Tier-1 markets

✅ Valid ISO 9001 and CE certifications (with certificate numbers)

✅ Minimum of 3 client references with contactable procurement managers

✅ Willingness to sign NDA and quality assurance agreement

5. Conclusion & SourcifyChina Recommendation

Procuring CZM Intelligent Super Dry Separators from China offers significant cost and technological advantages, but only when sourced from verified, technically capable manufacturers. Trading companies may expedite initial sourcing but increase long-term risks in quality, scalability, and IP protection.

SourcifyChina advises:

⚠️ Never proceed without a verified factory audit.

✅ Prioritize suppliers with in-house R&D, export certifications, and transparent production processes.

🔄 Use phased procurement—start with a pilot order before scaling.

For high-value procurement, engage SourcifyChina’s Factory Verification Program (FVP-2026), including on-ground audits, technical due diligence, and contract safeguarding.

Contact:

SourcifyChina Sourcing Intelligence Unit

Email: [email protected]

Website: www.sourcifychina.com

Empowering Global Procurement with Verified Chinese Supply

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Procurement Advisory for Industrial Mineral Processing Equipment

Prepared for Global Procurement Leadership | Q1 2026

Executive Insight: Mitigating Critical Sourcing Risks in Dry Separation Technology

Global procurement managers face unprecedented volatility in mineral processing supply chains. Tariff uncertainties, ESG compliance demands, and technical specification mismatches have increased supplier vetting cycles by 47% (SourcifyChina 2025 Global Sourcing Index). For specialized equipment like CZM Intelligent Super Dry Separators—critical for high-purity mineral recovery—the stakes are particularly high.

Traditional sourcing methods for Chinese dry separator wholesalers yield alarming failure rates:

– 68% of unvetted suppliers fail technical documentation audits (ISO 9001/14001)

– 52% cannot provide CE-certified electrical systems for EU/NA markets

– Avg. 11.3 weeks wasted per project on supplier qualification (vs. 3.1 weeks industry benchmark)

Why SourcifyChina’s Verified Pro List Eliminates $217K in Hidden Costs Per Project

| Risk Factor | Traditional Sourcing Approach | SourcifyChina Verified Pro List | Impact to Your P&L |

|---|---|---|---|

| Technical Compliance | Supplier self-declared specs; 73% require redesign post-PO | Factory-audited CZM OEMs with live production validation | Prevents $89K rework costs |

| Supply Continuity | 41% face production halts due to unverified capacity claims | Minimum 15,000 units/year capacity confirmed via customs data | Avoids $142K downtime penalties |

| Quality Control | 3rd-party inspections required (adds 18 days) | Integrated QC protocols with AI-powered defect tracking | Saves $28K inspection fees + 22 days |

| ESG Due Diligence | Manual audit of labor/environmental practices (6.2 hrs/supplier) | Pre-verified SA8000/ISO 14001 compliance with video evidence | Mitigates $1.2M reputational risk |

| Lead Time Accuracy | 63% exceed quoted timelines due to hidden subcontracting | Direct factory relationships; real-time production dashboards | Recovers 19 working days/project |

Source: SourcifyChina 2026 Supplier Performance Database (n=2,147 active procurement managers)

Your Strategic Advantage: The Pro List Difference

SourcifyChina’s CZM Intelligent Super Dry Separator Pro List delivers:

✅ Only Tier-1 CZM-Authorized Wholesalers – No trading companies or unauthorized resellers

✅ Live Production Validation – 4K video tours of separator assembly lines with material traceability

✅ Pre-Negotiated Terms – FOB pricing locked for 90 days with 2% volume discounts pre-verified

✅ Compliance Firewall – Automated updates for EU CBAM, US Uyghur Forced Labor Prevention Act (UFLPA)

“Using SourcifyChina’s Pro List cut our separator sourcing cycle from 14 weeks to 9 days. Zero quality deviations across 87 units deployed in Chile.”

— CPO, Global Mining Tech Leader (Fortune 500), Q4 2025 Client Reference

Call to Action: Secure Your 2026 Supply Chain Resilience

Every day delayed in qualifying dry separator suppliers risks:

⚠️ $18,200/day in project downtime (avg. copper processing facility)

⚠️ Non-compliance penalties under new EU Critical Raw Materials Act (effective Jan 2026)

⚠️ Lost market share to competitors with agile, verified supply chains

Act Now to Receive:

- 3 Pre-Vetted CZM Pro List Suppliers – With live capacity dashboards

- Technical Specification Crosswalk – Mapping your requirements to Chinese GB standards

- ESG Compliance Dossier – Ready for your sustainability audit team

→ Contact SourcifyChina Within 24 Hours for Priority Access:

📧 [email protected] (Quote: CZM-PRO2026)

📱 WhatsApp +86 159 5127 6160 (24/7 Sourcing Concierge)

First 15 respondents will receive our 2026 Dry Separation Technology Compliance Checklist (valued at $1,200) – valid through March 31, 2026.

SourcifyChina: Where Verified Supply Chains Drive Shareholder Value

Backed by DHL Supply Chain, ISO 20400 Certified Sourcing Partner | Serving 1,842 Global Procurement Teams

This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.