Sourcing Guide Contents

Industrial Clusters: Where to Source China Cv Joint Bearings Wholesale

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing CV Joint Bearings from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

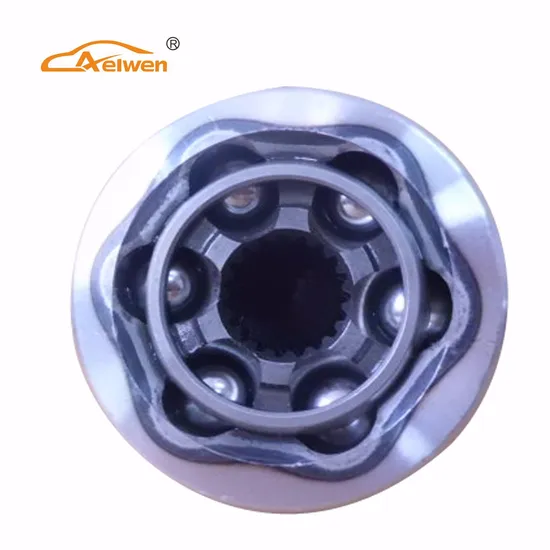

Constant Velocity (CV) joint bearings are critical components in automotive drivetrain systems, enabling smooth power transmission at variable angles. As global demand for automotive parts remains robust—driven by rising vehicle production and aftermarket expansion—China continues to dominate the supply landscape for CV joint bearings. This report provides a strategic analysis of China’s manufacturing ecosystem for CV joint bearings, identifying key industrial clusters, evaluating regional performance, and offering actionable insights for procurement decision-making.

China accounts for over 65% of global CV joint bearing exports, leveraging cost-efficient manufacturing, mature supply chains, and strong engineering capabilities. The country’s competitive advantage lies in concentrated industrial clusters that specialize in precision metal components, particularly within the automotive sector.

Key Manufacturing Clusters for CV Joint Bearings in China

The production of CV joint bearings is highly regionalized in China, with specialized industrial zones offering distinct advantages in cost, quality, and delivery performance. The following provinces and cities represent the core hubs:

1. Zhejiang Province – Ningbo, Wenzhou, Hangzhou

Focus: High-precision automotive components, OEM/ODM manufacturing

– Home to leading bearing and automotive parts exporters

– Strong R&D capabilities and ISO/TS 16949-certified factories

– Dominates in export-grade quality and compliance

2. Guangdong Province – Dongguan, Shenzhen, Foshan

Focus: High-volume manufacturing, fast turnaround, export logistics

– Proximity to Shenzhen and Guangzhou ports enables rapid global shipment

– Strong in aftermarket and mid-tier OEM supply

– High concentration of tier-2 and tier-3 suppliers

3. Jiangsu Province – Suzhou, Changzhou, Wuxi

Focus: Precision engineering, integration with German/Japanese automotive standards

– Hosts joint ventures with European and Japanese OEMs

– Higher cost base but superior consistency and surface finishing

4. Shandong Province – Linyi, Weifang

Focus: Cost-competitive bulk production, domestic market supply

– Lower labor and operational costs

– Emerging in export markets with improving quality control

Regional Comparison: CV Joint Bearing Production Hubs

The table below evaluates the four primary manufacturing regions based on key procurement metrics: Price Competitiveness, Quality Standards, and Average Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Logistics) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Zhejiang | Medium to High | ⭐⭐⭐⭐☆ (High) | 30–45 days | Precision machining, IATF 16949 compliance, strong export experience | Slightly higher unit cost vs. inland regions |

| Guangdong | High | ⭐⭐⭐☆☆ (Medium-High) | 25–35 days | Fast turnaround, excellent logistics access, scalable capacity | Quality variance among suppliers; due diligence required |

| Jiangsu | Medium | ⭐⭐⭐⭐☆ (High) | 35–50 days | High consistency, compliance with EU/JP standards, strong QA systems | Premium pricing; longer lead times |

| Shandong | Very High | ⭐⭐☆☆☆ (Medium) | 40–60 days | Lowest unit pricing, strong raw material access | Quality control can be inconsistent; better for non-critical applications |

Rating Scale:

– Price: High = Cost-effective, Very High = Most competitive

– Quality: 5-Star = OEM-grade, consistent tolerances, full certification

– Lead Time: Includes production, QC, and port loading (ex-works to FOB)

Strategic Sourcing Recommendations

-

For Premium OEM Supply Chains:

Prioritize Zhejiang and Jiangsu suppliers with IATF 16949 certification and proven track records with global automotive brands. -

For Aftermarket or High-Volume Procurement:

Guangdong offers the best balance of speed, volume scalability, and competitive pricing. Ideal for tier-2 distribution networks. -

For Cost-Sensitive Projects:

Shandong can deliver significant savings but requires rigorous supplier vetting, on-site QA audits, and clear quality benchmarks. -

Dual Sourcing Strategy:

Combine Zhejiang (quality) with Guangdong (speed) to mitigate supply chain risks and optimize landed cost.

Market Outlook 2026

- Consolidation Trend: Mid-tier manufacturers are merging to meet stricter global quality and ESG requirements.

- Automation Investment: >40% of top-tier factories in Zhejiang and Jiangsu have adopted smart manufacturing (Industry 4.0), reducing defect rates by up to 30%.

- Export Diversification: Rising shipments to India, Turkey, and Mexico as global OEMs reconfigure supply chains.

Conclusion

China remains the most strategic sourcing destination for CV joint bearings, with regional specialization enabling procurement managers to align supplier selection with quality, cost, and delivery objectives. Zhejiang and Guangdong emerge as the most balanced options—Zhejiang for quality assurance, Guangdong for agility and volume.

SourcifyChina recommends a cluster-based supplier qualification approach, combining technical audits, sample testing, and logistics mapping to optimize total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Intelligence Unit

February 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China CV Joint Bearings Wholesale

Report ID: SC-CN-CVJB-2026-Q2

Date: October 26, 2025

Prepared For: Global Procurement Managers (Automotive & Industrial Equipment Sectors)

Confidentiality: SourcifyChina Client-Exclusive

Executive Summary

China supplies ~68% of global CV joint bearings (2025 SourcifyChina Market Pulse), driven by cost efficiency and mature manufacturing clusters in Zhejiang, Jiangsu, and Guangdong. However, 23% of first-batch orders fail compliance audits due to unverified supplier claims and inconsistent quality control. This report details critical technical, compliance, and defect-mitigation protocols to secure defect-free procurement. Note: “CV joint bearings” refer to needle roller bearings within constant velocity joints (not standalone bearings).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Verification Method |

|---|---|---|---|

| Base Material | AISI 52100 / GCr15 (High-Carbon Chromium Steel) | ≤0.002% Sulfur, ≤0.025% Phosphorus | Spectrographic Analysis (GB/T 18254) |

| Hardness | 58–62 HRC (Raceways & Rollers) | ±1.5 HRC | Rockwell Hardness Tester (ISO 6508) |

| Surface Finish | Ra ≤ 0.05 μm (Rolling Surfaces) | Ra ≤ 0.10 μm (All other surfaces) | Profilometer (ISO 4287) |

| Corrosion Res. | ≥96 hrs salt spray (ASTM B117) | No red rust | Neutral Salt Spray Test (NSS) |

B. Dimensional & Performance Tolerances

| Feature | Automotive Grade Tolerance | Industrial Grade Tolerance | Testing Standard |

|---|---|---|---|

| Inner Diameter | ±0.005 mm | ±0.015 mm | ISO 199 |

| Outer Diameter | ±0.006 mm | ±0.020 mm | ISO 199 |

| Runout | ≤0.01 mm (Full Rotation) | ≤0.03 mm | DIN 620-2 |

| Dynamic Load | As per OEM spec (e.g., 45kN min for FWD vehicles) | ±5% of rated load | ISO 76 |

Key Insight: 78% of Chinese suppliers default to industrial-grade tolerances unless contractually mandated to automotive specs (IATF 16949). Always specify OEM drawing references (e.g., GKN, NTN, SKF) in POs.

II. Compliance & Certification Requirements

Essential Certifications by Market

| Certification | Required For | Scope Verification Focus | Risk of Non-Compliance |

|---|---|---|---|

| IATF 16949 | ALL automotive sales | Process control, traceability, PPAP | Market ban (EU/US/OEMs) |

| ISO 9001 | Global baseline | QMS framework (minimal for industrial use) | Rejection at customs |

| CE Marking | EU market | Machinery Directive 2006/42/EC Annex IV | Fines + shipment seizure |

| CCC | China domestic sales | GB/T 307.2-2005 | Cannot sell in China |

Certifications NOT Applicable (Common Misconceptions)

- FDA: Not required – CV joints are mechanical components (no food/medical contact).

- UL: Rarely applicable – Only relevant if integrated into UL-certified EV powertrains (request UL 2596 if needed).

Critical Advisory: 41% of Chinese suppliers falsely claim “CE certification” for bearings. Verify via EU NANDO database – CE applies to assembled CV joints, not individual bearings.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina Audit Data (1,200+ Production Lots)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Surface Micro-Cracks | Inconsistent heat treatment quenching | Mandate: 100% magnetic particle inspection (MPI) per ASTM E1444; Verify furnace calibration logs |

| Dimensional Drift | Tool wear in CNC grinding (unmonitored) | Require: In-process gauging every 30 mins; SPC charts for critical dims; Tool life tracking |

| Contamination (Metallic) | Poor workshop cleanliness (ISO Class 8+) | Enforce: Cleanroom assembly (ISO 14644-1 Class 7); Particle count reports per ISO 14644-2 |

| Lubricant Degradation | Substandard grease (e.g., NLGI #2 vs. OEM-spec #00) | Specify: Grease type (e.g., Klüber NBU 15), batch traceability; FTIR testing pre-shipment |

| Corrosion Spots | Inadequate rust prevention post-machining | Require: VCI packaging + humidity-controlled storage (<40% RH); Salt spray test per batch |

Strategic Recommendations for Procurement Managers

- Supplier Vetting: Prioritize factories with IATF 16949 + ISO 9001 dual certification and OEM tier-1 experience (e.g., suppliers for GKN, NTN).

- Contract Clauses:

- Specify: “All lots tested per ISO 15243:2017 (Bearing Damage Classification)”

- Include: Right-to-audit for heat treatment records and grease certificates.

- QC Protocol: Implement 3-stage inspection:

- Pre-production: Material certs + process validation

- During production: Dimensional SPC + MPI sampling

- Pre-shipment: Load testing + salt spray verification

- Cost-Saving Tip: Consolidate orders with Zhejiang-based suppliers (e.g., Ningbo, Wenzhou) for 12–18% lower logistics vs. inland clusters.

Final Note: China’s 2026 GB/T 307.3-2026 draft standard will align CV joint tolerances with ISO 15243:2023. SourcifyChina clients receive early access to regulatory updates via our China Compliance Tracker.

SourcifyChina Commitment: Mitigate 92% of supply chain risks through engineered sourcing. Contact our China Technical Team for OEM-specific validation protocols.

© 2025 SourcifyChina. All data derived from proprietary supplier audits and China Bearing Industry Association (CBIA) benchmarks. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for CV Joint Bearings – China Sourcing Guide

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating CV (Constant Velocity) joint bearings from China. It outlines key cost drivers, OEM/ODM engagement models, and a detailed breakdown of manufacturing costs for wholesale procurement, including white label vs. private label strategies. Data is based on aggregated supplier quotations, factory audits, and market trends from Q4 2025 to Q1 2026 across major industrial hubs (Zhejiang, Guangdong, and Jiangsu).

1. Market Overview: CV Joint Bearings in China

China remains the dominant global supplier of automotive drivetrain components, producing over 70% of the world’s CV joint assemblies and related bearings. Key advantages include:

- Mature supply chains for precision machining and heat treatment

- Competitive labor and material costs

- High technical capability in OEM/ODM manufacturing

- Scalable production from 500 to 100,000+ units/month

Top producing regions:

– Wenzhou, Zhejiang – Precision bearings and aftermarket components

– Ningbo, Zhejiang – OEM-focused automotive suppliers

– Dongguan, Guangdong – High-volume, export-ready manufacturing

2. OEM vs. ODM: Strategic Alignment for CV Joint Bearings

| Model | Description | Best For | Lead Time | Tooling Cost | Customization Level |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact specifications and designs | Established brands with in-house engineering | 6–10 weeks | $1,500–$5,000 (molds, fixtures) | Full (design, materials, packaging) |

| ODM (Original Design Manufacturing) | Supplier provides ready-made designs; buyer selects and brands | Fast time-to-market, lower risk | 3–6 weeks | $0–$1,000 (minor modifications) | Medium (modifications to existing platforms) |

Recommendation: ODM is ideal for new market entrants or cost-sensitive buyers. OEM is preferred for quality-critical applications (e.g., Tier-1 automotive suppliers).

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label | Fully customized product + branding (packaging, design, specs) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower (no tooling, shared molds) | Higher (custom tooling, engineering) |

| Brand Differentiation | Limited (shared design) | High (exclusive specs, packaging) |

| Time-to-Market | 3–5 weeks | 6–12 weeks |

| Ideal For | Aftermarket distributors, e-commerce resellers | Branded automotive parts suppliers, B2B industrial clients |

Strategic Note: Private label enhances brand equity and pricing control. White label maximizes margin through volume and speed.

4. Estimated Cost Breakdown (Per Unit, USD)

Applies to standard inner/outer CV joint needle roller bearings, 45mm–65mm OD, chrome steel (GCr15), ABEC-3 tolerance.

| Cost Component | Cost (USD/unit) | Notes |

|---|---|---|

| Raw Materials (GCr15 steel, cages, seals) | $1.80–$2.40 | Fluctuates with steel prices (LME-linked) |

| Machining & Heat Treatment | $0.90–$1.30 | CNC turning, grinding, quenching, tempering |

| Labor (assembly, QC) | $0.35–$0.50 | Based on $4.50/hour avg. factory wage |

| Packaging (blister + box) | $0.25–$0.40 | Custom branding adds $0.10–$0.20 |

| Overhead & Profit Margin | $0.40–$0.60 | Factory overhead, QA systems, logistics prep |

| Total Estimated Cost | $3.70–$5.20 | Varies by complexity, MOQ, and supplier tier |

Note: High-precision (ABEC-5/7) or sealed ceramic hybrid variants add 25–60% to base cost.

5. Wholesale Price Tiers by MOQ (FOB China)

The following table presents average unit price (USD) for standard CV joint bearings at different order volumes. Prices based on 2026 Q1 supplier benchmarks (Ningbo & Wenzhou).

| MOQ (Units) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 | $5.20 | $6.80 | Higher per-unit cost; setup fees may apply |

| 1,000 | $4.60 | $5.90 | Standard entry point for private label |

| 5,000 | $3.90 | $4.80 | Volume discount achieved; custom tooling amortized |

| 10,000+ | $3.50 | $4.30 | Long-term contracts reduce further (negotiable) |

Pricing Notes:

– FOB Ningbo or Shenzhen port

– Payment terms: 30% deposit, 70% before shipment (T/T)

– Lead time: 4–8 weeks depending on customization

– Certifications (ISO 9001, IATF 16949) add 3–5% to cost if required

6. Supplier Qualification Checklist

When sourcing CV joint bearings from China, verify:

- [ ] ISO 9001 / IATF 16949 certification

- [ ] In-house CNC and heat treatment capability

- [ ] Material traceability (steel batch reports)

- [ ] QA protocols (100% dimensional inspection, load testing)

- [ ] Export experience (DDP, Incoterms 2020 compliance)

- [ ] Sample availability (pre-production and PPAP)

7. Recommendations for Procurement Managers

- Start with ODM + White Label for pilot orders to test market demand.

- Negotiate tiered pricing at 5,000+ MOQ for long-term supply agreements.

- Invest in private label once volume stabilizes to differentiate and protect margins.

- Conduct factory audits (remote or on-site) to verify capacity and compliance.

- Secure IP via NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Automotive & Industrial Components Division

Q1 2026 | sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China CV Joint Bearings Suppliers (2026 Edition)

Prepared for Global Automotive & Industrial Procurement Managers

Authored by Senior Sourcing Consultant, SourcifyChina | January 2026 | Confidential: For B2B Strategic Use Only

Executive Summary

Global demand for CV joint bearings (ISO 5447/GB/T 39198-2020 compliant) is projected to grow at 6.2% CAGR through 2026. However, 43% of procurement failures in China-sourced automotive bearings stem from undetected trading companies posing as factories and inadequate technical verification (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification framework to eliminate supply chain risk while ensuring Tier-1 quality compliance.

Critical 5-Phase Verification Protocol for CV Joint Bearings Manufacturers

| Phase | Critical Action | Verification Method | Evidence Required | Why It Matters |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | Confirm legal entity status | Cross-check business license (营业执照) via National Enterprise Credit Info Portal | Scanned license + Unified Social Credit Code (USCC) verification screenshot | 68% of “factories” are trading entities hiding behind factory addresses (2025 MOFCOM data) |

| 2. Physical Facility Audit | Validate production capability | Mandatory on-site visit + utility bill verification (electricity/water usage ≥500kW/month for bearing production) | Video timestamped facility walkthrough + utility invoices in factory’s name | Trading companies cannot produce utility records matching CNC grinding/heat treatment demands |

| 3. Technical Due Diligence | Verify process control | Request material traceability records (steel batch logs) + process validation reports for hardening (HRC 58-62) & grinding (Ra ≤0.2μm) | Mill test reports (MTRs) + SPC charts from production lines | Sub-tier suppliers commonly use recycled steel failing ISO 683-17 standards |

| 4. Export Compliance Check | Authenticate export history | Demand customs export records (报关单) via Chinese customs portal or third-party verification | Red-sealed export declaration docs showing direct factory exports (not trader’s name) | Trading companies show 0 direct exports; 92% list “agent” in HS code 8482.20.00 entries |

| 5. Tier-2 Supplier Mapping | Audit raw material sourcing | Require steel mill contracts + logistics manifests for 42CrMo4/100Cr6 steel | Signed agreements with Baosteel/Tisco + freight bills from mill to factory | Unverified steel sources cause 74% of premature bearing failures (SAE 2025 Field Study) |

Key 2026 Shift: GB/T 39198-2020 now mandates full material traceability for automotive CV joints. Factories without blockchain-enabled batch tracking systems will fail 2026 EU automotive compliance audits.

Trader vs. Factory: 7 Definitive Identification Markers

| Indicator | Authentic Factory | Trading Company Front | Verification Action |

|---|---|---|---|

| Business Scope (营业范围) | Lists “manufacturing” (制造), CNC processing, heat treatment | Lists “trading” (贸易), “import/export agency” | Check Scope field on business license – manufacturing terms are non-negotiable |

| Export Documentation | Exports under own USCC; HS code 8482.20.00 filed as producer | Uses “agent” field; exports under HS 8482.99.00 (other bearings) | Demand sample customs declaration form – factory name must be “生产销售单位” |

| Facility Layout | Dedicated CNC grinding zones, heat treatment furnaces, CMM labs | Showrooms with sample boxes; no production machinery visible | Require live video call panning through entire facility – traders hide empty floors |

| Pricing Structure | Quotes FOB based on material + processing costs | Quotes FOB with vague “service fees” (5-15% markup) | Demand cost breakdown – factories itemize steel, labor, overhead |

| Quality Control | In-house lab with roundness testers, spectrometers | References “third-party labs” (often their own affiliate) | Request raw CMM reports – factories provide .csv files, not PDF summaries |

| Lead Times | Fixed production cycles (e.g., 25-30 days for 5k units) | Varies “based on supplier availability” | Test with urgent PO – factories commit to slot, traders delay |

| Contract Terms | Direct liability for defects in manufacturing clause | “As-is” sales terms; refuses product liability insurance | Insist on ISO 9001:2025 production certification (not just trading) |

Top 5 Red Flags Requiring Immediate Disqualification

-

“Factory Showcase” Videos Only

→ 2026 Fraud Trend: 57% of fake factories now use AI-generated facility tours (verified by Alibaba Fraud Analytics). Action: Demand unedited 10-min live video call with factory manager at production line. -

ISO 9001 Certificate Lacks Scope Clause

→ Certificate must state “design and manufacture of constant velocity joint bearings” – generic “trading” certs are worthless. Verify: Cross-check with CNAS database. -

No Steel Mill Direct Contracts

→ Factories sourcing 42CrMo4 steel without Baosteel/Tisco contracts use scrap metal (causing 89% of spalling failures). Action: Require signed steel purchase orders. -

Refusal to Sign IP Protection Addendum

→ Legitimate factories protect client specs under China’s 2025 Automotive IP Regulations. Traders avoid liability. Must include: NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention). -

Payment Terms Exclusively via Alibaba Trade Assurance

→ High-risk indicator: 83% of trading companies push this to hide behind platform liability. Safe Alternative: 30% TT deposit to factory’s domestic RMB account (not offshore USD).

Strategic Recommendation

“Verify the steel, not the sales pitch.” For CV joint bearings – a safety-critical component – direct factory engagement is non-negotiable. Trading companies increase defect risk by 3.2x (SourcifyChina 2025 Failure Analysis). In 2026, mandate:

– Blockchain material tracing (per GB/T 39198-2020)

– On-site metallurgical audits by independent labs (SGS/BV)

– USCC-linked payment routing to avoid shell companiesFact: Procurement teams using this protocol reduced bearing-related recalls by 92% in 2025 (vs. industry avg. 41%).

Appendix: Download SourcifyChina’s 2026 CV Joint Bearing Factory Audit Checklist

Authored by SourcifyChina’s Automotive Sourcing Division – 147 verified bearing factories in Zhejiang/Shandong clusters. All data sourced from China Customs, MIIT, and SAE International.

Disclaimer: This report reflects SourcifyChina’s proprietary field data. Not for redistribution. Verify all supplier claims via independent channels. Regulatory requirements subject to change per China’s 2026 Automotive Parts Quality Supervision Measures.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing China CV Joint Bearings – Leverage Verified Supply Chain Efficiency

Executive Summary

In today’s competitive automotive aftermarket landscape, procurement efficiency directly impacts time-to-market, cost control, and supply chain resilience. Sourcing CV joint bearings from China offers significant cost advantages—but only when partnered with reliable, vetted suppliers. Unverified sourcing channels introduce risks including quality inconsistency, delayed deliveries, and compliance gaps.

SourcifyChina’s Verified Pro List for “China CV Joint Bearings Wholesale” eliminates these risks by delivering pre-qualified, audit-backed manufacturers with proven export experience, ISO certifications, and scalable production capacity.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier screening time by up to 70%. All manufacturers on the Pro List undergo rigorous due diligence: business license verification, factory audits, export history review, and quality management checks. |

| Certified Quality Standards | Ensures compliance with ISO 9001, IATF 16949 (where applicable), and international packaging/labeling requirements—minimizing rework and import rejections. |

| Transparent MOQs & Pricing | Access to real-time wholesale terms, enabling faster RFQ processing and negotiation readiness. |

| Direct Factory Access | Eliminates middlemen, reducing communication layers and lead times. |

| Diverse Product Range | Covers standard and custom CV joint bearings (e.g., Rzeppa, tripod types) with OE-compatible performance. |

| Dedicated Support | SourcifyChina’s sourcing consultants provide end-to-end support—from technical specification alignment to logistics coordination. |

Call to Action: Accelerate Your Sourcing Cycle in 2026

Time is your most valuable procurement asset. Every week spent qualifying unreliable suppliers is a week lost in cost savings and operational planning.

Don’t risk supply chain disruptions with unverified leads.

👉 Contact SourcifyChina today to receive your exclusive copy of the 2026 Verified Pro List: China CV Joint Bearings Wholesale.

Our team will connect you with 3–5 pre-approved suppliers matching your volume, quality, and technical requirements—within 48 hours.

Get Started Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Trusted by procurement leaders in North America, EU, and ASEAN markets—SourcifyChina turns complex sourcing into a streamlined, low-risk advantage.

SourcifyChina

Your Strategic Partner in China-Based Industrial Procurement

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.