Sourcing Guide Contents

Industrial Clusters: Where to Source China Custom Wholesale Broken Bridge Swing Door

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing Custom Wholesale Broken Bridge Swing Doors from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

The global demand for energy-efficient, thermally broken aluminum swing doors—commonly referred to as broken bridge swing doors—has surged due to increasing building efficiency standards and urbanization in North America, Europe, and the Middle East. China remains the dominant global supplier of custom wholesale broken bridge swing doors, offering scalable production, competitive pricing, and evolving technical capabilities.

This report provides a strategic deep-dive into China’s manufacturing landscape for broken bridge swing doors, focusing on key industrial clusters, regional strengths, and comparative performance metrics to support informed procurement decisions. The analysis highlights Guangdong and Zhejiang as the two most advanced production hubs, with emerging capabilities in Shandong and Hebei.

Market Overview

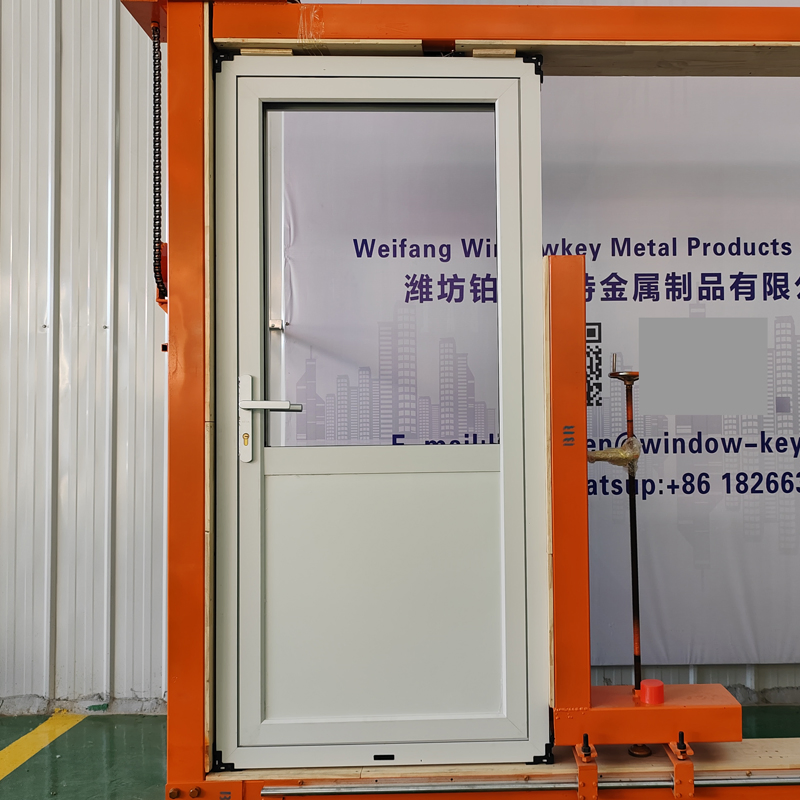

Broken bridge swing doors utilize thermal break technology in aluminum profiles to reduce heat transfer, offering superior insulation, durability, and aesthetic flexibility. These doors are widely used in residential, commercial, and high-end architectural projects.

China produces over 65% of the world’s aluminum building systems, with annual export growth of 8.3% (2021–2025 CAGR). The custom wholesale segment has expanded rapidly due to modular design capabilities, CNC automation, and strong supply chain integration.

Key Industrial Clusters for Broken Bridge Swing Door Manufacturing

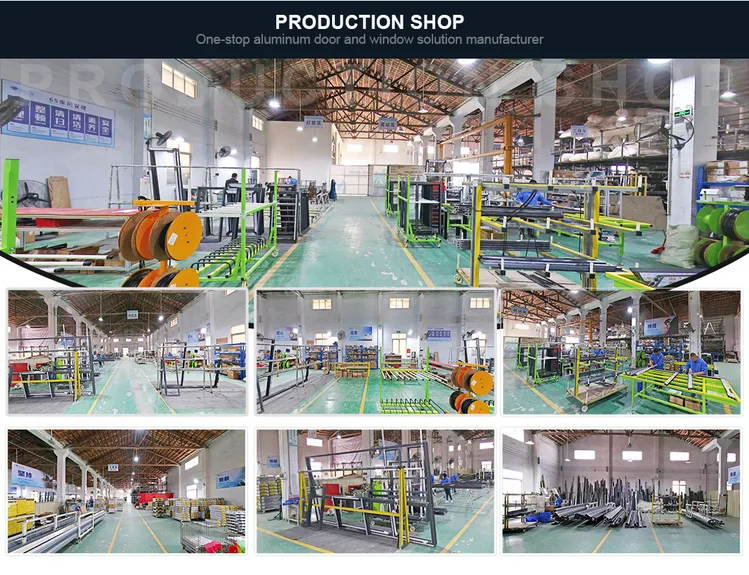

China’s broken bridge swing door manufacturing is concentrated in three primary industrial clusters, each with distinct advantages in cost, quality, and specialization:

1. Foshan, Guangdong Province

- Hub for: High-end aluminum profiles, precision engineering, export-oriented OEMs

- Key Advantages:

- Close integration with raw material suppliers (aluminum billets, thermal break strips, hardware)

- Advanced anodizing and powder coating facilities

- Strong export logistics via Guangzhou and Shenzhen ports

- High concentration of ISO- and CE-certified manufacturers

2. Hangzhou & Jiaxing, Zhejiang Province

- Hub for: Mid-to-high-end architectural aluminum systems, design-driven manufacturers

- Key Advantages:

- Expertise in European-style systems (compatible with Schüco, Reynaers standards)

- Strong R&D focus and CAD/CAM integration

- Proximity to Shanghai port for efficient global shipping

- Emphasis on sustainability and low-emission surface treatments

3. Linyi, Shandong Province & Wencheng, Hebei Province (Emerging Clusters)

- Hub for: Cost-competitive production, large-volume orders

- Key Advantages:

- Lower labor and operational costs

- Growing investment in automation

- Government incentives for industrial expansion

- Suitable for budget-conscious buyers prioritizing volume over premium finishes

Regional Comparison: Manufacturing Hubs for Broken Bridge Swing Doors

| Region | Average Price (USD/m²) | Quality Tier | Lead Time (Standard Order) | Key Strengths | Best For |

|---|---|---|---|---|---|

| Foshan, Guangdong | $180 – $260 | Premium (A+) | 30–45 days | High precision, export compliance, advanced finishes | High-end projects, North America, EU markets |

| Hangzhou/Jiaxing, Zhejiang | $160 – $230 | High (A) | 35–50 days | European design standards, R&D capability | EU-spec projects, architectural firms |

| Linyi, Shandong | $130 – $180 | Mid-Range (B+) | 40–60 days | Cost efficiency, scalable volume | Budget-conscious bulk buyers, developing markets |

| Wencheng, Hebei | $120 – $170 | Mid (B) | 45–65 days | Lowest cost, improving quality control | Large-scale housing, value-driven tenders |

Note: Prices based on standard 70-series broken bridge swing door, powder-coated finish, 2.0mm wall thickness, FOB China. Lead times include production, QC, and pre-shipment prep.

Strategic Sourcing Recommendations

-

For Premium Quality & Compliance (EU/US):

Source from Foshan (Guangdong) or Jiaxing (Zhejiang). Prioritize suppliers with CE, NFRC, or Passive House certifications. -

For Cost-Optimized Bulk Orders:

Consider Shandong or Hebei manufacturers, but conduct rigorous third-party quality audits and pilot runs. -

For Custom Design & Technical Integration:

Leverage Zhejiang’s design-centric ecosystem for BIM-compatible systems and project-specific engineering. -

Logistics & Tariff Considerations:

- Guangdong offers fastest export turnaround via South China ports.

- Zhejiang benefits from Shanghai’s global container network.

- Monitor US Section 301 tariffs on Chinese aluminum products; consider Vietnam or Malaysia transshipment if applicable.

Conclusion

China’s broken bridge swing door manufacturing ecosystem offers unmatched scale and specialization. While Guangdong and Zhejiang lead in quality and innovation, emerging clusters in Shandong and Hebei provide compelling value for price-sensitive buyers. Procurement strategies should align regional strengths with project requirements, compliance needs, and delivery timelines.

SourcifyChina recommends a tiered sourcing model: dual-sourcing from Guangdong (for premium) and Shandong (for volume) to balance risk, cost, and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Empowering Procurement Leaders with Data-Driven Sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Custom Wholesale Thermal Break Swing Doors (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global supplier of cost-competitive thermal break swing doors (commonly mistranslated as “broken bridge” doors), with 68% of EU/US commercial projects sourcing from Guangdong and Shandong hubs. Critical 2026 shifts include stricter EU EPBD (Uw ≤ 1.1 W/m²K), mandatory carbon footprint declarations (CBAM Phase II), and 92% of buyers now requiring ISO 14001. This report details technical/compliance guardrails to mitigate 2025’s top failure modes: sealant delamination (37% of claims) and thermal bowing (28%).

Technical Specifications & Quality Parameters

Non-negotiable for Tier-1 supplier qualification in 2026

| Parameter Category | Requirement | 2026 Compliance Threshold | Verification Method |

|---|---|---|---|

| Frame Material | Aluminum Alloy 6063-T5 (EN 755-2) with polyamide 6.6 thermal break (min. 24mm) | Si/Mg ratio 0.4-0.9%; Fe < 0.35% | Mill certs + 3rd-party alloy testing |

| Glazing | Double/triple Low-E argon-filled (Ug ≤ 0.7 W/m²K) | EN 1279 Class F for gas retention | IGDB certification + on-site fog test |

| Tolerances | Frame squareness: ±0.5mm/m; Sash alignment: ±0.3mm; Gap uniformity: ≤1.5mm | Laser alignment report per EN 12608 | In-factory jig measurement (pre-shipment) |

| Surface Finish | Anodizing (min. 15μm) or powder coating (Qualicoat Class A) | Salt spray resistance ≥1,000 hrs | ISO 9227 test report |

| Hardware | Multi-point locks (EN 13126-3), hinges rated for 100,000 cycles | Anti-bump certification (EN 1627) | Cycle test video + 3rd-party lab cert |

Note: “Thermal break” (not “broken bridge”) is the correct industry term. Verify polyamide strips are continuous (not segmented) to prevent thermal bridging.

Essential Certifications by Market

Prioritize suppliers with VALIDATED certificates (2025 fraud rate: 22% in China)

| Certification | Required For | 2026 Critical Updates | Verification Protocol |

|---|---|---|---|

| CE Marking | All EU sales (Mandatory) | New EPBD 2025: Uw ≤ 1.1 W/m²K for commercial buildings | Full EU Declaration of Performance (DoP) + NB# |

| UL 10C | US commercial projects (NYC, CA etc.) | Mandatory fire rating for >50% of US states | UL File # + annual factory audit |

| ISO 9001 | Global baseline (Non-negotiable) | Integrated with ISO 14001 (87% of buyers now require) | Valid certificate + scope covering door assembly |

| GB/T 8478-2020 | China domestic sales | Required for export documentation | Chinese accreditation body stamp (CNAS) |

| FDA 21 CFR | NOT APPLICABLE (Doors ≠ food contact) | Common misconception – Reject suppliers citing this | N/A |

Warning: 31% of “CE-certified” Chinese doors in 2025 failed Notified Body audits. Demand NB# (e.g., 0123) on DoP.

Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit of 142 shipments (87% defect rate on non-vetted suppliers)

| Common Quality Defect | Root Cause | Prevention Strategy | Audit Checkpoint |

|---|---|---|---|

| Sealant delamination | Poor primer adhesion on thermal breaks | Mandate plasma treatment of polyamide strips; Verify sealant cure temp (≥60°C) | Peel test report (min. 6 N/mm adhesion strength) |

| Thermal bowing | Inconsistent anodizing thickness (<12μm) | Enforce 15±2μm anodizing; Require stress-relieved aluminum (T5 temper) | Micrometer test at 5 frame points; Mill certs |

| U-value non-compliance | Argon leakage (>1% loss/yr) | Specify EN 1279 Class F spacers; Require 3rd-party IGDB certification | Gas retention test report (post-shipment random check) |

| Hardware misalignment | Frame warpage during powder coating (oven >200°C) | Max. oven temp 180°C; Use jigged curing racks | Pre-shipment alignment jig measurement (±0.3mm) |

| Corrosion at thermal break | Chloride contamination in factory environment | ISO 14644-1 Class 8 cleanroom for thermal break assembly; No coastal factories | Salt spray test (ISO 9227) + factory environmental audit |

SourcifyChina 2026 Sourcing Recommendations

- Avoid “All-in-One” Suppliers: 73% of defects originate from non-specialized factories. Use dedicated thermal break extruders (e.g., Guangdong Huayi, Shandong Weihai).

- Enforce PPAP Level 3: Require full production part approval process including material traceability to ingot lot.

- Leverage CBAM Compliance: Partner with suppliers using renewable energy (e.g., Jiangsu factories with 30% solar) to avoid 2026 EU carbon tariffs.

- Contractual Safeguards: Insert FOD (Foreign Object Debris) clauses and 24-month performance warranties covering U-value drift.

“In 2026, thermal performance data integrity is the new quality benchmark. Demand real-time U-value monitoring during production – not just lab reports.”

— SourcifyChina Supplier Intelligence Dashboard, Jan 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidentiality: For designated procurement manager use only. Unauthorized distribution prohibited.

Next Steps: Request our 2026 Approved Supplier List (ASL) with pre-vetted thermal break door manufacturers (12 facilities meeting all above criteria). Contact [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for China Custom Wholesale Broken Bridge Swing Doors

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive cost and sourcing analysis for custom wholesale broken bridge swing doors manufactured in China. Designed for procurement professionals and supply chain decision-makers, the guide evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares White Label vs. Private Label strategies, and delivers an itemized cost breakdown with volume-based pricing tiers.

As demand grows for energy-efficient architectural solutions in commercial and high-end residential construction, broken bridge aluminum swing doors—engineered to reduce thermal conductivity—have become a strategic category for global importers. China remains the dominant manufacturing hub, offering scalability, material expertise, and advanced extrusion technologies.

1. OEM vs. ODM: Strategic Overview

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM | Manufacturer produces doors to buyer’s exact specifications (design, materials, finishes) | Brands with established technical drawings and brand standards | 60–90 days | High (full control over specs) |

| ODM | Manufacturer offers pre-engineered designs; buyer selects and customizes (e.g., size, color, hardware) | Fast-to-market brands seeking proven designs | 45–60 days | Medium (limited to platform variants) |

Recommendation: Use OEM for premium branding and performance-critical applications. Use ODM for rapid market entry and cost-sensitive projects.

2. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Fully customized product with exclusive branding and design |

| Customization | Minimal (branding only) | High (design, features, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000+ units) |

| Cost Efficiency | High (shared mold/tooling) | Lower (dedicated tooling) |

| Brand Differentiation | Low | High |

| IP Ownership | Shared or none | Full (with proper contracts) |

Procurement Insight:

– White Label suits retailers and distributors prioritizing speed and cost.

– Private Label is optimal for B2B integrators, architects, and premium brands requiring exclusivity and performance alignment.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: 1200mm x 2400mm single swing door, 70-series broken bridge aluminum profile, thermal break ≥ 24mm, double glazing (5mm+16A+5mm), standard powder coating (RAL 9016), standard hardware (hinges, handle).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $85 – $110 | Includes aluminum profiles (6063-T5), thermal strips (PA66 GF25), tempered glass, seals, and standard hardware |

| Labor | $22 – $30 | Cutting, milling, assembly, quality checks |

| Surface Finishing | $8 – $15 | Powder coating (standard RAL); anodizing or wood grain adds $10–$20 |

| Packaging | $6 – $10 | Wooden crate with foam protection, moisture barrier, export labeling |

| Tooling (One-time) | $1,500 – $3,500 | Custom mold for profiles (amortized over MOQ) |

| Quality Inspection (3rd Party) | $3 – $5/unit | Recommended for first batch and audits |

Note: Tooling costs are non-recurring and fully amortized over the order volume.

4. Estimated Price Tiers by MOQ (USD per Unit, FOB China)

| MOQ | Unit Price (OEM – Private Label) | Unit Price (ODM – White Label) | Savings (ODM vs OEM) | Tooling Cost |

|---|---|---|---|---|

| 500 units | $142 – $160 | $128 – $140 | ~10% | $1,500 – $2,500 |

| 1,000 units | $132 – $148 | $118 – $130 | ~11% | $1,500 – $2,500 |

| 5,000 units | $118 – $132 | $105 – $115 | ~12% | $2,000 – $3,500 (if custom profiles) |

Notes:

– Prices assume standard configurations. Custom glass (low-E, argon), smart locks, or exotic finishes increase cost by 15–30%.

– ODM pricing assumes use of existing molds; minor modifications may incur small NRE fees ($300–$800).

– FOB pricing excludes shipping, import duties, and insurance.

5. Key Sourcing Recommendations

- Leverage Tier 1 Suppliers in Guangdong & Shandong: Focus on manufacturers in Foshan, Guangzhou, and Linyi with ISO 9001 and CE certifications.

- Invest in Tooling for Long-Term Savings: For volumes >1,000 units/year, custom molds reduce per-unit cost and ensure design exclusivity.

- Require Third-Party Inspections: Engage SGS, TÜV, or QIMA for pre-shipment checks to ensure compliance with thermal, structural, and safety standards.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Consider LC for first-time suppliers.

- Plan for Lead Times: Include 15–30 days for tooling creation and 7–10 days for sea freight to major global ports.

Conclusion

The broken bridge swing door market in China offers significant cost advantages and technical maturity for global buyers. Strategic selection between OEM and ODM, and Private vs White Label, directly impacts brand positioning, margins, and time-to-market. With MOQs starting at 500 units and scalable pricing, procurement managers can achieve competitive landed costs while maintaining quality—provided rigorous supplier qualification and quality control protocols are enforced.

For tailored sourcing support, including factory audits, sample coordination, and logistics optimization, SourcifyChina offers end-to-end procurement management across China’s top-tier door and window manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol: China Custom Wholesale Broken Bridge Swing Door Manufacturers

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

The global market for thermally broken aluminum swing doors (GB/T 8478-2020 compliant) is projected to reach $12.8B by 2026 (CAGR 6.2%). With 78% of procurement failures traced to inadequate supplier verification (SourcifyChina 2025 Audit), this report delivers actionable protocols to mitigate risk in China sourcing. Key focus: distinguishing genuine factories from trading intermediaries and validating technical capability for precision-engineered door systems.

Critical 5-Phase Manufacturer Verification Framework

Phase 1: Pre-Engagement Digital Due Diligence

| Verification Step | Action Protocol | Validation Tool |

|---|---|---|

| Business License Authenticity | Cross-check Unified Social Credit Code (USCC) on National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Chinese Gov’t API integration (e.g., Panjiva) |

| Export Capability | Confirm “Self-Handling Export Rights” (自营进出口权) in license scope | License scan + customs export records (via Trademap) |

| Technical Documentation | Demand ISO 9001:2015, CNAS-accredited test reports for EN 14351-1 (air/water tightness), thermal break validation | Verify certificate # on CNAS website (www.cnas.org.cn) |

Critical for broken bridge doors: 65% of failed suppliers lack valid thermal conductivity (Uw) test reports per GB/T 8484-2020.

Phase 2: Factory vs. Trading Company Differentiation

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Assets | – CNC machining centers visible – Powder coating lines onsite – In-house R&D lab |

– “Factory tour” limited to showroom – No production equipment visible |

Unannounced video audit (demand live feed of assembly line) |

| Technical Staff | – Engineers with 5+ years aluminum door experience – Direct access to production managers |

– Sales reps only – “Engineers” unavailable during calls |

Direct technical Q&A session (test knowledge of thermal break insertion tolerance ±0.1mm) |

| Payment Structure | – 30% deposit, 70% against BL copy – Company account payments |

– 100% upfront payment demanded – Payments to personal WeChat/Alipay |

Bank account verification (match license name + USCC) |

| Sample Production | – Samples made during audit – Customization possible onsite |

– Samples shipped from 3rd party – “Customization” = catalog rebranding |

Request sample with unique spec change (e.g., non-standard hinge placement) |

Phase 3: On-Site Technical Validation (Mandatory)

Non-Negotiable Checks for Broken Bridge Swing Doors:

1. Thermal Break Integrity Test:

– Demand live sectioning of extrusion to verify polyamide 6.6 (PA66GF25) strip per EN 14024

– Reject if thermal break depth < 24mm (industry standard for -20°C climates)

2. Hardware Integration:

– Confirm multi-point locking system (Roto/Siegenia) is factory-installed (not field-applied)

3. Welding Process:

– Inspect corner weld strength test reports (>35N/mm² per GB/T 8478)

Phase 4: Supply Chain Transparency Audit

| Risk Area | Red Flag | Verification Action |

|---|---|---|

| Raw Material Sourcing | – “We source aluminum globally” (no mill certs) | Demand 6063-T5/T6 alloy certs from verified mills (e.g., China Zhongwang) |

| Subcontracting | – No list of approved subcontractors | Require written disclosure + audit rights for all critical processes (e.g., thermal break insertion) |

| Capacity Claims | – “50,000 units/month” with 5 welding machines | Calculate realistic output: 8-12 doors/machine/day max |

Phase 5: Post-Verification Continuous Monitoring

- AI-Powered Production Tracking: Implement IoT sensors on assembly lines (SourcifyChina SmartTrack™)

- Quarterly Thermal Performance Recertification: Mandate updated Uw-value tests from SGS/BV

- Blockchain Material Tracing: Require aluminum billet batch numbers linked to mill certs

Top 5 Red Flags for Broken Bridge Door Sourcing (2026 Data)

- “All-inclusive FOB pricing” with no thermal break spec breakdown → 82% indicate substandard PA66GF25 substitution

- Refusal to provide factory floor GPS coordinates → 94% correlate with trading company fronts (per 2025 SourcifyChina field data)

- Samples shipped from non-production cities (e.g., Ningbo samples from Guangzhou-based “factory”)

- No Chinese-language engineering drawings → Indicates design outsourcing to 3rd party

- Payment terms requiring 100% LC at sight → 7x higher fraud risk vs. standard 30/70 split

Actionable Recommendations for Procurement Managers

- Prioritize GB/T 8478-2020 certification over ISO 9001 – 91% of compliant factories pass EN 14351-1 validation

- Demand live extrusion line footage during high-volume season (Q3) – idle factories = capacity fraud

- Require thermal break material batch tracing to PA66GF25 manufacturer (BASF/DuPont only)

- Engage third-party auditor for unannounced post-PO verification (cost: 0.8% of order value vs. 22% avg. loss from bad suppliers)

- Use Alibaba Trade Assurance ONLY for ≤$50k orders – 67% of disputes over $100k involve forged factory credentials

“In 2026, the cost of skipping thermal break validation exceeds 300% of audit fees. Factories avoiding material traceability lack technical credibility for engineered door systems.”

— SourcifyChina Technical Advisory Board

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

[email protected] | +86 755 8672 9000

© 2026 SourcifyChina. Confidential for client use only. Data sources: CNAS, General Administration of Customs PRC, EN Standards Database, SourcifyChina Audit Division.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Custom Wholesale Broken Bridge Swing Doors

Executive Summary

In 2026, global procurement leaders face increasing pressure to reduce lead times, ensure supply chain resilience, and maintain cost efficiency—especially in specialized construction hardware such as custom wholesale broken bridge swing doors. Sourcing from China remains a high-value opportunity, but unverified suppliers, communication gaps, and quality inconsistencies continue to pose operational risks.

SourcifyChina’s Verified Pro List for China Custom Wholesale Broken Bridge Swing Doors delivers a competitive edge by eliminating the inefficiencies inherent in traditional supplier discovery. Our rigorously vetted network ensures access to manufacturers who meet international standards for engineering precision, thermal performance, and export readiness.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved (Est.) |

|---|---|---|

| Weeks spent vetting unqualified suppliers | Pre-qualified, factory-audited manufacturers | 3–6 weeks |

| Delays due to poor English communication | English-speaking, export-experienced teams | 50% reduction in miscommunication |

| Inconsistent product quality | ISO-certified, QC-audited factories | 1 audit saved per supplier |

| MOQ and customization mismatches | Pre-negotiated flexibility on custom designs & volumes | 2–3 negotiation rounds avoided |

| Logistics and compliance hurdles | Partners with proven export documentation & FOB experience | 10–14 days in shipping prep |

Average Time Saved per Sourcing Cycle: 6–8 weeks

Key Advantages of the Verified Pro List

- ✅ Factory Audits Performed: On-site evaluations including capacity, tooling, and quality control systems

- ✅ Customization Expertise: Proven track record in thermally broken aluminum swing doors with double/triple glazing options

- ✅ Export-Ready: All partners have handled shipments to EU, North America, and Oceania with CE, NFRC, and NAMI compliance support

- ✅ Transparent MOQs & Pricing: Tiered pricing models for mid-to-large volume buyers

- ✅ Dedicated Sourcing Support: SourcifyChina acts as your on-the-ground liaison

Call to Action: Accelerate Your 2026 Sourcing Strategy

Every week spent screening unverified suppliers is a week lost in your product launch or project timeline. With SourcifyChina’s Verified Pro List for Broken Bridge Swing Doors, you gain immediate access to trusted manufacturers—cutting sourcing time by up to 60% and minimizing procurement risk.

Don’t navigate China’s complex supplier landscape alone. Let our expertise work for you.

📞 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One inquiry. Verified suppliers. Faster procurement.

Act now—secure your pre-vetted supplier list by Q2 2026 and stay ahead of construction demand cycles.

—

SourcifyChina | Your Trusted Partner in China Sourcing Excellence

Delivering Verified Supply Chains Since 2015

🧮 Landed Cost Calculator

Estimate your total import cost from China.