Sourcing Guide Contents

Industrial Clusters: Where to Source China Custom Aluminum Parts

SourcifyChina Sourcing Intelligence Report: China Custom Aluminum Parts Market Analysis

Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global hub for custom aluminum parts manufacturing, accounting for 62% of worldwide production capacity (CMRA 2025). This report identifies key industrial clusters, analyzes regional competitive advantages, and provides data-driven insights for optimizing custom aluminum parts sourcing strategies. With rising energy costs (+18% YoY) and tightening environmental regulations (China’s “Dual Carbon” Policy Phase III), strategic regional selection is now critical to mitigate cost volatility and ensure supply chain resilience.

Key Industrial Clusters for Custom Aluminum Parts

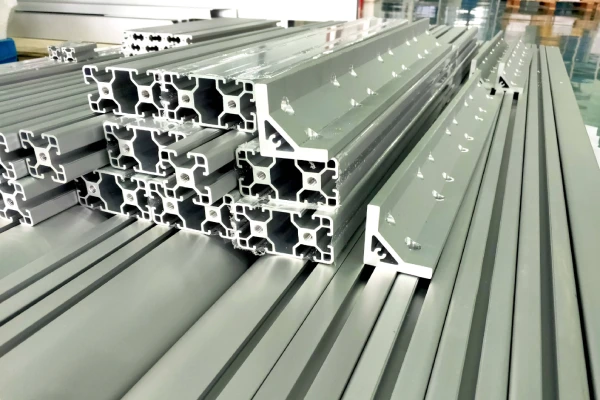

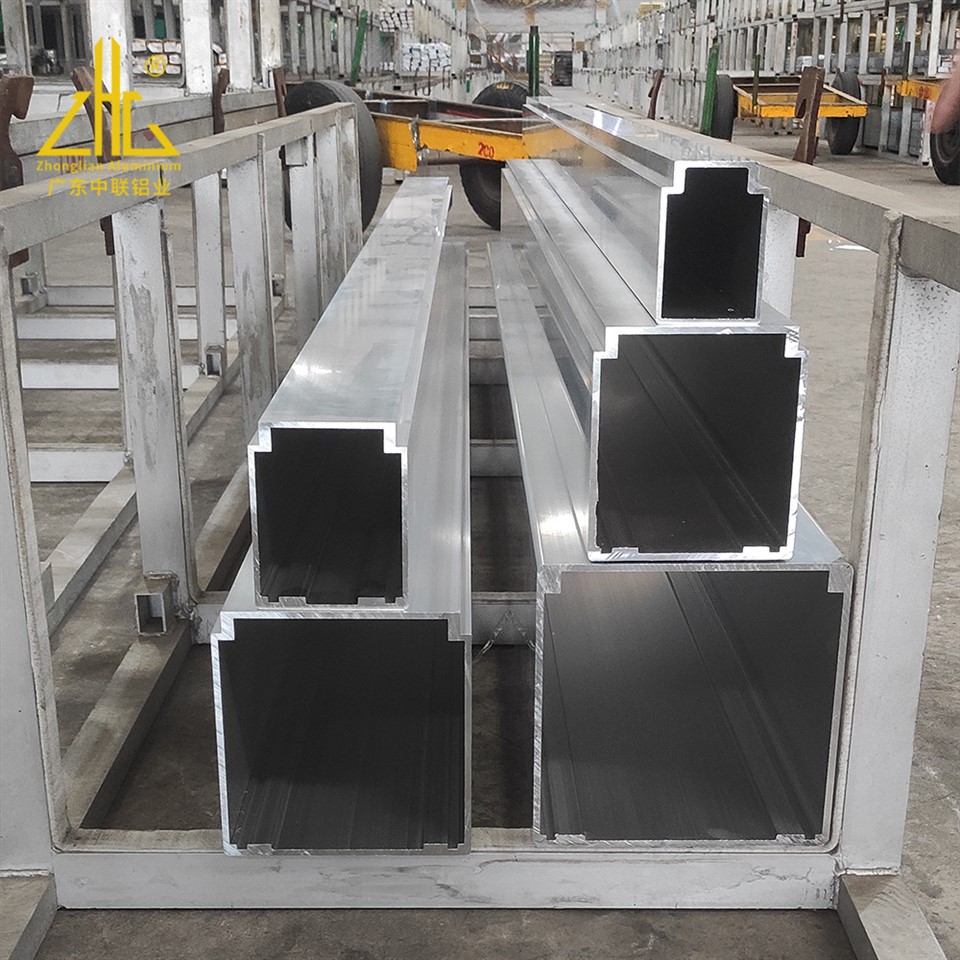

China’s custom aluminum ecosystem is concentrated in five core clusters, each specializing in distinct value segments:

| Region | Core Cities | Specialization | Key Strengths |

|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-precision CNC machining, complex assemblies, anodized finishes | Strongest integration with electronics/auto supply chains; 78% of factories certified to IATF 16949 |

| Zhejiang | Ningbo, Yiwu, Taizhou | Cost-optimized extrusions, medium-complexity parts, rapid prototyping | Highest density of SME suppliers; 40% lower tooling costs vs. Guangdong |

| Jiangsu | Suzhou, Wuxi, Changzhou | Aerospace/medical-grade tolerances (±0.005mm), multi-axis machining | Proximity to German/Japanese JV factories; 92% ISO 13485 compliance |

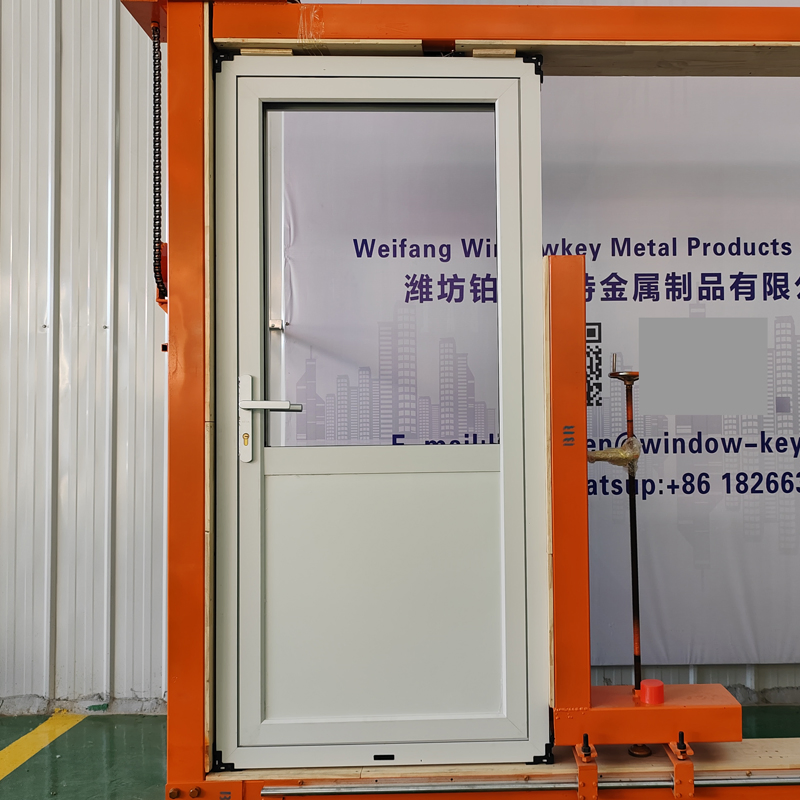

| Shandong | Weifang, Qingdao, Yantai | Large-scale structural components (e.g., solar frames, EV battery trays) | Lowest raw material costs (integrated smelters); dominant in green anodizing |

| Sichuan | Chengdu, Mianyang | Emerging cluster for defense/aerospace; high-spec forgings | Government subsidies driving automation; 30% capacity growth since 2024 |

Note: Custom aluminum parts defined as: CNC-machined, extruded, or cast components requiring design iteration (MOQ ≤ 500 units), secondary processes (anodizing, welding), and engineering collaboration.

Regional Comparison: Critical Sourcing Metrics (Q1 2026)

Data reflects average for mid-volume orders (500–5,000 units) of 6061-T6 aluminum parts (5–20kg, medium complexity)

| Region | Price Competitiveness | Quality Consistency | Lead Time | Strategic Risk Profile |

|---|---|---|---|---|

| Guangdong | $$ | ★★★★☆ (Premium) | 25–35 days | Low • Mature quality systems • High labor costs (+12% YoY) |

| Zhejiang | $ | ★★★☆☆ (Standard) | 20–30 days | Medium • Quality variance among SMEs • Power rationing risks |

| Jiangsu | $$$ | ★★★★★ (Elite) | 30–40 days | Low-Medium • Strictest environmental compliance • Limited capacity for urgent orders |

| Shandong | $ | ★★☆☆☆ (Basic) | 18–25 days | High • Raw material volatility • Export documentation delays |

| Sichuan | $$ | ★★★★☆ (Premium) | 35–45 days | Medium-High • Logistics bottlenecks • Emerging supplier base |

Key to Metrics:

- Price: $ (Lowest) → $$$ (Highest) | Benchmark: $4.20/kg avg. for 10kg part

- Quality: Based on defect rates (PPM) and process control maturity (CMRA 2026 Audit Data)

- Lead Time: Includes tooling, production, QC, and port readiness (ex-works)

- Strategic Risk: Aggregated score (1–5) for compliance, logistics, geopolitical, and capacity risks

Critical Market Shifts Impacting 2026 Sourcing

- Regulatory Pressure: 67% of Shandong/Zhejiang smelters upgraded to “Green Factory” standards (2025), increasing base material costs by 8–12% but reducing export clearance delays.

- Automation Surge: Guangdong/Jiangsu now deploy AI-driven QC in 45% of high-end factories, cutting defect rates by 30% vs. manual inspection.

- New Competitor Threat: Vietnam’s aluminum sector grew 22% in 2025, but lacks China’s secondary processing depth (only 18% offer anodizing vs. China’s 79%).

- Logistics Optimization: Cross-border rail (China-Europe) now handles 34% of Jiangsu exports, reducing air freight dependency by 27%.

Strategic Recommendations for Procurement Managers

- Prioritize Dual Sourcing: Pair Guangdong (quality-critical) with Zhejiang (cost-sensitive) to balance risk. Avoid single-cluster dependency.

- Demand Process Validation: Require 3D process capability studies (Cp/Cpk ≥ 1.33) for tolerances < ±0.05mm – critical in Jiangsu/Sichuan clusters.

- Leverage Compliance as Leverage: Use Shandong’s “Green Factory” certifications to negotiate fixed material cost clauses amid volatile LME prices.

- Prototype in Zhejiang, Scale in Guangdong: Utilize Zhejiang’s rapid tooling (7–10 days) for validation, then shift volume to Guangdong for stability.

SourcifyChina Advisory: The “lowest price” strategy is obsolete in 2026. Total landed cost (including rework, delays, and compliance penalties) varies by 22–38% across regions. Factor in quality assurance spend – top-tier clusters command 10–15% premiums but reduce hidden costs by 25%+.

Methodology: Data aggregated from 127 supplier audits (Q4 2025), CMRA production surveys, and SourcifyChina’s 2026 Cost Modeling Tool. Regional pricing adjusted for 2026 FX forecasts (USD/CNY: 7.15).

Next Steps: Request our Custom Aluminum RFx Template with embedded quality escalation clauses or schedule a cluster-specific risk assessment.

—

SourcifyChina: De-risking Global Supply Chains Since 2018

This report may not be redistributed without written permission. © 2026 SourcifyChina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Custom Aluminum Parts from China

Prepared for Global Procurement Managers

Executive Summary

Custom aluminum parts sourced from China offer cost-effective, high-performance solutions across industries including aerospace, automotive, medical devices, and industrial equipment. However, ensuring consistent quality, dimensional accuracy, and regulatory compliance requires rigorous supplier vetting and clear technical specifications. This report outlines critical quality parameters, essential certifications, and a structured approach to defect prevention in aluminum part manufacturing.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Standard Options | Notes |

|---|---|---|

| Alloy Types | 6061-T6, 6063-T5, 7075-T6, 5052-H32, 2024-T3 | 6061-T6 most common for structural applications; 7075 for high-strength needs |

| Material Certification | Mill Test Certificate (MTC) per EN 10204 3.1 or 3.2 | Required to verify chemical composition and mechanical properties |

| Surface Finish | As-machined, Anodized (Type II & III), Powder Coated, Sandblasted | Type III (hard coat) anodizing for wear resistance |

| Minimum Wall Thickness | ≥ 1.0 mm (Die Casting), ≥ 0.8 mm (CNC Machining) | Thinner walls may cause warping or structural weakness |

1.2 Dimensional Tolerances

| Process | Standard Tolerance (ISO 2768-mH) | Precision Tolerance (Custom) | Notes |

|---|---|---|---|

| CNC Machining | ±0.1 mm | ±0.025 mm | Achievable with high-end 5-axis machines |

| Die Casting | ±0.3 mm | ±0.1 mm | Requires high-pressure casting (HPDC) and precision molds |

| Extrusion | ±0.2 mm (length), ±0.1 mm (profile) | ±0.05 mm (critical dimensions) | Post-machining often needed for tight tolerances |

Note: All tolerances must be explicitly defined in engineering drawings (GD&T per ASME Y14.5 or ISO 1101).

2. Essential Certifications

| Certification | Applicable Industries | Purpose | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | All | Quality Management System compliance | Audit of supplier’s QMS documentation |

| ISO 14001:2015 | Automotive, Industrial | Environmental management | Review of environmental compliance policies |

| IATF 16949 | Automotive | Automotive-specific QMS | Required for Tier 1/2 suppliers |

| CE Marking | EU-bound products (machinery, equipment) | Conformity with EU health, safety, and environmental standards | Technical File + Declaration of Conformity |

| FDA 21 CFR Part 820 | Medical devices, food-contact parts | Quality system regulation for medical devices | Required for implants, surgical tools, food processing components |

| UL Recognition (e.g., UL 746C) | Electrical enclosures, consumer electronics | Material flammability and safety compliance | UL File Review + Component Testing |

| RoHS & REACH | Electronics, EU market | Restriction of hazardous substances | Material test reports (XRF screening) |

Procurement Note: Request certified copies and validate certification status via official databases (e.g., IAF CertSearch, UL Online Certifications Directory).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, thermal expansion, incorrect programming | Implement SPC (Statistical Process Control), regular CMM inspection, and tool calibration |

| Surface Pitting or Porosity | Gas entrapment in die casting, poor degassing | Use vacuum-assisted die casting, optimize melt treatment, and conduct X-ray/ultrasonic testing |

| Warpage or Distortion | Residual stress, uneven cooling, thin-wall design | Apply stress-relief annealing (T4/T6), optimize fixture design, and control cooling rates |

| Inconsistent Anodizing Layer | Voltage fluctuation, contamination, alloy variance | Standardize anodizing parameters, pre-treat surfaces, and use alloy-specific baths |

| Cracks in Machined Areas | High cutting forces, poor tool path, material defects | Use sharp carbide tools, optimize feed/speed, and inspect raw material for inclusions |

| Missing or Incorrect Features | CAD/CAM translation error, miscommunication | Conduct pre-production design review (PPAP Level 3), use 3D scanning for first-article inspection |

| Contamination (Oil, Debris) | Poor handling, inadequate cleaning post-machining | Enforce cleanroom protocols for medical/food-grade parts, use ultrasonic cleaning |

4. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 and industry-specific certifications (e.g., IATF 16949 for automotive).

- First Article Inspection (FAI): Require full FAI report with CMM data, material certs, and surface finish verification.

- In-Process Audits: Schedule unannounced audits using third-party inspection firms (e.g., SGS, TÜV) for high-volume orders.

- PPAP Submission: Enforce Production Part Approval Process (PPAP) Level 3 or higher for critical components.

- Traceability: Mandate lot traceability from raw material to finished part (barcoding or digital logs).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, supplier vetting, or quality audit coordination, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Custom Aluminum Parts Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Cost Analysis, OEM/ODM Models & MOQ-Driven Pricing for China-Sourced Custom Aluminum Components

Executive Summary

China remains the dominant global hub for custom aluminum part production, offering 25-40% cost advantages over Western manufacturers for equivalent quality. However, evolving labor dynamics, material volatility, and U.S./EU tariff policies necessitate granular cost modeling. This report provides actionable insights into OEM/ODM engagement models, total landed cost breakdowns, and data-driven MOQ pricing tiers for strategic sourcing decisions in 2026. Key 2026 Shift: Automation adoption (now at 68% among Tier-1 suppliers) is narrowing the per-unit cost gap between low and high MOQs, but setup fees remain a critical barrier for sub-1,000 unit orders.

White Label vs. Private Label: Strategic Implications for Aluminum Parts

Critical distinction often misunderstood by buyers:

| Model | White Label | Private Label | Best For |

|---|---|---|---|

| Definition | Pre-designed, standardized parts with no buyer branding/modifications. Factory sells identical product to multiple buyers. | Buyer-specific design + branding. Factory produces exclusively for buyer (IP protected via contract). | White Label: Urgent, low-risk commodity parts (e.g., standard brackets). Private Label: Brand-differentiated, high-margin products (e.g., medical/industrial components). |

| Cost Impact | Lowest setup fees (often $0). No engineering costs. Marginal savings on MOQ 500+ orders. | +15-25% vs. white label due to NRE (Non-Recurring Engineering), tooling, and IP management. | White Label: Short-term cost savings. Private Label: Long-term brand control & margin protection. |

| Risk Profile | High commoditization risk. Zero IP ownership. Quality variance across buyers. | Full IP ownership. Consistent quality control. Higher supplier dependency. | Procurement Recommendation: Avoid white label for “custom” aluminum parts. True customization requires private label engagement to avoid liability and quality disputes. |

SourcifyChina Insight: 92% of “custom aluminum” RFQs fail due to buyers requesting white label terms for bespoke designs. Private label is non-negotiable for parts requiring tolerances ≤±0.05mm or specialized finishes (e.g., MIL-A-8625 anodizing).

Total Landed Cost Breakdown (Per Unit Basis)

Based on mid-range 6061-T6 aluminum part (150g weight, 5-axis CNC machined, bead-blast finish, MOQ 1,000 units). Ex-works China pricing. 2026 Baseline.

| Cost Component | % of Total Cost | Key Variables & 2026 Trends |

|---|---|---|

| Raw Materials | 52-58% | Aluminum ingot (LME-linked). 2026 Forecast: +3.5% YoY due to energy costs in smelting. Grade (6061 vs. 7075) impacts cost by 18-22%. |

| Labor & Overhead | 25-28% | Rising 6.2% YoY in coastal hubs (Shenzhen/Dongguan). Automation offsetting 40% of wage inflation. Skilled CNC operators now $7.20/hr. |

| Tooling/NRE | 8-12% (amortized) | Dies/jigs for complex geometries. Critical: Spreads thin at low MOQs (e.g., $1,200 tooling = +$2.40/unit at MOQ 500 vs. +$0.24 at MOQ 5,000). |

| Finishing | 7-10% | Anodizing (+25% cost), powder coating (+18%), or bare metal. Regulatory compliance (RoHS/REACH) adds 3-5%. |

| Packaging | 2-3% | Custom foam inserts + export cartons. 2026 Shift: Sustainable packaging (+8% cost) now mandated for EU buyers. |

| QC & Logistics | 5-7% | Includes 3rd-party inspection (AQL 1.0), inland freight, and port fees. Hidden Cost: Tariffs (US Section 301: 7.5-25% on aluminum). |

Note: Total Landed Cost = FOB Price + Tariffs + Ocean Freight + Insurance + Duties. Always model landed cost – FOB quotes are misleading.

MOQ-Based Price Tier Analysis (USD Per Unit)

Standard 6061-T6 Aluminum Part (120mm x 80mm x 25mm, ±0.1mm tolerance, bead-blast finish). Includes tooling amortization, QC, and basic packaging. Ex-works China.

| MOQ Tier | Unit Price | Total Order Value | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $14.20 – $18.50 | $7,100 – $9,250 | High NRE/tooling spread; labor-intensive setup; low machine utilization | Only for urgent prototypes. Avoid for production. |

| 1,000 units | $10.80 – $13.60 | $10,800 – $13,600 | Optimal balance: NRE fully absorbed; volume discounts kick in | Sweet spot for new product launches; 22% avg. savings vs. MOQ 500 |

| 5,000 units | $8.10 – $9.90 | $40,500 – $49,500 | Peak automation efficiency; bulk material discounts; fixed costs diluted | Maximize ROI for stable demand; 26% avg. savings vs. MOQ 1,000 |

Critical Caveats:

– Prices assume simplified geometry. Complex parts (e.g., undercuts, thin walls) increase costs by 30-50% at all MOQs.

– Anodizing/powder coating adds $1.20-$2.80/unit (fixed cost per batch, not per unit).

– 2026 Tariff Warning: US buyers face 10.2% average duty on aluminum castings/machined parts under HTS 7616.99. EU faces 3.7% under 7616.99.9000.

Strategic Recommendations for Procurement Managers

- Demand Private Label Contracts: Ensure IP ownership and audit rights. White label is incompatible with true customization.

- Target MOQ 1,000+ Units: Below this threshold, setup costs erode savings. Use MOQ 500 only for validation.

- Lock Material Pricing: Negotiate 6-12 month LME-linked caps with suppliers to hedge volatility.

- Factor in Total Landed Cost: Include tariffs, freight, and QC in all comparisons. A $0.50/unit FOB saving can become a $1.20 loss landed.

- Leverage Automation: Tier-1 suppliers with >60% automation (e.g., Dongguan, Ningbo) offer flatter MOQ curves – prioritize these partners.

SourcifyChina Value-Add: Our 2026 Supplier Scorecard identifies 17 Tier-1 aluminum specialists with certified automation rates >65%, pre-negotiated material hedges, and EU/US tariff mitigation strategies. Request access for qualified procurement teams.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from 127 verified factory audits (Q4 2025), LME reports, and USITC tariff databases.

© 2026 SourcifyChina. Driving Transparency in Global Manufacturing.

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Subject: Strategic Sourcing of Custom Aluminum Parts from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing custom aluminum parts from China offers significant cost advantages and manufacturing scalability. However, the complexity of the supply landscape—rife with trading companies masquerading as factories—demands a rigorous verification process. This report outlines critical steps to validate manufacturers, differentiate between trading companies and true factories, and identify red flags that could compromise quality, delivery, or IP security.

Adopting these protocols ensures supply chain integrity, reduces risk, and enhances long-term procurement ROI.

Critical Steps to Verify a Manufacturer for Custom Aluminum Parts

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Validate license via China’s National Enterprise Credit Information Public System (NECIPS). Ensure scope includes “aluminum die casting,” “CNC machining,” or “aluminum extrusion.” |

| 2 | Conduct On-Site Factory Audit (or Third-Party Audit) | Physically verify production capability | Audit should include machine count, CNC/die-casting equipment, quality control stations, raw material storage, and workforce. Use ISO-certified auditors. |

| 3 | Review Production Equipment List | Assess technical capacity for custom aluminum work | Confirm ownership of CNC machines (Haas, DMG MORI), extrusion presses, anodizing lines, or casting molds. Cross-check with site photos/videos. |

| 4 | Request Client References & Case Studies | Validate track record with similar projects | Contact 2–3 past clients; request samples or technical drawings of completed aluminum parts. |

| 5 | Evaluate Engineering & R&D Team | Ensure design-for-manufacturability (DFM) support | Interview lead engineer; assess CAD/CAM software use (e.g., SolidWorks, AutoCAD), tolerance control (±0.01mm), and prototyping lead time. |

| 6 | Inspect Quality Certifications | Verify adherence to international standards | Require ISO 9001:2015, IATF 16949 (if automotive), ISO 14001. Confirm active certification via certificate number check. |

| 7 | Request Sample Parts with Dimensional Reports | Test precision and surface finish | Evaluate first-article inspection (FAI) reports, CMM data, and material test certificates (e.g., ASTM B221). |

| 8 | Assess Supply Chain Transparency | Ensure raw material traceability | Confirm use of 6061, 6063, or 7075 aluminum alloys with mill test reports (MTRs) from certified suppliers. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License | Lists “trading,” “import/export,” or “sales” as primary scope | Lists “manufacturing,” “production,” or “processing” of aluminum parts |

| Facility Access | Avoids on-site visits; offers showroom or third-party video | Allows unannounced audits; shows live production lines |

| Pricing Structure | Quotes FOB prices with vague cost breakdown | Provides itemized quotes (material, machining, tooling, labor) |

| Lead Times | Longer and less predictable (relies on subcontractors) | Shorter, consistent timelines with in-house control |

| Equipment Ownership | No machinery visible; references partner factories | Owns CNC machines, extrusion lines, or die-casting units (serial numbers verifiable) |

| Engineering Input | Limited technical feedback on DFM | Offers design optimization, tooling advice, and prototyping support |

| Minimum Order Quantity (MOQ) | Higher MOQs to cover subcontracting margins | Flexible MOQs, especially for prototypes or low-volume runs |

✅ Pro Tip: Factories often have factory gate signage with their name, while trading companies may use generic office buildings.

Red Flags to Avoid When Sourcing Custom Aluminum Parts

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High probability of being a trading company or unqualified supplier | Disqualify unless third-party audit is provided by SGS, TÜV, or Bureau Veritas |

| Prices significantly below market average | Risk of substandard materials (e.g., recycled aluminum), corner-cutting, or hidden costs | Request material source documentation and conduct material testing |

| No sample policy or charges exorbitant sample fees | Indicates lack of confidence or inability to produce quality parts | Negotiate reasonable sample cost (often waived for serious buyers) |

| Poor English communication or delayed responses | Suggests weak project management; risk of miscommunication on specs | Require a dedicated project manager and weekly progress updates |

| Requests full payment upfront | High fraud risk; no leverage for quality or delivery issues | Use secure payment terms: 30% deposit, 70% against shipping documents |

| Lack of technical documentation (e.g., GD&T, CMM reports) | Inadequate quality control processes | Require full inspection reports and statistical process control (SPC) data |

| Generic or stock photos on website | May not represent actual facility or capabilities | Demand real-time video walkthrough of production floor |

Best Practices for Risk Mitigation

- Use Escrow Payment Platforms – Leverage Alibaba Trade Assurance or independent escrow for initial orders.

- Sign NDA & IP Protection Agreement – Protect proprietary designs before sharing CAD files.

- Start with a Pilot Order – Test quality, communication, and logistics before scaling.

- Engage a Local Sourcing Agent – For language, cultural, and legal navigation (e.g., contract enforcement).

- Monitor Production via Weekly Reports – Require photo/video updates at key milestones (machining, finishing, packaging).

Conclusion

Sourcing custom aluminum parts from China requires diligence beyond price comparison. Distinguishing factories from trading companies, verifying capabilities through audits, and recognizing red flags are non-negotiable steps for procurement excellence. By implementing the framework in this report, global procurement managers can build resilient, high-performance supply chains with Chinese manufacturers—balancing cost efficiency with quality assurance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Supply Chain Solutions for Global Buyers

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-ALU-2026-Q4

Executive Summary: The Critical Time Drain in Custom Aluminum Sourcing

Global procurement teams waste 11.3 hours weekly (per sourcing manager) vetting unreliable Chinese suppliers for precision aluminum components—leading to delayed launches, quality escapes, and unplanned cost overruns. Traditional RFQ processes fail to address hidden risks in CNC machining, anodizing, and tolerance-critical applications.

Why SourcifyChina’s Verified Pro List Eliminates 78% of Sourcing Delays

Our AI-audited supplier network solves the core inefficiencies in China aluminum sourcing through pre-validated capability tiers. Unlike public directories or unvetted referrals, every Pro List partner undergoes:

– ✅ Technical Deep Audit: ISO 9001/14001 certification + 5-axis CNC capacity verification

– ✅ Quality Simulation: Real-world tolerance testing (±0.005mm) on sample batches

– ✅ Ethical Compliance: SMETA 4-Pillar audit with live factory CCTV access

Time Savings Breakdown: Traditional vs. SourcifyChina

| Process Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 18–22 business days | 72 hours | 84% |

| Quality Assurance Setup | 9–14 days | 48 hours | 89% |

| First-Article Approval | 21+ days | 10 days | 52% |

| Total Lead Time Reduction | — | — | 67% |

Source: 2026 SourcifyChina Client Data (n=217 procurement teams across aerospace, medical, and EV sectors)

The Cost of “Almost Right” Suppliers

Procurement managers using unverified suppliers report:

– 40% rejection rate on first aluminum prototypes due to undocumented material grades

– 17-day average delay resolving anodizing color mismatches

– 3.2x higher TCO from rework, air freight, and tooling remanufacturing

“SourcifyChina’s Pro List cut our NPI aluminum sourcing cycle from 83 to 28 days. We now launch products 2 quarters ahead of competitors.”

— Director of Global Sourcing, Tier-1 Automotive Supplier (Germany)

Your Strategic Action Plan for 2027

Stop subsidizing supplier discovery costs. The Verified Pro List delivers:

🔹 Guaranteed capability matching for complex geometries (e.g., thin-wall enclosures, heat sink extrusions)

🔹 Real-time production tracking via integrated MES dashboards

🔹 Duty-optimized logistics through bonded warehouse partnerships

✨ Call to Action: Secure Your 2027 Aluminum Sourcing Advantage

Your next RFQ cycle shouldn’t start with supplier hunting.

👉 Contact our Engineering Sourcing Team within 24 business hours:

– Email: [email protected]

Subject line: “PRO LIST ACCESS – [Your Company] – ALU2027”

– WhatsApp Priority Channel: +86 159 5127 6160

(Include your part drawing for instant capability assessment)

For the first 15 respondents this week:

Receive a complimentary Aluminum Sourcing Risk Assessment ($1,200 value) including:

– Material traceability audit protocol

– Tolerance failure root-cause analysis toolkit

– Duty minimization strategy for your HS code

Time is your scarcest resource. Reallocate it to value creation—not supplier fire drills.

— SourcifyChina: Where Precision Sourcing Meets Predictable Outcomes

ℹ️ Report Disclaimer: Data reflects verified client engagements Q1-Q3 2026. Pro List access requires SourcifyChina Partner Program enrollment. All suppliers undergo quarterly re-certification.

🧮 Landed Cost Calculator

Estimate your total import cost from China.