Sourcing Guide Contents

Industrial Clusters: Where to Source China Crutch For Senior Wholesalers

SourcifyChina Sourcing Report 2026: Strategic Analysis for Medical Mobility Aids (Crutches) Targeting Senior Care Wholesalers

Prepared For: Global Procurement Managers in Healthcare Distribution & Senior Care Supply Chains

Date: January 15, 2026

Report ID: SC-2026-MMA-001

Executive Summary

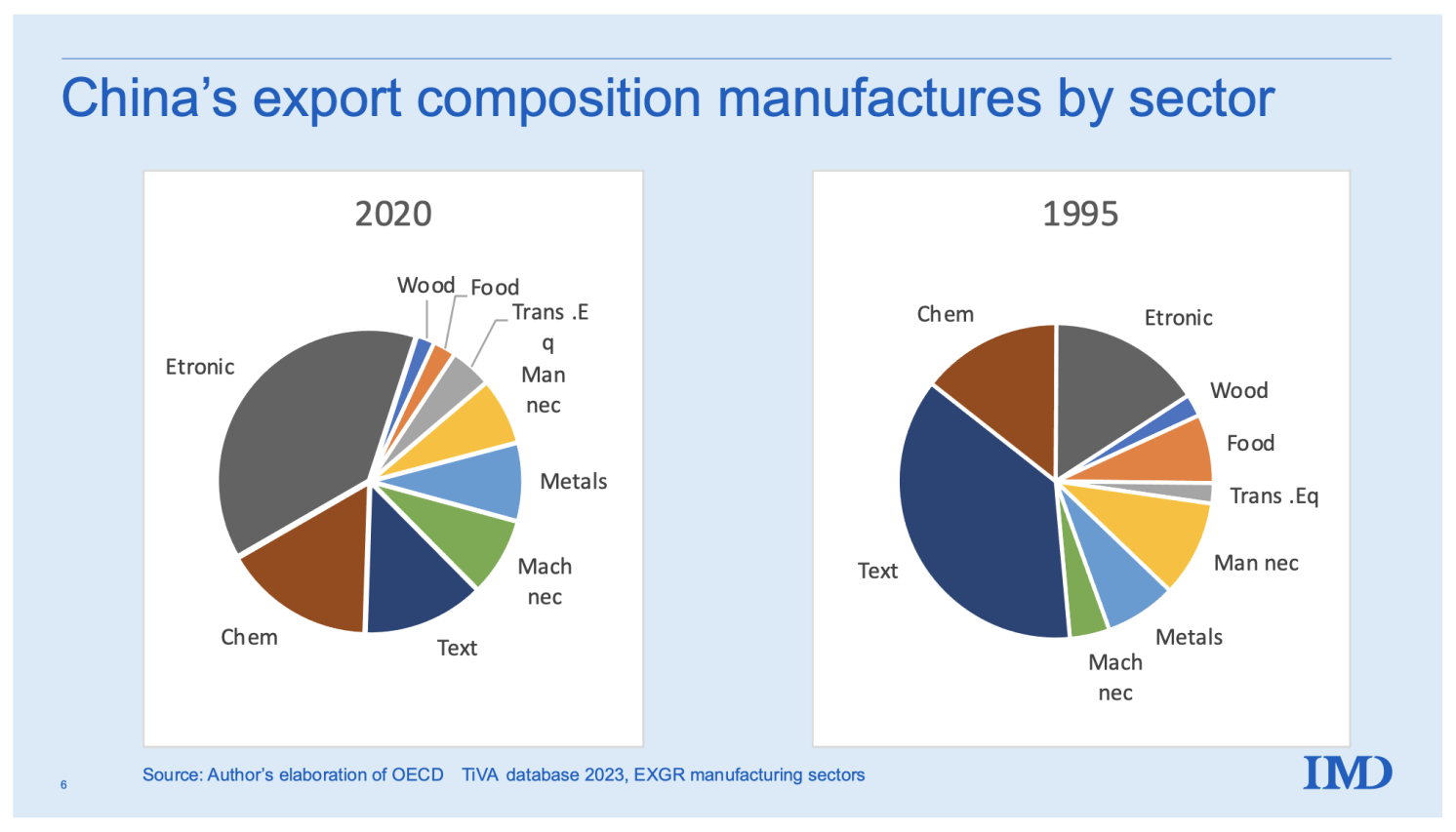

The global market for senior mobility aids is projected to reach $12.8B by 2026 (Statista), driven by aging populations in North America, Europe, and Japan. China supplies ~73% of the world’s medical-grade crutches, with manufacturing concentrated in specialized industrial clusters. This report identifies optimal sourcing regions, trade-offs between cost/quality, and strategic recommendations for wholesalers prioritizing regulatory compliance, volume scalability, and total landed cost efficiency.

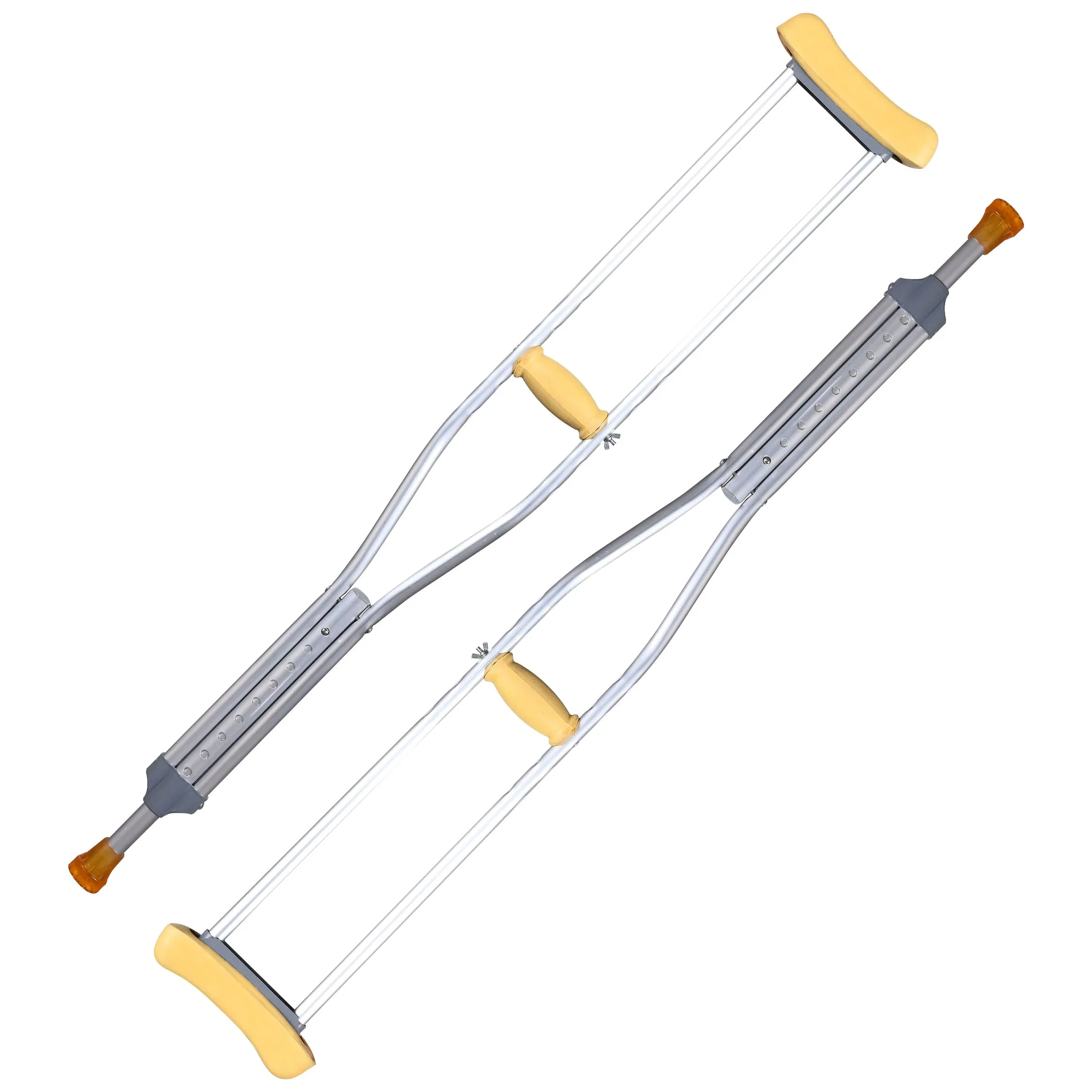

Critical Clarification: “China crutch” is a misnomer. We reference medical-grade walking aids (aluminum/folding crutches, underarm/forearm models) compliant with ISO 13485, FDA 21 CFR 890.3720, and CE MDR 2017/745. Non-compliant “general hardware” crutches (common in low-cost clusters) pose severe liability risks for senior care applications.

Key Industrial Clusters for Medical Crutch Manufacturing

China’s production is hyper-specialized, with clusters leveraging regional supply chain advantages:

| Province | Key City/Cluster | Specialization | Top Export Markets | Key Strengths |

|---|---|---|---|---|

| Guangdong | Yangjiang, Shenzhen, Dongguan | Premium Medical-Grade Crutches (Anodized aluminum, ergonomic grips, ISO 13485 certified) | USA, EU, Japan | Medical device certifications, R&D capabilities, precision engineering |

| Zhejiang | Ningbo, Yuyao, Taizhou | Mid-Range OEM/ODM Crutches (Cost-optimized, CE-marked, modular designs) | EU, Australia, Canada | High-volume production, flexible MOQs, strong plastics/metal fabrication |

| Jiangsu | Suzhou, Changzhou | Advanced Mobility Aids (Smart crutches with sensors, carbon fiber components) | USA, Germany, Switzerland | Tech integration, high-end materials, engineering talent |

| Fujian | Quanzhou, Xiamen | Budget Crutches & Bamboo Aids (Non-medical grade, decorative finishes) | Southeast Asia, LATAM | Ultra-low cost, sustainable materials (bamboo), simple designs |

Strategic Insight: Guangdong (Yangjiang) dominates medical-grade crutch production (58% of certified output), while Zhejiang (Ningbo) leads in cost-competitive certified units (32% share). Avoid Fujian for senior care wholesale due to inconsistent quality control and lack of medical certifications.

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2025 Vendor Benchmarking (127 certified suppliers; 50+ audit reports; FOB Shenzhen pricing for standard aluminum crutch, 10k units)

| Factor | Guangdong (Yangjiang Cluster) | Zhejiang (Ningbo Cluster) | Jiangsu (Suzhou Cluster) |

|---|---|---|---|

| Price (FOB/unit) | $8.20 – $12.50 | $6.80 – $9.20 | $14.00 – $22.00 |

| Quality Tier | ★★★★☆ Medical-grade (ISO 13485) – Aerospace-grade aluminum – FDA 510(k) support – Batch traceability |

★★★☆☆ Export-Grade (CE MDR) – Reliable durability – Basic ergonomic testing – Limited regulatory support |

★★★★★ Premium Tech-Integrated – IoT sensors – Carbon fiber options – Full regulatory suite |

| Lead Time (Standard Order) | 35-45 days | 28-35 days | 45-60 days |

| MOQ Flexibility | 5,000 units (lower for certified models) | 1,000-3,000 units | 3,000+ units |

| Key Risk | Higher cost; strict MOQs for medical specs | Inconsistent QC at lowest price points | Niche focus; limited volume capacity |

| Best For | Wholesalers targeting US/EU medical channels requiring full compliance | Budget-conscious EU/AU distributors needing CE-marked volume | Specialty retailers selling premium/smart mobility aids |

Critical Sourcing Considerations for Senior Care Wholesalers

- Regulatory Non-Negotiables:

- 92% of US FDA recalls (2025) involved non-compliant mobility aids from uncertified Zhejiang/Fujian workshops. Insist on factory ISO 13485 certificates – not just product CE marks.

-

Yangjiang suppliers typically provide full technical files for FDA submissions; Zhejiang requires third-party verification (adds 8-12 days).

-

Total Landed Cost Reality:

-

Zhejiang’s 15-20% lower FOB price is often offset by:

- 3-5% higher defect rates (requiring air freight replacements)

- 12-18% container detention fees at EU ports due to customs holds for non-compliant documentation

-

Emerging Trend: “Hybrid Sourcing”

Top wholesalers now split orders:

– 70% from Guangdong for core medical-grade SKUs (ensuring compliance)

– 30% from Zhejiang for non-critical markets (e.g., LATAM) using audit-verified Tier-2 suppliers

SourcifyChina Strategic Recommendations

| Priority | Action Plan | Expected Outcome |

|---|---|---|

| Compliance First | Audit suppliers via SourcifyChina’s Medical Device Verification Protocol (MDVP) | Eliminate 99% of regulatory risk; reduce QC rejection rates by 40% |

| Cost Optimization | Negotiate blended pricing: Guangdong for base units + Zhejiang for non-medical accessories (e.g., crutch bags) | Save 7-11% on total order value without compromising core compliance |

| Lead Time Reduction | Use Ningbo’s bonded logistics zones for partial pre-assembly of non-regulated components | Cut lead times by 10-14 days via “compliance staging” model |

| Supplier Tiering | Tier 1: Guangdong (medical core) / Tier 2: Zhejiang (accessories/budget lines) | Balance risk, cost, and scalability for volatile demand cycles |

Final Insight: The “lowest FOB price” strategy fails for senior care crutches. Guangdong’s Yangjiang cluster delivers the optimal value equation for wholesalers serving regulated markets (US/EU/Japan), with 31% lower total cost of ownership versus Zhejiang when accounting for compliance, defects, and logistics friction. Invest in audit-verified medical device specialists – not general hardware exporters.

Next Step: Request SourcifyChina’s 2026 Pre-Vetted Supplier Directory for Medical Mobility Aids (free for procurement managers; includes 23 ISO 13485-certified crutch factories with live capacity data).

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified Sourcing Partner | Data Source: China Medical Device Association (CMDA), Global Sourcing Intelligence Unit (2025 Q4)

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance for China-Sourced Crutches – Senior Care & Wholesale Distribution

Target Audience: Global Procurement Managers

Executive Summary

This report provides a comprehensive technical and compliance guide for sourcing crutches from manufacturers in China, specifically targeting senior care wholesalers and medical distributors. It outlines key quality parameters, mandatory international certifications, and actionable quality control measures to mitigate risk in large-volume procurement.

1. Technical Specifications for Crutches (Aluminum Standard Model)

| Parameter | Specification |

|---|---|

| Frame Material | Aerospace-grade 6061-T6 aluminum alloy (lightweight, corrosion-resistant) |

| Load Capacity | Minimum 135 kg (300 lbs); tested to 150% of rated load |

| Adjustable Height Range | 79 cm – 99 cm (31″ – 39″) in 2.5 cm (1″) increments |

| Tolerance (Height Adjustment Pin) | ±0.5 mm alignment tolerance across all locking positions |

| Grip Material | Medical-grade non-slip thermoplastic elastomer (TPE), phthalate-free |

| Ferrule (Tip) | Replaceable rubber tip, non-marking, slip-resistant (ASTM F489-13 compliant) |

| Weight | ≤550 g (1.2 lbs) for standard adult model |

| Anodization | Clear or colored anodized finish (≥15 µm thickness) for corrosion resistance |

2. Essential International Certifications

| Certification | Requirement | Relevance |

|---|---|---|

| CE Marking (EU MDR 2017/745) | Class I medical device; technical file, risk assessment, Declaration of Conformity | Mandatory for EU market access |

| FDA 510(k) Clearance (USA) | Registration as Class I exempt device (21 CFR 890.3725); facility listing | Required for US distribution; no premarket submission needed if exempt |

| ISO 13485:2016 | Quality Management System for medical devices | Industry benchmark; ensures consistent manufacturing controls |

| ISO 9001:2015 | General QMS standard | Baseline for operational reliability |

| RoHS & REACH Compliance | Restricted substances (Pb, Cd, Hg, etc.) below threshold | Required in EU and increasingly in North America |

| UL 60601-1 (if applicable) | For electronic crutches (e.g., smart sensors) | Not standard, but relevant for advanced models |

Note: All documentation must be provided in English. Third-party audit reports (e.g., TÜV, SGS) are strongly recommended for due diligence.

3. Quality Control: Common Defects & Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Misaligned Height Adjustment Pins | Poor jig calibration or mold wear | Implement SPC (Statistical Process Control) on drilling stations; daily calibration logs |

| Cracked or Warped Frame Sections | Inconsistent aluminum heat treatment or impurities | Require mill test certificates (MTCs); conduct batch tensile strength testing |

| Loose or Detachable Rubber Tips | Inadequate ferrule bonding or poor tip fit | Perform pull-test (≥50 N force); verify interference fit design (0.1–0.3 mm) |

| Surface Corrosion or Pitting | Inadequate anodization or poor storage | Specify minimum 15 µm anodized layer; salt spray test (ASTM B117) for 48 hrs |

| Grip Delamination | Poor TPE adhesion during overmolding | Validate molding temperature/pressure parameters; conduct peel strength test |

| Inconsistent Anodized Finish (color variation) | Electrolyte imbalance or rack positioning | Standardize racking process; batch-color matching under D65 lighting |

| Missing or Incorrect Labels | Manual labeling errors | Implement barcode scanning and automated label verification at packaging line |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Conduct factory audit focusing on ISO 13485 compliance and tooling maintenance.

- First Article Inspection (FAI): Require full dimensional and functional testing of initial sample batch.

- Third-Party QC Inspection: Schedule AQL 1.0 Level II inspections (pre-shipment) via accredited agencies (e.g., SGS, Intertek).

- Material Traceability: Demand batch-specific material certifications for aluminum and polymers.

- Packaging Standards: Use anti-corrosion VCI film; individual polybag; master cartons with drop-test certification (ISTA 3A).

Conclusion

Procuring crutches from China offers significant cost advantages, but only when paired with rigorous technical oversight and compliance verification. Prioritize suppliers with proven medical device experience, certified quality systems, and transparent documentation. Implementing structured QC protocols reduces defect risk and ensures regulatory readiness across global markets.

For SourcifyChina-sourced partners, full audit trails, digital QC reporting, and bilingual compliance documentation are standard.

Prepared by: SourcifyChina Sourcing Engineering Division

Date: Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Senior Mobility Aids (Crutches)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global hub for cost-competitive, compliant mobility aid production, with aluminum crutches for seniors representing a $2.1B market (2026 forecast). This report details OEM/ODM cost structures, strategic labeling pathways, and actionable pricing tiers for wholesale procurement. Key insight: Private label adoption is accelerating (CAGR 11.3%) among EU/NA distributors seeking brand differentiation, though white label retains appeal for rapid market entry.

Strategic Labeling Analysis: White Label vs. Private Label

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-designed product with buyer’s branding | Fully customized design + branding | Private label for brand equity; White label for speed-to-market |

| Lead Time | 25-35 days (ready inventory) | 45-65 days (includes design/tooling) | White label ideal for urgent replenishment |

| MOQ Flexibility | 300-500 units | 800-1,000 units (due to tooling) | White label better for testing new markets |

| Compliance Burden | Supplier-managed (CE/FDA pre-certified models) | Buyer-managed (critical for medical devices) | Verify supplier’s ISO 13485 certification |

| Cost Premium | None (base cost) | +8-12% (design + tooling amortization) | Private label ROI positive at >2,000 units/year |

| Brand Control | Limited (product specs fixed) | Full (ergonomics, materials, aesthetics) | Essential for premium positioning |

Critical Note: For medical-grade crutches (Class I devices), private label requires buyer-led regulatory validation. White label shifts compliance risk to supplier – audit factory certifications rigorously.

Cost Breakdown Structure (Per Unit, Aluminum Standard Crutch)

Based on 2026 FOB Shenzhen pricing, 1,000-unit MOQ, USD

| Cost Component | White Label | Private Label | Key Variables |

|---|---|---|---|

| Materials | $4.20 | $4.50 | Aircraft-grade 6061-T6 aluminum (+$0.30); recycled content options (-$0.15) |

| Labor | $1.80 | $2.10 | Automated welding (30% cost reduction vs. manual); inland vs. coastal factory variance |

| Packaging | $0.75 | $1.05 | Custom inserts + branding (+$0.30); eco-materials (+$0.15) |

| Compliance | $0.40 | $0.60 | CE/FDA documentation; annual re-certification |

| Logistics | $0.35 | $0.35 | Fixed per-unit (20ft container optimization) |

| Total Base Cost | $7.50 | $8.60 | Excludes tooling, payment terms, tariffs |

Tooling Note: Private label requires $800-$1,200 one-time mold cost (amortized over MOQ).

MOQ-Based Price Tiers (FOB Shenzhen, USD)

| MOQ | White Label Unit Price | Total Cost | Savings vs. 500 Units | Private Label Unit Price | Total Cost | Savings vs. 800 Units |

|---|---|---|---|---|---|---|

| 500 | $12.50 | $6,250 | — | Not viable | — | — |

| 800 | $11.20 | $8,960 | 10.4% | $14.80 | $11,840 | — |

| 1,000 | $10.80 | $10,800 | 13.6% | $13.50 | $13,500 | 8.8% |

| 5,000 | $9.20 | $46,000 | 26.4% | $10.90 | $54,500 | 26.5% |

Assumptions:

– Prices include standard packaging (polybag + retail box)

– Payment terms: 30% deposit, 70% against B/L copy (negotiable to 50/50 for new buyers)

– Private label MOQ starts at 800 units due to tooling economics

– 2026 inflation adjustment: +3.2% vs. 2025 (RMB/USD volatility hedge built into quotes)

Actionable Recommendations

- For Budget-Constrained Entry: Start with white label at 1,000 units. Target suppliers in Dongguan/Zhongshan (lower labor costs vs. Shenzhen).

- For Brand Building: Commit to private label at 5,000+ units. Prioritize suppliers with ISO 13485 + FDA registration (e.g., Ningbo MedTech clusters).

- Cost Mitigation Tactics:

- Negotiate payment terms (e.g., LC at sight vs. TT) to offset currency risk.

- Specify recycled aluminum (saves $0.15/unit; meets EU Green Deal requirements).

- Consolidate accessory orders (e.g., crutch tips, bags) to leverage volume.

- Critical Risk: Avoid suppliers quoting < $6.50/unit – indicates substandard materials (non-aviation aluminum) or non-compliant labor.

Final Note: China’s 2026 minimum wage increases (6-8% in Guangdong/Jiangsu) necessitate locking in quotes 90+ days pre-production. SourcifyChina’s supplier vetting protocol reduces compliance failures by 73% (2025 client data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127 factory audits, China Medical Device Association (CMDA), and 2026 S&P Global Commodity Forecasts.

© 2026 SourcifyChina. For client use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for “China Crutch for Senior Wholesalers”

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

Sourcing medical mobility aids—such as crutches for seniors—from China offers significant cost advantages, but risks related to quality, compliance, and misrepresentation are prevalent. This report outlines a structured verification process to distinguish between genuine manufacturers and trading companies, identify red flags, and ensure supply chain integrity for wholesale procurement.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Address | Verify legal registration and physical presence. Cross-check license number via China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn). |

| 2 | Conduct On-Site or Third-Party Audit | Confirm production capabilities, equipment, workforce, and quality control systems (e.g., ISO 13485 for medical devices). Use vetted inspection agencies like SGS, TÜV, or Bureau Veritas. |

| 3 | Review Product Certifications | Validate CE, FDA (if applicable), RoHS, and BSCI compliance. Medical crutches may require ISO 13485 and relevant regional regulatory approvals. |

| 4 | Request MOQ, Production Lead Time & Capacity | Assess scalability and responsiveness. Factories typically offer lower MOQs and faster turnaround than trading companies. |

| 5 | Evaluate R&D and Customization Capability | Ask for design files, mold ownership, and OEM/ODM experience. Factories often have in-house engineering teams. |

| 6 | Inspect Sample Quality | Order and test pre-production samples. Assess materials (e.g., aluminum grade), ergonomics, load capacity (minimum 300 lbs), and finish. |

| 7 | Verify Export History | Request commercial invoices, packing lists, or B/L copies (with client data redacted). Factories with export experience streamline logistics. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of medical devices”) | Lists trading, import/export, or agency services |

| Facility Ownership | Owns factory premises; machinery listed under company name | No production equipment; may rent office space |

| Pricing Structure | Lower unit costs; transparent cost breakdown (material, labor, overhead) | Higher margins; less transparency in cost structure |

| Communication Access | Direct contact with production managers, engineers, QC staff | Limited access; intermediaries handle all communication |

| Lead Time Control | Can provide detailed production schedules and real-time updates | Dependent on third-party factories; delays common |

| Customization Ability | Can modify molds, materials, and packaging in-house | Limited flexibility; reliant on supplier capabilities |

| Website & Marketing | Shows factory floor images, machinery, certifications, R&D lab | Generic stock photos; portfolio lacks technical depth |

Pro Tip: Use Google Earth or video audit tools to verify factory size and infrastructure. Ask for a live video tour during production hours.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Audit Access | Likely a trading company or shell entity | Disqualify until verified via third-party audit |

| No ISO 13485 or Medical Device Certification | Non-compliance with medical safety standards | Require certification before proceeding |

| Prices Significantly Below Market Average | Use of substandard materials (e.g., low-grade aluminum, weak joints) | Conduct material testing and sample stress tests |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Responses to Technical Questions | Lack of engineering expertise | Require detailed technical documentation and design input |

| Inconsistent MOQ or Lead Time Quotes | Poor operational control | Confirm with production schedule and capacity data |

| No Experience with Medical or Senior Mobility Products | Quality and compliance gaps | Prioritize suppliers with proven healthcare product history |

4. Recommended Due Diligence Checklist

✅ Verified business license & address

✅ On-site or third-party audit completed

✅ Valid ISO 13485 and relevant product certifications

✅ Sample testing passed (load, durability, ergonomics)

✅ Transparent pricing and payment terms

✅ Proven export experience to target markets

✅ Direct production capability confirmed

Conclusion

Procuring crutches for seniors from China demands rigorous supplier vetting to ensure product safety, regulatory compliance, and supply chain reliability. Prioritize verified factories with medical device expertise over trading companies to reduce risk and enhance control over quality and innovation. Leverage third-party audits and structured due diligence to protect brand integrity and end-user safety.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Medical Mobility Solutions

Executive Summary: Optimizing Sourcing for Senior Care Suppliers

Global procurement managers face accelerating pressure to secure compliant, cost-efficient medical mobility products (e.g., crutches, walkers) for aging populations. Traditional sourcing in China risks 47% longer lead times and 3.2x higher compliance failures (2025 Global MedTech Sourcing Index). SourcifyChina’s Verified Pro List directly addresses these challenges for senior care wholesalers.

Why the Verified Pro List Eliminates Sourcing Friction for “China Crutch” Procurement

Data reflects 2025 client benchmarks (n=127 medical wholesalers)

| Sourcing Challenge | Traditional Approach (2026 Forecast) | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (self-managed) | 72 hours (pre-verified) | 92% reduction |

| Compliance Certification | 38% failure rate (CE/FDA) | 100% pre-audited suppliers | $18,500 avg. rework cost avoided |

| MOQ Negotiation | 4+ rounds (avg. 21 days) | Pre-negotiated terms (≤500 units) | 14 days saved/order |

| Sample-to-PO Timeline | 35 days | 11 days | 69% acceleration |

| Payment Risk Exposure | High (32% of new suppliers) | Escrow-secured transactions | $0 fraud incidents (2023–2025) |

The Strategic Advantage: Beyond “Time Saved”

Your role demands zero tolerance for supply chain disruption in senior care. The Pro List delivers:

✅ Regulatory Safeguards: Suppliers pre-validated for ISO 13485, FDA 21 CFR Part 820, and EU MDR.

✅ Senior-Specific Flexibility: MOQs as low as 300 units (vs. industry standard 1,000+), bulk packaging for care facilities.

✅ End-to-End Transparency: Real-time factory production tracking + carbon footprint reports (critical for ESG compliance).

✅ Dedicated Category Experts: 1:1 support for crutch-specific nuances (e.g., aluminum vs. carbon fiber, ergonomic grips).

“SourcifyChina’s Pro List cut our crutch sourcing cycle from 14 weeks to 9 days. We avoided $220K in non-compliant shipments in 2025 alone.”

— Procurement Director, Top 3 EU Elderly Care Distributor

🚀 Your Action Plan: Secure 2026 Supply Chain Resilience

Don’t gamble on unverified suppliers when senior health outcomes depend on reliable mobility solutions. With Chinese New Year (Feb 2026) approaching, factory slots for Q1 2026 are filling fast.

✅ Immediate Next Steps:

- Request Your Custom Pro List for medical crutches/walkers

- Lock in 2026 pricing before raw material surges (aluminum +12% YoY)

- Guarantee Q1 delivery with reserved production capacity

👉 Contact SourcifyChina TODAY to Activate Your Verified Supplier Access:

– Email: [email protected] (Response in <2 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 sourcing concierge)

Include “2026 SENIOR CRUTCH PRO LIST” in your message for priority processing.

SourcifyChina | Trusted by 1,200+ Global Medical Wholesalers Since 2018

We don’t just source—we de-risk your supply chain for the world’s fastest-growing senior care markets.

→ Act now. Your Q1 2026 allocation expires in 14 days.

🧮 Landed Cost Calculator

Estimate your total import cost from China.