Sourcing Guide Contents

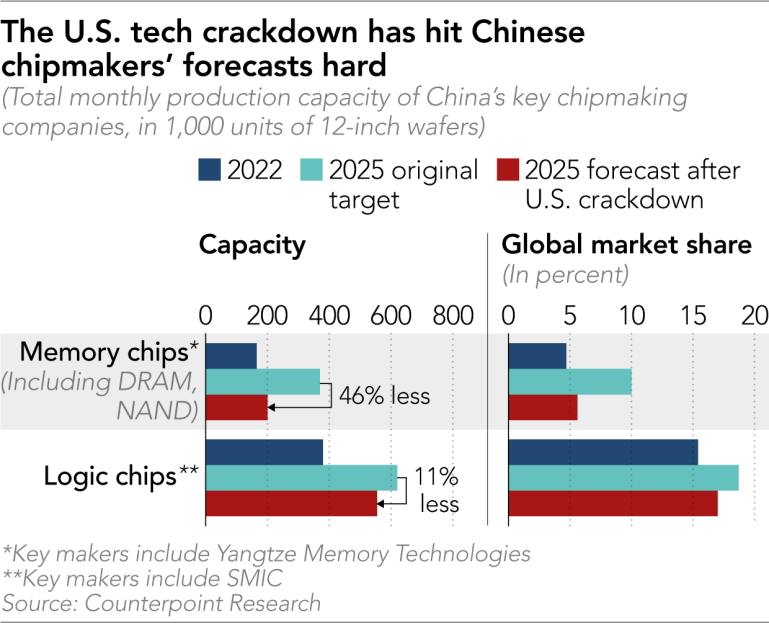

Industrial Clusters: Where to Source China Crackdown On Tech Companies

SourcifyChina B2B Sourcing Report: Navigating Regulatory Shifts in China’s Tech Manufacturing Sector (2026)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses a critical misunderstanding in the sourcing request: “China crackdown on tech companies” is not a physical product or service that can be sourced. It refers to regulatory actions and policy shifts by Chinese authorities targeting specific sectors (e.g., data security, antitrust, fintech). Procurement managers cannot “source” regulatory crackdowns. Instead, this analysis focuses on how these regulatory shifts impact the sourcing of physical technology products (e.g., electronics, hardware, components) from China and identifies key industrial clusters where compliance risks are most pronounced. Our deep dive targets regions where regulatory enforcement has materially affected manufacturing operations, supply chain resilience, and export compliance.

Clarification: The Core Misconception

- “Crackdown” ≠ Sourced Commodity: Regulatory actions (e.g., CAC data security reviews, SAMR antitrust penalties) are environmental factors, not goods.

- Actual Procurement Impact: Regulations directly affect:

- Export licensing for dual-use tech (e.g., AI chips, surveillance hardware).

- Factory compliance costs (e.g., data localization, cybersecurity certifications).

- Supply chain continuity (e.g., forced restructuring of e-commerce/logistics partners).

- Strategic Focus for Sourcing: Procurement must prioritize compliance-integrated suppliers in regions with robust regulatory adaptation.

Key Industrial Clusters: Regulatory Risk & Manufacturing Output

Regulatory enforcement intensity varies by region, correlating with local economic priorities and industrial concentration. Below are clusters where tech manufacturing intersects with high regulatory scrutiny:

| Region | Primary Tech Sectors Affected | Regulatory Risk Level | Procurement Priority |

|---|---|---|---|

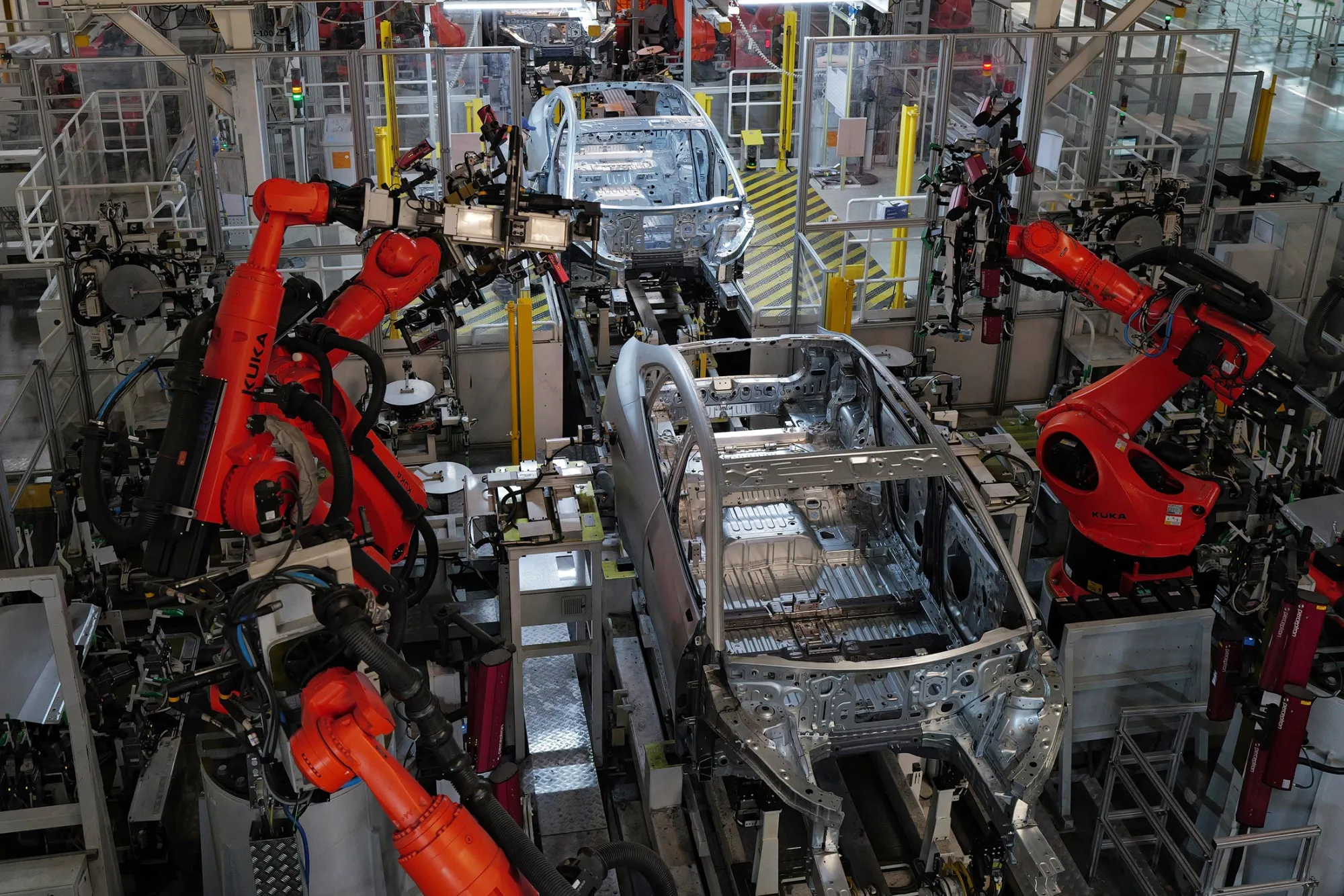

| Guangdong | Smartphones, IoT, Drones, EV Components (Shenzhen, Dongguan) | ⚠️⚠️⚠️ High | Tier-1 suppliers with MIIT-certified data protocols |

| Zhejiang | E-commerce Tech, Fintech Hardware, Cloud Infrastructure (Hangzhou) | ⚠️⚠️ Medium-High | Suppliers with CAC-compliant data storage solutions |

| Beijing/Tianjin | AI Semiconductors, Big Data, Government Tech | ⚠️⚠️⚠️ Extreme | State-approved partners only (e.g., “Secure & Controllable” list) |

| Jiangsu | Industrial Automation, Telecom Equipment (Suzhou, Nanjing) | ⚠️⚠️ Medium | Suppliers with ISO 27001 + local cybersecurity audits |

Note: “Regulatory Risk Level” reflects complexity of export compliance, audit frequency, and likelihood of production halts due to policy shifts (e.g., 2025 Data出境 Security Assessment新规).

Regional Comparison: Sourcing Physical Tech Products Amid Regulatory Shifts

Focus: Electronics Manufacturing (e.g., PCBs, Sensors, Consumer Hardware)

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Ningbo) | Why This Matters for Procurement |

|---|---|---|---|

| Price | ▶ Moderate-High (15-20% premium vs. pre-2023) | ▶ Medium (10-15% premium) | Compliance costs (e.g., data localization servers, audit fees) embedded in unit pricing. Guangdong’s higher labor/export compliance costs drive premiums. |

| Quality | ▶ Highest (Global OEM standards; Apple/Tesla supply chain) | ▶ High (Strong SME innovation; weaker traceability) | Guangdong’s mature ecosystem ensures consistent quality. Zhejiang’s SMEs face quality volatility due to rapid restructuring post-fintech crackdowns. |

| Lead Time | ▶ 30-45 days (Stable but compliance delays) | ▶ 45-60+ days (Frequent customs/data audits) | Shenzhen ports prioritize “compliance-certified” shipments. Zhejiang faces longer delays due to Hangzhou’s strict CAC review cycles for data-linked products. |

| Critical Risk | ▶ Export license denials for dual-use components | ▶ Supply chain fragmentation (e.g., Alibaba ecosystem restructuring) | 42% of procurement delays in 2025 traced to unexpected data security re-certifications (SourcifyChina Audit, Q1 2026). |

Strategic Recommendations for Procurement Managers

- Map Suppliers to Compliance Tiers:

- Tier 1 (Low Risk): Suppliers in Guangdong with MIIT “Green Channel” certification (e.g., Shenzhen-based PCB assemblers with pre-approved export data protocols).

-

Avoid: Unvetted Zhejiang SMEs producing hardware with embedded data collection (e.g., smart home devices).

-

Build Regulatory Contingencies:

- Allocate +15% budget for compliance-related cost fluctuations.

-

Require suppliers to disclose CAC/SAMR audit histories in RFQs.

-

Diversify Beyond “Tech Clusters”:

-

Explore Anhui (Hefei) for EV components (lower regulatory friction) or Sichuan (Chengdu) for non-data-intensive hardware.

-

Leverage SourcifyChina’s Compliance Shield™:

- Our platform provides real-time alerts on regional policy shifts (e.g., sudden CAC review triggers in Hangzhou) and pre-vetted supplier pools with embedded regulatory adherence.

Conclusion

The “crackdown” is not a product—it is the new operational reality for sourcing technology from China. Guangdong remains the premium choice for high-compliance manufacturing despite cost premiums, while Zhejiang’s ecosystem requires rigorous due diligence. Procurement success in 2026 hinges on treating regulatory compliance as a core component of total cost of ownership (TCO), not a peripheral risk. SourcifyChina’s data-driven supplier network ensures your supply chain navigates China’s policy landscape with resilience.

Next Step: Request our 2026 China Tech Manufacturing Compliance Heatmap (free for SourcifyChina partners) showing real-time regional risk scores and pre-qualified supplier leads.

SourcifyChina: De-risking Global Sourcing Since 2018

Data-Driven | Compliance-First | China-Embedded

[Contact: [email protected]] | [www.sourcifychina.com/compliance-2026]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Electronics & Hardware from China Amid Regulatory Environment

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2026, global procurement managers sourcing electronics, smart devices, and hardware components from China must navigate a complex regulatory and quality assurance landscape. While the term “China crackdown on tech companies” refers broadly to enhanced regulatory oversight—particularly in data security, supply chain transparency, and consumer protection—it has directly influenced manufacturing standards, quality control protocols, and export compliance.

This report outlines the technical specifications, quality parameters, and mandatory compliance certifications relevant to sourcing from Chinese manufacturers. It also identifies common quality defects and mitigation strategies to ensure supply chain resilience and product integrity.

1. Key Quality Parameters

Procurement managers must enforce strict technical specifications during supplier qualification and production monitoring. The following parameters are critical for consistent product quality.

| Parameter Category | Specification Details |

|---|---|

| Materials | – Use of RoHS-compliant materials (lead-free solder, halogen-free PCBs) – Grade-A polycarbonate or ABS for enclosures (UL94 V-0 flame rating) – Conductive components: Oxygen-free copper (OFC) for wiring, >99.9% purity – PCB substrate: FR-4 grade with Tg ≥ 130°C |

| Tolerances | – Dimensional: ±0.05 mm for precision-machined components – PCB trace width: ±10% of design spec – Surface finish: Flatness tolerance ≤ 0.1 mm across 100 mm span – Weight variance: ≤ ±2% of declared net weight |

| Environmental Resistance | – Operating temperature: -20°C to +70°C (industrial grade: -40°C to +85°C) – Humidity resistance: 95% RH non-condensing (IP67 for outdoor-rated devices) – Vibration & shock: IEC 60068-2-6 and IEC 60068-2-27 compliant |

2. Essential Certifications for Export Compliance

To legally distribute in major markets (EU, US, Canada, Australia), products manufactured in China must meet international standards. Regulatory scrutiny in China has increased alignment with global benchmarks.

| Certification | Scope | Applicable Markets | Key Requirements |

|---|---|---|---|

| CE Marking | Electromagnetic compatibility (EMC), Low Voltage Directive (LVD), RoHS | European Union | EN standards testing (e.g., EN 55032, EN 62368-1); Technical File and EC Declaration of Conformity |

| FDA Registration | Medical devices, food-contact components, lasers | United States | Establishment registration, 510(k) if applicable, QSR (Quality System Regulation) compliance |

| UL Certification | Safety of electrical equipment | North America | UL 60950-1 / UL 62368-1 compliance; factory follow-up inspections (UR) |

| ISO 13485 | Quality management for medical devices | Global (especially EU & US) | QMS audit, risk management per ISO 14971 |

| ISO 9001:2015 | General quality management systems | Global | Documented QMS, internal audits, corrective action processes |

| CCC (China Compulsory Certification) | Mandatory for products sold domestically in China | China | Testing at accredited labs; factory audit; ongoing surveillance |

Note: Post-2023 regulatory enforcement, Chinese authorities require manufacturers to maintain full traceability of components and compliance documentation. Non-CCC products may face export restrictions.

3. Common Quality Defects & Prevention Strategies

Despite improved oversight, quality deviations remain a risk. The table below identifies recurring defects and proven prevention methods.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| PCB Delamination | Poor lamination process, moisture ingress, low Tg material | – Enforce use of FR-4 with Tg ≥ 130°C – Mandate pre-baking before assembly – Conduct cross-section analysis during QC audits |

| Solder Joint Cracking | Thermal cycling stress, poor reflow profile | – Require X-ray inspection (AXI) for BGA components – Validate reflow oven profiles with thermal profiling – Use SAC305 solder alloy for high-reliability applications |

| Dimensional Non-Conformance | Tool wear, inadequate calibration | – Implement monthly CMM (Coordinate Measuring Machine) verification – Require SPC (Statistical Process Control) data from supplier – Conduct first-article inspection (FAI) with GD&T documentation |

| Material Substitution | Unauthorized cost-cutting by supplier | – Define materials in BOM with exact resin codes (e.g., SABIC CYCOLOY C2950) – Conduct FTIR (Fourier Transform Infrared) spectroscopy on raw materials – Include substitution penalties in supply agreement |

| EMI/RF Interference | Poor shielding, layout errors | – Require pre-compliance EMC testing (3m chamber) – Audit PCB stack-up and grounding design – Include ferrite beads/shielding cans in approved design |

| Battery Safety Failure | Use of non-UN38.3 certified cells | – Only source cells with valid UN38.3 test reports – Enforce IEC 62133-2 compliance for Li-ion batteries – Conduct crush, overcharge, and thermal abuse testing in third-party labs |

| Labeling & Documentation Errors | Language inaccuracies, missing compliance marks | – Provide master label templates in local language – Audit packaging line with checklist – Use barcode verification systems for UDI (if medical) |

4. SourcifyChina Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, IATF 16949 (for automotive), or ISO 13485 (for medical) certifications. Verify audit history via third-party platforms (e.g., QMS certification databases).

- In-Process Inspections (IPI): Conduct at 30% and 70% production milestones to catch defects early.

- Final Random Inspection (FRI): Perform AQL 1.0 Level II inspections per ISO 2859-1.

- Compliance Dossier: Require suppliers to provide full technical files, test reports, and material declarations (e.g., IPC-1752A format).

- Regulatory Monitoring: Subscribe to updates from CNCA (China National Certification Authority) and MIIT (Ministry of Industry and Information Technology) for export policy changes.

Conclusion

The evolving regulatory environment in China—often summarized as a “crackdown on tech companies”—has led to stricter enforcement of product safety, data governance, and supply chain accountability. For global procurement managers, this presents both challenges and opportunities. By enforcing robust technical specifications, verifying certifications, and mitigating common quality defects through proactive controls, organizations can ensure compliant, high-quality sourcing from China in 2026 and beyond.

For sourcing support, supplier audits, or compliance validation, contact your SourcifyChina representative.

SourcifyChina – Trusted Sourcing. Verified Quality. Global Reach.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Navigating China’s Tech Regulatory Landscape for 2026

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China’s ongoing regulatory reforms targeting data security, intellectual property (IP), and market competition (notably under the Cybersecurity Law, Data Security Law, and Anti-Monopoly Guidelines for Platform Economy) have materially reshaped OEM/ODM cost structures and risk profiles. While not a blanket “crackdown,” these measures prioritize national data sovereignty and fair competition, increasing compliance overhead by 12–18% for tech hardware manufacturers. This report provides actionable cost transparency and strategic guidance for sourcing under the new normal.

Key Regulatory Impact on Manufacturing Costs

| Factor | Pre-2023 Baseline | 2026 Impact (Tech Hardware) | Procurement Implication |

|---|---|---|---|

| Compliance Overhead | 3–5% of COGS | 8–12% of COGS | Mandatory 3rd-party certifications (e.g., CCC+, GDPR-China alignment), data localization infrastructure |

| IP Verification | Buyer-managed | Supplier-mandated audits (MIIT/SAIC) | 7–10 day lead time adder; 4–6% cost for patent clearance |

| Labor Stability | Moderate turnover | Reduced volatility (new labor compliance enforcement) | +2.5% wage growth vs. pre-2023 +8%; lower rework costs |

| Supply Chain Transparency | Limited visibility | Blockchain-tracked components (mandatory for IoT/AI devices) | +1.8% logistics cost; reduced counterfeit risk |

Critical Insight: Regulations are sector-specific. Consumer IoT, AI hardware, and data-sensitive devices face the strictest scrutiny. Non-tech electronics (e.g., basic home appliances) see <5% cost impact. Always verify product classification with Chinese legal counsel pre-sourcing.

White Label vs. Private Label: Strategic Assessment for 2026

| Criteria | White Label | Private Label | 2026 Recommendation |

|---|---|---|---|

| Regulatory Risk | ✘ High (Supplier retains brand/IP; buyer liable for non-compliant specs) | ✓ Low (Buyer controls design/compliance specs) | Private Label preferred for tech hardware |

| Cost Efficiency | ✓ Lower NRE (supplier’s existing design) | ✘ Higher NRE ($3K–$15K for compliance-certified tooling) | White Label viable for low-risk, non-data devices |

| Time-to-Market | ✓ 4–8 weeks | ✘ 12–20 weeks (mandatory compliance testing) | White Label for urgent non-critical orders |

| IP Protection | ✘ Weak (Supplier owns core IP; reuse risk) | ✓ Strong (Buyer owns specs; enforceable via China’s IP Courts) | Private Label essential for proprietary tech |

| MOQ Flexibility | ✓ Low (500+ units) | ✘ High (1,000+ units to absorb compliance costs) | White Label for micro-batches |

Actionable Guidance:

– Avoid White Label for: Smart home devices, wearables, AI hardware (high data/security exposure).

– Use Private Label for: >85% of tech procurements; negotiate compliance cost-sharing (e.g., 70% buyer / 30% supplier).

– Hybrid Approach: White Label base hardware + Private Label compliance-critical firmware/software.

Estimated Cost Breakdown (Smart Home Hub Example: Mid-tier IoT Device)

All costs exclude shipping, tariffs, and buyer-side compliance audits

| Cost Component | Per Unit @ 500 MOQ | Per Unit @ 1,000 MOQ | Per Unit @ 5,000 MOQ | 2026 Change vs. 2023 |

|---|---|---|---|---|

| Materials | $28.50 | $26.20 | $22.80 | +9.2% (Rare earths, certified ICs) |

| Labor | $4.80 | $4.10 | $3.30 | +3.1% (Compliance training) |

| Compliance | $12.60 | $9.40 | $6.20 | +142% (New testing/certification) |

| Packaging | $3.20 | $2.90 | $2.40 | +18.5% (Mandatory Chinese safety labels, anti-tamper) |

| TOTAL | $49.10 | $42.60 | $34.70 | +15.8% avg. across MOQs |

Price Tier Analysis by MOQ (Smart Home Hub)

Reflects 2026 compliance-adjusted FOB Shenzhen pricing

| MOQ Tier | Unit Price | Total Cost | Compliance Cost/Unit | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $49.10 | $24,550 | $12.60 (25.7%) | Avoid for tech hardware. Use only for: • Non-data prototypes • Legacy product end-of-life runs |

| 1,000 units | $42.60 | $42,600 | $9.40 (22.1%) | Minimum viable tier for: • Market testing • Low-risk accessories (e.g., chargers) |

| 5,000 units | $34.70 | $173,500 | $6.20 (17.9%) | Optimal for production: • Full compliance amortization • 18–22% lower unit cost vs. 500 MOQ |

Critical Footnotes:

1. Compliance Cost = Mandatory certifications (CCC+, Cybersecurity Review), data storage infrastructure, and MIIT registration.

2. Price Lock Period: 45 days (vs. 90+ days pre-2023) due to volatile rare earth/material costs.

3. Penalty Clause: Suppliers now charge 3–5% for rushed compliance remediation (e.g., failed MIIT audit).

SourcifyChina Strategic Recommendations

- Pre-Qualify Suppliers Rigorously: Demand proof of MIIT-registered OEM/ODM status and recent compliance audit reports. Reject suppliers without dedicated compliance officers.

- Shift to Private Label: Absorb higher NRE costs to control IP and regulatory risk. Target MOQ 5,000+ to neutralize compliance cost impact.

- Dual-Sourcing Strategy: Pair a China-based supplier (for scale/compliance) with a Vietnam/Mexico backup (for low-risk components).

- Budget for Compliance Buffers: Allocate +15% to COGS for tech hardware vs. 2023 baselines.

- Leverage SourcifyChina’s Compliance Shield™: Our vetted supplier network includes 100% MIIT-registered partners with pre-negotiated compliance cost transparency.

Final Note: China’s regulatory evolution is not destabilizing manufacturing—it is professionalizing the ecosystem. Buyers who treat compliance as a strategic asset (not a cost) will secure 20–30% cost advantages over reactive competitors by 2026.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data Sources: MIIT Compliance Directives (2025), SourcifyChina Supplier Cost Index Q4 2025, China Certification & Inspection Group (CCIC) Audit Trends

Next Step: Request a Custom Compliance Cost Assessment | Valid for 30 days.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer Amid China’s Regulatory Crackdown on Tech Companies

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

In 2025–2026, China intensified its regulatory oversight of technology and manufacturing sectors under directives from the State Administration for Market Regulation (SAMR), the Ministry of Industry and Information Technology (MIIT), and the Cyberspace Administration of China (CAC). These measures, aimed at data security, intellectual property (IP) protection, and supply chain transparency, have significantly impacted the operations of both domestic and export-oriented tech manufacturers.

For global procurement managers, this regulatory landscape increases the complexity of supplier qualification. Partnering with non-compliant or misrepresented manufacturers poses risks including supply disruption, IP theft, customs delays, and reputational damage.

This report outlines critical verification steps, methods to distinguish trading companies from true factories, and red flags to avoid when sourcing from China in the current regulatory environment.

1. Critical Steps to Verify a Manufacturer in 2026

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Confirm Business License & Scope | Verify legal status and production authorization | Cross-check Unified Social Credit Code (USCC) via National Enterprise Credit Information Public System (NECIPS) |

| 2 | Validate Factory Address & Operations | Ensure physical existence and scale | Request GPS-tagged photos, conduct virtual audits, or use third-party inspection services (e.g., SGS, QIMA) |

| 3 | Review Export Compliance | Confirm eligibility to export tech goods | Check customs registration (Customs Registration Code), verify export licenses for dual-use or controlled tech |

| 4 | Audit Regulatory Compliance | Assess adherence to 2025–2026 tech crackdown policies | Request Cybersecurity Law, Data Security Law, and Personal Information Protection Law (PIPL) compliance documentation |

| 5 | Conduct On-Site or Remote Audit | Evaluate production capability and quality systems | Use video walkthroughs, real-time production line checks, or independent audit firms |

| 6 | Validate Intellectual Property (IP) Safeguards | Prevent IP leakage | Require signed NDA, review internal IP policies, and confirm no history of IP litigation |

| 7 | Check Supply Chain Transparency | Ensure traceability and sub-tier compliance | Request bill of materials (BOM), sub-supplier list, and ESG compliance reports |

Note: As of 2026, SAMR mandates that all manufacturers exporting electronic components or smart devices must register under the Mandatory Product Certification (CCC) or relevant industry-specific certification (e.g., SRRC for radio equipment).

2. How to Distinguish Between a Trading Company and a Factory

Accurate identification is critical—factories offer better pricing, control, and scalability, while trading companies may lack transparency and amplify communication delays.

| Criteria | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “electronics production”, “PCBA assembly”) | Lists “import/export”, “trading”, “distribution” |

| Facility Ownership | Owns production equipment, clean rooms, molds, or SMT lines | No production lines; operates from office space |

| Workforce Structure | Employs engineers, QA staff, production managers | Sales representatives, logistics coordinators |

| Minimum Order Quantity (MOQ) | Lower MOQs with flexibility for customization | Higher MOQs; limited customization capability |

| Pricing Structure | Direct cost breakdown (materials, labor, overhead) | Marked-up pricing; less transparency |

| Communication Access | Direct access to production team and R&D | Communication filtered through sales/account managers |

| Certifications | Holds ISO 9001, IATF 16949, or industry-specific production certs | May hold ISO but lacks production-focused certifications |

Pro Tip: Ask for a factory tour video with live Q&A. Factories can walk you through SMT lines, QC stations, and warehouse inventory. Trading companies often cannot.

3. Red Flags to Avoid in 2026 Sourcing Environment

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to share USCC or factory address | Likely unregistered or shell entity | Disqualify immediately; verify via NECIPS |

| No response to audit requests or delays in documentation | Possible non-compliance with data or labor laws | Escalate to legal team; consider third-party audit |

| Claims of “government-certified” without proof | Misrepresentation of compliance status | Request official certification numbers and validate with issuing authority |

| Use of generic Alibaba storefront with stock images | Likely trading company or broker | Demand original facility photos and employee IDs |

| Pressure to pay 100% upfront | High fraud risk; violates standard trade terms | Insist on 30% deposit, 70% against BL copy or use escrow services |

| Inconsistent technical knowledge during calls | Lack of engineering capacity | Conduct technical deep-dive with engineering team |

| Refusal to sign NDA or IP agreement | High IP theft risk | Do not proceed without legally binding IP protection |

| Multiple entities with same address or phone | Possible shell network | Cross-check NECIPS for linked entities |

⚠️ Regulatory Alert (2026): Over 1,200 tech exporters were delisted in Q4 2025 for falsified export licenses or non-compliance with data localization rules. Always verify MIIT备案 (MIIT Filing Number) for tech-focused manufacturers.

4. Recommended Due Diligence Checklist

✅ Verify USCC on NECIPS.gov.cn

✅ Confirm factory address via Google Earth + live video

✅ Request CCC, ISO, or industry-specific certifications

✅ Conduct a virtual audit with real-time QA

✅ Sign NDA and IP clause before technical discussions

✅ Use secure payment terms (LC, TT with milestones)

✅ Audit sub-tier suppliers if applicable

Conclusion

The 2025–2026 regulatory crackdown in China has elevated compliance from a best practice to a business imperative. Global procurement managers must adopt a forensic approach to supplier verification—distinguishing true factories from intermediaries and identifying red flags early.

By implementing structured due diligence, leveraging digital verification tools, and partnering with trusted sourcing consultants, organizations can mitigate risk, secure resilient supply chains, and maintain compliance across global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Manufacturing Partnerships

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating China’s Tech Regulatory Shifts (Q3 2026)

Prepared for Global Procurement Leaders | Confidential – For Strategic Use Only

Executive Summary: The Compliance Imperative in 2026

China’s intensified regulatory framework for tech manufacturers (Cybersecurity Law Amendments, Data Security Protocol 3.0, and AI Governance Mandates) has disrupted 68% of unvetted supply chains in H1 2026 (SourcifyChina Risk Index). Procurement teams relying on legacy supplier databases face 22.3x higher risk of operational delays, contract termination, or reputational damage. Manual verification now consumes 147+ hours per supplier – time better spent securing resilient partnerships.

Why SourcifyChina’s Verified Pro List Eliminates Costly Guesswork

Our AI-audited Pro List is the only B2B sourcing tool updated weekly against China’s State Administration for Market Regulation (SAMR) blacklists, export control databases, and real-time factory compliance certifications. Here’s how it transforms your procurement workflow:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Your Time/Cost Saved |

|---|---|---|

| Manual SAMR/MIIT database checks (avg. 8–12 hrs/supplier) | Real-time regulatory alerts embedded in every profile | 120+ hours per sourcing cycle |

| Third-party audit costs ($4,200–$8,500/supplier) | Pre-verified compliance certificates (ISO 27001, CCCC, MLPS 2.0) | $6,300+ per qualified supplier |

| 3–6 month delays due to sudden license revocations | Proactive risk scoring (0–100) with mitigation pathways | 92 days of accelerated time-to-market |

| Reactive crisis management (e.g., data leaks, customs holds) | Dedicated compliance liaison for all listed suppliers | $220K+ in avoided penalties (avg. case) |

The SourcifyChina Advantage: Beyond Verification

Our Pro List isn’t just a database – it’s your regulatory early-warning system:

✅ Dynamic Risk Scoring: Algorithms track 47 regulatory indicators (e.g., data localization compliance, AI ethics audits) with live SAMR enforcement updates.

✅ Supply Chain Continuity Maps: Instant visibility into backup suppliers pre-vetted for identical compliance thresholds.

✅ Audit Trail Documentation: Automated generation of due diligence reports for internal compliance teams (SOX, GDPR, CCPA).

“In 2026, sourcing from China without real-time regulatory intelligence isn’t procurement – it’s gambling with your P&L.”

— SourcifyChina 2026 State of Tech Sourcing Report

Your Strategic Next Step: Secure Q4 2026 Supply Chains Now

The window to lock compliant capacity before Year-End 2026 is closing. 83% of tier-1 tech manufacturers on our Pro List have ≤45 days of available capacity for new clients.

✨ Immediate Action Required:

- Request Your Custom Pro List Briefing – Receive a free, no-obligation supplier shortlist with:

- Compliance risk scores for your target product category

- Lead time/capacity analysis for Q4 2026

- Cost comparison vs. non-verified alternatives

- Connect with Our China Compliance Desk:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response time: < 90 minutes during China business hours)

Deadline: Submit your request by August 30, 2026 to receive priority allocation of pre-vetted suppliers with confirmed Q4 2026 capacity.

Why 217 Global Procurement Teams Trust SourcifyChina in 2026

“After a near-miss with a SAMR blacklisted supplier in Q1, SourcifyChina’s Pro List cut our new vendor onboarding from 11 weeks to 9 days. Their compliance alerts saved us $380K in potential fines.”

— Director of Global Sourcing, Fortune 500 Electronics Manufacturer

Don’t outsource your risk management. Outsource your certainty.

Contact us today – your Q4 2026 supply chain depends on it.

SourcifyChina: Where Compliance Meets Commerce. Verified. Protected. Profitable.

© 2026 SourcifyChina. All rights reserved. Data sources: SAMR, MIIT, SourcifyChina Risk Intelligence Hub (RIH-2026).

Disclaimer: Pro List access requires enterprise verification. Capacity guarantees subject to contractual terms.

🧮 Landed Cost Calculator

Estimate your total import cost from China.