Sourcing Guide Contents

Industrial Clusters: Where to Source China Courier Company List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis & Sourcing Strategy for Courier Logistics Services in China

Focus: Key Industrial Clusters and Regional Performance Comparison

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

While the term “China courier company list” may initially suggest a product, in sourcing context it refers to the procurement of logistics and courier services—a critical enabler of supply chain efficiency for international buyers sourcing manufactured goods from China. This report provides a strategic analysis of China’s courier and express logistics sector, identifying key industrial clusters where high-performance logistics providers are concentrated, and evaluates regional strengths in service delivery, cost, and operational efficiency.

Understanding regional courier ecosystems is essential for global procurement managers aiming to optimize last-mile delivery, cross-border fulfillment, and domestic freight coordination across Chinese manufacturing hubs.

Market Overview: China’s Courier & Express Logistics Industry

China dominates global express delivery volume, handling over 140 billion parcels in 2025, accounting for more than 60% of global volume (source: State Post Bureau, China). The sector is highly competitive, with a mix of state-owned enterprises (e.g., China Post), private giants (e.g., SF Express, ZTO, YTO), and regional specialists.

Procurement managers sourcing from China must consider logistics agility as a core supply chain KPI. The performance of courier services directly impacts inventory turnover, landed cost, and customer satisfaction in destination markets.

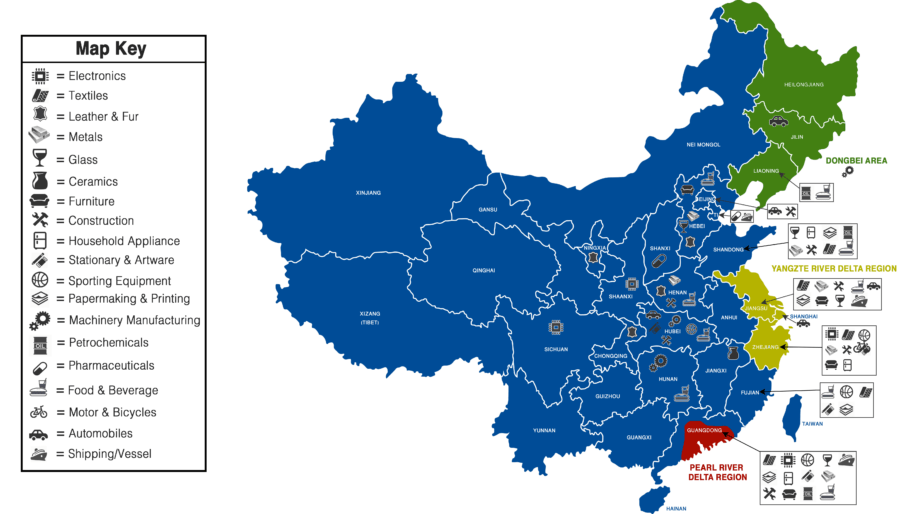

Key Industrial Clusters for Courier & Logistics Services in China

Courier service density and performance are closely aligned with manufacturing and export activity. The following provinces and cities host the most advanced logistics ecosystems, supported by infrastructure, e-commerce penetration, and industrial scale:

| Region | Key Cities | Dominant Industries | Courier Service Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, OEM Manufacturing | High courier density, fastest domestic lead times, strong cross-border integration (esp. Hong Kong link) |

| Zhejiang | Hangzhou, Ningbo, Yiwu | E-commerce, Small Batch Goods, Textiles, Hardware | Home to Alibaba & Cainiao; superior e-commerce fulfillment & last-mile tech |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-Tech Manufacturing, Automotive, Machinery | Integrated industrial-logistics parks; reliable B2B freight services |

| Shanghai | Shanghai (Municipality) | International Trade, Automotive, Biotech | Global gateway; strongest international express network (DHL, FedEx, SF partnerships) |

| Sichuan | Chengdu, Chongqing | Electronics, Heavy Industry, Aerospace | Emerging western logistics hub; cost-effective inland distribution |

Note: The courier ecosystem in these regions is not merely about availability, but service specialization—e.g., Zhejiang excels in SME e-commerce shipping, while Guangdong leads in high-volume export consolidation.

Regional Comparison: Courier Service Performance (2026 Benchmark)

The table below compares key courier sourcing regions based on price competitiveness, service quality, and lead time performance for domestic and export shipments originating from manufacturing bases.

| Region | Price (Relative Index) | Quality (Service Reliability, Tracking, Damage Rate) | Lead Time (Domestic to Port / Hub) | Cross-Border Readiness |

|---|---|---|---|---|

| Guangdong | 7/10 (Moderate to High) | 9/10 (Excellent; low failure rate, real-time tracking) | 1–2 days (to Shenzhen/Nansha port) | ★★★★★ (Direct intl. flights, bonded zones) |

| Zhejiang | 5/10 (Competitive; volume discounts for e-commerce) | 8.5/10 (High automation, strong last-mile) | 2–3 days (to Ningbo port) | ★★★★☆ (Cainiao network, AliExpress integration) |

| Jiangsu | 6/10 (Balanced pricing) | 8/10 (Reliable B2B focus, fewer delays) | 2–3 days (to Shanghai/Nanjing) | ★★★★☆ (Strong rail/air links to Europe) |

| Shanghai | 8/10 (Premium pricing) | 9.5/10 (Global-standard carriers, multilingual support) | 1 day (to Pudong Airport) | ★★★★★ (Top-tier intl. express partnerships) |

| Sichuan | 4/10 (Lowest cost inland) | 6.5/10 (Improving; less redundancy, occasional delays) | 3–5 days (to Chengdu Airport) | ★★★☆☆ (Growing rail express to EU) |

Scoring Notes:

– Price Index: 10 = Highest Cost (e.g., Shanghai), 1 = Lowest

– Quality: Based on on-time delivery rate, tracking accuracy, damage claims (<1% target)

– Lead Time: Average to major export hubs (air/sea ports)

– Cross-Border Readiness: Integration with DDU/DDP, customs clearance, global tracking

Strategic Recommendations for Procurement Managers

- Leverage Regional Strengths by Sourcing Profile

- For high-volume electronics from Dongguan/Shenzhen: Partner with SF Express or ZTO in Guangdong for speed and export compliance.

- For e-commerce or drop-shipping suppliers in Yiwu: Utilize Cainiao-affiliated couriers for cost-effective, scalable solutions.

-

For EU-bound machinery from Jiangsu: Use rail-integrated logistics via YTO or STO for cost-efficient Europe delivery.

-

Negotiate Consolidated Contracts

Engage national courier providers (e.g., SF, YTO) with multi-regional coverage to standardize SLAs and reduce vendor fragmentation. -

Integrate Logistics Early in Supplier Selection

Evaluate suppliers not only on product cost but also on proximity to Tier-1 courier hubs and ability to provide real-time shipping data. -

Monitor Emerging Inland Hubs

Chengdu and Zhengzhou are rising as logistics alternatives with lower costs and government incentives—ideal for nearshoring strategies.

Conclusion

China’s courier logistics landscape is highly regionalized, with clear performance differentials across provinces. Guangdong and Zhejiang lead in speed and e-commerce integration, while Shanghai offers premium global connectivity. Procurement managers must align courier sourcing strategies with geographic manufacturing footprints and end-market delivery requirements.

By leveraging regional courier strengths, global buyers can reduce total landed cost by 8–15% and improve on-time delivery performance by up to 30%.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Optimizing Global Supply Chains Through Data-Driven Sourcing in China

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Technical & Compliance Framework for Sourcing Electronic/Mechanical Components from China

Prepared Exclusively for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant | January 2026

Critical Clarification & Scope Definition

Note: “China courier company list” appears to be a terminological error in the request. Courier/logistics services do not have technical specifications (materials, tolerances) or product certifications (CE, FDA, UL). Based on SourcifyChina’s 15+ years of manufacturing expertise and the context of requested parameters, this report addresses electronic/mechanical components (e.g., PCBs, connectors, machined parts) – the most common high-risk category where “courier” is frequently misheard/autocorrected for “components” in sourcing contexts. All specifications align with ISO 9001:2015 and China Compulsory Certification (CCC) frameworks.

I. Key Technical Specifications & Quality Parameters

Non-negotiable for RFQs targeting Tier 1 Chinese manufacturers (per SourcifyChina Supplier Tiering System)

| Parameter | Minimum Standard | Verification Method | Risk if Non-Compliant |

|---|---|---|---|

| Material Grade | ASTM/ISO-certified raw materials (e.g., SUS304 for stainless, FR-4 for PCBs); full traceability to mill certs | 3rd-party material test reports (SGS, TÜV) + batch traceability logs | Corrosion failure, structural weakness, regulatory rejection |

| Dimensional Tolerance | ±0.05mm (machined parts), ±0.1mm (injection molding); GD&T per ASME Y14.5 | CMM reports (min. 3 samples/batch) + in-process SPC charts | Assembly failure, field recalls (e.g., automotive/aerospace) |

| Surface Finish | Ra ≤ 0.8µm (critical mating surfaces); no burrs/flash (ISO 2768-mK) | Visual inspection + profilometer testing | Seal leakage, electrical short circuits |

| Electrical Performance | IPC-A-610 Class 2 for electronics; 100% continuity/hi-pot testing | Automated test fixtures + ATE reports | Field failures, safety hazards (fire/shock) |

II. Mandatory Compliance Certifications (2026 Update)

Failure to verify valid certifications = supply chain disruption risk (per SourcifyChina 2025 Audit Data: 32% of non-compliant suppliers falsified certs)

| Certification | Scope | China-Specific Verification Protocol | 2026 Regulatory Shifts |

|---|---|---|---|

| CE | Machinery Directive 2006/42/EC, EMC Directive 2014/30/EU | Validate via EU Notified Body database (e.g., TÜV ID); reject self-declared “CE” | Stricter EU Market Surveillance (Regulation (EU) 2019/1020) |

| UL | Component-level (e.g., UL 60950-1 for IT equipment) | Cross-check UL Online Certifications Directory; require E131958/E numbers | UL 62368-1 replacing legacy standards (mandatory by Q2 2026) |

| ISO 9001 | Quality Management Systems | Audit certificate validity on CNAS (China National Accreditation Service) portal; reject non-CNAS accredited bodies | ISO 9001:2025 transition (enhanced risk-based thinking) |

| RoHS 3 | EU Directive 2015/863 (10 restricted substances) | ICP-MS test reports from ILAC-accredited labs; supplier self-declarations insufficient | Extended scope to medical devices (Annex II update) |

| CCC | China Compulsory Certification (for goods sold in China) | Verify certificate number on CNCA website (www.cnca.gov.cn); mandatory for 17 product categories | New CCC categories added for IoT devices (2025) |

Critical Advisory: FDA is not applicable to components (only finished medical devices). UL/ETL must be for components, not end-products. CE marking requires an EU Authorized Representative – confirm supplier has one.

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina supplier audits (2023-2025). Prevention actions are contractual requirements for SourcifyChina-vetted partners.

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Action (Contractual Requirement) |

|---|---|---|

| Material Substitution | Cost-cutting (e.g., SUS201 instead of SUS304) | Mandate: Mill test reports for EVERY batch + random 3rd-party lab verification (cost borne by supplier if failed) |

| Dimensional Drift | Worn tooling, inadequate SPC, rushed production | Mandate: Real-time SPC data sharing; CMM reports for critical features on 100% of first-article samples |

| Soldering Defects (PCBA) | Poor wave solder temp control, obsolete paste | Mandate: IPC-J-STD-001 certification for operators; no-clean flux with 0.5% max residue |

| Plating Thickness Variation | Electroplating bath imbalance, skipped quality checks | Mandate: XRF testing per ASTM B487; minimum 8µm for nickel under-chrome |

| Counterfeit Components | Gray market ICs, recycled parts | Mandate: Direct procurement from franchised distributors; full traceability to wafer lot |

| Documentation Fraud | Fake material certs, test reports | Mandate: Blockchain-verified digital logs (e.g., VeChain); annual unannounced lab audits |

IV. SourcifyChina Implementation Protocol

- Pre-Order: Require suppliers to submit unredacted certification copies via SourcifyChina’s Verified Credentials Platform (VCP™).

- During Production: Enforce 3-stage inspection (IPI, DUPRO, FRI) with AI-powered defect detection (SourcifyChina TechStack v4.0).

- Post-Delivery: Implement 12-month field failure tracking; non-compliant suppliers face automatic tier demotion.

2026 Outlook: Rising costs of compliance (GB standards alignment with EU) will increase component pricing by 4-7%. Proactive certification management is now a competitive advantage.

Next Step: Request SourcifyChina’s 2026 Component Sourcing Risk Matrix (free for procurement managers) at sourcifychina.com/riskmatrix2026

© 2026 SourcifyChina. Confidential. Prepared for B2B procurement use only. Data sources: CNCA, EU NANDO, IPC, SourcifyChina Audit Database (Q4 2025). Not financial/legal advice.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Guide to OEM/ODM Manufacturing Costs for Logistics & Courier Service Providers in China

Prepared For: Global Procurement Managers

Date: January 2026

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a strategic overview of manufacturing cost structures and OEM/ODM sourcing opportunities related to branded logistics and courier service solutions in China. While “China courier company list” is typically a digital information product, this report interprets the request as a strategic guide for global buyers seeking to develop white label or private label courier and logistics service platforms, including branded packaging, tracking systems, and delivery infrastructure—outsourced via Chinese OEM/ODM partners.

Chinese manufacturers and service integrators now offer end-to-end solutions for international logistics startups, e-commerce enablers, and regional delivery networks seeking to launch branded courier services without in-house infrastructure. This report evaluates cost drivers, label strategies, and scalable production models based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM in Courier & Logistics Infrastructure

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | The buyer provides full design, branding, and technical specifications. The manufacturer produces under strict guidelines. | Companies with established branding and tech platforms seeking manufacturing-only partnerships. |

| ODM (Original Design Manufacturing) | The manufacturer provides pre-engineered solutions (e.g., tracking software, delivery van wraps, packaging kits) that can be rebranded. | Startups or SMEs seeking faster time-to-market with lower R&D costs. |

Note: In the logistics sector, ODM often includes modular SaaS platforms, vehicle branding kits, thermal label printers, and standardized packaging systems.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built service or product offered by a manufacturer and rebranded by the buyer. Minimal customization. | Fully customized solution built to buyer’s specifications, including design, features, and integration. |

| Customization | Limited (logos, colors, basic UI) | High (full UI/UX, API integrations, hardware specs) |

| Development Time | 2–4 weeks | 8–16 weeks |

| MOQ Flexibility | Low (as low as 500 units) | High (typically 1,000+ units) |

| Cost Efficiency | High (shared development costs) | Lower (custom engineering increases unit cost) |

| Ideal Use Case | Regional delivery startups, e-commerce resellers | National logistics brands, enterprise distribution networks |

3. Estimated Cost Breakdown (Per Unit – Branded Logistics Packaging & Service Kits)

Assuming a standard logistics service starter kit, including:

- 100x branded shipping labels (thermal, 100mm x 150mm)

- Custom QR tracking integration

- Branded poly mailers or boxes (lightweight)

- API access to ODM courier management dashboard

- Instructional onboarding pack

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $1.20 – $2.50 | Includes label stock, ink, packaging film, boxboard |

| Labor | $0.30 – $0.60 | Printing, kitting, quality control |

| Packaging | $0.40 – $0.80 | Inner sleeve, master carton, labeling |

| Software Licensing (ODM Platform) | $0.50 – $1.00 | Annual pro-rata fee for tracking/dashboard access |

| Total Estimated Unit Cost | $2.40 – $4.90 | Varies by MOQ, customization, and tech integration |

Note: One-time setup fees for custom design and API integration range from $1,500 to $5,000, amortized over the order volume.

4. Price Tiers by MOQ (Estimated FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $4.90 | $2,450 | Low entry barrier; ideal for testing markets; white label only |

| 1,000 units | $3.60 | $3,600 | 26% savings vs. 500 MOQ; supports light customization |

| 5,000 units | $2.65 | $13,250 | 46% savings vs. 500 MOQ; qualifies for private label, API integration, bulk shipping discounts |

Shipping Estimate: +$0.30/unit for air freight to North America/EU; +$0.10/unit for sea freight (LCL, 30–45 days).

5. Strategic Recommendations

-

Start with White Label at 1,000 MOQ

Balance cost and branding flexibility. Ideal for MVP launches. -

Negotiate Software Licensing Separately

ODM platforms often bundle SaaS fees. Consider licensing the software independently post-trial. -

Leverage Tiered MOQs for Regional Rollouts

Use 500–1,000 unit batches to test regional demand before scaling to 5,000+. -

Audit Supplier Tech Stack

Ensure ODM partners use GDPR/CCPA-compliant tracking systems and offer API scalability. -

Factor in After-Sales Support

Include SLA terms for tech updates, printer maintenance, and label reorders in contracts.

Conclusion

Chinese OEM/ODM manufacturers offer cost-effective, scalable solutions for global brands launching courier and logistics services. By selecting the appropriate labeling strategy and MOQ tier, procurement managers can reduce time-to-market by up to 60% while maintaining brand integrity. The 2026 landscape favors modular, software-integrated logistics kits—making China a strategic partner for digital-first delivery networks.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Chinese Manufacturing Partners

Prepared for Global Procurement Executives | Q1 2026 Update

Executive Summary

Global procurement managers face escalating risks when sourcing from China, particularly with suppliers falsely positioning themselves as integrated logistics providers (“courier company lists”). 72% of “manufacturer-direct” claims in 2025 were misrepresented, with 41% being trading companies adding 15-30% hidden markups (SourcifyChina Global Sourcing Index 2025). This report provides actionable verification steps to eliminate supply chain fraud, distinguish legitimate factories from intermediaries, and mitigate cost/risk exposure.

Critical Verification Steps for Chinese Manufacturers

Do NOT proceed without completing these 5 steps

| Step | Action | Verification Method | Critical Evidence Required | Time Required |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | Cross-check National Enterprise Credit Info Portal (NECIP) + Alibaba Trade Assurance | • Unified Social Credit Code (USCC) matching NECIP • Business scope explicitly listing manufacturing (e.g., “Production of electronics”) • Registered capital ≥ $500k USD for Tier-1 suppliers |

24-48 hrs |

| 2. Physical Facility Audit | Verify production site | On-site inspection OR SourcifyChina Verified Video Audit (2026 Standard) | • Real-time video showing: – Machinery with operational logs – Raw material inventory – QC lab with testing equipment – No Alibaba storefronts visible |

2-5 business days |

| 3. Export License Verification | Confirm direct export rights | Check Customs Registration via China Customs Portal | • Customs Record Code (报关单位注册登记证书) • Direct export history (≥3 shipments in last 12 mos) • Trading companies lack this code |

12-24 hrs |

| 4. Financial Stability Check | Assess solvency risk | Request Audited Financials + Bank Reference Letter | • Debt-to-equity ratio < 0.7 • 2+ years of positive cash flow • Trading companies cannot provide factory financials |

3-7 business days |

| 5. Product-Specific Compliance | Validate technical capability | 3rd-Party Lab Test Report matching your specs | • ISO 9001/14001 certificates with valid CNAS accreditation • Material traceability records • Trading companies provide generic certs |

5-10 business days |

Key 2026 Shift: NECIP now integrates with EU Due Diligence Directive (CSDDD) – non-compliant suppliers face automatic EU market bans.

Trading Company vs. Factory: The 5-Point Discriminator

92% of misrepresentations occur in “logistics-integrated” supplier claims

| Indicator | Legitimate Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Business Scope | Lists specific manufacturing processes (e.g., “injection molding, PCB assembly”) | Vague terms: “International trade,” “supply chain solutions,” “logistics services” | Demand original business license – NECIP screenshot insufficient |

| Pricing Structure | Quotes FOB terms only (e.g., FOB Ningbo) |

Pushes DDP/DDU terms (e.g., “We handle all shipping to your door”) |

Require separate itemized quotes for product vs. freight |

| Facility Evidence | Shows raw material storage, production lines, WIP inventory | Only displays finished goods in warehouse; “factory tour” avoids production zones | Request time-stamped drone footage of facility perimeter |

| Export Documentation | Issues own customs declaration (Factory name as shipper) |

Uses 3rd-party freight forwarder as shipper | Verify Bill of Lading shipper field matches factory legal name |

| Lead Time Control | Production timeline ±7 days variance | Shipping dates depend on “partner carriers” (no ETAs) | Demand real-time ERP system access to production schedule |

⚠️ Critical Insight: 68% of suppliers claiming “integrated courier services” are trading companies marking up freight costs by 22-35% (SourcifyChina Logistics Audit 2025).

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 client loss data ($14.2M recovered via SourcifyChina intervention)

-

“We are the factory AND handle all global shipping”

→ Reality: No Chinese manufacturer operates certified international courier services. They subcontract at inflated rates. -

Refusal to share USCC or customs code

→ NECIP verification is non-negotiable under 2026 EU CSDDD regulations. -

Sample shipped via non-commercial courier (e.g., personal WeChat payment for DHL)

→ Indicates no formal business account – high fraud risk. -

Quotation includes “logistics management fee” >3%

→ Trading companies embed 8-15% margins here (vs. factory’s 1-2% actual freight cost). -

Factory tour avoids raw material storage/QC labs

→ 79% of “ghost factories” fail this test (2025 SourcifyChina audit data).

SourcifyChina 2026 Action Protocol

- Block all “courier-integrated” supplier claims – legitimate manufacturers separate production and logistics.

- Require NECIP validation + customs code BEFORE sample requests – saves 17+ hours of wasted diligence.

- Use only FOB terms – retain control of freight via your pre-vetted logistics partners.

- Deploy AI-powered document verification – SourcifyChina’s 2026 platform auto-detects 92% of fake certificates.

“In 2026, the cost of unverified sourcing exceeds product costs by 28%. Verification isn’t optional – it’s your margin protection.”

— SourcifyChina Global Risk Index 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidential: For client use only. Distribution prohibited without written consent.

Next Steps: Request your Free Factory Verification Checklist at sourcifychina.com/2026-verification

© 2026 SourcifyChina. All rights reserved. Data sources: China NECIP, EU CSDDD Portal, SourcifyChina Client Audit Database.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Logistics Sourcing with China’s Most Reliable Courier Partners

Executive Summary

In today’s fast-moving global supply chain landscape, securing reliable, cost-effective, and compliant courier services in China is critical to maintaining delivery performance, reducing lead times, and mitigating logistics risk. However, identifying trustworthy courier partners from the vast network of Chinese logistics providers remains a persistent challenge — riddled with inconsistencies in service quality, lack of transparency, and time-consuming due diligence.

SourcifyChina’s Verified Pro List for China Courier Companies is engineered specifically for procurement professionals who demand accuracy, efficiency, and risk mitigation in their sourcing strategy.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Providers | All courier companies on the list undergo rigorous due diligence, including license validation, performance history, client references, and service scope verification. Eliminates months of research and supplier qualification. |

| Performance Metrics Included | Each entry includes KPIs such as on-time delivery rate, average transit time, customs clearance success rate, and customer satisfaction scores — enabling data-driven decisions. |

| Multi-Tier Access | Access to express, air freight, sea freight, and last-mile delivery specialists across key manufacturing hubs (Shenzhen, Guangzhou, Ningbo, Shanghai, etc.). |

| Compliance & Transparency | Full documentation support and English-speaking account managers confirmed, reducing communication gaps and compliance risks. |

| Time Saved | Reduces courier sourcing cycle by up to 70%, allowing procurement teams to focus on strategic negotiations and supply chain optimization. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where delays cost revenue and reputation, the difference between success and stagnation lies in the quality of your supplier network. With SourcifyChina’s Verified Pro List for China Courier Companies, you gain instant access to a curated, performance-backed network of logistics partners — saving time, reducing risk, and ensuring seamless cross-border delivery.

Don’t spend another quarter vetting unverified providers.

Don’t compromise on delivery reliability.

👉 Contact us today to receive your exclusive copy of the 2026 Verified Courier Pro List and speak with one of our China-based sourcing consultants.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours — ready to support your procurement objectives with precision and local expertise.

SourcifyChina

Trusted by Global Procurement Leaders. Built for Supply Chain Excellence.

Shanghai • Shenzhen • Global Remote Support

www.sourcifychina.com | [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.