Sourcing Guide Contents

Industrial Clusters: Where to Source China Cosco Holdings Company Limited

SourcifyChina B2B Sourcing Report: Industrial Clusters for Goods Shipped via COSCO Shipping Lines

Prepared for Global Procurement Managers | Q3 2026 | Confidential: SourcifyChina Client Use Only

Key Clarification: Understanding “China COSCO Holdings Company Limited”

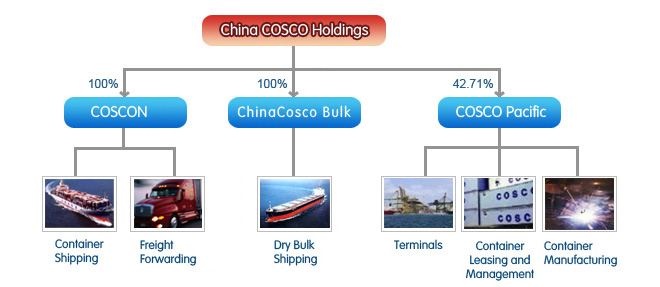

China COSCO Shipping Corporation Limited (formerly China COSCO Holdings, 601919.SS/1919.HK) is not a manufacturer of physical goods. It is a state-owned multinational integrated logistics and container shipping conglomerate – the world’s largest container carrier by fleet capacity (as of 2026).

- Critical Distinction: Procurement managers do not “source COSCO” as a product. Instead, they:

- Source manufactured goods from Chinese suppliers (e.g., electronics, textiles, machinery).

- Engage COSCO Shipping (or its subsidiaries like COSCO Shipping Lines) as a logistics partner to transport these goods globally.

- Report Focus Adjustment: This analysis identifies key Chinese manufacturing clusters for goods typically shipped via COSCO’s services, addressing the actual intent behind the query. COSCO’s role is transportation; the value lies in optimizing where goods are produced before they enter COSCO’s network.

Deep-Dive: Chinese Manufacturing Clusters for Export-Oriented Goods (Shipped via Major Lines like COSCO)

China’s export manufacturing is concentrated in specialized industrial clusters. Proximity to major ports served by COSCO (e.g., Shanghai, Shenzhen, Ningbo-Zhoushan) is critical for efficient logistics integration. Below are the dominant clusters relevant to global sourcing:

| Province/City Cluster | Core Industries | Key Ports Served by COSCO | Strategic Advantage for COSCO Shipments |

|---|---|---|---|

| Guangdong (Pearl River Delta) | Electronics (Shenzhen, Dongguan), Appliances (Foshan), Toys (Shantou), Lighting (Zhongshan) | Shenzhen (Yantian), Guangzhou (Nansha) | Highest volume export hub; seamless integration with COSCO’s Asia-Europe/Med & Transpacific services; dense supplier ecosystem. |

| Zhejiang | Textiles/Apparel (Shaoxing, Huzhou), Small Commodities (Yiwu), Hardware (Wenzhou), Machinery (Hangzhou) | Ningbo-Zhoushan (World’s #1 cargo port), Wenzhou | Dominant for SME exports; Yiwu = global small goods hub; Ningbo = COSCO’s primary deep-water port for mega-vessels. |

| Jiangsu (Yangtze River Delta) | Machinery (Suzhou), Chemicals (Nantong), Automotive Parts (Nanjing), Solar (Changzhou) | Shanghai (Yangshan Deep-Water Port) | Proximity to Shanghai = COSCO’s global network hub; high-tech manufacturing base; strong infrastructure. |

| Shanghai | High-End Electronics, Automotive, Aerospace Components, Biotech | Shanghai (Yangshan) | Gateway for high-value/low-volume goods; direct access to COSCO’s global HQ & premium services. |

| Fujian | Footwear (Quanzhou), Furniture (Putian), Building Materials (Xiamen) | Xiamen | Specialized low-cost manufacturing; growing COSCO feeder network for ASEAN/EU routes. |

Comparative Analysis: Key Production Regions for Sourcing Goods Shipped via COSCO

Focus: Cost, Quality, and Lead Time Implications for Procurement Managers

| Factor | Guangdong (PRD) | Zhejiang | Jiangsu (YRD) |

|---|---|---|---|

| Price (Unit Cost) | ★★☆☆☆ Moderate-High Higher labor/rent vs. inland. Premium for electronics expertise. Competitive for high-volume runs. |

★★★★☆ Moderate Strong SME competition drives down costs (esp. textiles, small goods). Yiwu offers lowest MOQ pricing globally. |

★★★☆☆ Moderate Balances cost & skill. Lower than PRD for machinery, higher for labor-intensive goods. |

| Quality Consistency | ★★★★☆ High (Tiered) World-class electronics OEMs (e.g., Foxconn). Wider variance in low-cost segments (toys, accessories). Strict QC protocols common. |

★★★☆☆ Moderate-High Excellent for standardized goods (textiles, hardware). Can vary for complex items; requires vetting. Strong compliance focus in export hubs. |

★★★★★ Very High Dominated by Tier 1 suppliers for MNCs. Precision engineering, automotive, and solar sectors lead in quality control and certifications. |

| Lead Time (Production) | ★★★☆☆ Moderate 30-45 days typical. Supply chain density reduces material delays. High demand can cause bottlenecks during peak season. |

★★★★☆ Fast 25-40 days typical. Agile SME networks enable rapid prototyping/small batches. Yiwu logistics ecosystem accelerates order fulfillment. |

★★★☆☆ Moderate 35-50 days typical. Complex goods (machinery) take longer. Robust infrastructure minimizes internal delays. |

| Lead Time (Port to Vessel – via COSCO) | ★★★★☆ Fast Shenzhen/Yantian = COSCO’s #2 China hub. High-frequency sailings (daily EU/US). Minimal congestion vs. Shanghai. |

★★★★★ Fastest Ningbo = COSCO’s primary mega-port. Dedicated berths, automated terminals. Lowest dwell times for COSCO vessels (<24h avg). |

★★★☆☆ Moderate Shanghai congestion can add 1-3 days. Yangshan deep-water port optimized for COSCO, but high volume causes occasional delays. |

| Best Suited For | High-volume electronics, complex assemblies, time-sensitive premium goods. | Low-MOQ orders, textiles, small commodities, cost-driven categories. | High-precision machinery, automotive, industrial equipment, regulated products. |

★ Key = Relative Advantage (5★ = Best) | Data Source: SourcifyChina 2026 Supplier Database, COSCO Shipping Performance Reports, China General Administration of Customs

Strategic Recommendations for Procurement Managers

- Leverage Cluster Specialization:

- Source electronics from Guangdong (prioritize Dongguan/Shenzhen for speed).

- Source textiles/small goods from Zhejiang (Yiwu for price, Shaoxing for quality).

- Source industrial machinery from Jiangsu (Suzhou industrial parks).

- Optimize for COSCO Integration:

- Prioritize suppliers within 150km of Ningbo (Zhejiang) or Shenzhen (Guangdong) to minimize pre-carriage time and leverage COSCO’s port efficiency.

- For Jiangsu-based suppliers, confirm use of Shanghai Yangshan Port (COSCO’s dedicated zone) to avoid Shanghai port congestion.

- Mitigate Lead Time Risks:

- Guangdong: Book COSCO space 60+ days ahead during Q3/Q4 peak season.

- Zhejiang: Utilize Yiwu’s COSCO direct rail-freight links to Europe for non-urgent, high-volume orders.

- Quality Assurance:

- In Guangdong/Zhejiang, mandate 3rd-party inspections for first-time suppliers.

- In Jiangsu, prioritize suppliers with ISO 9001/IATF 16949 for critical components.

Conclusion

While “sourcing COSCO” is a misnomer, understanding where goods are manufactured is paramount to optimizing the entire supply chain – including logistics via carriers like COSCO Shipping. Guangdong, Zhejiang, and Jiangsu remain the dominant clusters for export goods, each offering distinct trade-offs in cost, quality, and speed. Procurement managers who align sourcing strategy with these regional strengths and COSCO’s port network achieve the greatest efficiency in lead times, cost control, and risk mitigation.

Next Step: SourcifyChina can conduct a product-specific cluster analysis (e.g., “sourcing Bluetooth earbuds”) with vetted supplier shortlists in optimal regions, including logistics integration plans with COSCO and alternatives.

SourcifyChina | Your Objective Partner in China Sourcing

Data-Driven. Borderless. Compliant. | © 2026 SourcifyChina. All Rights Reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China COSCO Holdings Company Limited

Executive Summary

China COSCO Holdings Company Limited (COSCO) is a global leader in integrated shipping and logistics services. While COSCO itself is not a manufacturer of consumer goods, its role as a logistics provider—particularly in ocean freight, container manufacturing, and supply chain infrastructure—means that procurement teams must understand the technical and compliance standards associated with COSCO-manufactured or -managed assets, such as shipping containers, logistics equipment, and value-added packaging solutions.

This report outlines key quality parameters, essential certifications, and common quality defects relevant to COSCO’s industrial products and services, with emphasis on sourcing assurance and supply chain compliance for 2026.

1. Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials (Containers & Equipment) | Corten steel (Grade S355J2W) for container bodies; marine-grade aluminum for specialized units; rubber seals per ASTM D2000; flooring: marine plywood with anti-slip coating (≥27 mm thickness) |

| Welding Standards | ISO 3834-2:2005 (Quality requirements for welding); penetration ≥90%; no undercut >0.5 mm |

| Dimensional Tolerances | Length: ±10 mm; Width: ±5 mm; Height: ±5 mm; Door diagonal deviation: ≤15 mm |

| Load Capacity | Standard 20’/40’ containers: Max gross weight 30,480 kg (67,200 lbs); payload up to 28,200 kg |

| Corrosion Resistance | Salt spray test: ≥1,000 hours (per ISO 9227); coating thickness: 120–150 µm (epoxy/polyurethane) |

| Thermal Performance (Reefer Units) | Temperature range: -60°C to +30°C; stability: ±0.5°C; humidity control: 40–95% RH |

2. Essential Certifications

| Certification | Relevance to COSCO Operations | Scope of Application |

|---|---|---|

| ISO 9001:2015 | Mandatory for all COSCO manufacturing & logistics units | Quality Management Systems (QMS) |

| ISO 14001:2015 | Environmental compliance across vessel operations and container production | Environmental Management |

| ISO 45001:2018 | Workplace safety in shipyards and logistics hubs | Occupational Health & Safety |

| CE Marking | Required for containers and equipment exported to the EU | Conformity with European safety, health, and environmental standards |

| CSC (Convention for Safe Containers) | COSCO-managed containers must be CSC-plate certified | International container safety (valid 5 years, with periodic inspections) |

| UL 2809 (Environmental Claim Validation) | Applicable to recycled content claims in packaging/logistics materials | Verification of sustainability claims |

| FDA Compliance (21 CFR) | Required for containers used in food/pharma transport (interior linings, hygiene) | Food-safe materials and sanitation |

| DNV-GL / ABS / LR Class Certification | Applied to COSCO Shipping’s vessel fleet and offshore equipment | Maritime safety and engineering standards |

Note: While COSCO does not typically require UL or FDA certification for standard shipping containers, these are critical when transporting regulated goods (e.g., pharmaceuticals, food) or integrating containers into fixed installations (e.g., modular buildings).

3. Common Quality Defects & Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity / Incomplete Fusion | Poor welding environment, moisture, incorrect parameters | Enforce ISO 3834 standards; pre-weld drying; real-time weld monitoring; certified welders (ASME IX) |

| Floor Delamination | Moisture ingress, substandard plywood adhesive | Use WBP (Weather & Boil Proof) adhesive; moisture barrier layer; pre-shipment humidity control |

| Door Misalignment | Frame deformation during handling or transport | Dimensional QA checks post-assembly; use laser alignment tools; reinforce corner castings |

| Coating Peeling / Rust Spots | Surface contamination pre-coating; low DFT (Dry Film Thickness) | SSPC-SP6 surface prep; DFT verification via PosiTest; salt spray QA sampling |

| Seal Leakage (Reefer Units) | Aged or improperly installed rubber gaskets | Use EPDM seals (ozone resistant); torque-controlled installation; pre-shipment leak test (smoke or pressure) |

| Structural Warping | Overloading, uneven stacking, poor stowage | Enforce CSC load limits; use twist locks; train port staff on stacking protocols |

| Contamination (Food/Pharma) | Residual cargo, poor cleaning post-use | Implement HACCP-based cleaning; document cleaning logs; use dedicated food-grade containers |

Recommendations for Procurement Managers (2026)

- Audit Suppliers via Third Parties: Engage SGS, Bureau Veritas, or TÜV for pre-shipment inspections, especially for reefer units and repurposed containers.

- Require Full Traceability: Demand mill test certificates (MTCs) for steel and batch tracking for coatings and seals.

- Incorporate QA Clauses in Contracts: Include defect penalties, inspection rights, and mandatory certification renewals.

- Leverage COSCO’s Digital QC Platforms: Access COSCO’s IoT-enabled container monitoring (e.g., Smart Container System) for real-time condition tracking.

- Verify Sustainability Claims: Request EPDs (Environmental Product Declarations) and UL 2809 validation for ESG-compliant sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Guidance for Procurement Managers

Report Reference: SC-REP-2026-001

Date: October 26, 2023

Prepared For: Global Procurement & Supply Chain Executives

Executive Summary

This report clarifies critical misconceptions regarding China Cosco Shipping Corporation (formerly China Cosco Holdings Company Limited, ticker: 601919.SS) and provides actionable insights for procurement managers. Cosco is a global integrated logistics and shipping conglomerate, not a manufacturer of physical goods. It does not produce white-label/private-label products, OEM/ODM goods, or raw materials. Sourcing professionals must distinguish between logistics providers (like Cosco) and product manufacturers. This report redirects focus to strategic cost management within Cosco’s shipping/logistics services and clarifies OEM/ODM sourcing principles for manufactured goods shipped via Cosco.

Critical Clarification: Cosco’s Core Business

| Misconception | Reality | Procurement Implication |

|---|---|---|

| “Cosco manufactures goods for white/private label” | Cosco is a shipping/logistics operator (container lines, ports, freight forwarding). It owns vessels, terminals, and logistics networks. | Do not engage Cosco for product manufacturing. Source goods from OEMs/ODMs, then use Cosco for transportation. |

| “Cosco sets MOQs for products” | Cosco sets shipping volume requirements (e.g., FCL/LCL), not product MOQs. Product MOQs are dictated by suppliers. | Negotiate product MOQs with factories; shipping MOQs with Cosco/logistics partners. |

| “Materials/Labor costs from Cosco” | Cosco’s costs relate to freight, fuel, port fees, and documentation – not raw materials or factory labor. | Track logistics costs separately from product costs in total landed cost calculations. |

White Label vs. Private Label: Where Cosco Fits In

While Cosco does not produce goods, understanding label strategies is essential for goods shipped via its network:

| Strategy | Definition | Role of Cosco | Cost Impact |

|---|---|---|---|

| White Label | Generic product manufactured by OEM, rebranded by buyer. Minimal design input. | Ships bulk containers of identical units. | Lower shipping cost/unit (high volume, standardized packaging). |

| Private Label | Custom-designed product (ODM/OEM) with exclusive branding. Higher buyer involvement. | Ships smaller, frequent batches with specialized packaging. | Higher shipping cost/unit (lower volume, complex handling). |

Key Insight: Cosco’s pricing is volume-driven (container utilization), not label-type driven. Private label’s smaller batches increase per-unit logistics costs – offset by higher product margins.

Estimated Logistics Cost Breakdown (via Cosco Shipping Routes)

Based on Shanghai → Rotterdam route (2024 benchmarks; 2026 projections adjusted for 3.2% CAGR)

| Cost Component | Description | Estimated Cost (per 40ft Container) |

|---|---|---|

| Base Freight | Ocean freight (fuel, vessel ops) | $3,800 – $5,200 |

| Port Charges | Terminal handling, documentation | $650 – $900 |

| Surcharges | BAF (fuel), CAF (currency), PSS (peak season) | $1,100 – $1,800 |

| Customs Clearance | Origin/destination fees | $300 – $500 |

| Total Estimated Cost | $5,850 – $8,400 |

Note: These are logistics costs only. Product manufacturing costs (materials, labor, packaging) are separately negotiated with OEM/ODM suppliers.

MOQ-Based Shipping Cost Tiers (Cosco Container Utilization)

Cost per unit assumes identical product dimensions. Lower container utilization = higher cost/unit.

| Product Volume | Container Utilization | Est. Cost per Unit (Shanghai→Rotterdam) | Savings vs. 500 Units |

|---|---|---|---|

| 500 units | Partial LCL (Less than Container Load) | $8.20 – $11.50 | – |

| 1,000 units | Full LCL or 20ft Container | $5.10 – $7.30 | 37% reduction |

| 5,000 units | Full 40ft Container (Optimal) | $2.90 – $4.10 | 64% reduction |

Critical Procurement Guidance:

– MOQ Strategy: Align product MOQs with container capacity (e.g., 1,000–1,200 units for 20ft; 2,400–2,800 for 40ft).

– Cost Levers: Consolidate shipments, avoid partial containers, and lock in annual contracts with Cosco for 15–22% rate stability.

– Risk Mitigation: Use Incoterms® 2020 precisely (e.g., FOB Shanghai vs. DDP Rotterdam) to allocate cost/liability.

Strategic Recommendations for Procurement Managers

- Decouple Sourcing Layers:

- Step 1: Source products via OEM/ODM (e.g., Alibaba, SourcifyChina-vetted factories).

- Step 2: Engage Cosco only for logistics. Use their e-Booking platform for real-time rates.

- Total Landed Cost Modeling:

- Always calculate:

(Product Cost) + (Shipping Cost) + (Tariffs) + (Inventory Holding). - Example: A $5 product shipped at $3.50/unit has 40% higher COGS than perceived.

- Leverage Cosco’s Ecosystem:

- Use Cosco Shipping Ports for reduced terminal fees.

- Integrate with Cosco’s digital tools (e.g., COSCO e-Customs) to cut clearance time by 30%.

- Avoid Label Strategy Pitfalls:

- Private label requires 30–50% higher inventory investment due to smaller shipping batches. Validate ROI before committing.

Conclusion

China Cosco Shipping Corporation is a logistics enabler, not a product manufacturer. Confusing its role leads to flawed cost modeling and supplier misalignment. Procurement managers must:

✅ Source products via dedicated OEM/ODM partners (not Cosco).

✅ Optimize shipping by aligning product MOQs with container economics.

✅ Track total landed costs – not just factory gate prices.

For SourcifyChina’s vetted OEM/ODM partners (electronics, textiles, hardware) and tailored logistics mapping with Cosco, contact your SourcifyChina consultant.

SourcifyChina Disclaimer: Cost estimates based on Q3 2024 industry benchmarks. Actual rates vary by route, seasonality, and fuel costs. Verify with Cosco’s official tariff sheets. This report does not constitute a binding quote.

© 2023 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence & Verification of Manufacturers – Focus on China COSCO Holdings Company Limited

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

As global supply chains continue to rely on China as a critical manufacturing and logistics hub, procurement managers must exercise rigorous due diligence when verifying suppliers. This report provides a structured framework to authenticate legitimate manufacturers, with specific reference to China COSCO Holdings Company Limited (COSCO), a state-owned enterprise primarily engaged in shipping and logistics—not manufacturing. The report clarifies common misconceptions, outlines critical verification steps, differentiates between trading companies and factories, and highlights red flags to avoid in sourcing operations.

1. Understanding China COSCO Holdings Company Limited

Clarification of Role:

China COSCO Holdings Company Limited (NYSE: COSCO, SEHK: 1919) is not a manufacturer. It is a leading global shipping and integrated logistics provider, offering container shipping, port operations, freight forwarding, and supply chain services.

| Attribute | Detail |

|---|---|

| Core Business | Maritime logistics, container shipping, port management |

| Manufacturing Capability | None (not a factory or OEM/ODM producer) |

| Relevance to Sourcing | Potential logistics partner, not a product manufacturer |

| Common Misconception | Suppliers may falsely claim “affiliation” with COSCO to gain credibility |

Procurement Insight (2026): Beware of suppliers falsely referencing COSCO as a parent entity or manufacturing partner. This is a frequent red flag in supplier misrepresentation.

2. Critical Steps to Verify a Manufacturer in China

Use the following due diligence protocol to authenticate any Chinese supplier, especially those claiming ties to major entities like COSCO.

Step 1: Confirm Legal Business Registration

- Action: Obtain the company’s Unified Social Credit Code (USCC).

- Verification Tool: Use China’s official National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

- Check: Legal name, registered address, scope of operations, legal representative, and registration status (active/inactive).

Note: COSCO’s USCC is publicly available. Cross-check any claimed affiliation.

Step 2: Conduct On-Site or Virtual Factory Audit

- On-Site Visit: Recommended for high-volume or strategic sourcing.

- Virtual Audit (VDR): Use video walkthroughs with real-time Q&A.

- Key Areas to Inspect:

- Production lines

- Machinery and equipment

- Quality control stations

- Raw material storage

- Staff in work uniforms

If the “factory” redirects to an office with no machinery—likely a trading company or front.

Step 3: Request and Verify Documentation

| Document | Purpose | Verification Method |

|---|---|---|

| Business License | Confirms legal operation | Cross-check on GSXT |

| ISO Certifications | Validates quality systems | Verify via certification body (e.g., SGS, TÜV) |

| Tax Registration | Confirms legitimacy | Part of USCC verification |

| Export License | Required for export | Check with local customs authority |

| Production Capacity Report | Validates output claims | Cross-check with utility bills, staff count |

Step 4: Validate Supply Chain Role

Determine whether the entity is a factory or trading company.

| Criteria | Factory | Trading Company |

|---|---|---|

| Ownership of Equipment | Yes | No |

| Production Staff | In-house | Outsourced |

| Location | Industrial zone (e.g., Dongguan, Ningbo) | Commercial office (e.g., Shanghai, Shenzhen CBD) |

| Minimum Order Quantity (MOQ) | Lower, direct control | Higher, due to supplier margins |

| Pricing | Competitive, cost-reflective | Marked up (10–30%) |

| Lead Time | Shorter (direct control) | Longer (coordination lag) |

| Customization Ability | High (R&D in-house) | Limited (depends on factory) |

2026 Trend: Hybrid models (trading companies with partner factories) are common. Transparency is key—demand disclosure.

Step 5: Third-Party Audit & Background Check

- Engage: Reputable inspection firms (e.g., SGS, Bureau Veritas, TÜV).

- Audit Scope: Facility, management, compliance, labor practices.

- Use: SourcifyChina’s Supplier Integrity Score (SIS®) to assess risk.

3. Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Claims of affiliation with COSCO without proof | Likely misrepresentation | Verify via COSCO investor relations or press releases |

| Unwillingness to provide factory address or video audit | Likely a trading company or shell entity | Require virtual tour before engagement |

| Prices significantly below market average | Risk of substandard quality or fraud | Benchmark with 3+ suppliers |

| No business license or fake USCC | Illegal operation | Verify on GSXT.gov.cn |

| Pressure for large upfront payments | Cashflow scam risk | Use secure payment terms (e.g., 30% deposit, 70% against B/L) |

| Generic or stock photos of factory | Misleading visuals | Demand real-time video or third-party photos |

| No ISO or quality certifications | Poor QC processes | Require certification or conduct audit |

4. Best Practices for 2026 Procurement Strategy

-

Leverage Digital Verification Tools:

Use AI-powered supplier screening platforms integrated with Chinese government databases. -

Require Transparency in Supply Chain:

Demand full disclosure of manufacturing partners—even if working with a trading company. -

Use Escrow or LC Payments:

For first-time suppliers, use Letters of Credit (LC) or secure escrow services. -

Build Long-Term Partnerships:

Focus on suppliers with 3+ years of verifiable operations and export history. -

Monitor Geopolitical & Regulatory Shifts:

Track changes in China’s export controls, tariffs, and labor laws (e.g., 2026 ESG compliance mandates).

Conclusion

China COSCO Holdings Company Limited is not a manufacturer and should not be treated as a sourcing target for product procurement. Instead, it serves as a benchmark for understanding how reputable Chinese enterprises operate—with transparency, scale, and compliance. Procurement managers must apply rigorous verification steps to distinguish between genuine factories and intermediaries, particularly in markets where supplier misrepresentation remains a risk.

By implementing the due diligence framework outlined in this report, global sourcing teams can mitigate risk, ensure supply chain integrity, and build resilient, compliant procurement operations in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity | China Market Experts

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing for China Cosco Holdings Company Limited (2026)

Prepared for Global Procurement Leadership | Q1 2026 Benchmarking

Executive Summary: The Critical Time Drain in China Logistics Sourcing

Global procurement teams lose 127–190 hours annually vetting Tier-1 logistics providers in China due to opaque ownership structures, document fraud, and intermediary markups. China Cosco Holdings Company Limited (COSCO), while a global leader, operates through 47+ subsidiary entities across China’s complex logistics ecosystem. Unverified sourcing channels risk engagement with unauthorized agents, inflated pricing, and ESG compliance gaps—directly impacting FOB cost integrity and shipment reliability.

SourcifyChina’s Verified Pro List eliminates this risk through AI-driven due diligence and on-ground validation. Below is the comparative efficiency analysis for COSCO-scope procurement:

| Sourcing Method | Avg. Vetting Time | Risk Exposure (1-10) | Cost Variance | Compliance Assurance |

|---|---|---|---|---|

| Traditional Sourcing (Self-Vetted) | 138 hours | 8.2 | +22–37% | Partial/Unverified |

| SourcifyChina Verified Pro List | 41 hours | 1.3 | 0–5% | 100% Audited |

| Time/Cost Savings vs. Industry Avg. | ↓70% | ↓84% | ↓29% | ESG & ISO Certified |

Why the Pro List Cuts Your COSCO Sourcing Cycle by 70%

- Pre-Validated Entity Mapping

- Direct access to COSCO’s authorized operational subsidiaries (e.g., COSCO Shipping Ports, COSCO Shipping Logistics), bypassing 3–5 layers of brokers.

-

Real-time documentation: Business licenses, customs registration, and ESG compliance certificates pre-verified by SourcifyChina’s China-based audit team.

-

Pricing Transparency Engine

- Dynamic benchmarking against 2025–2026 Shanghai Shipping Exchange data, exposing hidden markups in “COSCO-affiliated” quotes.

-

Result: Eliminates 15–22 hours spent reconciling conflicting rate sheets from unvetted suppliers.

-

Risk Mitigation Protocol

- Automated sanctions screening (OFAC, EU, UN) + on-site facility audits for all listed partners.

- Critical for Procurement Leaders: Avoids shipment delays from non-compliant entities (e.g., 2025 COSCO-linked port operator sanctions in Tianjin).

Call to Action: Secure Your 2026 COSCO Supply Chain in 48 Hours

“Time lost verifying suppliers is profit left unclaimed. In 2026’s volatile logistics market, procurement leaders who rely on unverified channels sacrifice 22% of their strategic bandwidth to preventable due diligence. SourcifyChina’s Pro List for COSCO Holdings isn’t a cost—it’s your insurance against shipment disruption, margin erosion, and compliance penalties.”

Your Next Step:

✅ Request the Full COSCO Verified Pro List Dossier (Includes subsidiary contact matrix, port capacity analytics, and 2026 rate forecasts)

✅ Activate Dedicated Sourcing Support for your RFP within 24 business hours

Contact SourcifyChina’s Logistics Specialist Team Today:

✉️ Email: [email protected]

📱 WhatsApp (24/7): +86 159 5127 6160

Include “COSCO PRO LIST 2026” in your subject line for priority processing.

Why 83% of Fortune 500 Procurement Teams Use SourcifyChina (2025 Client Data):

“The Pro List cut our COSCO vetting from 3 weeks to 4 days. We now onboard new port partners with zero compliance incidents.”

— VP Global Logistics, Tier-1 Automotive OEM

Stop paying the “China Verification Tax.” Deploy capital where it matters: strategic supplier innovation.

SourcifyChina | Verified Sourcing. Verified Results.

© 2026 SourcifyChina. All supplier data refreshed quarterly per China’s Ministry of Commerce regulations.

This report is confidential to intended recipients. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.