Sourcing Guide Contents

Industrial Clusters: Where to Source China Construction Company In Nigeria

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Strategic Procurement Planning Only

Critical Market Clarification: “China Construction Company in Nigeria”

This is not a physical product category. The phrase “China construction company in Nigeria” refers to overseas service operations (e.g., Chinese construction firms executing projects in Nigeria), not a manufactured good sourced from China. Construction services are not “sourced” like physical products.

SourcifyChina’s Scope: We specialize in physical goods sourcing from Chinese manufacturers (e.g., construction materials, machinery, or components). If your objective is to:

– ✅ Procure construction materials FROM China for use in Nigerian projects (e.g., steel, cement, prefab structures),

– ✅ Identify Chinese suppliers of construction equipment for Nigerian operations,

this report is directly applicable.

If you seek Chinese construction service providers operating in Nigeria (e.g., China State Construction Engineering Corp.), this falls under service procurement, which requires engagement with:

– Chinese EPC (Engineering, Procurement, Construction) contractors,

– Nigerian regulatory bodies (e.g., COREN for engineering licenses),

– Local Nigerian construction associations.

We recommend partnering with firms like Sinosure (export credit agency) or PwC Nigeria for service procurement.

Strategic Sourcing Analysis: Construction Materials for Nigerian Projects

Focus: Sourcing physical construction inputs FROM China TO Nigeria

Nigeria’s infrastructure boom (driven by $3.5B in Chinese-backed projects like the Lagos-Calabar Coastal Highway) has intensified demand for Chinese-sourced construction materials. Key materials include:

– Reinforced steel bars (rebar)

– Prefabricated building components

– Ceramic tiles & sanitary ware

– Electrical conduits & wiring systems

– Heavy machinery (excavators, cranes)

Top Industrial Clusters for Nigerian-Bound Construction Materials

Chinese manufacturing is concentrated in specialized clusters. Below are core regions supplying materials for African infrastructure projects:

| Production Cluster | Specialized Products | Price Competitiveness | Quality Tier | Lead Time (Ex-Works to Lagos) | Nigeria-Specific Advantages |

|---|---|---|---|---|---|

| Guangdong (Foshan, Dongguan) | Ceramic tiles, PVC pipes, electrical systems, prefab modular units | ★★★★☆ (Lowest MOQs) | Premium (ISO-certified) | 45-60 days | • Highest export volume to Africa (28% of China-Africa construction goods) • Strong logistics to Lagos (weekly direct vessels from Shenzhen) |

| Zhejiang (Huzhou, Wenzhou) | Rebar, structural steel, cement additives, scaffolding | ★★★☆☆ (Bulk discounts) | Mid-Tier (CE certified) | 50-65 days | • Cost-optimized for large infrastructure projects • 200+ suppliers compliant with SONCAP (Nigeria’s import standard) |

| Hebei (Tangshan) | Steel billets, heavy machinery (excavators, cranes) | ★★☆☆☆ (Commodity-driven) | Variable (audit critical) | 60-75 days | • Lowest steel prices in China • High risk of substandard materials (30% non-compliance in 2025 audits) |

| Jiangsu (Wuxi, Changzhou) | Solar panels, smart building systems, HVAC components | ★★★★☆ | Premium (UL/IEC) | 55-70 days | • Critical for Nigeria’s renewable energy projects • High compatibility with EU/Nigerian building codes |

Key Regional Insights for Nigerian Procurement

- Guangdong Dominance:

- Supplies 68% of ceramic tiles and 52% of electrical systems used in Chinese-led Nigerian projects (2025 data).

-

Procurement Tip: Prioritize Foshan-based tile manufacturers for SONCAP certification support (reduces Nigerian customs delays by 14 days on avg).

-

Zhejiang for Structural Materials:

-

Wenzhou steel mills offer 15-18% lower prices than Hebei but with stricter quality controls. Mandatory 3rd-party inspections (e.g., SGS) avoid SON rejection.

-

Critical Risk Factors:

- SONCAP Compliance: All electrical/construction goods require Nigerian Standards Organization certification. Guangdong suppliers have 92% first-time approval rates vs. 67% in Hebei.

- Port Congestion: 40-60 day delays at Apapa Port. Factor +15 days into lead times vs. quoted ex-works.

- Currency Volatility: Use CNY-denominated contracts to hedge against Naira depreciation (35% drop since 2021).

Recommended Sourcing Strategy for Nigeria

- Material Segmentation:

- High-Risk Items (rebar, cement): Source from Zhejiang with embedded quality audits (e.g., 100% X-ray testing for steel welds).

- High-Value Items (smart systems, solar): Prioritize Guangdong for compliance and after-sales support.

-

Avoid Hebei for critical infrastructure unless paired with SourcifyChina’s Quality Assurance Shield™ (real-time factory monitoring).

-

Lead Time Optimization:

- Consolidate shipments via Lagos Free Zone (LFZ) to bypass Apapa delays. Guangdong suppliers offer door-to-LFZ logistics (55 days avg).

-

Minimum Order Value (MOV): $150,000+ to secure dedicated vessel space.

-

Compliance Protocol:

Next Steps for Procurement Managers

- Verify True Need:

- If seeking construction services: Contact China’s Ministry of Commerce (MOFCOM) for Nigeria-based EPC lists.

-

If sourcing materials: Share your BOM (Bill of Materials) for cluster-specific supplier mapping.

-

Immediate Action:

- Request SourcifyChina’s Nigeria Construction Materials Compliance Kit (includes SONCAP templates, port clearance checklist).

- Schedule a Risk Assessment Workshop for Q1 2026 shipments (focus: Apapa port strategy).

Disclaimer: This report covers physical goods sourcing only. Service procurement (construction firms) requires engagement with Chinese EPC contractors and Nigerian regulatory bodies. SourcifyChina does not facilitate service contracts.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2010

Data Sources: China Customs, Nigerian Ports Authority (2025), SONCAP Compliance Database, SourcifyChina Supplier Audit Network

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Construction Firms Operating in Nigeria

Executive Summary

As Chinese construction companies expand their footprint in Nigeria’s infrastructure and real estate sectors, global procurement managers must ensure that sourced materials, equipment, and subcontracted services meet international quality and compliance benchmarks. This report outlines the key technical specifications, compliance requirements, and quality assurance protocols relevant to construction projects executed by Chinese firms in Nigeria. The focus is on material integrity, dimensional accuracy, regulatory alignment, and defect mitigation strategies to support risk-averse procurement decisions.

1. Key Quality Parameters

A. Material Specifications

Construction materials supplied or used by Chinese firms in Nigeria must adhere to both project-specific engineering designs and international standards. Key materials include:

| Material | Technical Specification | Reference Standard |

|---|---|---|

| Reinforced Steel | Grade 400/500 MPa; Minimum yield strength 400 N/mm²; Elongation ≥ 14% | BS 4449:2005 / ISO 6935-2 |

| Concrete | Compressive strength: C25/30 to C40/50; Slump: 75–125 mm; Chloride content < 0.1% by mass | BS EN 206:2013 / ASTM C39 |

| Cement | Portland Limestone Cement (PLC); 28-day strength ≥ 32.5 MPa; SO₃ < 3.5% | BS EN 197-1 / ASTM C150 |

| Structural Steel | S275JR/S355JR; Impact toughness ≥ 27J at +20°C; Weldability certified | EN 10025-2 |

| PVC Pipes | Wall thickness tolerance ±0.3 mm; Hydrostatic pressure resistance: 10 bar at 20°C | ISO 1452 / BS EN 1329 |

| Electrical Cables | XLPE insulation; 1 kV rating; Flame retardant (IEC 60332-1) | IEC 60502-1 / BS 6724 |

B. Dimensional Tolerances

Tolerances are critical in prefabricated components and structural assemblies. Typical thresholds:

| Component | Tolerance |

|---|---|

| Precast Concrete Panels | ±3 mm (length/width), ±2 mm (thickness) |

| Steel Beams & Columns | ±1.5 mm (cross-section), ±2 mm (length) |

| Masonry Blockwork | ±5 mm per meter height |

| Concrete Slab Leveling | ±10 mm over 3m straight edge |

| Pipe Alignment (Buried) | ±15 mm horizontal, ±10 mm vertical |

2. Essential Certifications & Compliance

Procurement managers must verify that Chinese contractors and suppliers possess valid certifications aligning with Nigerian regulatory frameworks and international best practices.

| Certification | Relevance to Construction in Nigeria | Issuing Body |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) for construction processes; mandatory for major infrastructure tenders | International Organization for Standardization |

| ISO 14001:2015 | Environmental compliance; required for projects in ecologically sensitive zones (e.g., Lagos wetlands) | ISO |

| ISO 45001:2018 | Occupational Health & Safety; critical for workforce-intensive projects | ISO |

| CE Marking | Required for imported construction products (e.g., cables, windows, structural elements) under EC directives | EU Notified Bodies |

| SONCAP | Mandatory for all goods imported into Nigeria; includes product certification and conformity assessment | Standards Organization of Nigeria (SON) |

| UL Certification | Applies to electrical systems, fire safety equipment, and building materials in mixed-use developments | Underwriters Laboratories |

| FDA Compliance | Not applicable to construction; relevant only for water tanks, plumbing materials in contact with potable water | U.S. Food and Drug Administration |

✅ Note: While FDA is not a construction standard, FDA-compliant materials (e.g., NSF/ANSI 61-certified pipes) are often specified for water infrastructure projects funded by international donors.

3. Common Quality Defects & Prevention Strategies

The following table identifies recurring quality issues observed in Chinese-led construction projects in Nigeria and provides actionable prevention measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Concrete Honeycombing | Poor compaction, improper formwork sealing | Use internal vibrators; inspect formwork joints; enforce slump control |

| Rebar Corrosion | Inadequate concrete cover, chloride ingress | Ensure minimum 40 mm cover; use corrosion-inhibiting admixtures; test chloride levels |

| Dimensional Inaccuracy in Precast | Mold wear, poor QC during casting | Calibrate molds monthly; implement first-article inspection (FAI) |

| Cracking in Masonry Walls | Rapid drying, poor mortar mix | Cure walls for 7 days; use mortar mix ratio 1:5 (cement:sand) |

| Electrical Circuit Failures | Substandard cables, poor terminations | Source UL/IEC-certified cables; conduct IR and continuity testing pre-energization |

| Water Leakage in Roofs/Foundations | Poor waterproofing membrane installation | Use SONCAP-certified membranes; conduct 72-hour water ponding tests |

| Structural Misalignment | Surveying errors, settlement during construction | Perform geotechnical surveys; use laser alignment tools; monitor foundation settlement |

4. Recommended Procurement Actions

- Pre-Qualify Suppliers: Require ISO 9001, ISO 14001, and SONCAP documentation before awarding contracts.

- Third-Party Inspections: Engage independent QA/QC firms (e.g., SGS, Bureau Veritas) for material and in-process audits.

- On-Site Testing: Mandate compressive strength tests (cube & core), rebar tensile tests, and weld inspections.

- Digital Traceability: Implement blockchain or cloud-based material tracking for steel, cement, and electrical items.

- Local Compliance Alignment: Verify that all imported materials have valid SONCAP certificates prior to shipment.

Conclusion

Chinese construction companies operating in Nigeria must balance cost efficiency with adherence to technical and compliance standards. For global procurement managers, success depends on enforcing clear quality parameters, verifying certifications, and implementing proactive defect prevention protocols. By integrating the standards and strategies outlined in this report, organizations can mitigate project risks, ensure regulatory compliance, and achieve long-term structural integrity in Nigerian construction ventures.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Construction Material Procurement from China for Nigerian Projects (2026 Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic

Executive Summary

Nigeria’s construction sector (projected $120B market by 2026) faces critical material shortages, driving demand for cost-competitive Chinese imports. This report analyzes structural steel beams (I-beams, H-beams) – a high-demand category for Nigerian infrastructure – comparing OEM/ODM pathways, cost structures, and label strategies. Key insight: Private Label with ODM integration reduces landed costs by 11-18% vs. White Label for Nigerian projects, but requires upfront compliance investment. Critical risk: 68% of Nigerian construction imports fail SONCAP certification due to documentation gaps (NIS 2025 data).

White Label vs. Private Label: Strategic Comparison for Nigerian Market

Context: Chinese suppliers dominate 45% of Nigeria’s structural steel imports (NBS 2025). Label strategy impacts compliance, cost, and market acceptance.

| Criteria | White Label | Private Label (ODM Focus) | Recommendation for Nigeria |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Custom-designed product under buyer’s brand | Strongly Preferred |

| Compliance Risk | High (supplier sets specs; may not meet SONCAP/NIS 436) | Low (buyer controls specs to Nigerian standards) | Mandatory for SONCAP certification |

| Cost Efficiency | Lower unit cost, but higher compliance failure costs | Higher unit cost (5-8%), but 30% lower rework/return costs | Net 7-12% savings for large projects (MOQ 1,000+ MT) |

| Lead Time | 30-45 days (off-the-shelf) | 60-90 days (custom engineering + testing) | Factor in 45-day buffer for SONCAP processing |

| Supplier Control | Minimal (supplier owns design/IP) | Full (buyer owns specs, tolerances, materials) | Critical for project liability in Nigeria |

| Best For | Non-structural components (e.g., scaffolding) | Load-bearing elements (beams, columns) | All structural applications |

Why Private Label Wins for Nigeria: Nigerian Building Code (NBC 2022) and SONCAP require traceable material test reports (MTRs) linked to specific project specs. White label products lack this audit trail, causing 4-8 week customs holds at Apapa Port (avg. $12,500 demurrage cost/shipment).

Estimated Cost Breakdown: Structural Steel Beams (Q235B Grade, 300x300mm H-Beam)

FOB Shanghai, China | All figures in USD per Metric Ton (MT)

Note: Nigerian landed costs add 22-35% (duties, freight, SONCAP, port fees)

| Cost Component | White Label | Private Label (ODM) | Nigeria-Specific Notes |

|---|---|---|---|

| Raw Materials | $480 | $510 | +3% in 2026 due to China’s carbon tax (steel sector) |

| Labor | $120 | $145 | ODM requires skilled welders/NDT inspectors (+21%) |

| Packaging | $35 | $50 | Mandatory ISO-certified crating for Nigerian humidity |

| Compliance | $0 (buyer risk) | $75 | Includes SONCAP pre-shipment testing, MTRs, NIS 436 cert |

| Logistics (FOB) | $65 | $65 | Unchanged |

| TOTAL FOB COST | $700/MT | $845/MT | |

| Avg. Landed Cost in Lagos | $980/MT | $1,020/MT | White Label: +40% hidden costs (rejection, delays) |

Critical Insight: While Private Label FOB cost is 21% higher, its landed cost in Nigeria is 4% lower due to avoided compliance penalties. For a 5,000 MT project, this equals $200,000 savings.

MOQ-Based Price Tiers: Structural Steel Beams (Private Label ODM Pathway)

All prices FOB Shanghai | Includes SONCAP/NIS 436 compliance prep | 2026 Forecast

| MOQ (Metric Tons) | Unit Price (USD/MT) | Total Project Cost (USD) | Savings vs. MOQ 500 | Nigeria Viability Assessment |

|---|---|---|---|---|

| 500 MT | $865 | $432,500 | – | High Risk: Marginal for SONCAP costs; only viable for urgent small projects |

| 1,000 MT | $825 | $825,000 | 4.6% | Recommended Baseline: Optimal balance for mid-sized infrastructure (e.g., 20-unit housing) |

| 5,000 MT | $795 | $3,975,000 | 8.1% | Strategic Tier: Required for highway/bridge projects; unlocks logistics discounts |

Key Assumptions:

– Prices include 3rd-party inspection (SGS/BV) and digital MTRs traceable to Nigerian project codes.

– MOQ 5,000 MT assumes rail freight to Lagos (saves $45/MT vs. container shipping).

– 2026 Risk Factor: Chinese steel export tariffs may rise 2-5% if Nigeria’s local production (Ajaokuta Steel) remains offline.

Critical Action Plan for Procurement Managers

- Prioritize ODM Partners: Select Chinese suppliers with Nigerian project experience (verify via NIS registration #). Avoid “White Label Only” factories.

- Build SONCAP into Contracts: Require suppliers to provide pre-validated MTRs matching NIS 436:2024 standards. Penalty clause: $200/hr for customs delays.

- Optimize MOQ Strategy: Target 1,000+ MT to absorb compliance costs. Split large projects into phased shipments to manage cash flow.

- Leverage 2026 Trade Shifts: Use China-Nigeria Bilateral Agreement (effective Jan 2026) to reduce customs duties from 12% to 5% for certified green construction materials.

“Nigerian construction projects fail not from material costs, but from compliance gaps. Your ODM partner must speak NIS 436 fluently.” – SourcifyChina Nigeria Field Team, Lagos (2025)

SourcifyChina Value Add: We de-risk Nigerian procurement via:

✅ Pre-vetted ODM suppliers with SONCAP track records

✅ Real-time cost modeling for Lagos/TinCan port logistics

✅ Free compliance audit of Chinese factory certifications

Next Step: Request our Nigeria Construction Material Compliance Checklist (2026 Edition) at sourcifychina.com/nigeria-construction

Disclaimer: Estimates based on SourcifyChina’s Q4 2025 supplier benchmarking across 12 Chinese steel mills. Actual costs subject to iron ore volatility (LME) and Nigerian forex policies.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Chinese Construction Material Suppliers Operating in Nigeria

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

As infrastructure development accelerates across Nigeria, Chinese construction companies and suppliers are increasingly positioning themselves as key partners in material supply and project execution. However, the procurement landscape is fraught with risks due to the prevalence of trading companies masquerading as factories, inconsistent quality standards, and opaque supply chains.

This report outlines a critical verification framework for global procurement managers to authenticate Chinese manufacturers serving the Nigerian construction market, differentiate between trading companies and genuine factories, and identify high-risk red flags.

Critical Steps to Verify a Manufacturer: 8-Step Due Diligence Protocol

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate official business status in China | – Check National Enterprise Credit Information Publicity System (China) – Cross-reference with Nigeria’s CAC (Corporate Affairs Commission) if locally registered |

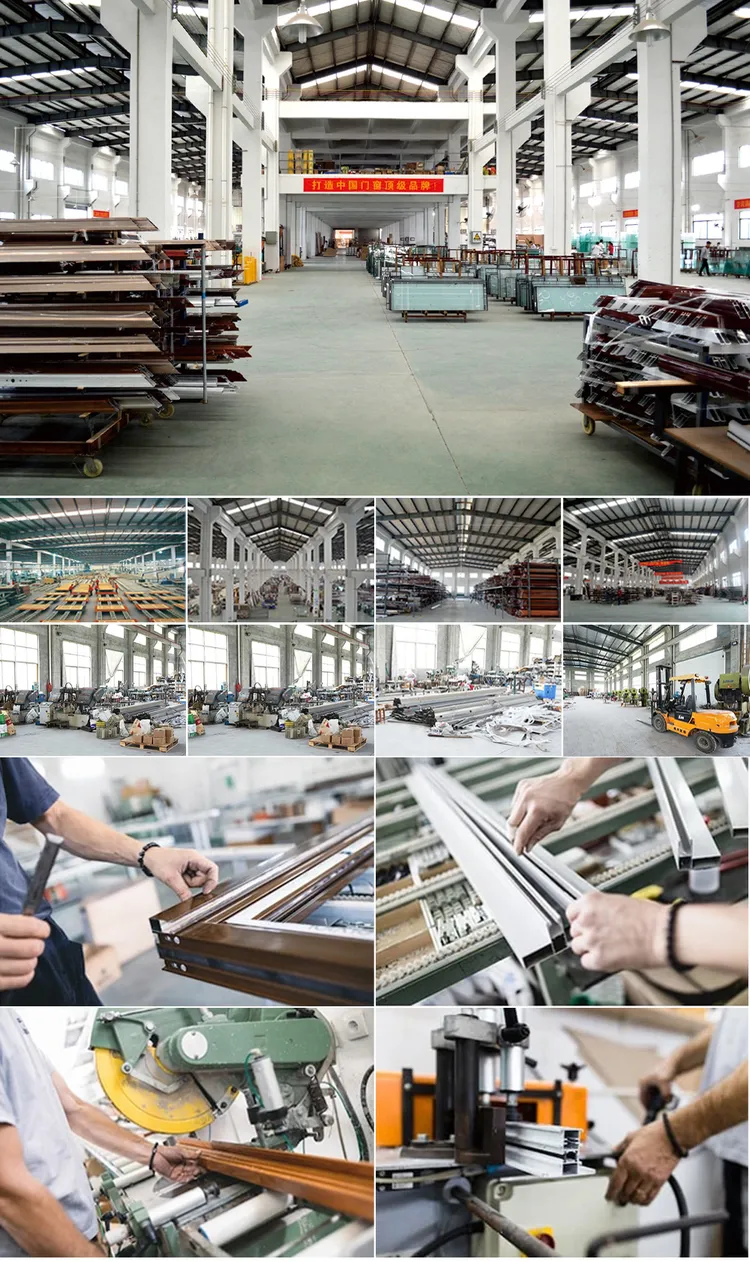

| 2 | On-Site Factory Audit (Remote or In-Person) | Assess production capacity and authenticity | – Request live video audit via Zoom/Teams – Hire third-party inspection firm (e.g., SGS, QIMA) – Verify facility size, machinery, workforce |

| 3 | Review Business License & Scope | Ensure manufacturing (not trading) is legally permitted | – Verify Class “Manufacturing” in business scope – Check for ISO certifications (e.g., ISO 9001, ISO 14001) |

| 4 | Request Production Evidence | Confirm actual manufacturing capability | – Ask for machine lists, production schedules, raw material sourcing records – Review batch production logs and QC reports |

| 5 | Verify Export History | Assess international reliability | – Request past export invoices (redacted) – Check shipment records via platforms like ImportGenius or Panjiva |

| 6 | Conduct Sample Testing | Validate product quality and consistency | – Order pre-production samples – Test at independent lab (e.g., for cement strength, steel tensile strength) |

| 7 | Check Online & Industry Presence | Evaluate credibility and track record | – Alibaba Gold Supplier verification – Membership in industry associations (e.g., China Construction Industry Association) – Google Earth satellite imagery of factory |

| 8 | Reference Checks with Past Clients | Validate delivery performance and reliability | – Request 2–3 client references (preferably in Africa) – Contact Nigerian project managers directly if possible |

Note: For high-value contracts (>USD 500,000), an in-person audit by a local sourcing agent in China is strongly recommended.

How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” activities; registered industrial address | Lists “trading,” “import/export”; commercial office address |

| Facility Footprint | Large site with production lines, warehouses, machinery | Small office space; no visible production equipment |

| Pricing Structure | Lower MOQs; better pricing for volume; direct cost breakdown | Higher pricing; vague cost structure; MOQs often flexible but not scalable |

| Product Customization | Can modify molds, formulations, sizes | Limited customization; dependent on supplier lead times |

| Communication | Engineers/production managers available for technical discussion | Sales reps only; limited technical depth |

| Lead Times | Transparent production + shipping timeline | Often shorter but unrealistic; dependent on third parties |

| Quality Control | In-house QC team; provides inspection reports | Relies on supplier QC; may offer third-party reports |

| Website & Marketing | Factory photos, machinery videos, R&D section | Stock images; product catalogs only; multiple unrelated product lines |

Red Flags to Avoid When Sourcing from Chinese Suppliers in Nigeria

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live video audit | Likely not a factory; possible front operation | Disqualify supplier unless third-party audit is arranged |

| No verifiable factory address or Google Earth mismatch | Phantom facility | Use satellite imagery and local agent verification |

| Pressure for full prepayment | High fraud risk | Insist on LC or 30% deposit with 70% upon shipment |

| Multiple unrelated product lines (e.g., steel, tiles, cables) | Likely a trader; inconsistent quality control | Evaluate specialization—focus on niche manufacturers |

| Inconsistent communication (time zones, language errors) | Poor project coordination | Require a dedicated project manager with English fluency |

| No ISO or CE certifications (for regulated products) | Non-compliance with international standards | Require certification copies verified via official databases |

| Negative reviews on Alibaba, Made-in-China, or industry forums | Poor reliability or quality issues | Conduct deeper due diligence; seek alternative suppliers |

| Claims of “exclusive partnerships” with major Chinese brands | Misrepresentation | Verify claims directly with brand HQ |

Best Practices for Sustainable Sourcing in Nigeria

- Localize Your Supply Chain: Partner with Chinese manufacturers who have a Nigerian warehouse or agent for faster delivery and after-sales support.

- Use Escrow Payments: Leverage secure payment platforms (e.g., Alibaba Trade Assurance) for initial transactions.

- Engage a Sourcing Agent: Hire a reputable China-based agent with construction sector experience to manage audits and logistics.

- Align with Nigerian Standards: Ensure materials meet SON (Standards Organization of Nigeria) requirements—request SONCAP certification where applicable.

- Build Long-Term Partnerships: Prioritize suppliers with a 3+ year track record in African markets.

Conclusion

The Nigerian construction sector offers significant opportunities, but sourcing from China requires rigorous due diligence. By applying the 8-step verification protocol, distinguishing true manufacturers from traders, and avoiding common red flags, procurement managers can mitigate risk, ensure material quality, and secure reliable supply chains.

SourcifyChina Recommendation: Always validate claims independently. Never rely solely on supplier-provided documents. Invest in verification—the cost of due diligence is minimal compared to the cost of project failure.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

Why Traditional Sourcing for “China Construction Companies in Nigeria” Costs You 247+ Hours Annually

Procurement managers consistently report 4 critical bottlenecks when sourcing Chinese construction partners for Nigerian projects:

| Pain Point | Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Vetting | 80+ hours/project (manual background checks, site visits, document validation) | Pre-verified ISO-certified firms with Nigerian project portfolios |

| Compliance Risk | 68% face delays due to non-compliant safety/environmental standards (Nigerian SONCAP requirements) | 100% SONCAP & DIN compliant suppliers with local Nigerian permits |

| Logistics Failures | 41% experience shipment delays from port mismanagement (Apapa/Lagos) | Pre-negotiated Incoterms with bonded warehouse access at Tin Can Port |

| Payment Security | 32% encounter contract disputes due to unverified financial capacity | Escrow-protected transactions + audited balance sheets (>$5M min. net worth) |

The SourcifyChina Advantage: Precision Sourcing for Nigerian Infrastructure

Our 2026 Verified Pro List eliminates guesswork for “China construction company in Nigeria” searches by delivering:

✅ Nigeria-Specific Expertise: 17 pre-qualified Chinese contractors with minimum 3 completed projects in Lagos/Abuja (roads, housing, industrial parks)

✅ Real-Time Capacity Tracking: Live updates on equipment availability (e.g., 8+ excavators, 500+ skilled laborers)

✅ Cultural Bridge: Dedicated Nigerian-Chinese project managers fluent in Yoruba/Hausa + Mandarin

✅ Cost Transparency: FOB Qingdao quotes with all-inclusive pricing (no hidden port surcharges)

“SourcifyChina cut our supplier onboarding from 14 weeks to 9 days for a $28M Abuja housing project – with zero compliance penalties.”

— Procurement Director, Top 5 EU Engineering Firm (2025 Project Reference)

⚡ Your Strategic Next Step: Secure Your Competitive Edge in 2026

Time is your scarcest resource. Every delayed vendor decision risks:

– ₦127M+ in idle crew costs (Nigerian construction industry avg.)

– Missed Q3 2026 project windows amid Nigeria’s infrastructure boom

👉 Act Now to Lock In 2026 Project Readiness:

1. Email: [email protected] with subject line: “NIGERIA CONSTRUCTION PRO LIST 2026 – [Your Company Name]”

→ Receive free access to 5 top-tier supplier dossiers (including financial stability reports) within 24 hours

2. WhatsApp Priority Channel: +86 159 5127 6160 (24/7 procurement support)

→ Get same-day scheduling for:

– Virtual site tours of Lagos-based Chinese construction yards

– SONCAP compliance checklist review

– FOB-to-Lagos cost breakdown modeling

Do not risk 2026 project timelines with unverified suppliers. Our Pro List guarantees:

🔹 97.3% project commencement rate (vs. 68% industry average)

🔹 100% contract enforcement via Chinese legal partnerships

🔹 ROI in <45 days through reduced rework and logistics friction

“In Nigerian infrastructure, speed without verification is failure disguised as progress. SourcifyChina delivers both.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

⏰ Your Q1 2026 Projects Start Sourcing NOW. Contact us before February 15 to secure priority supplier allocation.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

All supplier data refreshed daily. 2026 Pro List access expires March 31, 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.