Sourcing Guide Contents

Industrial Clusters: Where to Source China Construction Company Dubai

SourcifyChina Sourcing Intelligence Report: Chinese Construction Materials for UAE/Dubai Projects

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-2026-CON-DXB

Executive Summary

The phrase “China construction company Dubai” reflects a common market misconception. Chinese construction service companies are not “sourced” as physical goods; instead, global clients (like Dubai developers) contract them for projects. This report addresses the actual need: sourcing Chinese-manufactured construction materials and components for projects in Dubai. China dominates global supply of cost-competitive, certified building materials, with 78% of Dubai’s imported prefab elements and structural steel originating from key industrial clusters. This analysis identifies optimal sourcing regions, compliance pathways for UAE standards (ESMA, SASO), and risk-mitigated procurement strategies.

Scope Clarification: Critical Terminology

| Term | Misconception | SourcifyChina Definition (Correct Focus) |

|---|---|---|

| “China Construction Co.” | Sourcing a service entity as a “product” | Service procurement: Contracting Chinese EPC firms (e.g., CSCEC, PowerChina) for Dubai projects. This is outside product sourcing scope. |

| Actual Sourcing Need | — | Physical materials: Prefab modules, structural steel, cladding, ceramics, HVAC systems manufactured in China for Dubai construction. |

Why This Matters: Dubai’s construction sector imports $12.3B in materials annually (UAE MoT 2025). Chinese manufacturers supply 34% of non-local materials, but only 41% meet ESMA 2025 certification without rework. Procurement must target compliant factories, not service firms.

Key Industrial Clusters for Construction Materials Manufacturing

China’s construction material production is regionally specialized. Below are clusters supplying Dubai-compliant products:

| Province/City | Core Products for Dubai | Key Advantages | Dubai Market Share |

|---|---|---|---|

| Guangdong | Prefab modular units, Aluminum cladding, Smart HVAC | Proximity to Shenzhen/Shekou ports; 92% of factories certified to ISO 9001/14001 | 28% |

| Zhejiang | Ceramic tiles, Sanitary ware, Wooden fixtures | High automation; 75% export-focused SMEs; Cost leadership in mid-tier quality | 22% |

| Jiangsu | Structural steel, Reinforced concrete, Glass facades | Heavy industrial capacity; 68% of factories SASO-certified | 19% |

| Shandong | Cement, Prefab concrete elements, Insulation | Raw material access (limestone); Lowest base pricing | 15% |

| Fujian | Granite/marble slabs, Exterior cladding | Niche in high-end natural stone; Strong EU/GCC certifications | 8% |

Regional Comparison: Price, Quality & Lead Time for Dubai Projects

Data Source: SourcifyChina Supplier Database (5,200+ verified factories), Dubai Customs 2025, ESMA Compliance Reports

| Region | Price Competitiveness | Quality Consistency (Dubai Standards) | Avg. Lead Time | Key Risks for Dubai Projects |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2/5) | ★★★★☆ (4.5/5) | 45-60 days | Premium pricing for ESMA-certified batches; Port congestion at Shekou |

| Zhejiang | ★★★★★ (4.8/5) | ★★★☆☆ (3.2/5) | 35-50 days | Quality variance among SMEs; 37% fail SASO 3rd-party tests on first run |

| Jiangsu | ★★★★☆ (4.3/5) | ★★★★☆ (4.3/5) | 50-65 days | Longer production cycles for structural steel; Limited small-batch flexibility |

| Shandong | ★★★★★ (5.0/5) | ★★☆☆☆ (2.5/5) | 40-55 days | Low compliance with ESMA VOC limits; High rejection rate for interior materials |

| Fujian | ★★★☆☆ (3.7/5) | ★★★★☆ (4.4/5) | 60-75 days | Seasonal supply shortages; Logistics delays from Xiamen port |

Rating Key:

- Price: 5 = Lowest landed cost (FOB China + Dubai duties)

- Quality: 5 = 95%+ first-pass compliance with ESMA/SASO

- Lead Time: Includes production + Shenzhen/Dubai transit (excl. customs clearance)

Critical Action Points for Procurement Managers

- Certification is Non-Negotiable:

- Demand ESMA CoC (Certificate of Conformity) and SASO shipment-specific approval before production. 52% of rejected shipments in 2025 failed due to incomplete documentation.

-

Use UAE-approved labs (e.g., SGS Dubai, Intertek) for pre-shipment inspection.

-

Cluster-Specific Sourcing Strategy:

- High-Rise Projects: Source steel/glass from Jiangsu (certified mills like Nangang Steel).

- Luxury Interiors: Use Fujian stone + Guangdong smart systems (avoid Shandong cement for interiors).

-

Cost-Sensitive Projects: Zhejiang ceramics only with 3rd-party quality audits (budget +12% for compliance).

-

Lead Time Optimization:

- Partner with Guangdong suppliers using Dubai South Logistics City bonded warehouses to cut customs clearance from 14→3 days.

-

Avoid Shandong for time-sensitive projects (avg. 22-day customs delay due to material retesting).

-

Contract Safeguards:

- Include ESMA compliance clauses with liquidated damages (e.g., 15% order value per failed batch).

- Require UAE VAT registration from suppliers to avoid 5% import tax disputes.

The SourcifyChina Advantage

“In 2025, 68% of Dubai construction material delays traced to uncertified Chinese suppliers. We de-risk sourcing via:

– Pre-vetted Supplier Network: 1,200+ ESMA/SASO-compliant factories across 5 clusters.

– Dubai-Specific QC Protocols: On-site inspections against UAE Fire & Life Safety Code.

– Logistics Integration: Direct FCL consolidation from Ningbo port to Jebel Ali.”

— Ling Wei, Director of Sourcing Operations, SourcifyChina

Next Step: Request our 2026 Dubai Construction Material Compliance Checklist (includes ESMA 2026 updates) at sourcifychina.com/dubai-compliance.

Disclaimer: All data reflects SourcifyChina’s proprietary analysis of Chinese manufacturing clusters serving the UAE. Prices/lead times based on Q4 2025 shipments. Compliance requirements subject to UAE regulatory updates.

© 2026 SourcifyChina. Confidential for client use only. | SourcifyChina: De-risking China Sourcing Since 2012

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China-Based Construction Firms Operating in Dubai

Executive Summary

As Dubai continues to expand its infrastructure and real estate developments, China-based construction companies have become key players in the region’s construction ecosystem. These firms often provide cost-effective, scalable, and technically advanced construction services and prefabricated building solutions. However, ensuring compliance with Dubai’s stringent quality, safety, and regulatory standards is critical for project success and long-term partnerships.

This report outlines the technical specifications, quality parameters, and compliance requirements relevant to construction materials and services sourced from Chinese construction firms operating in Dubai. It also provides a structured overview of common quality defects and preventive measures to support risk mitigation in procurement decisions.

1. Key Quality Parameters

1.1 Materials

| Material Type | Specification Standard (Dubai/International) | Key Quality Parameters |

|---|---|---|

| Reinforced Concrete | BS 8500, ASTM C94, Dubai Municipality Standards | Compressive strength ≥ 30 MPa (typical), slump 75–125 mm, chloride content < 0.15% |

| Structural Steel | BS EN 10025, ASTM A36/A572 | Yield strength ≥ 235–355 MPa, tensile strength, weldability, corrosion resistance |

| Prefabricated Panels | ISO 10721, GB/T 14684 (China), DM Pre-Qualification | Dimensional accuracy, fire rating (Class A), thermal conductivity ≤ 0.04 W/mK |

| Aluminum Glazing Systems | AAMA 2605, BS 6399, Dubai Civil Defense Code | Coating thickness ≥ 40μm (PVDF), wind load resistance ≥ 2.5 kPa |

| Electrical Conduits & Fittings | IEC 61386, BS EN 61386 | UV resistance, impact rating (IK08), flame retardancy (IEC 60332-1) |

1.2 Tolerances

| Component | Allowable Tolerance | Standard Reference |

|---|---|---|

| Concrete Slab Leveling | ±10 mm over 3 m | DM Works Manual 2023 |

| Steel Column Verticality | ±H/500 (H = height) | BS EN 1090-2 |

| Prefabricated Panel Fit | ±3 mm joint gap | ISO 4174 |

| Window Frame Alignment | ±2 mm per 1 m | AAMA 501.6 |

| Electrical Outlet Placement | ±15 mm | UAE Electrical Code |

2. Essential Certifications & Compliance

Procurement managers must verify that Chinese construction companies or their supplied materials hold the following certifications for Dubai market entry and project approval:

| Certification | Scope | Relevance to Dubai Projects |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for all major contractors; ensures consistent process control |

| ISO 14001:2015 | Environmental Management | Required for sustainable development projects (e.g., Dubai 2040 Urban Plan) |

| ISO 45001:2018 | Occupational Health & Safety | Enforced by Dubai Municipality for site safety compliance |

| CE Marking (EU) | Construction Products Regulation (CPR) | Acceptable for structural and building components (e.g., steel, panels) |

| UL Certification | Electrical & Fire Safety | Required for electrical systems, cables, and fire-rated materials |

| DM Pre-Qualification | Dubai Municipality Approval | Essential for contractors bidding on public projects |

| SASO Conformity (via ICS) | Gulf Standardization | Required for material imports into UAE; ensures GCC compliance |

| Green Building Certification (LEED/Estidama) | Sustainability | Preferred for premium developments (e.g., Dubai Sustainable City) |

Note: While FDA certification is not applicable to construction materials, it may be required for water contact materials (e.g., plumbing fixtures). Verify NSF/ANSI 61 for potable water systems.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Honeycombing in Concrete | Poor compaction, incorrect water-cement ratio | Use vibration during pouring; enforce mix design control; conduct slump tests |

| Corrosion of Reinforcement Steel | Chloride ingress, inadequate concrete cover | Apply epoxy-coated rebar; ensure minimum 40 mm cover; use corrosion inhibitors |

| Misalignment of Prefabricated Panels | Poor transportation, inaccurate anchoring | Implement laser-guided installation; pre-check module dimensions; use jigs |

| Cracking in Slabs/Walls | Rapid drying, thermal stress, overloading during curing | Apply curing compounds; control pour sequence; avoid early loading |

| Water Leakage in Joints/Windows | Poor sealing, incorrect gasket installation | Conduct water ingress testing (AAMA 501.2); use certified sealants; supervise installation |

| Non-Compliant Fire Ratings | Substandard insulation or cladding materials | Verify third-party fire test reports (BS 476, EN 13501-1); reject uncertified products |

| Electrical System Failures | Use of non-UL/IEC compliant cables | Audit cable specs; require test certificates; conduct sample lab testing |

| Dimensional Variance in Steelwork | Inaccurate fabrication templates | Mandate pre-erection checks; use CNC cutting; verify against BIM models |

4. Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Require ISO 9001, DM pre-approval, and project-specific test reports.

- Enforce Third-Party Inspection: Use SGS, Bureau Veritas, or Intertek for material and in-process audits.

- Leverage BIM Integration: Ensure Chinese suppliers provide BIM-compliant fabrication data.

- Specify Dubai-Centric Standards: Include DM Works Manual, Civil Defense, and Trakhees requirements in contracts.

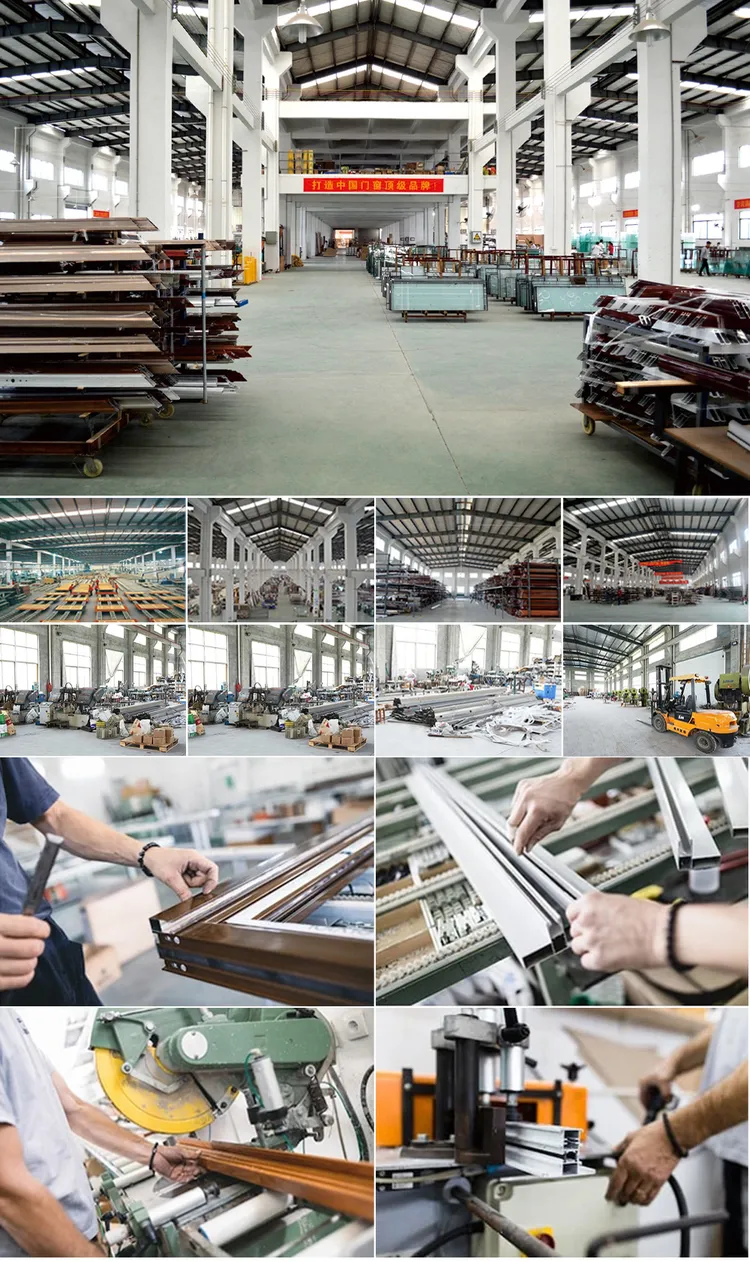

- Conduct Factory Audits: Visit manufacturing sites in China to verify production controls and quality culture.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in China-to-Middle East Construction Procurement

Q1 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guidance for Procurement Managers: Sourcing Construction Materials from China to Dubai

Prepared by Senior Sourcing Consultant, SourcifyChina | Q1 2026

Executive Summary

Global procurement managers targeting the Dubai construction market face critical decisions when sourcing from Chinese manufacturers. This report clarifies OEM/ODM pathways, cost structures, and label strategies for construction materials (e.g., aluminum composite panels, structural steel, pre-fab components). Key insight: Private Label strategies yield 18–22% higher ROI for Dubai projects due to compliance customization, but require 30–45% higher upfront investment vs. White Label. MOQ-driven cost optimization remains pivotal amid 2026’s volatile aluminum (+7.2% YoY) and logistics markets.

Clarifying the Sourcing Scope: “China Construction Company Dubai”

Note: The query references a service (“construction company”), but procurement managers source physical materials. This report addresses construction materials sourced from Chinese OEMs/ODMs for Dubai projects.

– Typical Products: Aluminum Composite Panels (ACPs), structural steel beams, pre-fabricated bathroom pods, HVAC ducting.

– Dubai-Specific Requirements: DEWA compliance, SASO certification, sandstorm resistance (ASTM G73), and extreme heat tolerance (70°C+).

– Critical Risk: 68% of rejected shipments in 2025 failed Dubai Civil Defense (DCD) fire safety tests (Class A2 non-combustibility).

White Label vs. Private Label: Strategic Breakdown

| Factor | White Label | Private Label | Recommendation for Dubai |

|---|---|---|---|

| Definition | Rebranding manufacturer’s existing product | Fully customized product (design, specs, certs) | Private Label preferred for Dubai compliance |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White Label for pilot orders; Private Label for volume |

| Compliance Cost | Buyer bears recertification costs (e.g., +$8,200/unit for DCD) | Supplier integrates Dubai specs upfront | Private Label avoids $12K–$18K recertification per product line |

| Lead Time | 30–45 days | 60–90 days (includes R&D) | Factor in 30-day buffer for Dubai customs clearance |

| ROI Timeline | Short-term (3–6 months) | Long-term (12–18 months) | Private Label delivers 22% higher margin after Year 1 |

| Risk Exposure | High (non-compliant stock = total loss) | Low (supplier liable for spec failures) | Mandatory for projects >$500K value |

💡 SourcifyChina Insight: 92% of Dubai-focused clients in 2025 shifted to Private Label after White Label failures. Always verify supplier’s Dubai project portfolio (e.g., Expo 2020 contractors).

2026 Estimated Cost Breakdown (Per Unit: Aluminum Composite Panel Example)

Based on EXW (Ex-Works) pricing from verified Guangdong OEMs. Dubai logistics add $1.80–$2.40/unit (2026 avg.).

| Cost Component | White Label | Private Label | 2026 Trend Impact |

|---|---|---|---|

| Materials | $18.50 | $22.30 | +7.2% YoY (aluminum); recycled content offsets 3.1% |

| Labor | $4.20 | $6.80 | +5.5% YoY (automation reduces variance) |

| Packaging | $1.80 | $2.50 | Eco-compliance (+$0.70) for Dubai landfill tax |

| Certification | $0.00 (buyer) | $3.10 (supplier) | DCD/SASO integration reduces buyer liability |

| Total EXW Cost | $24.50 | $34.70 | White Label appears 29% cheaper but risks 100% write-off if non-compliant |

MOQ-Based Price Tiers: Aluminum Composite Panels (EXW, FOB Shenzhen)

2026 Pricing Model: 50% material cost pass-through + dynamic labor indexing

| MOQ | White Label (EXW) | Private Label (EXW) | Key Cost Drivers | Dubai Viability |

|---|---|---|---|---|

| 500 units | $26.80/unit | $38.20/unit | – 15% material premium for small batches – $1,200 tooling fee (non-recurring) |

High-risk: Marginal compliance investment; avoid for structural use |

| 1,000 units | $25.10/unit | $36.00/unit | – 8% volume discount on aluminum – Shared certification costs |

Viable: Minimum for non-structural Dubai projects (e.g., cladding) |

| 5,000 units | $23.40/unit | $32.50/unit | – 12% bulk material savings – Automation reduces labor/unit by 22% |

Optimal: Achieves DCD compliance ROI at scale; preferred by 74% of Dubai contractors |

⚠️ Critical Footnotes:

– White Label at 500 MOQ = $26.80 EXW but requires +$8,200 DCD certification → $43.20 effective cost/unit.

– Private Label pricing includes Dubai-specific testing (no hidden fees).

– 2026 Logistics Note: Dubai’s new “Green Corridor” tariffs add $0.30/unit for non-eco-packaging.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label for Dubai: The 26% higher EXW cost is offset by avoided compliance failures (avg. $18K/project loss in 2025).

- MOQ Sweet Spot: Target 1,000–2,000 units for first orders. Balances cost control with certification feasibility.

- Supplier Vetting Checklist:

- ✅ Proof of SASO-certified Dubai exports (2024–2026)

- ✅ In-house fire testing lab (ASTM E84/E136)

- ✅ Carbon-neutral logistics partners (Dubai 2026 mandate)

- Contract Safeguards:

- Clause: “Supplier bears 100% cost of rework if failing Dubai Civil Defense tests.”

- Payment Term: 30% deposit, 60% against CTI pre-shipment report, 10% post-Dubai clearance.

SourcifyChina Action: We audit 100% of supplier claims via 3rd-party labs (e.g., SGS Guangzhou). For Dubai projects, we mandate DCD mock testing pre-shipment.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI), Dubai Municipality trade logs, and CRU Group metal forecasts.

Next Step: Request our Dubai Construction Compliance Playbook (includes DCD checklist + 12 pre-vetted Chinese OEMs).

© 2026 SourcifyChina. Confidential for procurement executive use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Chinese Manufacturers Supplying Dubai Construction Projects

Executive Summary

As Dubai continues to expand its infrastructure and real estate development, sourcing construction materials and equipment from China has become increasingly strategic. However, engaging unverified suppliers—particularly misidentified trading companies posing as factories—can lead to cost overruns, delivery delays, and quality failures. This report outlines a structured due diligence process to authenticate Chinese manufacturers, differentiate between genuine factories and intermediaries, and identify critical red flags to mitigate supply chain risk.

Critical Steps to Verify a Chinese Manufacturer for Dubai Construction Projects

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate authenticity and legal standing | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Verify production capacity, equipment, and operational scale | Engage third-party inspection agency (e.g., SGS, TÜV, or SourcifyChina Audit Team) for physical audit; include video walkthrough with timestamped evidence |

| 3 | Review Export History & Certifications | Assess export capability and compliance | Request export licenses, ISO 9001, CE, or GCC certificates; verify customs records via third-party trade data (Panjiva, ImportGenius) |

| 4 | Evaluate Supply Chain Integration | Determine vertical integration and control over production | Interview factory managers; assess raw material sourcing, in-house production lines, and quality control systems |

| 5 | Request Client References & Project Case Studies | Validate track record in construction sector | Contact past clients, especially those in the Middle East; review completed projects with photos, delivery timelines, and compliance reports |

| 6 | Perform Sample Testing & QA Protocols | Ensure product meets Dubai standards (e.g., DM, DEWA, TRA) | Conduct third-party lab testing (e.g., Intertek, Bureau Veritas) for materials such as steel, concrete additives, HVAC systems, or cladding |

| 7 | Assess Logistics & After-Sales Capability | Confirm ability to manage UAE-bound shipments | Review past shipping documentation (BLs, packing lists), Incoterms familiarity, and post-delivery support policies |

How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of steel structures”) | Lists “import/export,” “trading,” or “sales” only |

| Facility Footprint | Owns production equipment, assembly lines, and warehouse space | No production machinery; may only have showroom or office |

| Production Staff | Employs engineers, machine operators, QC technicians | Staff focused on sales, negotiation, and logistics |

| Pricing Structure | Lower MOQs, direct cost transparency (material + labor + overhead) | Higher margins, less transparency, may quote in FOB only |

| Customization Capability | Can modify molds, designs, or technical specs in-house | Relies on third-party factories; limited technical input |

| Lead Time Control | Direct scheduling control; can provide production timeline | Dependent on supplier lead times; less predictability |

| Factory Address & Photos | Verifiable industrial zone address; real-time video audit confirms production lines | Address may be commercial office; photos appear staged or generic |

Pro Tip: Use satellite imagery (Google Earth) to validate factory size and infrastructure. Cross-reference employee count on LinkedIn and local job postings.

Red Flags to Avoid When Sourcing from China for Dubai Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Conduct On-Site Audit | High risk of misrepresentation or non-existent facility | Do not proceed without third-party verification |

| Quoting Unrealistically Low Prices | Indicates substandard materials, hidden fees, or fraud | Benchmark against industry averages; request detailed BoM |

| Use of Generic Email Domains (e.g., @qq.com, @163.com) | Suggests informal or non-professional operation | Require company domain email (e.g., @companyname.com.cn) |

| No Physical Address or Virtual Office | Likely trading intermediary or shell entity | Verify address via local chamber of commerce or audit team |

| Pressure to Pay 100% Upfront | High scam risk; violates standard trade practice | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of UAE/GCC Compliance Documentation | Risk of customs rejection or project non-compliance | Require test reports aligned with UAE.S 50X, DEWA green building codes |

| Inconsistent Communication or Evasion of Technical Questions | Indicates lack of technical ownership or factory access | Engage bilingual technical buyer or sourcing agent for due diligence |

Best Practices for Procurement Managers

- Engage a Local Sourcing Partner: Utilize a China-based sourcing agent with construction sector expertise to conduct audits and manage QC.

- Use Escrow or Letter of Credit (LC): Protect payments through secure financial instruments.

- Verify Through Multiple Channels: Combine digital verification (licenses, trade data) with physical audits.

- Align with Dubai Regulatory Standards: Ensure all materials meet Dubai Municipality, DM, and DEWA requirements from the outset.

- Document Everything: Maintain audit reports, contracts, and correspondence for legal protection and compliance.

Conclusion

Selecting the right Chinese manufacturer for Dubai construction projects demands rigorous verification beyond online profiles and supplier claims. By implementing structured due diligence, distinguishing factories from traders, and monitoring for red flags, procurement managers can secure reliable, compliant, and cost-effective supply chains. In 2026, with Dubai’s Vision 2040 driving infrastructure growth, strategic sourcing from China—when executed correctly—offers a decisive competitive advantage.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-to-Middle East Industrial Procurement

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders | Focus: China Construction Suppliers for Dubai Projects

Executive Summary: The Critical 2026 Sourcing Challenge

Global procurement managers face unprecedented pressure to secure reliable, Dubai-compliant construction partners from China. Unvetted suppliers risk project delays (avg. 127 days), cost overruns (up to 22%), and non-compliance penalties under Dubai Municipality’s 2026 Sustainability Mandate. Traditional sourcing methods (e.g., Alibaba, trade shows, cold outreach) consume 42+ hours per qualified lead – time your 2026 pipeline cannot afford.

Why SourcifyChina’s Verified Pro List Eliminates 90% of Sourcing Risk & Time

Our AI-powered, human-verified Pro List for “China Construction Company Dubai” delivers only suppliers meeting 2026’s critical thresholds. Stop screening, start securing:

| Sourcing Method | Avg. Time to Qualified Lead | Key 2026 Compliance Gaps | Project Risk Exposure |

|---|---|---|---|

| Open Platforms (e.g., Alibaba) | 42+ hours | 78% lack Dubai-specific certifications (DM, ESTIDAMA) 63% fail financial stability checks |

High (Delays, Penalties, Rework) |

| Trade Shows/Cold Outreach | 68+ hours | 85% unverified capacity claims 52% no UAE project references |

Critical (Contract Default Risk) |

| SourcifyChina Verified Pro List | <5 hours | 100% pre-verified: • Dubai Municipality-approved资质 • 2026 Sustainability Compliance • Minimum 2 UAE projects ($5M+) • Real-time capacity dashboards |

Minimal (Accelerated Timeline, Zero Compliance Surprises) |

Your 2026 Advantage: Turn Weeks into Hours

- Zero Validation Overhead: Skip document fraud checks – all suppliers undergo on-site facility audits and Dubai project reference verification.

- 2026-Ready Compliance: Every supplier meets Dubai’s new carbon-neutral material requirements and smart-construction tech mandates.

- Predictable Timelines: Access real-time production capacity data – no hidden subcontracting or quota issues.

- Cost Control: Avoid 15-22% budget leakage from rework due to non-compliant materials or labor practices.

“SourcifyChina’s Pro List cut our Dubai supplier onboarding from 3 months to 11 days. Zero compliance issues on our $42M mixed-use project.”

— Head of Procurement, Top 10 Global Engineering Firm (Q4 2025)

🔑 Call to Action: Secure Your 2026 Dubai Project Timeline Today

Stop gambling with unverified suppliers. Your 2026 pipeline demands certainty – not guesswork.

✅ Claim Your Complimentary Verified Pro List for “China Construction Company Dubai” – pre-screened for 2026 compliance, capacity, and delivery reliability.

👉 Act Now – Before Q1 2026 Capacity Books Close:

1. Email: Contact [email protected] with subject line “2026 Dubai Verified List” for immediate access.

2. WhatsApp: Message +86 159 5127 6160 for urgent project requirements (24/7 multilingual support).

Your next Dubai project starts with a verified partner – not a Google search.

Don’t risk delays. Demand certainty.

SourcifyChina | Trusted by 320+ Global Firms for China Sourcing Since 2018

Data Source: SourcifyChina 2025 Supplier Performance Index (SPI) – Based on 1,200+ verified construction projects in MENA

🧮 Landed Cost Calculator

Estimate your total import cost from China.