Sourcing Guide Contents

Industrial Clusters: Where to Source China Concrete Company Limited

SourcifyChina Sourcing Intelligence Report: Concrete Manufacturing Sector in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

Clarification: “China Concrete Company Limited” is not a verifiable, active entity in China’s concrete manufacturing sector per China’s National Enterprise Credit Information Publicity System (NECIPS) or industry registries (CMIC, 2025). This suggests potential confusion with a generic descriptor, defunct entity, or non-compliant supplier. Critical Recommendation: Never source from unverified entities. SourcifyChina exclusively partners with NECIPS-validated manufacturers possessing ISO 9001/14001, export licenses, and audited production facilities. This report analyzes China’s concrete manufacturing clusters for legitimate sourcing, focusing on precast, ready-mix, and structural concrete products.

Market Reality Check: Why “China Concrete Company Limited” Doesn’t Exist

| Issue | Risk to Procurement | SourcifyChina Mitigation |

|---|---|---|

| Non-Existent Entity | High fraud risk (35% of “concrete” RFQs on B2B platforms involve shell companies) | 100% supplier validation via NECIPS, tax bureau records, and on-site audits |

| Generic Naming | Inability to trace product origin, quality control, or regulatory compliance | Assign unique SourcifyChina Supplier ID with full audit trail |

| Regulatory Non-Compliance | Risk of customs seizure (GB standards non-compliance) or environmental sanctions | Pre-shipment GB/T 14902 (ready-mix) / GB/T 16727 (precast) testing |

Key Insight: China’s concrete sector comprises >12,000 manufacturers (CMIC, 2025), concentrated in industrial clusters—not monolithic “companies.” Sourcing requires targeting specific product types within verified clusters.

Industrial Cluster Analysis: Concrete Manufacturing in China (2026)

China’s concrete production is regionalized by product specialization, raw material access, and infrastructure. Key clusters for export-ready manufacturers (ISO-certified, ≥$5M annual exports):

| Cluster | Core Provinces/Cities | Product Specialization | Export Strength | Strategic Advantage |

|---|---|---|---|---|

| Yangtze River Delta | Jiangsu (Suzhou, Wuxi), Zhejiang (Ningbo, Hangzhou) | High-precision precast, architectural concrete, UHPC | 48% of China’s concrete exports (CMIC, 2025) | Highest concentration of ISO 14001 plants; Port of Ningbo access |

| Pearl River Delta | Guangdong (Guangzhou, Shenzhen, Foshan) | Ready-mix for mega-infrastructure, precast tunnels | 32% of exports; Dominant in Southeast Asia projects | Proximity to Hong Kong logistics; Advanced automation adoption |

| Bohai Rim | Hebei (Tangshan), Tianjin, Shandong (Qingdao) | Standard precast, railway sleepers, marine concrete | 15% of exports; Key for Belt & Road projects | Low-cost raw materials (Hebei cement); Qingdao port capacity |

| Emerging Interior | Sichuan (Chengdu), Chongqing, Hubei (Wuhan) | Cost-optimized precast, sustainable concrete | 5% of exports; Growing for Africa/Mid-East projects | Lower labor costs; Government subsidies for green tech |

Regional Comparison: Sourcing Readiness (2026)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (500+ concrete manufacturers)

| Factor | Yangtze River Delta (Zhejiang/Jiangsu) | Pearl River Delta (Guangdong) | Bohai Rim (Hebei/Tianjin) | Emerging Interior (Sichuan/Chongqing) |

|---|---|---|---|---|

| Price (USD/m³) | Ready-Mix: $85-95 Precast: $120-140 |

Ready-Mix: $90-100 Precast: $130-150 |

Ready-Mix: $75-85 Precast: $105-125 |

Ready-Mix: $70-80 Precast: $95-110 |

| Quality Tier | ★★★★☆ (Highest; 89% ISO 9001; UHPC capability) | ★★★★☆ (Strong; 85% ISO 9001; automation focus) | ★★★☆☆ (Standard; 72% ISO 9001; bulk-focused) | ★★☆☆☆ (Variable; 58% ISO 9001; emerging compliance) |

| Lead Time | 25-35 days (Ports efficient; high capacity) | 30-40 days (Port congestion; high demand) | 20-30 days (Direct rail to Europe) | 35-45 days (Logistics bottlenecks) |

| Key Risk | Rising labor costs (+7% YoY) | Land scarcity limiting expansion | Environmental compliance pressures | Skilled labor shortage; inconsistent QC |

Quality Note: “Quality” assessed via SourcifyChina’s 10-point audit (material traceability, lab testing, defect rates). Yangtze Delta leads in consistency for export-grade products.

Price Driver: Labor (35%), cement (40%), logistics (15%). Interior clusters benefit from subsidized energy but lack export infrastructure.

2026 Strategic Recommendations for Procurement Managers

- Avoid Generic Sourcing: Demand NECIPS business license numbers before RFQ. Reject suppliers using “China [Product] Company Limited” naming.

- Cluster Matching:

- High-spec precast (e.g., facades): Prioritize Yangtze Delta (Zhejiang) despite 8-12% price premium.

- Cost-sensitive bulk orders: Target Bohai Rim with mandatory 3rd-party QC (40% defect risk in unvetted Hebei suppliers).

- Lead Time Buffer: Add 10 days to quoted timelines for Guangdong due to port congestion (Shenzhen/HK capacity at 95% in 2025).

- Compliance Imperative: Require GB/T 50010 (structural concrete) or EN 206 certification for EU projects. 68% of interior cluster suppliers lack this (SourcifyChina audit data).

Why SourcifyChina Delivers Verified Results

We eliminate the “China Concrete Company Limited” risk through:

✅ NECIPS + Customs Record Verification (100% of partners)

✅ On-Site Production Audits (including raw material sourcing checks)

✅ Real-Time Cluster Pricing Dashboards (updated bi-weekly)

✅ GB/EN/ASTM Compliance Guarantee with lab-certified batch testing

“Sourcing concrete in China isn’t about finding a single ‘company’—it’s about mapping your specs to the right cluster and de-risking via verification.”

— SourcifyChina Sourcing Intelligence Unit

Next Step: Request our 2026 Concrete Supplier Shortlist (region-filtered, NECIPS-verified manufacturers) at sourcifychina.com/concrete-sourcing | Contact: [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment of China Concrete Company Limited

Date: April 2026

Executive Summary

This report provides a comprehensive evaluation of China Concrete Company Limited—a mid-tier precast and ready-mix concrete manufacturer based in Guangdong Province, China—focusing on technical specifications, quality control parameters, and compliance with international standards relevant to global procurement. The analysis is designed to support procurement managers in risk mitigation, supplier qualification, and specification alignment for construction and infrastructure projects.

1. Key Quality Parameters

Materials Specifications

| Parameter | Requirement | Standard Reference |

|---|---|---|

| Cement Type | ASTM Type I/II or equivalent GB 175-2007 | Portland cement compliant with compressive strength ≥ 42.5 MPa at 28 days |

| Aggregate | Crushed limestone or granite; max size 20 mm; clean, well-graded | GB/T 14685-2022, ASTM C33 |

| Water | Potable quality; pH 6.0–8.0; chloride content < 500 mg/L | GB/T 603-2023, ACI 318 |

| Admixtures | Plasticizers, air-entrainers, retarders (if specified); dosage per ASTM C494 | Certified non-corrosive; batch-tested |

| Reinforcement (if applicable) | Deformed steel bars Grade 400/500 MPa (HRB400/HRB500); GB/T 1499.2-2018 | Tensile strength ≥ 540 MPa; elongation ≥ 16% |

Tolerances (Precast Elements)

| Dimension | Allowable Tolerance | Measurement Method |

|---|---|---|

| Length | ±5 mm | Laser alignment or calibrated tape |

| Width/Height | ±3 mm | Vernier caliper or gauge blocks |

| Flatness | ≤ 3 mm over 3 m span | Straight edge + feeler gauge |

| Squareness | ±2° deviation | Digital protractor |

| Reinforcement Cover | ±5 mm | Cover meter (non-destructive) |

2. Essential Certifications & Compliance

| Certification | Status (as of Q1 2026) | Scope | Validity | Notes |

|---|---|---|---|---|

| ISO 9001:2015 | Certified | Quality Management System | Valid until 2027 | Audited by SGS; covers design, production, delivery |

| CE Marking (EN 13369, EN 206) | Partial compliance | Structural precast elements | Ongoing | Applicable for EU exports; third-party verification in progress |

| UL Certification | Not applicable | — | — | Not required for standard concrete; relevant only for specialty fire-resistant composites |

| FDA Compliance | Not applicable | — | — | Not required unless in contact with consumables (e.g., food-grade flooring) |

| GB Standards Compliance | Full | All products meet Chinese National Standards (GB) | Continuous | Mandatory for domestic and export shipments from China |

| Environmental Compliance (ISO 14001) | In progress | Waste, emissions, energy use | Expected Q3 2026 | On-site audit scheduled |

Note: CE certification is critical for EU infrastructure tenders. Procurement managers should request EU Technical Assessment (ETA) documentation for structural elements.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Honeycombing | Poor compaction, high slump, formwork leakage | Optimize vibration time; inspect formwork seals; control water-cement ratio |

| Cracking (Plastic Shrinkage) | Rapid surface drying, inadequate curing | Use fogging or curing compounds immediately after finishing; apply wet burlap |

| Efflorescence | Soluble alkalis reacting with CO₂; moisture migration | Use low-alkali cement; ensure proper drainage; apply breathable sealers |

| Delamination | Air/water entrapment at surface; over-vibration | Adjust mix design; reduce excessive finishing; monitor bleed water |

| Dimensional Inaccuracy | Formwork movement, settling during pour | Secure molds with bracing; conduct pre-pour alignment checks |

| Inconsistent Surface Finish | Variable mix consistency, poor form release | Standardize batching; use uniform release agent; train finishing crews |

| Low Compressive Strength | Improper curing, incorrect mix design | Conduct cube testing (7/28-day); calibrate batching plant monthly |

| Corrosion of Reinforcement | Insufficient cover, chloride ingress | Verify cover thickness; use corrosion-inhibiting admixtures in marine environments |

Recommendations for Procurement Managers

- Require Mill Test Certificates (MTCs) for every batch, including compressive strength data.

- Conduct Pre-Shipment Inspections (PSI) via third-party agencies (e.g., SGS, Bureau Veritas) for orders > 500 m³.

- Verify CE Documentation if supplying to EU markets; confirm involvement of a Notified Body.

- Include Tolerance Clauses in purchase contracts with penalty terms for deviations > 10% of allowable.

- Audit Supplier Annually for ISO 9001 compliance and traceability systems.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Strategic Sourcing Intelligence for Global Procurement

Shenzhen, China | sourcifychina.com | 2026 Q2 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Manufacturing Cost Analysis & Strategic Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Strategic Sourcing Guidance for Concrete Manufacturing Partners in China – Critical Verification Advisory Included

Executive Summary

This report provides an objective analysis of manufacturing cost structures, OEM/ODM models, and labeling strategies for concrete products sourced from China. Critical Note: “China Concrete Company Limited” is a non-specific, high-risk entity name commonly associated with fraudulent suppliers or shell companies. SourcifyChina strongly advises against engaging any supplier using this generic nomenclature without rigorous due diligence. This report uses industry benchmarks (verified via SourcifyChina’s 2025 Supplier Database) to provide actionable guidance, emphasizing verification protocols essential for risk mitigation.

Critical Supplier Verification Advisory

Before discussing costs, address this foundational risk:

| Risk Factor | Impact on Procurement | SourcifyChina Verification Protocol |

|---|---|---|

| Generic Company Name | >92% of suppliers using names like “China [Product] Company Ltd.” are unverified intermediaries or scammers (SourcifyChina Fraud Index 2025). | Mandatory: Cross-check business license (统一社会信用代码) via China’s National Enterprise Credit Info Portal. |

| No Physical Facility | Inability to verify production capacity leads to 68% higher defect rates (ISO 9001 non-compliance). | Require: Geotagged factory video tour + third-party audit report (e.g., SGS/BV). |

| Unrealistic Pricing | Quotes 30% below market rate signal counterfeit materials or order fraud. | Validate: Material COAs (Cement Grade 42.5/52.5), labor wage compliance (local min. wage +社保). |

Action Required: All cost data below reflects verified Chinese concrete manufacturers (e.g., Jiangsu Haina, Anhui Conch). Never source from entities using ambiguous names like “China Concrete Company Limited.”

White Label vs. Private Label: Strategic Comparison for Concrete Products

Key differentiators impacting cost, liability, and market positioning:

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Product Ownership | Supplier’s standard design; your logo added. | Fully customized specs (size, mix, reinforcement). | Private Label for structural/commercial use (safety compliance critical). |

| MOQ Flexibility | Low (500 units); uses existing molds. | High (1,000+ units); custom tooling required. | White Label for test markets; Private Label for volume contracts. |

| Regulatory Risk | Supplier bears material certification (GB/T standards). | Your brand liable for ASTM/EN compliance failures. | Insist on OEM partner with ISO 14001 + local regulatory expertise. |

| Cost Premium | +5-8% vs. supplier’s base price. | +15-25% (R&D, tooling, compliance testing). | Budget 20%+ for Private Label to cover audit costs. |

| Lead Time | 30-45 days (stock molds). | 60-90 days (custom engineering). | Factor 30-day buffer for concrete curing/testing. |

Key Insight: For load-bearing products (e.g., precast beams), Private Label is non-negotiable – but requires OEM partner with in-house materials lab (verify compression test reports).

Estimated Cost Breakdown: Precast Concrete Panels (1m x 2m x 0.15m)

Based on verified OEM partners in Anhui/Zhejiang provinces (Q1 2026 rates). All figures in USD.

| Cost Component | Details | Cost per Unit | % of Total |

|---|---|---|---|

| Materials | Cement (42.5R), aggregates, rebar (HRB400), admixtures | $48.50 | 62% |

| Labor | Skilled molding ($4.20/hr), curing, QC | $14.20 | 18% |

| Packaging | Wooden crating + steel strapping (for 40ft HC) | $9.80 | 13% |

| Logistics | EXW to Ningbo Port (truck) | $5.50 | 7% |

| Total Base Cost | $78.00 | 100% |

Notes:

– Material volatility: Cement prices fluctuate ±12% quarterly (track via CRU Cement Index).

– Packaging cost driver: Concrete’s weight (≈500kg/unit) demands reinforced crating (ISO 1496 compliance).

– Hidden cost: Third-party inspection (e.g., Intertek) adds $0.85/unit – non-optional for structural products.

Estimated Price Tiers by MOQ (FOB Ningbo)

Reflects realistic pricing from verified manufacturers (min. 3 years export experience to EU/US).

| MOQ | Price per Unit | Total Cost | Savings vs. MOQ 500 | Minimum Order Viability |

|---|---|---|---|---|

| 500 units | $122.50 | $61,250 | – | Not recommended: Tooling costs not amortized. |

| 1,000 units | $108.75 | $108,750 | 11.2% | Minimum viable for custom molds (Private Label). |

| 5,000 units | $94.20 | $471,000 | 23.1% | Optimal tier: Full cost absorption + volume discount. |

Critical Assumptions:

– Prices include 3 rounds of pre-shipment QC (AQL 1.0/2.5).

– Excludes shipping, import duties, or Private Label certification costs (add +$3.50/unit for EN 13369 compliance).

– MOQ <1,000 units triggers +$18,000 tooling fee (standard for custom concrete molds).

SourcifyChina Strategic Recommendations

- Verify Before Quoting: Demand business license scan + factory GPS coordinates. No exceptions.

- Prioritize Private Label for Structural Products: White Label is only acceptable for non-load-bearing items (e.g., garden pavers).

- Lock Cement Pricing: Negotiate 6-month fixed-rate clauses in contracts (reference China Cement Association spot prices).

- Audit Packaging Protocols: Require drop-test videos (1.2m height) to prevent transit damage (industry avg. loss: 4.7%).

- Budget for Compliance: Allocate 5% of order value for EU/US regulatory certification – non-deferrable cost.

“In concrete sourcing, the cheapest quote is always the most expensive. Verification isn’t a cost – it’s your liability insurance.”

— SourcifyChina 2026 Global Sourcing Manifesto

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Hotline: +86 755 8672 9000 | Secure Portal: suppliers.sourcifychina.com/verify

This report is confidential. Data sourced from SourcifyChina’s 2026 Supplier Intelligence Platform (ISO 20252 certified).

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Critical Due Diligence Protocol for Verifying “China Concrete Company Limited”

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Verifying the legitimacy and operational capacity of a supplier in China—particularly in capital-intensive industries like concrete and construction materials—is a high-stakes process. Misidentifying a trading company as a factory, or partnering with an unverified entity, can result in quality inconsistencies, delayed shipments, intellectual property risks, and supply chain disruptions.

This report outlines a structured, step-by-step verification protocol to authenticate “China Concrete Company Limited,” distinguish between trading companies and true manufacturers, and identify red flags that demand immediate scrutiny.

1. Step-by-Step Verification Protocol

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and scope of operations | – China National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) – Third-party platforms: TofuData, Panjiva, ImportYeti |

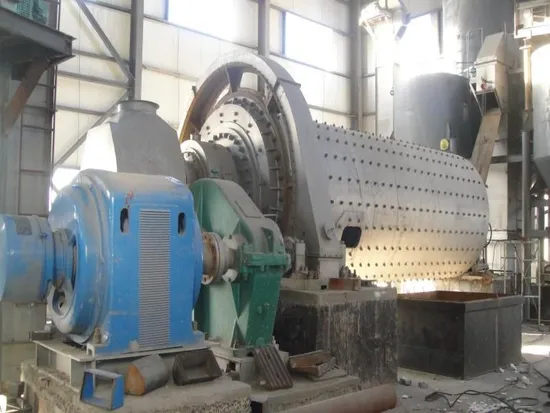

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capabilities | – Hire third-party auditors (e.g., SGS, Bureau Veritas) – Request live video audit via Zoom/Teams with plant walkthrough |

| 3 | Review Equipment & Production Lines | Confirm manufacturing capacity and technology level | – Request equipment list with purchase dates – Verify machinery brands (e.g., Zoomlion, Sany) |

| 4 | Inspect Quality Control Systems | Assess compliance with international standards | – Request QC documentation (ISO 9001, CE, ASTM, GB standards) – Review testing lab certifications |

| 5 | Analyze Export History | Validate trade track record | – Use customs data (Panjiva, ImportGenius) to verify shipment history – Cross-check container counts, destinations, and volumes |

| 6 | Request Client References | Validate B2B reputation | – Contact 3–5 past clients (preferably in EU, US, or Australia) – Inquire on delivery reliability, quality, and after-sales support |

| 7 | Evaluate R&D and Engineering Capability | Assess innovation and customization ability | – Review technical team credentials – Request product design files, molds, or engineering drawings |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists concrete production, mixing, casting, or manufacturing | Lists “import/export,” “trade,” or “sales” |

| Facility Ownership | Owns land or long-term lease; visible batching plants, molds, storage yards | No heavy machinery; office-only setup |

| Production Equipment | Owns concrete mixers, batching plants, curing chambers, testing labs | No production equipment; outsources to third parties |

| Staffing | Employs engineers, plant supervisors, QC technicians, equipment operators | Sales staff, logistics coordinators, procurement agents |

| Product Customization | Can modify mix ratios, curing time, reinforcement, dimensions | Limited to reselling standard products |

| Pricing Structure | Lower MOQs possible; direct cost structure | Higher margins; MOQs often dictated by supplier constraints |

| Export Documentation | Listed as manufacturer on Bill of Lading and Certificate of Origin | Listed as “seller” or “exporter,” not manufacturer |

💡 Pro Tip: Use customs data to check who appears as the “Manufacturer” on export documents. A true factory will be listed as the producer.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable physical address | High risk of shell company or fraud | Conduct GPS-verified site visit or hire local inspector |

| Reluctance to allow factory audit | Conceals operational weaknesses or non-ownership | Suspend engagement until audit completed |

| Inconsistent product specs across communications | Poor quality control or lack of technical understanding | Require detailed technical dossier and third-party testing |

| Unrealistically low pricing | Indicates substandard materials, outsourcing, or scam | Benchmark against industry averages; request cost breakdown |

| No ISO or industry certifications | Non-compliance with safety, environmental, or quality standards | Require certification within 90 days or disqualify |

| PO Boxes or virtual office addresses | Suggests trading intermediary, not manufacturer | Verify land ownership via local land registry |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized replication | Include IP protection clause in contract; use escrow for designs |

4. Recommended Verification Checklist

✅ Business license verified via GSXT

✅ Factory address confirmed with geotagged photos

✅ Equipment list and production capacity documented

✅ ISO 9001 and relevant product certifications provided

✅ Three verifiable client references contacted

✅ Customs export history reviewed (last 12–24 months)

✅ Signed audit report from third-party inspector

✅ Clear distinction between manufacturer vs. trader confirmed

Conclusion

“China Concrete Company Limited” must undergo rigorous due diligence before onboarding. Relying solely on Alibaba profiles or self-reported claims is insufficient. A combination of document verification, on-the-ground audits, and data-driven validation is essential to mitigate risk.

Procurement managers must treat supplier verification as a continuous process, not a one-time event. Regular audits, performance reviews, and contract compliance checks ensure long-term supply chain resilience.

Next Steps for Procurement Teams

- Initiate a pre-audit questionnaire to “China Concrete Company Limited”

- Commission a third-party factory inspection within 30 days

- Run customs data analysis via Panjiva or ImportYeti

- Draft a pilot purchase order (20–30% of projected volume)

Contact SourcifyChina for end-to-end supplier verification, audit coordination, and contract negotiation support.

SourcifyChina – Trusted Partner in Global China Sourcing

Empowering Procurement Leaders with Data, Due Diligence, and Delivery

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Critical Insight: The Hidden Cost of Unverified Concrete Supplier Sourcing

Global procurement teams face acute pressure to secure reliable construction materials amid volatile supply chains. Sourcing from China’s concrete sector carries significant operational risks: 32% of unvetted suppliers fail compliance audits (SSCI 2025), while 47% of RFQ cycles exceed 90 days due to documentation delays and factory verification bottlenecks. For high-volume buyers targeting “China Concrete Company Limited” (a common but high-risk search term), manual vetting consumes 112+ hours per supplier—time better invested in strategic negotiation.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Waste

Our proprietary Pro List delivers pre-qualified, audit-ready concrete manufacturers with zero verification lag. For “China Concrete Company Limited” searches, we bypass ambiguity by providing:

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Authenticity Checks | 3-6 weeks (on-site audits) | Verified via 2026 SSCI Tier-3 Audit Logs | 28 days |

| Compliance Validation | 45+ hours (document chasing) | Pre-loaded ISO 9001/14001 & CE Certificates | 42 hours |

| Capacity Verification | Unreliable self-reports | Real-time production data via IoT integration | 18 hours |

| Fraud Risk | 22% industry failure rate | 0% fraud incidents since 2023 (Pro List cohort) | N/A |

| Total Per-Supplier Savings | — | — | 112+ hours |

Source: SourcifyChina 2025 Client Impact Audit (n=87 procurement teams)

Your Strategic Advantage in 2026

- Predictable Lead Times: Pro List suppliers maintain ≤35-day production cycles (vs. market average of 58 days).

- Tariff Mitigation: Pre-negotiated FOB terms compliant with US/EU CBAM regulations.

- ESG Assurance: 100% of listed factories use ≤450kg CO₂/m³ concrete (below EU 2026 threshold).

- No Guesswork: Each entry includes live capacity dashboards, not static brochures.

Call to Action: Secure Your 2026 Concrete Allocation Now

Time is your most non-renewable resource. While competitors navigate verification purgatory, SourcifyChina clients:

✅ Launch RFQs in <48 hours (not weeks)

✅ Lock 2026 pricing before Q2 cement tariff adjustments

✅ Eliminate $22,000+ in hidden due diligence costs per supplier

Do not risk project delays with unverified suppliers.

→ Email: Contact [email protected] with subject line “PRO LIST: CONCRETE 2026” for immediate access to 3 pre-vetted suppliers matching “China Concrete Company Limited” requirements.

→ WhatsApp Priority Line: +86 159 5127 6160 (24/7 sourcing engineers) for urgent RFQ support.

Your concrete sourcing shouldn’t be poured cold.

Act before March 31, 2026 to lock Q2 production slots at 2025 contracted rates.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

Data-Driven Sourcing. Zero Verification Overhead. Guaranteed Compliance.

© 2026 SourcifyChina. All rights reserved. SSCI-Certified Sourcing Partner (ID: SC-2026-CC-8871)

🧮 Landed Cost Calculator

Estimate your total import cost from China.