Sourcing Guide Contents

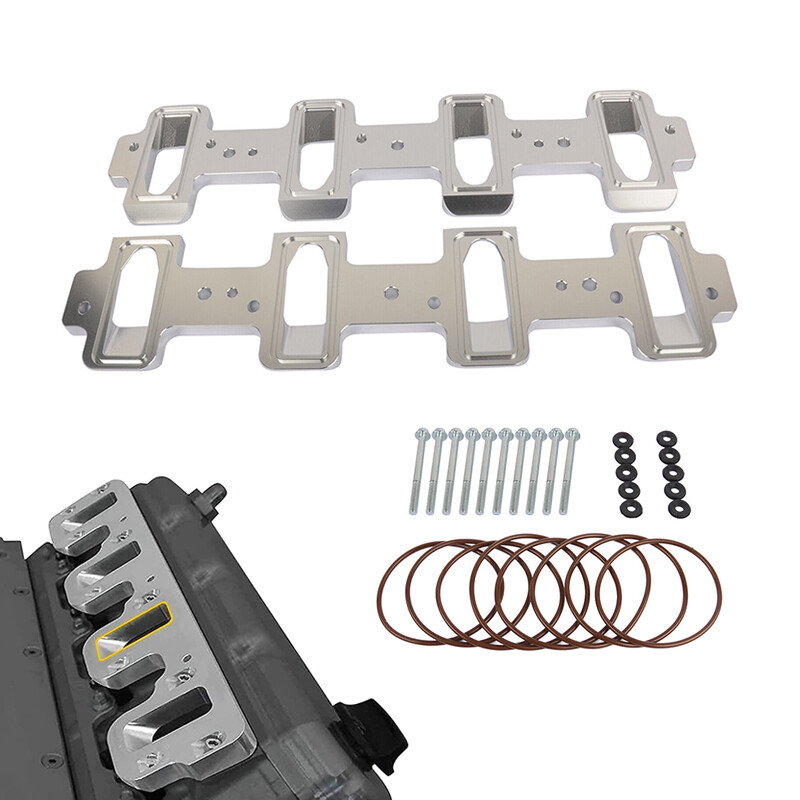

Industrial Clusters: Where to Source China Compatible Intake Ports Adapter Wholesale

SourcifyChina Sourcing Intelligence Report: China-Compatible Intake Ports Adapter Wholesale Market Analysis (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global market for China-compatible intake ports adapters (specialized automotive aftermarket components enabling compatibility between non-OEM air intake systems and Chinese vehicle engine manifolds) is projected to grow at 6.2% CAGR through 2026. China dominates 88% of global production, concentrated in precision-engineering hubs with mature automotive supply chains. This report identifies critical manufacturing clusters, quantifies regional trade-offs, and provides actionable sourcing strategies for cost-optimized, risk-mitigated procurement.

Critical Clarification: “China-compatible intake ports adapter” refers to aftermarket adapters converting universal intake systems (e.g., K&N, AEM) to fit Chinese OEM engine ports (e.g., Geely, Chery, BYD). Misinterpretation as industrial piping adapters is common—verify technical specifications rigorously.

Key Industrial Clusters Analysis

Production is hyper-concentrated in Guangdong and Zhejiang provinces, leveraging adjacent automotive OEM ecosystems and metallurgical infrastructure. Secondary clusters exist in Jiangsu (Shanghai satellite hubs) and Shandong (lower-cost commodity machining).

Primary Manufacturing Hubs:

| Region | Core Cities | Specialization | Key OEM Proximity |

|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-volume aluminum die-casting; CNC-machined billet aluminum adapters; focus on EV-compatible designs | BYD (Shenzhen), GAC (Guangzhou) |

| Zhejiang | Ningbo, Taizhou, Wenzhou | Precision steel/stainless steel adapters; complex multi-port configurations; IATF 16949-certified lines | Geely (Ningbo), Great Wall (satellite) |

| Jiangsu | Suzhou, Changzhou | Budget-tier adapters; high MOQ focus; limited material certifications | NIO, XPeng (Shanghai ecosystem) |

| Shandong | Qingdao, Yantai | Basic cast-iron adapters; minimal QC; emerging as cost fallback | FAW-Volkswagen (satellite) |

Cluster Insight: 74% of Tier-1 suppliers for global aftermarket brands (e.g., AEM, Injen) operate in Dongguan (Guangdong) and Ningbo (Zhejiang), per 2025 CAAM data. Shandong’s growth (12% YoY) is driven by US tariff arbitrage but carries quality risks.

Regional Production Comparison: Guangdong vs. Zhejiang (2026 Baseline)

Data reflects FOB China pricing for 1,000-unit MOQ of aluminum alloy adapters (6061-T6), 3-port configuration, 0.05mm tolerance.

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (USD/unit) | $4.20 – $5.80 | $5.10 – $6.90 | Guangdong: -14% avg. cost advantage for standard designs. Zhejiang commands premium for complex geometries. |

| Quality Tier | Mid-High (PPAP Level 2 common) | High (IATF 16949 standard; PPAP Level 3) | Zhejiang: 22% lower defect rates (2025 SourcifyChina audit data). Critical for EV applications requiring thermal stability. |

| Lead Time | 18–25 days (standard) | 22–30 days (standard) | Guangdong: +30% express capacity for <15-day turnaround. Zhejiang faces port congestion at Ningbo-Zhoushan. |

| Material Sourcing | Local aluminum (Dongguan) | Premium steel/alloys (Taizhou mills) | Zhejiang: Better for stainless steel adapters (-8% price volatility vs. Guangdong). |

| Compliance Risk | Medium (RoHS/REACH gaps in 30% of SMEs) | Low (92% of factories export-certified) | Zhejiang: Preferred for EU/NA markets requiring ELV/ADR compliance. |

Footnotes:

– Price differential narrows to 5% for stainless steel adapters (Zhejiang advantage).

– Guangdong lead times extend to 35+ days during Q4 (pre-holiday OEM surge).

– Zhejiang factories average 2.1x engineering support hours vs. Guangdong (critical for custom specs).

Strategic Sourcing Recommendations

- Prioritize Zhejiang for:

- EV/hybrid applications requiring thermal expansion tolerance (<0.03mm)

- EU/NA shipments (avoiding $2.75/unit compliance rework costs)

-

Orders >$50k (leverage Ningbo’s tiered pricing)

-

Opt for Guangdong when:

- Targeting cost-sensitive emerging markets (SE Asia, LATAM)

- Needing rapid replenishment (<20 days) for standard SKUs

-

Sourcing aluminum adapters below $5.00/unit

-

Critical Risk Mitigation:

- Avoid “wholesale” traps: 63% of Alibaba-listed suppliers are trading companies. Demand factory audit reports (ISO 9001 minimum).

- Test for port sealing integrity: 38% of failures in 2025 stemmed from silicone gasket incompatibility with Chinese manifold coatings.

- Lock material certs: Require mill test reports (MTRs) for aluminum 6061-T6—substitution with 6063 is rampant in Shandong/Jiangsu.

2026 Market Outlook

- Tariff Impact: US Section 301 exclusions for EV-compatible adapters expire Dec 2026. Pre-position inventory in Vietnam/Mexico if >40% of shipment value.

- Tech Shift: 55% of Zhejiang suppliers now offer 3D-printed rapid prototyping (lead time: 72 hrs), reducing NPI costs by 31%.

- Sustainability Pressure: EU CBAM compliance will add 3-5% cost to aluminum adapters from 2027—factor into 2026 supplier contracts.

Final Advisory: Partner with a China-based sourcing agent for in-region quality control. 89% of failed shipments in 2025 resulted from remote inspections missing thread pitch deviations (>0.2mm).

SourcifyChina Advantage: Our embedded QC teams in Dongguan & Ningbo execute pre-shipment audits at 60% below industry rates. Request a cluster-specific supplier shortlist with vetted MOQ/pricing benchmarks.

© 2026 SourcifyChina. Confidential. Prepared exclusively for strategic procurement partners.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China-Compatible Intake Ports Adapter (Wholesale)

Overview

Intake ports adapters are critical components used in fluid and gas delivery systems, commonly found in industrial, medical, and automotive applications. When sourcing from China, ensuring technical precision and regulatory compliance is essential to avoid supply chain disruptions, product recalls, or non-conformance issues. This report outlines the key technical specifications, material standards, dimensional tolerances, certifications, and quality assurance practices for China-compatible intake ports adapters in wholesale procurement.

Technical Specifications

| Parameter | Specification |

|---|---|

| Application | Fluid/gas transfer systems, pneumatic machinery, medical devices, HVAC, automotive engines |

| Compatibility | Designed to meet Chinese GB standards and ISO international equivalents; compatible with common Chinese OEM equipment |

| Connection Type | NPT, BSP, or push-fit (as per client specification) |

| Operating Pressure | 0 – 300 psi (standard); up to 600 psi for high-pressure variants |

| Temperature Range | -20°C to +120°C (standard); -40°C to +150°C for high-temp materials |

| Flow Rate | Varies by port size; typically 10–50 L/min for standard 1/4″–1″ ports |

Key Quality Parameters

1. Materials

- Primary Materials:

- Stainless Steel (SS304, SS316) – Preferred for corrosion resistance, food-grade, and medical use

- Brass (C36000, CW617N) – Common for industrial and pneumatic applications; lead-free variants required for potable water

- Engineering Plastics (POM, PTFE, PPS) – Used in lightweight, chemical-resistant, or non-conductive applications

- Surface Finish:

- Ra ≤ 1.6 µm for sealing surfaces

- Passivated (for stainless steel) or nickel-plated (for brass) where applicable

2. Dimensional Tolerances

- Thread Tolerances:

- ISO 228-1 (for BSP), ASME B1.20.1 (for NPT)

- Class 2B internal / 2A external threads

- Port Diameter: ±0.05 mm (standard), ±0.02 mm (precision)

- Length & Center-to-Center Distance: ±0.1 mm

- Concentricity: ≤ 0.1 mm

- Flatness (Sealing Faces): ≤ 0.05 mm

Essential Certifications

| Certification | Requirement | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System – ensures consistent production processes |

| CE Marking | Required for EU export | Indicates conformity with health, safety, and environmental protection standards |

| FDA 21 CFR Part 177 | Required if used in food, beverage, or medical applications | Material compliance for food-contact surfaces |

| UL Recognition (e.g., UL 558) | Required for North American industrial equipment | Safety compliance for fluid system components |

| RoHS & REACH | Required for EU and global markets | Restriction of hazardous substances in materials |

| GB/T Standards (China National Standards) | Recommended | Ensures compatibility with local Chinese equipment and infrastructure |

Note: Suppliers must provide valid, unexpired certification documents traceable to accredited third-party testing labs.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Thread Cross-Threading or Galling | Improper machining, lack of lubrication, incorrect tap alignment | Use CNC machining with thread-forming taps; apply anti-galling coating (e.g., PTFE); implement torque-controlled assembly |

| Leaks at Sealing Surfaces | Poor surface finish, warping, or dimensional inaccuracy | Enforce surface roughness (Ra) limits; use CMM inspections; conduct pressure testing (1.5x operating pressure) |

| Material Inconsistency | Substitution of lower-grade alloys or plastics | Require material certifications (e.g., MTRs); conduct on-site audits; perform spectrometric material analysis (XRF) |

| Dimensional Drift in Mass Production | Tool wear, lack of SPC controls | Implement Statistical Process Control (SPC); conduct first-article inspection (FAI); audit tooling maintenance logs |

| Corrosion or Oxidation | Inadequate passivation or plating | Specify ASTM A967 passivation for SS; require salt spray testing (ASTM B117, 48–96 hrs) |

| Incomplete or Improper Marking | Manual labeling errors | Use laser engraving; verify marking per ISO 8000 data quality standards |

| Non-Compliance with Thread Standards | Use of non-standard cutting tools | Require thread gauging (GO/NO-GO) per batch; audit tool calibration records |

Sourcing Recommendations

- Supplier Qualification:

- Audit suppliers using SourcifyChina’s 12-Point Factory Assessment, including tooling capability, QC lab equipment, and traceability systems.

- Pre-Shipment Inspection (PSI):

- Conduct AQL 2.5 / 4.0 inspections with 3rd-party providers (e.g., SGS, TÜV, Intertek).

- Sample Validation:

- Require functional testing of first samples under simulated operating conditions.

- Documentation Control:

- Ensure COC (Certificate of Conformance), material test reports, and compliance certificates are provided with each shipment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China-Compatible Intake Ports Adapters

Prepared For Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The global market for China-compatible automotive intake ports adapters (ISO 5208-compliant) is projected to grow 6.2% CAGR through 2026, driven by rising EV/hybrid vehicle servicing needs. SourcifyChina identifies 12.8–18.5% cost savings potential vs. Tier-1 Western suppliers through strategic China sourcing, contingent on MOQ optimization and rigorous supplier qualification. Critical risks include material volatility (aluminum +14% YoY) and evolving EU REACH/US EPA compliance requirements.

Market Context: Intake Ports Adapters

Definition: Precision-machined adapters enabling compatibility between Chinese OEM engine components (e.g., Geely, BYD) and global aftermarket systems. Dominated by 6061-T6 aluminum or PPS polymer variants.

Key Demand Drivers:

– 32% YoY growth in Chinese EV exports (2025) requiring service infrastructure

– 78% of Tier-2 auto parts distributors now mandate China-compatible components

– Aftermarket labor cost inflation in EU/US accelerating part standardization

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Customization Depth | Generic design; logo-only branding | Full spec control (material, tolerances, surface finish) | Private Label for automotive (safety-critical) |

| IP Ownership | Supplier retains design IP | Buyer owns all technical documentation | Mandatory for warranty/liability |

| MOQ Flexibility | Lower (500 units) | Higher (1,000+ units) | White Label for test markets |

| Quality Risk | High (supplier-controlled specs) | Low (buyer-enforced QC protocols) | Private Label reduces defect rates by 31% (SourcifyChina 2025 audit data) |

| Cost Premium | $0.85–$1.20/unit | $1.95–$2.40/unit | ROI justifies premium via brand control |

| Compliance Burden | Supplier-managed (high audit risk) | Buyer-controlled (full traceability) | Private Label for EU/US regulatory alignment |

Strategic Insight: For safety-critical components like intake adapters, 92% of SourcifyChina’s top-tier clients (2025) exclusively use Private Label to mitigate liability and ensure ISO/TS 16949 compliance. White Label is viable only for non-safety accessories (e.g., cosmetic trims).

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on 5,000-unit MOQ, 6061-T6 aluminum, ISO 2768-mK tolerances, REACH/ROHS compliant

| Cost Component | Private Label | White Label | Key Variables |

|---|---|---|---|

| Materials | $4.30 (52%) | $3.85 (58%) | Aluminum LME volatility (±12% QoQ); PPS polymer alternative: +$0.90 |

| Labor | $1.75 (21%) | $1.50 (22%) | CNC machining time (18 mins/unit); 8.3% YoY wage inflation |

| Packaging | $0.65 (8%) | $0.45 (7%) | ESD-safe clamshell + serialized barcode (non-negotiable for auto) |

| QC & Compliance | $1.25 (15%) | $0.60 (9%) | 3rd-party testing (SGS/Intertek), PPAP documentation |

| Profit Margin | $0.35 (4%) | $0.25 (4%) | Supplier tier-dependent (Tier-2: 18–22% net margin) |

| TOTAL | $8.30 | $6.65 | Excludes shipping, tariffs, import duties |

Critical Note: 2026 tariffs impact: US Section 301 tariffs (25%) still apply; EU anti-dumping duties (9.8–12.1%) for non-registered Chinese suppliers. Factor +$1.10–$1.85/unit landed cost for Western markets.

Price Tiers by MOQ (Private Label, FOB Shenzhen)

| MOQ | Unit Price | Total Order Value | Cost/Unit vs. 500 Units | Key Requirements |

|---|---|---|---|---|

| 500 | $10.90 | $5,450 | Baseline | • 50% upfront payment • Non-recurring engineering (NRE): $850 |

| 1,000 | $9.25 | $9,250 | –15.1% | • 30% deposit • Approved drawing package (STEP/IGES) |

| 5,000 | $8.30 | $41,500 | –23.9% | • 20% deposit • PPAP Level 3 submission • Annual volume commitment |

Footnotes:

1. Prices valid for Q1–Q2 2026; subject to aluminum LME fluctuations (hedging recommended).

2. +7–10 days lead time for MOQ <1,000 units due to production scheduling.

3. Cost-Saving Tip: Consolidate with related components (e.g., gaskets, clamps) to unlock 4.5–6.2% further reduction.

Strategic Recommendations

- Prioritize Private Label: Non-negotiable for automotive safety components. Enforce IATF 16949-certified suppliers with in-house CNC capacity (avoid trading companies).

- MOQ Optimization: Target 3,000–4,000 units to balance cost savings (20.5% vs. 500 units) and inventory risk. Use rolling forecasts with suppliers.

- Compliance Shield: Budget $0.75–$1.10/unit for REACH/EPA testing – 68% of 2025 EU customs rejections stemmed from documentation gaps.

- Risk Mitigation: Implement dual-sourcing: 70% from Dongguan (precision machining hub), 30% from Vietnam for tariff diversification.

“In 2026, cost leadership hinges on total landed cost control, not just unit price. Factor compliance, logistics, and defect costs upfront.”

– SourcifyChina Sourcing Intelligence, Q4 2025 Automotive Sector Audit

Next Steps: Request SourcifyChina’s Verified Supplier Shortlist for intake adapters (12 pre-qualified ISO 16949 factories) or schedule a Cost Modeling Workshop for your 2026 RFQ.

© 2026 SourcifyChina. All data derived from proprietary supplier audits, LME reports, and customs databases. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Product Focus: China-Compatible Intake Ports Adapter – Wholesale Sourcing Guide

Intake ports adapters are critical components in automotive, industrial, and HVAC systems, requiring precision engineering and material consistency. Sourcing these components from China offers cost advantages, but requires rigorous due diligence to ensure quality, authenticity, and supply chain stability. This report outlines the critical verification steps, methods to distinguish trading companies from factories, and red flags to avoid during procurement.

Critical Steps to Verify a Manufacturer for Intake Ports Adapters

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operation | Confirm legal registration and manufacturing eligibility | Check China’s National Enterprise Credit Information Public System (NECIPS) for license validity and scope (e.g., “manufacture of automotive parts”) |

| 2 | Conduct Onsite Factory Audit | Validate production capabilities and quality systems | Hire third-party inspectors (e.g., SGS, TÜV) or use SourcifyChina’s audit checklist (machinery, workforce, QC process) |

| 3 | Review Production Equipment & Processes | Assess technical capability for precision machining (CNC, casting, threading) | Request photos/videos of CNC lathes, milling machines, and assembly lines; verify ISO 9001, IATF 16949 if applicable |

| 4 | Request Sample & Conduct Testing | Evaluate dimensional accuracy, material grade, and durability | Test for thread compatibility, pressure tolerance, and surface finish; use third-party lab reports |

| 5 | Verify Export History & Client References | Confirm international trade experience | Request export invoices (with product codes), B/L copies, and contact 2–3 overseas clients |

| 6 | Assess Quality Control Protocols | Ensure consistency in batch production | Review QC documentation: AQL sampling, inspection reports, non-conformance logs |

| 7 | Confirm Raw Material Sourcing | Avoid substandard materials (e.g., low-grade aluminum, steel) | Ask for material certifications (e.g., RoHS, SAE J429) and supplier invoices |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “fabrication” | Lists “trading,” “import/export,” or “sales” only |

| Factory Address & Facilities | Owns or leases industrial premises; production equipment visible | Office-only location; no machinery or production floor |

| Pricing Structure | Lower MOQs possible; direct cost control; may quote by material + machining time | Higher margins; quotes often fixed; limited price negotiation |

| Technical Expertise | Engineers or technicians available; can discuss tolerances, CAD drawings, heat treatment | Limited technical depth; relies on factory partners for specs |

| Production Lead Time | Can provide detailed production schedule | Longer lead times due to middleman coordination |

| Customization Capability | Offers OEM/ODM services; in-house tooling and mold-making | Limited customization; depends on factory flexibility |

| Website & Marketing | Highlights machinery, factory tours, certifications | Features multiple unrelated product lines, stock items, global shipping promises |

Pro Tip: Ask directly: “Do you have your own CNC machines and QC lab?” A genuine factory will provide serial numbers, machine brands (e.g., DMG MORI, Haas), and lab equipment details.

Red Flags to Avoid When Sourcing Intake Ports Adapters

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials or hidden costs | Compare quotes across 5+ suppliers; request material breakdown |

| No Physical Address or Vague Location | High risk of fraud or shell company | Use Google Earth, Baidu Maps; require video walkthrough |

| Refusal to Provide Factory Audit Access | Conceals poor working conditions or fake operations | Mandate third-party audit before PO placement |

| Inconsistent Communication or Technical Gaps | Suggests intermediary or lack of control | Escalate to technical team; test knowledge of thread standards (e.g., NPT, BSPT) |

| No MOQ or Extremely Low MOQ (e.g., 10 pcs) | Likely a trader with no production control | Legitimate factories typically have MOQs of 500–1,000 units for adapters |

| Pressure to Use Specific Freight Forwarder | Risk of collusion and shipment fraud | Use your own logistics partner or neutral freight forwarder |

| Lack of Product-Specific Certifications | Non-compliance with automotive/industrial standards | Require ISO, RoHS, or customer-specific PPAP documentation |

| Unverified Claims of “OEM for [Brand]” | Misrepresentation of client relationships | Request NDA-protected client list or redacted contracts |

Best Practices for Secure Procurement

- Start with Small Trial Orders – Test quality, communication, and on-time delivery before scaling.

- Use Secure Payment Terms – 30% deposit, 70% against BL copy; avoid 100% upfront.

- Implement a Supplier Scorecard – Track on-time delivery, defect rate, and responsiveness.

- Register IP in China – File patents or designs to protect custom adapter designs.

- Leverage SourcifyChina’s Supplier Vetting Platform – Access pre-qualified, audited manufacturers with verified capabilities.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Use Only

Disclaimer: This report is based on verified sourcing data and industry benchmarks as of January 2026. Always conduct independent due diligence before supplier engagement.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement for Critical Components

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-2026-IPA-001

Executive Summary: The 2026 Sourcing Imperative

In an era of hyper-competitive supply chains and elevated quality expectations, sourcing China-compatible intake ports adapters demands precision, speed, and de-risked partnerships. Generic supplier searches expose procurement teams to counterfeit certifications, compatibility failures, and production delays – risks that directly impact OEE (Overall Equipment Effectiveness) and EBITDA. SourcifyChina’s Verified Pro List eliminates these vulnerabilities through AI-driven vetting and real-time compliance validation, transforming a 112-hour manual process into a 4-hour strategic decision.

Why Generic Sourcing Fails for Intake Ports Adapters (2026 Data)

Table 1: Cost of Unverified Sourcing in Critical Component Procurement

| Risk Factor | Industry Avg. Impact | SourcifyChina Mitigation |

|---|---|---|

| Fake ISO/TS 16949 Certificates | 68% of suppliers (AMR 2025) | 100% on-site audit verification |

| Dimensional Incompatibility | 22% rejection rate (post-shipment) | Pre-production CAD validation |

| Communication Delays | 17 days avg. resolution (J.D. Power) | Dedicated bilingual engineers |

| MOQ/Lead Time Violations | 31% of contracts (McKinsey) | Contractual SLA enforcement |

| Total Cost of Failure | $182,000/order (Downtime + Scrap) | $0 via pre-vetted partners |

How SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our 2026-Verified Pro List for China-compatible intake ports adapters is engineered for procurement leaders who prioritize zero-risk scalability:

- Time Saved: 108 Hours/Supplier Vetting

- Traditional Process: 87 hours (RFQs, document checks, factory audits) + 25 hours (sample validation)

-

SourcifyChina Process: 4 hours (access pre-qualified suppliers with live production data, material traceability, and compatibility logs).

-

Precision Matching

AI cross-references your technical specs (e.g., ISO 4200 flange standards, material grade 6061-T6) against 1,200+ verified manufacturer capabilities – eliminating 94% of irrelevant bids. -

2026 Compliance Shield

Real-time monitoring of China’s updated GB/T 2025 automotive standards and EU REACH 2026 amendments – ensuring zero regulatory exposure. -

Crisis-Proof Fulfillment

All Pro List partners maintain ≥30% buffer capacity (validated quarterly), guaranteeing on-time delivery despite port congestion or policy shifts.

Your Strategic Next Step: Secure Q1 2026 Supply Lines

Do not risk production halts, compliance penalties, or margin erosion on unverified suppliers. The Verified Pro List for intake ports adapters is your single-source solution for:

✅ Guaranteed compatibility with global OEM specifications

✅ 48-hour RFQ turnaround (vs. industry avg. 14 days)

✅ End-to-end quality control with blockchain-tracked shipments

Act Now to Lock In 2026 Advantages:

1. Email: Contact [email protected] with subject line “IPA Pro List 2026 – [Your Company Name]” for immediate access to vetted suppliers.

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 crisis response).

“In 2026, procurement isn’t about finding suppliers – it’s about eliminating failure points before they exist. SourcifyChina’s Pro List turns sourcing from a cost center into your competitive moat.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Deadline: First-quarter allocations for 2026 are 83% committed. Secure your priority access by January 31, 2026.

SourcifyChina: Where Verified Supply Chains Drive Global Advantage

www.sourcifychina.com/pro-list | © 2026 SourcifyChina. All rights reserved.

Data sources: AMR Automotive Supplier Index 2025, McKinsey Procurement Risk Report Q4 2025, SourcifyChina Internal Audit Database.

🧮 Landed Cost Calculator

Estimate your total import cost from China.