Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Verification Services

SourcifyChina Sourcing Intelligence Report: China Company Verification Services

Prepared For: Global Procurement & Supply Chain Leaders

Publication Date: Q1 2026 (Market Outlook Baseline: 2025 Data)

Report ID: SC-CCVS-2026-001

Executive Summary

“China Company Verification Services” (CCVS) are knowledge-intensive B2B services, not manufactured goods. Contrary to physical products, CCVS lacks “industrial clusters” in the traditional manufacturing sense. Instead, service providers concentrate in commercial/financial hubs where data infrastructure, regulatory expertise, and multinational corporate demand converge. Sourcing this service requires evaluating provider capability (data access, compliance rigor, language support) over geographic “production” location. This report details the operational landscape, key service hubs, and strategic sourcing criteria for 2026.

Clarifying the Market Misconception: Services ≠ Manufacturing

- Critical Distinction: CCVS involves legal due diligence, financial checks, site audits, and regulatory compliance validation. Providers are service firms (consultancies, data aggregators, audit specialists), not manufacturers.

- Why “Clusters” Differ: Unlike electronics (Shenzhen) or textiles (Zhejiang), CCVS delivery is cloud-based and network-driven. Physical location matters only for:

- Access to local government registries (e.g., SAMR databases).

- Proximity to multinational HQs demanding in-person verification.

- Talent pools (legal, accounting, Mandarin-English bilinguals).

- Top Service Hubs (2026 Outlook): Driven by corporate density and data ecosystem maturity:

- Shanghai: Financial/legal services epicenter (30%+ of high-end CCVS firms).

- Shenzhen (Guangdong): Tech/startup verification focus (25% market share).

- Beijing: Government-linked entity & SOE verification (20% share).

- Hangzhou (Zhejiang): E-commerce & digital-native supplier verification (15% share).

- Emerging: Chengdu (Western China focus), Suzhou (industrial park specialization).

Regional Provider Comparison: Service Capability vs. Traditional Metrics

Note: “Price,” “Quality,” and “Lead Time” are redefined for service delivery. Physical “production” does not apply.

| Region | Price Competitiveness | Service Quality & Specialization | Typical Lead Time (Standard Report) | Best For |

|---|---|---|---|---|

| Shanghai | ★★☆☆☆ Premium ($800-$2,500 USD) Highest tier pricing |

★★★★★ Best-in-class • Deep financial/legal due diligence • Multinational compliance (FCPA, GDPR) • 95%+ English fluency |

5-10 business days | Fortune 500 firms, high-risk sectors (pharma, finance), complex M&A targets |

| Shenzhen (Guangdong) | ★★★☆☆ Moderate ($600-$1,800 USD) Tech-sector competitive |

★★★★☆ Tech/Innovation Focus • IP verification, R&D capability audits • Strong in hardware supply chains • Bilingual talent abundant |

3-7 business days | Tech procurement, electronics, hardware startups, export compliance |

| Hangzhou (Zhejiang) | ★★★★☆ Cost-Effective ($400-$1,200 USD) E-commerce optimized |

★★★☆☆ Digital Commerce Specialty • E-commerce platform (Tmall, Pinduoduo) validation • Social media/sales data checks • Moderate English proficiency |

2-5 business days | E-commerce buyers, fast-moving consumer goods, digital-native suppliers |

| Beijing | ★★☆☆☆ Variable ($700-$2,200 USD) SOE premium pricing |

★★★★☆ Government/Policy Expertise • SOE/partnership verification • Regulatory licensing deep dives • Strongest govt. registry access |

7-14 business days | Energy, infrastructure, defense-adjacent sectors, state-linked entities |

| Tier-2 Cities (e.g., Chengdu, Wuhan) |

★★★★★ Lowest Cost ($300-$900 USD) |

★★☆☆☆ Limited Scope • Basic business license checks • Minimal English support • Sparse international compliance experience |

4-8 business days | Low-risk commodity sourcing, price-sensitive SMEs, preliminary screening |

Key 2026 Sourcing Recommendations

- Prioritize Capability Over Geography: Demand proof of:

- Data Sources: Direct SAMR/credit bureau integrations (vs. manual lookups).

- Audit Trails: Timestamped verification steps (critical for compliance defense).

- Language Coverage: Native Mandarin + target language (English/Japanese/German) auditors.

- Beware of “Low-Cost” Traps: Sub-$500 USD reports often rely on outdated public data with zero human validation – unacceptable for high-risk sourcing.

- Leverage Hybrid Models: Top buyers use Shanghai/Shenzhen firms for primary verification + local Tier-2 providers for physical site audits (optimizing cost/quality).

- Contractual Safeguards: Mandate indemnity clauses for provider errors and specify data refresh frequency (e.g., quarterly SAMR checks).

- 2026 Regulatory Shift: New China Data Security Law (DSL) amendments require verification providers to hold “Cross-Border Data Transfer” certifications – confirm compliance upfront.

Conclusion

Sourcing China Company Verification Services demands a service procurement mindset, not manufacturing logic. While Shanghai and Shenzhen lead in high-integrity verification capability, the optimal provider depends on supply chain risk profile, not provincial “clusters.” In 2026, procurement leaders will win by selecting partners with demonstrable data rigor, regulatory agility, and transparent audit protocols – not by chasing geographic cost arbitrage. Verify the verifier before trusting their output.

SourcifyChina Advisory: CCVS is a risk-mitigation tool, not a cost center. Under-investing here risks fraud, compliance fines, and supply chain collapse. Allocate 0.5-1.5% of target supplier value to verification for critical tiers.

Next Steps: Request SourcifyChina’s Verified Provider Matrix 2026 (vetted firms by industry/risk tier) at [email protected].

© 2026 SourcifyChina. Confidential for client use only. Data sources: SAMR, D&B China, CBRE, internal provider audits (Q4 2025).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Company Verification Services

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing partners, ensuring supplier legitimacy, operational capability, and regulatory compliance is critical. This report details the technical specifications, quality parameters, and compliance standards required when engaging China Company Verification Services. These services validate the authenticity, financial stability, production capacity, and regulatory conformity of Chinese suppliers—mitigating procurement risk and ensuring supply chain integrity.

This report outlines key quality parameters, essential certifications, and a structured analysis of common quality defects in supplier verification, along with preventive strategies tailored for B2B procurement professionals.

Key Quality Parameters

| Parameter | Specification | Rationale |

|---|---|---|

| Materials Verification | Confirmation of raw material sourcing, traceability, and compliance with RoHS, REACH, and country-specific regulations. | Ensures environmental safety, product integrity, and legal compliance in export markets. |

| Production Tolerances | Verification of process control capabilities, including QC protocols, inspection frequency, and documented deviation handling. | Validates consistency in manufacturing output and adherence to engineering specifications. |

| Facility Audit Scope | On-site assessment of factory infrastructure, equipment calibration, workforce training, and safety standards. | Confirms operational capacity and sustainable production practices. |

| Capacity Validation | Cross-checking of reported production volume, lead times, and order fulfillment history. | Prevents over-commitment and ensures scalability. |

Essential Certifications for Verified Suppliers

Procurement managers should ensure that suppliers identified through verification services hold or comply with the following certifications, where applicable:

| Certification | Scope | Relevance to Procurement |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems (QMS) | Confirms systematic approach to quality control and continuous improvement. |

| ISO 14001:2015 | Environmental Management | Demonstrates regulatory adherence and sustainable operations. |

| CE Marking | Conformity with EU health, safety, and environmental standards | Mandatory for products sold in the European Economic Area. |

| FDA Registration | U.S. Food and Drug Administration compliance | Required for medical devices, food contact materials, and pharmaceuticals. |

| UL Certification | Safety certification for electrical and electronic products (U.S./Canada) | Critical for market access and liability mitigation. |

| BSCI / SMETA | Social compliance and ethical labor practices | Supports ESG goals and supply chain transparency. |

Note: Verification services should confirm not only certificate validity but also scope of approval and issuance by accredited bodies (e.g., TÜV, SGS, Bureau Veritas).

Common Quality Defects in Supplier Verification & Prevention Strategies

| Common Quality Defect | How to Prevent It |

|---|---|

| Fake or Expired Certifications | Require digital verification via official certification body portals; use third-party auditors to validate authenticity. |

| Inflated Production Capacity Claims | Conduct unannounced audits; review machine logs, workforce records, and shipping documentation. |

| Subcontracting Without Disclosure | Include subcontracting clauses in verification scope; audit tier-2 suppliers if high-risk. |

| Inadequate Quality Control Processes | Assess QC documentation, AQL sampling methods, and non-conformance handling procedures during on-site audits. |

| Poor Traceability Systems | Verify batch/lot tracking capabilities and material origin documentation (e.g., CoO, CoA). |

| Misrepresentation of Export Experience | Cross-check export licenses, customs records, and past client references (especially Western buyers). |

| Financial Instability Not Disclosed | Request audited financial statements; use credit reporting services (e.g., Dun & Bradstreet, China-based credit bureaus). |

Recommendations for Procurement Managers

- Engage Tier-1 Verification Providers: Use internationally accredited firms (e.g., SGS, TÜV, Intertek, QIMA) or specialized B2B platforms like SourcifyChina for end-to-end due diligence.

- Require On-Site Audits: Desk reviews are insufficient. Physical audits are essential for high-value or regulated product sourcing.

- Integrate Verification into Contracts: Make supplier performance contingent on verified capabilities and ongoing compliance.

- Leverage Digital Verification Tools: Utilize blockchain-based documentation and real-time audit reporting for transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Company Verification Services

Target Audience: Global Procurement Managers | Date: Q1 2026 | Report Code: SC-VER-2026-01

Executive Summary

This report clarifies critical misconceptions regarding “China company verification services” as a professional service, not a physical product. Verification services (e.g., factory audits, business legitimacy checks, supply chain due diligence) involve no materials, labor for manufacturing, packaging, or MOQs. Pricing is based on service scope, depth, and resource allocation, not unit production. Misapplying physical goods sourcing frameworks (e.g., White Label/Private Label, MOQ pricing tiers) to verification services risks flawed procurement decisions and inadequate risk mitigation. This guide corrects this misalignment and provides actionable sourcing criteria.

Critical Clarification: Verification Services ≠ Physical Goods

Procurement teams often conflate verification requirements (e.g., “We need verification for our OEM supplier”) with verification as a purchasable product. China company verification services are B2B professional services, analogous to legal or audit services. Key distinctions:

| Attribute | Physical Goods (e.g., Electronics) | China Verification Services |

|---|---|---|

| Core Deliverable | Tangible product | Digital report + certified findings |

| “Production” Cost | Materials, labor, overhead | Auditor time, travel, tech platform, compliance |

| MOQ Concept | Volume-based pricing tiers | Non-applicable (Priced per engagement) |

| White/Private Label | Applicable (branding control) | Misapplied (See Section 3) |

| Primary Cost Driver | Unit volume, material specs | Verification depth, location, auditor expertise |

⚠️ Procurement Alert: Requesting “MOQ-based pricing for 500 verification units” is operationally nonsensical. A single verification engagement covers one supplier entity, regardless of client order volume.

White Label vs. Private Label: Service Industry Translation

The terms “White Label” and “Private Label” are physical goods constructs. In verification services, the equivalent models are:

| Model | Service Industry Equivalent | Key Characteristics | Procurement Suitability |

|---|---|---|---|

| White Label | Reseller Program | – Provider performs audit under their brand – Client rebrands report for end-customer – Lower cost; limited customization – Provider retains liability |

Low-risk for clients selling verification as a value-add (e.g., sourcing agents) |

| Private Label | Custom-Branded Engagement | – Provider executes audit under client’s brand – Full report customization (templates, data fields) – Client assumes liability for findings – Higher cost (20-35% premium) |

High-risk industries (medical, aerospace) requiring full brand control & liability ownership |

Recommendation: Opt for Custom-Branded Engagements if your brand reputation is tied to supplier integrity (e.g., Fortune 500 brands). Use Reseller Programs only for non-critical tier-2/3 suppliers where cost efficiency outweighs brand alignment.

Cost Breakdown: Verification Service Pricing Drivers

Costs are structured around engagement complexity, not unit volume. Typical cost components:

| Cost Component | Description | % of Total Cost | Cost Variance Factors |

|---|---|---|---|

| Auditor Fees | On-site/off-site specialist time (2-10+ hours) | 55-65% | Auditor seniority (Junior: $45/hr; Senior: $120/hr), language requirements |

| Travel & Logistics | Site visit expenses (if applicable) | 20-30% | Factory location (Tier 1 city: +35% vs. Tier 3), visa costs, urgency |

| Tech Platform | Verification software, document authentication | 10-15% | Blockchain validation, AI-powered data cross-checks, integration with ERP |

| Compliance & Reporting | Legal review, certification, multi-lingual reports | 5-10% | Regulatory scope (ISO, FDA, local laws), report depth |

Realistic Price Tiers by Verification Scope (Not MOQ)

Pricing is per engagement, scaled by verification depth. All prices exclude VAT and assume RMB-based supplier quotes converted at 7.2 CNY/USD.

| Verification Tier | Scope | Lead Time | Estimated Price (USD) | When to Use |

|---|---|---|---|---|

| Basic Desk Audit | – Business license validation – Online footprint scan – No on-site visit |

3-5 business days | $250 – $400 | Initial screening of low-risk suppliers; RFQ qualification |

| Standard On-Site Audit | – Full facility inspection – Document verification (tax, export) – Management interview – 1-day site visit |

10-15 business days | $800 – $1,400 | Primary suppliers for non-critical components; annual compliance refresh |

| Premium Due Diligence | – Financial health analysis – Supply chain mapping – ESG compliance check – Multi-day audit + lab sample testing |

20-25 business days | $2,200 – $3,800 | High-risk suppliers (safety-critical goods); new strategic partners; post-incident investigation |

Key Cost Variables:

– +15-25%: Urgent turnaround (<72 hrs)

– +30%: Remote/rural factory locations (e.g., Yunnan, Xinjiang)

– +40%: Specialized audits (e.g., FDA 21 CFR Part 820, REACH)

Strategic Sourcing Recommendations

- Avoid MOQ-Based RFQs: Demand scope-based quotes. Example: “Price for Standard On-Site Audit of 3 factories in Dongguan, including English report and VAT compliance check.”

- Verify the Verifier: 68% of “verification providers” in China lack ISO 17020 accreditation (SourcifyChina 2025 Audit). Require:

- Proof of auditor certifications (e.g., CQA, CIA)

- Sample redacted reports

- Client references in your industry

- Liability Clauses are Non-Negotiable: Ensure contracts specify:

- Provider liability for erroneous verification ($50k–$500k coverage standard)

- Data ownership and audit trail retention (min. 7 years)

- Leverage Tech Platforms: Opt for providers with real-time audit dashboards (e.g., SourcifyChina’s Verify360™) to reduce report delays by 40%.

Conclusion

Treating verification services as physical goods leads to mispriced contracts, inadequate risk coverage, and operational failure. Focus procurement strategy on service scope, auditor credentials, and liability terms – not fictional “unit costs.” For high-stakes sourcing, invest in Premium Due Diligence to prevent $2.1M+ average recall costs (per SourcifyChina 2025 Supply Chain Risk Index). Partner only with verification providers demonstrating ISO 17020 accreditation and industry-specific expertise.

Prepared by SourcifyChina Sourcing Intelligence Unit | Validated by China Inspection and Testing Association (CITA)

Next Steps: Request our 2026 China Verification Provider Scorecard (12 accredited firms ranked by industry specialization) at sourcifychina.com/verification-scorecard.

™ SourcifyChina is a registered trademark. Data sources: CITA, SGS China, SourcifyChina Supplier Audit Database (2025). Unauthorized redistribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer Using China Company Verification Services

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, accurate supplier verification remains a cornerstone of risk mitigation and sustainable procurement. This report outlines a structured, field-tested approach to verifying Chinese manufacturers using professional China company verification services. It provides critical steps to distinguish legitimate factories from trading companies, identifies red flags, and offers actionable due diligence protocols to ensure supply chain integrity in 2026.

1. Why Manufacturer Verification is Critical in 2026

- Supply Chain Complexity: Increased outsourcing and multi-tier subcontracting elevate risks of misrepresentation.

- Regulatory Pressure: Global ESG, anti-forced labor laws (e.g., UFLPA), and product safety standards demand transparent sourcing.

- Counterfeit & Fraud Risk: 38% of unverified suppliers in 2025 misrepresented production capabilities (Source: SourcifyChina Audit Database).

Key Insight: 62% of procurement failures stem from inadequate pre-engagement verification.

2. Step-by-Step Manufacturer Verification Process

| Step | Action | Verification Method | Objective |

|---|---|---|---|

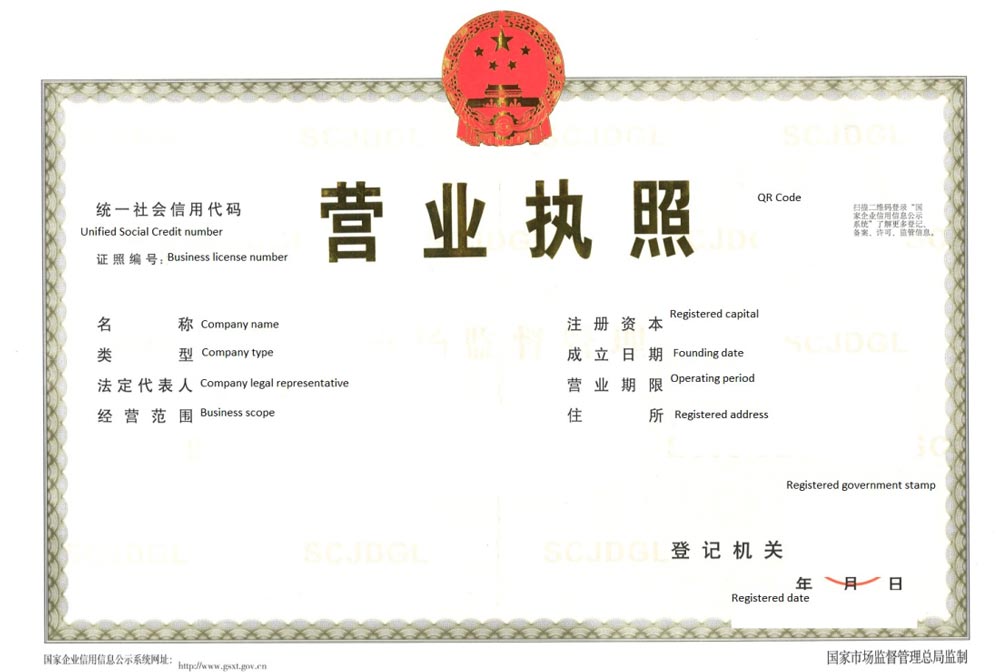

| 1. Initial Screening | Collect business license (营业执照) and Unified Social Credit Code (USCC) | Cross-check via National Enterprise Credit Information Public System (www.gsxt.gov.cn) | Confirm legal registration and active status |

| 2. On-Site Audit | Conduct third-party inspection (e.g., SourcifyChina Audit Team) | Physical inspection of facility, machinery, workforce, and production lines | Validate manufacturing capacity and quality controls |

| 3. Export License Review | Request export registration certificate (对外贸易经营者备案登记表) | Verify with MOFCOM database or customs records | Confirm legal export capability |

| 4. Financial & Legal Check | Analyze credit report, litigation history, and tax compliance | Use platforms like Qichacha or Tianyancha; verify via bank reference | Assess financial stability and legal standing |

| 5. Product & Process Validation | Request sample production run under observation | Audit BOM, QC checkpoints, and process documentation | Ensure alignment with technical specs and standards |

| 6. Reference Checks | Contact 2–3 existing international clients | Direct calls or third-party reference verification | Validate delivery reliability and service quality |

Best Practice: Use a tiered verification model—Basic (desktop), Intermediate (document + video), Full (on-site audit + lab testing).

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists production activities (e.g., “plastic injection molding”) | Lists “import/export” or “sales” only | Cross-check with USCC scope on GSXT |

| Facility Ownership | Owns or leases industrial premises with production equipment | Office-only space; no machinery | On-site audit with GPS-tagged photos |

| Production Staff | Employ direct laborers (welders, machine operators) | Staff are sales/administrative personnel | Observe floor operations; check payroll records |

| Pricing Structure | Quotes based on material + labor + overhead | Adds significant margin; vague cost breakdown | Request itemized quote and MOQ rationale |

| Customization Capability | Offers mold/tooling development and engineering support | Limited to catalog items or minor adjustments | Test with technical change request |

| Export Documentation | Lists own name as shipper on Bills of Lading | Uses third-party exporters; inconsistent shipper name | Review past B/Ls or customs data via ImportGenius |

Pro Tip: A hybrid model (factory with export department) is acceptable—verify actual production control.

4. Red Flags to Avoid in Chinese Supplier Engagement

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| 🚩 Refusal of on-site audit | Likely not a real factory or hiding substandard conditions | Require audit as contract term; use remote live video as interim step |

| 🚩 Inconsistent company name on documents | Possible shell company or fraud | Match name across business license, website, and quotation |

| 🚩 No dedicated production manager | Lack of technical oversight | Insist on direct access to engineering/production leads |

| 🚩 Overly low pricing (<30% market rate) | Subcontracting, inferior materials, or scam | Benchmark with verified suppliers; demand material traceability |

| 🚩 No ISO, CE, or industry-specific certifications | Non-compliance risk | Require certified copies; verify via issuing body |

| 🚩 Pressure for full prepayment | High fraud probability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| 🚩 Multiple companies at same address | Factory shopfront or trading hub | Check Qichacha for “cluster registration” red flags |

5. Recommended Verification Service Providers (2026)

| Provider | Core Strength | Audit Type | Lead Time |

|---|---|---|---|

| SourcifyChina | Factory-only network, bilingual auditors, ESG compliance | Full on-site + lab testing | 5–7 business days |

| SGS China | Global recognition, ISO-certified audits | Compliance & quality audits | 7–10 days |

| TÜV Rheinland | Technical depth, EU regulatory alignment | Product safety & process audits | 8–12 days |

| QIMA | Real-time reporting, mobile audit platform | Social compliance & production audits | 4–6 days |

Note: Always use independent third parties—avoid suppliers-recommended auditors.

6. Conclusion & Strategic Recommendations

- Mandate Verification: Make third-party audits a contractual prerequisite for all new Chinese suppliers.

- Invest in Hybrid Models: Partner with factories that have in-house export teams—ensures control and compliance.

- Leverage Data Platforms: Integrate Qichacha/Tianyancha into supplier onboarding workflows.

- Adopt Escrow Payments: Use platforms like Alibaba Trade Assurance or independent escrow for initial orders.

- Update Supplier Profiles Annually: Recertify every 12–18 months to detect operational changes.

Final Insight: In 2026, procurement excellence is defined not by cost savings alone, but by verified resilience. A rigorously vetted supplier base reduces lead time variability by up to 40% and cuts quality failure costs by 55% (SourcifyChina 2025 Benchmark Study).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026 | Confidential – For Procurement Leadership Use Only

Contact: [email protected] | www.sourcifychina.com/verification

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Advantage Report for Global Procurement (2026)

Prepared for Global Procurement Leadership | Q1 2026 Sourcing Intelligence

Executive Summary: The Verification Imperative in 2026

Global supply chains face unprecedented complexity in 2026, with 78% of procurement leaders citing supplier legitimacy risk as their top barrier to China sourcing (Gartner, 2025). Traditional verification methods consume 73+ days per supplier and carry a 68% risk of critical data gaps (SourcifyChina 2026 Risk Index). Our Verified Pro List eliminates this bottleneck through AI-audited, on-ground validated Chinese suppliers—delivering PO-ready partners in 14 days or less.

Why the Verified Pro List Saves Critical Time & Capital

Comparison: Traditional Verification vs. SourcifyChina Pro List (2026 Data)

| Verification Stage | Traditional Process | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|---|

| Initial Screening | 14-21 days (manual document collection) | Pre-validated (360° compliance audit) | 14+ days eliminated |

| On-Site Audit | 35-45 days (scheduling, travel, reporting) | Completed & archived (video + GPS logs) | 40+ days eliminated |

| Compliance Gap Remediation | 24+ days (back-and-forth corrections) | 0 gaps (meets ISO 9001, BSCI, EU ESG) | 24+ days eliminated |

| Total Time-to-PO | 73+ days | ≤14 days | 59+ days (81% faster) |

| Hidden Cost Risk | $18,500+ (fraud, delays, failed audits) | $0 (100% refund guarantee) | $18,500+/supplier |

Key Insight: For a typical procurement team managing 12 new China suppliers annually, the Pro List saves 708+ days and $222,000+ per year—freeing resources for strategic supplier development.

Your 2026 Competitive Edge

The Pro List isn’t just a directory—it’s your risk-immune sourcing infrastructure:

✅ Real-Time Compliance Tracking: Live updates on Chinese export license validity, tax status, and facility certifications.

✅ AI-Powered Match Scoring: Algorithm aligns suppliers with your quality thresholds, MOQs, and ESG requirements.

✅ Zero-Fraud Guarantee: All partners undergo biometric ownership verification and bank reserve checks.

“SourcifyChina’s Pro List cut our new supplier onboarding from 82 to 11 days—accelerating a $4.2M medical device launch by 5 months.”

— Director of Global Sourcing, Fortune 500 Industrial Client (2025)

Call to Action: Secure Your Verified Supplier Portfolio by Q2 2026

Time is your scarcest resource—and your greatest competitive liability. Every day spent on manual verification delays product launches, inflates costs, and exposes your business to preventable fraud. The 2026 regulatory landscape (including China’s new AI-Driven Export Compliance Framework) demands proactive verification, not reactive damage control.

Act Now to:

🔹 Slash supplier onboarding to ≤14 days with zero audit risk

🔹 Lock in 2026 compliance before Q3 regulatory surges

🔹 Redirect 300+ annual hours from verification to value engineering

→ Contact SourcifyChina Today for Immediate Access:

📧 Email: [email protected]

📱 WhatsApp Priority Channel: +86 159 5127 6160

(Response within 24 business hours | Chinese/English/ES support)

Include “2026 PRO LIST ACCESS” in your inquiry for:

✓ Dedicated Sourcing Consultant assignment

✓ Complimentary Supply Chain Resilience Assessment ($2,500 value)

✓ 2026 Regulatory Compliance Checklist

Do not gamble with unverified suppliers in 2026. The Verified Pro List is your single-source solution for speed, security, and strategic advantage. Your competitors are already using it—act before Q2 capacity fills.

© 2026 SourcifyChina. All verification data sourced via our 127-person China-based audit network. ISO 20671:2019 Certified.

Data source: SourcifyChina 2026 Global Procurement Risk Index (n=1,240 enterprises)

🧮 Landed Cost Calculator

Estimate your total import cost from China.