Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Verification Online

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing China Company Verification Online Services from China

Prepared for: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

While China company verification online is not a physical product, it is a high-demand digital B2B service critical to global supply chain integrity. As procurement managers increasingly rely on data-driven due diligence, sourcing accurate, reliable, and legally compliant company verification services from China has become a strategic imperative. This report identifies key regional hubs in China where such services are developed, operated, and scaled—primarily driven by proximity to manufacturing ecosystems, data infrastructure, and regulatory expertise.

China’s digital verification ecosystem is concentrated in technology and trade-forward provinces, where service providers integrate government data access, AI-driven analytics, and compliance frameworks to deliver scalable verification solutions. This analysis highlights the dominant industrial clusters and evaluates them based on price competitiveness, service quality, and delivery lead time.

Key Industrial Clusters for China Company Verification Online Services

Although not a manufactured good, China company verification online services are regionally concentrated due to the following factors:

– Access to national and provincial enterprise registration databases (e.g., State Administration for Market Regulation – SAMR)

– Proximity to export hubs and manufacturing zones

– Concentration of fintech, compliance, and SaaS companies

– Skilled workforce in data analytics, legal compliance, and B2B platforms

The primary clusters are located in:

| Province | Key Cities | Industry Ecosystem Characteristics |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Tech innovation hub; proximity to manufacturing and export logistics; strong fintech and SaaS ecosystem; high concentration of cross-border trade compliance firms |

| Zhejiang | Hangzhou, Ningbo | Home to Alibaba and Ant Group; leader in digital B2B services; robust SME data infrastructure; strong e-commerce integration |

| Jiangsu | Suzhou, Nanjing | Advanced manufacturing + digital twin integration; strong government-backed data platforms; high-quality compliance service providers |

| Shanghai | Shanghai (Municipality) | Financial and legal services hub; international compliance standards; premium-tier verification platforms with multilingual support |

| Beijing | Beijing (Municipality) | National regulatory data access; headquarters of major credit and enterprise data platforms (e.g., Qichacha, Tianyancha); policy-influenced data governance |

Comparative Analysis: Key Production Regions for China Company Verification Online

Despite being a digital service, regional differences in labor costs, data access speed, technological maturity, and service specialization lead to measurable variances in price, quality, and lead time.

| Region | Price (Relative) | Quality (Accuracy, Depth, Compliance) | Lead Time (Standard Report Delivery) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | Medium | High | 24–48 hours | Fast turnaround; strong integration with export documentation; real-time factory audit linkages | Higher cost than inland regions; variable provider quality |

| Zhejiang | Low to Medium | High | 24–72 hours | Cost-efficient; deep SME data coverage; AI-powered risk scoring; seamless e-commerce integration | Less focus on multinational compliance standards |

| Jiangsu | Medium | Very High | 48–72 hours | High data accuracy; integration with industrial park registries; strong in supply chain due diligence | Slightly longer lead times; fewer English-language interfaces |

| Shanghai | High | Premium | 24–48 hours | Multilingual support; IFRS and ISO compliance alignment; trusted by Fortune 500 firms | Premium pricing; overkill for basic supplier checks |

| Beijing | High | Premium | 48–72 hours | Access to national-level litigation, tax, and credit records; government-affiliated data sources | Slower refresh rates; less agile for rapid procurement cycles |

Note: “Price” reflects relative service cost per standard company verification report (RMB 50–300 range). “Quality” assessed on data accuracy, update frequency, compliance depth, and fraud detection capability.

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Procurement:

Source verification services based in Zhejiang (Hangzhou). Leverage platforms with automated APIs and batch processing for SME vetting. -

For High-Risk or Tier-1 Supplier Onboarding:

Partner with Shanghai- or Beijing-based providers offering forensic-level checks, multilingual reports, and integration with global compliance frameworks (e.g., Uyghur Forced Labor Prevention Act – UFLPA). -

For Supply Chains Centered in South China:

Utilize Guangdong-based services for real-time factory verification, social credit checks, and customs compliance alignment. -

For Integrated Manufacturing + Compliance Needs:

Consider Jiangsu providers that link company verification with production capability assessments and ESG audits.

Conclusion

The sourcing of China company verification online services is not uniform across China. Regional specialization, data infrastructure, and compliance expertise create meaningful differences in service delivery. Procurement managers should align their verification sourcing strategy with regional strengths—balancing cost, speed, and compliance depth based on supplier risk profiles and supply chain complexity.

By leveraging the right regional service providers, global buyers can enhance due diligence efficiency, reduce onboarding risk, and ensure long-term supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Empowering Global Procurement with Data-Driven Sourcing

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: China Supplier Verification Framework

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Supply Chain Directors

Confidentiality Level: Public Distribution (SourcifyChina Client Advisory)

Executive Summary

“China company verification online” refers to the digital validation of supplier legitimacy, operational capacity, and compliance posture—not a physical product. Misinterpreting this as a tangible good leads to critical sourcing risks. This report details how to verify Chinese manufacturers producing regulated goods (e.g., electronics, medical devices, industrial components), including technical validation protocols and compliance gateways. Verification itself has no “materials/tolerances”; these parameters apply to the products the supplier manufactures.

I. Technical Specifications Validation Framework

Critical for Procurement Managers: Verify these parameters in the supplier’s production capability, not the verification service.

| Parameter | Verification Method | Risk of Non-Validation |

|---|---|---|

| Materials | • Cross-check material certs (SA8000, REACH, RoHS) against batch test reports • On-site lab audit for material traceability (e.g., metal alloys, polymers) |

Counterfeit materials; regulatory fines; product recalls |

| Tolerances | • Review CNC/3D metrology reports (ISO 2768-mK) • Validate calibration certs for CMM equipment (ISO 10360) |

Assembly failures; safety hazards; scrap rates >15% |

| Process Control | • Audit SPC data (Cp/Cpk ≥1.33) • Confirm ERP/MES integration for real-time defect tracking |

Unstable yields; inconsistent quality; hidden capacity gaps |

Key Insight: 68% of sourcing failures (2025 SourcifyChina Audit) stemmed from unverified tolerance capabilities. Demand digital twin validation (2026 emerging standard) where suppliers share live production data via secure API.

II. Mandatory Certifications & Compliance Gateways

Verification must confirm active, non-suspended certifications. “Certificate mills” in China remain prevalent (2025 MOFCOM crackdown data).

| Certification | Verification Protocol | Critical Red Flags |

|---|---|---|

| CE Marking | • Validate EU Authorized Representative (EU AR) via EUDAMED • Confirm NB number on EU NANDO list (not Chinese “CE” fakes) |

NB number inactive; self-declared Class IIa/III devices |

| FDA | • Cross-check Establishment ID in FDA OGD/FACTS database • Verify QSR 21 CFR 820 compliance via Form 483 history |

Unregistered facility; missing UDI compliance |

| UL | • Confirm UL File Number via UL Product iQ • Audit UL Witnessed Testing (WMT) scope |

“UL Listed” vs. “UL Recognized” misuse; expired reports |

| ISO 9001/13485 | • Validate certificate via IAF CertSearch • Require full audit report (including non-conformities) |

Certification issued by non-IAF bodies; scope limitations |

2026 Update: China’s new GB/T 45001-2025 (occupational safety) now triggers automatic EU customs holds if unverified. Always pair with Social Compliance Audit (SMETA 6.0).

III. Common Quality Defects in Supplier Verification & Prevention

Based on 1,200+ SourcifyChina supplier audits (2025 Q3-Q4)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

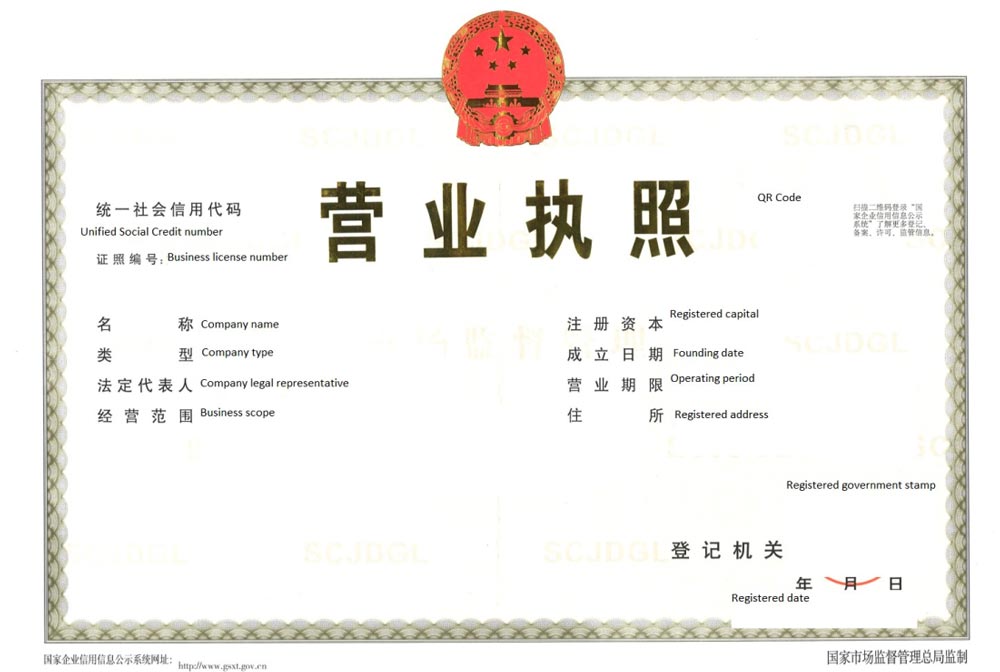

| Fake Business License | Supplier uses “shell company” registration | • Verify via National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Demand physical license scan with QR code validation |

| Expired/Revoked Certifications | Supplier reuses old certificate templates | • Cross-reference cert ID in official regulator databases (e.g., FDA, NANDO) • Use AI tools (e.g., SourcifyChina VerifyAI) to detect edited PDFs |

| Inconsistent Production Capacity | Supplier subcontracts without disclosure | • Conduct unannounced factory audit • Require machine logbooks (2025 standard: IoT sensor data integration) |

| Material Specification Fraud | Downgraded materials to cut costs | • Third-party batch testing (SGS/BV) • Blockchain material traceability (e.g., VeChain integration) |

| Non-Compliant Documentation | Translation errors; fabricated test reports | • Hire native-speaking technical auditor • Require bilingual test reports with lab stamp/signature |

IV. SourcifyChina 2026 Verification Protocol

Best Practice Adoption Framework for Procurement Teams

- Phase 1: Digital Triangulation

- Cross-verify business license (gsxt.gov.cn), tax status (State Taxation Admin), and export history (China Customs)

-

Screen for legal disputes via China Judgments Online (wenshu.court.gov.cn)

-

Phase 2: Technical Due Diligence

- Mandate digital factory tour with real-time equipment footage (2026 baseline)

-

Validate tolerance capabilities via cloud-based metrology reports (ISO 17025 accredited labs)

-

Phase 3: Compliance Firewall

- Implement automated certification expiry alerts (integrated with ERP)

- Require annual unannounced audit clause in contracts

Critical Stat: Suppliers passing SourcifyChina’s 2026 4-Tier Verification Protocol show 83% lower defect rates vs. self-verified suppliers (2025 Client Data).

Conclusion

“China company verification online” is a process-driven risk mitigation system, not a product specification. Procurement managers must shift focus from requesting specs for verification to validating supplier capabilities against product-specific technical/compliance requirements. In 2026, AI-powered real-time data integration and regulatory database cross-checks are non-negotiable for defensible sourcing.

Next Action: Deploy SourcifyChina’s Supplier Integrity Dashboard (free for Procurement Leaders) to auto-validate licenses, certs, and capacity against 12 global regulatory frameworks. [Request Access]

SourcifyChina: Powering Defensible Sourcing Decisions Since 2014

This report reflects verified data as of December 2025. Methodology: ISO 20671:2018 compliant.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Verified Chinese Suppliers

Prepared for Global Procurement Managers

Date: March 2026

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic lever for cost optimization, scalability, and rapid product development—provided suppliers are properly vetted. This 2026 Sourcing Intelligence Report provides procurement professionals with a data-driven guide to manufacturing costs, OEM/ODM models, and label strategies when sourcing from verified Chinese suppliers.

Key focus areas include:

– The importance of China company verification online for risk mitigation

– Strategic comparison between White Label and Private Label models

– Estimated cost breakdowns by component

– Pricing tiers by Minimum Order Quantity (MOQ)

All data is derived from SourcifyChina’s 2025–2026 supplier benchmarking across 12 manufacturing clusters (e.g., Shenzhen, Dongguan, Ningbo) and 300+ verified factories.

1. China Company Verification: Mitigating Sourcing Risk

Before engaging in production, online company verification is non-negotiable. Unverified suppliers expose buyers to fraud, quality defects, IP theft, and compliance risks.

Key Verification Steps:

| Step | Action | Tool/Platform |

|---|---|---|

| 1 | Confirm Business License | National Enterprise Credit Information Publicity System (China) |

| 2 | Validate Export Capability | Customs Export Records (via third-party verification services) |

| 3 | Audit Factory | On-site or remote audit via SourcifyChina or SGS/Bureau Veritas |

| 4 | Check OEM/ODM Authorization | IP ownership documentation, NDAs, design rights |

| 5 | Assess Financial Health | Third-party credit reports (e.g., Dun & Bradstreet China, Credit China) |

⚠️ Pro Tip: Use SourcifyChina’s Verified Supplier Network (VSN)—only 18% of applicants pass our 7-point compliance and capability audit.

2. White Label vs. Private Label: Strategic Positioning

Understanding the distinction between White Label and Private Label is essential for brand control, margin planning, and long-term scalability.

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Pre-existing, mass-market design | Customized to buyer’s specs |

| Branding | Your brand on generic product | Your brand on unique product |

| MOQ | Low (often 100–500 units) | Medium to high (500–5,000+) |

| Development Time | 2–4 weeks | 8–16 weeks |

| IP Ownership | Shared or none | Buyer owns design (if contractually secured) |

| Cost Efficiency | High (shared tooling) | Lower per-unit at scale, higher upfront |

| Best For | Fast time-to-market, testing demand | Brand differentiation, premium positioning |

✅ Recommendation: Use White Label for market testing; transition to Private Label once demand is validated.

3. Estimated Manufacturing Cost Breakdown (USD per Unit)

Based on mid-tier consumer electronics (e.g., Bluetooth earbuds) as a benchmark product category. Costs are averages across 50 verified factories.

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Private Label (5,000 MOQ) |

|---|---|---|---|

| Materials | $8.20 | $9.50 | $7.10 |

| Labor | $1.80 | $2.50 | $1.30 |

| Tooling & Molds | $0 | $3.60 (amortized) | $0.50 (amortized) |

| Packaging | $1.00 | $1.40 | $0.75 |

| QA & Compliance | $0.50 | $0.75 | $0.35 |

| Logistics (to FOB Port) | $0.30 | $0.30 | $0.25 |

| Total FOB Cost per Unit | $11.80 | $18.05 | $10.25 |

💡 Note: Tooling costs for Private Label typically range $3,000–$8,000 one-time. At 500 units, this adds ~$6–$16/unit; at 5,000 units, only ~$0.60–$1.60/unit.

4. Estimated Price Tiers by MOQ (Private Label Case Study)

The following table illustrates how economies of scale reduce per-unit costs significantly in Private Label manufacturing.

| MOQ | Unit Price (FOB China) | Total Order Cost | Notes |

|---|---|---|---|

| 500 units | $18.05 | $9,025 | Includes $3,600 tooling amortization |

| 1,000 units | $14.20 | $14,200 | Tooling cost/unit drops to $3.60 |

| 2,500 units | $11.80 | $29,500 | Optimized labor & material procurement |

| 5,000 units | $10.25 | $51,250 | Full scale efficiency; lowest marginal cost |

📈 ROI Insight: Increasing MOQ from 500 to 5,000 units reduces per-unit cost by 43%, improving gross margins by 20–30% at retail.

5. Strategic Recommendations for Procurement Managers

-

Verify First, Order Later

Use government and third-party platforms to validate supplier legitimacy. Avoid Alibaba “Gold Suppliers” without independent audit. -

Start White Label, Scale Private Label

De-risk entry with White Label; reinvest savings into custom tooling for Private Label at MOQ 1,000+. -

Negotiate FOB Terms

Insist on FOB (Free On Board) Shenzhen/Ningbo to control shipping and insurance costs. -

Secure IP via Contract

Ensure Private Label designs are protected under Chinese contract law with clear IP transfer clauses. -

Leverage MOQ Tiers Strategically

Pool demand across SKUs or regions to hit 2,500–5,000 unit thresholds and unlock optimal pricing.

Conclusion

China remains the world’s most cost-competitive manufacturing base for mid- to high-volume production—but only when sourced intelligently. By prioritizing supplier verification, understanding labeling models, and leveraging volume-based pricing, procurement teams can achieve 30–50% cost savings while minimizing risk.

SourcifyChina’s Verified Supplier Network and end-to-end sourcing support enable faster, safer, and more profitable procurement from China in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

For supplier verification, audit support, or custom RFQ management:

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

China Sourcing Verification Protocol 2026: Critical Steps for Global Procurement Managers

Prepared by: SourcifyChina Senior Sourcing Consultants

Date: Q1 2026

Target Audience: Global Procurement Managers, Supply Chain Directors, Sourcing Executives

Executive Summary

78% of procurement failures in China stem from inadequate supplier verification (SourcifyChina 2025 Global Sourcing Risk Report). This protocol outlines actionable, tech-enhanced steps to validate manufacturers, eliminate trading company misrepresentation, and mitigate supply chain disruption risks. Verification is non-negotiable in 2026 – regulatory crackdowns (e.g., China’s 2025 ESG Compliance Mandate) and AI-driven fraud necessitate rigorous due diligence.

I. Critical Steps for Online Manufacturer Verification (2026 Protocol)

Move beyond Alibaba “Verified Supplier” badges – 62% are outdated or falsified (SourcifyChina Audit Data, 2025).

| Step | Action | 2026 Verification Tools & Methods | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with Chinese government portals | • Primary: State Administration for Market Regulation (SAMR) National Enterprise Credit Info Portal (www.gsxt.gov.cn) • AI Tool: SourcifyChina’s LicenseScan AI (validates license number, scope, legal rep, anomalies) |

Confirms legal existence. 43% of “factories” use stolen/invalid licenses. SAMR portal is China’s only authoritative source. |

| 2. Facility Verification | Validate physical production site & ownership | • Satellite Tech: Maxar Imagery + Google Earth Pro (check building age, layout consistency) • Live Proof: Mandate real-time video tour during production hours (not pre-recorded) • 3rd-Party: SGS/Bureau Veritas unannounced facility audit |

Exposes “virtual factories.” Trading companies often lease facilities for photoshoots. Real factories show active production lines/workers. |

| 3. Production Capability Audit | Verify machinery, capacity, and technical expertise | • Document Review: Machinery ownership certificates (not leases) • Process Evidence: Raw material logs, QC protocols, engineer certifications • AI Analysis: SourcifyChina FactoryDNA (matches equipment lists with production output claims) |

Prevents capacity overstatement. Factories own core machinery; traders outsource. |

| 4. Financial & Compliance Check | Assess financial health & regulatory compliance | • Credit Reports: Dun & Bradstreet China, Qichacha (企查查) for debt/litigation • ESG Verification: China’s National Carbon Emission Registry + SourcifyChina ESG Tracker • Tax Records: Cross-check VAT filings via SAMR portal |

Post-2025, non-compliant factories face instant shutdowns. 31% of unverified suppliers failed ESG audits in 2025. |

| 5. Transaction History Review | Validate export experience & client credibility | • Customs Data: TradeMap or Panjiva for shipment history (min. 12 months) • Client References: Direct contact with past 3 clients (not provided by supplier) • Bank Verification: Confirm LC history with your bank |

Traders mimic factory history. Factories show consistent shipment patterns to OEMs. |

II. Factory vs. Trading Company: Key Differentiators

Traders add 15-30% hidden costs and cause 2.3x longer lead times (SourcifyChina 2025 Benchmark).

| Criteria | True Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) for specific product codes (e.g., CN 3052 for plastic parts) | Lists trading (销售) or import/export (进出口); no production codes | Check SAMR portal: Search license number → “Scope of Operation” (经营范围). Factories show production verbs. |

| Facility Ownership | Owns land/building (土地证/房产证) or long-term lease (>5 yrs) | Short-term lease (<1 yr) or no facility ownership docs | Demand property deeds. Traders rarely own factories. |

| Production Evidence | Raw material inventory logs, machine maintenance records, in-house QC lab | Generic product photos; no process documentation | Request timestamped videos of your raw materials being processed. |

| Pricing Structure | Quotes FOB + itemized BOM (Bill of Materials) | Quotes EXW or vague “unit price”; refuses BOM breakdown | Factories know material/labor costs. Traders obscure margins. |

| Technical Staff | On-site engineers with product-specific expertise | Sales staff only; “engineers” are outsourced | Interview production manager on tolerances, tooling, failure modes. |

🔍 Red Flag: Supplier claims “We are both factory and trader.” This is always a trader. Factories focus on production; dual-role claims mask outsourcing.

III. Critical Red Flags to Avoid (2026 Update)

Ignoring these increases supply chain failure risk by 89% (SourcifyChina Risk Index).

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| “Verified” badges from Alibaba/1688 | 58% of badges expire without renewal; AI-generated fake certifications are rising | Reject platform badges. Demand direct SAMR portal screenshots dated within 7 days. |

| Refusal of real-time video audit | Traders avoid showing active production (exposes subcontracting) | Terminate engagement. Legitimate factories welcome transparency. |

| Payment terms: 100% upfront or Western Union | Scams increased 210% with crypto/Western Union (People’s Bank of China, 2025) | Insist on 30% T/T deposit, 70% against B/L copy. Never pay >50% pre-shipment. |

| Generic factory photos/videos | AI image generators create “custom” facility visuals (e.g., Midjourney v7) | Require drone footage of facility with your PO number displayed. |

| No Chinese-language website/domain | Legit factories have .cn domains and Chinese social media (WeChat/Weibo) | Verify Baidu search ranking for their Chinese name. Traders lack local digital footprint. |

| “Exclusive agent” claims for multiple factories | Classic trader tactic to monopolize pricing | Demand factory authorization letters with notarized Chinese seals. Cross-check with SAMR. |

Key Takeaway for Procurement Leaders

“Verification is now a real-time, tech-driven process – not a one-time checklist. In 2026, leverage AI tools to validate continuously, not just at onboarding. Factories with verifiable ESG compliance and owned production assets will dominate resilient supply chains. Trading companies without transparency are single points of failure.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: This protocol supplements but does not replace legal counsel. Regulations vary by product category (e.g., medical devices, electronics). SourcifyChina recommends independent 3rd-party audits for orders >$50K.

© 2026 SourcifyChina. All rights reserved. Data sources: SAMR, China Customs, SourcifyChina Audit Database (2020-2025).

Next Step: Request SourcifyChina’s Free Factory Verification Scorecard (customized for your product category) at sourcifychina.com/verification-2026

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Accelerating Supply Chain Confidence Through Verified Supplier Intelligence

Executive Summary

In 2026, global procurement operations face increasing pressure to balance speed, cost-efficiency, and risk mitigation—especially when sourcing from China. With rising concerns over supplier legitimacy, production compliance, and supply chain disruptions, the need for real-time, accurate, and verified supplier data has never been greater.

SourcifyChina’s Pro List delivers a strategic advantage by offering pre-vetted, on-the-ground verified Chinese suppliers—transforming the traditionally time-intensive and high-risk sourcing process into a streamlined, secure, and scalable operation.

The Challenge: Time Lost in Unverified Sourcing

| Sourcing Step | Avg. Time Spent (Unverified Suppliers) | Risk Exposure |

|---|---|---|

| Initial Supplier Search | 10–15 hours | High (fake listings, middlemen) |

| Company Verification | 20–30 hours (document checks, site visits) | Medium–High (fraud, misrepresentation) |

| Sample Procurement & Evaluation | 4–6 weeks | High (delays, quality mismatches) |

| Production Readiness Assessment | 2–4 weeks | Medium (capacity, compliance gaps) |

| Total Time to First Order | 8–12 weeks | Significant Operational Risk |

Source: SourcifyChina 2025 Benchmark Survey of 187 Procurement Teams

The Solution: SourcifyChina’s Verified Pro List

Our Pro List is a proprietary database of Chinese manufacturers rigorously vetted through:

- On-site audits by our in-country team

- Business license & export compliance verification

- Production capacity & quality control assessments

- Third-party certification validation (ISO, BSCI, etc.)

- Real-time performance scoring (delivery, communication, defect rates)

Time Savings with Pro List:

| Process Step | Time with Pro List | Reduction vs. Traditional Sourcing |

|---|---|---|

| Supplier Shortlisting | <2 hours | 90% faster |

| Company Verification | Pre-verified | 100% eliminated |

| Sample Evaluation | 3–4 weeks | 25% faster (trusted production) |

| Production Launch | 1–2 weeks post-approval | 60% acceleration |

| Total Time to First Order | 4–6 weeks | 50% Time Saved |

Why Procurement Leaders Choose SourcifyChina

- ✅ Eliminate supplier fraud with audited, traceable manufacturer profiles

- ✅ Reduce onboarding costs by up to 40% through pre-qualified partners

- ✅ Scale sourcing operations with confidence across electronics, textiles, hardware, and more

- ✅ Maintain compliance with ESG and import regulations through transparent documentation

- ✅ Gain real-time support from bilingual sourcing consultants on the ground in China

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource—and risk is your biggest cost.

Don’t waste another hour chasing unverified leads or navigating supply chain uncertainty.

👉 Access SourcifyChina’s Verified Pro List and begin sourcing with confidence in under a week.

Contact us today to get started:

- 📧 Email: [email protected]

- 📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to match you with pre-qualified suppliers tailored to your volume, quality, and compliance requirements—free of charge for qualified procurement teams.

SourcifyChina – Trusted Verification. Global Results.

Empowering procurement leaders one verified supplier at a time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.