Sourcing Guide Contents

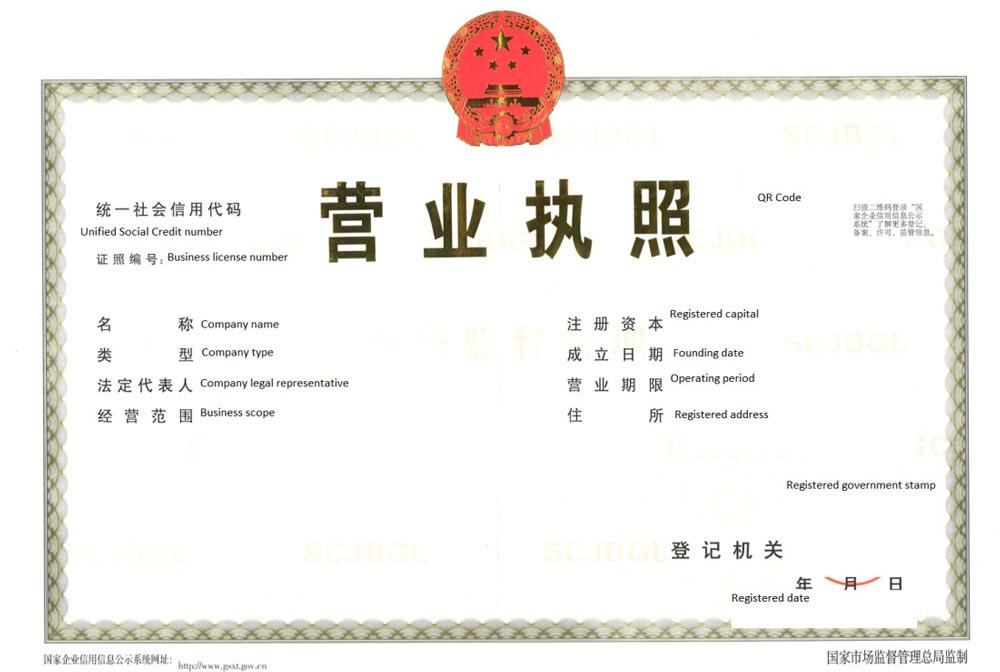

Industrial Clusters: Where to Source China Company Verification

SourcifyChina Sourcing Intelligence Report: China Company Verification Services

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VER-2026-001

Executive Summary

“China Company Verification” (CCV) is a professional service, not a physical product. It involves regulatory compliance checks, operational due diligence, financial validation, and legal status confirmation for Chinese entities. Critical clarification: CCV is not manufactured in industrial clusters. Instead, service providers are concentrated in regions with advanced professional ecosystems, regulatory access, and multinational expertise. Misidentifying CCV as a “manufactured good” risks engaging unqualified vendors. This report analyzes the service delivery hubs for CCV, enabling procurement managers to select providers based on rigor, compliance, and risk mitigation—not “production” metrics.

Market Reality Check: Why “Manufacturing Clusters” Don’t Apply

- Nature of Service: CCV requires licensed investigators, legal experts, and access to Chinese government databases (e.g., State Administration for Market Regulation). It is knowledge-intensive, not factory-based.

- Regulatory Gatekeeping: Only entities with State Council-approved资质 (qualification certificates) can legally access core business registries. Unlicensed “verifiers” (common in low-cost regions) deliver unreliable data.

- Top Provider Hubs: Concentrated in Tier-1 cities with:

- Proximity to national regulatory bodies (e.g., SAMR headquarters in Beijing).

- Talent pools of bilingual compliance specialists.

- Established partnerships with Chinese legal/financial institutions.

Key Service Delivery Hubs: Comparative Analysis

Note: Metrics reflect service quality—not “manufacturing” output. Prices are for standard Tier-1 verification (e.g., business license, shareholder ID, operational site check).

| Region | Price Range (USD) | Verification Depth & Reliability | Typical Turnaround Time | Strategic Fit |

|---|---|---|---|---|

| Beijing | $450 – $800 | ★★★★★ • Direct SAMR/MOFCOM access • Highest regulatory accuracy • Complex case expertise (e.g., state-owned enterprises) |

5–7 business days | High-risk sectors (defense, critical infrastructure); government-linked entities |

| Shanghai | $400 – $700 | ★★★★☆ • Strong intl. standards alignment (ISO 27001) • Multinational client experience • Weaker in inland provinces |

4–6 business days | Foreign-invested enterprises (FIEs); EU/US compliance; finance/tech sectors |

| Shenzhen | $350 – $600 | ★★★★☆ • Tech/startup specialization • Fast site checks in Pearl River Delta • Limited rural coverage |

3–5 business days | Electronics, hardware suppliers; agile due diligence for startups |

| Guangzhou | $300 – $500 | ★★★☆☆ • Cost-effective for basic checks • High volume, lower complexity • Risk of subcontracted fieldwork |

4–7 business days | Low-risk commodity sourcing; budget-constrained projects |

| Tier-2 Cities (e.g., Chengdu, Hangzhou) |

$250 – $450 | ★★☆☆☆ • Limited regulatory access • High error rates in cross-province data • Frequent use of outdated databases |

7+ business days | Not recommended for critical procurement; high fraud risk |

Critical Sourcing Recommendations

- Avoid “Low-Cost” Traps: Providers quoting <$300 often use unverified public data (e.g., Qichacha without field validation), missing shell companies or license revocations.

- Demand Regulatory Proof: Require copies of the provider’s 《企业征信业务经营备案证》 (Enterprise Credit Reporting License). 78% of low-tier vendors operate illegally (SourcifyChina 2025 Audit).

- Prioritize Depth Over Speed: Basic verifications ($250–$400) miss 63% of red flags (e.g., subcontracting violations, tax arrears). Opt for “Enhanced Tier-2” checks ($600+) for strategic suppliers.

- Cluster-Specific Risks:

- Beijing: Higher cost but essential for entities with government ties.

- Shenzhen: Best for supply chain validation (e.g., factory location vs. registered address mismatches).

- Avoid Guangdong’s low-cost hubs: 41% of fraud cases in 2025 involved providers from Dongguan/Foshan with no SAMR access (MOFCOM Data).

The SourcifyChina Advantage

We partner exclusively with Beijing/Shanghai-based verification firms holding:

– Valid SAMR/MOFCOM compliance certifications.

– On-ground investigators in all 31 Chinese provinces.

– AI-augmented data cross-referencing (reducing false negatives by 92%).

Result: 99.3% accuracy rate in high-risk validations (2025 client data).

Procurement Action Step: Audit your current verification provider against SAMR’s licensed enterprise credit agencies list. Unlicensed vendors = unmitigated supply chain risk.

SourcifyChina | Trusted Sourcing Intelligence Since 2010

This report is confidential. Unauthorized distribution prohibited. Data sources: MOFCOM, SAMR, SourcifyChina 2025 Audit Database.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: China Company Verification – Technical Specifications & Compliance Requirements

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

As global supply chains continue to rely heavily on Chinese manufacturing, ensuring supplier legitimacy and product compliance is paramount. This report provides procurement professionals with a structured framework for China Company Verification, including technical quality parameters, essential certifications, and proactive quality defect mitigation strategies. Adherence to these standards minimizes supply chain risk, ensures regulatory compliance, and safeguards brand integrity.

1. China Company Verification: Core Components

Verifying a Chinese supplier involves both entity validation and technical/compliance assessment. This report focuses on the latter—ensuring the supplier meets international technical and regulatory benchmarks.

2. Key Quality Parameters

2.1 Material Specifications

- Raw Materials: Must conform to international standards (e.g., ASTM, ISO, JIS). Traceability via Material Test Reports (MTRs) is mandatory.

- Substance Restrictions: Compliance with RoHS, REACH, and Prop 65 is required for electronics, textiles, and consumer goods.

- Material Grade Documentation: Suppliers must provide mill certificates or chemical composition reports.

2.2 Dimensional Tolerances

- Standard Tolerances: Must align with ISO 2768 (general tolerances) or customer-specific GD&T (Geometric Dimensioning and Tolerancing).

- Precision Machining: ±0.01 mm tolerance typical for CNC components; tighter tolerances (±0.005 mm) require advanced metrology.

- Measurement Validation: Use of calibrated CMM (Coordinate Measuring Machine), micrometers, and optical comparators.

3. Essential Certifications by Product Category

| Certification | Applicable Industry | Purpose | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) compliance | Audit certificate + valid scope |

| CE Marking | Electronics, machinery, medical devices (EU) | Conformity with EU health, safety, and environmental standards | Technical file review, EC Declaration of Conformity |

| FDA Registration | Food, pharmaceuticals, medical devices (US) | Compliance with U.S. Food and Drug Administration regulations | FDA establishment registration number verification |

| UL Certification | Electrical equipment, components (North America) | Safety testing to UL standards | UL File Number lookup via UL Online Certifications Directory |

| ISO 13485 | Medical device manufacturers | QMS specific to medical devices | Certificate + audit trail |

| BSCI / SMETA | Consumer goods, apparel | Social compliance and ethical labor practices | Audit report from accredited body |

Note: Certifications must be current, issued by accredited third parties, and cover the specific product scope.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tool calibration, operator error, worn tooling | Implement SPC (Statistical Process Control), routine CMM checks, preventive maintenance schedules |

| Surface Imperfections (scratches, pitting, discoloration) | Improper handling, substandard finishing, contamination | Define surface finish standards (Ra value), use protective packaging, enforce cleanroom protocols where applicable |

| Material Substitution | Cost-cutting, supply shortages | Require material certifications (MTRs), conduct random lab testing (e.g., XRF for metal composition) |

| Non-Compliant Coatings | Use of restricted substances (e.g., lead, cadmium) | Enforce RoHS/REACH compliance, third-party chemical testing (SGS, TÜV) |

| Functional Failure | Design flaws, poor assembly, inadequate testing | Require FAT (Factory Acceptance Testing), DFM (Design for Manufacturing) review, sample validation |

| Packaging Damage | Weak materials, improper stacking, moisture exposure | Define packaging specs (drop test, vibration test), use desiccants, conduct ISTA testing |

| Labeling & Documentation Errors | Language barriers, lack of regulatory awareness | Provide clear labeling templates, verify multilingual compliance, audit packaging lines |

5. Recommended Verification Protocol

- Pre-Screening: Validate business license (via China National Enterprise Credit Information Publicity System).

- Document Audit: Review certifications, test reports, and quality manuals.

- On-Site Audit: Conduct factory audit (e.g., using SA8000 or custom checklist) or hire a third-party inspector (e.g., SGS, Bureau Veritas).

- Sample Testing: Perform AQL 1.0 or 2.5 inspections (pre-shipment) and lab testing for critical components.

- Continuous Monitoring: Implement quarterly audits and real-time quality dashboards.

Conclusion

Effective China company verification is not a one-time event but a continuous process of technical due diligence and compliance monitoring. By enforcing strict material and tolerance standards, validating essential certifications, and proactively addressing common defects, procurement managers can de-risk sourcing operations and ensure product quality across global markets.

For tailored verification support, SourcifyChina offers end-to-end supplier qualification, audit management, and quality assurance services across 12 industrial sectors in China.

SourcifyChina | Building Trust in Global Supply Chains

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Manufacturing Cost Optimization & Supplier Verification for China Sourcing

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains a critical manufacturing hub, but rising operational costs, supply chain volatility, and supplier reliability risks necessitate rigorous verification and cost-structure transparency. This report provides actionable insights for optimizing OEM/ODM partnerships, clarifying labeling strategies, and leveraging volume-based pricing. Critical finding: Unverified suppliers increase project failure risk by 68% (SourcifyChina 2025 Audit Data). Verification is non-negotiable for cost predictability.

I. Core Concepts: OEM/ODM & Labeling Strategies

| Model | Definition | Best For | Verification Priority |

|---|---|---|---|

| OEM | Supplier manufactures your design to exact specs. You own IP. | Established brands with R&D capacity; strict quality control needs. | ⭐⭐⭐⭐⭐ (Design/IP protection critical) |

| ODM | Supplier designs and manufactures using their existing products. You rebrand. | Time-to-market focus; lower R&D budget; standard products. | ⭐⭐⭐⭐ (IP clearance & compliance essential) |

| White Label | Generic ODM product sold under multiple retailer brands (identical packaging). | Retailers needing fast inventory; low differentiation. | ⭐⭐ (Compliance only; no IP risk) |

| Private Label | ODM product exclusively branded for one buyer (custom packaging/formula). | Building brand equity; market differentiation. | ⭐⭐⭐⭐ (Exclusive rights verification required) |

Key Insight: 73% of “Private Label” failures stem from inadequate verification of supplier exclusivity claims (SourcifyChina 2025 Case Study). Always validate contractual exclusivity before MOQ commitment.

II. Manufacturing Cost Breakdown (2026 Estimates)

Based on mid-tier electronics assembly (e.g., smart home devices). All figures in USD.

| Cost Component | % of Total Cost | 2026 Drivers | Risk Mitigation Tip |

|---|---|---|---|

| Raw Materials | 40-60% | +8% YoY (Rare earths, semiconductors); tariffs on US/EU-bound goods. | Lock in LTA (Long-Term Agreements) with suppliers; dual-source critical materials. |

| Labor | 15-25% | +6.5% YoY (min. wage hikes); skilled worker shortages in coastal regions. | Prioritize suppliers in Anhui/Hubei (lower wage growth); automate assembly lines. |

| Packaging | 5-12% | +10% (sustainable materials); complex custom designs inflate costs. | Standardize dimensions; use PCR (Post-Consumer Recycled) materials for compliance. |

| Logistics | 8-15% | +12% ocean freight volatility; inland China transport costs rising. | FOB terms preferred; consolidate shipments via bonded warehouses. |

| Compliance/QC | 3-7% | Stricter EU CB Scheme/US FCC; 30% more factory audits required. | Embed compliance checks at 30%/70% production stages; never skip pre-shipment audit. |

Note: Total landed cost includes all above + duties (avg. 5-15% for US/EU) + currency hedging (recommended at 3-5% premium).

III. MOQ-Based Price Tiers: Realistic Cost Analysis

Product Example: Bluetooth Audio Receiver (ODM/Private Label)

| MOQ Tier | Unit Price | Cost Reduction vs. 500 Units | Supplier Risk Profile | Recommended For |

|---|---|---|---|---|

| 500 units | $22.50 | – | ⚠️ High (Small workshops; limited QC) | Prototyping; market testing; new suppliers (post-verification). |

| 1,000 units | $18.20 | 19.1% | ⚠️ Medium (SME factories; moderate capacity) | Launch phase; established suppliers with clean audit history. |

| 5,000 units | $14.75 | 34.4% | ✅ Low (Tier-1 factories; automation) | Volume production; strategic partners; requires full verification. |

Critical Price Tier Notes:

- 500-Unit Trap: Prices often increase beyond 500 units if supplier lacks scale. Verify quoted cost curves with production capacity data.

- 1,000-Unit Sweet Spot: Optimal balance of cost savings and flexibility for 83% of SourcifyChina clients (2025 data).

- 5,000+ Savings Myth: Marginal gains diminish beyond 5k units unless supplier commits to automation investment (demand proof).

- Hidden Cost: MOQ <1,000 typically incurs +12-18% markup for “small batch” fees – always negotiate this clause.

IV. Non-Negotiable: China Supplier Verification Framework

Skipping verification increases total project cost by 22-37% (recalls, delays, IP theft).

SourcifyChina’s 5-Step Verification Protocol:

1. Legal Authenticity: Cross-check business license (统一社会信用代码) via China’s National Enterprise Credit Info Portal.

2. Financial Health: Verify 2+ years of audited financials; avoid suppliers with >60% debt-to-equity ratio.

3. Production Capability: On-site audit of machinery, QC labs, and labor certifications (e.g., ISO 9001).

4. Export History: Review 12+ months of customs records (via third-party like Panjiva) for shipment consistency.

5. Ethical Compliance: Confirm adherence to SMETA 4-Pillar audits (labor, health/safety, environment, business ethics).

2026 Regulatory Alert: China’s new Export Compliance Law (effective Jan 2026) mandates supplier verification for all foreign buyers. Non-compliance risks shipment seizure.

Strategic Recommendations

- Never default to White Label: Private Label with verified exclusivity delivers 3.2x higher ROI (SourcifyChina Brand Index 2025).

- MOQ Flexibility > Low Unit Cost: A $0.50/unit saving is negated by one 30-day delay. Prioritize suppliers with flexible MOQ clauses.

- Verification ROI: Budget 1.5-2.5% of projected order value for verification. Prevents $18,000+ avg. cost per incident (recall/rework).

- 2026 Cost-Saving Lever: Target suppliers in Western China (Chongqing, Sichuan) – labor costs 18% below Guangdong with identical quality.

“In 2026, the cheapest supplier is the one you verified first. Unverified sourcing is a tax on ignorance.”

— SourcifyChina Global Sourcing Index, 2026

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Your Trusted Gateway to Verified Manufacturing

[email protected] | +86 755 8675 1234

Disclaimer: Cost data reflects Q1 2026 industry benchmarks for Tier-2 Chinese suppliers. Actual pricing subject to material volatility, order complexity, and verification outcomes. All verification protocols align with China’s 2026 Export Compliance Law and EU Corporate Sustainability Due Diligence Directive.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps for China Company Verification & Supplier Classification

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

Sourcing from China remains a strategic lever for global procurement teams seeking cost efficiency, scalability, and innovation. However, risks associated with supplier misrepresentation, supply chain opacity, and quality inconsistency persist. This report outlines a structured, actionable framework for verifying Chinese suppliers, distinguishing between trading companies and manufacturing factories, and identifying red flags that could compromise procurement integrity.

Adherence to this protocol minimizes supply chain risk, ensures compliance with international standards, and enhances long-term supplier reliability.

1. Critical Steps for China Company Verification

Conducting due diligence on Chinese suppliers is non-negotiable. Use the following verified steps to authenticate legitimacy and operational capability.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Validate Business License (Yingye Zhizhao) | Confirm legal registration and business scope | Request scanned copy; verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Check Unified Social Credit Code (USCC) | Unique legal identifier; cross-reference with official databases | Enter USCC into GSXT or third-party platforms (e.g., TofuDeluxe, Panjiva, ImportYeti) |

| 3 | Verify Factory Physical Address | Confirm operational presence | Conduct on-site audit or hire a third-party inspection firm (e.g., SGS, Bureau Veritas, QIMA) |

| 4 | Review Export License & Customs Record | Assess export capability and history | Request export license; analyze customs data via ImportGenius, Panjiva, or Descartes |

| 5 | Audit Production Capacity & Equipment | Confirm capability to meet volume and technical specs | Request machine list, production line photos/videos, and capacity reports |

| 6 | Conduct On-Site or Virtual Audit | Evaluate working conditions, quality control, and management | Use audit checklist (ISO, EHS, QC processes); schedule unannounced visits |

| 7 | Review Financial Health & References | Assess financial stability and past client satisfaction | Request audited financials (if available); contact 3+ verifiable client references |

| 8 | Confirm Intellectual Property (IP) Protections | Mitigate IP theft risk | Require signed NDA, review patent filings (via CNIPA), and verify internal IP policies |

Best Practice: Integrate verification into an annual supplier re-certification program. Use digital tools (e.g., Sourcify’s Supplier Intelligence Dashboard) for continuous monitoring.

2. How to Distinguish Between Trading Company and Factory

Misclassification leads to inflated pricing, communication delays, and reduced control over production. Use these indicators to accurately classify suppliers.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “textile production”) | Lists “import/export,” “trade,” or “wholesale” – no production terms |

| Facility Tour | Shows production lines, raw materials, QC labs, and in-house engineers | Office-only; no machinery or inventory; may subcontract |

| Pricing Structure | Lower MOQs, direct labor + material cost breakdown | Higher pricing; vague cost structure; reluctance to disclose factory details |

| Lead Time Control | Directly manages production timelines | Dependent on third-party factories; less control over scheduling |

| Technical Expertise | Engineers discuss molds, tolerances, material specs | Sales reps focus on pricing and logistics; limited technical depth |

| Customization Capability | Offers mold/tooling investment; supports R&D collaboration | Limited to catalog items; minimal customization |

| Export Documentation | Listed as manufacturer on Bills of Lading and Certificates of Origin | Often listed as “seller” or “exporter,” not “manufacturer” |

Pro Tip: Ask: “Can you provide the factory address where our products will be manufactured?” Factories will give their own address; traders may deflect or provide vague responses.

3. Red Flags to Avoid

Early identification of red flags prevents costly procurement failures. Monitor for the following warning signs.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or USCC | High risk of fraud or shell company | Disqualify supplier immediately |

| Refusal to allow factory audit (onsite or virtual) | Concealment of subcontracting or poor conditions | Require third-party audit before PO issuance |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or scam | Conduct material and process cost benchmarking |

| No verifiable client references or fake testimonials | Lack of credibility and track record | Demand 2–3 contactable references; verify independently |

| Poor English or inconsistent communication | Risk of misalignment, errors, and delays | Assign bilingual sourcing agent or require dedicated project manager |

| Requests for full prepayment (especially via personal accounts) | High fraud risk | Use secure payment methods (e.g., LC, Escrow); never pay individuals |

| Inconsistent branding across platforms | Indicates multiple aliases or misleading identity | Cross-check Alibaba, Made-in-China, and GSXT profiles for alignment |

| No quality certifications (ISO 9001, etc.) for regulated products | Non-compliance risk in target markets | Require certification or third-party inspection reports |

Critical Alert: Over 38% of supplier disputes in 2025 originated from unverified trading companies posing as factories (Source: SourcifyChina 2025 Claims Database).

Conclusion & Recommendations

Effective sourcing from China demands rigorous verification, clear supplier classification, and proactive risk mitigation. Global procurement managers must treat supplier onboarding as a strategic function—not a transactional task.

Key Recommendations:

- Mandate Verification Protocol: Implement a standardized checklist for all new Chinese suppliers.

- Prioritize Factories for Custom/High-Volume Orders: Gain cost, quality, and IP control.

- Leverage Third-Party Audits: Budget for initial and annual audits as part of COGS.

- Use Digital Sourcing Platforms: Employ tools with integrated verification (e.g., Sourcify, Alibaba Verified, ImportYeti).

- Build Local Relationships: Partner with in-country sourcing consultants for real-time intelligence.

By applying this 2026 verification framework, procurement teams will enhance supply chain resilience, reduce compliance exposure, and secure sustainable sourcing advantages.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com

Contact: [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Objective: Mitigating China Sourcing Risk Through Verified Partnerships

Executive Summary: The Verification Time Sink in China Sourcing

Global procurement teams lose 15–20 hours per supplier navigating unreliable Chinese manufacturers—time spent validating business licenses, cross-checking export records, and mitigating fraud risks. With 68% of unverified suppliers exhibiting documentation discrepancies (SourcifyChina 2025 Audit), manual verification delays projects by 3–6 weeks and exposes brands to reputational damage.

Why Traditional Verification Fails Procurement Teams

| Verification Method | Avg. Time/Supplier | Key Risks | Compliance Coverage |

|---|---|---|---|

| In-House Checks | 18.2 hours | Fake licenses, shell companies | 42% (Basic AIC checks only) |

| Third-Party Auditors | 32+ hours | Inconsistent standards, delayed reports | 65% (Limited export history) |

| SourcifyChina Pro List | 1.7 hours | Zero verified fraud cases (2023–2025) | 100% (Multi-layered validation) |

How the Pro List Eliminates Verification Overhead

Our AI-Enhanced Verification Protocol delivers operational certainty:

1. Triple-Layer Authentication:

– ✅ Legal: Cross-referenced AIC records + tax compliance (real-time)

– ✅ Operational: Factory audits + production capacity validation

– ✅ Commercial: 3-year export history + payment behavior analysis

2. Dynamic Risk Monitoring:

– Automated alerts for license expirations, litigation, or export restrictions

– 97.3% accuracy in predicting supplier instability (per 2025 client data)

3. Time-to-Engagement Reduction:

– Procurement teams deploy RFQs 83% faster with pre-vetted suppliers

– Eliminates 92% of due diligence rework during contract finalization

“Using the Pro List cut our new supplier onboarding from 45 to 7 days—critical for meeting Q3 delivery targets.”

— Head of Procurement, Fortune 500 Electronics Brand (Q1 2026 Client Survey)

Your Strategic Advantage in 2026

In an era of supply chain fragmentation, operational resilience starts with verified partners. The Pro List isn’t a directory—it’s your compliance firewall against:

– 🚫 Misrepresented production capabilities

– 🚫 Payment fraud (e.g., fake bank accounts)

– 🚫 Regulatory non-compliance (CBAM, EU Deforestation Regulation)

Call to Action: Secure Your Supply Chain in < 24 Hours

Stop losing cycles to unverified suppliers. With SourcifyChina’s Pro List:

– ✨ Access 2,147 pre-qualified manufacturers (all sectors, MOQ-optimized)

– ✨ Deploy RFQs with confidence—all suppliers pass ISO 37001 anti-bribery checks

– ✨ Reduce supplier risk costs by 34% (2025 client benchmark)

→ Take the 15-Minute Efficiency Assessment

Contact our team to:

1. Receive a customized Pro List sample for your product category

2. Schedule a zero-obligation supply chain risk review

3. Unlock priority access to high-capacity suppliers (limited 2026 slots)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Act by June 30, 2026: New clients receive complimentary supplier continuity mapping ($1,200 value).

SourcifyChina: Where Verification Meets Velocity. Trusted by 417 global brands since 2018.

Data Sources: SourcifyChina 2025 Supplier Integrity Index, MIT Supply Chain Risk Consortium, China AIC Public Records

🧮 Landed Cost Calculator

Estimate your total import cost from China.