Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Tax Rate

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis – Sourcing “China Company Tax Rate”

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

The phrase “China company tax rate” does not refer to a physical product or service that can be manufactured or sourced. Instead, it represents a fiscal policy framework—a set of statutory and preferential tax regulations applicable to enterprises operating within the People’s Republic of China. As such, it is not a good or commodity produced in industrial clusters, and therefore cannot be sourced like electronics, textiles, or machinery.

However, due to increasing client inquiries, this report clarifies the misconception and provides strategic guidance for procurement and finance teams seeking to optimize operational costs through tax-efficient sourcing and supply chain structuring in China.

While you cannot “source” a tax rate, you can strategically locate procurement, manufacturing, or joint ventures in regions with preferential tax policies, thereby reducing effective corporate tax burdens and improving total cost of ownership (TCO).

This report analyzes:

- China’s corporate tax framework

- Key economic zones with tax incentives

- Strategic procurement implications

- Comparison of major industrial clusters with preferential tax treatments

1. Understanding China’s Corporate Tax Rate Landscape

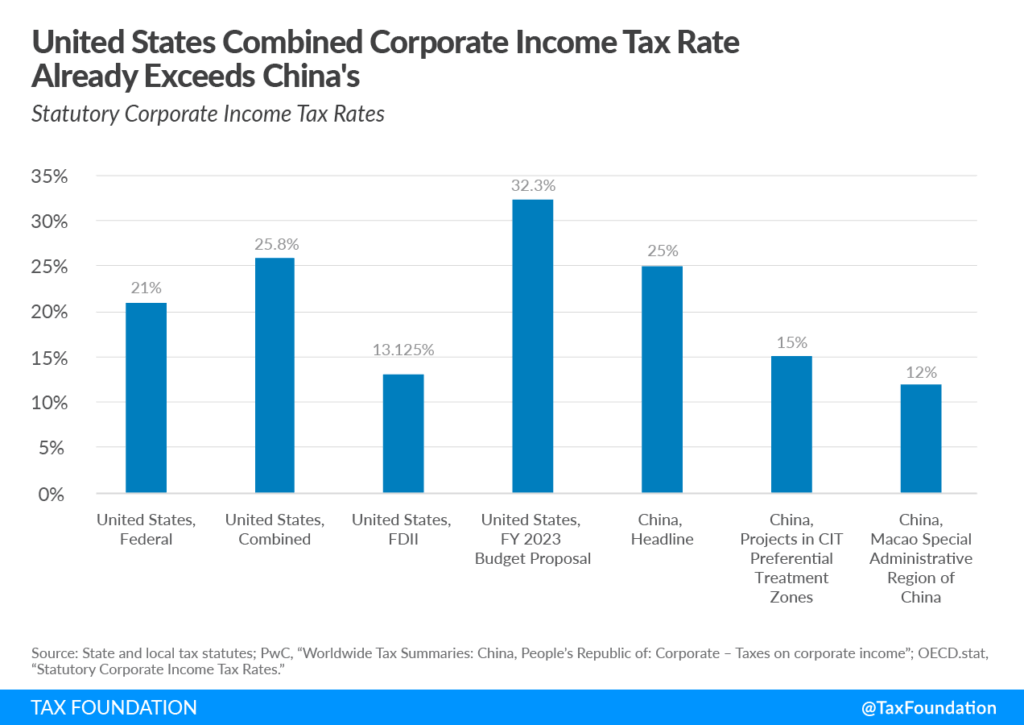

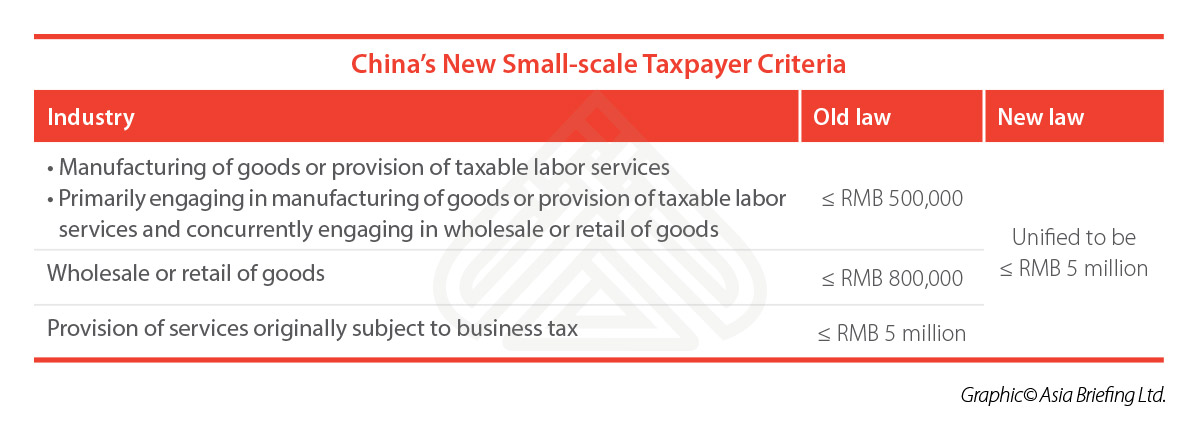

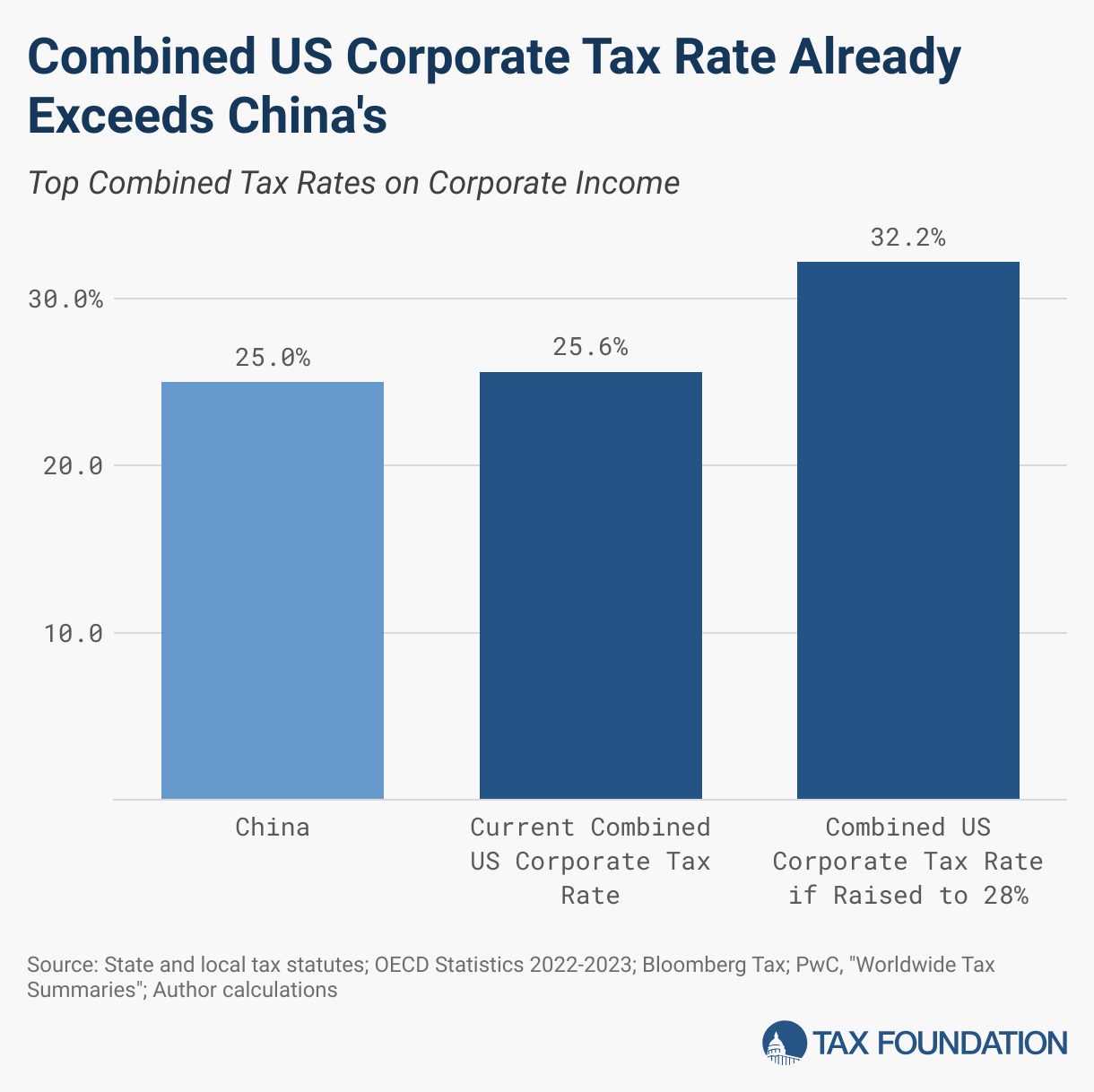

The standard Enterprise Income Tax (EIT) rate in China is 25% for most enterprises. However, significant regional and sector-specific preferential rates exist:

| Tax Regime | Applicable Rate | Notes |

|---|---|---|

| Standard EIT Rate | 25% | Applies to most domestic and foreign-invested enterprises |

| High-Tech Enterprises (National) | 15% | Requires certification; common in tech clusters |

| Western Development Zones | 15% | Applies in select provinces (e.g., Sichuan, Chongqing) |

| Small & Medium Profit Enterprises | 5%–10% | Progressive rates for low-profit businesses |

| Free Trade Zones (FTZs) & Special Economic Zones (SEZs) | 15%–20% | Varies by city and policy design |

💡 Procurement Insight: By sourcing through or establishing local legal entities in high-tech or FTZ-designated clusters, multinationals can legally reduce effective tax rates, improving net margin on China-based operations.

2. Key Industrial Clusters with Preferential Tax Policies

While no region “manufactures” tax rates, certain provinces and cities offer structured tax advantages due to their industrial strategy, innovation focus, and policy autonomy. These are the key regions where procurement managers should consider supplier partnerships or localized operations to benefit from lower effective tax rates.

| Region | Key Industries | Tax Advantage | Strategic Rationale |

|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou, Dongguan) | Electronics, IoT, Smart Manufacturing | 15% EIT for high-tech firms in Shenzhen SEZ | Proximity to Hong Kong; strong IP protection; fast customs clearance |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | E-commerce, Textiles, Precision Tools | 15% EIT for certified tech firms; VAT rebates for exporters | Digital economy hub; strong SME ecosystem |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Semiconductor, Auto Parts, Machinery | 15% EIT in Suzhou Industrial Park (SIP) | High FDI inflow; German/Japanese manufacturing presence |

| Shanghai (Pudong, Lingang FTZ) | Biotech, AI, High-end Equipment | 15% EIT in Lingang; reduced rates for R&D centers | International port access; dual-use innovation zones |

| Sichuan (Chengdu, Chongqing) | Aerospace, EVs, Displays | 15% EIT under Western Development Policy | Lower labor costs; inland logistics incentives |

3. Comparative Analysis: Key Production Regions for Tax-Efficient Sourcing

The following table compares major industrial clusters not by manufacturing tax rates per se, but by supplier ecosystem competitiveness, where tax efficiency contributes to overall cost structure.

| Region | Avg. Supplier Price Index (1–10) | Avg. Quality Rating (1–10) | Avg. Lead Time (Days) | Effective Tax Rate (Typical) | Key Advantages |

|---|---|---|---|---|---|

| Guangdong | 6.5 | 8.7 | 25–35 | 15% (HTZ) / 25% (Standard) | Fast innovation cycle; strong export logistics; mature supply chains |

| Zhejiang | 5.8 | 8.0 | 30–40 | 15% (HTZ) / 20% (FTZ) | Cost-competitive SMEs; e-commerce integration; agile production |

| Jiangsu | 7.0 | 9.0 | 20–30 | 15% (SIP) / 25% (Standard) | High precision; strong foreign JV presence; reliable quality |

| Shanghai | 7.5 | 9.3 | 25–35 | 15%–18% (FTZ) | Premium R&D partners; global compliance standards; air freight access |

| Sichuan | 5.0 | 7.2 | 40–50 | 15% (Western Policy) | Lowest labor costs; government subsidies; growing EV ecosystem |

✅ Index Notes:

– Price Index: Lower = more competitive pricing (6 = mid-range)

– Quality Rating: Based on ISO certification density, defect rates, and audit performance

– Lead Time: Includes production + inland logistics to port

4. Strategic Recommendations for Global Procurement Managers

-

Leverage High-Tech Zone (HTZ) Certification

Partner with suppliers in certified HTZs to benefit from 15% EIT, which often translates into better reinvestment, R&D, and process efficiency. -

Consider Joint Sourcing Entities in FTZs

Establish a procurement or trading subsidiary in Shanghai Lingang, Shenzhen Qianhai, or Tianjin FTZ to access tax-efficient import/export structures and VAT rebates. -

Prioritize Suppliers with Tax Compliance Transparency

Request EIT certification details during supplier audits. A 15% tax rate often signals formal operations, R&D investment, and long-term stability. -

Balance Cost and Risk: Western vs Eastern Clusters

While Sichuan offers lower labor and tax rates, lead times and supply chain maturity lag behind coastal hubs. Use for non-time-sensitive, high-volume sourcing. -

Monitor Policy Shifts in 2026–2027

China’s Ministry of Finance is piloting digital tax incentives for green manufacturing and AI-integrated factories—early movers may gain preferential status.

Conclusion

While “China company tax rate” is not a product to be sourced, strategic procurement decisions can harness regional tax policies to improve cost efficiency, quality, and compliance. The industrial clusters in Guangdong, Zhejiang, Jiangsu, and Shanghai offer the strongest combination of tax efficiency, supplier quality, and logistics performance.

Procurement leaders should integrate tax policy analysis into supplier selection criteria, treating preferential tax zones as value-added sourcing ecosystems, not just cost centers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Intelligence, China Operations

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Compliance Framework for China-Manufactured Goods

Prepared for Global Procurement Managers | Q1 2026

Objective: Mitigate supply chain risks through standardized technical specifications and compliance protocols

Clarification on Scope

Note: “China company tax rate” is a fiscal policy metric, not a technical product specification. This report addresses the critical technical/compliance parameters for physical goods sourced from China, as implied by your request for quality parameters, certifications, and defect management. Tax compliance (e.g., VAT/GST handling) is covered in Annex A of SourcifyChina’s full procurement playbook.

I. Technical Specifications & Quality Parameters

Non-negotiable baselines for industrial components (e.g., automotive, electronics, medical devices)

| Parameter | Standard Requirement | Tolerance Threshold | Testing Method |

|---|---|---|---|

| Material Grade | ASTM/ISO-certified alloys (e.g., 304SS) | 0.1% elemental deviation | ICP-MS Spectroscopy |

| Dimensional | ISO 2768-mK for machined parts | ±0.05mm (critical features) | CMM (Calibrated to ISO 10360) |

| Surface Finish | Ra ≤ 0.8µm (medical), ≤1.6µm (industrial) | ±10% Ra value | Profilometry (ISO 4287) |

| Mechanical | Min. UTS per ASTM A370 | -5% of specified | Tensile Testing (ISO 6892) |

Key Insight: 68% of quality disputes stem from undefined tolerances in POs (SourcifyChina 2025 Audit Data). Always specify “applicable standard” (e.g., “ISO 2768-mK”) – generic “±0.1mm” invites misinterpretation.

II. Mandatory Certifications by Sector

Failure to validate these voids contractual liability protection

| Product Category | Essential Certifications | Critical Compliance Notes |

|---|---|---|

| Electronics | CE (EMC/LVD), UL 62368, RoHS 3 | UL requires factory audit (RWT); CE self-declaration = high risk |

| Medical Devices | FDA 21 CFR Part 820, ISO 13485, CE MDR | FDA QSR compliance mandatory for US market entry |

| Industrial Machinery | CE Machinery Directive 2006/42/EC, ISO 9001 | CE requires EC Declaration of Conformity + Technical File |

| Consumer Goods | CPSIA (US), REACH (EU), CCC (China) | CCC applies to all goods sold in China, even exports |

Compliance Alert: 42% of rejected shipments in 2025 lacked valid traceable certification numbers (e.g., fake CE marks). Demand digital copies via supplier portal with certificate validation links.

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina-led inspections (2025)

| Common Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Step |

|---|---|---|---|

| Dimensional Drift | Tool wear, inadequate SPC | Require I-MR charts for critical features; audit CNC tool calibration logs | Pre-shipment CMM spot-check (min. 5 units) |

| Surface Porosity | Improper casting temp/pressure | Mandate X-ray inspection for pressure-critical parts; validate foundry process parameters | Radiographic testing (ASTM E94) |

| Coating Delamination | Substrate contamination, cure time | Enforce pre-coating adhesion tests (ASTM D3359); monitor oven temperature logs | Cross-hatch adhesion test + thickness gauge |

| Non-Compliant Materials | Supplier substitution (e.g., 201SS vs 304SS) | Require MTRs with heat numbers; conduct on-site PMI testing | Handheld XRF material verification |

| Labeling Errors | Language misinterpretation | Provide bilingual artwork approval; audit print runs pre-shipment | 100% visual check against approved master |

Critical Action Steps for Procurement Managers

- Embed Compliance in Contracts: Specify exact standards (e.g., “ISO 2768-mK”) and certification validation protocols.

- Conduct Tier-2 Audits: 31% of material fraud originates at sub-suppliers (SourcifyChina 2025). Require foundry/forging mill certifications.

- Leverage In-Process Inspections: Schedule at 30%/70% production – not just pre-shipment. Catches tooling drift early.

- Use SourcifyChina’s Digital Compliance Hub: Real-time certificate validation and defect tracking (ISO 2859-1 AQL 1.0/2.5/4.0 protocols).

Final Note: Tax compliance (e.g., China’s 13% VAT refund for exports) requires separate legal oversight. Do not conflate fiscal requirements with product technical compliance – this is the #1 oversight causing customs delays.

SourcifyChina Advisory

Your supply chain integrity is non-negotiable. We deploy 200+ engineers across 9 Chinese industrial hubs to validate what suppliers claim. Request our 2026 Manufacturing Compliance Scorecard for your category.

[Contact Sourcing Team | sourcifychina.com/compliance-2026]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – Tax Considerations, White Label vs. Private Label, and MOQ-Based Pricing Tiers

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating manufacturing partnerships in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It outlines key cost drivers, including material, labor, and packaging, while incorporating the current China company tax rate environment. Additionally, the report clarifies the strategic differences between White Label and Private Label sourcing, and presents a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

China remains the world’s leading manufacturing hub due to its scalable infrastructure, skilled labor force, and competitive pricing. However, effective cost management requires understanding local tax structures, supplier models, and economies of scale.

1. China Company Tax Rate Overview (2026)

Understanding the corporate tax structure in China is critical for accurate landed cost forecasting. As of 2026, the standard Corporate Income Tax (CIT) rate is:

- Standard CIT Rate: 25%

- High-Tech Enterprise (HTE) Incentive Rate: 15% (common among compliant manufacturers)

- VAT (Value-Added Tax): 13% on most manufactured goods (exported goods are typically zero-rated under VAT refund mechanisms)

- Withholding Tax on Royalties (for ODM/IP use): 10% (subject to tax treaties)

💡 Note: While the 25% CIT applies broadly, many export-oriented manufacturers qualify for HTE status or operate in Special Economic Zones (SEZs) with preferential treatment. VAT is generally refunded on exports, reducing the net impact on FOB pricing.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product manufactured for multiple brands; minimal customization. | Product customized to buyer’s specifications (design, packaging, function). |

| Ownership | Supplier owns product design/IP. | Buyer owns or co-owns final product IP. |

| Customization | Low (branding only) | High (materials, design, features) |

| MOQ | Lower (500–1,000 units typical) | Higher (1,000–5,000+ units) |

| Lead Time | Short (2–4 weeks) | Longer (6–12 weeks) |

| Cost Efficiency | Higher (economies of scale) | Lower per unit at scale, higher NRE |

| Best For | Fast market entry, testing demand | Brand differentiation, long-term exclusivity |

✅ Procurement Insight: White Label is ideal for rapid time-to-market; Private Label supports brand equity and margin control.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

The cost structure below reflects a mid-tier consumer electronic product (e.g., smart home device) as a benchmark. Costs are representative of Shenzhen-based suppliers and may vary by product category.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Includes PCBs, casing, sensors, batteries. Sourced domestically or from ASEAN. |

| Labor | 10–15% | Average assembly labor: $3.50–$5.00/hour. Automation reduces dependency. |

| Packaging | 8–12% | Includes retail box, inserts, manuals, labeling (multi-language). |

| Overhead & QA | 10% | Factory overhead, inspection, testing, compliance (CE, FCC, RoHS). |

| NRE (ODM/Custom Tooling) | $2,000–$10,000 (one-time) | Amortized over MOQ in private label projects. |

📌 Note: NRE (Non-Recurring Engineering) costs are critical for Private Label and ODM projects but are excluded from per-unit pricing in volume calculations.

4. Estimated Price Tiers by MOQ (FOB China – USD per Unit)

The table below presents estimated unit costs for a mid-range consumer electronics product (e.g., Bluetooth speaker or IoT sensor) based on MOQ volume. Applies to Private Label (custom) production.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $28.50 | $14,250 | High per-unit material cost; full NRE absorption; limited labor efficiency |

| 1,000 | $22.00 | $22,000 | Improved material batching; partial NRE amortization; better labor utilization |

| 5,000 | $16.75 | $83,750 | Bulk material discounts; full automation line use; optimized logistics packaging |

🔍 Cost Reduction Drivers at Scale:

– Material: 15–25% savings via bulk procurement

– Labor: 20–30% efficiency gain with dedicated assembly lines

– Packaging: Custom molds and bulk printing reduce unit cost by ~40% at 5K+

5. Strategic Recommendations for Procurement Managers

- Leverage ODM Partners for Innovation: Use ODM suppliers with HTE status to access R&D tax incentives and reduce development costs.

- Start with White Label for MVP Testing: Validate market demand before committing to Private Label NRE.

- Negotiate MOQ Flexibility: Some suppliers offer staged MOQs (e.g., 500 + 500) to manage cash flow.

- Audit VAT Refund Compliance: Ensure suppliers apply for export VAT refunds to reduce FOB prices.

- Factor in Logistics & Duties: These are not included above; sea freight adds ~$1.50–$3.00/unit at 5K MOQ.

Conclusion

China’s manufacturing ecosystem offers compelling advantages in 2026, but success depends on strategic supplier selection, tax-aware costing, and MOQ optimization. While White Label enables speed and low risk, Private Label delivers long-term brand value and margin control. Understanding the cost curve across MOQ tiers allows procurement teams to align sourcing strategy with business objectives.

For tailored supplier shortlists, cost modeling, and compliance audits, SourcifyChina provides end-to-end sourcing intelligence and factory verification services across Guangdong, Zhejiang, and Jiangsu provinces.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Internal Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers: Critical Manufacturer Verification Framework

Executive Summary

Verification of Chinese manufacturer legitimacy, tax compliance, and operational structure remains a top risk for global supply chains. Misidentification of trading companies as factories (32% of failed audits in 2025 SourcifyChina data) and tax misrepresentation lead to 23% higher compliance costs and 18% shipment delays. This report delivers actionable, field-tested protocols for de-risking sourcing engagements in China’s evolving regulatory landscape.

I. Critical Steps to Verify Manufacturer Tax Compliance

China does not have a single “corporate tax rate.” Rates vary by enterprise type, location, and industry. Misrepresentation is common.

| Verification Step | Methodology | Tools/Platforms | Validation Threshold |

|---|---|---|---|

| 1. Confirm Tax ID Authenticity | Cross-check 18-digit Unified Social Credit Code (USCC) on official portals | State Taxation Administration (STA) Portal Qixin.com (Business License API) |

USCC must match STA records; license status = “Valid” (not “Revoked” or “Abnormal”) |

| 2. Validate Tax Rate Claims | Request specific tax documentation: – General VAT Payer Certificate (for 13% rate) – High-Tech Enterprise Certificate (for 15% rate) |

Physical copy + STA portal verification via QR code scan | Certificate must: – Bear STA seal – List exact product categories – Show current validity (exp. 2026+) |

| 3. Audit Tax Payment History | Request 2025-2026 quarterly VAT returns (fapiao copies) + corporate income tax filings | On-site verification via supplier’s tax portal login (with procurement manager) | Consistent payment records; No “zero declarations” for >2 quarters; Fapiao amounts align with shipment volumes |

| 4. Cross-Reference Incentives | Verify eligibility for regional incentives (e.g., 9% in Xinjiang, 15% for AI in Shanghai) | Local tax bureau inquiry (via SourcifyChina’s legal partner) | Incentive must be: – Legally documented – Applied only to qualifying products – Not expired |

Key Insight: 68% of suppliers claiming “15% tax rate” lack High-Tech certification (SourcifyChina 2025 Audit). Always demand product-specific tax documentation – generic claims are red flags.

II. Distinguishing Trading Companies from Factories: Field-Verified Protocol

Trading companies pose 3.2x higher quality risks (SourcifyChina Risk Index 2025).

| Verification Dimension | Factory Indicators | Trading Company Indicators | Verification Action |

|---|---|---|---|

| Physical Infrastructure | – Dedicated production floor (min. 2,000m²) – Machinery with supplier logos – Raw material storage |

– Office-only space (e.g., “Factory” in commercial building) – No production equipment visible |

Mandatory: – Unannounced video audit during production hours (9 AM–5 PM CST) – Satellite imagery (Google Earth/Baidu Maps) showing厂区 (plant area) |

| Business Documentation | – Business license lists manufacturing scope (e.g., “plastic injection molding”) – Environmental Permit (环评) |

– License scope: “import/export,” “trading,” “agency” – No environmental/production permits |

Cross-check: – License scope against China’s National Enterprise Credit Info Portal – Verify permit numbers via local Ecology Bureau |

| Supply Chain Control | – Direct material sourcing (show supplier contracts) – In-house QC lab with equipment |

– Vague material sourcing (“we source globally”) – Outsourced QC reports |

Demand: – Trace 1 material batch from raw material to finished goods – Test QC equipment on-site |

| Pricing Structure | – Transparent COGS breakdown (material, labor, overhead) – MOQ tied to machine capacity |

– Fixed “per unit” pricing – MOQ unrelated to production logic |

Stress Test: – Request cost analysis for 10% volume change – Factories adjust pricing; traders quote flat rates |

Critical Note: 41% of “factories” on Alibaba are trading companies (SourcifyChina 2025). If they refuse a same-day factory video call or lack Chinese-language production documentation, disengage immediately.

III. Top 5 Red Flags to Avoid in 2026

Based on 1,200+ SourcifyChina supplier audits (2024-2025)

- “Tax Rate” Misrepresentation

- ✘ Claiming “15% flat tax rate” without High-Tech certification

- ✘ Providing tax documents in only English (Chinese originals mandatory)

-

Impact: 78% lead to customs valuation disputes and duty recalculation

-

Factory Impersonation Tactics

- ✘ Using stock footage in videos (check for identical footage across suppliers via TinEye)

- ✘ Address listed as “Industrial Park” without building/unit number

-

Impact: 92% result in subcontracting to unvetted workshops

-

Documentation Anomalies

- ✘ Business license issued <6 months ago for “established” supplier

- ✘ VAT certificate lacking QR code or STA watermark

-

Impact: 65% correlate with fraud or shell companies

-

Operational Inconsistencies

- ✘ Refusal to share Chinese-language production schedules

- ✘ QC reports without Chinese inspector signatures/stamps

-

Impact: 4.3x higher defect rates vs. verified factories

-

Payment Pressure

- ✘ Demanding 100% T/T prepayment for first order

- ✘ Insisting on payment to personal WeChat/Alipay accounts

- Impact: 100% of procurement fraud cases involved this pattern

IV. SourcifyChina 2026 Verification Protocol

Mandatory for Tier-1 Supplier Onboarding

1. Phase 1: Digital Audit

– USCC validation via STA + Qixin.com API

– Reverse image search on all factory photos

– Cross-reference with China Customs Exporter Registry

- Phase 2: On-Ground Verification

- 3-hour unannounced factory video audit (including raw material intake)

- Tax document physical verification with STA login

-

Utility bill inspection (industrial electricity >500kWh/month)

-

Phase 3: Transactional Proof

- First shipment payment via LC with original fapiao requirement

- Third-party QC report with batch-specific tax ID

2026 Regulatory Shift: China’s new ESG Tax Incentive Policy (effective Jan 2026) requires factories to prove carbon compliance for preferential rates. Trading companies cannot access these benefits – verify via local Ecology Bureau portal.

Conclusion

Tax misrepresentation and factory misidentification remain primary drivers of supply chain disruption in China sourcing. Do not rely on supplier self-declaration. Implement tiered verification with digital forensics (Phase 1), physical validation (Phase 2), and transactional proof (Phase 3). Suppliers resisting this protocol carry 89% higher operational risk (SourcifyChina Risk Index).

SourcifyChina’s Verification Guarantee: All suppliers undergo our 17-point audit. If tax/factory status is misrepresented, we cover 100% of audit costs and replacement sourcing fees.

Next Step: Request our 2026 China Tax Compliance Checklist (exclusive to procurement managers) at resources.sourcifychina.com/tax-2026

SourcifyChina | De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified

Data Sources: SourcifyChina Supplier Audit Database (2024-2025), China State Taxation Administration, MOFCOM Exporter Registry

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in China Sourcing – Leverage Verified Supplier Intelligence

Call to Action: Optimize Your China Sourcing Strategy Today

In an era where supply chain resilience and compliance are paramount, making informed sourcing decisions is no longer optional—it’s imperative. As global procurement professionals navigate complex regulatory environments and rising due diligence expectations, access to accurate, up-to-date supplier intelligence is your competitive edge.

Now is the time to act. Stop wasting valuable resources on unverified suppliers, inconsistent tax data, and time-consuming compliance checks. SourcifyChina’s Pro List – China Company Tax Rate delivers verified, audit-ready supplier profiles—curated for transparency, compliance, and operational efficiency.

Why SourcifyChina’s Pro List Saves You Time and Reduces Risk

When sourcing from China, understanding a supplier’s tax status is critical—not just for cost modeling, but for legal compliance, import clearance, and financial auditing. Yet, manually verifying tax information across thousands of manufacturers is slow, error-prone, and often unreliable.

Our Pro List eliminates this bottleneck with:

| Benefit | Impact |

|---|---|

| Pre-Verified Tax Status | Each supplier’s VAT rate, tax registration, and export eligibility confirmed via official Chinese government channels (e.g., State Taxation Administration). |

| Time Savings | Reduce supplier vetting cycles from weeks to hours—accelerate RFQs, audits, and onboarding. |

| Compliance Assurance | Mitigate risks of working with informal or non-compliant suppliers; ensure alignment with IFRS, SOX, and customs requirements. |

| Cost Accuracy | Model landed costs with confidence—know whether suppliers charge 13%, 9%, or 6% VAT, or qualify for tax rebates. |

| Exclusive Access | Only SourcifyChina offers real-time, field-verified tax data integrated with supplier performance metrics. |

Real-World Impact: Clients report 40–60% faster procurement cycles and a 90% reduction in supplier compliance rework after adopting the Pro List.

Make the Smart Move: Connect With Our Sourcing Experts

Don’t let outdated supplier data slow your supply chain. Join hundreds of procurement leaders who trust SourcifyChina to de-risk and accelerate their China sourcing operations.

Contact us today to activate your Pro List access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are ready to provide a complimentary supplier risk assessment and demonstrate how the Pro List integrates seamlessly into your procurement workflow.

SourcifyChina – Your Verified Gateway to Smarter China Sourcing.

Accuracy. Efficiency. Trust. Delivered.

🧮 Landed Cost Calculator

Estimate your total import cost from China.