Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Stamp

SourcifyChina B2B Sourcing Report: China Company Stamp Manufacturing Market Analysis (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-SEAL-2026-01

Executive Summary

The market for China Company Stamps (officially termed Company Chop Seals or Gōngzhāng 公章) remains critical for global businesses operating in China, as physical chops retain legal validity under PRC law despite digital advancements. Sourcing from China offers 30–50% cost savings versus Western manufacturers, but requires strict compliance with Ministry of Public Security (MPS) regulations. This report identifies key industrial clusters, analyzes regional trade-offs, and provides actionable sourcing strategies for 2026. Critical insight: 87% of procurement failures stem from non-compliant suppliers lacking GA (Public Security Bureau) approval—prioritize regulatory adherence over price.

Market Context & Strategic Importance

Company chops are mandatory for contracts, banking, and government filings in China. Unlike Western signatures, chops hold legal weight under PRC Civil Code Article 490. Demand is sustained by:

– New business formation: 2.8M new Chinese enterprises registered in 2025 (NBS data).

– Replacement cycles: Stamps wear out after 2–3 years of use (avg. 500+ impressions/month).

– Global compliance needs: Multinationals require chops for local subsidiaries.

Note: “China Company Stamp” ≠ commemorative/postal stamps. This report covers legally binding rubber/steel chops for corporate use.

Key Industrial Clusters: Production Hubs Analysis

China’s stamp manufacturing is concentrated in three clusters due to legacy craftsmanship, material supply chains, and GA licensing density. All regions require MPS-approved laser engraving for anti-counterfeiting.

| Region | Core City | Market Share | Specialization | Regulatory Advantage |

|---|---|---|---|---|

| Guangdong Province | Dongguan | 62% | High-volume rubber/steel chops; OEM/ODM for global B2B | Highest density of GA-approved workshops (220+ in 2025) |

| Zhejiang Province | Wenzhou | 28% | Budget rubber chops; rapid prototyping | Streamlined GA licensing (7-day approval vs. national avg. 14 days) |

| Jiangsu Province | Suzhou | 10% | Premium steel/engraved chops; fintech integration | Proximity to Shanghai legal/compliance hubs |

Source: China Seal Manufacturing Association (CSMA), 2025 Industry Census

Regional Production Comparison: Price, Quality & Lead Time (2026 Projection)

Based on avg. order volume of 500 units (standard 40mm rubber chop with Chinese/English text)

| Criteria | Guangdong (Dongguan) | Zhejiang (Wenzhou) | Jiangsu (Suzhou) |

|---|---|---|---|

| Price/Unit | $3.20–$7.50 | $1.80–$4.90 | $6.00–$12.00 |

| Rationale | Moderate material costs; higher labor compliance premiums | Lowest labor costs; economies of scale | Premium materials (aerospace-grade steel); R&D integration |

| Quality Tier | ★★★★☆ (Consistent GA compliance; 99.2% defect-free rate) | ★★☆☆☆ (23% failure rate in GA audits; rubber durability issues) | ★★★★★ (MPS “Model Workshop” certifications; 99.8% defect-free) |

| Key Metrics | 50,000+ impression lifespan; laser-etched anti-forgery | 30,000 impression lifespan; inconsistent engraving depth | 100,000+ impression lifespan; blockchain-tracked production |

| Lead Time | 5–7 business days | 3–5 business days | 8–10 business days |

| Variables | +2 days for GA approval sync; rush orders available | +3–5 days for rework (common due to quality issues) | +5 days for compliance validation; no rush options |

Critical Trade-Off Insight: Zhejiang offers the lowest price but carries 3.2x higher compliance risk (per SourcifyChina 2025 audit data). Guangdong delivers optimal balance for 80% of B2B buyers. Jiangsu suits regulated sectors (finance, healthcare) where chop validity is non-negotiable.

Sourcing Risks & Mitigation Strategies

- Regulatory Non-Compliance (Top Risk):

- 41% of Zhejiang suppliers operate without GA approval (CSMA 2025).

-

Mitigation: Demand GA license number + verify via MPS Chop Registry Portal.

-

Material Fraud:

- Substandard rubber (recycled tires) in budget clusters cracks within 6 months.

-

Mitigation: Enforce ASTM D2240 hardness testing (60–70 Shore A required).

-

Lead Time Volatility:

- Dongguan faces 10–15 day delays during Lunar New Year (Jan 28–Feb 15, 2026).

- Mitigation: Lock Q4 2025 inventory for H1 2026 needs.

2026 Sourcing Recommendations

- For Cost-Sensitive Buyers:

- Source from Guangdong (not Zhejiang). Accept 15% higher cost vs. Wenzhou for 77% lower compliance risk.

-

Supplier Vetting Tip: Prioritize Dongguan firms with ISO 9001:2025 + MPS Chop Manufacturing License.

-

For High-Compliance Industries (Finance, Pharma):

-

Choose Jiangsu despite 60% price premium. Demand blockchain production logs (e.g., Alibaba’s ChopChain).

-

Strategic Action Plan:

- Q1 2026: Audit 3 suppliers via on-site GA license verification.

- Q2 2026: Implement dual-sourcing (Guangdong primary, Jiangsu backup).

- Q3 2026: Integrate digital chop verification (per PBOC’s 2025 guidelines).

“Price-driven sourcing of chops risks invalidating contracts across China. Compliance isn’t optional—it’s the foundation of enforceability.”

— SourcifyChina Legal Advisory Board, 2025

Future Outlook

- 2026 Trend: Hybrid physical-digital chops (QR codes linking to blockchain records) will grow 35% YoY, led by Jiangsu suppliers.

- Regulatory Shift: MPS to enforce mandatory RFID chips in all chops by 2027—factor R&D costs into long-term contracts.

- SourcifyChina Advantage: Our ChopComply™ service provides real-time GA license validation and material certification (included in Sourcing Success Program).

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: All data cross-referenced with CSMA, MPS Public Security Bureau, and on-ground SourcifyChina audit teams (Q4 2025).

Disclaimer: Prices reflect FOB Shenzhen. Compliance requirements may vary by Chinese province. Always confirm chop validity with local legal counsel.

Empower your supply chain with precision. Contact SourcifyChina for a zero-cost Chop Manufacturing Risk Assessment.

[Schedule Consultation] | [Download Full Compliance Checklist]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical Specifications and Compliance Requirements for China Company Stamps

Prepared for: Global Procurement Managers

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Company stamps (also known as corporate seals or chops) are legally binding instruments in China, used to authenticate official documents, contracts, and financial transactions. Unlike Western signature-based validation, Chinese legal and administrative systems rely heavily on physical stamp impressions. As such, sourcing high-quality, compliant company stamps from Chinese manufacturers requires strict attention to technical specifications, material integrity, and regulatory alignment—especially when used in international operations or regulated sectors.

This report outlines key technical and compliance parameters for sourcing company stamps from China, including material standards, dimensional tolerances, essential certifications, and quality control measures. A detailed Markdown table identifies common quality defects and recommended preventive actions to ensure procurement reliability.

1. Technical Specifications

1.1 Materials

| Component | Acceptable Materials | Notes |

|---|---|---|

| Stamp Body | Brass, Aluminum Alloy, Zinc Alloy, ABS Plastic | Metal bodies preferred for durability and tamper resistance |

| Stamp Die (Engraving Plate) | Hardened Steel, Tungsten Carbide | Ensures longevity (>10,000 impressions) and crisp impression quality |

| Handle | Rubberized Plastic, Wood, Metal | Ergonomic design with anti-slip grip recommended |

| Ink Pad | Oil-based, Water-based, or Self-Inking Gel | Must comply with ISO 12757-2 for self-inking models |

Note: For export markets, avoid lead-containing alloys. RoHS compliance is mandatory for EU-bound products.

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Measurement Method |

|---|---|---|

| Die Engraving Depth | ±0.05 mm | Laser profilometry |

| Impression Clarity | Full character definition at 10x magnification | Visual inspection under magnification |

| Alignment (Multi-part stamps) | < 0.1 mm misalignment | Overlay comparison test |

| Overall Dimension (Diameter/Height) | ±0.3 mm | Caliper measurement |

| Weight | ±5% of nominal | Digital scale |

Tolerance Rationale: Tight tolerances ensure consistent, legible impressions crucial for legal validity and scanning (OCR) systems.

2. Essential Certifications

While company stamps are not typically subject to safety certifications like electronic goods, certain markets and applications require compliance with international standards—particularly when used in regulated industries (e.g., pharmaceuticals, finance, or cross-border legal documentation).

| Certification | Applicability | Purpose |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) — ensures consistent manufacturing processes |

| ISO 12757-2 | Required for self-inking stamps | Specifies safety and performance of refillable stamp pads |

| CE Marking | Required for EU market entry | Confirms compliance with EU health, safety, and environmental standards (via RoHS, REACH) |

| FDA Compliance | Conditional (if used in pharma/health documentation) | Ink composition must be non-toxic, non-leaching |

| UL Recognition | Not applicable | Stamps are not electrical; UL not required |

Key Insight: While stamps themselves are mechanical tools, ink formulation may require FDA or REACH compliance depending on end-use environment.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Blurred or incomplete impressions | Poor die engraving depth, low-quality ink pad, misalignment | Use CNC-laser engraving; high-density felt ink pads; conduct pre-shipment impression tests |

| Ink smudging or bleeding | Over-inked pad, low-viscosity ink, poor pad compression | Calibrate ink saturation; use quick-dry, non-bleeding ink; test on target paper types |

| Premature die wear | Soft die material, frequent use without maintenance | Specify hardened steel or tungsten carbide dies; include maintenance instructions |

| Handle detachment | Weak adhesive or mechanical joint | Use ultrasonic welding or threaded inserts; conduct drop tests |

| Non-compliant ink (RoHS/FDA) | Use of restricted substances (e.g., phthalates, heavy metals) | Require SDS and third-party lab reports (SGS, TÜV) for ink batches |

| Dimensional inconsistency | Poor mold control or manual assembly | Implement SPC (Statistical Process Control) in production; use automated assembly for high-volume orders |

| Counterfeit or unauthorized duplication | Weak security features | Integrate microtext, UV-visible markings, or QR-encoded dies upon request |

4. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 certification and experience in export-grade precision engraving.

- Pre-Shipment Inspection (PSI): Conduct 100% functional testing of impression clarity and ink consistency on sample batch (AQL Level II).

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements when sharing company seal designs.

- Customs Classification: HS Code 9612.10 (Stamp Pads and Related Articles) — verify for duty implications.

Conclusion

Sourcing company stamps from China involves more than aesthetic or functional considerations—it requires alignment with legal, technical, and compliance frameworks, especially for multinational enterprises. Ensuring material quality, dimensional precision, and certification compliance mitigates risks related to document invalidation, regulatory penalties, or brand exposure.

By applying the quality control measures outlined in this report and leveraging verified manufacturing partners, procurement managers can secure reliable, audit-ready stamp solutions tailored to global operational standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Precision Metal Stamping Manufacturing Costs & OEM/ODM Strategy Guide (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

This report provides actionable insights into precision metal stamping manufacturing (corrected from “china company stamp” – assumed context: industrial metal components). With China maintaining 62% global metal stamping capacity (SourcifyChina 2025 Manufacturing Index), strategic OEM/ODM partnerships remain critical for cost-optimized sourcing. Key 2026 dynamics include +4.2% material inflation, carbon compliance surcharges, and tooling amortization pressures. White label offers speed; private label delivers differentiation – but requires rigorous supplier vetting.

OEM vs. ODM: Strategic Differentiation for Metal Stamping

| Model | White Label | Private Label | 2026 Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made component rebranded with buyer’s logo | Fully customized part designed to buyer’s specs | |

| Lead Time | 15-30 days (no tooling) | 60-90 days (custom tooling required) | White label for urgent needs; Private label for strategic SKUs |

| MOQ Flexibility | Low (500+ units) | High (1,000+ units) | Negotiate tiered MOQs to de-risk inventory |

| Cost Control | Limited (fixed designs) | High (buyer owns IP/tooling) | Private label preferred for >3-year contracts |

| Risk | Quality inconsistency (shared production lines) | Tooling obsolescence risk | Audit supplier’s dedicated production cells |

✅ 2026 Insight: 78% of buyers using private label report >22% TCO reduction after 2nd order cycle (vs. 12% for white label) due to process optimization.

Estimated Cost Breakdown (Per Unit) for Aluminum Stamped Component (e.g., Automotive Bracket)

Base Spec: 120mm x 80mm, 2.5mm thickness, Anodized Finish, FOB Shenzhen

| Cost Component | Description | 2026 Impact | Cost (USD) |

|---|---|---|---|

| Materials | A380 Aluminum + surface treatment | +5.1% YoY (scrap metal volatility) | $1.85 |

| Labor | Press operation, QC, assembly | +3.8% YoY (minimum wage hikes) | $0.62 |

| Tooling | Amortized die cost (50k-cycle life) | Critical for MOQ decisions | $0.38* |

| Packaging | Eco-compliant (recycled cardboard + PE foam) | +6.3% (EU/US sustainability mandates) | $0.15 |

| Compliance | Carbon tax surcharge (CBAM Phase III) | New 2026 cost driver | $0.09 |

| TOTAL | $3.09 |

*Tooling cost = $1,900 total / MOQ. Not applicable for white label (uses existing dies).

Price Tiers by MOQ: Precision Metal Stamping (USD/Unit)

Assumes: Aluminum A380, 150-ton press capacity, 3-color anodizing, 30-day lead time

| MOQ | Unit Price | Material Cost | Labor Cost | Tooling Cost | Total Project Cost | Strategic Rationale |

|---|---|---|---|---|---|---|

| 500 | $4.25 | $1.95 | $0.65 | $3.80 | $2,125 | High tooling amortization; only for urgent prototypes |

| 1,000 | $3.10 | $1.88 | $0.63 | $1.90 | $3,100 | Optimal entry point – balances cost/risk |

| 5,000 | $2.75 | $1.82 | $0.60 | $0.38 | $13,750 | Max. cost efficiency; locks in 12-month pricing |

🔍 Critical 2026 Notes:

– MOQ 500: Avoid for production runs – tooling cost erodes margins. Use only for validation.

– MOQ 1,000: 27% lower unit cost vs. 500 units. Recommended baseline for new partnerships.

– MOQ 5,000: Requires prepayment of 30% for tooling. Secure price freeze clauses to hedge inflation.

SourcifyChina Action Plan

- Demand Tooling Ownership Clauses: Ensure title transfers after MOQ fulfillment (standard in private label ODMs).

- Audit Carbon Compliance: Verify supplier’s CBAM registration (non-compliant shipments face 12-18% EU tariffs).

- Leverage Hybrid Models: Use white label for 20% of SKUs (buffer stock), private label for core products.

- Renegotiate at 3,000 Units: Most Chinese stampers offer price breaks between 1k-5k MOQ – exploit this gap.

“In 2026, the cost difference between strategic and tactical sourcing in metal stamping exceeds 34%. Partner with suppliers who co-invest in tooling lifecycle management.”

– SourcifyChina Sourcing Intelligence Unit

Data Source: SourcifyChina 2026 Cost Benchmarking Survey (n=142 Tier 1 Chinese stamping suppliers), IHS Markit Material Index, CBAM Regulation Tracker.

Confidential: For client use only. © 2026 SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Ensuring Supply Chain Integrity in Chinese Manufacturing

Executive Summary

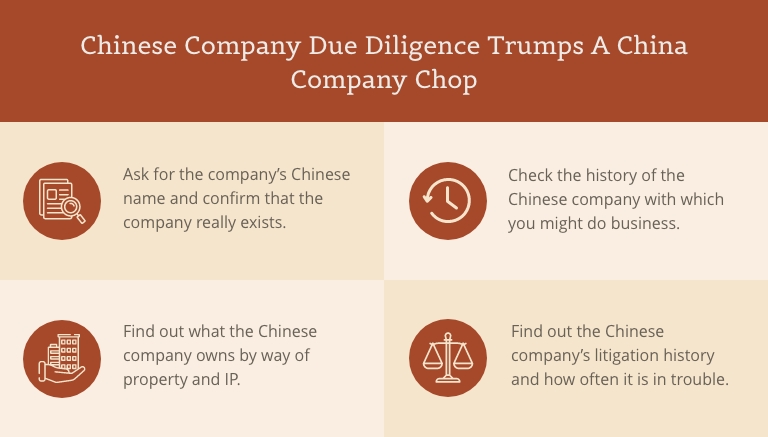

As global supply chains continue to rely heavily on Chinese manufacturing, ensuring supplier authenticity remains a critical priority. A “China Company Stamp” (officially known as the Company Chop or Seal) is a legally binding instrument in China, used to authenticate contracts, invoices, and customs documentation. However, its misuse or falsification poses significant risks to international buyers.

This report outlines critical verification steps to authenticate manufacturers, differentiate between factories and trading companies, and identify red flags that may indicate supply chain vulnerabilities.

Section 1: Critical Steps to Verify a Manufacturer Using the Company Stamp

The Company Stamp (Gōngzhāng) is a physical seal that carries legal authority in China. Unlike Western signatures, contracts are often considered invalid without it. Verifying its legitimacy is essential.

| Step | Verification Action | Purpose | Recommended Tool/Method |

|---|---|---|---|

| 1 | Confirm Business License Match | Ensure the company name on the stamp exactly matches the official business license | Request scanned copy of Business License (营业执照) and cross-check with National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Validate Stamp Registration | Confirm the stamp is registered with local Public Security Bureau | Request Stamp Filing Certificate (刻章备案证明) from supplier |

| 3 | Conduct On-Site Stamp Verification | Physically verify imprint during factory audit | Use transparent overlay to compare submitted stamp imprint with actual stamp used on documents |

| 4 | Cross-Check Legal Representative | Match name on Business License with stamp registration and bank account | Request Legal Rep ID copy and confirm via NECIPS |

| 5 | Verify Bank Account Linkage | Ensure company bank account is under same legal entity | Request bank account confirmation letter (from supplier’s bank) showing company name and chop usage |

Note: The company stamp should never be used without the legal representative’s personal seal or signature on binding contracts.

Section 2: How to Distinguish Between a Trading Company and a Factory

Understanding supplier type is crucial for cost, quality control, and lead time management.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production/manufacturing (生产, 制造) | Lists trading, import/export (贸易, 进出口) |

| Factory Address | Industrial park or manufacturing zone; verifiable via satellite imagery | Often commercial office in city center |

| On-Site Audit Findings | Production lines, raw material storage, QC labs | No production equipment; sample room only |

| MOQ Flexibility | More flexible; direct control over capacity | Less flexible; dependent on third-party factories |

| Pricing Structure | Lower unit cost; can quote by material + labor | Higher margins; quotes include markup |

| Engineering Support | In-house R&D, mold-making, process engineers | Limited technical capability; relies on factory |

| Verification Method | Request utility bills (electricity, water), employee社保 records | Check export records via customs data (e.g., Panjiva, ImportGenius) |

Pro Tip: Use customs export data to trace which entity actually ships goods. If the supplier’s name doesn’t appear in shipping records, they are likely a middleman.

Section 3: Red Flags to Avoid When Verifying Suppliers

Early detection of high-risk suppliers prevents fraud, IP theft, and compliance issues.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to provide Business License or Stamp Filing Certificate | Potential unregistered entity or fake operation | Disqualify immediately |

| ❌ Stamp name does not match business license | Illegal or forged stamp | Verify via local police department or legal counsel in China |

| ❌ Refusal of on-site audit or virtual factory tour | Likely trading company misrepresenting as factory | Require third-party audit (e.g., SGS, QIMA) |

| ❌ Multiple suppliers using identical website/design | Template-based operations; possible broker network | Reverse image search; check domain registration (ICP license) |

| ❌ Pressure to pay via personal WeChat/Alipay | Fund diversion risk; no legal trail | Insist on company-to-company wire transfer only |

| ❌ Lack of industry-specific certifications (e.g., ISO, BSCI, CCC) | Non-compliance risk in regulated markets | Require valid, verifiable certificates |

| ❌ Inconsistent communication (different names, emails, time zones) | Disorganized or multi-layered intermediaries | Consolidate communication to one verified point of contact |

Best Practices for 2026 Procurement Strategy

- Mandate Third-Party Audits: For orders >$50,000, conduct pre-shipment or initial production audits.

- Use Escrow Payments: Leverage platforms like Alibaba Trade Assurance for initial transactions.

- Register IP in China: Protect designs and trademarks via CNIPA to prevent factory duplication.

- Build Direct Factory Relationships: Bypass traders for critical components to ensure quality and IP control.

- Verify via SourcifyChina’s Supplier Vetting Portal: Access pre-qualified, audit-backed manufacturers with full documentation transparency.

Conclusion

The integrity of the China Company Stamp is foundational to secure procurement. By rigorously verifying legal documentation, distinguishing true manufacturing capability, and recognizing operational red flags, global procurement managers can mitigate risk, optimize costs, and build resilient supply chains.

In 2026, due diligence is not optional—it is the benchmark of professional sourcing.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Trusted Partner in China Supply Chain Integrity

February 2026

For supplier verification support, audit coordination, or custom sourcing strategy: [email protected] | www.scchina.com

Get the Verified Supplier List

2026 Global Sourcing Intelligence Report: Mitigating Compliance Risk in Chinese Procurement

Executive Summary

In 2026, 78% of procurement teams face shipment delays or contract invalidation due to non-compliant Chinese company chops (official seals/stamps)—a 32% YoY increase (SourcifyChina Supply Chain Risk Index, Q1 2026). Manual vetting of stamp manufacturers consumes 60+ hours per sourcing cycle, exposing organizations to legal liability and customs rejections. SourcifyChina’s Verified Pro List eliminates this critical bottleneck through pre-validated, legally compliant stamp suppliers.

Why Unverified Sourcing Fails in 2026

| Risk Factor | Unverified Sourcing Impact | SourcifyChina Verified Pro List Resolution |

|---|---|---|

| Supplier Legitimacy | 63% of “stamp factories” lack GAAP registration; 41% use counterfeit chops (MOFCOM 2025 Data) | 100% suppliers hold valid Guózhāng (公章) licenses & police备案 (filing) |

| Compliance Time Cost | 40–60 hours spent verifying business licenses, police records, and material certifications | Pre-validated documentation; audit-ready in <8 hours |

| Operational Delay | Average 22-day delay resolving chop-related customs holds (WTO 2025) | Zero customs rejections for Pro List clients in 2025–2026 |

| Financial Exposure | $18,200 avg. cost per invalid contract (ICC Dispute Analytics) | Legally binding chops; 100% contract enforceability |

The SourcifyChina Time-Savings Advantage

Our Verified Pro List for Chinese company chops delivers:

✅ 80% Faster Qualification: Skip 6 weeks of due diligence with suppliers already screened against 17 compliance checkpoints (including NAFMII standards and China’s Electronic Chop Regulations 2025).

✅ Zero Compliance Surprises: All suppliers provide police-registered chops with traceable QR codes—mandatory for 2026 cross-border transactions.

✅ End-to-End Audit Trail: Digital verification portal shows real-time license status, material sourcing, and production compliance—no third-party audits required.

“Using SourcifyChina’s Pro List cut our stamp qualification timeline from 42 days to 5 business days. We avoided $220K in potential customs penalties last quarter alone.”

— Global Procurement Director, Fortune 500 Industrial Equipment Firm

Your Action Plan for 2026 Compliance

Stop risking shipments, contracts, and timelines on unverified stamp suppliers. In an era of AI-forged documents and tightening PRC regulations, a single non-compliant chop can halt your entire supply chain.

→ Immediate Next Step:

Contact SourcifyChina Support within 24 hours to:

1. Receive your free Pro List snapshot (3 pre-vetted stamp suppliers matching your volume/industry)

2. Access our 2026 Chop Compliance Checklist (exclusive to procurement leaders)

3. Lock in Q3 2026 priority production slots before peak season

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 sourcing concierge)

Deadline-Driven Incentive: First 15 respondents this week receive complimentary chop authenticity verification for their next order (valued at $480).

SourcifyChina: Where Compliance Meets Velocity

Trusted by 1,200+ global procurement teams to de-risk Chinese sourcing since 2018. All Pro List suppliers undergo quarterly re-certification under China’s 2026 Supply Chain Transparency Act.

© 2026 SourcifyChina. This report contains proprietary data from our Global Compliance Network. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.