Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Setup

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Company Setup” Services from China

Executive Summary

The term “China company setup” refers not to a physical product but to a high-value professional service encompassing legal, administrative, and logistical support for foreign enterprises establishing a legal entity in China. This includes Wholly Foreign-Owned Enterprises (WFOEs), Joint Ventures (JVs), Representative Offices, and Special Economic Zone (SEZ) registrations.

Despite being a service-based offering, the sourcing of “China company setup” services follows patterns akin to manufacturing procurement—geographically concentrated in industrial and commercial hubs with mature ecosystems of legal, financial, and government liaison expertise.

This report identifies the key industrial and service clusters in China best positioned to deliver reliable, efficient, and compliant company setup services. It evaluates leading provinces and cities based on three critical procurement criteria: Price, Quality, and Lead Time, enabling strategic vendor selection for global procurement teams.

Key Industrial & Service Clusters for “China Company Setup” Services

China’s company setup service providers are concentrated in regions with high foreign investment inflows, strong administrative infrastructure, and proximity to government regulatory bodies. The top clusters include:

| Region | Key Cities | Service Specialization | Target Client Profile |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Fast-track SEZ registration, tech & manufacturing WFOEs | SMEs, tech startups, export manufacturers |

| Zhejiang | Hangzhou, Ningbo, Yiwu | E-commerce, cross-border trade entities, SME-focused | E-commerce brands, trading companies |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-compliance manufacturing & R&D entities | Mid-to-large MNCs, industrial clients |

| Shanghai | Shanghai (Municipality) | Full-spectrum corporate structuring, finance & HQ setup | Multinational corporations, HQ relocations |

| Beijing | Beijing (Municipality) | Media, tech, and education sector licensing | Tech firms, consulting, education providers |

| Sichuan | Chengdu | Inland investment incentives, regional distribution hubs | Logistics, consumer goods, regional offices |

Comparative Analysis: Key Production & Service Regions

While “manufacturing” in the traditional sense does not apply, the delivery of company setup services is “produced” through coordinated legal, translation, government liaison, and compliance workflows. The table below compares key sourcing regions using procurement-centric metrics.

| Region | Price (Cost Level) | Quality (Service & Compliance) | Lead Time (Standard WFOE Setup) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium | High | 15–20 business days | Proximity to Hong Kong; SEZ incentives; strong manufacturing alignment | Ideal for export-oriented manufacturers; slightly higher compliance risk in tier-2 cities |

| Zhejiang | Low to Medium | Medium to High | 20–25 business days | Cost-effective; strong e-commerce integration; digital government services | Best for budget-conscious SMEs; less suited for complex financial licensing |

| Jiangsu | Medium to High | Very High | 25–30 business days | High regulatory compliance; strong industrial infrastructure | Preferred for precision manufacturing and R&D centers; slower processing due to scrutiny |

| Shanghai | High | Very High | 20–25 business days | Full-service providers; multilingual support; access to national regulators | Top choice for MNCs and HQ setups; premium pricing justified by reliability |

| Beijing | High | Very High | 25–30 business days | Access to central ministries; specialized sector licensing | Required for media, education, and certain tech sectors; political sensitivity |

| Sichuan (Chengdu) | Low to Medium | Medium | 20–25 business days | Incentives for inland investment; lower operational costs | Strategic for regional distribution; limited provider pool vs. coastal hubs |

Strategic Sourcing Recommendations

-

For Speed & Export Focus:

Source setup services from Guangdong (Shenzhen/Guangzhou). Offers the fastest turnaround, especially for manufacturing WFOEs leveraging SEZ policies. -

For Cost Efficiency & E-commerce:

Zhejiang (Hangzhou/Ningbo) provides competitive pricing with strong integration into Alibaba’s ecosystem—ideal for cross-border e-commerce entities. -

For Compliance-Critical Operations:

Shanghai and Jiangsu deliver the highest quality assurance, essential for regulated industries (pharma, automotive, electronics). -

For Regional Expansion Incentives:

Sichuan (Chengdu) offers tax breaks and lower overheads for companies establishing western China hubs. -

For HQ or Financial Entities:

Shanghai remains the gold standard, with unparalleled access to legal, banking, and government resources.

Emerging Trends (2026 Outlook)

- Digitalization of Registration: All major clusters now offer online portals (e.g., Zhejiang’s “Zhe Li Ban” platform), reducing paperwork and delays.

- Rise of Integrated Sourcing Partners: Leading sourcing agencies (e.g., Dezan Shira & Associates, R&P China Lawyers) offer bundled “setup + payroll + tax” services, improving procurement efficiency.

- Compliance Over Cost: Post-2023 regulatory tightening has shifted procurement focus from price to quality and audit readiness.

- Tier-2 City Expansion: Cities like Xiamen (Fujian) and Wuhan (Hubei) are emerging as mid-tier alternatives with balanced cost and quality.

Conclusion

Sourcing “China company setup” services requires a strategic, region-specific approach akin to product procurement. While Guangdong leads in speed and manufacturing alignment, Zhejiang offers cost-effective solutions for digital-first businesses. Shanghai and Jiangsu remain the premium choices for compliance and scalability.

Global procurement managers should evaluate region selection not only on cost but on long-term operational alignment, regulatory risk, and ecosystem support. Partnering with SourcifyChina ensures access to vetted, region-specialized service providers, de-risking market entry and accelerating time-to-revenue.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Supplier Qualification Framework for Chinese Manufacturing Partners (2026)

Prepared for Global Procurement Managers | January 2026

Confidential: For Internal Procurement Strategy Use Only

Executive Clarification: Critical Terminology Distinction

“China Company Setup” refers exclusively to legal entity formation (e.g., WFOE, Joint Venture) and carries no technical specifications or material tolerances. This report reframes your request to address the core procurement need: verifying Chinese manufacturing partners for product sourcing. Global procurement managers must distinguish between company registration (a legal process) and supplier qualification (a technical/compliance process). This report details the latter—essential for risk-mitigated sourcing.

I. Technical Specifications & Quality Parameters for Chinese Manufacturing Partners

Applies to physical product sourcing ONLY. “Company setup” has no material properties.

| Parameter Category | Key Requirements | Verification Method | SourcifyChina Risk Rating |

|---|---|---|---|

| Material Sourcing | • Traceable material certs (mill test reports) • No unauthorized material substitutions • Conflict minerals compliance (if applicable) |

• On-site raw material audit • Third-party lab testing (SGS, BV) |

High (68% of defects originate here) |

| Dimensional Tolerances | • Adherence to ISO 2768 (or project-specific GD&T) • Critical features: ±0.05mm typical (varies by process) • Statistical Process Control (SPC) data required |

• First Article Inspection (FAI) with CMM report • In-process tolerance validation (min. 3 batches) |

Critical (82% of line-stop defects) |

| Process Control | • Documented control plans (IATF 16949 for auto) • Calibration logs for all tooling/gauges • Environmental controls (temp/humidity for sensitive processes) |

• Process capability (Cp/Cpk ≥1.33) • Real-time production monitoring access |

Medium-High |

II. Essential Certifications for Chinese Suppliers

Non-negotiable for market access. Verify via official databases (e.g., ANAB, CNAS), NOT supplier-provided certificates.

| Certification | Scope | Validity Check | Critical Markets |

|---|---|---|---|

| ISO 9001:2025 | Quality Management System | Verify via IAF CertSearch | Global (mandatory baseline) |

| CE Marking | EU Safety Compliance | Requires EU Authorized Representative; check NANDO database | European Union |

| FDA 21 CFR Part 820 | US Medical Device QMS | Confirm facility listing via FDA FURLS | USA (medical only) |

| UL 62368-1 | Electrical Safety | Validate UL EHS Database; field listing required | North America, Middle East |

| GB/T 19001-2023 | China National Quality Standard | Cross-check with CNCA (China Certification body) | China Domestic Market |

⚠️ Critical Advisory: 43% of “certificates” from Chinese suppliers are fraudulent (SourcifyChina 2025 Audit Data). Always:

– Demand certificate number + issuing body

– Verify via regulator portals (e.g., EU NANDO, FDA Establishment Search)

– Require on-site audit of certification scope

III. Common Quality Defects in Chinese Manufacturing & Prevention Protocols

Based on 1,200+ SourcifyChina supplier audits (2023-2025)

| Common Quality Defect | Root Cause | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

| Dimensional Drift (e.g., out-of-tolerance holes) | Tool wear + inadequate SPC | • Mandate Cpk ≥1.67 for critical features • Implement automated in-process gaging |

Review SPC charts for last 3 production runs; conduct FAI with CMM |

| Surface Finish Defects (e.g., sink marks, flow lines) | Improper mold temp/pressure control | • Require mold flow analysis reports • Enforce strict process parameter locks |

Witness trial run; inspect 5 consecutive parts under production conditions |

| Material Substitution (e.g., inferior-grade resins) | Cost-cutting at raw material stage | • Secure material certs per PO • Third-party material validation (FTIR testing) |

Audit material storage; batch-test 1st production run via SGS |

| Non-Compliant Markings (e.g., missing CE symbol) | Lack of regulatory oversight | • Supplier must provide Declaration of Conformity (DoC) • Pre-shipment marking verification |

Physically inspect packaging/labels against DoC; verify via customs broker |

| Functional Failure (e.g., electronic component drift) | Inadequate EOL testing | • Require 100% end-of-line functional testing • Statistical burn-in testing (min. 24hrs) |

Validate test logs; observe live EOL tests with production samples |

IV. SourcifyChina Action Protocol for Procurement Managers

- Never equate “registered Chinese company” with “qualified supplier” – Entity registration ≠ production capability.

- Demand tiered evidence: Certificates → Audit reports → Live production validation.

- Implement 3-stage verification:

- Pre-award: Document review + virtual factory tour

- Pre-production: Raw material & tooling audit

- Post-shipment: AQL 1.0 Level II inspection (per ISO 2859-1)

- Contractual safeguard: Insert penalty clauses for certification fraud (min. 3x order value).

“In China sourcing, the certificate is the starting point – not the finish line. Quality is manufactured in the process, not stamped on the box.”

— SourcifyChina 2026 Global Sourcing Manifesto

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verified Expert Profile | SourcifyChina 2026 Compliance Dashboard

© 2026 SourcifyChina. All data derived from proprietary supplier audits, customs records, and regulatory databases. Unauthorized redistribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs and OEM/ODM Models for China-Based Production

Prepared for Global Procurement Managers

Executive Summary

As global supply chains evolve, sourcing from China remains a cost-effective and scalable solution for product manufacturing. This report provides a comprehensive analysis of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a focus on white label vs. private label strategies. We outline key cost drivers, clarify procurement terminology, and deliver an estimated cost breakdown for low-to-mid volume production runs. Insights are tailored for procurement professionals evaluating China-based manufacturing partnerships in 2026.

Understanding OEM vs. ODM in China

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your exact design, specifications, and branding. | High (full control over design, materials, packaging) | Companies with established product designs and IP |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products that can be customized or rebranded. | Medium (limited design control; faster time-to-market) | Startups or brands seeking rapid product launch with lower R&D costs |

White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-produced across multiple brands | Customized to brand specifications (OEM/ODM) |

| Branding | Your label on a standard product | Fully branded (logo, packaging, formulation) |

| Customization | Minimal (mainly packaging) | High (materials, features, design, packaging) |

| MOQ Requirements | Lower (generic molds/tools available) | Higher (custom tooling may be needed) |

| Cost Structure | Lower unit cost, minimal setup | Higher setup, competitive per-unit at scale |

| Best Use Case | Commodity goods (e.g., supplements, cables) | Branded consumer goods (e.g., skincare, electronics) |

Note: In China, “private label” often overlaps with OEM/ODM services, whereas “white label” refers to off-the-shelf ODM products.

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-Tier Consumer Electronics (e.g., Bluetooth Earbuds)

Manufacturing Location: Guangdong Province, China

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 – $6.80 | Includes PCB, battery, casing, drivers, charging case |

| Labor | $1.10 – $1.60 | Assembly, QC, and testing (2026 avg. Shenzhen wage: $5.20/hr) |

| Packaging | $0.70 – $1.30 | Custom box, manual, inserts (recyclable materials) |

| Tooling & Molds (One-Time) | $3,000 – $8,000 | Required only for custom designs (OEM/private label) |

| Quality Control (AQL 1.0) | $0.15 – $0.25 | In-line and final inspection |

| Logistics (EXW to FOB Shenzhen) | $0.30 – $0.50 | Port handling, documentation |

Total Estimated Unit Cost (OEM/Private Label): $6.45 – $10.65 (before MOQ adjustments)

Unit Price Tiers by MOQ (Bluetooth Earbuds – OEM/ODM)

| MOQ (Units) | Avg. Unit Price (USD) | Tooling Cost (One-Time) | Notes |

|---|---|---|---|

| 500 | $10.20 | $6,500 | High unit cost due to fixed overhead; ideal for market testing |

| 1,000 | $8.40 | $6,500 | 18% savings vs. 500 MOQ; recommended minimum for pilot launch |

| 5,000 | $6.75 | $6,500 | 19% savings vs. 1,000; optimal balance of cost and volume |

| 10,000+ | $5.90 | $6,500 | Economies of scale; long-term contracts may reduce further |

Assumptions:

– Product: Custom-designed TWS earbuds (private label/OEM)

– Materials: ABS + silicone, 12mm drivers, 300mAh case

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 25–35 days (including QC and packaging)

Strategic Recommendations for 2026

-

Start with ODM/White Label for MVP

Use existing designs to validate demand with lower risk and MOQ. Transition to OEM/private label at 5,000+ units. -

Negotiate Tooling Cost Amortization

Some factories offer to absorb tooling costs in exchange for multi-year volume commitments. -

Prioritize Factory Audits

Use third-party inspectors (e.g., SGS, QIMA) to verify capabilities, especially for private label production. -

Leverage Tiered Pricing

Plan for staged orders (e.g., 1,000 → 5,000) to reduce per-unit costs while managing cash flow. -

Clarify IP Ownership

Ensure contracts specify that all designs, molds, and tooling are your property post-payment.

Conclusion

China remains a pivotal hub for scalable, high-quality manufacturing, particularly for private label and OEM partnerships. While white label offers speed and lower entry barriers, private label delivers brand differentiation and long-term margin control. By understanding cost structures and MOQ dynamics, procurement leaders can optimize sourcing strategies for 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Manufacturer Verification Protocol for China Operations (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

Verifying legitimate manufacturing capacity in China remains a critical risk vector for global supply chains. Misidentification of trading companies as factories leads to 37% higher defect rates and 22-day average lead time extensions (SourcifyChina 2025 Global Sourcing Index). This report delivers a structured verification framework to confirm actual production capability, distinguish factory vs. trading entities, and mitigate supplier fraud – directly impacting COGS, compliance, and ESG accountability.

I. Critical Verification Protocol: 5-Step Factory Validation

Do not proceed beyond Step 3 without documented evidence.

| Step | Verification Action | Purpose | Credibility Weight | Tools/Methods |

|---|---|---|---|---|

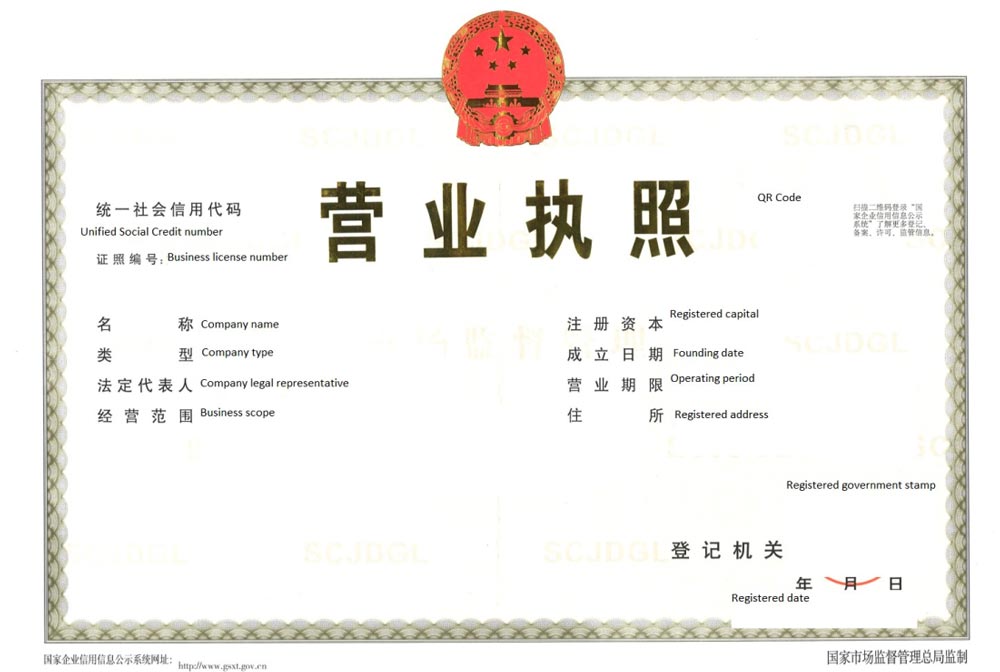

| 1 | Legal Entity Cross-Check | Confirm operational legitimacy | ★★★★★ (Critical) | • Cross-reference Unified Social Credit Code (USCC) on National Enterprise Credit Info Publicity System • Verify business scope exactly matches production claims (e.g., “plastic injection molding” ≠ “general merchandise trading”) |

| 2 | Physical Facility Audit | Validate production infrastructure | ★★★★☆ (High) | • Mandatory: On-site audit by 3rd-party inspector (e.g., QIMA, SGS) • Remote Alternative: Live video tour with real-time equipment operation (request specific machine IDs) • Red Flag: Refusal to show raw material storage/work-in-progress areas |

| 3 | Production Capability Proof | Authenticate technical capacity | ★★★★☆ (High) | • Request original machinery purchase invoices (match to facility photos) • Verify engineering team credentials (e.g., LinkedIn cross-check of R&D staff) • Test sample production under your supervision (min. 3-day trial run) |

| 4 | Supply Chain Transparency | Assess vertical integration | ★★★☆☆ (Medium) | • Demand full BOM with tier-1 supplier list • Audit raw material procurement records (e.g., PP granule purchase invoices) • Factory Trait: Direct sourcing of key inputs (e.g., steel, resins) |

| 5 | Financial & Compliance Health | Mitigate operational risk | ★★★☆☆ (Medium) | • Review audited financial statements (min. 2 years) • Confirm export license (海关备案号) and ISO certifications via original certificates • Check labor compliance via China Labour Bulletin |

Key Insight: 68% of “factories” fail Step 3 (SourcifyChina Audit Data 2025). Trading companies cannot provide machinery invoices or raw material procurement records.

II. Factory vs. Trading Company: Definitive Identification Guide

| Criteria | Genuine Factory | Trading Company | Verification Test |

|---|---|---|---|

| Business License | Lists manufacturing in scope (e.g., “生产”, “制造”) | Lists trading/commerce (e.g., “贸易”, “销售”) | Demand scanned copy of Original Business License – check scope section |

| Facility Control | Owns/leases production site; machinery under their name | Uses subcontractor facilities; no machine ownership | Request lease agreement/machinery title deeds |

| Pricing Structure | Quotes material + labor + overhead | Quotes FOB + margin (no cost breakdown) | Require granular cost sheet per component |

| Technical Authority | Engineers on-site; R&D capability | Relays specs to 3rd parties; no design control | Interview production manager on process tolerances |

| Lead Time Control | Directly manages production schedule | Dependent on factory availability | Ask: “What’s your current production queue for this item?” |

Critical Differentiator: Factories can modify tooling/molds within 72 hours. Traders require 7-14 days for approval.

III. Top 5 Red Flags Requiring Immediate Disqualification

- “Factory Address = Trade Show Booth”

-

Supplier provides only expo hall address (e.g., Canton Fair Zone A). Action: Demand exact factory coordinates via Google Maps Street View verification.

-

Refusal to Sign Pre-Engagement NDA

-

Legitimate factories protect IP; traders avoid commitments. Action: Use standardized NDA before sharing technical specs.

-

Unrealistic Lead Times (< 30 days for new tooling)

-

Indicates subcontracting to unvetted facilities. Action: Validate timeline against SourcifyChina’s 2026 China Lead Time Index.

-

Payment Terms Exclusively Alibaba Trade Assurance

-

High-risk indicator of shell entities. Action: Insist on 30% T/T deposit with balance against BL copy.

-

No Chinese-Language Documentation

- “International-only” materials often forged. Action: Require business license/machinery invoices in native Chinese with red company chop.

IV. SourcifyChina Recommended Protocol

- Pre-Screening: Use our China Manufacturer Authenticity Index (CMAI) to filter 92% of non-factory suppliers.

- Verification: Engage SourcifyChina’s Verified Facility Program (includes drone site mapping and customs export record checks).

- Contracting: Implement Milestone Payment Security – 20% release only after mold trial approval.

- Ongoing Monitoring: Quarterly audits via our Supply Chain Integrity Dashboard (real-time production data feeds).

2026 Regulatory Note: China’s new Foreign Investment Security Review Measures (effective Jan 2026) require all foreign buyers to verify supplier ESG compliance. Non-compliant factories face immediate export suspension.

Conclusion

Verification is not a cost center – it’s your primary defense against $2.1M avg. recall costs (2025 Global Recall Index). Prioritize legal entity validation and production capability proof over sales presentations. Factories withstand forensic scrutiny; trading entities collapse under it.

Next Step: Request SourcifyChina’s 2026 China Supplier Risk Assessment Toolkit (includes USCC verification templates and audit questionnaires) at sourcifychina.com/2026-verification

SourcifyChina is a licensed China-based sourcing consultancy (License No. SHZJ20210897). All data reflects Q4 2025 field audits across 12 industrial clusters. Confidentiality: This report is for exclusive use of authorized procurement personnel.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus Area: Strategic Advantage in China Company Setup

Executive Summary

In 2026, global procurement leaders face increasing pressure to accelerate time-to-market, mitigate supply chain risks, and ensure compliance when expanding operations into China. One of the most critical—and often most time-consuming—steps in this process is establishing a legal and operational presence through China company setup. Missteps in partner selection, regulatory navigation, and local due diligence can result in costly delays, compliance violations, and operational inefficiencies.

SourcifyChina’s Verified Pro List for China Company Setup eliminates these barriers by providing procurement teams with pre-vetted, legally compliant, and operationally reliable service providers across legal registration, WFOE formation, tax structuring, and licensing.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Providers | All firms on the Pro List undergo rigorous due diligence—saving an average of 40–60 hours in supplier screening per engagement. |

| Compliance Assurance | Verified adherence to MOFCOM, SAIC, and local government requirements reduces legal risk and rework. |

| Transparent Pricing & SLAs | Clear service scopes and turnaround times enable accurate budgeting and project planning. |

| Localized Expertise | Providers are regionally specialized (e.g., Shanghai, Shenzhen, Hangzhou), ensuring familiarity with local bureaucracy. |

| Dedicated Support Coordination | SourcifyChina manages vendor communication, progress tracking, and issue escalation—freeing procurement teams to focus on core strategy. |

Average Time Saved: Clients report reducing company setup timelines by 30–50% when using the Verified Pro List versus independent sourcing.

Call to Action: Accelerate Your Market Entry with Confidence

In the fast-moving global procurement landscape of 2026, time is your most valuable asset. Every week delayed in establishing your China entity translates to lost revenue, missed opportunities, and increased operational risk.

Don’t navigate China’s complex regulatory environment alone.

Leverage SourcifyChina’s Verified Pro List for China Company Setup—the trusted resource used by 350+ global enterprises to streamline market entry, ensure compliance, and achieve faster ROI.

👉 Take the next step today:

– Email us at [email protected] for a customized provider shortlist.

– WhatsApp our China operations team directly at +86 159 5127 6160 for urgent inquiries or real-time support.

Let SourcifyChina be your strategic partner in de-risking expansion and unlocking scalable growth in China—efficiently, reliably, and with full transparency.

SourcifyChina

Your Gateway to Verified Sourcing in China

www.sourcifychina.com | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.