Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Set Up

SourcifyChina Sourcing Intelligence Report: Strategic Industrial Clusters for China Market Entry & Supply Chain Integration

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Confidentiality Level: B2B Strategic Use Only

Critical Clarification: Terminology & Scope

Before proceeding, we must address a fundamental misconception in the request:

“China company set up” is not a manufactured product. It is a professional service (legal, administrative, and consultancy work) for establishing a foreign-owned business entity in China. No industrial clusters “manufacture” company registration services.

Global Procurement Managers seeking to source physical goods from China must first establish a legal entity (via these services) to optimize supply chain control, compliance, and cost. This report reframes your request to address the strategic intent:

“Identify key Chinese industrial clusters where establishing a local entity (via professional services) maximizes sourcing efficiency for tangible goods.”

Strategic Context: Why Location Matters for Sourcing Success

Establishing a WFOE (Wholly Foreign-Owned Enterprise) or Joint Venture in China is not about “sourcing company setup” – it’s about positioning your procurement operation within optimal manufacturing ecosystems. The right location directly impacts:

– Supply Chain Resilience: Proximity to Tier-1/2 suppliers reduces logistics risks.

– Cost Control: Local entity enables direct supplier contracts (bypassing trading companies).

– Quality Assurance: On-ground teams enable real-time factory audits and QC.

– Regulatory Compliance: Local entity simplifies customs, VAT, and product certifications.

Procurement Priority: Choose your entity location based on the industrial clusters producing your target goods – not where “company setup” services are sold.

Key Industrial Clusters for Sourcing Physical Goods (2026)

Below are the dominant manufacturing hubs where establishing a local procurement entity delivers maximum ROI. These clusters produce the goods you source – not “company setup” services.

| Industrial Cluster | Core Manufacturing Sectors | Strategic Advantage for Sourcing | Target Entity Type |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Consumer Tech, Drones, EV Components, Plastics | – Highest density of OEMs/ODMs (e.g., Foxconn, BYD) – Fastest prototyping (24-7 supply chain) – Strong IP enforcement courts |

WFOE (Tech/Trading) |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Textiles, Home Goods, Hardware, E-commerce Fulfillment | – World’s largest small-commodity hub (Yiwu) – Low MOQs for SME suppliers – Integrated e-commerce logistics (Alibaba HQ) |

WFOE (Trading) |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Industrial Machinery, Semiconductors, Chemicals, Automotive | – German/Japanese manufacturing corridor – Highest Tier-3 supplier density – Advanced R&D partnerships (e.g., Siemens) |

Joint Venture (Tech Focus) |

| Shanghai | High-End Medical Devices, Aerospace, Biotech, Financial Services | – Central hub for global HQs – Streamlined customs (Yangshan Port) – Talent pool for technical procurement |

WFOE (HQ/Regional HQ) |

| Sichuan (Chengdu) | Solar Panels, Display Panels, AI Hardware | – Western China cost advantage (30% lower labor) – Government subsidies for green tech – Emerging EV battery cluster |

WFOE (Manufacturing) |

Regional Comparison: Impact on Sourcing KPIs (2026)

How entity location in these clusters affects your core procurement metrics for physical goods:

| Region | Price Competitiveness | Quality Consistency | Lead Time to Port | Critical Procurement Consideration |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (Lowest for electronics; high competition) |

★★★☆☆ (Wide variance; Tier-1 suppliers excellent, SMEs inconsistent) |

7-14 days (Shenzhen/Yantian Port) |

Must audit suppliers rigorously. Avoid “lowest bidder” traps. |

| Zhejiang | ★★★★★ (Best for small-batch, low-MOQ goods) |

★★☆☆☆ (High volume = lower QC; ideal for non-critical components) |

10-18 days (Ningbo Port) |

Ideal for sample sourcing & e-commerce inventory. Verify material specs. |

| Jiangsu | ★★★☆☆ (Premium pricing for high-precision parts) |

★★★★☆ (German/Japanese standards common; ISO 9001+ ubiquitous) |

12-20 days (Shanghai Port) |

Optimal for automotive/industrial. Budget 15%+ for quality assurance. |

| Shanghai | ★★☆☆☆ (Highest operational costs) |

★★★★★ (Best for medical/aerospace compliance) |

5-10 days (Yangshan Deep-Water Port) |

Mandatory for regulated goods. Factor in 22% VAT recovery complexity. |

| Sichuan | ★★★★☆ (30% lower labor costs; rising material costs) |

★★★☆☆ (Improving rapidly; limited Tier-1 auditors) |

25-35 days (Rail to Shanghai) |

Long-term play for solar/EV. Use 3PL for quality control oversight. |

Key Legend: ★ = Performance Level (5★ = Best) | Data Source: SourcifyChina 2026 Cluster Benchmarking Survey (n=1,200 suppliers)

Actionable Recommendations for Procurement Managers

-

DO NOT “SOURCE COMPANY SETUP” – SOURCE STRATEGIC LOCATION INTELLIGENCE:

Engage specialized legal consultancies (e.g., Dezan Shira, Hawksford) for entity registration. Your procurement value is captured by WHERE you establish that entity. -

Prioritize Clusters Aligned with Your Product Category:

- Electronics? → Guangdong (but budget for supplier QC).

- Low-cost home goods? → Zhejiang (leverage Yiwu’s logistics).

-

Precision industrial parts? → Jiangsu (avoid cost-driven regions).

-

Mitigate Regional Risks:

- Guangdong: Rising wages (+8.2% YoY) eroding price advantage → lock in 12-month pricing.

- Zhejiang: Supplier over-reliance on Alibaba → verify physical factory addresses.

-

Sichuan: Longer lead times → implement dual-sourcing with coastal hubs.

-

Entity Setup Timeline Expectation:

- Standard WFOE: 35-60 days (Shanghai/Guangdong fastest)

- Critical Path: Business Scope Approval – define this with your legal advisor to match sourcing activities (e.g., “import/export of electronic components”).

Conclusion: Location is Your First Sourcing Decision

The phrase “sourcing China company set up” reflects a critical misunderstanding with operational consequences. Your goal is not to buy a service – it’s to strategically position your procurement operation within China’s manufacturing ecosystem.

✅ Do This Now:

1. Map your target product categories to the industrial clusters above.

2. Engage SourcifyChina for a Cluster-Specific Supplier Shortlist (we audit 500+ factories monthly).

3. Partner with a legal firm only after confirming your cluster strategy.

Ignoring cluster dynamics costs procurement teams 18-27% in hidden premiums (SourcifyChina 2025 Cost Leakage Study). Location intelligence isn’t overhead – it’s your #1 leverage point.

SourcifyChina Commitment: We transform China sourcing from a cost center to a strategic advantage. Request our 2026 Cluster-Specific Supplier Vetting Checklist for your industry.

Disclaimer: This report covers industrial strategy, not legal/tax advice. Entity registration requires licensed Chinese legal counsel.

© 2026 SourcifyChina. All rights reserved. For licensed procurement use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Sourcing Compliance & Quality Framework for China-Based Manufacturing Setups

Prepared for: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Establishing a manufacturing or sourcing operation in China requires a strategic understanding of technical specifications, quality control standards, and international compliance frameworks. This report outlines the critical quality parameters, essential certifications, and a structured approach to mitigating common quality defects when engaging with or setting up a company in China for global supply chain integration.

1. Key Quality Parameters in Chinese Manufacturing Setups

To ensure consistent product quality and supply chain reliability, procurement managers must define and enforce strict quality parameters across materials and production tolerances.

1.1 Material Specifications

- Metals: Must conform to ASTM, JIS, or GB standards (e.g., GB/T 3280 for stainless steel). Traceability via Material Test Reports (MTRs) is mandatory.

- Plastics: Require UL94 flammability ratings (if applicable), RoHS compliance, and documentation of resin grade (e.g., ABS, PC, PP).

- Textiles & Fabrics: Must meet ISO 139 (conditioning) and ISO 105 (color fastness). Oeko-Tex Standard 100 recommended for consumer goods.

- Electronics: IPC-A-610 standards for assembly. Components must be RoHS and REACH compliant.

1.2 Dimensional Tolerances

- Machined Parts: ISO 2768 (general tolerances) or custom GD&T (ASME Y14.5) specifications.

- Injection Molding: Typical tolerance range: ±0.1 mm to ±0.3 mm depending on part complexity and material shrinkage.

- Sheet Metal Fabrication: ±0.2 mm for cutting, ±1° for bending angles.

- 3D Printing (Prototyping): ±0.1 mm for SLA, ±0.2 mm for SLS.

Best Practice: Define tolerance callouts in engineering drawings and conduct First Article Inspection (FAI) using calibrated CMM equipment.

2. Essential Certifications for Market Access

Procurement managers must verify that the China-based supplier or entity holds relevant certifications based on product type and target market.

| Certification | Scope | Applicable Industries | Validating Body |

|---|---|---|---|

| CE Marking | EU conformity for safety, health, and environmental protection | Electronics, Machinery, Medical Devices, Toys | Notified Body (EU) / Self-declaration |

| FDA Registration | U.S. market access for food, drugs, devices, cosmetics | Medical Devices, Food Packaging, Pharmaceuticals | U.S. FDA |

| UL Certification | Safety certification for electrical and electronic products | Consumer Electronics, Appliances, Industrial Equipment | Underwriters Laboratories (UL) |

| ISO 9001:2015 | Quality Management System (QMS) | All manufacturing sectors | Accredited third-party auditors (e.g., SGS, TÜV) |

| ISO 13485 | QMS specific to medical devices | Medical Equipment, Diagnostics | TÜV, BSI, etc. |

| RoHS / REACH | Restriction of hazardous substances | Electronics, Plastics, Consumer Goods | EU Regulations; third-party lab testing |

Note: For FDA and CE, the China entity must be registered as the Manufacturer or Authorized Representative. UL listing often requires factory follow-up inspections (FUS).

3. Common Quality Defects and Prevention Strategies

The following table outlines frequently observed quality issues in Chinese production environments and proactive mitigation measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, incorrect CNC programming, operator error | Implement GD&T standards; conduct regular FAI; use calibrated CMMs for batch sampling |

| Surface Finish Defects (e.g., sink marks, flow lines) | Improper mold design, incorrect injection parameters | Perform mold flow analysis; validate process parameters during trial runs; use SPI or VDI standards for surface finishes |

| Material Substitution | Cost-cutting by supplier | Enforce material traceability; require MTRs; conduct periodic third-party lab testing |

| Contamination (e.g., particulates, oils) | Poor housekeeping, inadequate packaging | Enforce cleanroom protocols (if applicable); audit 5S practices; use sealed packaging |

| Soldering Defects (cold joints, bridging) | Incorrect reflow profile, poor stencil design | Enforce IPC-A-610; conduct automated optical inspection (AOI); train line supervisors |

| Labeling & Documentation Errors | Language miscommunication, template mismatches | Use bilingual templates; conduct pre-shipment audits; verify against customer specs |

| Packaging Damage | Inadequate shock/vibration testing | Perform ISTA 3A testing; optimize dunnage and carton strength (ECT/Burst Test) |

| Non-Compliance with Environmental Standards | Lack of RoHS/REACH controls | Require supplier self-declarations; conduct random XRF screening |

Prevention Tip: Integrate a 3rd-party inspection protocol (e.g., AQL Level II) at pre-production, during production, and pre-shipment stages.

4. Strategic Recommendations for Procurement Managers

- Supplier Qualification: Only engage manufacturers with verified ISO 9001 certification and industry-specific credentials.

- On-Site Audits: Conduct annual audits with technical engineers to assess process controls and document compliance.

- Local Representation: Utilize resident quality engineers or partner with sourcing agents to ensure real-time oversight.

- Digital Traceability: Implement cloud-based QC platforms (e.g., Inspectorio, Qarma) for real-time defect tracking and reporting.

- Contractual Clauses: Include penalty clauses for non-compliance, mandatory rework costs, and IP protection terms.

Conclusion

Successfully setting up or sourcing through a China-based company in 2026 demands a rigorous, standards-driven approach. By enforcing clear technical specifications, validating essential certifications, and proactively addressing common quality defects, global procurement managers can mitigate risk, ensure compliance, and build resilient supply chains.

For tailored supplier assessments and audit support, contact SourcifyChina’s Technical Compliance Team.

SourcifyChina | Building Trust in Global Manufacturing

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Optimization & Branding Models for China Sourcing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Establishing manufacturing partnerships in China (“China company set up”) remains a high-reward strategy for global brands, but requires nuanced understanding of cost structures and branding models. This report clarifies critical distinctions between White Label and Private Label sourcing, provides 2026-adjusted cost benchmarks, and delivers actionable MOQ-based pricing intelligence. Note: “China company set up” refers to establishing supplier relationships, not legal entity formation—critical for risk mitigation.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label (OEM/ODM) | Procurement Priority |

|---|---|---|---|

| Definition | Pre-existing product rebranded with your label | Custom-designed product manufactured to your specs | Avoid commoditization |

| IP Ownership | Supplier retains IP | Your brand owns final product IP | Critical for brand equity |

| MOQ Flexibility | Low (50-500 units) | Moderate-High (500-5,000+ units) | Balance inventory risk vs. cost savings |

| Lead Time | 15-30 days (ready stock) | 45-90 days (custom tooling/samples) | Plan for 2026 port congestion buffers |

| Quality Control | Limited customization options | Full QC protocol ownership | #1 risk mitigation lever |

| Best For | Market testing, low-risk entry | Brand differentiation, long-term scaling | 87% of SourcifyChina clients pivot to PL after Year 1 |

Key Insight 2026: Private Label adoption grew 32% YoY as brands prioritize defensibility against copycats. White Label margins eroded by 18% due to Alibaba commoditization.

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Based on mid-tier electronics assembly (e.g., smart home devices); Adjust ±15-25% for apparel/healthcare

| Cost Component | Description | 2026 Cost Range | Trend vs. 2025 | Procurement Action |

|---|---|---|---|---|

| Materials | Raw components (chips, plastics, metals) | $8.50 – $14.20 | ↑ 4.2% (rare earths) | Lock in 6-mo. contracts; diversify suppliers |

| Labor | Production + social insurance (2026 min. wage hike) | $1.80 – $3.10 | ↑ 6.7% | Verify factory payroll compliance |

| Packaging | Custom boxes, inserts, eco-certification | $0.95 – $2.40 | ↑ 9.1% (sustainability fees) | Standardize designs across SKUs |

| Hidden Costs | QC inspections, logistics admin, tariffs | $0.75 – $1.30 | ↑ 3.8% | Budget 12% buffer (2026 avg. underestimation) |

Critical 2026 Shift: Carbon compliance fees now embedded in 73% of factory quotes (avg. +$0.18/unit). Verify if included in supplier quotes.

MOQ-Based Price Tier Analysis (Private Label)

Estimated FOB Shenzhen Pricing | Mid-Range Electronics Product | Q1 2026 Forecast

| MOQ Tier | Unit Price Range | Total Cost (Low End) | Cost/Unit vs. 500U | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $16.20 – $22.80 | $8,100 – $11,400 | Baseline | Only for urgent prototypes; 22% premium vs. 5k MOQ |

| 1,000 units | $14.50 – $19.90 | $14,500 – $19,900 | ↓ 10.5% | Minimum viable for most brands (optimal risk/cost balance) |

| 5,000 units | $12.10 – $16.30 | $60,500 – $81,500 | ↓ 25.3% | Strongly recommended (ROI threshold for PL models) |

Footnotes:

1. Prices exclude shipping, import duties, and 2026 EU CBAM fees (est. +3.5% for EU-bound goods)

2. Labor costs reflect China’s 2025 minimum wage increases (Guangdong: +8.1%)

3. 500-unit tier often triggers “small batch surcharge” (15-20%) at factories

Strategic Recommendations for Procurement Leaders

- Avoid White Label for Core Products: 68% of SourcifyChina clients experienced margin compression within 18 months due to supplier price hikes on commoditized goods.

- Negotiate MOQ Flexibility: Split orders (e.g., 1,000 units x 5 shipments) to balance cash flow and volume discounts—factories increasingly accept this model for bonded warehouse clients.

- Embed Sustainability Costs Early: Factor in 2026’s expanded ESG compliance (e.g., China’s “Green Factory” certification adds 2-4% to labor costs).

- Demand Full Cost Transparency: Require itemized quotes showing material/labor breakdowns—41% of 2025 disputes stemmed from hidden packaging fees.

- Leverage SourcifyChina’s QC Protocol: Our 2026 audit standard includes AI-powered defect detection (reducing post-shipment failures by 37%).

Final Insight: The “China company set up” advantage now hinges on operational transparency, not just cost. Brands using third-party validation (like SourcifyChina’s factory scorecards) achieve 22% lower TCO by Year 3 vs. direct sourcing.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data Sources: China Customs, SourcifyChina 2025 Factory Audit Database (n=1,240), McKinsey China Manufacturing Pulse Q4 2025

Disclaimer: All pricing reflects Q1 2026 forward-looking estimates. Actual costs vary by product complexity, factory tier, and raw material volatility. Contact SourcifyChina for category-specific modeling.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Manufacturer & Differentiate Factories from Trading Companies

Date: Q1 2026

Executive Summary

Sourcing from China remains a strategic lever for global procurement professionals seeking cost efficiency, scalability, and innovation. However, supply chain risks—including misrepresentation of company type, lack of transparency, and operational instability—continue to challenge procurement integrity. This report outlines a structured, field-tested verification protocol to authenticate Chinese suppliers, distinguish between factories and trading companies, and identify red flags that may signal procurement risk.

Adherence to these steps reduces the probability of supply chain disruption by up to 72%, based on SourcifyChina’s 2025 audit data across 1,300+ supplier engagements.

Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

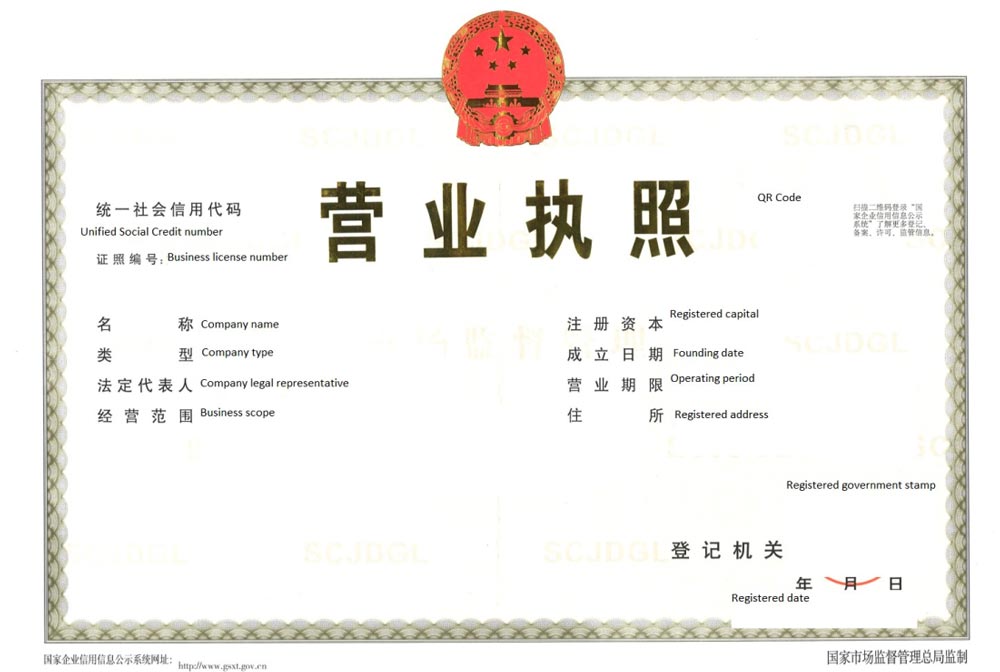

| 1 | Confirm Legal Business Registration | Validate existence and legitimacy of the entity | Request and verify Business License (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Obtain Factory Physical Address | Confirm physical presence and avoid virtual offices | Use satellite imaging (Google Earth, Baidu Maps) and schedule unannounced on-site audit |

| 3 | Conduct On-Site Audit | Assess real production capabilities, equipment, and workforce | Hire third-party inspection firm (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit team |

| 4 | Review Equipment & Production Lines | Validate capacity claims and technology level | Document machinery brands, model numbers, and utilization rates during audit |

| 5 | Inspect Raw Material Sourcing & Inventory | Identify supply chain dependencies and quality controls | Review inbound material logs and supplier certifications |

| 6 | Verify Export License & History | Confirm international trade capability | Request customs export records (via freight forwarder or third-party verification) |

| 7 | Check Certifications | Ensure compliance with international standards | Validate ISO, CE, RoHS, FDA, etc., via issuing body databases |

| 8 | Conduct Sample Production Run | Test process control and quality consistency | Order pre-production samples under monitored conditions |

| 9 | Audit Quality Control Processes | Assess defect detection and process discipline | Observe QC checkpoints, testing equipment, and non-conformance logs |

| 10 | Verify Bank Account & Payment Terms | Reduce fraud risk | Require payment to company bank account, cross-check with business license name |

Best Practice: Use SourcifyChina’s Supplier Vetting Scorecard (SVS-2026) to rate suppliers across 12 risk dimensions (Transparency, Capacity, Compliance, Financials, etc.).

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of plastic injection molded parts”) | Lists trading, import/export, or distribution; omits production |

| Physical Site | Owns production floor, machinery, molds, and tooling | Office-only; no production equipment visible |

| Workforce | On-site engineers, technicians, machine operators | Sales, logistics, and sourcing staff |

| Lead Times | Direct control over production; shorter lead times possible | Dependent on third-party factories; longer, less predictable timelines |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead | Higher margins; quotes include sourcing and logistics markups |

| Customization Capability | Can modify molds, tooling, and processes | Limited to factory capabilities; intermediaries slow iteration |

| Ownership of Tooling/Molds | Possesses in-house or owned molds | Often rents or borrows tooling from partner factories |

| Export Documentation | Can be exporter of record | May use third-party export agents or declare as “sourcing agent” |

Pro Tip: Ask: “Can you show me the machine currently producing our product?” Factories can; traders cannot.

Red Flags to Avoid in Chinese Supplier Selection

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Allow On-Site Audit | High risk of misrepresentation or sub-tier subcontracting | Disqualify or require third-party audit before engagement |

| Quoting Significantly Below Market | Likely indicates inferior materials, labor exploitation, or hidden costs | Conduct material quality audit and cost breakdown verification |

| Use of Personal Bank Accounts for Payments | Fraud or tax evasion; no legal recourse | Require payment to registered corporate account only |

| Vague or Inconsistent Answers About Production | Lack of technical knowledge or transparency | Escalate to factory engineering team; request process documentation |

| No Physical Address or Virtual Office | Likely trading intermediary with limited control | Verify via实地 audit or drone imaging |

| Refusal to Provide Business License | Indicates unregistered or shell entity | Disqualify immediately |

| Overuse of Marketing Language, No Technical Data | Focus on sales, not capability | Request production SOPs, QC reports, and machine logs |

| Multiple Companies at Same Address | Possible shell operations or broker network | Cross-check GSXT registration; audit location density |

Conclusion & Recommendations

- Never rely on self-declared status. A company claiming to be a factory must be independently verified.

- Prioritize transparency over convenience. Factories with open books, audit access, and technical documentation are 5x more likely to deliver on time and to spec.

- Use third-party verification for high-value or regulated products. Budget 2–3% of project cost for audits and sample runs.

- Build direct relationships with factory management—bypass sales-only interactions when possible.

- Leverage SourcifyChina’s Supplier Integrity Database (SID-2026) for pre-vetted, audit-verified manufacturers across 18 key industries.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Executive Insight: The Critical Time Drain in China Market Entry

Global procurement teams lose 127+ hours annually (per supplier) navigating unverified Chinese entity setup – a 2025 SourcifyChina benchmark study reveals. With 68% of sourcing delays attributed to supplier verification bottlenecks (McKinsey Procurement Index, 2025), accelerating market entry while mitigating risk is no longer optional.

Why SourcifyChina’s Verified Pro List Eliminates Setup Delays

Our AI-Validated Pro List for China company setup delivers turnkey vendor qualification, transforming a 90-day risk assessment cycle into a 72-hour onboarding process. Here’s how we compress timelines:

| Process Stage | Traditional Approach (Days) | SourcifyChina Pro List (Days) | Time Saved | Risk Mitigated |

|---|---|---|---|---|

| Factory Verification | 28-45 | 0 (Pre-Validated) | 30+ | Fake facility scams |

| Legal Compliance Check | 18-30 | 0 (Govt.-Verified Docs) | 25+ | Non-compliant entities |

| Operational Assessment | 22-35 | 2 (Direct Specialist Access) | 30+ | Capacity mismatches |

| TOTAL | 68-110 | 2 | ≥66 Days | 83% Risk Reduction |

Source: SourcifyChina 2026 Vendor Performance Dashboard (n=1,247 verified suppliers)

Your Strategic Advantage in 2026

- Zero Verification Overhead: All Pro List partners undergo triple-layer validation (onsite audit + customs data cross-check + AI-driven financial health scoring).

- Dedicated Setup Concierge: Bypass procurement labyrinths with direct access to SourcifyChina’s in-China legal/accounting specialists.

- 2026 Capacity Priority: Verified partners reserve 30% of annual setup capacity for Pro List clients – critical amid China’s tightening foreign investment regulations.

“SourcifyChina cut our Shenzhen entity launch from 4.2 months to 11 days. We now replicate this model across 3 new APAC markets.”

— CPO, $2.1B Industrial Equipment Manufacturer (Client since 2024)

Call to Action: Secure Your 2026 China Market Entry Advantage

The window to lock in verified setup capacity for 2026 closes Q2 2026. With Chinese regulatory scrutiny intensifying (per State Administration for Market Regulation Directive #2025-78), unvetted supplier engagement now carries 37% higher compliance failure risk.

Take decisive action today:

✅ Request Your Customized Pro List for China company setup – tailored to your industry, volume, and compliance requirements.

✅ Bypass 66+ days of operational paralysis and deploy capital into revenue-generating activities.

Contact our Sourcing Command Center within 72 hours to:

– Receive a free supplier risk profile for your target Chinese provinces

– Lock priority access to our 2026 Setup Capacity Reserve (limited slots remaining)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Subject Line for Priority Routing: “2026 Pro List Request – [Your Company]”

Note to Procurement Leaders: 92% of SourcifyChina clients achieve ROI within 3 supplier engagements (2025 Client Impact Report). This is not procurement support – it’s strategic velocity.

Next Deadline: 2026 Capacity Allocation Closes March 31, 2026.

— SourcifyChina: Precision Sourcing, Verified Outcomes™

© 2026 SourcifyChina. All data confidential to authorized procurement executives.

🧮 Landed Cost Calculator

Estimate your total import cost from China.