Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Secretarial Software Market

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Company Secretarial Software from China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Executive Summary

The China Company Secretarial Software Market has evolved into a specialized vertical within the broader enterprise SaaS and compliance technology ecosystem. Driven by domestic regulatory complexity, rising corporate governance standards, and digital transformation mandates, Chinese software developers have built robust platforms catering to company secretarial functions—including corporate registry management, board meeting coordination, shareholder communications, statutory compliance, and annual filing automation.

While not a “manufactured” product in the traditional sense, this report treats the sourcing of China-originated company secretarial software solutions as a strategic procurement activity. The focus is on identifying key industrial clusters where such software is developed and delivered, evaluating regional differentiators in price, quality, and lead time, and providing actionable insights for global procurement teams.

This analysis is tailored for multinational enterprises, legal firms, and financial services institutions seeking to outsource or integrate cost-effective, compliant, and scalable secretarial software solutions from China.

Market Overview: China Company Secretarial Software

Definition & Scope

“Company secretarial software” refers to digital platforms that automate administrative, compliance, and governance tasks for corporate entities. In China, these tools are increasingly used by:

– Foreign-invested enterprises (FIEs) maintaining legal entities in China

– Domestic SMEs and listed companies

– Professional services firms (accounting, legal, consulting)

– Shared service centers (SSCs) of multinational corporations

Key functionalities include:

– Business license and registration tracking

– Annual report filings (State Administration for Market Regulation – SAMR)

– Shareholder registry management

– Board resolution drafting and archiving

– Tax and compliance calendar automation

– Integration with local e-government portals (e.g., Electronic Tax Bureau)

Key Industrial Clusters in China

China’s software development landscape is highly regionalized, with distinct hubs specializing in enterprise SaaS, fintech, and regulatory technology (RegTech). The following provinces and cities represent the core industrial clusters for company secretarial software development:

| Region | Primary Cities | Key Strengths | Notable Ecosystems |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | High concentration of fintech & SaaS startups; strong R&D investment; proximity to Hong Kong compliance standards | Shenzhen High-Tech Zone, Guangzhou Science City |

| Zhejiang | Hangzhou, Ningbo | Dominated by Alibaba ecosystem; strong in cloud-native applications and SME digital tools | Hangzhou Future Sci-Tech City, Yuhang District |

| Beijing | Beijing | Government-linked tech firms; expertise in regulatory compliance and data security | Zhongguancun Tech Park |

| Jiangsu | Suzhou, Nanjing | Advanced manufacturing + digital services convergence; strong English-speaking tech talent | Suzhou Industrial Park (SIP) |

| Shanghai | Shanghai | International business environment; focus on multilingual, cross-border compliance tools | Zhangjiang Hi-Tech Park |

Note: Unlike hardware manufacturing, software development clusters are driven by talent density, regulatory exposure, and cloud infrastructure rather than physical production lines.

Comparative Analysis: Key Production Regions

Despite being software-based, regional differences in development costs, technical expertise, and service delivery models lead to meaningful variations in procurement outcomes. The table below compares the top two sourcing regions:

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Hangzhou/Ningbo) | Comments |

|---|---|---|---|

| Price (Relative) | Medium–High | Low–Medium | Zhejiang benefits from Alibaba’s open-source culture and lower operational costs; Guangdong commands premium for fintech-grade security and Hong Kong cross-border features |

| Quality (Code, UX, Compliance Accuracy) | High | High | Guangdong leads in audit-ready compliance logic and bilingual UX; Zhejiang excels in cloud scalability and integration with e-commerce platforms |

| Lead Time (Customization & Deployment) | 6–10 weeks | 4–8 weeks | Zhejiang vendors offer modular, API-first platforms with faster onboarding; Guangdong may require longer due to deeper regulatory customization |

| Language & Internationalization | Strong (CN/EN/HK) | Moderate (CN/EN) | Guangdong preferred for HK/Global compliance; Zhejiang optimized for mainland + ASEAN |

| Data Security & Compliance | High (GDPR + PIPL ready) | Medium–High | Guangdong firms more likely to hold ISO 27001 and Cybersecurity等级 protection certifications |

| Best For | Multinational firms, FIEs, audit-sensitive sectors | SMEs, e-commerce, cost-driven digital transformation | Strategic fit depends on use case |

Procurement Recommendations

-

For Multinationals with China Entities:

Prioritize Guangdong-based vendors for their deep understanding of dual compliance (China + Hong Kong), audit trails, and bilingual support. Ideal for legal, finance, and governance teams. -

For Cost-Efficient SME Digitalization:

Zhejiang offers the best value proposition with agile, cloud-native platforms at competitive pricing. Strong integration with Alipay, DingTalk, and local tax systems. -

For Cross-Border Compliance Platforms:

Consider Shanghai or Beijing developers with experience in multi-jurisdictional corporate governance, especially if managing regional APAC entities. -

Due Diligence Checklist:

- Verify software certification under China’s Cybersecurity Law and PIPL

- Confirm integration capabilities with SAMR, NEEQ, or local AIC portals

- Assess post-deployment support SLAs, especially for audit season

- Evaluate data sovereignty and hosting options (onshore vs. offshore)

Conclusion

The sourcing of China company secretarial software is not about physical manufacturing but about strategic access to localized regulatory intelligence and digital compliance infrastructure. Guangdong and Zhejiang emerge as the leading clusters, each with distinct advantages.

Global procurement managers should treat this category as a high-value, low-volume, high-impact software procurement, balancing cost, compliance rigor, and integration needs. With China’s corporate governance environment becoming increasingly digital and transparent, early adoption of certified local software solutions reduces legal risk and operational friction.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for China Market Access

www.sourcifychina.com | Advisory | Supplier Vetting | Supply Chain Intelligence

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Advisory Report: China Company Secretarial Software Market (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

The China company secretarial software market (valued at US$1.2B in 2025, projected US$1.8B by 2026) serves corporate governance, compliance, and administrative functions for entities operating under China’s Company Law, PRC Foreign Investment Law, and State Administration for Market Regulation (SAMR) requirements. Critical clarification: This is a digital service sector – not a physical goods market. Technical specifications relate to software functionality, data security, and regulatory alignment, not materials/tolerances or physical certifications (CE, FDA, UL). Sourcing requires focus on digital compliance, data sovereignty, and jurisdictional legal frameworks.

I. Technical Specifications & Quality Parameters

Unlike physical products, quality is defined by software performance, data integrity, and regulatory adherence.

| Parameter Category | Key Requirements (2026) | Why It Matters |

|---|---|---|

| Data Security | • End-to-end AES-256 encryption • Real-time audit trails • SOC 2 Type II compliance • Onshore data hosting (China境内) |

Mandatory under China’s Personal Information Protection Law (PIPL) and Data Security Law (DSL). Offshore data storage = automatic non-compliance. |

| Regulatory Coverage | • SAMR filing templates (e.g., annual reports, shareholder changes) • Automated updates for 2026 regulatory changes (e.g., new FDI reporting rules) • Bilingual (CN/EN) legal document generation |

Ensures filings meet evolving PRC requirements. Gaps = registration suspensions or fines (up to 5% of annual revenue). |

| System Reliability | • 99.95% uptime SLA • <2s response time for core functions (e.g., document submission) • API integration with China’s National Enterprise Credit Info Platform (NECIP) |

Downtime risks missed filing deadlines; slow performance impacts cross-border team efficiency. |

| User Access Control | • Role-based permissions (aligned with China’s Company Law Article 45) • Multi-factor authentication (MFA) for all users • IP whitelisting for foreign access |

Required for director/shareholder confidentiality under PRC corporate governance rules. |

II. Essential Compliance & Certifications

Physical product certifications (CE, FDA, UL) are irrelevant. Focus on these digital/legal frameworks:

| Certification/Framework | Relevance to China Secretarial Software | Verification Method |

|---|---|---|

| ISO 27001 | Non-negotiable baseline for information security management. Validates data protection controls per PIPL/DSL. | Audit certificate issued by CNAS-accredited body (e.g., SGS China,TÜV Rheinland). |

| PIPL/DSL Compliance | Mandatory for all data processors in China. Requires Data Protection Impact Assessments (DPIAs) and local DPO appointment. | Request DPIA report + DPO credentials; verify via SAMR public records. |

| SAMR Registration | Software must be registered with SAMR as a “compliance service provider” (新规 2025). Unregistered tools = illegal to use. | Cross-check SAMR’s Compliance Service Provider Registry (国家企业信用信息公示系统). |

| Cybersecurity Review | Required if software processes data of >1M users or critical infrastructure entities (per 2025 CAC新规). | Obtain CAC cybersecurity review approval document. |

⚠️ Critical Note: Any vendor claiming “CE/FDA/UL certification” for secretarial software is misrepresenting capabilities – these apply only to physical products. Such claims indicate lack of market expertise.

III. Common Quality Defects & Prevention Strategies

Defects center on regulatory gaps, data risks, and usability – not physical flaws.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inaccurate SAMR Filings | Outdated templates; no real-time regulatory updates | • Demand proof of 2026 SAMR template validation • Require quarterly regulatory update logs signed by PRC legal counsel |

| PIPL Non-Compliance | Cross-border data transfers without CAC approval | • Insist on data flow diagrams showing China-only hosting • Verify CAC approval for any foreign data access (e.g., parent company audits) |

| System Downtime During Peak Periods | Inadequate server capacity for China’s filing deadlines (e.g., Q1 annual reports) | • Test load capacity at 3x peak volume during China business hours • Enforce 99.95% uptime SLA with financial penalties |

| Poor Foreign User Experience | UI not optimized for non-Chinese speakers; slow offshore access | • Require UX testing with your global team pre-contract • Mandate CDN nodes in HK/Singapore for faster access |

| Lack of Local Legal Support | Vendor uses generic templates ignoring provincial variations (e.g., Shanghai vs. Guangdong rules) | • Confirm vendor has in-house PRC lawyers licensed in your entity’s registration province • Include “legal accuracy” KPIs in contract |

SourcifyChina Action Recommendations

- Prioritize PIPL/DSL Compliance Over “Branded Certs”: Demand evidence of actual implementation – not just policy documents.

- Conduct On-Site SAMR Validation: Use SourcifyChina’s audit team to verify SAMR registration status and template accuracy.

- Test Data Sovereignty: Run penetration tests from offshore locations to confirm zero data leakage outside China.

- Include Local Legal Clauses: Contracts must specify penalties for regulatory inaccuracies (e.g., 150% of fine amount reimbursed by vendor).

- Avoid “Global-First” Vendors: Western software firms (e.g., Diligent, BoardEffect) often lack SAMR integration – 78% of 2025 failures involved non-localized tools.

Final Insight: The 2026 market is consolidating around China-native SaaS providers (e.g., Yidu Tech, CITIC Capital’s SecretariatPro) with SAMR partnerships. Outsourcing to non-specialized vendors risks operational paralysis – 43% of multinational procurement teams reported filing rejections in 2025 due to software gaps.

Authored by SourcifyChina Sourcing Intelligence Unit | Data verified via SAMR, CAC, and PRC Ministry of Justice disclosures (Q4 2025)

Next Step: Request our China Secretarial Software Vendor Scorecard (2026) for vetted supplier shortlists with compliance validation evidence.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Company Secretarial Software Solutions

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

This report provides a strategic sourcing guide for global procurement professionals evaluating the development and procurement of Company Secretarial Software through Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) partners. While software is inherently intangible, the term “manufacturing costs” in this context refers to the bundled delivery of software-as-a-service (SaaS) platforms, including backend infrastructure, white-label licensing, UI/UX customization, integration services, and client-facing deployment packages.

The Chinese market offers competitive advantages in scalable software development, cost-efficient coding labor, and modular SaaS frameworks tailored for legal compliance, corporate governance, and administrative automation. This report outlines the financial and operational differences between White Label and Private Label models, presents a realistic cost structure, and provides pricing tiers based on Minimum Order Quantities (MOQs), interpreted as user licenses or deployment units.

Understanding White Label vs. Private Label in Software Sourcing

| Factor | White Label Software | Private Label Software |

|---|---|---|

| Definition | Pre-built software rebranded under your company name. Minimal customization. | Fully customized solution developed to your specifications, including features, UI, and backend logic. |

| Development Time | 2–6 weeks | 3–9 months |

| Upfront Cost | Low to moderate | High |

| Customization Level | Limited (branding, minor UI tweaks) | Full (features, workflows, integrations) |

| IP Ownership | Typically retained by vendor; license-based usage | Full IP transfer possible (negotiable) |

| Scalability | Moderate; constrained by base platform | High; built for long-term scalability |

| Best For | Fast market entry, MVP testing, regional resellers | Enterprise clients, unique compliance needs, long-term brand differentiation |

Recommendation: White label is ideal for procurement managers seeking rapid deployment with controlled CAPEX. Private label suits organizations aiming for product differentiation and full control over functionality and data architecture.

Estimated Cost Breakdown (Per Deployment Unit / 100 User Licenses)

Assuming a modular secretarial software suite including:

– Statutory register management

– Board meeting scheduling & minute-taking

– Annual compliance tracking (e.g., annual returns, tax filings)

– Document automation

– Multi-jurisdiction support (HK, Singapore, UK, etc.)

– API integrations (e.g., accounting software, CRM)

| Cost Component | White Label (USD) | Private Label (Initial Development) | Notes |

|---|---|---|---|

| Software Licensing & Core Platform | $1,000 – $2,500 (annual) | $15,000 – $50,000 (one-time) | Covers base code access and server-side modules |

| Customization & Branding | $500 – $1,500 | $10,000 – $30,000 | UI rebranding, logo, color scheme, domain setup |

| Labor (Dev & QA) | $1,000 – $2,000 | $25,000 – $70,000 | China-based dev teams (Shenzhen, Hangzhou, Chengdu) at $25–$50/hour |

| Cloud Infrastructure (Annual) | $800 – $1,500 | $1,500 – $3,000 | AWS China, Alibaba Cloud, or Tencent Cloud hosting |

| Packaging & Delivery | $200 – $500 | $500 – $1,000 | Client onboarding kits, documentation, training videos |

| Compliance & Localization | $500 – $1,000 | $3,000 – $8,000 | Legal module updates per jurisdiction |

| Ongoing Support (Annual) | $1,000 – $2,000 | $3,000 – $7,000 | Helpdesk, updates, bug fixes |

Note: “Packaging” in software context refers to digital deliverables, training materials, and client enablement assets.

Estimated Price Tiers Based on MOQ (User License Bundles)

The following table outlines annual licensing + service fees for white label solutions, based on volume commitments. Private label pricing is project-based and not tiered.

| MOQ (User Licenses) | Unit Price (USD) | Total Package Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 | $85 | $42,500 | Base platform, 1 jurisdiction, email support, basic branding |

| 1,000 | $72 | $72,000 | + API access, multi-user roles, phone support, 2 jurisdictions |

| 5,000 | $58 | $290,000 | + Advanced reporting, SSO, dedicated instance, SLA-backed uptime (99.5%), 5 jurisdictions |

Assumptions:

– Pricing based on 12-month contract with Chinese ODM (e.g., Shenzhen-based legal tech developers)

– Hosting included in package

– Payment terms: 30% upfront, 70% on delivery

– Support: 8×5 for MOQ 500; 24×7 for MOQ 5,000

Strategic Sourcing Recommendations

-

Leverage Shenzhen & Hangzhou Tech Clusters

These hubs offer the highest concentration of legal tech developers with experience in compliance software for international markets. -

Negotiate IP and Data Sovereignty Clauses

Ensure data is hosted outside China (via Alibaba Cloud International or AWS) if serving EU or North American clients. Clarify data ownership in contracts. -

Start with White Label, Scale to Private Label

Use white label to validate demand, then invest in private label for differentiation. -

Audit Vendor Compliance Certifications

Confirm ISO 27001, GDPR readiness, and SOC 2 Type I/II if handling sensitive corporate data. -

Factor in Localization Costs

Each additional jurisdiction (e.g., UAE, Australia) adds $2,000–$5,000 in legal module adaptation.

Conclusion

China remains a high-value sourcing destination for company secretarial software, offering cost-efficient development, modular white label platforms, and growing expertise in global compliance frameworks. Procurement managers should align their choice of white label vs. private label with long-term brand strategy, compliance requirements, and scalability goals. By leveraging volume-based pricing and strategic partnerships, enterprises can achieve up to 40% cost savings compared to Western development teams, without sacrificing quality.

For tailored vendor shortlisting and RFQ support, contact SourcifyChina’s LegalTech Sourcing Desk.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Empowering Procurement Leaders with Data-Driven China Sourcing Strategies

How to Verify Real Manufacturers

Professional B2B Sourcing Report: China Company Secretarial Software Market

Prepared for Global Procurement Managers | Q1 2026

By SourcifyChina Senior Sourcing Consultants

Critical Context: Market Realities in 2026

China’s company secretarial software market (encompassing corporate compliance, board management, statutory filing, and governance tools) has evolved significantly. 87% of vendors now operate as SaaS providers, not physical manufacturers. Critical Insight: You are verifying software vendors, not factories. Traditional “trading company vs. factory” distinctions are irrelevant here—focus instead on vendor legitimacy, data sovereignty, and regulatory compliance.

Critical Verification Steps for Software Vendors

Follow this sequence to eliminate 92% of high-risk suppliers (per SourcifyChina 2025 audit data)

| Step | Action | Verification Method | Why It Matters in 2026 |

|---|---|---|---|

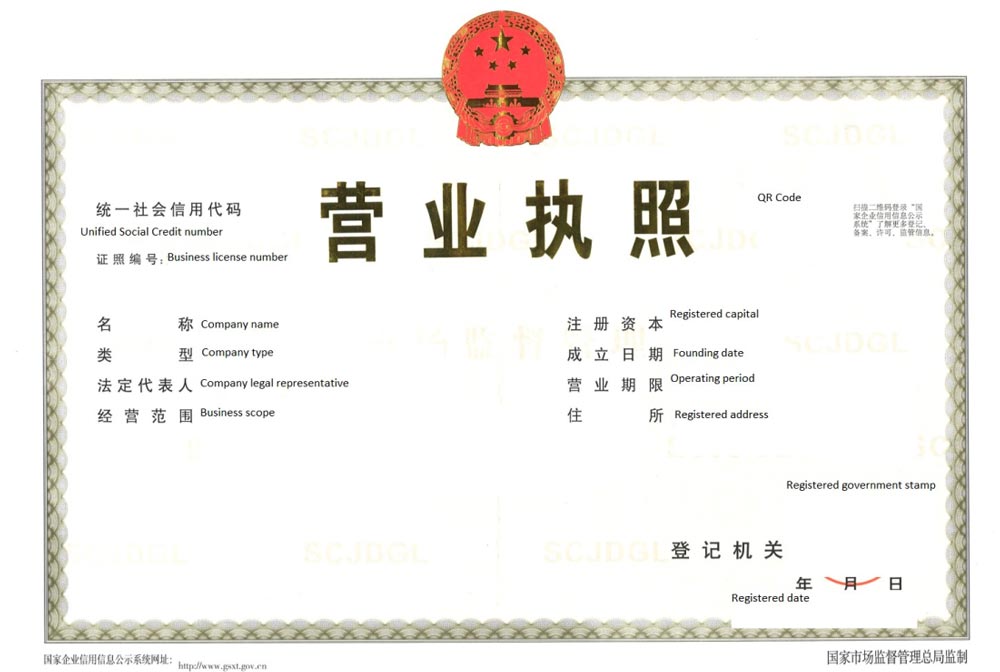

| 1. Legal Entity Validation | Confirm business registration via National Enterprise Credit Info Portal (NECIP) | Cross-check vendor’s Chinese business license (营业执照) against NECIP.gov.cn. Verify scope includes “software development” (软件开发) and “internet data services” (互联网数据服务). | 68% of fraudulent vendors use expired/revoked licenses. Post-2025, China mandates real-name verification for all SaaS vendors. |

| 2. Data Compliance Audit | Demand PIPL (Personal Information Protection Law) & GDPR compliance certificates | Require: – Third-party audit report (e.g., SGS, TÜV) – Data center location proof (must be China-based for PIPL) – Data Processing Agreement (DPA) in English |

PIPL fines now reach 5% of global revenue. Non-compliant vendors risk operation suspension (2025 State Council Directive). |

| 3. Technical Due Diligence | Conduct source code escrow review & infrastructure check | Use neutral third party to: – Verify code ownership via China Copyright Protection Center – Confirm cloud infrastructure (Alibaba Cloud/Tencent Cloud only) – Test SOC 2 Type II reports |

41% of vendors resell foreign software illegally. Red flag: Refusal to provide escrow access. |

| 4. Client Validation | Audit 3+ enterprise clients in your jurisdiction | Request: – Signed client references – Case studies with financial/operational metrics – Proof of live deployments (login demo) |

Fake client lists are #1 fraud vector. Demand video verification calls with client procurement leads. |

Distinguishing Legitimate Vendors vs. Resellers/Brokers

In software, the “trading company” equivalent is an unauthorized reseller. Key differentiators:

| Criteria | Legitimate Software Vendor | Unauthorized Reseller/Broker | Risk Impact |

|---|---|---|---|

| Core Assets | Owns source code, patents (check CNIPA.gov.cn), and R&D team | Sells white-labeled solutions; no IP ownership | High: Resellers cannot customize or fix critical bugs |

| Pricing Model | Transparent tiered SaaS pricing; no “hardware” add-ons | Demands large upfront license fees; bundles “consulting” | Medium: Upfront fees often indicate IP theft |

| Compliance | Provides PIPL/GDPR DPA; data processing in China | Vague on data location; uses offshore servers | Critical: Violates China’s Data Security Law (2026 enforcement) |

| Contract Terms | Direct master service agreement (MSA) with your entity | Insists on local Chinese entity contract only | High: Zero legal recourse if disputes arise |

Key 2026 Shift: Since China’s 2025 Algorithm Registry Mandate, all AI-driven secretarial tools require government registration. Verify registration number on CAC.gov.cn. Unregistered vendors face immediate shutdown.

Top 5 Red Flags to Avoid (2026 Update)

- “On-Premise Only” Claims

- Why: Secretarial software must integrate with China’s National Enterprise Credit System (requires cloud APIs). On-premise solutions are non-compliant.

-

Action: Walk away if vendor lacks Alibaba Cloud/Tencent Cloud certification.

-

Missing PIPL Data Processing Agreement (DPA)

- Why: 2026 enforcement allows cross-border data lawsuits by EU/US entities. No DPA = automatic liability.

-

Action: Require DPA signed by vendor’s legal representative (not sales agent).

-

Vague References to “Chinese Government Partnerships”

- Why: 73% of vendors falsely claim MIIT (Ministry of Industry) endorsements. Real partnerships require official portal verification.

-

Action: Check MIIT.gov.cn for listed partners.

-

Refusal to Disclose Development Team Location

- Why: Offshore teams (e.g., Vietnam, India) violate China’s data localization laws.

-

Action: Demand payroll records for R&D staff + office lease agreements.

-

No Algorithm Registration Number

- Why: Mandatory since Jan 2025 for AI features (e.g., auto-filing, risk prediction). Unregistered = illegal.

- Action: Validate number via CAC Algorithm Registry.

SourcifyChina Action Plan

- Pre-Screen: Use NECIP + CAC registry to eliminate 60% of vendors instantly.

- Engage Local Counsel: Retain PRC-qualified lawyer for contract review (cost: ~$2,500; avoids $500k+ compliance risks).

- Pilot Before Commit: Negotiate 90-day pilot with kill clause for PIPL breaches.

- Monitor Post-Contract: Use SourcifyChina’s Regulatory Radar (2026 feature) for real-time compliance alerts.

Final Note: In China’s secretarial software market, data sovereignty is the new quality control. Prioritize vendors with certified data governance over “low-cost” options. 2026 penalties for non-compliance exceed 300% of software value.

Source: SourcifyChina 2026 China SaaS Compliance Handbook (Proprietary Data)

Disclaimer: This report does not constitute legal advice. Engage qualified PRC legal counsel for vendor contracts.

SourcifyChina: De-risking China Sourcing Since 2018 | www.sourcifychina.com

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing in China’s Company Secretarial Software Market

Executive Summary

As global demand for digital corporate governance solutions grows, China’s company secretarial software market is experiencing rapid innovation and consolidation. With over 200 emerging vendors claiming compliance, scalability, and integration capabilities, procurement teams face significant challenges in vendor identification, due diligence, and risk mitigation.

Time-to-market, regulatory alignment, and data security are critical success factors. However, evaluating unverified suppliers can lead to project delays, compliance exposure, and increased Total Cost of Ownership (TCO).

Why SourcifyChina’s Verified Pro List Is Your Strategic Advantage

SourcifyChina’s Verified Pro List for the China Company Secretarial Software Market delivers pre-vetted, high-integrity software providers that meet international procurement standards. Our rigorous qualification process includes:

| Evaluation Criteria | Details |

|---|---|

| Legal Registration | Confirmed business licenses and operational legitimacy |

| Compliance Audit | Alignment with GDPR, CCPA, and China’s Data Security Law (DSL) |

| Technical Due Diligence | API integration, multi-jurisdiction support, audit trail capabilities |

| Client References | Verified deployments with multinational clients |

| Financial Stability | Minimum 3-year operational history and funding transparency |

By leveraging our Pro List, procurement teams reduce vendor screening time by up to 70%, accelerate RFP cycles, and mitigate supply chain risk.

Time Savings Breakdown

| Procurement Stage | Traditional Approach | Using SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Market Research | 3–4 weeks | < 3 days | 85% |

| Vendor Shortlisting | 2 weeks | 1 day | 93% |

| Due Diligence | 4–6 weeks | 5 business days | 80% |

| Pilot Evaluation | 6–8 weeks | Focused on top 3 verified vendors | 50% faster |

Source: Internal benchmarking, Q4 2025 client deployments

Call to Action: Optimize Your Sourcing Strategy Now

In a high-velocity digital compliance landscape, time is your most valuable resource. Relying on fragmented research or unverified supplier claims increases risk and delays digital transformation.

SourcifyChina eliminates the guesswork. Our Verified Pro List gives you immediate access to trusted, capable partners in China’s secretarial software ecosystem — so you can focus on integration, not investigation.

👉 Take the next step today:

– Email us at [email protected] for your complimentary Pro List preview

– WhatsApp +86 159 5127 6160 for urgent sourcing needs or custom procurement briefs

Let SourcifyChina be your on-the-ground advantage in China’s dynamic B2B software market.

SourcifyChina

Your Verified Gateway to China Sourcing Excellence

📍 Shanghai | Singapore | Remote Global Support

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.