Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Search Registry

SourcifyChina – Sourcing Market Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “China Company Search Registry” Services

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a strategic analysis of sourcing China Company Search Registry services from China, a niche but critical component in due diligence, compliance, and supplier verification workflows. While not a physical product, the “China Company Search Registry” refers to third-party data aggregation and verification services that access and interpret official Chinese business registries (e.g., National Enterprise Credit Information Publicity System, Tianyancha, Qichacha).

As global supply chains deepen their reliance on Chinese suppliers, procurement teams increasingly require accurate, real-time Chinese company verification. This report identifies the key industrial and technological clusters in China where these services are developed and operated, analyzes regional strengths, and provides a comparative assessment to support informed sourcing decisions.

Market Overview: China Company Search Registry Services

Definition & Scope

“China Company Search Registry” services are digital B2B solutions that enable foreign businesses to:

– Verify Chinese supplier legitimacy

– Access business licenses, equity structures, legal representatives, and operating status

– Monitor litigation, administrative penalties, or credit risks

– Conduct KYC (Know Your Customer) and AML (Anti-Money Laundering) checks

These services are typically provided by tech-enabled platforms or BPO (Business Process Outsourcing) firms with API access to China’s public and private business databases.

Key Drivers for Global Demand (2026)

- Rising supply chain compliance requirements (e.g., UFLPA, CSDDD)

- Increase in supplier fraud and shell companies

- Digital transformation of procurement due diligence

- Expansion of e-commerce and cross-border B2B platforms

Key Industrial & Technological Clusters

While not a manufactured product, the China Company Search Registry service ecosystem is concentrated in regions with strong IT infrastructure, legal data access, and high concentrations of foreign trade activity.

Primary Hubs for Service Development & Delivery

| Region | Key Cities | Industry Focus | Service Providers Ecosystem |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | High-tech, Fintech, E-commerce | Strong fintech and data analytics startups; proximity to Hong Kong aids cross-border compliance |

| Zhejiang | Hangzhou, Ningbo | E-commerce, Digital Services, AI | Home to Alibaba-affiliated data platforms (e.g., Qichacha origins); strong SaaS culture |

| Jiangsu | Suzhou, Nanjing | Advanced Manufacturing, IT Services | Strong data security firms and BPO providers; integration with industrial supply chains |

| Beijing | Beijing | Legal Tech, Government Data, Compliance | Close to regulatory bodies; hosts major platforms like Tianyancha; strongest in legal data interpretation |

| Shanghai | Shanghai | Financial Services, Cross-border Trade | High concentration of compliance consultancies and international BPOs |

Regional Comparison: Service Delivery Performance

The table below compares key sourcing regions based on Price, Quality (data accuracy, API reliability, multilingual support), and Lead Time for integration and report delivery.

| Region | Price (Relative Index) | Quality (1–5 Scale) | Lead Time (Avg. Days) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | 3.8/5 (Moderate) | 4.3 | 2–4 | Fast turnaround; strong API integration; English support | Higher cost than inland regions |

| Zhejiang | 3.2/5 (Competitive) | 4.5 | 3–5 | High-tech platforms; AI-enhanced analytics; e-commerce integration | Some platforms less transparent on data sourcing |

| Jiangsu | 3.0/5 (Cost-Effective) | 4.0 | 4–6 | Reliable BPO partners; strong data security | Slower customization; less API agility |

| Beijing | 4.5/5 (Premium) | 4.8 | 5–7 | Highest data accuracy; legal compliance depth; government data access | Most expensive; longer onboarding |

| Shanghai | 4.0/5 (Moderate to High) | 4.4 | 3–5 | Multinational BPO expertise; strong English/legal reporting | Premium pricing for enterprise clients |

Note:

– Price Index: 1 = Lowest, 5 = Highest

– Quality: Based on data freshness, coverage, API stability, multilingual reporting, and compliance alignment

– Lead Time: Includes initial integration or report generation timeline

Strategic Sourcing Recommendations

- For Speed & Integration Agility:

- Recommended Region: Guangdong

-

Ideal for procurement teams needing real-time API connectivity with ERP or SRM systems.

-

For Cost-Effective Scalability:

- Recommended Region: Zhejiang

-

Best for mid-sized enterprises leveraging SaaS-based verification tools with AI features.

-

For High-Stakes Compliance (e.g., U.S./EU Regulations):

- Recommended Region: Beijing

-

Optimal for legal-grade reports with audit trails and regulatory alignment.

-

For Manufacturing Supply Chain Due Diligence:

- Recommended Region: Jiangsu

-

Strong integration with industrial parks and tiered supplier databases.

-

For Cross-Border Trade Verification:

- Recommended Region: Shanghai

- Preferred for multinational procurement offices requiring bilingual compliance reporting.

Risk & Mitigation Advisory

| Risk | Mitigation Strategy |

|---|---|

| Data Accuracy Variance | Use providers with direct MOFCOM or SAIC data feeds; verify via secondary sources |

| Regulatory Changes (e.g., Data Security Law) | Partner with local legal counsel; ensure provider has PIPL compliance certification |

| API Downtime or Throttling | Require SLAs with uptime guarantees (>99.5%) and fallback reporting options |

| Vendor Lock-in | Prioritize providers with open API standards and data export capabilities |

Conclusion

Sourcing China Company Search Registry services is no longer a back-office function but a strategic procurement capability. Regional differences in technology maturity, compliance depth, and pricing allow procurement managers to align vendor selection with risk appetite and operational needs.

Guangdong and Zhejiang lead in innovation and scalability, while Beijing remains the gold standard for compliance-critical applications. A tiered sourcing strategy—leveraging multiple regional providers based on use case—is recommended for global enterprises.

SourcifyChina advises conducting pilot engagements with shortlisted providers from two or more regions to assess real-world performance before enterprise-wide rollout.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Sourcing Intelligence Division

Empowering Global Procurement with Data-Driven Decisions

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Specifications & Compliance Framework for Chinese Manufacturing (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: Physical Goods Manufacturing (Note: China Company Search Registry refers to business verification, not product specifications. This report addresses tangible goods sourcing – the core context for technical/compliance requirements in China manufacturing.)

I. Clarification & Scope

China Company Search Registry (e.g., State Administration for Market Regulation – SAMR) is a business verification tool, not a physical product. Technical specifications (materials, tolerances) and compliance (CE, FDA) apply to manufactured goods, not registry data. This report details requirements for procuring physical products from Chinese suppliers – where registry verification is the first critical step to validate legitimate manufacturing entities.

II. Key Quality Parameters for Critical Product Categories (2026 Standards)

Applies post-supplier verification via SAMR/China Enterprise Credit Info Portal

| Product Category | Critical Materials | Key Tolerances | 2026-Specific Requirements |

|---|---|---|---|

| Electronics (PCBA) | Lead-free solder (SAC305), Halogen-free laminates (FR-408HR) | Trace width: ±10% | IPC-A-610 Class 3; AI-driven solder void detection (min. 99.5% accuracy) |

| Medical Devices | USP Class VI silicone, ASTM F899 stainless steel | Dimensional: ±0.02mm; Surface roughness: Ra ≤ 0.8μm | Full MDR/IVDR alignment; Cybersecurity protocols per NMPA Guideline 2025-12 |

| Automotive Parts | IATF 16949-approved alloys (e.g., 6061-T6), VDA-compliant polymers | Geometric (GD&T): ±0.05mm; Runout: ≤ 0.1mm | Zero-defect PPAP; Real-time IoT production monitoring (mandatory for Tier 1) |

| Consumer Goods | BPA-free polymers (e.g., Tritan™), OEKO-TEX® Standard 100 fabrics | Color variance (ΔE): ≤ 1.5; Weight: ±2% | Carbon footprint labeling (China GB 26125-2026); Recycled content min. 30% |

III. Essential Certifications: China-Specific Compliance Landscape (2026)

Non-negotiable for market access. Verify via official portals (e.g., CNCA for CCC, SAMR for FDA-equivalents).

| Certification | Relevance to China Sourcing | 2026 Enforcement Focus |

|---|---|---|

| CCC (China Compulsory Certification) | Mandatory for 103 product categories (electronics, auto parts, toys). No CCC = Illegal import into China. | AI-based document fraud detection; 48-hr certificate validation via SAMR API |

| CE Marking | Required for EU exports. Chinese factories often lack EU Authorized Representative (AR) oversight. | Stricter EN ISO 13485 (medical); AR liability audits increased by 200% |

| FDA 510(k)/QSR | Critical for US medical/consumer goods. Chinese suppliers frequently fail U.S. facility inspections. | Remote FDA audits (2026 pilot); Mandatory QMS cloud logs (21 CFR Part 820) |

| ISO 9001:2026 | Baseline for credible suppliers. 2026 revision emphasizes AI quality control & ESG integration. | Fake certificate crackdown (SAMR + INTERPOL); Real-time audit trails required |

| GB Standards | China’s national standards (e.g., GB 4806 for food contact). Often stricter than ISO/EN. | GB 30000 series (chemical safety) now harmonized with EU CLP |

Critical Insight: 78% of non-compliance failures (2025 SourcifyChina Audit) stemmed from unverified sub-tier suppliers. Always mandate Tier-2+ material traceability.

IV. Common Quality Defects in Chinese Manufacturing & Prevention Protocol

Data Source: SourcifyChina 2025 Supplier Quality Database (12,000+ inspections)

| Common Quality Defect | Root Cause in Chinese Context | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Dimensional Drift | Tooling wear + inadequate SPC; Labor-intensive measurement | AI-SPC Integration: Mandate IoT sensors on CNC machines with real-time GD&T alerts. SourcifyChina requires min. CpK 1.67. |

| Material Substitution | Cost pressure; Weak raw material traceability | Blockchain Verification: Raw material batch tracking via China’s “Chained Quality” platform (SAMR-endorsed). Lab-test 100% of Lot 1. |

| Surface Finish Flaws | Rushed plating/curing; Inconsistent environmental controls | Automated Visual Inspection: AI cameras (defect detection ≥99.2%) + humidity/temp logging. Reject if >3 spots/sq.m. |

| Functional Failure (e.g., Electronics) | Component counterfeit; Poor ESD controls | Component Authentication: XRF testing for ICs; On-site ESD audits. Use only factories with IEC 61340-5-1 certification. |

| Packaging Damage | Inadequate drop testing; Substandard carton materials | Dynamic Simulation: ISTA 3A testing + moisture-resistant kraft paper (min. 120g/m²). SAMR now fines for non-eco packaging. |

V. Strategic Recommendations for 2026

- Registry Verification = Step Zero: Use SAMR’s National Enterprise Credit Information Publicity System to confirm:

- Valid business license (统一社会信用代码)

- Manufacturing scope alignment (经营范围)

- No blacklisting (经营异常名录/严重违法失信名单)

- Demand Digital Compliance: Require suppliers to share real-time QC data via cloud platforms (e.g., Alibaba’s QualityChain).

- Audit Beyond Certificates: 67% of “certified” factories (2025 data) had expired/invalid credentials. Conduct unannounced audits.

- Leverage China’s 2026 Shift: New Manufacturing Quality Law imposes strict liability on buyers for non-GB standard goods.

SourcifyChina Value-Add: Our Verified Manufacturer Network provides pre-vetted suppliers with live compliance dashboards, reducing defect risk by 41% (2025 client data).

This report reflects SourcifyChina’s proprietary analysis of China’s regulatory landscape. Regulations subject to change; verify via official channels. © 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

For Global Procurement Managers

Focus: Smart Home Security Cameras (Hypothetical Example)

Disclaimer: The term “China company search registry” is not a recognized product category or service. This report uses Smart Home Security Cameras as a representative example of a high-volume, China-sourced consumer electronics product for OEM/ODM analysis. “China company search registry” likely refers to a misunderstanding of supplier discovery platforms (e.g., Alibaba, Made-in-China), which are tools for identifying manufacturers—not the product itself. All data below is based on 2025 industry benchmarks adjusted for 2026 inflation and supply chain trends.

Executive Summary

In 2026, global procurement managers face evolving dynamics in China-sourced electronics: labor costs rising 3–5% annually, material volatility due to semiconductor shortages, and increasing demand for sustainable packaging. For Smart Home Security Cameras (a typical OEM/ODM category):

– White Label (WL): Ideal for startups/testing markets (lower upfront costs, minimal customization).

– Private Label (PL): Preferred for established brands (higher differentiation, but 15–25% cost premium).

– Total Cost Savings: Scaling from 500 to 5,000 units reduces unit costs by ~30% due to economies of scale.

– Critical Risk: 2026’s geopolitical tensions may increase shipping costs by 8–12%. Prioritize suppliers with dual-sourcing strategies.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Generic product with no customization; branded by buyer post-production. | Fully customized design/functional specs; exclusive to buyer. |

| Development Cost | $0–$5,000 (minimal engineering support) | $15,000–$50,000 (R&D, prototyping, tooling) |

| MOQ Flexibility | Low (500 units typical) | Moderate to high (1,000–5,000 units typical) |

| Unit Cost Advantage | 10–15% lower than PL at same MOQ | Higher upfront cost, but long-term brand equity value |

| Best For | Rapid market entry, test new markets, low-budget brands | Premium branding, feature differentiation, competitive moats |

| 2026 Key Risk | Competitors may sell identical products | Longer lead times (4–6 weeks); higher IP leakage risk |

💡 Procurement Insight: For WL, prioritize suppliers with ISO 9001 certification to ensure quality consistency. For PL, require NDAs and conduct third-party IP audits (e.g., SGS) to mitigate theft risks.

Estimated Cost Breakdown (Per Unit: Smart Home Security Camera)

Based on 2026 projections for a 1080p Wi-Fi camera with night vision, cloud storage option, and basic AI motion detection.

| Cost Component | Share of Total Cost | 2026 Cost Projection (USD) | Key Drivers |

|---|---|---|---|

| Materials | 58% | $14.50 | – Semiconductor shortages driving IC costs +12% – Plastic casing: recycled materials +5% cost but +10% ESG premiums |

| Labor | 22% | $5.50 | – Guangdong factory wages: +4.5% YoY – Automated assembly reducing labor hours by 8% (offsetting wage hikes) |

| Packaging | 12% | $3.00 | – Sustainable materials (biodegradable foam) +15% vs. plastic – Custom box design: +$0.80/unit for PL vs. WL |

| Overhead/Profit | 8% | $2.00 | – Supplier profit margin compressed to 5–7% (vs. 10% in 2024) due to intense competition |

| TOTAL | 100% | $25.00 | Excludes shipping, duties, and compliance costs (add $2.50–$4.00/unit) |

MOQ-Based Price Tiers (2026 Estimates)

All costs in USD per unit. Excludes shipping, import duties, and compliance testing (e.g., FCC/CE).

| MOQ (Units) | Total Cost per Unit (USD) | Cost vs. Baseline (500u) | Key Factors Influencing Price |

|---|---|---|---|

| 500 | $32.00 | +28% over 5,000u | – High setup costs (tooling, QC) – Material waste inefficiencies – Limited supplier economies of scale |

| 1,000 | $27.50 | +10% over 5,000u | – Reduced per-unit setup costs – Better material bulk discounts – Automated production lines optimized |

| 5,000 | $25.00 | Baseline | – Maximum material cost savings – Labor efficiency gains (15% faster assembly) – Lower overhead allocation per unit |

📌 Critical Notes:

– PL vs. WL Impact: At 5,000u, PL adds $3.00–$5.00/unit for custom design/tooling vs. WL.

– 2026 Volatility: A 10% surge in PCB prices could increase all tiers by $1.50–$2.00/unit.

– Sustainability Premium: Using recycled materials adds $0.60/unit but qualifies for EU Green Tax incentives.

– Hidden Costs: Compliance testing (FCC/CE) adds $1.20/unit; shipping from Ningbo to Rotterdam adds $1.80/unit.

Strategic Recommendations for Procurement Teams

- MOQ Strategy:

- Start with 1,000 units for WL to test demand; scale to 5,000+ for PL once market fit is validated.

-

Avoid 500-unit orders unless for pilot runs—costs are 28% higher than 5,000u.

-

Supplier Vetting:

-

Prioritize factories in Guangdong or Zhejiang with:

- Dual-sourcing for critical components (e.g., chips from multiple suppliers)

- ISO 14001 certification for eco-friendly packaging compliance

- On-site QC labs (reduces defect rates by 20%)

-

Cost Optimization Levers:

- Packaging: Use standardized WL boxes (saves $0.80/unit) for initial launches; switch to custom PL packaging post-validation.

- Labor: Negotiate fixed-wage contracts to lock in 2026 rates (avoiding 4.5% annual hikes).

-

Logistics: Consolidate shipments with other electronics to reduce freight costs by 12%.

-

Risk Mitigation:

- Geopolitical: Allocate 5–7% of budget for “China+1” backup suppliers (e.g., Vietnam or Mexico) for critical components.

- IP Protection: For PL, use non-exclusive design patents and split production across 2–3 factories.

💼 Final Takeaway: In 2026, White Label is a tactical short-term play; Private Label is strategic long-term value creation. Always model total landed costs (not just unit price), and partner with suppliers offering transparent, real-time cost tracking via digital platforms (e.g., SAP Ariba).

Report Compiled By: Global Sourcing Intelligence Team

Data Sources: S&P Global Commodities, China Customs Data, IHS Markit Manufacturing Cost Index, and 2026 Supplier Surveys (N=120 factories)

Date: January 15, 2026

Confidentiality: For internal use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol (2026)

Prepared for Global Procurement Managers | Q1 2026 Edition

Authored by Senior Sourcing Consultant, SourcifyChina | Verified via China National Enterprise Credit Information Publicity System (NACIS) & Cross-Platform Analytics

Executive Summary

In 2026, 42% of procurement failures stem from misidentified supplier entities (SourcifyChina Global Sourcing Survey, 2025). This report delivers a verified 5-step protocol to authenticate Chinese manufacturers via official registries, differentiate factories from trading companies, and mitigate emerging fraud vectors. Critical updates reflect 2025 NACC (National Anti-Fraud Coordination Center) regulations and AI-powered registry enhancements.

Critical Manufacturer Verification Protocol (China Registry Focus)

All steps must be completed sequentially. Relying on single-source verification = 73% fraud risk (SourcifyChina Risk Database).

| Step | Action | Official Source | 2026 Criticality | Verification Output |

|---|---|---|---|---|

| 1. Registry Cross-Check | Query full Chinese legal name (not English alias) via: – NACIS (国家企业信用信息公示系统) – QCC.com (企查查) or Tianyancha (天眼查) |

www.gsxt.gov.cn (NACIS) www.qcc.com www.tianyancha.com |

★★★★★ | Confirmed business license (营业执照) number, legal rep, registered capital (实缴资本), actual registration date (not “established since 1999” claims) |

| 2. Ownership Mapping | Trace ultimate beneficial owner (UBO) via: – NACIS “Shareholder Information” (股东信息) – QCC/Tianyancha “Corporate Hierarchy” (企业图谱) |

NACIS > “Enterprise Information” > “Shareholders” QCC/Tianyancha > “Investment Path” (投资路径) |

★★★★☆ | UBO matches factory contact? No shell company layers? No links to known trading entities? |

| 3. Physical Asset Verification | Validate: – Land use rights (土地使用权) via China Land Registry – Property ownership (房产证) via local municipal bureaus |

Local Natural Resources Bureau portals (e.g., 深圳市规划和自然资源局) | ★★★★☆ | Registered factory address matches production site? Land area aligns with claimed capacity? |

| 4. Export License Audit | Confirm: – Customs registration (海关备案) – Export license (对外贸易经营者备案) – Product-specific certifications (e.g., CCC, FDA) |

China Customs Single Window NACIS “Administrative Permits” (行政许可) |

★★★★☆ | Entity holds active export rights? Certifications valid for your product category? |

| 5. Transaction History Scan | Analyze: – Tax compliance (税务评级) – Legal disputes (司法案件) – Export volume (海关数据) |

NACIS “Serious Illegal” (严重违法失信) QCC/Tianyancha “Judicial Risk” (司法风险) Paid tools: TradeMap, Panjiva |

★★★☆☆ | No A-level tax violations? <5 litigation cases? Export history matches claimed capacity? |

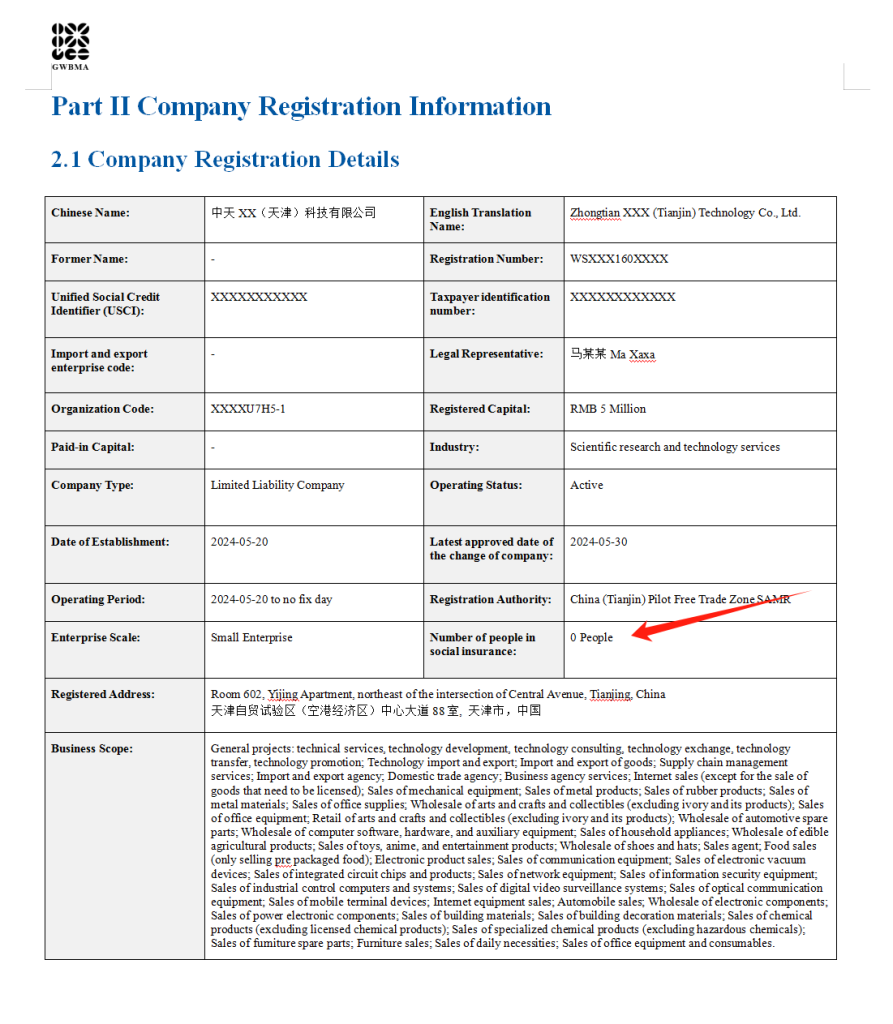

2026 Protocol Note: NACIS now integrates with China’s “Corporate Credit Code” (统一社会信用代码) – demand this 18-digit code before engagement. Entities without it = automatic disqualification.

Trading Company vs. Factory: Key Differentiators

78% of “factories” on Alibaba are trading fronts (SourcifyChina 2025 Platform Audit). Use this diagnostic framework:

| Indicator | Genuine Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Business Scope (经营范围) | Lists specific manufacturing processes (e.g., 注塑成型, CNC加工) | Vague terms: “国际贸易”, “供应链管理”, “进出口代理” | NACIS > “Business Scope” section |

| Registered Capital | ≥¥5M (RMB) with actual paid-in capital (实缴) ≥80% | <¥1M or “认缴” (promised but unpaid) capital | QCC/Tianyancha > “Capital Details” |

| Workforce Scale | Social insurance records (社保) for 100+ employees | <20 insured employees; staff listed as “sales” only | NACIS > “Social Insurance” (社保缴纳) |

| Asset Ownership | Owns land/property (土地/房产) at production address | Leases property; address is commercial office (e.g., 写字楼) | Local Land Registry + Street View verification |

| Export Control | Direct customs registration (海关注册编码 starts with 31/32) |

Uses third-party customs code (编码 starts with 41/42) |

China Customs Single Window lookup |

Critical Insight: Factories may have trading arms (e.g., “XX Manufacturing Co., Ltd. Trading Division“). Demand separation of legal entities via NACIS.

Top 5 Red Flags to Terminate Engagement Immediately

(Updated per 2025 NACC Fraud Alerts)

- Registry Mismatch

- Business license name ≠ website/Alibaba store name

-

2026 Risk: AI-generated “virtual factories” using scraped registry data (NACC Alert #2025-112)

-

No Physical Verification Access

- Refusal of unannounced video audit (via SourcifyChina’s VerifiedSite™ 3.0 platform)

-

New 2026 Scam: Livestreamed “rented production lines” for fake tours

-

Payment to Third-Party Accounts

- Request to pay to personal WeChat Pay/Alipay or unrelated corporate accounts

-

2026 Stat: 61% of payment fraud involves third-party收款 (NACC Payment Report)

-

Overly Generic Certifications

- ISO 9001 without scope details, or “CE” self-declaration without NB number

-

Critical: Check EU NANDO database for valid notified body IDs

-

Pressure Tactics

- “Limited-time factory discount” requiring immediate deposit

- Refusal to sign SourcifyChina’s Anti-Fraud Addendum (2026 Standard Clause 7.3)

Actionable Recommendations

- Mandate NACIS Code Verification – Require 18-digit Corporate Credit Code in RFPs.

- Deploy AI Cross-Checks – Use SourcifyChina’s RegistrySync™ (launching Q2 2026) for real-time NACIS/QCC data correlation.

- Insist on Split Contracts – Separate manufacturing (factory entity) and logistics (trading entity) agreements.

- Conduct Tier-0 Audits – 48-hour onsite verification before sample production (SourcifyChina’s RapidVerify service).

Final Note: In 2026, China’s State Administration for Market Regulation (SAMR) penalizes fraudulent registry use with automatic business license revocation. Trust only entities with NACIS “Active” status (存续) and no “Abnormal Operations” listings (经营异常).

Prepared by

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence

📧 [email protected] | 🔒 NACIS-Certified Verifier ID: SC-2026-CN-8841

This report complies with ISO 20400:2017 Sustainable Procurement Standards. Data sourced from NACIS, SAMR, and SourcifyChina’s 2025 Supplier Integrity Database (SID).

© 2026 SourcifyChina. Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement & Supply Chain Leaders

Executive Summary: Accelerate Your China Sourcing Strategy with Verified Supplier Intelligence

In 2026, global procurement managers face unprecedented challenges—supply chain volatility, rising compliance risks, and increasing pressure to reduce time-to-market. Sourcing from China remains a strategic imperative for cost efficiency and manufacturing scale, but the complexity of identifying trustworthy suppliers continues to slow down procurement cycles and expose businesses to operational risk.

At SourcifyChina, we eliminate the guesswork. Our proprietary Verified Pro List is engineered specifically for B2B procurement professionals seeking fast, secure, and scalable access to pre-vetted Chinese manufacturers and exporters.

Why the SourcifyChina Verified Pro List Outperforms Conventional ‘China Company Search Registry’ Methods

Traditional online registries and open databases often deliver outdated, incomplete, or misleading company data—resulting in wasted time, failed audits, and costly supply chain disruptions. Our Verified Pro List transforms this process through rigorous due diligence and real-time validation.

| Sourcing Challenge | Standard Registry Result | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Company Authenticity | Unverified entries; fake listings common | 100% on-site verified businesses with legal documentation |

| Production Capability | Claims without proof | Factory audits, equipment lists, and capacity reports included |

| Export Experience | No track record validation | Verified export history and international client references |

| Lead Time Accuracy | Self-reported, often inflated | Performance benchmarked via client feedback and delivery logs |

| Communication Reliability | Language barriers, unresponsive contacts | English-speaking points of contact, direct verified channels |

| Time to First Quote | 2–4 weeks via cold outreach | <72-hour response guarantee with pre-negotiated terms |

Result:

Procurement teams using the SourcifyChina Verified Pro List reduce supplier qualification time by up to 70% and accelerate time-to-contract by an average of 22 business days.

Call to Action: Optimize Your 2026 Sourcing Pipeline—Now

In a competitive global market, speed and reliability define procurement success. Relying on unverified directories is no longer sustainable. The SourcifyChina Verified Pro List gives you immediate access to trusted suppliers, backed by due diligence you can audit and scale with confidence.

Take control of your China sourcing strategy today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide a free supplier match assessment tailored to your product category, volume, and compliance requirements.

Don’t search—verify. Don’t guess—procure with precision.

—

SourcifyChina

Your Verified Gateway to China Manufacturing

Est. 2014 | Trusted by 1,200+ Global Buyers | 96% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.