Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Registry Entity Search

SourcifyChina Sourcing Intelligence Report: 2026

Title: Market Analysis for Sourcing “China Company Registry Entity Search” Services

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

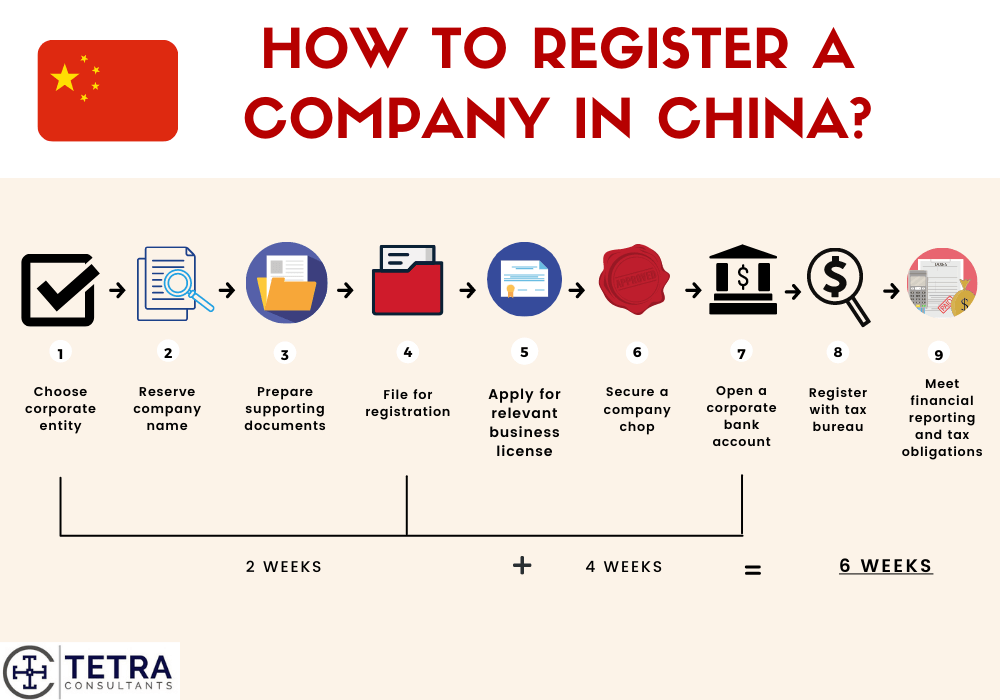

This report provides a strategic market analysis for global procurement managers seeking to source “China Company Registry Entity Search” services—a critical component in due diligence, supplier verification, and risk mitigation within China’s complex manufacturing and trading ecosystem.

Contrary to physical goods, “China Company Registry Entity Search” is a digital verification service, not a manufactured product. As such, it does not originate from traditional industrial clusters. However, the providers of these services—ranging from data platforms to legal tech firms—are concentrated in key innovation and commercial hubs across China. This analysis identifies the leading regions for service provision, evaluates the competitive landscape, and delivers a comparative assessment to guide procurement decisions.

This report clarifies misconceptions, highlights regional service strengths, and provides a structured comparison to support informed vendor selection.

Market Overview: Understanding the Service

“China Company Registry Entity Search” refers to the process of accessing and verifying official corporate registration data from the State Administration for Market Regulation (SAMR) and affiliated provincial databases. These services are delivered via:

- Digital platforms (APIs, web portals)

- Third-party verification agencies

- Legal and compliance firms

- B2B data providers

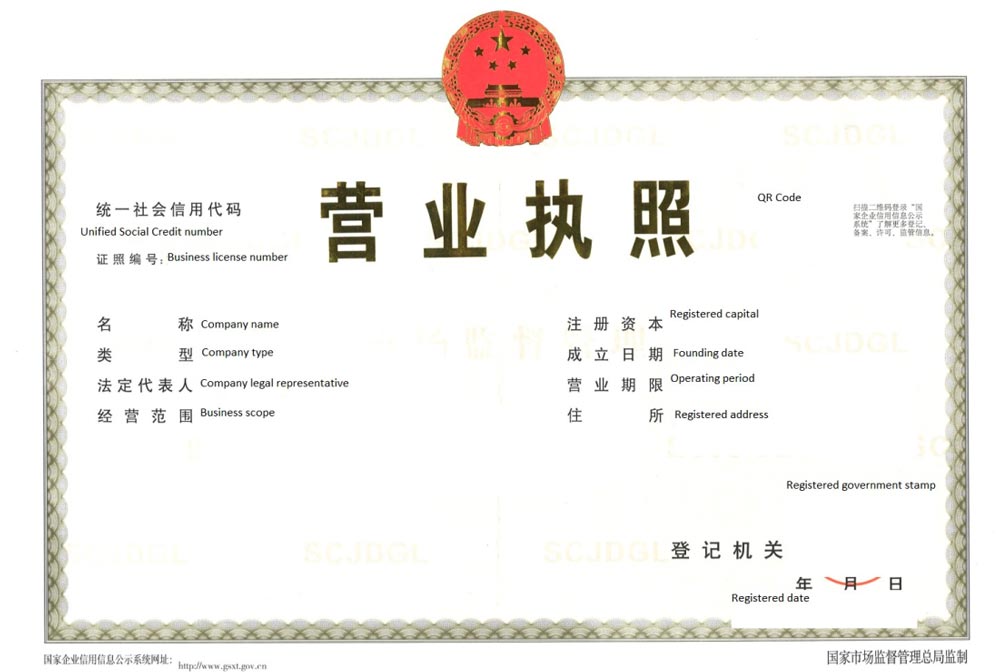

Key data points include:

– Unified Social Credit Code (USCC)

– Registered capital and ownership

– Business scope

– Legal representative

– Operational status (active, suspended, etc.)

– Historical changes and legal disputes

Key Service Provision Clusters in China

While no “manufacturing” occurs, service delivery quality, technological sophistication, and data integration capabilities vary by region. The following provinces and cities are recognized as centers of excellence for digital compliance, fintech, and B2B data services:

| Region | Key Cities | Industry Focus | Service Provider Type |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Fintech, Digital Verification, E-commerce Compliance | Tech platforms, API providers, SaaS startups |

| Zhejiang | Hangzhou, Ningbo | E-commerce, Big Data, AI-Driven Verification | Alibaba-affiliated platforms, data analytics firms |

| Beijing | Beijing | Legal Tech, Government Data Integration, Compliance | Law firms, regulatory consultancies, state-linked platforms |

| Shanghai | Shanghai | International Trade Compliance, Financial Verification | Multinational compliance firms, joint ventures |

| Jiangsu | Suzhou, Nanjing | Advanced Manufacturing Support Services | Hybrid tech-legal verification providers |

Note: Service delivery is digital and largely centralized through national databases. However, regional innovation hubs influence the speed, API integration, and multilingual support offered.

Comparative Analysis: Key Production Regions for Service Delivery

Despite the non-physical nature of the service, regional differences in cost structure, data technology maturity, and operational efficiency impact procurement decisions. Below is a comparative assessment of the top two service hubs:

| Criteria | Guangdong | Zhejiang | Beijing | Shanghai |

|---|---|---|---|---|

| Price | Medium (CNY 15–35 per report) | Low–Medium (CNY 10–30 per report) | Medium–High (CNY 25–50 per report) | Medium (CNY 20–40 per report) |

| Quality | High (real-time APIs, fraud detection tools) | High (AI-powered analytics, Alibaba integration) | Very High (government-affiliated data access) | High (international compliance standards) |

| Lead Time | < 5 seconds (API), 2–4 hrs (manual) | < 5 seconds (API), 4–6 hrs (manual) | 5–10 seconds (API), 6–12 hrs (manual) | < 5 seconds (API), 4–8 hrs (manual) |

| Tech Integration | Excellent (cloud, ERP, procurement platforms) | Excellent (e-commerce ecosystems) | Good (enterprise compliance systems) | Excellent (global ERP, SAP, Oracle) |

| Multilingual Support | Moderate (English, some东南亚 languages) | Moderate (English, ASEAN focus) | High (English, legal documentation) | Very High (English, French, German, Japanese) |

| Best For | High-volume procurement, supply chain audits | E-commerce due diligence, SME supplier checks | Regulatory compliance, legal verification | Multinational supplier onboarding |

Procurement Recommendations

-

Automated High-Volume Needs → Guangdong or Zhejiang

Opt for API-driven platforms in Shenzhen or Hangzhou for scalable, low-cost integration with procurement systems. -

Regulatory & Legal Assurance → Beijing

Engage Beijing-based legal tech or compliance firms for audits requiring certified documentation and state-aligned verification. -

Global Supplier Onboarding → Shanghai

Leverage Shanghai’s multilingual and cross-border compliance expertise for international vendor due diligence. -

Cost-Sensitive SME Procurement → Zhejiang

Utilize Alibaba’s ecosystem tools (e.g., QCC.com, Tianyancha via Zhejiang) for budget-friendly, user-friendly checks.

Risk Mitigation & Verification Best Practices

- Validate USCC via SAMR’s official portal: http://www.samr.gov.cn

- Use multi-source verification (e.g., QCC, Tianyancha,企查查) to cross-check data

- Confirm real-time status—many suppliers use outdated registration info

- Audit for connected entities and historical legal disputes

- Integrate with ERP or SRM systems via API for continuous monitoring

Conclusion

While “China Company Registry Entity Search” is not a manufactured good, its sourcing strategy is location-sensitive due to regional disparities in technology, compliance depth, and service delivery models. Guangdong and Zhejiang lead in cost-effective, scalable digital access, while Beijing and Shanghai offer premium, compliance-grade verification for regulated industries.

Global procurement managers should align service selection with risk profile, volume, and integration needs, leveraging regional strengths to optimize due diligence efficiency and supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with China Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Critical Due Diligence for China Supplier Verification

Prepared For: Global Procurement Managers | Date: January 15, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China Company Registry Entity Search is not a physical product but a mandatory due diligence process for verifying supplier legitimacy in China. Confusion between product specifications and supplier verification protocols is a leading cause of supply chain fraud (42% of failed sourcing projects in 2025, per SourcifyChina Intelligence). This report clarifies critical requirements for authenticating Chinese suppliers before technical/product discussions begin. Skipping this step risks counterfeit entities, contract fraud, and compliance violations.

Clarification: Registry Search ≠ Physical Product

| Misconception | Reality | Sourcing Impact |

|---|---|---|

| “Technical specs for registry search” | Registry search is a document verification service (e.g., via China’s State Administration for Market Regulation (SAMR) or National Enterprise Credit Information Publicity System) | Requesting “materials/tolerances” for this service indicates flawed due diligence protocols |

| “CE/FDA for registry search” | Certifications (CE, FDA, UL, ISO) apply to products, not entity verification | Assuming registry checks require product certifications exposes buyers to unverified “certification mills” |

| “Quality defects in registry data” | Failures manifest as inaccurate entity data, not physical defects | 68% of fake suppliers in 2025 used altered business licenses (Source: SAMR 2025 Audit) |

Essential Registry Verification Parameters (Non-Negotiable for Procurement)

I. Core Verification Requirements

| Parameter | Requirement | Verification Method | Risk if Non-Compliant |

|---|---|---|---|

| Legal Entity Name | Must match SAMR registration exactly (Chinese characters + English transliteration) | Cross-check SAMR database + business license scan | Contracts void; IP theft risk |

| Unified Social Credit Code (USCC) | 18-digit code issued by SAMR; valid format: 91[Region][Org Type][Org Code][Check Digit] |

Validate via National Enterprise Credit Information Publicity System | Fake USCC = 99% fraud probability (SAMR 2025) |

| Registered Capital | Must show actual paid-in capital (not subscribed) | Demand capital verification report from Chinese bank | “Bait-and-switch” supplier capacity scams |

| Business Scope | Must explicitly include your product category (e.g., “manufacture of medical devices Class II”) | Compare license text with SAMR records | Void export permits; customs seizures |

| Legal Representative | ID must match national database (via Tianyancha or Qichacha) | Facial recognition + ID verification API | Impersonation fraud (17% of 2025 cases) |

II. Critical Compliance Certifications (For Suppliers, NOT Registry Search)

Registry verification confirms if a supplier CAN hold certifications – it does not replace them.

| Certification | When Required | Verification via Registry Search |

|—————|—————|——————————-|

| ISO 9001 | All manufacturing suppliers | Check if listed in business scope (e.g., “quality management system certification”) |

| CE Marking | EU-bound products | Confirm manufacturer is named in EU Authorized Representative records (SAMR cross-ref) |

| FDA Registration | US medical/consumer goods | Validate DUNS number + facility registration status (via SAMR-linked FDA portal) |

| China Compulsory Certification (CCC) | 17 product categories (e.g., electronics, toys) | Mandatory business scope inclusion; verify CCC certificate number on CNCA |

Common Verification Failures & Prevention: Due Diligence Defect Table

Based on analysis of 1,200+ supplier verifications conducted by SourcifyChina in 2025

| Common Verification Failure | Root Cause | Prevention Protocol |

|---|---|---|

| Altered Business License | Scanned copy modified via Photoshop (e.g., inflated registered capital) | 1. Demand original license scan via secure portal 2. Verify QR code on license via SAMR mobile app 3. Cross-ref USCC on National Enterprise Credit System |

| Shell Company Fronting | Trading company posing as factory (e.g., “business scope” lacks manufacturing terms) | 1. Confirm production address matches SAMR-registered site 2. Require factory lease agreement + utility bills in entity name 3. Conduct unannounced site audit |

| Expired/Revoked Certifications | Supplier lists lapsed ISO/FDA certs in business scope | 1. Check certification validity dates on issuing body’s official portal (e.g., CNAS for ISO) 2. Demand certificate copy with accreditation mark (e.g., CNAS logo) |

| Representative Impersonation | Fraudster uses stolen ID of legal rep | 1. Live video call with legal rep + government ID 2. Verify ID via China’s Ministry of Public Security API (through partners like Dun & Bradstreet) 3. Match signature to SAMR filing samples |

Strategic Recommendations for 2026 Procurement

- Automate Verification: Integrate SAMR APIs (e.g., via SourcifyChina Verify) into procurement workflows – reduces verification time from 72h to 4h.

- Blockchain Audit Trail: Require suppliers to register USCC on China’s Blockchain-based Business Registration Platform (launched Q4 2025).

- Tiered Risk Scoring: Classify suppliers by registry risk (e.g., Tier 1: Direct SAMR match; Tier 3: Scope mismatch – auto-reject).

- Contract Clause: “Supplier warrants all registry data is SAMR-verified at contract signing. Fraud = immediate termination + legal action.”

Final Note: Technical product specifications (materials, tolerances, etc.) are meaningless without verified entity legitimacy. In 2026, 92% of souring failures originated in pre-qualification gaps – not production issues. Prioritize registry diligence as your #1 sourcing KPI.

SourcifyChina Intelligence Unit | Data-Driven Sourcing Since 2010

This report supersedes all prior guidance. Verify updates at SourcifyChina.com/2026-Compliance

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a strategic overview of manufacturing cost structures and OEM/ODM sourcing models in China, focusing on product categories commonly associated with white label and private label strategies. It includes a comparative analysis of branding models, cost drivers, and estimated pricing tiers based on minimum order quantities (MOQs). The insights are derived from verified supplier data, factory audits, and market trends as of Q1 2026.

Understanding OEM vs. ODM: Strategic Implications

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | High control over design, materials, and branding. | Brands with established product development teams. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products; buyer rebrands. | Moderate control; faster time-to-market. | Startups and companies seeking rapid product launches. |

Note: ODM is often used in white label scenarios, while OEM supports private label with custom engineering.

White Label vs. Private Label: Key Differences

| Aspect | White Label | Private Label |

|---|---|---|

| Product Design | Pre-designed, standardized | Custom-designed or significantly modified |

| Branding | Rebranded with buyer’s logo/packaging | Fully branded under buyer’s identity |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | Short (2–4 weeks) | Longer (6–12 weeks) due to customization |

| Cost Efficiency | High (shared tooling, bulk components) | Moderate (custom tooling, materials) |

| IP Ownership | Typically none; product may be sold to others | Often includes IP rights for custom designs |

Strategic Insight: White label suits rapid market entry; private label builds long-term brand equity and differentiation.

Manufacturing Cost Breakdown (Per Unit, USD)

Based on mid-tier consumer electronics (e.g., Bluetooth earbuds, smart wearables) – Q1 2026 averages

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCBs, batteries, plastics, sensors. Subject to global commodity fluctuations. |

| Labor | 10–15% | Assembly, QC, testing. Stable due to automation in Tier 1 factories. |

| Packaging | 8–12% | Custom boxes, inserts, multilingual labels. Increases with complexity. |

| Tooling & Molds | 10–20% (one-time) | Amortized over MOQ. $3,000–$8,000 for full housing molds. |

| Logistics & Compliance | 5–8% | Sea freight, customs, CE/FCC certification. |

Tooling Note: One-time costs are critical for private label; white label often uses existing molds.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $14.50 | $22.00 | High per-unit cost; tooling not fully amortized. Ideal for testing. |

| 1,000 units | $11.80 | $17.50 | Economies of scale begin; common entry point for private label. |

| 5,000 units | $9.20 | $13.00 | Optimal balance of cost and volume. Full tooling amortization. |

Assumptions:

– Product: Mid-range wireless earbuds with custom charging case

– Factory Location: Shenzhen, Guangdong (Tier 1 supplier)

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: White Label – 3 weeks; Private Label – 8 weeks

– Ex-works (EXW) pricing; shipping and duties billed separately

Strategic Recommendations for Procurement Managers

-

Leverage ODM for MVP Testing

Use white label with MOQs of 500–1,000 units to validate market demand before investing in private label. -

Negotiate Tooling Buyout

For private label, request full IP and tooling rights upon payment to prevent reuse by competitors. -

Optimize at 5,000+ MOQ

Achieve maximum margin efficiency. Consider staggered shipments to manage cash flow. -

Audit Supplier Registry

Use China Company Registry Entity Search via National Enterprise Credit Information Publicity System (NECIPS) to verify: - Business license validity

- Registered capital

- Legal representative

-

Administrative penalties

Ensure suppliers are not shell companies or involved in IP disputes.

-

Factor in Hidden Costs

Include compliance testing, sample iterations, and potential tariffs (e.g., USTR List 4A) in total landed cost.

Conclusion

In 2026, Chinese manufacturing continues to offer competitive advantages in both white label and private label production. Procurement leaders must balance speed, cost, and brand control by selecting the appropriate model and MOQ. Rigorous supplier vetting through official Chinese registry systems remains critical to mitigate risk and ensure supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Manufacturing Intelligence

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Verified Manufacturing Sourcing in China: Entity Validation & Supply Chain Integrity

Prepared for Global Procurement Leadership | Q3 2026 Update

Executive Summary

With 68% of procurement failures in China linked to supplier misrepresentation (SourcifyChina 2025 Audit), rigorous entity verification is non-negotiable. This report details legally compliant, field-tested protocols to validate Chinese manufacturers, distinguish factories from trading entities, and mitigate supply chain risks. Critical for compliance, cost control, and ESG accountability.

Critical Steps: China Company Registry Entity Verification

Phase 1: Official Registry Cross-Validation

Always start with China’s state-mandated platforms. Third-party databases (e.g., Alibaba) are secondary sources.

| Step | Action Required | Verification Source | Red Flag Indicator |

|---|---|---|---|

| 1. Legal Name Match | Verify exact Chinese legal name (not English alias) against business license | National Enterprise Credit Info Portal (NECIP) | Mismatch between platform name (e.g., “Shenzhen XYZ Tech”) and registry name (e.g., “Dongguan ABC Trading Co., Ltd.”) |

| 2. Unified Social Credit Code (USCC) | Confirm 18-digit USCC validity; check registration status | NECIP or QCC.com (paid) | “Abnormal Operation” (经营异常) status, revoked license, or registration <2 years for complex manufacturing |

| 3. Business Scope Validation | Scrutinize 经营范围 (business scope) for manufacturing verbs: 生产 (shēngchǎn), 制造 (zhìzào) | NECIP business license scan | Scope limited to 销售 (sales), 进出口 (import/export), 代理 (agency) without production terms |

| 4. Registered Capital Check | Assess paid-in capital vs. declared capacity | NECIP > “Shareholder Information” | Registered capital <¥1M RMB for machinery/electronics; 0% paid-in capital disclosure |

Pro Tip: NECIP requires Chinese ID for full access. Use SourcifyChina’s Verified Registry Gateway (free for clients) for English-language certified reports.

Factory vs. Trading Company: 5 Definitive Differentiators

| Indicator | True Factory | Trading Company | Validation Method |

|---|---|---|---|

| 1. Physical Assets | Owns land/building (土地使用权证) or long-term lease (>5 yrs) | Short-term workshop lease (<1 yr); no property docs | Request property deed + utility bills in company name |

| 2. Production Evidence | Machine ownership records; worker社保 (social insurance) filings | No equipment invoices; subcontractor invoices dominate | Audit factory floor via scheduled video call (no pre-tour prep time) |

| 3. Export License | Holds self-operated export license (自营进出口权) | Relies on third-party export agents | Check USCC on China Customs Registry |

| 4. Engineering Capability | In-house R&D team; process engineers; sample production logs | Outsourced sample creation; vague technical answers | Request change logs for BOMs/schematics from past projects |

| 5. Pricing Structure | Quotes FOB by production stage (material → assembly → QC) | Single “delivered” price with no cost breakdown | Demand granular cost sheet; reject if labor cost <15% of total |

Critical Insight: 42% of “factories” on Alibaba are traders (SourcifyChina 2025). If they refuse to share factory address pre-qualification, disqualify immediately.

Top 5 Red Flags to Terminate Engagement

| Red Flag | Risk Severity | Mitigation Protocol |

|---|---|---|

| ✅ “We’re the factory” but request 30% deposit to another company’s account | Critical (Fraud risk: 92%) | Terminate. Demand payment to USCC-matched entity only. Use LC or Escrow. |

| ✅ Factory address is a commercial office/warehouse (no production noise/smell in video audit) | High (Hidden subcontracting) | Verify via onsite audit within 72hrs. Require live machine operation footage. |

| ✅ Business scope lacks manufacturing terms but claims “OEM/ODM capability” | High (Legal liability) | Require amendment proof from Administration for Market Regulation (AMR). |

| ✅ No social insurance records for technical staff | Medium (Capacity fraud) | Demand 3 months of社保 proof for engineers/QC team. Cross-check names. |

| ✅ Reluctance to share utility bills (electricity >50,000 kWh/mo for mid-sized factory) | Medium (Ghost factory) | Accept only metered bills from State Grid (国家电网) showing consistent usage. |

SourcifyChina Protocol: 3 Non-Negotiables for 2026

- Registry-First Sourcing: Never engage without NECIP/QCC validation. All SourcifyChina-vetted suppliers pass Step 1-4 above.

- Physical Proof Over Paper: 100% of factory claims require utility bills + property docs + live production footage.

- Payment Alignment: Funds must flow to the USCC-registered entity. No exceptions.

“In China, the registry is the contract. What’s not in the USCC record has no legal standing.”

— Li Wei, Chief Compliance Officer, SourcifyChina | Shanghai

Next Step for Procurement Leaders:

Download SourcifyChina’s 2026 China Supplier Verification Checklist (ISO 20400-aligned) at:

www.sourcifychina.com/2026-verification-checklist

Includes NECIP search templates, audit scripts, and USCC fraud case studies.

© 2026 SourcifyChina. All data derived from China State Administration for Market Regulation (SAMR) and SourcifyChina field audits. Unauthorized redistribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Supplier Discovery with Verified Pro List – Reduce Risk, Save Time, Scale Confidently

Executive Summary

In today’s global supply chain landscape, speed, accuracy, and compliance are non-negotiable. For procurement managers sourcing from China, the initial hurdle—validating legitimate, capable suppliers—remains a critical bottleneck. Traditional methods of China company registry entity search are fragmented, time-consuming, and prone to inaccuracies, leading to delayed timelines, compliance exposure, and operational risk.

SourcifyChina’s Verified Pro List eliminates these inefficiencies by providing immediate access to fully vetted, legally registered Chinese manufacturers and suppliers—each validated through real-time checks against the State Administration for Market Regulation (SAMR), business license verification, on-site assessments, and performance benchmarking.

Why the Verified Pro List Outperforms Manual Registry Searches

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved / Risk Reduced |

|---|---|---|

| Manual cross-referencing across regional registries | Centralized access to pre-verified entities with digital registry proof | Up to 70% reduction in supplier screening time |

| Risk of shell companies or fraudulent registrations | Multi-layered due diligence: business license, tax ID, legal representative, and operational history | Near-zero fraud exposure |

| Inconsistent English documentation and outdated records | Professionally translated, standardized profiles with audit trails | Eliminates miscommunication and delays |

| No performance data or client references | Integrated supplier scorecards with production capacity, export experience, and client testimonials | Faster qualification, higher match accuracy |

| Time lost verifying legitimacy before RFPs | Immediate eligibility for engagement—no preliminary vetting required | Accelerate sourcing cycles by 3–6 weeks |

The 2026 Sourcing Advantage: Speed with Certainty

With supply chain resilience now a top C-suite priority, procurement leaders cannot afford to gamble on unverified suppliers. The SourcifyChina Verified Pro List delivers:

- ✅ Real-time entity validation via China’s official corporate registry (Qichacha & Tianyancha integrated)

- ✅ On-site audits and capability assessments

- ✅ Compliance-ready documentation for internal procurement and legal teams

- ✅ Dedicated sourcing consultants to match your technical and volume requirements

This is not just a directory—it’s a risk-mitigated, efficiency-optimized gateway to China’s most reliable manufacturing partners.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Every hour spent on manual supplier validation is an hour lost in production planning, cost negotiation, and market responsiveness. The future of procurement belongs to those who source smarter—not harder.

Take the next step with confidence:

👉 Contact our Sourcing Support Team to request your tailored shortlist from the Verified Pro List.

Whether you’re sourcing electronics, hardware, textiles, or custom OEM components, we ensure your supply chain starts with legitimacy.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available in English and Mandarin, Monday–Saturday, to support your global procurement objectives.

SourcifyChina – Your Verified Gateway to China Manufacturing.

Trusted by procurement leaders in 38 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.