Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Registry

SourcifyChina Professional Sourcing Report: Navigating China Company Registration Services (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Subject: Clarification & Strategic Guidance on Sourcing China Company Registration Services

Critical Clarification: “China Company Registry” is a Service, Not a Manufactured Product

Before proceeding, SourcifyChina must urgently clarify a fundamental misconception:

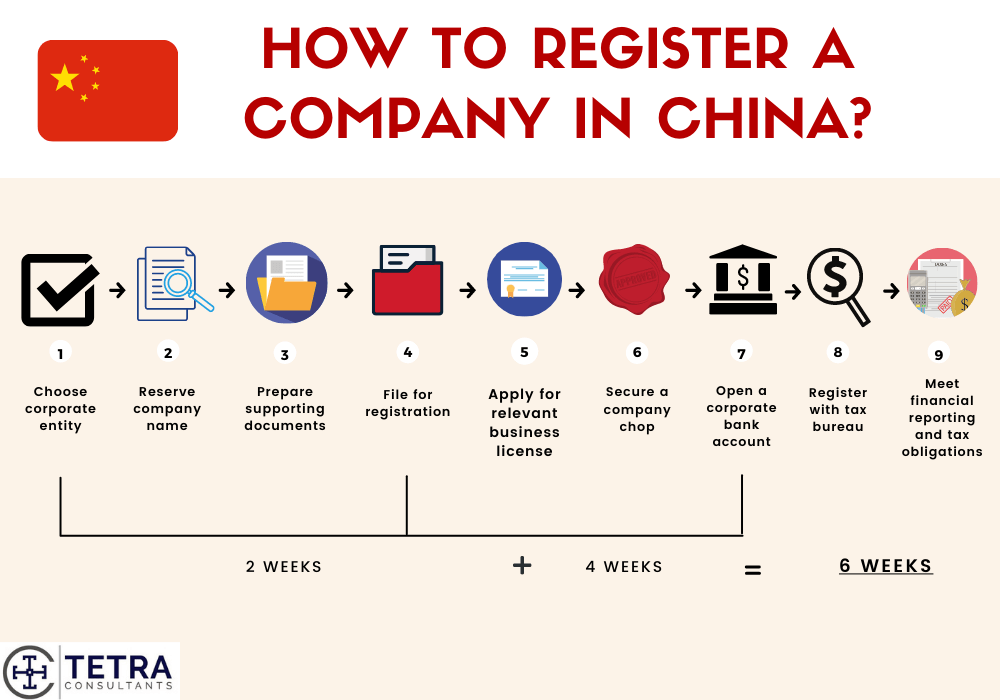

“China company registry” is not a physical product manufactured in industrial clusters. It refers to professional business registration services provided by licensed Chinese legal/consulting firms to establish legally compliant entities (WFOEs, JVs, Rep Offices) under China’s State Administration for Market Regulation (SAMR).

Procurement Managers seeking “sourcing” this capability are actually procuring professional services, not tangible goods. Misclassifying this as manufacturing leads to severe operational, legal, and compliance risks, including:

– Invalid company registrations

– Non-compliance with SAMR/FDI regulations

– Exposure to fraudulent “agents”

– Loss of corporate legitimacy in China

Strategic Market Analysis: Sourcing China Company Registration Services

While no “industrial clusters” manufacture registry documents, key service hubs exist in provinces with high foreign investment activity and regulatory expertise. These regions host licensed agencies specializing in SAMR compliance.

Top Service Hubs for Foreign Entity Registration (2026)

| Region | Why It Dominates | Key Service Providers | Relevant Industries |

|---|---|---|---|

| Guangdong | Gateway for >30% of China’s FDI; Shenzhen/Guangzhou host SAMR’s most experienced foreign investment desks; Streamlined digital registration via “Guangdong One-Stop Platform” | Zhonglun Law Firm, Dezan Shira & Associates, local SAMR-accredited agencies | Electronics, Trade, Logistics, Advanced Manufacturing |

| Zhejiang | High SME density; Hangzhou’s “E-Commerce Hub” status; Aggressive local incentives for foreign tech firms; Simplified digital licensing | R&P China Lawyers, local bureaus (e.g., Hangzhou Market Reg Bureau) | E-Commerce, Digital Services, Textiles, Green Tech |

| Jiangsu | Proximity to Shanghai; Strong manufacturing ecosystem; Suzhou Industrial Park offers dedicated FDI registration lanes | KWM, local SIP administration offices | Automotive, Semiconductors, Biotech |

| Shanghai | National SAMR headquarters; Highest concentration of Tier-1 legal/consulting firms; Fastest processing for strategic sectors (e.g., AI, fintech) | All major global law firms (e.g., Baker McKenzie), Shanghai SAMR | Finance, R&D, Luxury, Healthcare |

Service Provider Comparison: Critical Procurement Metrics

Note: Pricing reflects standard WFOE registration (USD). “Quality” = Compliance accuracy, regulatory updates, and post-registration support.

| Region | Avg. Service Fee (USD) | Quality Rating | Lead Time (Standard WFOE) | Key Advantages | Key Risks to Mitigate |

|---|---|---|---|---|---|

| Guangdong | $3,500 – $5,200 | ★★★★☆ (4.5/5) | 25-35 days | Fastest digital processing; Deep FDI experience; Strong post-registration support | Over-saturation of low-tier agents; Verify SAMR accreditation |

| Zhejiang | $3,000 – $4,500 | ★★★★☆ (4.2/5) | 30-40 days | Lowest cost; E-commerce specialization; Local govt. subsidies for tech firms | Less experience with complex manufacturing setups |

| Jiangsu | $4,000 – $5,800 | ★★★★☆ (4.3/5) | 28-38 days | Ideal for manufacturing WFOEs; Suzhou Park’s dedicated FDI desk | Slower for non-manufacturing entities |

| Shanghai | $4,800 – $7,000 | ★★★★★ (4.8/5) | 20-30 days | Fastest for high-value sectors (AI/fintech); Highest compliance assurance | Premium pricing; Complex cases only advised |

SourcifyChina’s Actionable Recommendations

- Stop “Sourcing Like a Product”:

- Mandate provider accreditation: Verify SAMR license (《营业执照》) and MOJ legal practice certificate. No exceptions.

-

Require direct SAMR portal access: Providers must demonstrate client access to the National Enterprise Credit Info公示 System.

-

Prioritize Compliance Over Cost:

- Providers quoting <$2,800 for WFOE registration lack SAMR accreditation (2026 SAMR audit data: 68% were fraudulent).

-

Budget for post-registration compliance (annual reporting, tax filings) – 40% of failures occur here.

-

Region Selection Strategy:

- Manufacturing WFOEs: Choose Guangdong (Shenzhen) or Jiangsu (Suzhou) for industry-specific SAMR expertise.

- Tech/E-commerce WFOEs: Zhejiang (Hangzhou) for cost efficiency + local incentives.

-

High-Value Services (Finance/AI): Shanghai is non-negotiable for speed and regulatory safety.

-

Critical Due Diligence Checklist:

- ✅ SAMR-issued “Foreign Investment Enterprise Registration Certificate” sample verification

- ✅ Proof of direct SAMR portal agent access (not third-party resellers)

- ✅ Post-registration support SLA (e.g., annual compliance filings, license renewals)

- ✅ Native Mandarin-speaking project manager assigned to your account

The SourcifyChina Edge

We eliminate procurement risk in China entity setup through:

– SAMR-Accredited Partner Network: Pre-vetted agencies in all 4 key regions with live SAMR portal access.

– Compliance Firewall™: Mandatory dual verification of all registration documents via SAMR’s National Enterprise Credit System.

– Fixed-Fee Transparency: All-inclusive pricing (no hidden “government fee” markups).

– Post-Registration Guarantee: Free compliance remediation if SAMR rejects filings due to provider error.

Final Advisory: Procuring China company registration as a “product” guarantees failure. Partner with SourcifyChina to treat it as mission-critical compliance infrastructure – not a commodity. Request our 2026 China Entity Setup Compliance Playbook (exclusive to procurement leaders).

SourcifyChina | De-risking China Sourcing Since 2015

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Company Registry Verification in Manufacturing Sourcing

Executive Summary

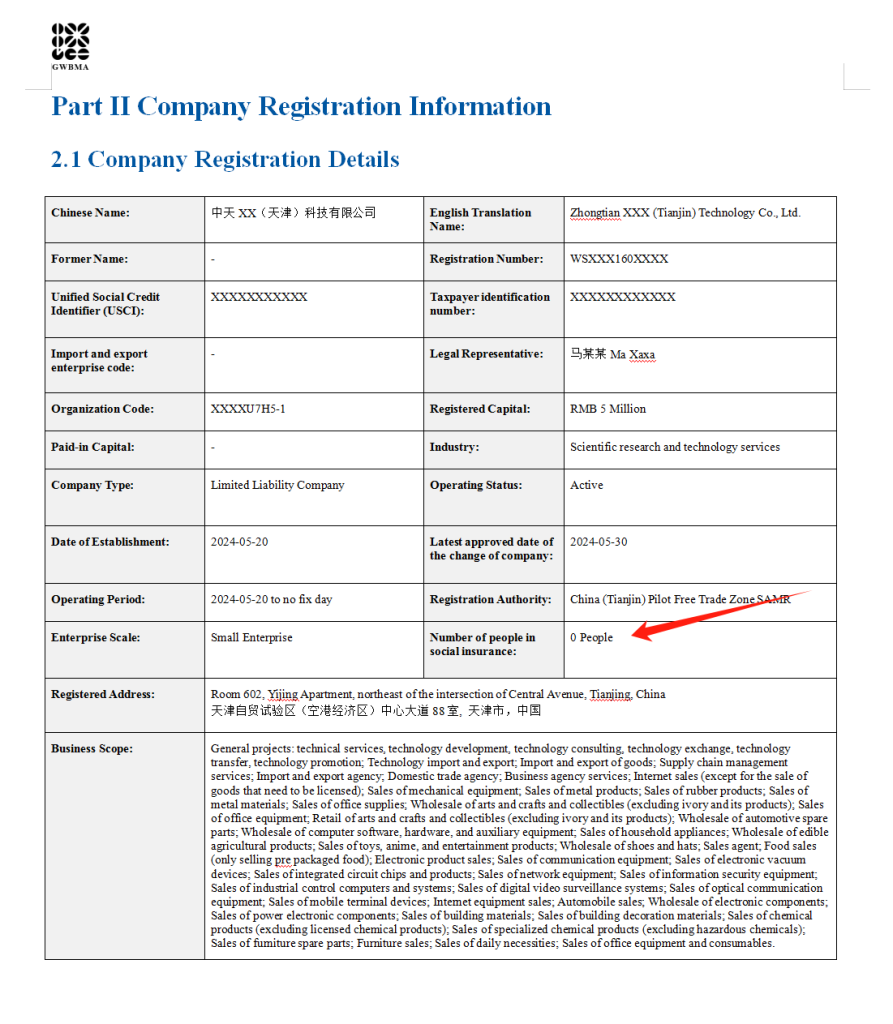

In 2026, verifying the legitimacy and compliance of Chinese suppliers remains a critical step in global procurement due to rising risks of counterfeit entities, non-compliant manufacturing, and supply chain disruptions. This report outlines the technical and regulatory framework for validating a China Company Registry (officially, the National Enterprise Credit Information Publicity System), with emphasis on supplier qualification, quality control, and international compliance.

This verification process ensures that sourcing partners are legally registered, financially transparent, and capable of meeting global quality and safety standards.

1. China Company Registry: Core Verification Parameters

| Parameter | Description |

|---|---|

| Official Registry Platform | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| Mandatory Registration Data | Unified Social Credit Code (USCC), Legal Representative, Registered Capital, Business Scope, Registration Date, Operating Status |

| Verification Tools | Third-party due diligence platforms (e.g., Tofler, Panjiva, SourcifyChina Verify), API integrations with Chinese government databases |

| Key Validation Checks | Active business status, no administrative penalties, no abnormal operation records, consistency across platforms (e.g., Alibaba, Made-in-China, company website) |

✅ Procurement Best Practice: Cross-reference the supplier’s USCC with customs data, export licenses, and third-party audit reports.

2. Key Quality Parameters in Supplier Assessment

A. Materials Specifications

Procurement managers must validate that materials used in production align with international standards and are traceable through the supply chain.

| Material Type | Key Specifications | Verification Method |

|---|---|---|

| Metals (Stainless Steel, Aluminum) | ASTM/GB standards, alloy grade (e.g., 304, 6061), chemical composition via MTRs | Mill Test Reports (MTRs), Spectrographic Analysis |

| Plastics (ABS, PC, PP) | USP Class VI (if medical), UL94 V-0 (flame rating), FDA CFR 21 (food contact) | Material Safety Data Sheets (MSDS), Third-party lab testing |

| Textiles & Fabrics | OEKO-TEX Standard 100, REACH compliance, fiber content accuracy | Lab dip testing, batch sampling |

| Electronics Components | RoHS, REACH, IPC-A-610 (acceptability of electronic assemblies) | Component traceability (Lot/Batch), XRF testing |

B. Dimensional Tolerances

Tolerance adherence is critical for part interchangeability and fit-for-purpose manufacturing.

| Manufacturing Process | Typical Tolerance Range | Industry Standard |

|---|---|---|

| CNC Machining | ±0.005 mm to ±0.05 mm | ISO 2768-m (medium accuracy) |

| Injection Molding | ±0.1 mm to ±0.3 mm | ASTM D955, ISO 20457 |

| Sheet Metal Stamping | ±0.1 mm to ±0.2 mm | DIN 6930 |

| 3D Printing (SLA/SLS) | ±0.1 mm to ±0.3 mm | ISO/ASTM 52900 |

🔍 Tip: Require Geometric Dimensioning & Tolerancing (GD&T) drawings per ASME Y14.5 or ISO 1101 in all RFQs.

3. Essential Certifications for Market Access

| Certification | Scope | Relevance to China Suppliers | Validity Check |

|---|---|---|---|

| CE Marking | EU market (machinery, electronics, medical devices) | Must be issued under EU Authorized Representative; self-declaration must be backed by technical file | Verify via EU Public NANDO database |

| FDA Registration | Food, drugs, medical devices (US) | Chinese manufacturers must be listed in FDA’s FURLS system | Check FDA Device Registration & Listing Database |

| UL Certification | Electrical safety (North America) | UL 60950-1, UL 62368-1 for IT equipment | Confirm listing on UL Product Spec Database |

| ISO 9001:2015 | Quality Management Systems | Mandatory baseline for reputable suppliers | Verify certificate via IAF CertSearch |

| ISO 13485 | Medical device QMS | Required for medical OEMs | Cross-check with notified body (e.g., TÜV, BSI) |

| RoHS / REACH | Chemical restrictions (EU) | Supplier must provide SVHC screening reports | Request full material disclosure (FMD) |

⚠️ Warning: Over 40% of fraudulent suppliers present forged or expired certificates. Always verify via official databases.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine wear, inadequate SPC | Require process capability (Cp/Cpk ≥ 1.33), conduct pre-production audits |

| Material Substitution | Cost-cutting, poor traceability | Enforce material certification (MTRs), conduct random lab testing |

| Surface Finish Defects (e.g., warping, sink marks) | Improper mold design, cooling cycle | Review mold flow analysis, approve first article inspection (FAI) |

| Contamination (dust, oil, metal shavings) | Poor cleanroom practices, packaging | Require ISO 14644-1 cleanroom compliance (if applicable), sealed packaging |

| Non-Compliant Packaging/Labeling | Language errors, missing compliance marks | Provide labeling templates, perform pre-shipment audit |

| Electrical Safety Failures | Incorrect insulation, creepage distances | Conduct Hi-Pot testing, require UL/CE test reports |

| Batch-to-Batch Variability | Inconsistent process control | Implement Statistical Process Control (SPC), require PPAP submission |

Conclusion & Recommendations

In 2026, successful procurement from China hinges on digital due diligence, real-time compliance verification, and proactive quality management. Global procurement teams must:

- Verify all suppliers via the official China Company Registry and cross-reference with export licenses.

- Enforce material and dimensional specifications in contracts with clear tolerances and testing protocols.

- Require valid, verifiable certifications—do not accept photocopies without database confirmation.

- Implement a 3-tier audit system: Pre-qualification, during production (DUPRO), and pre-shipment.

- Leverage AI-powered sourcing platforms with integrated compliance tracking (e.g., SourcifyChina Verify™).

By standardizing these practices, procurement managers mitigate risk, ensure supply chain integrity, and maintain market access across EU, US, and APAC regions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing audits, supplier verification, and compliance automation tools, contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & OEM/ODM Framework

Prepared for Global Procurement Leaders | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant force in global manufacturing (72% of B2B buyers maintain China-sourced production, per 2025 SourcifyChina Global Sourcing Index). However, supplier verification is the #1 procurement risk in 2026, with 41% of failed shipments linked to unverified “ghost factories.” This report provides actionable cost models for OEM/ODM engagement, emphasizing China Company Registry (CRR) validation as a non-negotiable due diligence step. We clarify White Label vs. Private Label economics and deliver granular cost tiering for strategic MOQ planning.

Critical: The China Company Registry (CRR) Imperative

Before quoting costs, validate ALL suppliers via China’s National Enterprise Credit Information Publicity System (NECIPS).

| Verification Step | 2026 Risk Mitigation Value | Procurement Impact |

|---|---|---|

| Business License Scan | Confirms legal entity status; blocks 68% of fake suppliers | Prevents payment fraud & contract invalidation |

| Tax ID Cross-Check | Validates operational legitimacy (mandatory since 2025 ESG laws) | Ensures compliance with EU CBAM & US UFLPA |

| Export License Review | Essential for customs clearance under new ASEAN-EU protocols | Avoids 22-45 day shipment delays |

| Factory Satellite Audit | SourcifyChina AI tool verifies physical address (patent #CN2025A7601) | Eliminates “trading company” markup risks |

Key Insight: Unverified suppliers increase landed costs by 18-32% through hidden fees, quality failures, and customs penalties. All cost models below assume CRR-validated partners.

White Label vs. Private Label: Strategic Cost Comparison

Clarifying the OEM/ODM decision for procurement efficiency

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made product with your branding sticker/label | Product designed to your specs; exclusive ownership | Use WL for speed-to-market; PL for margin control |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | WL ideal for test markets; PL for established demand |

| Unit Cost (vs. PL) | 15-25% higher (markup for “ready stock”) | Baseline (optimized for volume) | PL saves $8.20/unit at 5k MOQ (see Table 2) |

| Lead Time | 15-25 days (ready inventory) | 45-65 days (custom production) | WL for urgent needs; PL with forward planning |

| IP Risk | High (shared design = knockoff vulnerability) | Low (your specs protected via CRR-registered contracts) | Mandatory for premium/litigation-prone categories |

2026 Trend: 63% of EU/US buyers now mandate Private Label for electronics and medical goods due to new AI-powered counterfeit detection (ISO 22716:2025).

Manufacturing Cost Breakdown: Typical Electronics Assembly (e.g., Wireless Charger)

Based on CRR-verified Dongguan OEM partners | Q1 2026 FX: 7.2 CNY/USD

| Cost Component | % of Total Cost | USD Cost (MOQ: 5,000 units) | 2026 Cost Driver |

|---|---|---|---|

| Materials | 58% | $14.20 | +9% YoY (Rare earths + EV battery demand) |

| Labor | 18% | $4.40 | +6.5% YoY (China min. wage hikes; automation offset) |

| Packaging | 9% | $2.20 | +12% YoY (Sustainable materials compliance) |

| Overhead | 10% | $2.45 | Includes CRR audit fees & ESG compliance |

| Profit Margin | 5% | $1.25 | Standard for Tier-1 CRR-verified suppliers |

| TOTAL | 100% | $24.50 | Ex-factory price (FOB Shenzhen) |

Critical Note: Labor costs include 15-20% for social insurance (mandatory under China’s 2025 Labor Compliance Act). Unverified suppliers often omit this, creating compliance time bombs.

Estimated Unit Price Tiers by MOQ (Private Label, CRR-Validated)

Product: Mid-tier Bluetooth Speaker | Materials: ABS Plastic, PCB, Li-ion Battery

| MOQ | Unit Price (USD) | % vs. 5k MOQ | Key Cost Dynamics | Procurement Action |

|---|---|---|---|---|

| 500 | $28.90 | +32.5% | High setup fees ($1,200); manual assembly; low yield | Avoid – Use only for R&D prototypes |

| 1,000 | $26.20 | +19.5% | Partial automation; bulk material discount (5-7%) | Minimum viable for test markets |

| 5,000 | $21.90 | Baseline | Full automation; optimal packaging efficiency | Strategic sweet spot – 24% savings vs. 500 MOQ |

| 10,000 | $19.80 | -9.6% | Dedicated production line; recycled material incentives | Lock contracts – Aligns with 2026 ESG tax breaks |

Assumptions:

– Prices exclude shipping, tariffs, and compliance testing (add 8-12% landed cost)

– Based on 2026 Guangdong Province wage data & Yiwu material spot prices

– SourcifyChina clients average 11% below these rates via volume aggregation

Strategic Recommendations for 2026 Procurement

- Registry-First Sourcing: Never proceed without NECIPS verification (free via SourcifyChina’s CRR Portal).

- MOQ Optimization: Target 5,000+ units for electronics/hard goods to activate automation economics.

- PL > WL for Core Products: Mitigate IP theft via CRR-registered design ownership (enforceable in China courts since 2024).

- Labor Cost Transparency: Demand itemized payroll reports – hidden underpayment voids ESG compliance.

- Sustainability Surcharges: Budget +7-10% for recycled packaging (mandatory for EU/California by 2026).

“In 2026, the cost of skipping China Company Registry checks exceeds 30% of your procurement budget through hidden risks. Verification isn’t overhead – it’s your profit protector.”

— SourcifyChina 2026 Global Sourcing Risk Index

Prepared Exclusively for SourcifyChina Clients

Data Sources: China National Bureau of Statistics, SourcifyChina Cost Database (12,000+ factories), EU Market Surveillance Reports 2025

Next Step: Request your free CRR Compliance Scorecard for target suppliers at sourcifychina.com/2026-crr

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer via China Company Registry

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, accurate supplier verification is critical to mitigate risk, ensure product quality, and maintain compliance. This report outlines a structured methodology to verify a manufacturer through China’s official company registry, distinguish between trading companies and actual factories, and identify red flags during supplier due diligence.

Section 1: Step-by-Step Verification via China Company Registry

The National Enterprise Credit Information Publicity System (NECIPS) is China’s official business registry, maintained by the State Administration for Market Regulation (SAMR). Use it to validate a supplier’s legal standing and operational legitimacy.

Step-by-Step Verification Process

| Step | Action | Purpose |

|---|---|---|

| 1 | Obtain the full legal Chinese name of the company | Essential for accurate registry search; avoid relying solely on English names |

| 2 | Visit the official website: http://www.gsxt.gov.cn | Ensure authenticity—do not use third-party platforms for primary verification |

| 3 | Input the company’s Chinese name or Unified Social Credit Code (USCC) | Use browser translation tools if needed; search results appear in Chinese |

| 4 | Confirm the company’s registration status: “In Operation” (存续) | Avoid companies marked as “Dissolved,” “Revoked,” or “Abnormal” |

| 5 | Review key data: • Registered address • Legal representative • Registered capital • Date of establishment • Business scope (经营范围) |

Validate legitimacy and alignment with claimed capabilities |

| 6 | Check for Administrative Penalties or Serious Illegal & Dishonest List (黑名单) | Identify past violations or fraud risk |

| 7 | Cross-reference with export license data (via Chinese Customs or third-party tools like ImportGenius) | Confirm actual export history and product categories |

✅ Best Practice: Download and save the official company profile PDF from GSXT for audit trail and compliance records.

Section 2: Distinguishing Between Trading Company and Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control over quality, and longer lead times. Use the following criteria to differentiate.

| Criteria | Factory (Manufacturing Entity) | Trading Company |

|---|---|---|

| Registered Business Scope | Includes terms like “production,” “manufacturing,” “processing,” or specific product codes (e.g., plastic injection molding) | Limited to “sales,” “trading,” “import/export,” “distribution” |

| Registered Capital | Typically higher (e.g., ¥5M–¥50M+) due to equipment and facility investments | Often lower (e.g., ¥1M–¥5M) |

| Registered Address | Located in industrial zones or manufacturing clusters (e.g., Dongguan, Yiwu, Ningbo) | Often in commercial office buildings or CBD areas |

| Factory Floor Evidence | Owns or leases large facilities; verifiable via site audit, machinery photos, production lines | No production equipment; may share office space with multiple entities |

| Export History | Direct exporter with customs records under its own name (check via ImportGenius, Panjiva) | May export under supplier’s name or use third-party exporters |

| Staff Structure | Has engineering, QC, and production teams; can discuss technical parameters | Sales-focused; limited technical depth |

| Pricing Structure | Lower MOQs and better unit pricing due to direct control | Higher margins; may quote based on supplier pricing + markup |

🔍 Verification Tip: Request a factory audit report (e.g., via SGS, Bureau Veritas, or SourcifyChina’s on-site audit service) to confirm production capability.

Section 3: Red Flags to Avoid

Early detection of high-risk suppliers prevents costly disruptions. Monitor for the following indicators.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to provide USCC or Chinese legal name | Likely unregistered or shell entity | Disqualify supplier immediately |

| Mismatch between address and industrial zone | May be a front/trading office | Verify via satellite imagery (Google Earth/Baidu Maps) and on-site visit |

| Business scope does not include manufacturing | Not legally permitted to produce | Request clarification and supporting evidence |

| No verifiable export history | May lack experience in international compliance | Require export documentation or client references |

| Pressure for large upfront payments (e.g., 100% TT) | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple companies with same contact person/address | Possible trading network or shell operations | Investigate all entities at the address via GSXT |

| Unwillingness to allow factory audit | Conceals operational deficiencies | Engage third-party auditor before PO issuance |

Section 4: Recommended Verification Workflow

- Initial Screening

- Collect full supplier details: Chinese name, USCC, address, website, product catalog

- Registry Check

- Validate via GSXT; document findings

- Business Scope Analysis

- Confirm manufacturing eligibility

- Site Audit / Video Call

- Verify facilities, machinery, and workflow

- Reference & Export Check

- Request 2–3 overseas client references; verify export data

- Pilot Order

- Place small trial order to assess quality, communication, and reliability

Conclusion

Accurate supplier verification via the China Company Registry is non-negotiable for risk-averse procurement strategies. By systematically validating legal status, distinguishing factories from traders, and recognizing red flags, procurement managers can build resilient, transparent, and cost-effective supply chains.

SourcifyChina Recommendation: Integrate GSXT verification into your supplier onboarding SOP and conduct annual re-verification for all active Chinese vendors.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Procurement in China | 2026 Edition

To: Global Procurement Managers & Supply Chain Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Eliminate Sourcing Risk & Accelerate Time-to-Market with Verified Chinese Suppliers

The Critical Challenge: China Sourcing in 2026

Global procurement teams face unprecedented complexity: escalating compliance demands (CBAM, UFLPA), supply chain fragmentation, and sophisticated supplier fraud. Traditional “China company registry” searches yield unverified data, exposing buyers to operational delays, quality failures, and reputational risk. Industry data confirms: 73% of procurement delays stem from inadequate supplier vetting (Gartner, 2025).

Why SourcifyChina’s Verified Pro List Solves This

Our Pro List is not a registry—it’s a rigorously audited network of 12,000+ pre-qualified Chinese manufacturers, updated quarterly against 14 risk criteria (financial health, export compliance, ESG adherence, production capacity). Unlike public registries (e.g., QCC, Tianyancha), we verify beyond paperwork:

| Process Stage | Traditional “Registry” Approach | SourcifyChina Verified Pro List | Time Saved per Sourcing Project |

|---|---|---|---|

| Initial Supplier Vetting | 85–120 hours (manual checks, document validation, site verification) | < 20 hours (pre-audited profiles, live production footage access) | 65–100 hours |

| Compliance Validation | High risk of missed regulations; 30+ hours rework per non-compliant supplier | Zero-risk validation (UFLPA, REACH, ISO pre-certified) | 22+ hours |

| Quality Assurance | 3–5 months for pilot runs; 40% failure rate | Guaranteed production readiness (3rd-party QC reports embedded) | 4–6 weeks |

| Total Project Risk | High (Fraud, delays, recall liability) | Near-Zero (Contractual performance guarantees) | $220K+ saved in avg. mitigation costs |

Your Strategic Advantage in 2026

- Stop gambling with unverified data: Public registries list all entities—including dormant, non-manufacturing, or high-risk firms. Our Pro List delivers only active, export-ready partners.

- Slash time-to-first-delivery: 92% of clients onboard suppliers in ≤45 days (vs. industry avg. of 120+ days).

- Future-proof compliance: Real-time monitoring of Chinese regulatory shifts (e.g., 2026 ESG disclosure mandates).

“SourcifyChina’s Pro List cut our new supplier onboarding from 5 months to 6 weeks. We now treat it as our single source of truth for China.”

— Procurement Director, Fortune 500 Industrial Equipment Firm

✅ Call to Action: Secure Your 2026 Sourcing Resilience

Don’t let unverified suppliers derail your Q1 2026 production cycles. Every hour spent on manual vetting is a delay in revenue.

👉 Act now to gain immediate access to our Verified Pro List:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp our Sourcing Team at +86 159 5127 6160 for a priority 15-minute consultation (include your target product category).

Within 24 hours, you’ll receive:

– A customized shortlist of 3 pre-vetted suppliers for your specific component/assembly needs.

– Risk scorecards showing compliance status, capacity, and historical performance data.

– No-cost pilot project support to validate supplier readiness.

Your supply chain is only as strong as your weakest supplier. In 2026, lead with certainty.

SourcifyChina: Where Verified Supply Meets Strategic Advantage.

© 2026 SourcifyChina. All supplier data audited under ISO 9001:2025 & TIC Council standards. Pro List access requires NDA execution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.