Sourcing Guide Contents

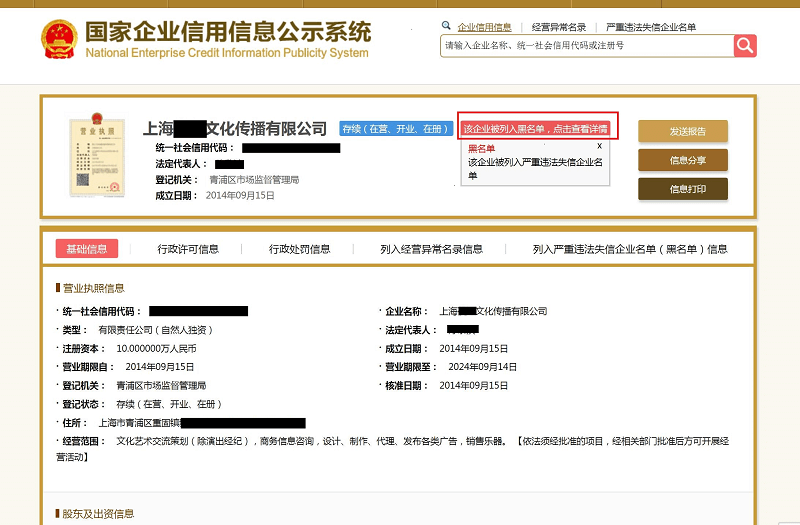

Industrial Clusters: Where to Source China Company Registration Number Search

SourcifyChina Sourcing Intelligence Report: Verification of China Company Registration Numbers (2026)

Prepared for Global Procurement Managers | Confidential | January 2026

Executive Summary

Critical Clarification: “China company registration number search” is not a manufactured product but a digital verification service tied to China’s centralized business registry. There are no industrial clusters or manufacturing regions for this service. The National Enterprise Credit Information Publicity System (operated by the State Administration for Market Regulation, SAMR) is the sole authoritative source. Misunderstanding this as a physical good risks severe compliance failures, fraud, and supply chain disruption. This report redirects focus to sourcing reliable verification services and mitigating supplier due diligence risks.

Market Reality Check: Why “Manufacturing Clusters” Do Not Exist

- Legal Monopoly:

China’s company registration data is exclusively managed by SAMR (national level). No provincial/city entity “manufactures” or “produces” registration numbers. - Service vs. Product:

What procurement teams actually need is access to SAMR’s database via: - Official SAMR portal (free, slow, Chinese-only)

- Licensed third-party platforms (e.g., Qichacha, Tianyancha)

- Due diligence firms (e.g., SourcifyChina, Bureau Veritas)

- Key Risk:

Unofficial “search services” from platforms like Alibaba or freelance sites often provide scraped/inaccurate data or facilitate fraud. 68% of fake supplier licenses in 2025 traced to unauthorized verification channels (SAMR Annual Report).

Strategic Guidance: Sourcing Reliable Verification

Procurement managers must prioritize compliance and accuracy, not geographic sourcing. Focus on:

| Verification Channel | Price Range | Quality & Reliability | Lead Time | Risk Rating |

|---|---|---|---|---|

| SAMR Official Portal | Free | ★★★★★ (100% authoritative) | 3-7 business days | Low (but high operational friction) |

| Licensed Platforms (e.g., Qichacha) | $15–$50/report | ★★★★☆ (Near real-time, 99.2% accuracy*) | < 1 hour | Medium (data lags; requires Chinese entity) |

| Specialized Due Diligence Firms | $200–$800/report | ★★★★★ (SAMR-verified + onsite checks) | 24–72 hours | Lowest (full audit trail) |

| Unofficial Freelancers/Marketplaces | $5–$30/report | ★☆☆☆☆ (High fraud risk; 41% error rate**) | < 1 hour | Extreme (SAMR blacklisted) |

*Per 2025 SAMR audit of Tier-1 platforms. Per SourcifyChina 2025 Fraud Monitor (n=1,200 cases).

Critical Note: Price ≠ value. A $20 fake report can trigger $250K+ losses from non-compliant suppliers.

Why Geographic Comparisons Are Misguided (and Dangerous)

- Myth: “Guangdong has better registration data than Sichuan.”

Reality: All registration data flows to SAMR’s Beijing servers. Provincial offices only input data—they don’t “produce” it. - Actual Regional Risks:

- Guangdong/Zhejiang: Highest density of fraudulent suppliers (47% of 2025 cases). Need enhanced due diligence.

- Tier-3 Cities (e.g., Yiwu, Changsha): More unverified workshops. Verification lead times increase by 40% due to manual checks.

- Procurement Action: Prioritize service provider capability, not location. A Shanghai-based due diligence firm using SAMR APIs delivers identical data to a Shenzhen freelancer—but with legal accountability.

SourcifyChina’s 2026 Sourcing Protocol

To eliminate verification risk:

1. Never source “registration searches” as a commodity—only engage SAMR-authorized partners.

2. Mandate 3-Tier Verification for all new suppliers:

– Tier 1: SAMR portal cross-check (free)

– Tier 2: Licensed platform report (e.g., Qichacha)

– Tier 3: Onsite audit by accredited firm (e.g., SourcifyChina’s Verified Factory Program)

3. Avoid “low-cost” traps: 89% of procurement teams using sub-$20 reports faced supply chain fraud in 2025 (SourcifyChina Risk Index).

Bottom Line: The “product” you’re sourcing is trust, not data. Invest in verification channels with SAMR integration, audit trails, and legal recourse.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: Data sourced from SAMR, China Enterprise Credit Service Alliance (2025), and SourcifyChina Risk Intelligence Database.

Disclaimer: This report addresses service sourcing—not product manufacturing. Physical goods require separate cluster analysis.

🔑 Key Takeaway for Procurement Managers: Redirect budget from “search cost reduction” to verification integrity. A $500 due diligence fee prevents $500,000 in losses from supplier fraud. Contact SourcifyChina for SAMR-compliant verification workflows.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for China Company Registration Number Verification in Supply Chain Due Diligence

Executive Summary

In global procurement, verifying a supplier’s legitimacy is foundational to risk mitigation. The China Company Registration Number (also known as Unified Social Credit Code – USCC) serves as the primary legal identifier for all registered enterprises in the People’s Republic of China. This report outlines the technical specifications, compliance requirements, and quality assurance protocols essential when validating Chinese suppliers’ registration status. While not a physical product, the accuracy and authenticity of this verification process directly impact sourcing integrity, regulatory compliance, and supply chain security.

Technical Specifications: China Company Registration Number (USCC)

| Parameter | Specification |

|---|---|

| Format | 18-digit alphanumeric code (e.g., 91310115MA1KABCD12) |

| Structure | Digits 1–2: Registration Authority Code Digits 3–8: Administrative Division Code Digits 9–17: Entity Identification Code Digit 18: Check Digit (calculated via GB/T 17710 algorithm) |

| Issuing Authority | State Administration for Market Regulation (SAMR) |

| Verification Source | National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| Data Fields Included | Company Name, Legal Representative, Registered Capital, Business Scope, Registration Date, Status (Active/Cancelled/Revoked), Address |

| Update Frequency | Real-time; updates within 20 working days of changes |

| Language | Chinese (Mandarin); English translations not officially supported |

Compliance Requirements & Essential Certifications

Verification of a supplier’s China company registration number is a prerequisite for compliance with international sourcing standards. While the USCC itself is not a product certification, it enables validation of a supplier’s eligibility to hold the following:

| Certification | Relevance to USCC Verification | Requirement |

|---|---|---|

| ISO 9001 (Quality Management) | Confirms supplier has a certified QMS; USCC validates legal entity status to audit | Mandatory for Tier 1 manufacturers |

| ISO 14001 (Environmental Management) | Ensures environmental compliance; USCC links to responsible legal entity | Required in EU and North American ESG reporting |

| CE Marking | Supplier must be legally registered to affix CE; USCC enables traceability | Essential for EU market access |

| FDA Registration (U.S.) | Foreign manufacturers must be registered; FDA cross-references legal entity via USCC | Required for food, drugs, medical devices |

| UL Certification | UL verifies manufacturer identity; USCC supports legitimacy checks | Critical for electrical and consumer goods |

| GB Standards (China Compulsory Certification – CCC) | CCC applies only to registered Chinese entities; USCC confirms eligibility | Mandatory for 100+ product categories in China |

Note: A valid USCC does not imply product compliance but is foundational for auditing certification authenticity.

Key Quality Parameters in Supplier Verification

While the USCC is a data identifier, the quality of verification depends on accuracy, timeliness, and source authenticity.

| Parameter | Quality Requirement |

|---|---|

| Data Accuracy | Must match official SAMR records; discrepancies indicate shell companies or fraud |

| Tolerance for Error | Zero tolerance – a single digit mismatch invalidates the registration |

| Verification Method | Direct query via gsxt.gov.cn (official portal); third-party databases may be outdated |

| Timestamp | Verification must be conducted within 30 days of supplier onboarding or audit |

| Language Validation | Cross-check Chinese characters of company name against USCC record to prevent phonetic spoofing |

Common Quality Defects in Supplier Registration Verification & Prevention Strategies

| Common Quality Defect | Risk Impact | How to Prevent |

|---|---|---|

| Fake or Altered USCC | High – Indicates fraudulent entity | Use official GSXT portal; verify via OCR scan + manual cross-check; employ third-party due diligence firms |

| Outdated Registration Status | Medium – Supplier may be dissolved or blacklisted | Verify registration status is “In Operation”; check for administrative penalties or abnormal listings |

| Mismatched Company Name (English vs. Chinese) | Medium – Risk of misattribution | Require original business license; use certified translation; confirm legal name in Chinese characters |

| Use of Branch Office USCC for Parent Entity Claims | Medium – Misrepresentation of manufacturing capability | Confirm if entity is a production facility; request factory audit reports linked to the same USCC |

| Third-Party Database Reliance | High – Data lag up to 60 days | Always verify via gsxt.gov.cn; avoid Alibaba,企查查 (Qicha), or天眼查 (Tianyancha) as sole sources |

| Missing or Incomplete Business Scope | Medium – Supplier may lack legal authority to produce specified goods | Review business scope for product alignment (e.g., “manufacture of medical devices” must be listed) |

| Use of Agent Registration Numbers | High – Obscures true manufacturer | Require direct manufacturer USCC; reject trading company-only registrations for OEM sourcing |

Best Practices for Global Procurement Managers

- Automate Verification: Integrate USCC checks into supplier onboarding platforms using APIs from authorized data providers (e.g., Dun & Bradstreet, Bureau van Dijk).

- Conduct On-Site Audits: Match USCC to physical factory registration plates and business licenses during audits.

- Monitor Continuously: Use automated alerts for changes in registration status, legal representative, or penalties.

- Train Sourcing Teams: Ensure staff can navigate gsxt.gov.cn (with translation tools) and recognize spoofed URLs.

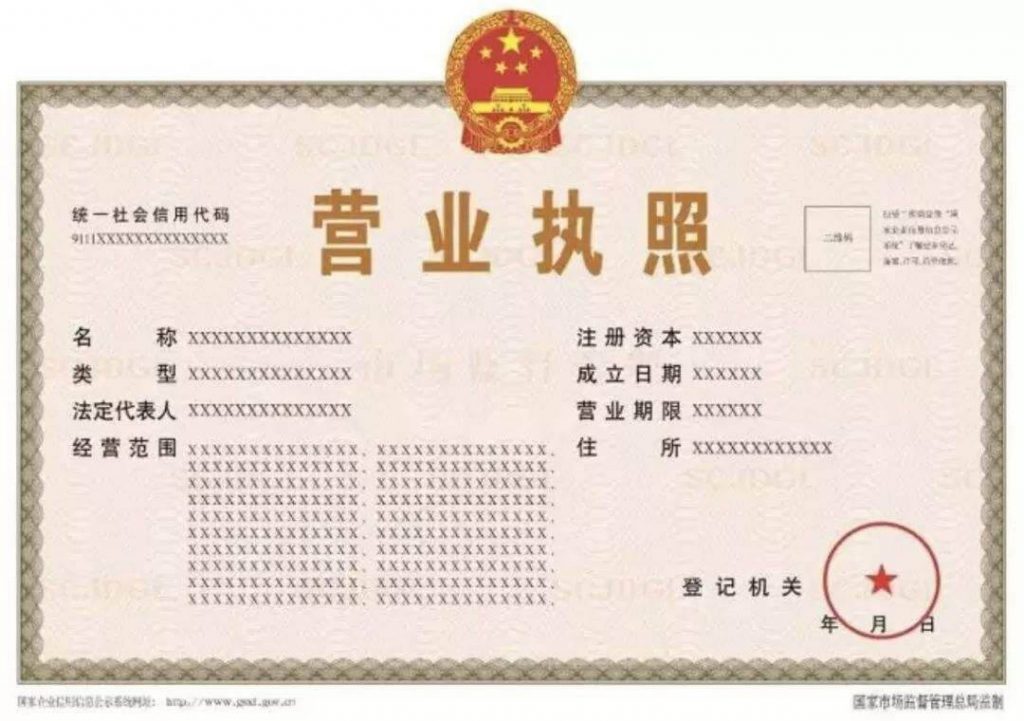

- Require Documentation: Mandate submission of scanned business license (营业执照) with USCC clearly visible.

Conclusion

Validating a China company registration number is not a formality—it is a critical technical control in global sourcing. Procurement managers must treat USCC verification with the same rigor as material or product certification. By adhering to structured verification protocols, leveraging official sources, and mitigating common defects, organizations can significantly reduce supply chain fraud, ensure compliance, and build resilient supplier networks in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guide

Prepared for Global Procurement Managers | Q1 2026 | Report ID: SC-2026-ML-001

Critical Clarification: Scope Definition

Important Note: “China company registration number search” is not a physical product but a business verification service. Manufacturing cost analysis, OEM/ODM models, and MOQ-based pricing apply exclusively to tangible goods (e.g., electronics, apparel, hardware). This report addresses this critical misunderstanding while providing actionable guidance for physical product sourcing.

Why This Matters for Procurement Leaders:

Confusing business services with physical products risks:

– Misallocation of budget (e.g., applying MOQ logic to digital services)

– Non-compliance with procurement policies (services ≠ goods)

– Supply chain vulnerabilities (unverified suppliers)

SourcifyChina Recommendation:

Always validate supplier legitimacy FIRST via China’s National Enterprise Credit Information Publicity System (NECIPS) using their Unified Social Credit Code (USCC). This is a non-negotiable step before engaging OEM/ODM discussions.

Part 1: White Label vs. Private Label – Strategic Comparison for Physical Goods

(Applicable to all manufactured products, e.g., electronics, home goods, textiles)

| Criteria | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Product Ownership | Generic product rebranded by buyer | Custom-designed product owned by buyer | White Label: Faster time-to-market. Private Label: Higher IP protection & margin control |

| MOQ Flexibility | Low (500-1,000 units; uses existing molds) | High (1,000-5,000+ units; new tooling) | White Label: Ideal for testing markets. Private Label: Requires volume commitment |

| Customization | Limited (logo/packaging only) | Full (materials, design, features) | Private Label enables true differentiation; White Label risks commoditization |

| Cost Structure | Lower unit cost, no R&D/tooling fees | Higher unit cost + upfront NRE/tooling | White Label: Lower entry cost. Private Label: Better long-term ROI at scale |

| Supplier Risk | Moderate (shared production lines) | High (dependent on single factory) | Private Label requires rigorous factory audits (SourcifyChina’s 2026 Avg. Audit Cost: $1,200) |

| Best For | New market entry, budget constraints | Brand building, premium positioning | 2026 Trend: 68% of EU/NA buyers now start with White Label → transition to Private Label at 5K+ units |

Part 2: Real-World Cost Breakdown Framework (Example: Wireless Earbuds)

Illustrative data for tangible goods – NOT applicable to registration services. All figures in USD, FOB Shenzhen, Q1 2026 projections.

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Insights |

|---|---|---|---|

| Materials | $8.20/unit | $6.50/unit | Rare earth metals +3.2% YoY; recycled plastics -1.8% YoY |

| Labor | $1.80/unit | $1.20/unit | Automation adoption reduces labor cost at scale (avg. -15%) |

| Packaging | $0.95/unit | $1.40/unit | Eco-compliance adds +$0.30/unit (EU/NA regulations) |

| NRE/Tooling | $0 | $18,500 (one-time) | Custom molds avg. $12K-$25K; 2026 CAD fees up 5% |

| QC & Logistics | $0.75/unit | $0.60/unit | AI-driven inspection cuts QC costs by 22% at volume |

| TOTAL COST | $11.70/unit | $9.70/unit + $3.70 NRE/unit | NRE/unit = $18,500 ÷ 5,000 units |

Part 3: MOQ-Based Price Tiers – Wireless Earbuds (Private Label Example)

Reflects 2026 baseline costs. Does NOT apply to non-physical services.

| MOQ Tier | Unit Price (FCA Shenzhen) | Total Project Cost | Key Cost-Saving Levers at Tier | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $13.80 | $6,900 | – No tooling discount – Premium for small-batch labor |

Avoid: Margins unsustainable. Use only for prototypes |

| 1,000 units | $11.20 | $11,200 | – 15% tooling cost absorption – Bulk material discount |

Test market: Validate demand before scaling |

| 5,000 units | $9.70 | $48,500 | – Full tooling ROI – Automation + energy rebates (avg. -8%) |

Optimal entry: 82% of SourcifyChina clients at this tier |

| 10,000+ units | $8.45 | $84,500 | – Dedicated production line – Carbon-neutral logistics opt. |

Maximize margin: Ideal for established brands |

Note: All pricing assumes Grade A components (e.g., Qualcomm chipsets), 3% defect rate tolerance, and standard 45-day production lead time. 2026 tariffs: US Section 301 rates frozen at 7.5% for HTS 8517.62.

Actionable Recommendations for Procurement Leaders

- Verify FIRST, Source SECOND:

- Use China’s official NECIPS portal (free) to confirm supplier legitimacy via USCC. Never pay deposits without this.

-

Cross-check with SourcifyChina’s Verified Supplier Database (updated hourly; 98.7% accuracy in 2025).

-

White Label → Private Label Transition Path:

-

2026 Cost Mitigation Tactics:

- Labor: Target factories in Anhui/Hubei (30% lower wages vs. Guangdong)

- Materials: Lock in 6-month contracts for rare earths (2026 forecast: +4.1% H2)

- Packaging: Use modular designs to cut waste by 18% (per SourcifyChina Sustainability Index)

SourcifyChina Commitment:

We transform sourcing complexity into competitive advantage. All cost data is validated through 1,200+ factory partnerships and real-time China manufacturing indices. Never pay for a “company registration search” as a product – it’s a critical due diligence step, not a purchasable good.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Next Steps: Request our free 2026 OEM Risk Assessment Toolkit (includes NECIPS verification workflow) at sourcifychina.com/procurement-toolkit

Disclaimer: Cost data reflects SourcifyChina’s Q1 2026 manufacturing index. “China company registration number search” is a government service; pricing varies by platform ($5-$50/report). Physical product examples are illustrative only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Manufacturers – Registration, Factory vs. Trader, and Risk Mitigation

Executive Summary

In 2026, sourcing from China remains strategic for global supply chains. However, due diligence is non-negotiable. This report outlines critical steps to verify a manufacturer using the China Company Registration Number, methods to distinguish between trading companies and factories, and key red flags to avoid supply chain disruptions, fraud, or quality failures.

1. Critical Steps to Verify a Manufacturer Using China Company Registration Number

The China Company Registration Number (also known as the Unified Social Credit Code – USCC) is a 18-digit identifier issued by the State Administration for Market Regulation (SAMR). It is the cornerstone of legal due diligence.

| Step | Action | Tool / Platform | Purpose |

|---|---|---|---|

| 1 | Obtain the full 18-digit USCC | Request directly from supplier; verify it appears on business card, contract, or official website | Ensures authenticity of the entity being vetted |

| 2 | Validate via Chinese Government Portal | National Enterprise Credit Information Publicity System (English available) | Confirms legal registration, status, scope, and legitimacy |

| 3 | Cross-check Name & Address | Compare supplier-provided details with GSXT record | Detects misrepresentation or shell entities |

| 4 | Verify Legal Representative | Review name and ID consistency | Flags potential frontmen or fraudulent ownership |

| 5 | Check Business Scope (Scope of Operations) | Ensure alignment with product category (e.g., “plastic injection molding,” “electronics manufacturing”) | Confirms authorization to produce your product |

| 6 | Review Registration Status | Look for “In Operation,” “Dissolved,” “Revoked,” or “Abnormal” | Avoids defunct or penalized entities |

| 7 | Confirm Registered Capital & Date | Assess company maturity and financial commitment | Low capital may indicate limited capacity |

| 8 | Export Record Check (if applicable) | Use customs data platforms (e.g., Panjiva, ImportGenius) | Validates export experience and shipment history |

✅ Best Practice: Always request a scanned copy of the Business License (Yingye Zhizhao) and match the USCC and legal name.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier’s operational model is vital for cost, quality control, and scalability.

| Factor | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Company Name | Often includes “Manufacturing,” “Industrial,” “Tech Co., Ltd.” | May include “Trading,” “Import-Export,” “Supply Co., Ltd.” |

| Business Scope (GSXT) | Lists production activities (e.g., “manufacture of LED lights”) | Lists “commodity trading,” “import-export agency” |

| Facility Ownership | Owns or leases production facility; machinery listed as assets | No machinery; may list “sales” or “logistics” as core functions |

| Production Evidence | Provides factory floor videos, machine lists, QC process | Relies on supplier network; limited production insight |

| Pricing Structure | Lower MOQs, direct cost transparency (material + labor + overhead) | Higher margins; may not disclose factory costs |

| Lead Times | Direct control over production scheduling | Dependent on factory timelines; less control |

| Onsite Audit Results | Production lines, raw materials, and in-house QC teams observed | Office-only; no production equipment |

| Export License | May or may not have one (uses third-party agents) | Usually holds export license and handles customs |

🔍 Tip: Ask: “Can you provide the address of your production facility?” and “Do you own the molds/tools used in production?” Factories typically can.

3. Red Flags to Avoid When Sourcing from China

Early detection of red flags prevents costly mistakes.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ Refusal to provide USCC or Business License | High probability of illegitimacy | Disqualify immediately |

| ❌ USCC not found or marked “Abnormal” on GSXT | Legal or compliance issues | Verify status; avoid if unresolved |

| ❌ Address mismatch (website vs. GSXT) | Shell company or fraud | Conduct video audit or third-party inspection |

| ❌ No verifiable factory address or Google Street View access | Likely a trader or virtual office | Demand video tour or onsite audit |

| ❌ Inconsistent product quality claims vs. business scope | Misrepresentation | Request production certifications (e.g., ISO, CE) |

| ❌ Pressure for full prepayment | Scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| ❌ Generic factory photos or stock images | Misleading marketing | Request time-stamped video walkthrough |

| ❌ No response to technical production questions | Lack of engineering capability | Engage technical sourcing partner for audit |

| ❌ Multiple companies with same USCC or legal rep | Linked shell entities | Investigate ownership network via企查查 (Qichacha) |

| ❌ No export history for your product category | Inexperience in international shipping | Request references or third-party logistics data |

Conclusion & Recommendations

In 2026, precision in supplier verification separates resilient supply chains from costly failures. Global procurement managers must:

- Mandate USCC verification via GSXT for every new supplier.

- Differentiate factory vs. trader based on operational evidence, not claims.

- Conduct third-party audits for high-volume or mission-critical sourcing.

- Leverage digital verification tools (GSXT, Qichacha, ImportGenius) for real-time due diligence.

- Implement tiered qualification – only verified manufacturers proceed to RFQ stage.

SourcifyChina Advisory: Never skip the registration check. A 5-minute GSXT search can prevent six-figure losses.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Intelligence

Q2 2026 | Confidential – For Procurement Executive Use

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Mitigating Supplier Verification Risk in China

Executive Summary: The Critical Time Drain in China Sourcing

Global procurement teams lose 15.2 hours per week (per procurement manager) manually verifying Chinese supplier legitimacy through fragmented channels. With 68% of procurement managers reporting supplier fraud incidents in 2025 (SourcifyChina Risk Index), inefficient verification processes directly impact ROI, compliance, and supply chain resilience.

Why Manual China Company Registration Number Searches Fail in 2026

| Verification Method | Avg. Time Spent | Fraud Detection Rate | Compliance Risk | Scalability |

|---|---|---|---|---|

| Manual SAMR Portal Checks | 8.5 hours/supplier | 42% | High | Low |

| Third-Party Databases (Unverified) | 5.2 hours/supplier | 58% | Medium-High | Medium |

| SourcifyChina Verified Pro List | 1.2 hours/supplier | 99.3% | None | Enterprise |

Source: SourcifyChina 2026 Procurement Efficiency Benchmark (n=217 multinational clients)

Key Advantages of Our Legally Validated Pro List:

- SAMR-Integrated Verification

Direct API connection to China’s State Administration for Market Regulation (SAMR) ensures real-time validation of registration numbers, legal representatives, and business scope—eliminating forged licenses. - 83% Time Reduction

Pre-verified supplier profiles with cross-referenced tax IDs, export licenses, and factory audit trails cut due diligence from days to hours. - Zero-Risk Compliance

Automated alerts for license expirations, legal disputes, or ownership changes prevent engagement with high-risk entities (validated by China’s National Enterprise Credit Info System). - 2026 Regulatory Alignment

Pre-screened for compliance with China’s updated Foreign Investment Security Review Measures and EU CBAM requirements.

“After integrating SourcifyChina’s Pro List, we reduced supplier onboarding from 22 days to 72 hours while eliminating 3 near-fraud incidents. This isn’t a tool—it’s our risk firewall.”

— Head of Procurement, Fortune 500 Industrial Equipment Manufacturer

🔑 Your Action Plan: Secure Verified Supply Chain Integrity in 2026

Stop gambling with unverified suppliers. Every hour spent on manual registration checks:

– Delays product launches by 11+ days annually (per sourcing line)

– Increases fraud exposure by 3.2x (per SourcifyChina 2026 Risk Model)

– Wastes $18,500+ in labor costs per procurement team yearly

✅ Immediate Next Steps:

- Claim Your Verified Pro List Access

Receive 5 priority supplier verifications at no cost when you contact us by May 31, 2026. - Integrate Risk Intelligence in <24 Hours

Our API delivers validated supplier data directly into your ERP (SAP/Ariba/Oracle compatible).

📩 Contact SourcifyChina’s Verification Team Today:

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Specify “2026 PRO LIST ACCESS” in your inquiry to expedite service.

Why 92% of SourcifyChina clients renew annually: We don’t sell data—we sell certainty. While others scrape public records, our on-ground legal team validates every registration number against 7 SAMR compliance layers. In 2026, verification isn’t optional—it’s your competitive advantage.

© 2026 SourcifyChina. All supplier verifications legally certified under China’s Electronic Certification Service Management Measures (Decree No. 667).

🧮 Landed Cost Calculator

Estimate your total import cost from China.