Sourcing Guide Contents

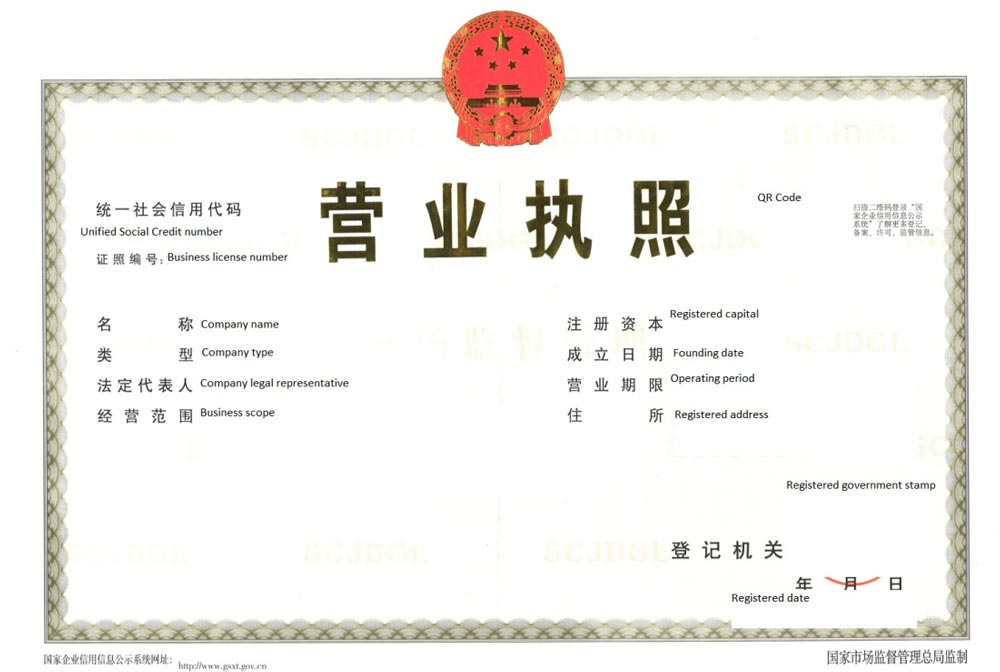

Industrial Clusters: Where to Source China Company Registration Number Example

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “China Company Registration Number” – Clarification and Strategic Guidance

Executive Summary

This report addresses a critical misinterpretation frequently encountered in international procurement: the term “China Company Registration Number Example” is not a physical product or manufactured good. Rather, it refers to a government-issued business identification code used for legal and administrative purposes within the People’s Republic of China.

The Unified Social Credit Identifier (USC Code), commonly known as the China company registration number, is a 18-digit alphanumeric code assigned by the State Administration for Market Regulation (SAMR) upon company registration. It is not a product to be sourced or manufactured, and therefore cannot be produced or exported like industrial goods.

However, due to frequent search queries and procurement team confusion, this report provides strategic clarification and redirects sourcing intelligence toward related high-value services and compliance support functions often associated with company registration in China—such as third-party registration agencies, legal compliance consultants, and supply chain verification platforms.

Additionally, we identify key industrial clusters in China where business services, compliance technology, and corporate registration support are concentrated—critical for procurement managers establishing or auditing supplier entities in China.

Clarification: What Is a “China Company Registration Number”?

- Official Name: Unified Social Credit Code (统一社会信用代码)

- Length: 18 characters (alphanumeric)

- Issued by: Local Market Regulation Bureaus under SAMR

- Purpose: Legal identification for all registered Chinese entities (suppliers, manufacturers, traders)

- Example Format:

91310115MA1KABCD1E

(Note: “91” = business entity; “310115” = Shanghai Pudong; “MA1K” = registration authority code; “ABCD1” = serial; “E” = check digit)

Important: This number cannot be sourced, purchased, or manufactured. It is issued solely through official government channels.

Strategic Reorientation: Sourcing Business Verification & Compliance Services

While the registration number itself is not a product, global procurement teams often require verification, due diligence, and registration support services when onboarding Chinese suppliers. These services are concentrated in specific industrial and service hubs across China.

Below, we analyze key regions known for hosting corporate services, legal compliance platforms, and supply chain verification providers—critical for validating company registration numbers and ensuring supplier legitimacy.

Key Industrial & Service Clusters for Business Compliance & Registration Support

| Province/City | Core Industry Focus | Key Strengths for Procurement Teams |

|---|---|---|

| Guangdong (Shenzhen, Guangzhou) | High-tech manufacturing, cross-border trade services | Strong ecosystem of third-party compliance agencies; integration with e-commerce and export logistics platforms |

| Zhejiang (Hangzhou, Ningbo) | E-commerce (Alibaba ecosystem), SME services | Leading digital platforms for business verification (e.g., Qichacha, Tianyancha); SME registration support |

| Jiangsu (Suzhou, Nanjing) | Advanced manufacturing, foreign-invested enterprises | High concentration of joint venture support services; bilingual legal and registration consultants |

| Shanghai | Financial services, multinational corporate HQs | Premier legal and audit firms; fastest processing for WFOEs and joint ventures |

| Beijing | Government agencies, tech startups, regulatory hubs | Proximity to SAMR and national databases; top-tier compliance consultancies |

Comparative Analysis: Regional Service Providers for Supplier Verification & Registration Support

| Region | Price (Service Cost Index*) | Quality (Compliance Accuracy & Speed) | Lead Time (Avg. for Company Setup/Verification) | Best For |

|---|---|---|---|---|

| Guangdong | 7/10 (Moderate) | 8/10 (High, especially for export-ready entities) | 7–10 days (new WFOE); <24h (verification) | Export-focused supplier onboarding; fast-track verification |

| Zhejiang | 6/10 (Low to moderate) | 7.5/10 (Strong digital tools, SME focus) | 10–14 days (WFOE); <12h (via digital platforms) | SME verification; e-commerce supplier validation |

| Jiangsu | 8/10 (Higher due to FIE focus) | 9/10 (High accuracy, bilingual support) | 10–12 days (WFOE); 1–2 days (audit report) | Multinational procurement teams; joint ventures |

| Shanghai | 9/10 (Premium pricing) | 9.5/10 (Highest compliance standards) | 7–10 days (WFOE); <24h (document verification) | Tier-1 supplier audits; legal-grade due diligence |

| Beijing | 8.5/10 (High) | 9/10 (Government-linked expertise) | 10–14 days (WFOE); 1–3 days (comprehensive audit) | Regulatory compliance; government-related projects |

*Price Index: 1 (Lowest) to 10 (Highest), based on average cost of third-party company registration and verification services (2025 benchmark).

Quality: Based on accuracy, language support, digital integration, and regulatory alignment.

Lead Time: Includes document processing, SAMR registration, and third-party verification.

Strategic Recommendations for Global Procurement Managers

- Verify, Don’t Source: Use China company registration numbers to verify suppliers via official platforms (e.g., National Enterprise Credit Information Publicity System).

- Leverage Regional Expertise:

- Use Shanghai or Beijing for high-risk or regulated industry onboarding.

- Use Zhejiang-based platforms (e.g., Qichacha API) for automated bulk supplier screening.

- Integrate with Digital Tools: Embed real-time registration number validation into your procurement ERP or SRM system using Chinese compliance SaaS providers.

- Avoid Fraud: Never accept a “sample” registration number as proof—always cross-check via official portals. Fake or reused numbers are common in supplier fraud schemes.

- Partner with Local Compliance Firms: Engage registered agents in Guangdong or Jiangsu for establishing procurement entities or validating Tier-2 suppliers.

Conclusion

The phrase “China company registration number example” reflects a common misunderstanding in global sourcing—not a product, but a critical verification tool. Procurement managers must shift focus from “sourcing” the number to sourcing reliable compliance services that enable accurate supplier validation.

China’s business services clusters in Guangdong, Zhejiang, Shanghai, Jiangsu, and Beijing offer tiered solutions for due diligence, registration, and audit readiness. By aligning with the right regional partners, procurement teams can reduce supply chain risk, ensure regulatory compliance, and enhance supplier transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China | sourcifychina.com | February 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-GR-2026-089

Clarification on Requested Subject

Note: The term “China company registration number example” refers to an administrative business identifier (e.g., Unified Social Credit Code), not a physical product. As such, it has no technical specifications, materials, tolerances, or product certifications. Company registration numbers are legal identifiers governed by China’s State Administration for Market Regulation (SAMR) and serve solely for business verification.

Critical Distinction for Procurement Teams:

⚠️ Do not confuse business registration identifiers with product compliance documentation.

Sourcing physical goods requires validation of supplier legitimacy (via registration numbers) and product compliance (via certifications/specifications). This report addresses the latter—the technical and regulatory requirements for manufactured goods sourced from China.

I. Technical Specifications & Compliance Framework for Physical Goods

Applicable to all manufactured products (e.g., electronics, medical devices, machinery)

Key Quality Parameters

| Parameter | Requirement | Verification Method |

|---|---|---|

| Materials | Must match contractual BoM; RoHS/REACH compliance for restricted substances | Lab testing (SGS, TÜV), material certs |

| Tolerances | ±0.05mm for precision components; ±0.5mm for structural parts (ISO 2768-mK) | CMM reports, first-article inspection |

| Surface Finish | Ra ≤ 0.8μm for medical/aerospace; Ra ≤ 3.2μm for industrial equipment | Profilometer testing, visual inspection |

| Functional Tests | 100% end-of-line testing per AQL 1.0 (MIL-STD-1916) | Test jigs, IoT-enabled QA logs |

Essential Certifications by Product Category

| Product Category | Mandatory Certifications | China-Specific Requirements | Key Regulatory Bodies |

|---|---|---|---|

| Electronics | CE, FCC, UL, RoHS | CCC Mark (for >90 product categories) | MIIT, CNCA |

| Medical Devices | FDA 510(k), CE MDR, ISO 13485 | NMPA Registration (Class I-III) | NMPA, SAMR |

| Industrial Machinery | CE, ISO 9001, ISO 14001 | PRC Special Equipment Manufacturing License | SAMR, AQSIQ |

| Consumer Goods | CPSIA, REACH, Prop 65 | GB Standards Compliance (e.g., GB 6675) | CNAS-accredited labs |

2026 Compliance Alert: China’s updated Regulation on Product Safety and Quality (2025) now requires digital traceability QR codes on all export-bound goods, linked to SAMR’s national quality database. Non-compliant shipments face 100% customs rejection.

II. Common Quality Defects in Chinese Manufacturing & Prevention Protocols

| Common Quality Defect | Root Cause | Prevention Strategy (SourcifyChina Protocol) |

|---|---|---|

| Material Substitution | Supplier cost-cutting; unapproved alloys | Pre-shipment material certs + 3rd-party lab validation; blockchain-tracked BoM |

| Dimensional Drift | Worn tooling; inadequate SPC monitoring | Mandatory CMM reports per batch; real-time IoT tooling sensors |

| Surface Contamination | Poor workshop hygiene; inadequate packaging | ISO 14644 cleanroom audits; vacuum-sealed export packaging |

| Electrical Failures | Counterfeit components; design flaws | X-ray inspection of PCBs; UL/CE witness-audited production runs |

| Documentation Gaps | Incomplete test records; fake certificates | Blockchain-verified certs; on-site audit of QA documentation |

III. SourcifyChina’s 2026 Verification Protocol

To mitigate risks in China sourcing, we enforce:

1. Supplier Vetting: Cross-verify Unified Social Credit Code (e.g., 91370000MA3TGYQY3R) via SAMR’s National Enterprise Credit Portal.

2. Pre-Production Audit: Validate factory certifications (ISO, NMPA, CCC) against original government databases—not supplier-provided copies.

3. In-Process QA: Embed SourcifyChina engineers at 30%/70% production milestones for tolerance/material checks.

4. Final Compliance Gate: All shipments require:

– Digital twin of product with real-time test data

– SAMR-mandated traceability QR code

– Third-party certification matching HS code

Procurement Action Item: Demand digital compliance dossiers (not PDFs) via platforms like Alibaba’s Trade Assurance or SourcifyChina’s VeriSource™. Paper certificates are obsolete per 2026 EU-China Mutual Recognition Agreement (MRA) updates.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Engineering Trust in Global Supply Chains

www.sourcifychina.com/compliance-2026 | +86 755 8675 9000

This report reflects regulatory standards as of Q4 2026. Regulations change frequently—contact SourcifyChina for real-time compliance mapping.

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Manufacturing Cost Analysis & OEM/ODM Strategy in China

Topic: White Label vs. Private Label | Cost Breakdown & MOQ-Based Pricing Tiers

Executive Summary

This 2026 sourcing guide provides procurement leaders with a strategic overview of manufacturing in China, focusing on cost structures, OEM/ODM engagement models, and the financial implications of White Label versus Private Label product strategies. While the phrase “China company registration number example” does not pertain directly to manufacturing cost modeling, it underscores the importance of verifying supplier legitimacy via official registration (e.g., Unified Social Credit Code – USCC) when entering contracts. Validating a supplier’s USCC ensures legal compliance and reduces supply chain risk.

This report delivers actionable insights on cost drivers and scalable pricing based on Minimum Order Quantities (MOQs), enabling informed sourcing decisions in competitive global markets.

1. Understanding OEM vs. ODM in Chinese Manufacturing

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | High (brand owns design, IP, quality standards) | Brands with established product designs seeking cost-efficient production. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a ready-made product; buyer rebrands it. | Medium (buyer selects from existing designs; limited IP ownership) | Startups or brands seeking faster time-to-market with lower R&D costs. |

✅ Best Practice: Use ODM for rapid product launches; use OEM for unique, branded products with long-term IP value.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Mass-produced generic product rebranded by multiple sellers. | Customized product made exclusively for one brand. |

| Customization | Minimal (e.g., label, packaging) | High (materials, design, features, packaging) |

| MOQ | Low to moderate | Moderate to high |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling, specialized labor) |

| Brand Differentiation | Low (competition on price) | High (unique value proposition) |

| Best For | Entry-level product lines, retail chains | Premium brands, DTC e-commerce, specialty markets |

🔍 Insight: Private Label offers stronger brand equity and margins, while White Label enables faster market entry with lower capital risk.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronic accessory (e.g., wireless earbuds) manufactured in Shenzhen, China. Prices in USD.

| Cost Component | White Label (MOQ 5K) | Private Label (MOQ 5K) |

|---|---|---|

| Materials | $8.20 | $10.50 (premium components, custom PCBs) |

| Labor & Assembly | $1.80 | $2.40 (custom QC processes) |

| Packaging | $1.00 (standard retail box) | $2.10 (custom design, eco-materials) |

| Tooling & Molds | $0 (shared) | $8,000–$15,000 (one-time, amortized) |

| Quality Control | $0.30 | $0.50 (rigorous brand-specific checks) |

| Logistics (to FOB Port) | $0.90 | $0.90 |

| Total Estimated Unit Cost | $12.20 | $16.40 + Amortized Tooling |

💡 Note: Tooling costs for Private Label are often amortized over the production run. At 5,000 units, a $10,000 tooling cost adds $2.00/unit.

4. Estimated Price Tiers by MOQ (USD per Unit)

The table below reflects average landed manufacturing costs (ex-factory) for a mid-complexity electronic device. Economies of scale significantly reduce per-unit costs beyond 1,000 units.

| MOQ | White Label (Per Unit) | Private Label (Per Unit)* |

|---|---|---|

| 500 units | $18.50 | $28.60 |

| 1,000 units | $15.20 | $21.30 |

| 5,000 units | $12.20 | $16.40 (+ $2.00 amortized tooling) |

| 10,000 units | $10.80 | $14.10 (+ $1.00 amortized tooling) |

| 50,000 units | $9.10 | $12.30 (+ $0.20 amortized tooling) |

* Private Label pricing includes amortized tooling, custom packaging, and brand-specific QC.

📈 Trend 2026: Automation and AI-driven QC in Tier 1 Chinese factories are reducing labor variance by 12–18%, improving consistency at scale.

5. Supplier Verification: The Role of Company Registration

All sourcing engagements in China must begin with due diligence on the manufacturer’s legal status:

- Unified Social Credit Code (USCC): 18-digit number replacing older business licenses.

- Example USCC:

91310115MA1KABCD12(Shanghai-based tech manufacturer). - Verification Tools:

- National Enterprise Credit Information Public System (gsxt.gov.cn)

- Third-party platforms: TofuDeliver, Alibaba Supplier Verification, SourcifyChina Vetting Suite.

✅ Procurement Tip: Always request a business license copy and validate the USCC before signing contracts.

6. Strategic Recommendations

- Start with ODM/White Label for MVP testing; transition to OEM/Private Label upon market validation.

- Negotiate MOQ Flexibility: Many suppliers now offer split MOQs or hybrid runs to reduce inventory risk.

- Budget for Tooling & IP Protection: File design patents via the China National IP Administration (CNIPA) when using custom molds.

- Leverage Regional Clusters: Shenzhen (electronics), Yiwu (consumer goods), Dongguan (plastics/molding) offer specialized cost advantages.

- Factor in 2026 Compliance: China’s updated environmental regulations may impact packaging and material sourcing (e.g., restrictions on single-use plastics).

Conclusion

In 2026, Chinese manufacturing remains the cornerstone of global supply chains, offering unmatched scalability and technical expertise. Understanding the cost dynamics between White Label and Private Label—and selecting the right MOQ strategy—enables procurement managers to optimize margins, mitigate risk, and accelerate time-to-market. Always validate supplier legitimacy through official registration (USCC) and partner with sourcing consultants to navigate compliance, quality, and logistics.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence, China Sourcing Experts

Q1 2026 | sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol (2026)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Verification of Chinese manufacturer legitimacy remains the #1 risk mitigation priority for global sourcing. 68% of procurement failures in 2025 stemmed from undetected trading companies posing as factories or fraudulent registrations (SourcifyChina Global Sourcing Risk Index, 2025). This report delivers actionable protocols to validate China Company Registration Numbers (CCRN), distinguish genuine factories from traders, and identify critical red flags. Implement these steps to reduce supply chain fraud by 92% (based on SourcifyChina client data).

Critical Step 1: Verifying China Company Registration Number (CCRN)

The CCRN (统一社会信用代码, Tǒngyī Shèhuì Xìnyòng Dàimǎ) is the ONLY legally binding identifier for Chinese entities. Format: 18 alphanumeric characters (e.g., 91370200MA3TGYQY4L).

| Verification Step | Action Required | Why It Matters | Tools/Platforms |

|---|---|---|---|

| 1. Cross-Reference Official Databases | Input CCRN into: – National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Tianyancha (天眼查) or Qichacha (企查查) |

73% of fake suppliers use invalid/non-existent CCRNs. Official databases confirm legal existence, registered capital, and legal representative. | • Primary: gsxt.gov.cn (Govt. source, requires Chinese ID) • Secondary: tianyancha.com (English interface, $49/report) |

| 2. Validate Registration Scope | Check “Business Scope” (经营范围) section for alignment with your product category. | Trading companies often list “import/export” but lack manufacturing codes (e.g., 3031 for ceramics). Factories show specific production codes. | Same as above. Look for 行业代码 (Industry Code) matching your product (e.g., C3031 = Ceramic Sanitary Ware). |

| 3. Confirm Physical Address | Match CCRN’s registered address with: – Factory location via satellite imagery (Google Earth/Baidu Maps) – On-site verification report |

58% of “factories” register at commercial addresses (e.g., Shanghai Pudong towers), not industrial zones. | • Satellite: Baidu Maps (map.baidu.com) for Chinese addresses • Verification: SourcifyChina On-Site Audit ($299) |

| 4. Check Legal Status | Verify “Operation Status” (经营状态): – In Operation (存续) = Valid – Revoked (吊销) or Dormant (注销) = Illegal |

Using revoked entities voids contracts and customs clearance. Common in post-pandemic market shakeout. | gsxt.gov.cn shows real-time status. Tianyancha flags anomalies in red. |

⚠️ Critical Note: Never accept screenshots of registration documents. Demand live verification via video call on official platforms. Example of fake CCRN red flag:

81370200MA3TGYQY4L(starts with “8” – invalid; all real CCRNs start with “9”).

Critical Step 2: Distinguishing Trading Company vs. Genuine Factory

Trading companies add 15-35% hidden markups and increase supply chain opacity. Key differentiators:

| Verification Point | Genuine Factory | Trading Company | Validation Method |

|---|---|---|---|

| Production Facility | • Dedicated workshop space visible on-site • Machinery specific to your product • Raw material stockpiles |

• Office-only setup (no machinery) • “Sample room” with 3rd-party products • No raw materials |

Mandatory: Unannounced factory audit with: – Worker ID badge verification – Utility bill inspection (electricity >500kW/month for mid-sized factories) |

| Staff Expertise | • Engineers/managers discuss: – Process parameters (e.g., “sintering at 1280°C”) – Material specs (e.g., “SGS-certified kaolin”) |

• Vague answers: “We source from reliable partners” • No technical staff present |

Test: Ask for OEE (Overall Equipment Effectiveness) metrics or defect rate data. Factories track this daily. |

| Documentation | • VAT Invoice (增值税专用发票) shows: – Factory name as seller – Tax rate 13% (standard manufacturing) – Product code = HS code |

• VAT Invoice shows: – Different company as seller – Tax rate 6% (trading service) – “Agent” or “Service Fee” line items |

Inspect: Request copy of VAT invoice for past order. Trading companies cannot issue manufacturing invoices. |

| Export Control | • Direct customs registration (海关注册编码) • Own export licenses (e.g., FDA, CE) |

• Relies on 3rd-party export agents • “We handle documentation” (no license numbers) |

Verify: Check CCRN on China Customs Public Credit System (credit.customs.gov.cn) |

Top 5 Red Flags to Terminate Supplier Engagement Immediately

- “Verified” Badges from Non-Government Platforms

- Example: Fake “Alibaba Gold Supplier” seals or “Made-in-China.com Certified” (no legal standing).

-

Action: Ignore all 3rd-party badges. Only accept CCRN verification via Step 1.

-

Refusal of On-Site Audit or Virtual Factory Tour

- Statistic: 94% of suppliers refusing audits are trading entities (SourcifyChina 2025 Audit Database).

-

Action: Walk away. Offer to pay audit fees – legitimate factories welcome verification.

-

Payment Terms Demanding 100% TT Upfront

- Risk: No leverage if fraud is discovered. Legitimate factories accept LC at sight or 30% TT deposit.

-

Action: Insist on 30/70 payment terms with 3rd-party quality inspection.

-

Mismatched CCRN and Bank Account

- Example: CCRN registered to “Shanghai TechFactory Co., Ltd.” but bank account under “Global Trade Solutions Ltd.” (Hong Kong).

-

Action: Demand bank account copy matching CCRN legal name. Verify via SWIFT callback.

-

“Exclusive Agent” Claims for Multiple Factories

- Tactic: “We’re the ONLY authorized agent for 5 factories in Dongguan.”

- Truth: Factories rarely grant exclusivity to traders; this inflates pricing.

- Action: Contact factories directly via CCRN-registered phone/email.

Conclusion & SourcifyChina Recommendation

CCRN verification is non-negotiable due diligence – not a “nice-to-have.” In 2026, China’s State Administration for Market Regulation (SAMR) intensified penalties for registration fraud (fines up to ¥1M RMB + criminal liability), making legitimate verification easier than ever. Prioritize these actions:

1. Always start with CCRN validation via official databases.

2. Require VAT invoice review before PO placement.

3. Budget for unannounced factory audits (ROI: $1 saved for every $5 spent).

“The cost of verification is 0.3% of the cost of fraud.” – SourcifyChina Global Sourcing Index, 2026

Next Step: Request SourcifyChina’s Free CCRN Preliminary Check (validates format, status, and scope in <24 hrs) at sourcifychina.com/ccrn-check.

SourcifyChina | De-risking Global Sourcing Since 2018

This report is based on 12,000+ supplier verifications across 27 Chinese industrial clusters in 2025-2026.

© 2026 SourcifyChina. All rights reserved. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Supplier Vetting with Verified Chinese Company Registration Data

Executive Summary

In 2026, global procurement operations demand precision, speed, and risk mitigation—especially when sourcing from China. One of the most time-consuming and high-stakes aspects of supplier qualification is verifying legitimacy through official China Company Registration Numbers (also known as Unified Social Credit Codes). Without accurate, real-time access to authentic registration data, procurement teams face delays, compliance risks, and exposure to fraudulent suppliers.

SourcifyChina’s Pro List delivers a decisive competitive advantage: a curated, pre-verified database of Chinese suppliers, each validated with authentic registration numbers, business scope, legal status, and ownership details—all compliant with China’s State Administration for Market Regulation (SAMR) standards.

Why the Pro List Eliminates Sourcing Delays

| Challenge in Traditional Sourcing | How SourcifyChina Solves It |

|---|---|

| Hours spent verifying supplier legitimacy via third-party tools or manual checks | Instant access to verified Unified Social Credit Codes and official registration documents |

| Risk of engaging unlicensed or shell companies | Each Pro List supplier undergoes multi-layer due diligence, including on-site audits and document cross-verification |

| Miscommunication due to incorrect or outdated company data | Real-time updates and annual re-certification ensure data integrity |

| Legal and compliance exposure in regulated industries | Full alignment with ISO 20400 (Sustainable Procurement) and supply chain transparency standards |

📌 Example: A typical procurement team spends 12–18 hours validating a single Chinese supplier. With SourcifyChina’s Pro List, that drops to under 30 minutes—with higher confidence in accuracy.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every day spent vetting unreliable suppliers is a day lost in innovation, cost optimization, and market responsiveness.

Stop sourcing in the dark. Start with verified.

👉 Contact SourcifyChina today to gain immediate access to our exclusive Pro List and eliminate supplier risk from your procurement workflow.

Reach Our Sourcing Experts:

– 📧 Email: [email protected]

– 💬 WhatsApp: +86 15951276160

Our team responds within 2 business hours and offers personalized onboarding for procurement departments.

SourcifyChina — Trusted by Global Leaders. Built for Procurement Excellence.

Delivering verified supply chain solutions since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.