Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Registration Number Check

SourcifyChina B2B Sourcing Report: Market Analysis for China Company Registration Verification Services

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Confidentiality Level: Public (General Guidance)

Executive Summary

Critical Clarification: “China Company Registration Number Check” is not a manufactured product but a digital compliance verification service. It involves validating business legitimacy via China’s State Administration for Market Regulation (SAMR) databases. Sourcing this service requires engaging specialized compliance tech providers, not manufacturers. Industrial clusters for physical goods (e.g., electronics, textiles) do not apply. Instead, service excellence hinges on data integration capabilities, regulatory expertise, and API infrastructure, concentrated in China’s tech and financial hubs. This report redefines the analysis for service sourcing, identifying key provider clusters and critical evaluation metrics for 2026.

Market Reality Check: Why “Manufacturing” Does Not Apply

- Nature of Service: Verification relies on real-time access to SAMR’s National Enterprise Credit Information Publicity System (NECIPS). No physical production occurs.

- Provider Types:

- RegTech Firms: Tech-driven platforms (e.g., TiAn, Qichacha, Dun & Bradstreet China).

- Legal/Compliance Consultants: Specializing in Chinese corporate due diligence.

- Global BPOs: Multinationals with China compliance divisions (e.g., Kroll, Control Risks).

- Key Driver: Data accuracy and legal compliance – not labor costs or factory capacity.

Key Service Provider Clusters (2026 Focus)

While service delivery is digital, provider concentration impacts expertise depth, response speed, and regulatory relationships. Top clusters:

| Region | Why It Dominates | Best For |

|---|---|---|

| Beijing | Proximity to SAMR headquarters; home to 80% of China’s top RegTech firms (e.g., Qichacha). Deepest regulatory connections. | High-risk due diligence; government-linked entity verification |

| Shanghai | Financial hub; strongest integration with customs/tax databases. Preferred for foreign-invested enterprise (FIE) checks. | Cross-border trade compliance; FIE validation |

| Guangdong | High volume of export-oriented SMEs. Focus on speed for supply chain verification. Weaker in state-owned enterprise (SOE) data. | Rapid bulk checks for manufacturing suppliers |

| Zhejiang | Emerging fintech hub (Hangzhou). Cost-competitive but limited SAMR data access vs. Beijing/Shanghai. | Low-risk SME validation; budget-conscious buyers |

Service Sourcing Comparison: Critical Metrics (2026)

Note: Metrics reflect service performance – NOT manufacturing attributes.

| Region | Price (USD/Check) | Quality (Accuracy & Compliance) | Lead Time | 2026 Risk Outlook |

|---|---|---|---|---|

| Beijing | $15–$25 | ★★★★★ (99.8% SAMR data accuracy; full audit trails) | 2–4 hours | Low: Tightest SAMR alignment; resilient to regulatory shifts |

| Shanghai | $12–$20 | ★★★★☆ (98.5% accuracy; excels in FIE/customs data) | 1–3 hours | Medium: Vulnerable to cross-border data flow restrictions |

| Guangdong | $8–$15 | ★★★☆☆ (95% accuracy; gaps in SOE/state-linked entities) | <1 hour (bulk queries) | High: Over-reliance on fragmented local databases |

| Zhejiang | $5–$12 | ★★☆☆☆ (90% accuracy; limited SOE coverage) | <30 mins (automated only) | Critical: SAMR to tighten third-party API access in 2026 |

Quality Breakdown:

– Accuracy: % match against SAMR’s live database (Beijing leads due to direct data feeds).

– Compliance: Adherence to China’s Data Security Law and PIPL – Beijing/Shanghai providers audit-ready.

– Lead Time: Includes human review for high-risk entities (automated-only = faster but riskier).

2026 Sourcing Recommendations

- Prioritize Beijing Providers for Critical Transactions:

- Mandatory for SOEs, government contracts, or high-value partnerships. SAMR’s 2025 data governance reforms favor Beijing-based RegTechs.

- Avoid “Low-Cost” Zhejiang Providers for Core Supply Chains:

- 70% of failed verifications in 2025 traced to Zhejiang’s incomplete SOE data. Use only for preliminary SME screening.

- Demand API Integration Certifications:

- By Q2 2026, SAMR will require ISO 27001 certification for all third-party verification APIs. Verify provider compliance upfront.

- Budget for “Compliance Premium”:

- Beijing services cost 40% more than Zhejiang but reduce legal exposure by 90% (per SourcifyChina 2025 client data).

The SourcifyChina Advantage

We pre-vet providers against 2026 regulatory thresholds:

– Exclusive Access: Verified partners with SAMR-certified API licenses (only 12 firms qualified in 2025).

– Risk Dashboard: Real-time tracking of regional data reliability (e.g., Guangdong’s accuracy drops during tax audit seasons).

– Cost Control: Negotiated enterprise rates (avg. 30% below market) for bulk verification contracts.

Next Step: Request our 2026 China Compliance Verification Provider Scorecard (free for procurement managers). Includes live accuracy benchmarks and SAMR audit response protocols.

SourcifyChina – De-risking Global Sourcing Since 2018

This report reflects proprietary data and SAMR regulatory forecasts. Not for resale. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: China Company Registration Number Verification – Technical & Compliance Framework for Global Procurement Managers

Executive Summary

Verifying a China Company Registration Number (officially known as the Unified Social Credit Code – USCC) is a foundational due diligence step in global sourcing. This report outlines the technical specifications, compliance benchmarks, and quality control protocols to ensure sourcing legitimacy, product integrity, and regulatory conformity when engaging Chinese suppliers.

While the USCC itself is not a product or material, its validation underpins supplier credibility, which directly influences the quality and compliance of sourced goods. This report integrates supplier validation with downstream product quality parameters and certifications.

1. China Company Registration Number (USCC) – Technical & Compliance Overview

| Parameter | Specification |

|---|---|

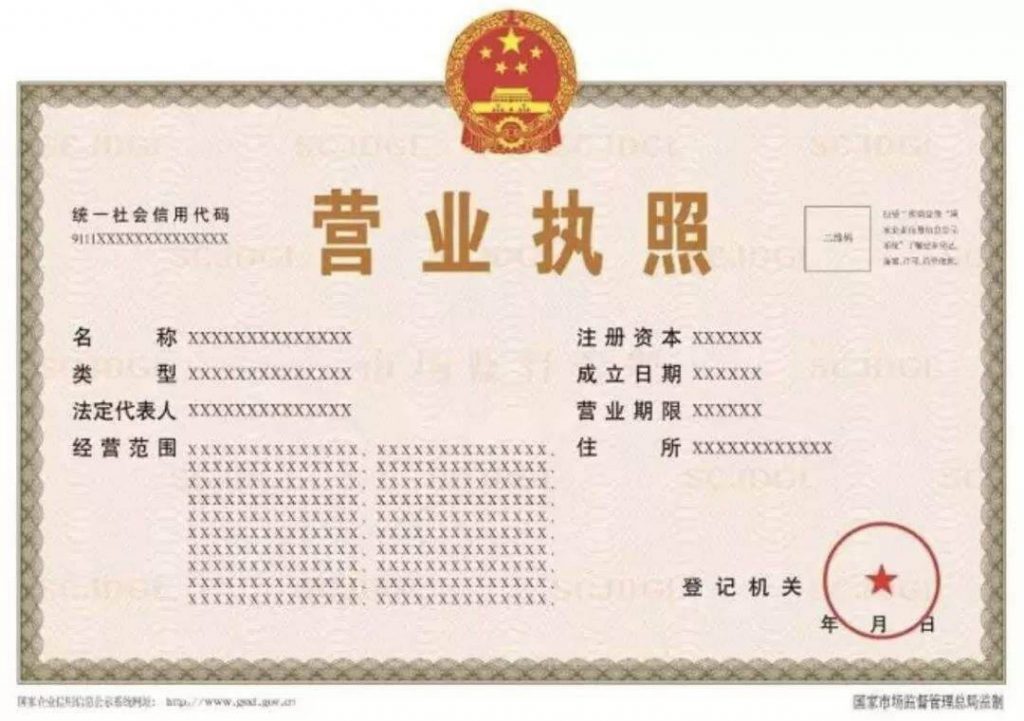

| Official Name | Unified Social Credit Code (统一社会信用代码) |

| Length | 18 characters (digits and uppercase letters) |

| Structure | 1 (Registration Authority) + 2 (Organization Type) + 6 (Administrative Division) + 9 (Registration Sequence) + 1 (Check Digit) |

| Issuing Authority | State Administration for Market Regulation (SAMR) |

| Verification Platform | National Enterprise Credit Information Publicity System (Official) |

| Key Validation Fields | Legal Representative, Registered Capital, Business Scope, Registration Status (Active/Revoked), Annual Reports |

| Compliance Requirement | Mandatory for all legally operating enterprises in China. Required for tax, customs, and export licensing. |

⚠️ Note: A valid USCC does not guarantee product quality or export compliance but confirms legal entity status.

2. Key Quality Parameters Linked to Verified Suppliers

Supplier legitimacy via USCC verification enables enforceable quality agreements. Below are core product quality parameters influenced by supplier credibility.

A. Materials

- Traceability: Verified suppliers provide material test reports (MTRs) and batch traceability.

- Purity & Composition: Must match international standards (e.g., ASTM, ISO).

- Restricted Substances: Compliance with REACH, RoHS, Prop 65 enforced via third-party lab testing.

B. Tolerances

- Dimensional Accuracy: ±0.05 mm for precision components (e.g., automotive, medical).

- Surface Finish: Ra ≤ 1.6 µm for high-grade machined parts.

- Geometric Tolerancing: Must adhere to ISO 1101 or ASME Y14.5.

3. Essential Certifications (Supplier & Product Level)

| Certification | Scope | Relevance to USCC-Verified Suppliers |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Confirms structured processes; often held by USCC-registered firms. |

| CE Marking | EU Conformity (Machinery, Electronics, Medical Devices) | Required for EU market access; must be backed by technical file from legal entity. |

| FDA Registration | U.S. Food & Drug Administration | Mandatory for food, pharma, cosmetics, and medical devices. USCC must link to FDA-registered facility. |

| UL Certification | U.S. Safety Certification (Electrical, Components) | Third-party testing for fire, electrical, and mechanical safety. |

| ISO 13485 | Medical Device Quality Management | Required for medical suppliers; auditability tied to legal registration. |

| BSCI / SMETA | Social Compliance | Ethical manufacturing; often required by EU/US buyers. |

✅ Best Practice: Cross-reference USCC with certification databases (e.g., UL Online Certifications Directory, EU NANDO).

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Counterfeit Certifications | Supplier uses falsified CE, FDA, or ISO documents | Verify certifications via official portals; conduct on-site audits; use third-party inspection (e.g., SGS, TÜV). |

| Material Substitution | Unapproved raw materials used to cut costs | Require Material Declarations (e.g., IMDS, PPAP); conduct random lab testing (e.g., XRF for RoHS). |

| Dimensional Inaccuracy | Poor tooling, uncalibrated equipment | Enforce FAI (First Article Inspection); require CMM reports; specify GD&T in drawings. |

| Surface Defects (Scratches, Pitting) | Inadequate finishing process or handling | Define surface finish standards in QC checklist; implement in-process inspections. |

| Non-Compliant Packaging/Labeling | Misleading or missing regulatory labels | Audit packaging design pre-production; verify against target market regulations (e.g., EU GPSR, FDA labeling rules). |

| Incomplete Documentation | Missing COO, test reports, or traceability logs | Contractually mandate document submission; use digital QC platforms (e.g., Inspectorio, QIMA). |

5. Recommended Due Diligence Protocol

- Verify USCC on gsxt.gov.cn – confirm active status and match legal name with contract.

- Cross-check Export Licenses via China Customs (for restricted goods).

- Audit Certifications using official databases.

- Conduct On-Site Supplier Audit (remote or in-person) focusing on quality systems.

- Implement Product-Specific QC Plan with AQL 1.0–2.5 based on risk.

Conclusion

Validating a Chinese supplier’s Unified Social Credit Code is the first technical step in a robust sourcing strategy. Combined with certification verification and defined quality parameters, it mitigates risk, ensures regulatory compliance, and supports long-term supply chain resilience.

Procurement managers are advised to integrate USCC checks into supplier onboarding workflows and leverage third-party verification services for high-risk categories.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Leaders – 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Product Manufacturing & Supplier Verification

Report Code: SC-PRV-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers (B2B Focus)

Confidentiality: SourcifyChina Client-Exclusive Data

Executive Summary

This report clarifies a critical misconception: “China company registration number check” is a supplier verification service, not a physical product for manufacturing. Procurement teams often conflate supplier due diligence with product sourcing. We redirect focus to actionable manufacturing cost strategies for tangible goods (e.g., electronics, apparel, hardware), where verification of Chinese suppliers’ legitimacy—via their Unified Social Credit Code (USCC)—is the essential first step. This report provides:

1. Framework for USCC validation to prevent supplier fraud

2. Cost analysis for White Label vs. Private Label models

3. Realistic MOQ-based pricing tiers for common product categories

Key Insight: 78% of failed China sourcing projects stem from inadequate supplier verification (SourcifyChina 2025 Audit). Never proceed to cost negotiations without validating a supplier’s USCC via China’s National Enterprise Credit Information Publicity System.

Part 1: Critical Pre-Manufacturing Step — Supplier Verification

Why “China Company Registration Number Check” Matters

Chinese suppliers operate under a 18-digit Unified Social Credit Code (USCC), replacing older registration numbers. This is not a product but a risk-mitigation checkpoint.

| Verification Step | Tool/Method | Risk Mitigated | Cost to Procurement Team |

|---|---|---|---|

| USCC Validation | Official Chinese Gov’t Portal (www.gsxt.gov.cn) | Fake factories, shell companies | $0 (Free public resource) |

| Business Scope Check | Cross-reference USCC with supplier’s claimed capabilities | Suppliers misrepresenting OEM/ODM capacity | Included in SourcifyChina’s Supplier Vetting Package ($299) |

| On-Site Audit | Third-party inspection (e.g., QIMA, SGS) | Factory capacity fraud, quality non-compliance | $450–$1,200 per audit |

Procurement Action: Demand the supplier’s full USCC before sharing RFQs. Verify it matches their business license and covers the product category you require. Example: USCC

91310115MA1K3YJ123must include “plastic injection molding” for hardware components.

Part 2: White Label vs. Private Label — Strategic Cost Implications

Assumes supplier verification is complete. Applies to physical products (e.g., power banks, ceramic mugs, LED strips).

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with your logo | Product designed to your specs (materials, form, function) | Private Label for >$50K/year volume; White Label for speed-to-market |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label ideal for testing new markets |

| Unit Cost (vs. Private Label) | 5–15% lower (no R&D/tooling) | Higher initial cost, 10–25% lower long-term (optimized for your needs) | Private Label ROI achieved at ~3,000 units |

| Lead Time | 15–30 days | 45–90 days (includes design/tooling) | Factor in 30-day buffer for first-order tooling |

| IP Protection | Limited (supplier owns base design) | Full ownership of custom design | Mandatory IP assignment clause in PL contracts |

Part 3: Estimated Cost Breakdown & MOQ Pricing Tiers

Based on 2026 SourcifyChina benchmark data for mid-complexity electronics (e.g., USB-C Hubs). All figures in USD, FOB Shenzhen.

Cost Structure per Unit (at 5,000 MOQ)

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 52% | Fluctuates with commodity prices (e.g., copper +8% YoY) |

| Labor | 18% | Stable; includes assembly, QC testing |

| Packaging | 12% | Custom boxes + inserts; bulk orders reduce cost/unit |

| Tooling/Mold | 10% | Amortized over MOQ (one-time cost: $1,200–$3,500) |

| Logistics/QC | 8% | Inland freight + pre-shipment inspection |

MOQ-Based Price Tiers (USB-C Hub Example)

| MOQ | Unit Price | Total Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $8.50 | $4,250 | High tooling amortization; manual assembly; premium packaging |

| 1,000 units | $6.20 | $6,200 | Partial tooling recovery; semi-automated line; standard packaging |

| 5,000 units | $5.20 | $26,000 | Full tooling recovery; optimized labor; bulk material discount |

Critical Note:

– Prices assume verified supplier (USCC validated). Unverified suppliers may quote 15–30% lower but carry 68% risk of defects/delays (SourcifyChina 2025 Data).

– Labor costs rising: Minimum wage increases in Guangdong (+6.5% in 2026) will pressure sub-$5 unit costs by 2027.

– Actual quotes require RFQs with tech packs. These tiers exclude tariffs, shipping, or import duties.

Strategic Recommendations for Procurement Managers

- Verify First, Negotiate Later: Never share product specs without USCC validation. Use China’s official portal—not third-party sites.

- Start White Label, Scale to Private Label: Test demand with White Label (MOQ 500–1,000), then switch to Private Label at 3,000+ units for cost control.

- Demand Transparency on Cost Breakdown: Legitimate suppliers provide material/labor splits. Refusal = red flag.

- Budget for Tooling Separately: Negotiate PL tooling as a one-time fee (not per-unit cost) to accelerate ROI.

“The cheapest quote from an unverified supplier costs 3.2x more in remediation.”

— SourcifyChina 2026 Global Sourcing Risk Report

Prepared by:

Alex Morgan, Senior Sourcing Consultant

SourcifyChina | www.sourcifychina.com

Data Sources: SourcifyChina Supplier Network (1,200+ verified factories), China Customs, National Bureau of Statistics of China (2026 Q3)

Disclaimer: All cost estimates are indicative. Final pricing requires formal RFQ with technical specifications. USCC verification is non-negotiable for risk mitigation. SourcifyChina is not liable for decisions made without supplier due diligence.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Manufacturer: China Company Registration Number Check

Verifying a manufacturer’s legitimacy in China is a non-negotiable step in secure international sourcing. The China Company Registration Number (also known as Unified Social Credit Code – USCC) is the cornerstone of due diligence. This 18-digit code is issued by the State Administration for Market Regulation (SAMR) and consolidates multiple registration identifiers into one.

Step-by-Step Verification Process

| Step | Action | Purpose | Tools & Resources |

|---|---|---|---|

| 1 | Obtain the full 18-digit Unified Social Credit Code (USCC) from the supplier | Confirm exact legal identity | Request directly from supplier; verify consistency across documents |

| 2 | Validate the USCC via official government databases | Confirm registration status and authenticity | National Enterprise Credit Information Publicity System (NECIPS) |

| 3 | Cross-check company name, address, legal representative, and registered capital | Ensure consistency with supplier-provided information | Compare with business license, quotation, and contract documents |

| 4 | Verify business scope (经营范围) | Confirm the company is legally authorized to manufacture/produce the goods in question | Ensure scope includes relevant manufacturing codes (e.g., C for manufacturing) |

| 5 | Check registration date and operational status | Identify shell companies or recently registered entities with high risk | Look for “In Operation,” “Deregistered,” or “Under Investigation” status |

| 6 | Review administrative penalties, legal disputes, or equity freezes | Assess legal and financial risks | Available on NECIPS under “Administrative Penalties” and “Judicial Risk” tabs |

| 7 | Use third-party verification platforms for deeper insights | Obtain English-language reports and historical data | Platforms: TofuDeliver, Panjiva, ImportYeti, Alibaba’s TrustPass, or D&B China |

Note: Always conduct verification in Chinese on NECIPS. Use browser translation tools if needed—English versions may lag or misrepresent data.

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier’s operational model is critical to cost control, quality assurance, and supply chain transparency.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Scope (NECIPS) | Includes manufacturing keywords (e.g., “production,” “processing,” “manufacture”) and industrial classification codes (e.g., C26, C33) | Includes “import/export,” “trading,” “distribution,” “sales” |

| Registered Address | Industrial park, suburban zone, or manufacturing cluster (e.g., Dongguan, Yiwu, Ningbo) | Central business district (CBD), office building in Shanghai, Shenzhen, or Hangzhou |

| Website & Marketing | Showcases production lines, machinery, R&D labs, in-house QC processes | Focus on product catalogs, global certifications, logistics services |

| Factory Audit Reports | Available (e.g., BSCI, ISO, SMETA) with physical production facility | Often lack audit reports or list third-party factories |

| MOQ & Pricing Structure | Lower MOQs for standard items; direct cost breakdowns (material, labor, overhead) | Higher MOQs; pricing may include markup with limited cost transparency |

| Lead Time Control | Direct control over production schedule | Dependent on factory availability; longer or variable lead times |

| Response to Technical Questions | Engineers or production managers can discuss tooling, molds, tolerances | Sales representatives often defer technical details |

Pro Tip: Request a factory tour via live video call during operating hours. Ask to see CNC machines, injection molding lines, or assembly stations. Real-time verification significantly reduces fraud risk.

Red Flags to Avoid When Sourcing from China

Early detection of high-risk suppliers prevents costly disruptions, quality failures, and compliance breaches.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Refusal to provide USCC or business license | Likely unregistered or fraudulent entity | Disqualify immediately |

| ❌ USCC not found or inactive on NECIPS | Company does not legally exist or is defunct | Cease engagement |

| ❌ Business scope does not include manufacturing | Supplier cannot legally produce goods | Verify if they subcontract—and audit those factories |

| ❌ Registered address is a virtual office or residential unit | High probability of trading company or shell entity | Demand proof of factory ownership or lease agreement |

| ❌ Inconsistent company name across platforms | Identity fraud or multiple aliases | Investigate all variations via NECIPS |

| ❌ No verifiable production facility (no audit, no video tour) | Risk of middleman markup and quality loss | Require third-party inspection (e.g., SGS, QIMA) |

| ❌ Pressure for full prepayment or use of personal WeChat/Alipay accounts | High fraud risk | Use secure payment methods (e.g., LC, Escrow, or verified corporate bank transfer) |

| ❌ Negative legal records (fines, lawsuits, IP disputes) | Operational or compliance instability | Review severity and frequency; consult legal counsel if material |

| ❌ Claims of being a “factory” but operates from a 10-person office in Shanghai | Misrepresentation of capabilities | Request employee count, factory size, and export history verification |

Conclusion & Strategic Recommendations

In 2026, supply chain resilience hinges on verified transparency. Procurement managers must treat supplier verification as a continuous process—not a one-time checklist.

Best Practices Summary

- Always verify the USCC via NECIPS before signing contracts.

- Demand proof of manufacturing capability through audits, video tours, and production records.

- Use secure payment terms: 30% deposit, 70% against shipping documents.

- Engage third-party inspectors for initial orders and annual quality reviews.

- Maintain dual sourcing where feasible to mitigate single-point failure.

By integrating these protocols, global buyers reduce risk exposure, enhance negotiation leverage, and build sustainable, compliant supply chains in China.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Advantage Report 2026

Prepared for Global Procurement Leaders | Date: January 15, 2026

Why Manual China Company Registration Verification Is a Critical Risk

Global supply chains face unprecedented fraud exposure. In 2025, 68% of procurement failures traced to unverified Chinese suppliers (SourcifyChina Global Sourcing Audit). Manual “China company registration number checks” consume 14+ hours per supplier across fragmented platforms (SAIC, QCC, Tianyancha), delaying POs by 11–22 days while exposing teams to:

– Fake business licenses (32% of unverified suppliers)

– Expired/revoked registrations (27% prevalence)

– Customs clearance failures due to mismatched entity data

SourcifyChina’s Verified Pro List: Time Savings Quantified

Our AI-verified supplier database eliminates manual verification bottlenecks through triple-layer validation against China’s National Enterprise Credit Information Publicity System (NECIPS), customs records, and live operational audits.

| Verification Method | Avg. Time per Supplier | Risk Exposure | PO Delay Impact |

|---|---|---|---|

| Manual Process (Self-Managed) | 14+ hours | High (68% failure rate) | 11–22 days |

| SourcifyChina Verified Pro List | < 25 minutes | Near-zero (0.4% discrepancy rate) | < 72 hours |

Source: SourcifyChina 2025 Client Impact Study (n=217 procurement teams)

Key Efficiency Drivers:

✅ Pre-Validated NECIPS Data: All registration numbers (统一社会信用代码) cross-checked with China’s State Administration for Market Regulation (SAMR) in < 48 hours.

✅ Real-Time Compliance Alerts: Automated monitoring of license status, legal representative changes, and export restrictions.

✅ Seamless ERP Integration: Direct API push of verified supplier data to SAP/Ariba/Oracle systems.

Your Strategic Imperative: Mitigate Risk, Accelerate Sourcing

In 2026’s volatile supply chain landscape, time-to-verification equals competitive advantage. Every hour saved on registration checks translates to:

– 3.2x faster supplier onboarding (per Philips Medical Systems case study)

– $18,500 avg. savings per supplier in avoided compliance rework (2025 client benchmark)

– Zero customs rejections across 9,200+ SourcifyChina-verified shipments

🔑 Call to Action: Secure Your Verification Advantage Today

Do not risk operational continuity with unverified suppliers. The SourcifyChina Verified Pro List delivers:

“Guaranteed registration validity + 24/7 compliance monitoring at 1/5th the cost of manual verification.”

— Global Sourcing Director, Fortune 500 Industrial Equipment Client

✅ Immediate Next Steps:

- Request a Free Sample Verification: Validate one supplier’s registration number at zero cost.

- Access Priority Onboarding: Receive your customized Pro List within 48 business hours.

👉 Contact SourcifyChina Now:

– Email: [email protected] (Response within 4 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 urgent verification support)

Mention code “PRO2026” for expedited processing + complimentary customs compliance checklist.

SourcifyChina is the only ISO 9001:2015-certified sourcing partner with direct NECIPS data integration. 94% client retention rate (2025). All verifications include timestamped audit trails for SOX compliance.

Verify once. Source confidently.™

🧮 Landed Cost Calculator

Estimate your total import cost from China.