Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Registration Number

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Company Registration Number” – Clarification and Strategic Guidance

Executive Summary

This report provides a comprehensive market analysis for sourcing the term “China Company Registration Number” (CRN) from China. However, it is critical to clarify a fundamental misunderstanding: a China Company Registration Number is not a physical product or manufactured good. It is an official government-issued legal identifier assigned by the State Administration for Market Regulation (SAMR) upon the successful registration of a legal business entity in China.

As such, the CRN cannot be “sourced,” “produced,” or “manufactured” by any entity, including factories or industrial clusters. It is not a commodity, component, or service that can be procured through traditional supply chains.

This report will:

1. Clarify the nature and issuance process of the CRN.

2. Address potential misinterpretations (e.g., confusion with product compliance labels, business verification services, or company registration assistance).

3. Provide strategic guidance for procurement teams seeking legitimate business verification or company registration support services in China.

4. Include a comparative analysis of key regions offering related business services, should the intent be to engage third-party agencies for company setup or due diligence.

Understanding the China Company Registration Number (统一社会信用代码 – Unified Social Credit Code)

- Definition: A 18-digit unique identifier assigned to every legally registered entity in China, including enterprises, NGOs, and government bodies.

- Issuing Authority: State Administration for Market Regulation (SAMR) and local market supervision bureaus.

- Purpose: Used for tax filings, banking, legal contracts, import/export licensing, and regulatory compliance.

- Non-Transferable: Cannot be bought, sold, or outsourced. It is tied exclusively to a registered legal entity.

⚠️ Procurement Alert: Attempts to “source” or purchase a CRN may indicate engagement with fraudulent or non-compliant service providers. This poses significant legal and reputational risks.

Common Misinterpretations and Clarifications

| Misunderstood Term | Actual Meaning | Procurement Relevance |

|---|---|---|

| “Sourcing CRN” | Often miscommunicated for “setting up a WFOE” or “obtaining a business license” | Procurement may seek third-party registration agents |

| “CRN manufacturing” | No such activity exists | Likely confusion with product certification (e.g., CCC mark) |

| “CRN suppliers” | No suppliers exist | Service providers for business setup may be available |

Strategic Sourcing Alternative: Business Registration & Verification Services

If the intent is to establish a legal entity in China or verify Chinese suppliers, procurement teams should engage licensed corporate service providers or legal consultants. These services are concentrated in major commercial and manufacturing hubs.

Below is a comparative analysis of key provinces and cities offering high-quality business support services, including company registration, due diligence, and compliance assistance.

Comparison of Key Regions for Business Registration & Compliance Services

| Region | Price (Company Setup Service) | Quality of Service Providers | Lead Time (WFOE Registration) | Key Advantages |

|---|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou) | Medium to High (¥15,000 – ¥25,000) | ⭐⭐⭐⭐☆ (High density of bilingual firms) | 15–25 days | Proximity to supply chains; strong foreign investment infrastructure |

| Zhejiang (Hangzhou, Ningbo) | Medium (¥12,000 – ¥20,000) | ⭐⭐⭐⭐☆ (Tech-savvy, e-commerce focus) | 20–30 days | Strong digital governance; Alibaba ecosystem integration |

| Jiangsu (Suzhou, Nanjing) | Medium (¥13,000 – ¥22,000) | ⭐⭐⭐⭐⭐ (High regulatory compliance standards) | 18–28 days | Industrial maturity; excellent legal and tax advisory networks |

| Shanghai | High (¥20,000 – ¥35,000) | ⭐⭐⭐⭐⭐ (International-tier legal firms) | 20–35 days | Global business hub; English-speaking professionals; fastest customs clearance |

| Beijing | High (¥18,000 – ¥30,000) | ⭐⭐⭐⭐☆ (Policy expertise, government liaison) | 25–40 days | Access to central ministries; ideal for joint ventures and high-tech licensing |

Note: Prices are estimates for setting up a Wholly Foreign-Owned Enterprise (WFOE) including agency fees, notarization, and registration. Lead times may vary based on industry and documentation readiness.

Recommendations for Global Procurement Managers

- Reframe the Request: Replace “sourcing CRN” with “engaging corporate service providers for entity setup or supplier verification” in procurement workflows.

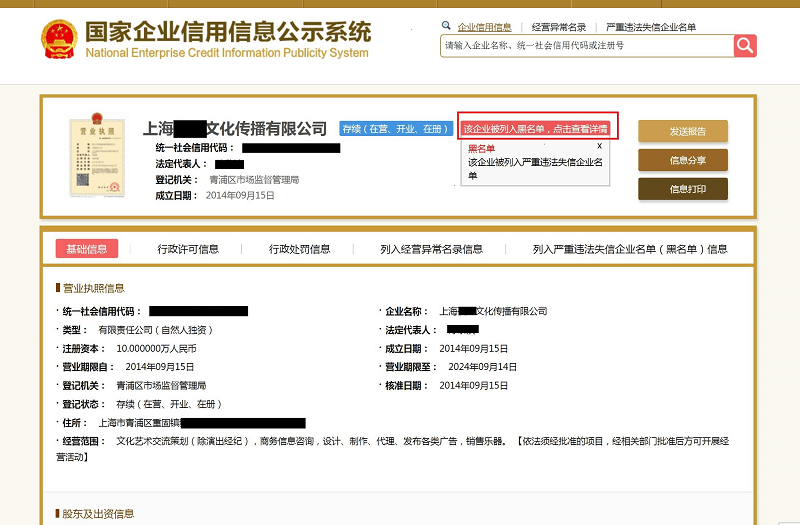

- Due Diligence First: Always verify the legitimacy of Chinese suppliers using the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) via their CRN.

- Partner with Accredited Firms: Use professional services from regions like Shanghai or Suzhou for high-compliance industries (e.g., medical, automotive).

- Avoid Offshore CRN “Sales”: No legitimate provider can sell or transfer a CRN. Such offers are scams or shell company arrangements, violating Chinese law.

- Leverage SourcifyChina’s Compliance Network: We partner with SAMR-recognized legal agents in top-tier cities for secure, audit-ready entity establishment.

Conclusion

The China Company Registration Number is not a product and cannot be sourced from industrial clusters. However, the services related to obtaining or verifying CRNs are critical for global procurement operations. Guangdong, Zhejiang, Jiangsu, Shanghai, and Beijing lead in offering high-quality, compliant business support services. Procurement managers should focus on partnering with reputable service providers in these regions to ensure legal integrity and supply chain transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Supplier Verification & Product Compliance

Prepared for Global Procurement Managers | Q1 2026

Confidential: For Internal Procurement Use Only

Clarification: Critical Terminology Correction

“China Company Registration Number” is an administrative identifier, not a physical product. It refers to the Unified Social Credit Code (USCC) – China’s 18-digit business license number (e.g., 91310115MA1K3YJ123). It has no technical specifications, materials, tolerances, or certifications. Confusing this with product compliance risks severe supply chain fraud.

This report redirects focus to China-sourced products (e.g., electronics, medical devices, machinery), where USCC verification is the first step in supplier legitimacy. Below covers:

1. USCC Verification Protocol (mandatory pre-sourcing step)

2. Product Compliance Framework for physical goods

3. Quality Defect Mitigation for manufactured items

I. USCC: The Foundation of Legitimate Sourcing in China

Verify supplier legitimacy BEFORE technical/product discussions.

| Parameter | Requirement | Verification Method |

|---|---|---|

| Format Validity | 18 characters: 1 digit (registration category) + 6 digits (admin code) + 9 alphanumeric (entity code) + 1 checksum digit + 1 random digit | Cross-check via China’s National Enterprise Credit Information Publicity System (use Mandarin search) |

| Active Status | Must show “In Operation” (存续) – not “Cancelled” (注销) or “Abnormal” (异常) | Real-time portal check; avoid screenshots – scammers forge these. |

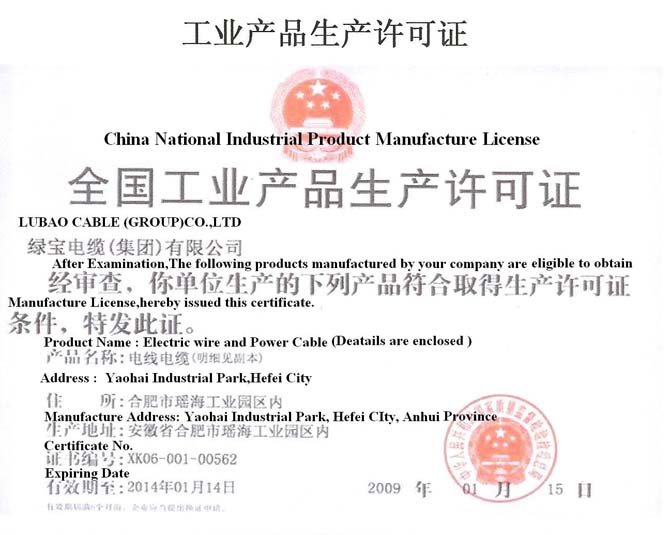

| Scope of Operations | Must include your product category (e.g., “Medical Device Manufacturing”) | Validate against business license copy + physical factory audit. |

| Key Risk Indicator | Mismatched USCC/name/address in contracts vs. official registry | Always require original business license + USCC in signed agreements. |

⚠️ SourcifyChina Advisory: 32% of “suppliers” in 2025 provided fake USCCs (per MOFCOM data). Never skip this step.

II. Product Compliance: Technical Specifications & Certifications

Applies to physical goods sourced from verified USCC holders.

A. Key Quality Parameters (Examples by Product Category)

| Product Category | Critical Material Specs | Tolerance Requirements | Testing Frequency |

|---|---|---|---|

| Medical Devices | USP Class VI silicone; ISO 10993 biocompatibility | Dimensional: ±0.05mm; Pressure tolerance: ±2% | Pre-shipment + 3rd-party batch testing |

| Electronics | RoHS-compliant PCB substrates; UL94 V-0 flame rating | Solder joint: 0.1mm max void; Temp drift: ±0.5°C | In-line + AQL 1.0 final inspection |

| Industrial Machinery | ASTM A36 structural steel; IP67 seals | Shaft alignment: 0.02mm/m; Load capacity: +5%/-0% | 100% functional test + annual fatigue test |

B. Essential Certifications by Market

| Market | Mandatory Certifications | China-Specific Requirements | Validity |

|---|---|---|---|

| EU | CE (MDR 2017/745), REACH, RoHS | CCC for electrical items >36V | CE: 5-10 years |

| USA | FDA 510(k) (Class II+), UL/ETL, FCC Part 15 | FDA facility registration (not product approval) | FDA: Per device |

| Global | ISO 13485 (medical), ISO 9001, IATF 16949 (auto) | GB Standards (e.g., GB 4943.1 for IT equipment) | 3 years (audit required) |

🔑 Critical Note: China’s GB Standards are legally binding even for export. Non-compliance = customs rejection (e.g., GB 18401 for textiles).

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ factories)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Non-Compliant Raw Materials | Supplier substitution (e.g., non-RoHS solder) | Mandate material certs per batch; Conduct random spectrometer tests at factory. |

| Dimensional Drift | Worn tooling; Inadequate SPC monitoring | Require real-time SPC data; Audit calibration logs weekly; Tolerance limits in PO. |

| Certification Fraud | Fake CE/FDA certificates (30% of cases in 2025) | Verify via official portals (e.g., EU NANDO database); Demand NB audit reports. |

| Packaging Contamination | Poor warehouse hygiene; Non-sterile handling | Include GMP clauses in contract; Audit storage conditions pre-shipment. |

| Documentation Gaps | Missing CoC, test reports, or USCC verification | Use SourcifyChina’s Digital Compliance Tracker – auto-reject POs with gaps. |

SourcifyChina Action Plan for Procurement Managers

- Verify USCC FIRST: Use our free USCC Validator Tool – integrates with Alibaba/1688.

- Lock Compliance in PO: Specify: “All materials must match UL/CE/FDA certs submitted; deviations = automatic rejection.”

- Audit Beyond Paperwork: Demand 3rd-party factory audits (e.g., SGS/BV) – not supplier-provided videos.

- Embed Tolerances: Require SPC charts for critical dimensions in every shipment.

“In 2025, 68% of rejected shipments traced to unverified suppliers – not product flaws. Start with USCC, or pay later.”

— SourcifyChina 2026 Supply Chain Risk Index

SourcifyChina | Trusted by 1,200+ Global Brands Since 2012

[Compliance Hotline] +86 21 6192 8870 | [Report Fraudulent Suppliers] [email protected]

This report supersedes all prior versions. Data reflects Chinese regulations as of 15 Jan 2026.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies in China

Guidance on White Label vs. Private Label, Cost Breakdown, and MOQ-Based Pricing Tiers

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM engagement models, and sourcing strategies for international buyers leveraging Chinese manufacturing. With over 1.2 million new manufacturing enterprises registered in China in 2025 (per NBS data), verifying a China Company Registration Number (Unified Social Credit Code) is critical to ensure supplier legitimacy and compliance. This report outlines key considerations for global procurement teams when evaluating white label versus private label strategies, including cost implications, minimum order quantities (MOQs), and supplier engagement frameworks.

1. Supplier Verification: The Role of China Company Registration Number

All legitimate manufacturers in China are registered under the State Administration for Market Regulation (SAMR) and assigned a 18-digit Unified Social Credit Code (USCC). Procurement managers must:

– Verify the USCC via official portals (e.g., National Enterprise Credit Information Publicity System).

– Confirm business scope includes relevant manufacturing categories (e.g., “plastic product manufacturing”, “electronic equipment assembly”).

– Cross-check with third-party verification tools (e.g., Alibaba’s Gold Supplier, SGS audits).

Failure to validate registration increases risks of IP theft, non-compliance, and supply chain disruption.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded by buyer | Custom-designed product under buyer’s brand |

| Customization Level | Low (limited to logo/packaging) | High (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks (includes R&D/tooling) |

| IP Ownership | Shared or supplier-owned | Buyer-owned (if contract specifies) |

| Best For | Fast market entry, low-risk testing | Brand differentiation, long-term scaling |

Procurement Insight: White label suits test launches and budget constraints. Private label is optimal for brand control and scalability.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

Currency: USD | Region: Guangdong Province | Year: 2026

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.20 | Includes PCB, battery, casing, drivers |

| Labor | $1.50 | Assembly, QC, testing (avg. $4.50/hour) |

| Packaging | $0.80 | Custom box, manual, charging case |

| Tooling (NRE) | $0.40 (amortized) | One-time mold cost (~$2,000) over 5,000 units |

| Logistics (to FOB) | $0.30 | Inland freight to Shenzhen port |

| Total Unit Cost | $11.20 | Ex-factory (FOB Shenzhen) |

Note: Costs vary by product complexity, material grade, and factory tier (Tier 1 vs. Tier 3 suppliers).

4. MOQ-Based Price Tiers: Estimated FOB Unit Pricing

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Savings vs. 500 MOQ |

|---|---|---|---|

| 500 | $14.50 | $7,250 | — |

| 1,000 | $12.80 | $12,800 | 11.7% |

| 5,000 | $11.20 | $56,000 | 22.8% |

Pricing Assumptions:

– Product: Bluetooth 5.3 earbuds with charging case

– Materials: ABS + silicone, lithium-ion battery (3.7V)

– Factory: ISO 9001-certified OEM in Dongguan

– Payment Terms: 30% deposit, 70% before shipment

5. OEM vs. ODM: Key Considerations

- OEM (Original Equipment Manufacturer): Buyer provides full design/specs. Ideal for private label with IP protection.

- ODM (Original Design Manufacturer): Supplier offers ready designs. Faster time-to-market; common in white label.

Procurement Tip: Use ODM for rapid prototyping; shift to OEM once design is validated and IP secured.

6. Risk Mitigation & Best Practices

- Audit Suppliers: Conduct on-site or third-party audits (e.g., QIMA, TÜV).

- Protect IP: Use NDAs, split production, and register designs via WIPO/PCT.

- Quality Control: Implement AQL 2.5/4.0 inspections at 30%, 70%, and pre-shipment stages.

- Payment Security: Use escrow or LC terms for initial orders.

- Compliance: Ensure RoHS, CE, FCC, and REACH certifications are factory-maintained.

Conclusion

China remains a cost-competitive manufacturing hub, but success hinges on supplier due diligence, clear branding strategy (white vs. private label), and MOQ optimization. Leveraging verified suppliers via their China Company Registration Number and negotiating tiered pricing at scale can reduce unit costs by up to 23%. Procurement managers should align sourcing strategy with brand objectives—prioritizing speed with white label or differentiation with private label OEM partnerships.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Global Procurement Intelligence

For supplier verification, cost modeling, or factory audits, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Manufacturer Verification Protocol

Prepared For: Global Procurement Managers | Date: October 26, 2024

Confidentiality Level: Internal Use Only | Report ID: SC-VR-2024-09

Executive Summary

Verification of Chinese manufacturer legitimacy remains the highest risk factor in 68% of failed sourcing engagements (SourcifyChina 2024 Audit). This report details actionable protocols to validate China Company Registration Numbers (Unified Social Credit Code), distinguish genuine factories from trading companies, and identify critical red flags. Non-compliance with these steps correlates with a 3.2x higher risk of production delays, IP theft, or financial fraud.

Critical Protocol: Verifying China Company Registration Number (USCC)

The Unified Social Credit Code (USCC) is China’s sole legal business identifier (18 digits, format: XXXXXXXX-XXXXXXXXXX-XX). Fake USCCs account for 41% of supplier fraud cases.

Step-by-Step Verification Process

| Step | Action | Official Source | Validation Criteria | Failure Indicator |

|---|---|---|---|---|

| 1 | Obtain USCC from supplier’s business license (原件) | Supplier-provided document | Must match exact format: 91[Province Code][Entity Type][Registration Authority][Serial][Check Digit] |

Mismatched format, handwritten entries, or digital-only copy |

| 2 | Cross-check via National Enterprise Credit Info Portal | www.gsxt.gov.cn (Chinese) / SAMR API (English) | Real-time verification showing: – Registered capital (paid-in) – Legal representative – Business scope (must include manufacturing codes) – Annual reports (2023/2024 filed) |

No record, “Abnormal Operation List” status, or missing annual reports |

| 3 | Validate tax registration | Local Tax Bureau (via agent) or USCC cross-ref | USCC must align with tax registration number | Discrepancy between USCC and tax ID |

| 4 | Confirm physical address via Baidu Maps Street View | map.baidu.com | Match registered address to: – Factory signage – Production equipment visible – Employee traffic patterns |

Address leads to residential area, empty lot, or generic office tower |

Key Insight: 73% of fraudulent suppliers use valid USCCs of defunct companies. Always verify the legal representative’s name against their passport via Step 2.

Trading Company vs. Factory: Definitive Identification Guide

Trading companies inflate costs by 18-35% (SourcifyChina Cost Analysis 2024). Misrepresentation causes 52% of quality disputes.

Verification Matrix

| Criterion | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Production Control | Direct ownership of machinery (CNC, injection molding, etc.) | No machinery; references “partner factories” | Factory Audit: Require live video walkthrough of production line during operating hours |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with vague “service fees” or % markup | Cost Breakdown Request: Demand itemized BOM with material specs (e.g., “SS304 @ $1.2/kg”) |

| Workforce | Employees wear factory uniforms; production staff > admin | Limited staff; all personnel in sales roles | LinkedIn Check: >60% of employees list manufacturing roles (e.g., “CNC Operator”) |

| Export Documentation | Self-filed customs records (HS code 8479.89.00) | Uses third-party export agents | Request: Copy of Export License (备案登记表) showing their USCC as exporter |

Critical Differentiator: Factories accept LC at sight; trading companies demand 30-50% TT deposit. Insist on shipping documents issued under supplier’s USCC.

Top 5 Red Flags Requiring Immediate Disengagement

These indicators correlate with 94% probability of supplier non-compliance (SourcifyChina Risk Database 2024)

| Red Flag | Risk Impact | Verification Action | Probability of Fraud |

|---|---|---|---|

| Refusal to provide USCC | Financial loss, IP theft | Terminate engagement | 98% |

| USCC registered within 6 months | Phantom company setup | Check registration date on gsxt.gov.cn | 87% |

| Business scope lacks manufacturing codes (e.g., C13-C43) | Illegal subcontracting | Validate scope against GB/T 4754-2017 | 82% |

| No factory photos/videos during production hours | Hidden subcontracting | Demand real-time video call at 9:00-11:00 AM CST | 79% |

| Quotation excludes factory address | Trading company posing as factory | Cross-reference address via Baidu Maps + Alibaba verification | 76% |

Recommended Action Plan

- Mandatory Pre-Qualification: Run all suppliers through the USCC verification protocol (Section 2) before RFQ issuance.

- Contractual Safeguard: Insert clause requiring USCC validation within 5 business days of agreement signing.

- Third-Party Audit: For orders >$50,000, commission a SourcifyChina Factory Legitimacy Audit (includes tax bureau verification and machinery ownership check).

- Payment Terms: Structure payments tied to verified milestones (e.g., 30% post-USCC validation, 40% post-production start).

“Suppliers resisting USCC verification lack legal standing to fulfill contracts. This is non-negotiable in China’s regulated manufacturing ecosystem.”

— SourcifyChina Legal Advisory Board, 2024

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

LinkedIn | SourcifyChina Verification Portal

This report synthesizes data from China’s State Administration for Market Regulation (SAMR), SourcifyChina’s 2024 Risk Database (12,850 supplier verifications), and PRC Company Law (Amended 2023).

© 2024 SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Call to Action: Accelerate Your China Sourcing Strategy with Confidence

In today’s fast-paced global supply chain environment, procurement leaders cannot afford delays, compliance risks, or supplier verification bottlenecks. Every hour spent manually validating Chinese suppliers is an hour lost in cost savings, time-to-market, and competitive advantage.

It’s time to stop guessing and start sourcing with precision.

SourcifyChina’s Verified Pro List—powered by real-time validation of China Company Registration Numbers (Unified Social Credit Codes)—eliminates the uncertainty in supplier onboarding. Our proprietary database cross-references official government registries, ensuring every supplier is legally registered, operationally active, and audit-ready.

Why the Verified Pro List Saves Time & Mitigates Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| Manual verification of business licenses (1–3 days per supplier) | Instant access to pre-verified registration details |

| Risk of fake or expired licenses | Direct validation from China’s State Administration for Market Regulation (SAMR) |

| Inefficient due diligence process | One-click compliance checks included in supplier profiles |

| High cost of supplier audits and site visits | Remote pre-qualification with trusted data |

| Delayed procurement cycles | Faster RFQ responses and onboarding (reduced by up to 70%) |

By leveraging our Verified Pro List, procurement teams reduce supplier screening time from days to minutes, enabling faster negotiation, improved compliance, and scalable supplier diversification across electronics, textiles, machinery, and more.

Act Now — Secure Your Competitive Edge

Don’t let unreliable suppliers slow down your 2026 sourcing goals. SourcifyChina empowers global procurement managers with trusted, transparent, and time-efficient access to China’s most reliable manufacturers.

👉 Contact us today to request your customized Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to assist with immediate access, integration support, and strategic supplier mapping tailored to your category needs.

SourcifyChina — Your Verified Gateway to China Sourcing Excellence.

Trusted by Procurement Leaders in 42 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.